|

IFN712S- INTERNATIONAL FINANCE- 1ST OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION: BACHELOR OF ECONOMICS

QUALIFICATION CODE: 07BECO

LEVEL: 7

COURSE CODE: IFN712S

COURSE NAME: INTERNATIONAL FINANCE

SESSION: NOVEMBER 2023

DURATION: 3 HOURS

PAPER: THEORY

MARKS: 100

EXAMINER(S)

MODERATOR:

FIRST OPPORTUNITY EXAMINATION PAPER

MR. MALLY LIKUKELA

DR. GIFT l(AVARI

MR. IMMANUEL NASHIVELA

INSTRUCTIONS

1. This paper consist of 4 sections; A, B, C, and D.

2. Chose one question from each section.

3. Number your answers in accordance with the question paper.

4. Start each section answer on a new page

5. Write clearly and legibly

PERMISSIBLE MATERIALS

1. Pen

2. Ruler

3. Calculator (Programmable calculators are not allowed)

THIS PAPER CONSISTS OF 7 PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

SECTION A:

Answer questions 1 (a-c) or 2

Question l(a) MULTIPLE CHOICE QUESTIONS

[10 Marks]

1) Which of the following are securities?

a) A share of Texaco common stock

b) A Treasury bill

c) A certificate of deposit

d) All of the above

2) Which of the following are long-term financial instruments?

a) A six-month loan

b) A negotiable certificate of deposit

c) A bankers acceptance

d) A U.S.Treasury bill

e) None of the above

3) Which of the following are short-term financial instruments?

a) A bankers acceptance

b) A U.S.Treasury bill

c) A negotiable certificate of deposit

d) six-month loan

e) All of the above

4) Which of the following statements about financial markets and securities are true?

a) A debt instrument is long term if its maturity is ten years or longer.

b) The maturity of a debt instrument is the time (term) to that instrument's expiration date.

c) A debt instrument is intermediate term if its maturity is less than one year.

d) A bond is a long term security that promises to make periodic payments called dividends to the

firm's residual claimants.

5) A coupon bond pays the owner of the bond

a) the same amount every month until maturity date.

b) the face value of the bond plus an interest payment once the maturity date has been reached.

c) the face value at the maturity date.

d) a fixed-interest payment every period and repays the face value at the maturity date.

e) none of the above.

6 If a $10,000 face-value discount bond maturing in one year is selling for $5,000, then its yield to

maturity is

a) 50 percent.

b) 10 percent.

c) 100 percent.

d) 5 percent.

1

|

3 Page 3 |

▲back to top |

7 The......theory is not one of the theories developed to explain the determination of rate of exchange

a) Mint Parity Theory

b) Purchasing Power Parity Theory

c) Balance of Payment Theory

d) Monetarisim payment theory

8. Debit items in the BOP accounts reflect transactions that;

a) Give rise to payments outward from the country

b) Leads to exports and imports of goods and services

c) Maintain a systematic record of all economic transactions between the home country and the

rest of the world

d) None of the above

9. A credit market instrument that pays the owner a fixed coupon payment every year until the

maturity date and then repays the face value is called a

a) discount bond.

b) fixed-payment loan.

c) simple loan.

d) coupon bond.

10. In the foreign exchange market, the _____

_____

of another country.

a) currency; currency

b) currency; financial instruments

c) currency; goods

d) goods; goods

of one country is traded for the

2

|

4 Page 4 |

▲back to top |

Question l(b): TRUE OR FALSE

[10 Marks]

1. At the AfDB, each Governor represents his or her country and exercises a voting power

proportionate to the capital subscription of his or her country.

2. The IMF is a regional multilateral development finance institution established to contribute to the

economic development and social progress of African countries that are the institution's Regional

Member Countries {RMCs).

3. The current account balance is not important because it does not reflects sources and uses of

national income.

4. Change in price-cost structure of export oriented industries is an important external factor which

causes BOP Disequilibria.

5. On the current account table, Income (interest and dividends received from investments abroad)

is recorded on the credit side of the statement.

6. The demand for currencies is derived from the demand for a country's exports, and from

speculators looking to make a profit on changes in currency values.

