|

PNF712S-PUBLIC FINANCE-2ND OPP-JULY 2024 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVER s I TY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF MANAGEMENT SCIENCES

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ECONOMICS

QUALIFICATION CODE: 07BECO LEVEL: 7

COURSE CODE: PFN712S

COURSE NAME: PUBLIC FINANCE

SESSION: JUNE 2024

DURATION: 3 HOURS

PAPER:THEORY

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER(S) MRS. LAVINIA HOFNI

MODERATOR: MR. HANRY MBAHA

INSTRUCTIONS

1. This paper consists of 5 sections A, B, C, D and E

2. Answer ALL questions.

3. Number your answers in accordance with the question paper.

4. Staii each section answer on a new page.

5. Write clearly a:ndlegibly

PERMISSIBLE MATERIALS

1. Pen, pencil and eraser

2. Ruler

3. Calculator

THIS EXAMNATION PAPER CONSISTS OF 7 PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

SECTION A

20MARKS

QUESTION 1

[20 Marks]

Choose one possible answer for each question.

1. Operational Efficiency is

(2 Marks)

a) States that agencies should provide goods and services at a cost that achieves ongoing

efficiency gains

b) The budget system should facilitate reallocation from lesser to higher priorities and

from less to more effective programs

c) is the ability of a firm to produce as much output as possible with a specified level of

inputs, given the existing technology.

d) All of the above

2. A pure private good is

a) nonrival in consumption and subject to exclusion.

b) rival in consumption and subject to exclusion.

c) rival in consumption and not subject to exclusion.

d) all of the above

(2 Marks)

3. Positive Economics is based on:

(2 Marks)

a) Statements that contain opinions and value judgement. i.e. "what ought to be" or "what

should be

b) based on factual statements and such statements contain no value judgement

c) Statements that cannot be settled by science or by an appeal to and such statement

d) All of the above

4. The economic incidence of a unit tax is

a) Generally borne by the buyers

b) Generally borne by sellers

c) Generally borne by the government

d) Independent of the statutory incidence for the tax

(2 Marks)

5. Market failure can occur when

a) monopoly power exists in the market.

b) markets are missing.

c) consumers can influence prices.

d) all of the above.

(2 Marks)

1

|

3 Page 3 |

▲back to top |

6. Progressive tax

(2 Marks)

a) is when a taxpayer pay higher taxes ifhe earns more income and lower taxes ifhe earns

less

b) Is when low income individuals pay a higher percentage of their incomes in taxes, than

richer individuals

c) a tax in which the tax rate decreases as the taxable amount increases

d) All of the above

7. Pareto points in the Edgeworth Box are

(2 Marks)

a) Found when indifference curves are tangent.

b) Found when MRS are equal.

c) Found when one person cannot be made better off without making another person

worse off.

d) all of the above.

8. The slope of budget line is called

a) the diminishing marginal return

b) the marginal rate of substitution

c) the Marginal Rate of Transformation

d) the rate of marginal substitution

(2 Marks)

9. Movement from an inefficient allocation to an efficient allocation in the Edgeworth Box

will

(2 Marks)

a) Increase the utility of all individualsis what explain the law of demand

b) Increase the utility of at least one individual, but may decrease the level of utility of

another person.

c) Increase the utility of one individual, but cannot decrease the utility of any individual

d) Decrease the utility of all individuals

10. Allocative efficiency

(2 Marks)

a) Tells us the relationship between the quantity allocated, and the price

b) Is about allocating resources such that the maximum utility is generated

c) Is the ability of a fom to produce as much output as possible with a specified level of

inputs, given the existing technology.

d) All of the above

2

|

4 Page 4 |

▲back to top |

SECTIONB

20MARKS

QUESTION 1

Indicate whether T/F in the answer booklet provided.

1. Complexity theory seeks to define an ideal future (e.g culture) and then define strategies to

"close the gap.

(2 Marks)

2. If we fail to test our theories and their assumptions or continue to believe them when they fail

the tests, they become ideology, not theory.

