|

FAR811S-ADVANCED FINANCIAL ACCOUNTING -1ST OPP-JUNE 2024 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION : BACHELOR OF ACCOUNTING HONOURS

QUALIFICATION CODE: 08 BOAH

COURSE CODE: FAR811S

SESSION: June 2024

LEVEL: 8

COURSE NAME: ADVANCEDFINANCIALACCOUNTING

AND REPORTING

PAPER: THEORYAND CALCULATIONS

DURATION: 3 hours

MARKS: 100

EXAMINER(S)

FINAL ASSESSMENT - i5t Opportunity

D W Kamotho

MODERATOR: Dr E Wealth

INSTRUCTIONS

1. Answer ALL questions in blue or black ink only.

2. Write clearly and neatly.

3. Start each question on a new page and number the answers clearly.

4. No programmable calculators are allowed.

5. Questions relating to the paper may be raised in the initial 30 minutes after the start of

the paper. Thereafter, candidates must use their initiative to deal with any perceived

error or ambiguities & any assumption made by the candidate should be clearly stated.

6. Any resemblance to any people, places, organisations or anything is purely

coincidental.

THIS QUESTION PAPER CONSISTS OF 6 PAGES (excluding the front page)

|

2 Page 2 |

▲back to top |

Question 1

This question has two parts which are independent of each other.

(25 marks)

Part A

Indicate whether the below statements are true or false in regard to the requirements of

IFRS 13: Fair value measurement and briefly justify your answer.

a) Fair value is an entity-specific measurement.

(2)

b) IFRS 13 Fair value measurement must be applied when measuring and disclosing "fair

value less cost of disposal" being a term referred to in IAS36 Impairment of assets. (2)

c) Fair value is measured in terms of the most advantageous market, unless a most

advantageous market does not exist, in which case we must measure the fair value in

the terms of the principal market instead.

(2)

d) The most advantageous market is defined as a market that maximizes the amount that

would be received to sell the asset or minimize the amount that would be paid to transfer

the liability after taking into account the transaction costs.

(3)

e) The asset principal market is a market that offers the highest volume or activity relating

to that asset.

(2)

f) The highest and best use of an asset must be considered when measuring the fair value

of any asset.

f.11

Total for Part A

(15)

1

|

3 Page 3 |

▲back to top |

Part B

Aliena limited functions as an asset management company, employing a variety of trading

techniques to unlock value for its client. Presently they are busy with the preparation of their

financial statement for the current financial year ended 31st December 2023.

You are employed by the entity as a technical expert on IFRS, and as such you are actively

involved in the preparation of the financial statements. At the moment there is one particular

issue that is causing difficulties for the management, and you have been asked to provide an

opinion on the matter.

The company had purchased 1,000,000 shares in Rock Limited on the advice of a

consultancy, Future Analyst. Rock Limited is a company listed on the local security exchange,

NSX. The shares were purchased because they had, historically, been trading very well and

. the Analysts at the future analyst had convinced management, at the time of the purchase,

that the share would continue to do well into the future.

At the current reporting date, the NSX showed that Rock limited was trading at a bid price of

N$360 and an ask price of N$300 with a bid-ask spread of N$60.

However, in the process of gathering information, you requested an opinion from an expert at

Reiters Inc. on the absorption capacity of the market where Aliena limited to sell its entire

holding. The expert responded by saying that he concluded that the full absorption at the

current security price would not be possible. Accordingly, the bid price was N$330 and they

ask the price N$270 and the bid-ask spread is N$60.

Required.

Explain with reference to IFRS 13 Fair value measurement, how the fair value of this

investment in shares should be measured and identify whether the input into this calculation

would be considered level 1, level 2 or Level 3 inputs?

(10)

(25 marks)