7. The Eurodollar is not accepted in Namibia.

8. A Eurobank is a financial institution that only allows the deposits and loans of Euro currency.

9. Governments is not sufficient to encourage inward FDI by offering incentives to foreign firms to

invest in their countries.

10. When tax revenues are sufficient, the government can make up the difference by issuing debt.

3

|

5 Page 5 |

▲back to top |

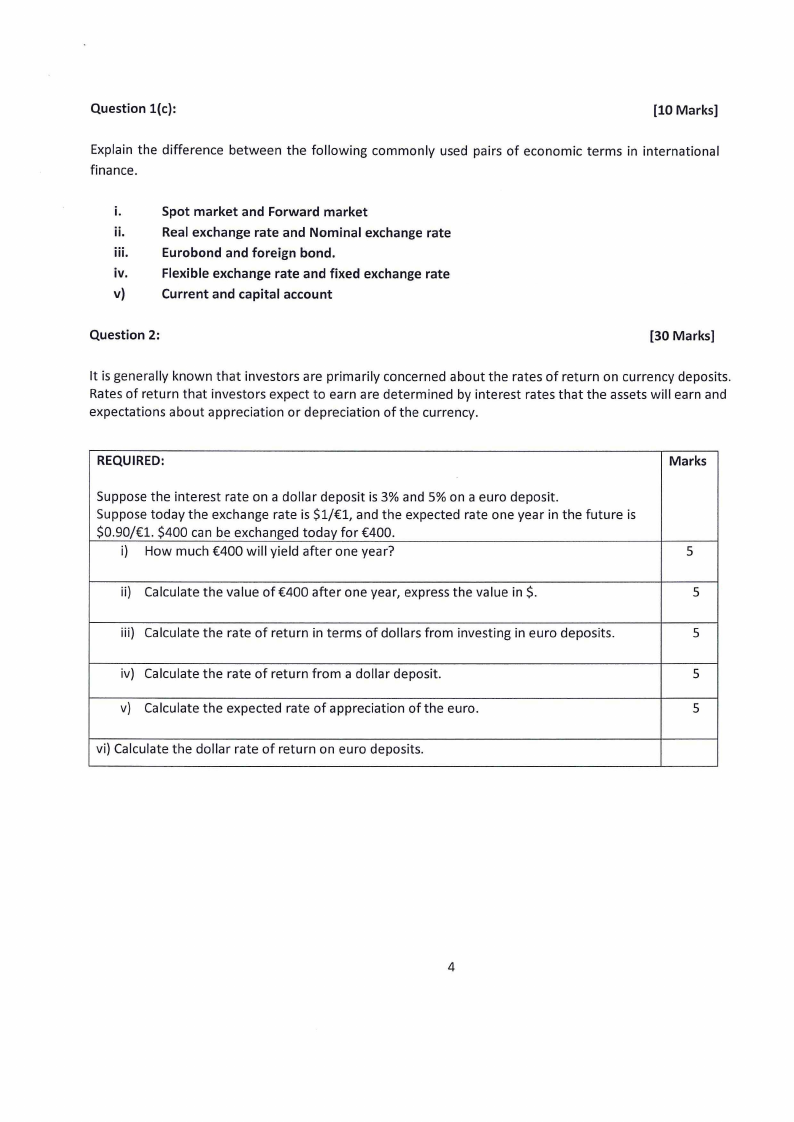

Question l(c):

[10 Marks]

Explain the difference between the following commonly used pairs of economic terms in international

finance.

i.

Spot market and Forward market

ii.

Real exchange rate and Nominal exchange rate

iii.

Eurobond and foreign bond.

iv.

Flexible exchange rate and fixed exchange rate

v)

Current and capital account

Question 2:

[30 Marks]

It is generally known that investors are primarily concerned about the rates of return on currency deposits.

Rates of return that investors expect to earn are determined by interest rates that the assets will earn and

expectations about appreciation or depreciation of the currency.

REQUIRED:

Suppose the interest rate on a dollar deposit is 3% and 5% on a euro deposit.

Suppose today the exchange rate is $1/€1, and the expected rate one year in the future is

$0.90/€1. $400 can be exchanged today for €400.

i) How much €400 will yield after one year?

ii) Calculate the value of €400 after one year, express the value in$.

iii) Calculate the rate of return in terms of dollars from investing in euro deposits.

iv) Calculate the rate of return from a dollar deposit.

v) Calculate the expected rate of appreciation of the euro.

vi) Calculate the dollar rate of return on euro deposits.