(2 Marks)

3. Conducting interviews is an empirical method that could be used to test theories. (2 Marks)

4. The Namibian employer is obliged to withhold income tax and pay the amount to NAMRA on

a monthly basis.

(2 Marks)

5. Economically and politically powerful rich taxpayers often prevent fiscal reforms that would

increase their tax burdens.

(2 Marks)

6. The effect of transferring wealth from the richer sections of society to poorer sections using

taxation is refered to as redistribution effects.

(2 Marks)

7. Distortions in economic incentives and the resulting inefficiencies and inequalities of

resources can be address through Tax Reforms.

(2 Marks)

8. The burden of the tax equals the tax revenue minus the deadweight loss.

(2 Marks)

9. Perverse incentives is the tendency for spenders to have incentive to use all the resources

provided them; fearing that if they don't, they risk cuts in the next budget. (2 Marks)

10. Where income has been subject to tax twice - in Namibia and foreign jurisdiction. (2 Marks)

3

|

5 Page 5 |

▲back to top |

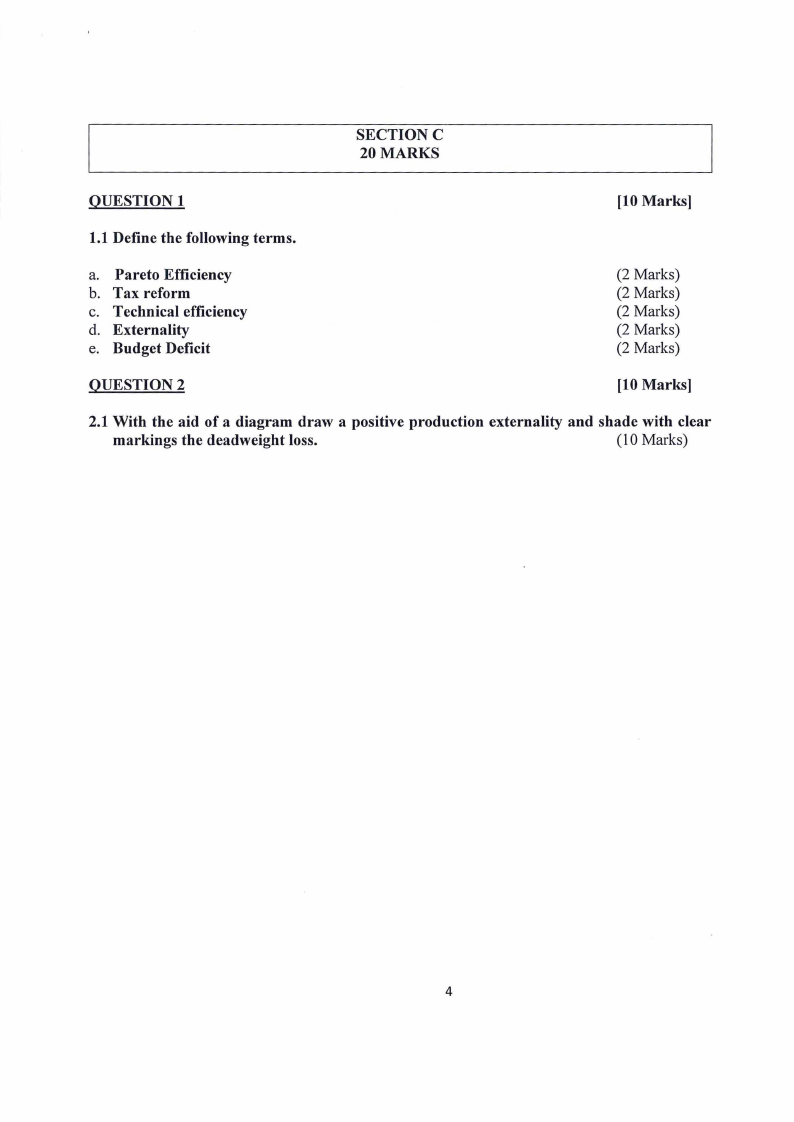

SECTIONC

20MARKS

QUESTION 1

[10 Marks]

1.1 Define the following terms.

a. Pareto Efficiency

b. Tax reform

c. Technical efficiency

d. Externality

e. Budget Deficit

(2 Marks)

(2 Marks)

(2 Marks)

(2 Marks)

(2 Marks)

OUESTION2

[10 Marks]

2.1 With the aid of a diagram draw a positive production externality and shade with clear

markings the deadweight loss.

