|

CMA512S - COST MANAGEMENT ACCOUNTING 102 - 2ND OPP - JAN 2020 |

|

1 Page 1 |

▲back to top |

NAMIBIA UNIVERSITY

OF SCIENCE AND TECHNOLOGY

FACULTY OF MANAGEMENT SCIENCES

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 07BACC LEVEL: 5

COURSE CODE: CMA512S

COURSE NAME: COST & MANAGEMENT ACCOUNTING 102

SESSION: JANUARY 2020

PAPER: THEORY AND CALCULATIONS

DURATION: 3 HOURS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS

E. Kangootui, S. Lishokomosi, G. Sneehama and L. Odada

MODERATOR | K. Boamah

INSTRUCTIONS

This question paper is made up of four (4) questions.

Answer ALL the questions and in blue or black ink. NO pencil

Start each question on a new page in your answer booklet and show all workings.

Questions relating to this examination may be raised in the initial 30 minutes after the

start of the paper. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities & any assumption made by the candidate should be

clearly stated.

THIS QUESTION PAPER CONSISTS OF 4 PAGES (Excluding this front page)

|

2 Page 2 |

▲back to top |

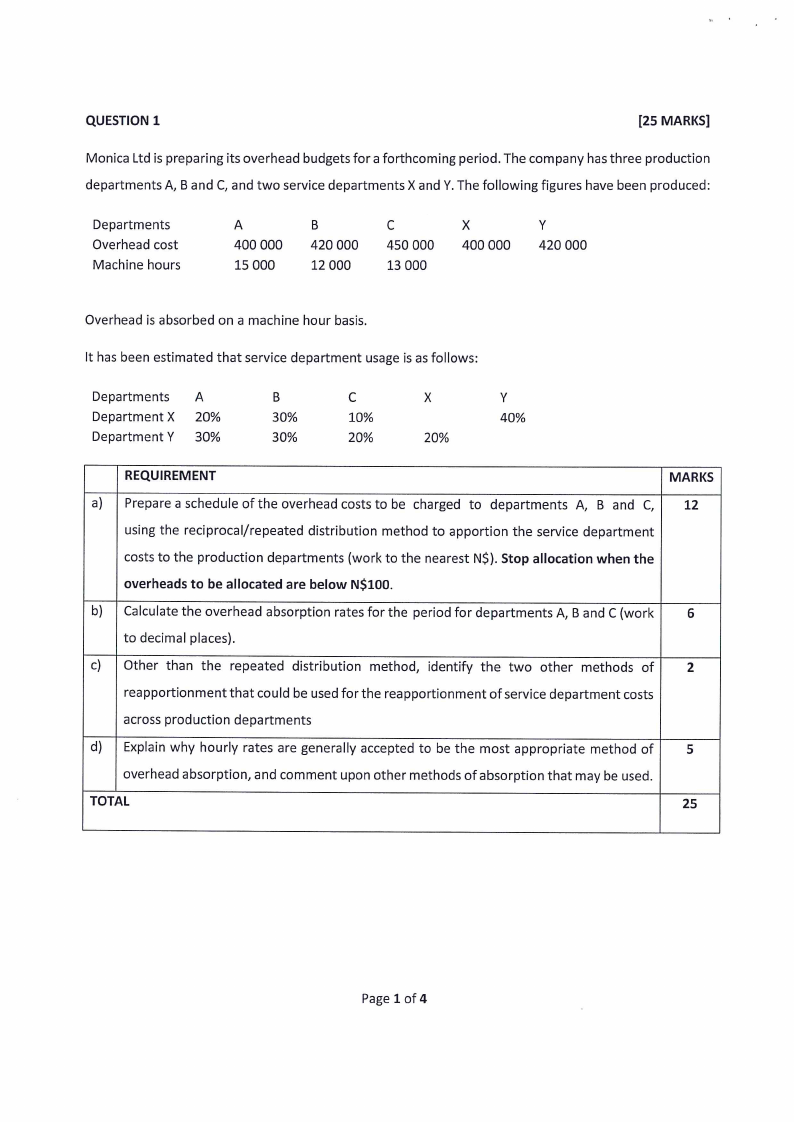

QUESTION 1

[25 MARKS]

Monica Ltd is preparing its overhead budgets for a forthcoming period. The company has three production

departments A, B and C, and two service departments X and Y. The following figures have been produced:

Departments

Overhead cost

Machine hours

A

400 000

15 000

B

420 000

12 000

C

450 000

13 000

X

400 000

Y

420 000

Overhead is absorbed on a machine hour basis.