Marks

5

5

5

5

5

4

|

6 Page 6 |

▲back to top |

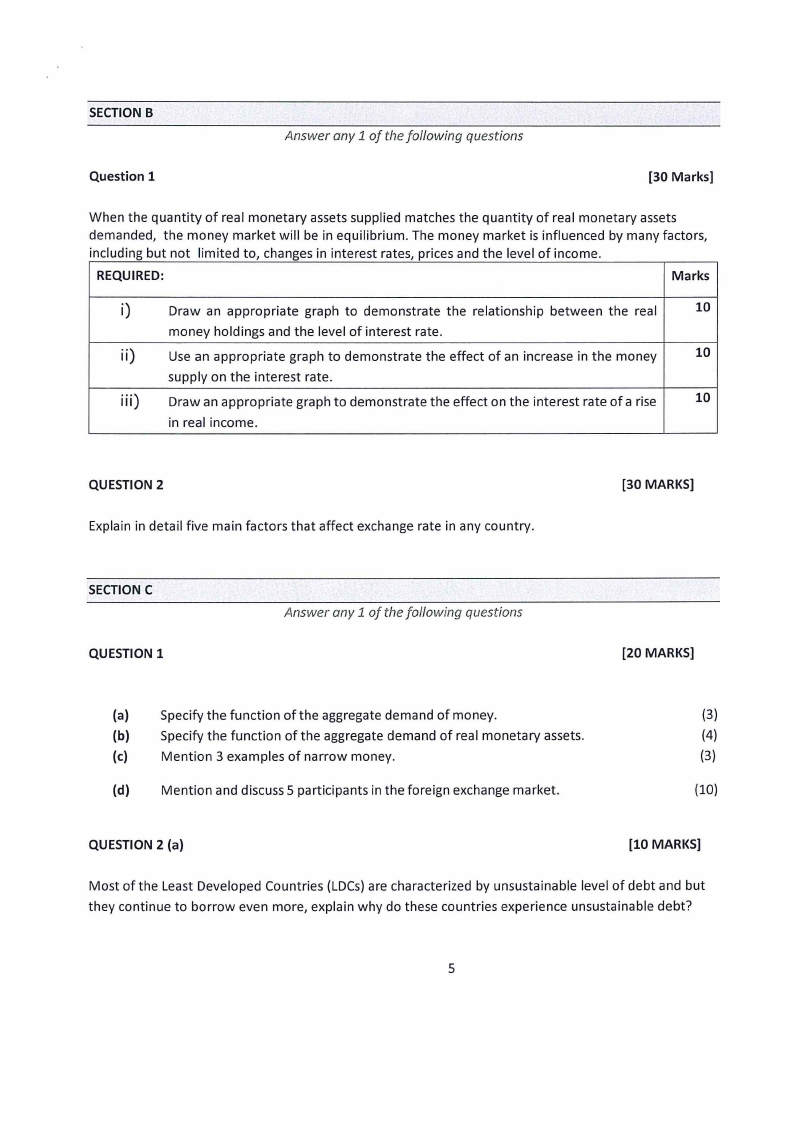

SECTION B

Answer any 1 of the following questions

Question 1

(30 Marks]

When the quantity of real monetary assets supplied matches the quantity of real monetary assets

demanded, the money market will be in equilibrium. The money market is influenced by many factors,

including but not limited to, changes in interest rates, prices and the level of income.

REQUIRED:

Marks

i)

Draw an appropriate graph to demonstrate the relationship between the real

10

money holdings and the level of interest rate.

ii)

Use an appropriate graph to demonstrate the effect of an increase in the money

10

supply on the interest rate.

iii) Draw an appropriate graph to demonstrate the effect on the interest rate of a rise

10

in real income.

QUESTION 2

Explain in detail five main factors that affect exchange rate in any country.

(30 MARKS]

SECTION C

QUESTION 1

Answer any 1 of the following questions

(20 MARKS]

(a)

Specify the function of the aggregate demand of money.