2

|

4 Page 4 |

▲back to top |

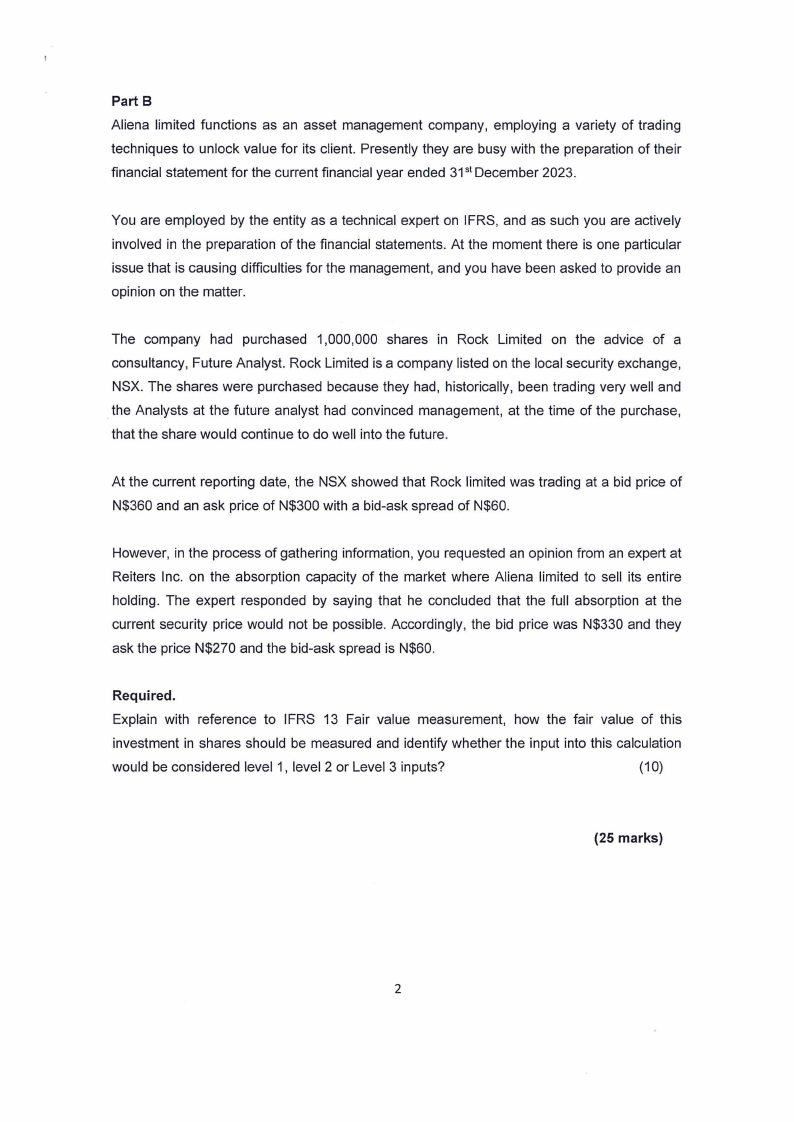

Question 2

(25 marks)

Trade store CC is a general dealer doing business in the country. The following items among

others (inter alia) are included in the revenue of N$781 340 for the year ended 31 December

2023.

1. Layby Sales

Payments have been made on the following parcels in the storeroom, and these are included

in the revenue of N$781,340.

Invoice number.

3161

4031

4056

5315

Selling price including

VAT at 14%.

342

171

513

410

Balance outstanding

52

104

311

352

Experience has shown that Layby sales, of which more than 80% have been collected, will be

completed. Trade Store CC can sell the layby goods to other customers and replace them with

the same items during the Layby period.

2. COD Sales.

The following COD invoices have not been collected at 31st December 2023 and are included

in the receivables and revenue.

• Invoice number 4136 amounting to N$363 vat exclusive was delivered to a farm where

only one employee was home. The money will be collected when the farmer visits the town

again. The farmer is creditworthy.

• Invoice number 5110, amounting to N$123 vat exclusive was paid by cheque. The cheque

was accidentally postdated to 15th January 2024.