It has been estimated that service department usage is as follows:

Departments

A

B

Cc

X

Y

Department X 20%

30%

10%

40%

Department Y 30%

30%

20%

20%

REQUIREMENT

MARKS

a) | Prepare a schedule of the overhead costs to be charged to departments A, B and C,

12

using the reciprocal/repeated distribution method to apportion the service department

costs to the production departments (work to the nearest NS). Stop allocation when the

overheads to be allocated are below N$100.

b) | Calculate the overhead absorption rates for the period for departments A, B and C (work

6

to decimal places).

c) | Other than the repeated distribution method, identify the two other methods of

2

reapportionment that could be used for the reapportionment of service department costs

across production departments

d) | Explain why hourly rates are generally accepted to be the most appropriate method of

5

overhead absorption, and comment upon other methods of absorption that may be used.

TOTAL

25

Page 1of4

|

3 Page 3 |

▲back to top |

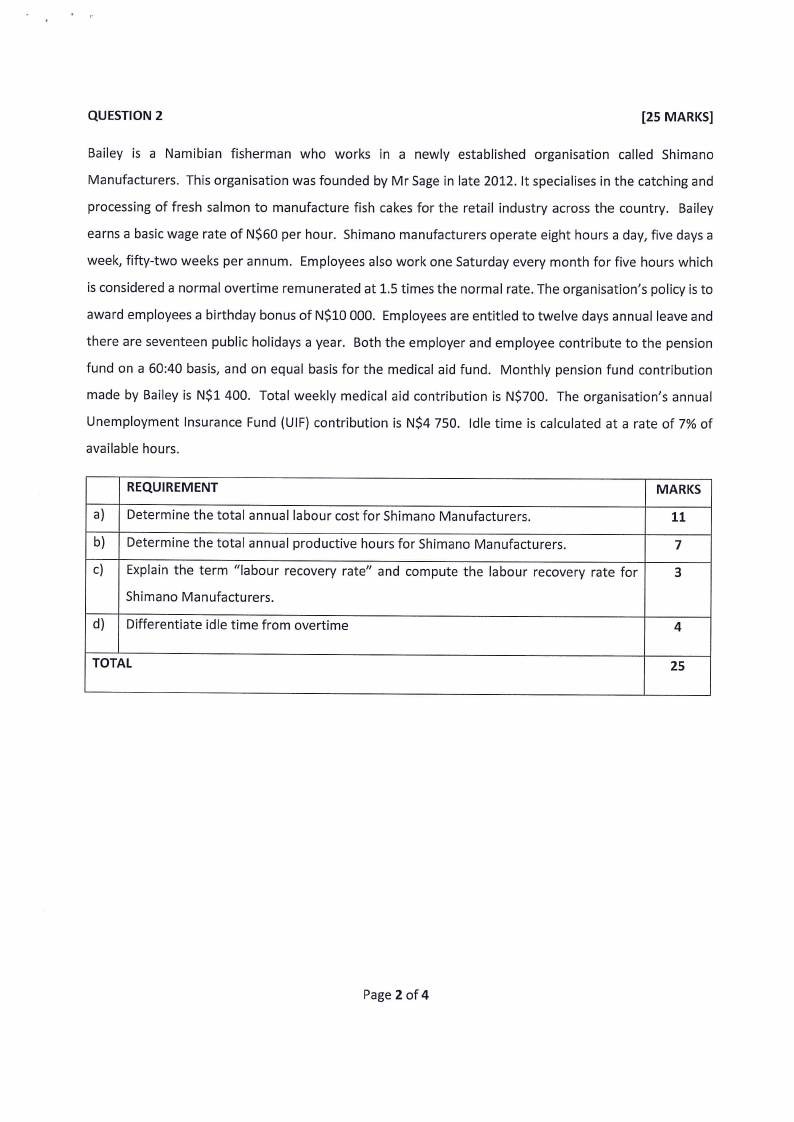

QUESTION 2

[25 MARKS]

Bailey is a Namibian fisherman who works in a newly established organisation called Shimano

Manufacturers. This organisation was founded by Mr Sage in late 2012. It specialises in the catching and

processing of fresh salmon to manufacture fish cakes for the retail industry across the country. Bailey

earns a basic wage rate of NS60 per hour. Shimano manufacturers operate eight hours a day, five days a

week, fifty-two weeks per annum. Employees also work one Saturday every month for five hours which

is considered a normal overtime remunerated at 1.5 times the normal rate. The organisation’s policy is to

award employees a birthday bonus of N$10 000. Employees are entitled to twelve days annual leave and

there are seventeen public holidays a year. Both the employer and employee contribute to the pension

fund on a 60:40 basis, and on equal basis for the medical aid fund. Monthly pension fund contribution

made by Bailey is NS1 400. Total weekly medical aid contribution is NS700. The organisation’s annual

Unemployment Insurance Fund (UIF) contribution is NS4 750. Idle time is calculated at a rate of 7% of

available hours.