(3)

{b) Specify the function of the aggregate demand of real monetary assets.

(4)

(c)

Mention 3 examples of narrow money.

(3)

(d) Mention and discuss 5 participants in the foreign exchange market.

(10)

QUESTION 2 {a)

(10 MARKS)

Most of the Least Developed Countries (LDCs)are characterized by unsustainable level of debt and but

they continue to borrow even more, explain why do these countries experience unsustainable debt?

5

|

7 Page 7 |

▲back to top |

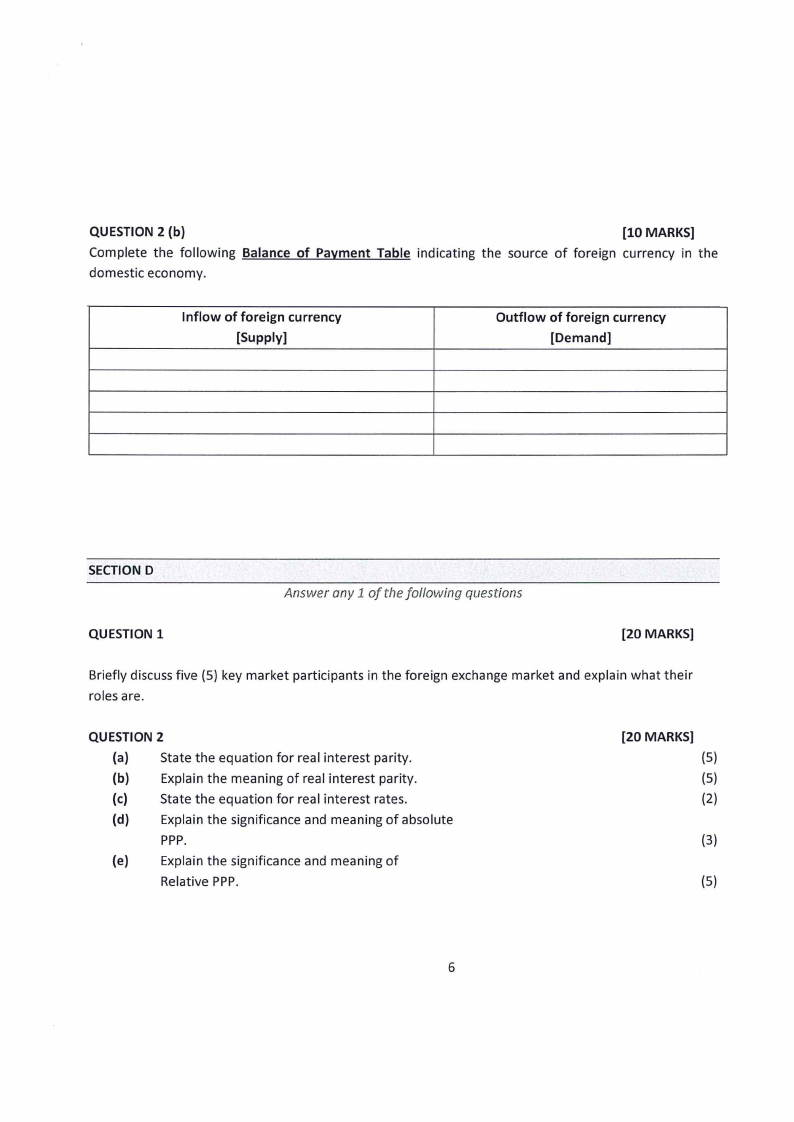

QUESTION 2 (b)

Complete the following

domestic economy.

Balance of Payment Table indicating

the source of foreign

(10 MARKS]

currency in the

Inflow of foreign currency

[Supply]

Outflow of foreign currency

[Demand]

SECTION D

Answer any 1 of the following questions

QUESTION 1

(20 MARKS]

Briefly discuss five (5) key market participants in the foreign exchange market and explain what their

roles are.

QUESTION 2

(a)

State the equation for real interest parity.

(b)

Explain the meaning of real interest parity.

(c)

State the equation for real interest rates.

(d)

Explain the significance and meaning of absolute

PPP.

(e)

Explain the significance and meaning of

Relative PPP.

(20 MARKS]

(5)

(5)

(2)

(3)

(5)

6