( 10 Marks)

4

|

6 Page 6 |

▲back to top |

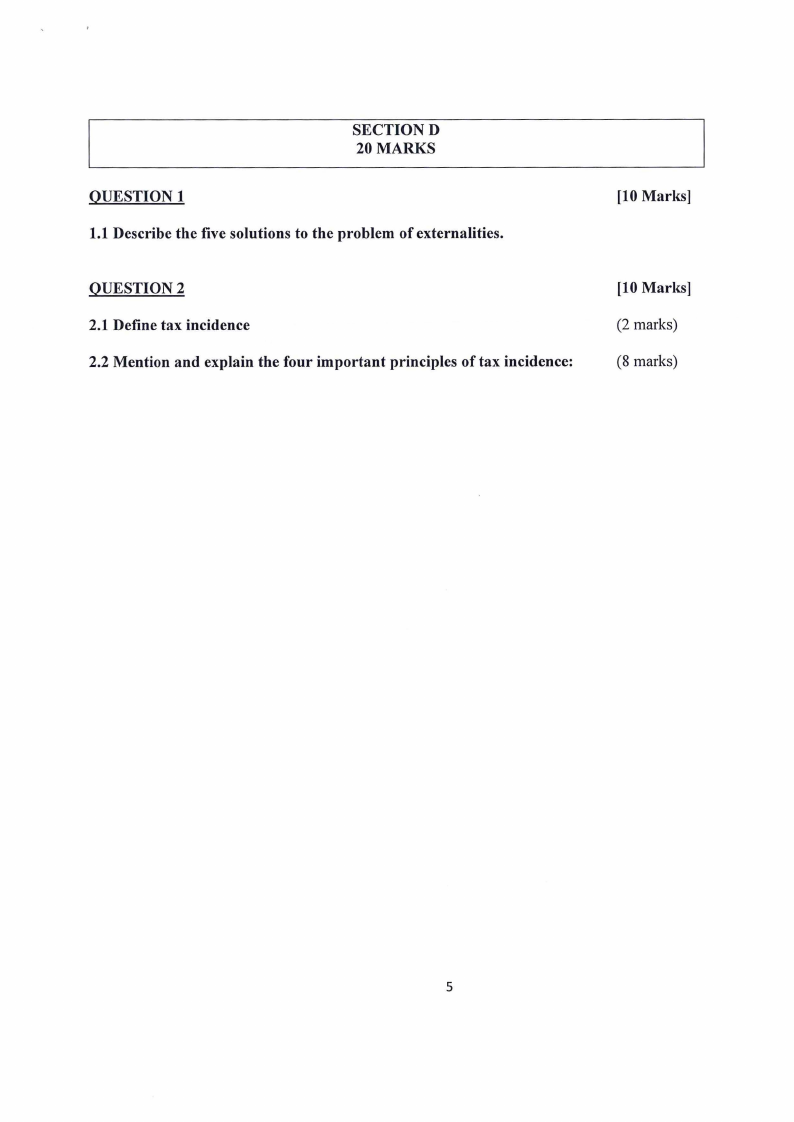

SECTIOND

20MARKS

QUESTION 1

1.1 Describe the five solutions to the problem of externalities.

OUESTION2

2.1 Define tax incidence

2.2 Mention and explain the four important principles of tax incidence:

[10 Marks]

[10 Marks]

(2 marks)

(8 marks)