REQUIREMENT

a) | Determine the total annual labour cost for Shimano Manufacturers.

b) | Determine the total annual productive hours for Shimano Manufacturers.

c) | Explain the term “labour recovery rate” and compute the labour recovery rate for

Shimano Manufacturers.

d) | Differentiate idle time from overtime

MARKS

11

7

3

4

TOTAL

25

Page 2 of 4

|

4 Page 4 |

▲back to top |

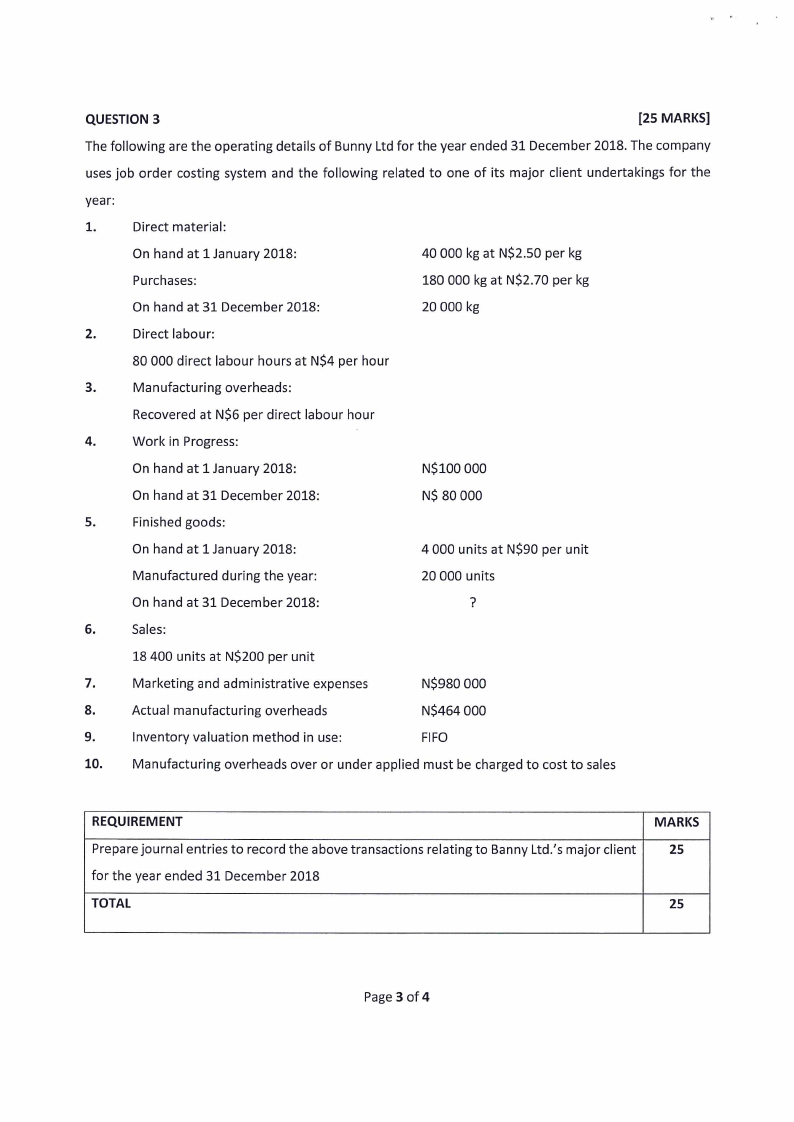

QUESTION 3

[25 MARKS]

The following are the operating details of Bunny Ltd for the year ended 31 December 2018. The company

uses job order costing system and the following related to one of its major client undertakings for the

year:

1.

Direct material:

On hand at 1 January 2018:

40 000 kg at NS$2.50 per kg

Purchases:

180 000 kg at NS2.70 per kg

On hand at 31 December 2018:

20 000 kg

2.

Direct labour:

80 000 direct labour hours at NS4 per hour

3.

Manufacturing overheads:

Recovered at NS6 per direct labour hour

4.

Work in Progress:

On hand at 1 January 2018:

NS100 000

On hand at 31 December 2018:

NS 80 000

5.

Finished goods:

On hand at 1 January 2018:

4 000 units at NS90 per unit

Manufactured during the year:

20 000 units

On hand at 31 December 2018:

?

6.

Sales:

18 400 units at NS200 per unit

7.

Marketing and administrative expenses

NS980 000

8.

Actual manufacturing overheads

NS464 000

9.

Inventory valuation method in use:

FIFO

10.