3

|

5 Page 5 |

▲back to top |

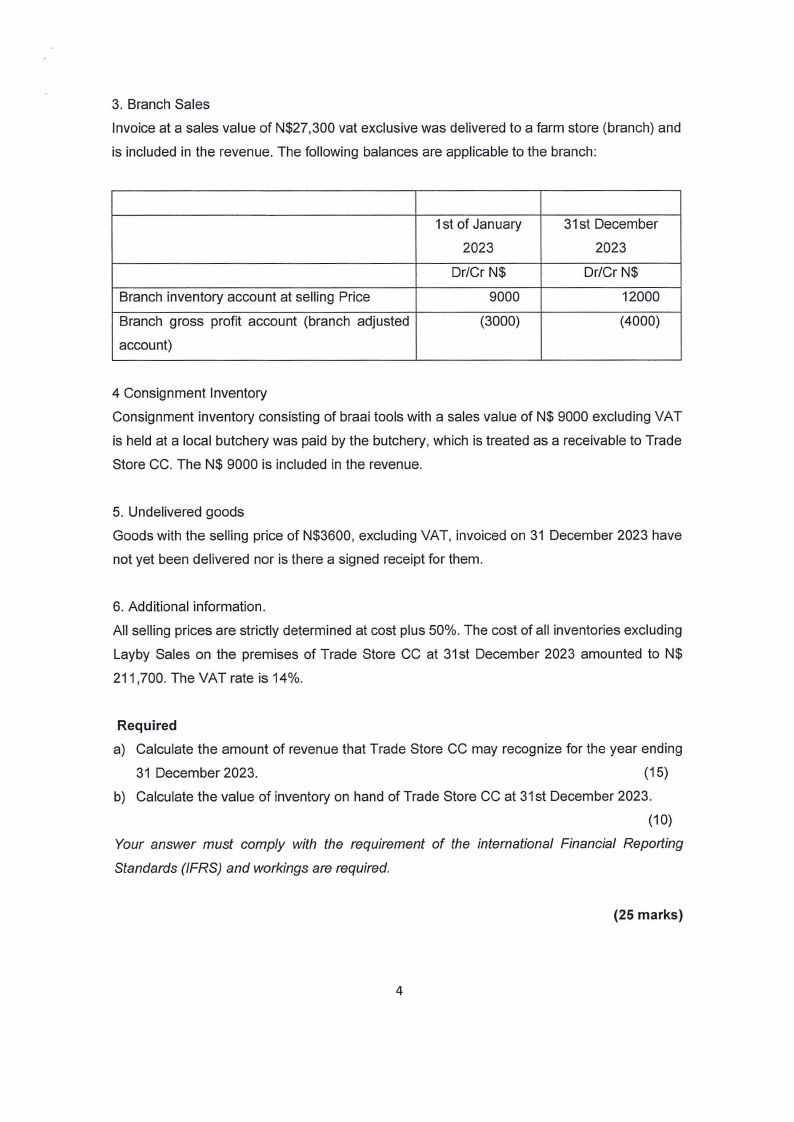

3. Branch Sales

Invoice at a sales value of N$27,300 vat exclusive was delivered to a farm store (branch) and

is included in the revenue. The following balances are applicable to the branch:

Branch inventory account at selling Price

Branch gross profit account (branch adjusted

account)

1st of January

2023

Dr/Cr N$

9000

(3000)

31st December

2023

Dr/Cr N$

12000

(4000)

4 Consignment Inventory

Consignment inventory consisting of braai tools with a sales value of N$ 9000 excluding VAT

is held at a local butchery was paid by the butchery, which is treated as a receivable to Trade

Store CC. The N$ 9000 is included in the revenue.

5. Undelivered goods

Goods with the selling price of N$3600, excluding VAT, invoiced on 31 December 2023 have

not yet been delivered nor is there a signed receipt for them.

6. Additional information.

All selling prices are strictly determined at cost plus 50%. The cost of all inventories excluding

Layby Sales on the premises of Trade Store CC at 31st December 2023 amounted to N$

211,700. The VAT rate is 14%.

Required

a) Calculate the amount of revenue that Trade Store CC may recognize for the year ending

31 December 2023.

(15)

b) Calculate the value of inventory on hand of Trade Store CC at 31st December 2023.

(10)

Your answer must comply with the requirement of the international Financial Reporting

Standards (IFRS) and workings are required.

(25 marks)

4

|

6 Page 6 |

▲back to top |

Question 3

(25 marks)

Button limited raised to specific loans to fund construction of a building (a qualifying asset).

• Loan A, 10% raised, 1 January 2023: N$500,000.

• Loan B, 15% raised one June 2023 N$400,000.

N$100,000 of the Loan B capital was repaid on 31 July 2023. No other loan capital was

repaid. Interest was payable (compounded) annually on 31 December.

The only other interest income earned during the year was interest on the investment of

surplus funds from the specific loans in a 6% interest account. This interest is not

compounded.

Additional information

Construction costs paid for as follows.

• 31 March 2023 - N$ 300,000

• 30 April 2023 - N$ 100,000

• 31 July 2023 - N$ 220,000

• Commencement date - 01 March 2023.

• Cessation date - 31 August 2023.

Required.

a) Calculate the amount of borrowing costs that must be capitalized in terms of IAS 23

(17)

b) Journalise the borrowing costs for the year ended 31st December 2023.

(8)

(25 marks)

5

|

7 Page 7 |

▲back to top |

Question 4

This question has two independent parts.

(25 marks)

General information

Big Vans Ltd entered into a lease contract with Super Foods Ltd for the lease of a refrigerated

delivery van on 1 January 2023. The lease instalment amounts to N$6 000 annually in arrears

for the duration of the three-year lease term. The lease is non-cancellable.

The interest rate implicit in the lease is 4.48%.

PART A - As a manufacturer

Big Vans Ltd is a manufacturer of delivery vans. The van in respect of this lease was

manufactured at a cost of N$12 000. The company uses the gross method for recording and

disclosing the lease in their accounts.

Required:

a) Determine the gross investment in the lease, the net investment in the lease and the

unearned finance income.

(4)

b) Prepare the journal entries in the accounting records of Big Vans Ltd for the year ended

31 December 2023.

(1 0)

Ignore tax.

PART B - As a Finance house

Big Vans Ltd is a finance house and purchases the vehicle on 1 January 2023 at a cost of

N$16 500. The company uses the net method for recording and disclosing the lease in their

accounts.

Required:

a) Determine the gross investment in the lease, the net investment in the lease and the total

of the unearned finance income.

(4)

b) Prepare the journal entries in the accounting records of Big Vans Ltd for the year ended

31 December 2023.

(7)

Ignore tax.

(25 Marks)

END OF QUESTION PAPER

6

|

8 Page 8 |

▲back to top |

7-~-~

I ~{r '?voO

21

2,0 (

'