5

|

7 Page 7 |

▲back to top |

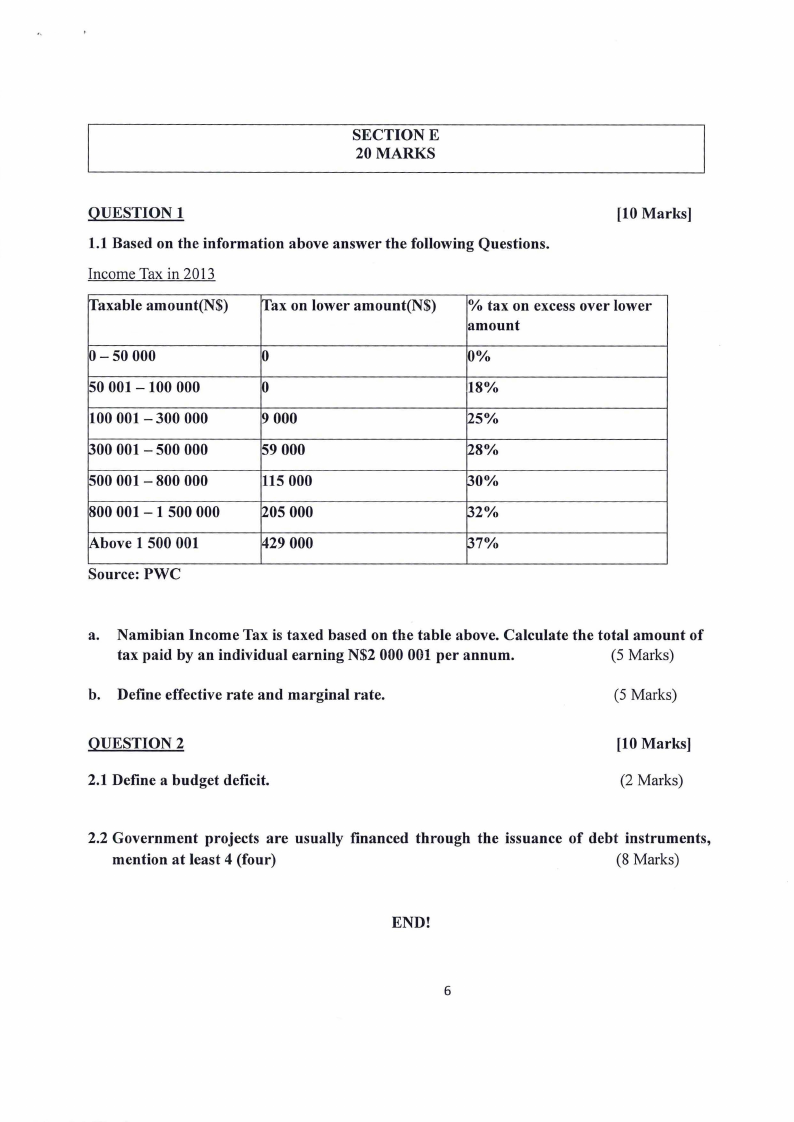

SECTIONE

20MARKS

QUESTION 1

[10 Marks]

1.1 Based on the information above answer the following Questions.

Income Tax in 2013

Taxable amount(N$)

rrax on lower amount(N$)

% tax on excess over lower

amount

0-50 000

0

0%

50 001-100 000

0

18%

100 001 -300 000

9 000

25%

300 001 - 500 000

59 000

28%

500 001 - 800 000

115000

30%

800 001-1500000

~05 000

32%

Above 1 500 001

~29 000

37%

Source: PWC

a. Namibian Income Tax is taxed based on the table above. Calculate the total amount of

tax paid by an individual earning N$2 000 001 per annum.

(5 Marks)

b. Define effective rate and marginal rate.

(5 Marks)

QUESTION 2

2.1 Define a budget deficit.

[10 Marks]

(2 Marks)

2.2 Government projects are usually financed through the issuance of debt instruments,

mention at least 4 (four)

(8 Marks)

END!

6