Manufacturing overheads over or under applied must be charged to cost to sales

REQUIREMENT

Prepare journal entries to record the above transactions relating to Banny Ltd.’s major client

for the year ended 31 December 2018

TOTAL

MARKS

25

25

Page 3 of 4

|

5 Page 5 |

▲back to top |

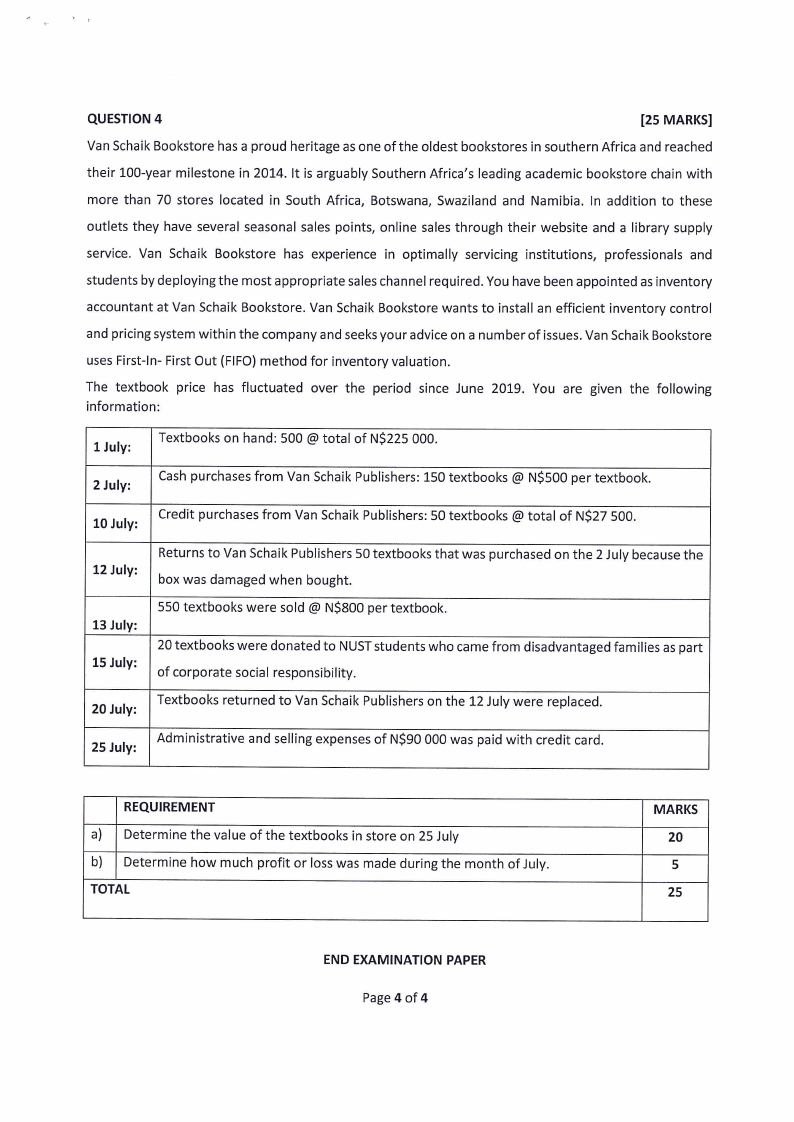

QUESTION 4

[25 MARKS]

Van Schaik Bookstore has a proud heritage as one of the oldest bookstores in southern Africa and reached

their 100-year milestone in 2014. It is arguably Southern Africa’s leading academic bookstore chain with

more than 70 stores located in South Africa, Botswana, Swaziland and Namibia. In addition to these

outlets they have several seasonal sales points, online sales through their website and a library supply

service. Van Schaik Bookstore has experience in optimally servicing institutions, professionals and

students by deploying the most appropriate sales channel required. You have been appointed as inventory

accountant at Van Schaik Bookstore. Van Schaik Bookstore wants to install an efficient inventory control

and pricing system within the company and seeks your advice on a number of issues. Van Schaik Bookstore

uses First-In- First Out (FIFO) method for inventory valuation.

The textbook price has fluctuated over the period since June 2019. You are given the following

information:

1 July: Textbooks on hand: 500 @ total of NS225 000.

2 July: Cash purchases from Van Schaik Publishers: 150 textbooks @ NS5O00 per textbook.

10 July: Credit purchases from Van Schaik Publishers: 50 textbooks @ total of NS27 500.

12 uyJuly:

13 July:

15 Jumlyy:

20 July:

Returns to Van Schaik Publishers 50 textbooks that was purchased on the 2 July because the

box was damaged when bought.

550 textbooks were sold @ NS800 per textbook.

20 textbooks were donated to NUST students who came from disadvantaged families as part

of corporate social responsibility.

Textbooks returned to Van Schaik Publishers on the 12 July were replaced.

25 July: Administrative and selling expenses of NS90 000 was paid with credit card.

REQUIREMENT

a) | Determine the value of the textbooks in store on 25 July

b) | Determine how much profit or loss was made during the month of July.

TOTAL

MARKS

20

5

25

END EXAMINATION PAPER

Page 4of 4

|

6 Page 6 |

▲back to top |