|

FTL821S - FINANCIAL TECHNIQUES FOR LOGISTICS MANGEMENT OPERATIONS - 1ST OPP - NOV 2022 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEn CE Ano TECHn

FACULTYOF COMMERCE, HUMAN SCIENCEAND EDUCATION

DEPARTMENT OF MARKETING, LOGISTICSAND SPORTMANAGEMENT

QUALIFICATION: BACHELOROF LOGISTICSAND SUPPLYCHAIN MANAGEMENT HONOURS

QUALIFICATION CODE: 08LSCH

LEVEL: 8

COURSECODE: FTL821S

COURSE NAME: FINANCIAL TECHNIQUES FOR LOGISTICS

MANAGEMENT OPERATIONS

SESSION:NOVEMBER 2022

PAPER:THEORYAND PRACTICAL

DURATION: 180 MINUTES

MARKS: 100

EXAMINER

FIRSTOPPORTUNITY EXAMINATION QUESTION PAPER

Mr. Twiitedululeni Nakweenda

MODERATOR

Mr. Johannes Ndjuluwa

INSTRUCTIONS

1. This question paper consists of six pages including this cover page.

2. Start with the question that you understand best, and please number all your answers clearly,

and correctly.

3. Avoid any form of academic dishonesty.

4. Where applicable, please show all your workings.

5. Students should use their intuitions to deal with any perceived ambiguities, and all

assumptions made should clearly be indicated as such.

6. For qualitative answers, the number of marks allocated should serve as the basis for the length

of your answer.

7. Unless otherwise stated, round off all your final answers to two decimal places.

8. The use of Financial Calculators or PV/FV Tables is permitted.

9. Strictly, pencil work shall be marked.

-*THE PAPERCONSISTOF 5 PAGESINCLUDING THIS COVERPAGE+ 1 PAGE OF PV & FV TABLE

|

2 Page 2 |

▲back to top |

QUESTION 1

(25 MARKS, 45 MINUTES)

Suppose your entity is contemplating to purchase a new motor vehicle as a way of increasing its fleets in

five years' time. The value of the motor vehicle is estimated at N$350 000. No deposit would be required.

In order to make this happen, your entity decides to invest N$25 000 at 12% per annum each year for the

next five years. The investment should be made at the end of each year. Accordingly, your entity would

be required to top up for any shortfall should there be any. Luckily, your entity's bank is willing to finance

the shortfall, payable at 10% interest per annum over five years' equal annual instalments.

REQUIRED:

1.1. What type of annuity implied in above?

1.2. Determine the value of your entity's investment at the end of five years.

1.3. Is the investment sufficient to cover the total purchase.

1.4. What made up an instalment?

1.5. Based on your answer in {1.3), calculate the instalment to be paid at 10% interest over

five year period.

1.4. Prepare an Amortization table based on the shortfall obtained in 1.3, and the

instalment figure you have calculated in (1.5). Show all the applicable columns.

TOTAL MARKS

MARKS

2

5

2

2

3

11

25

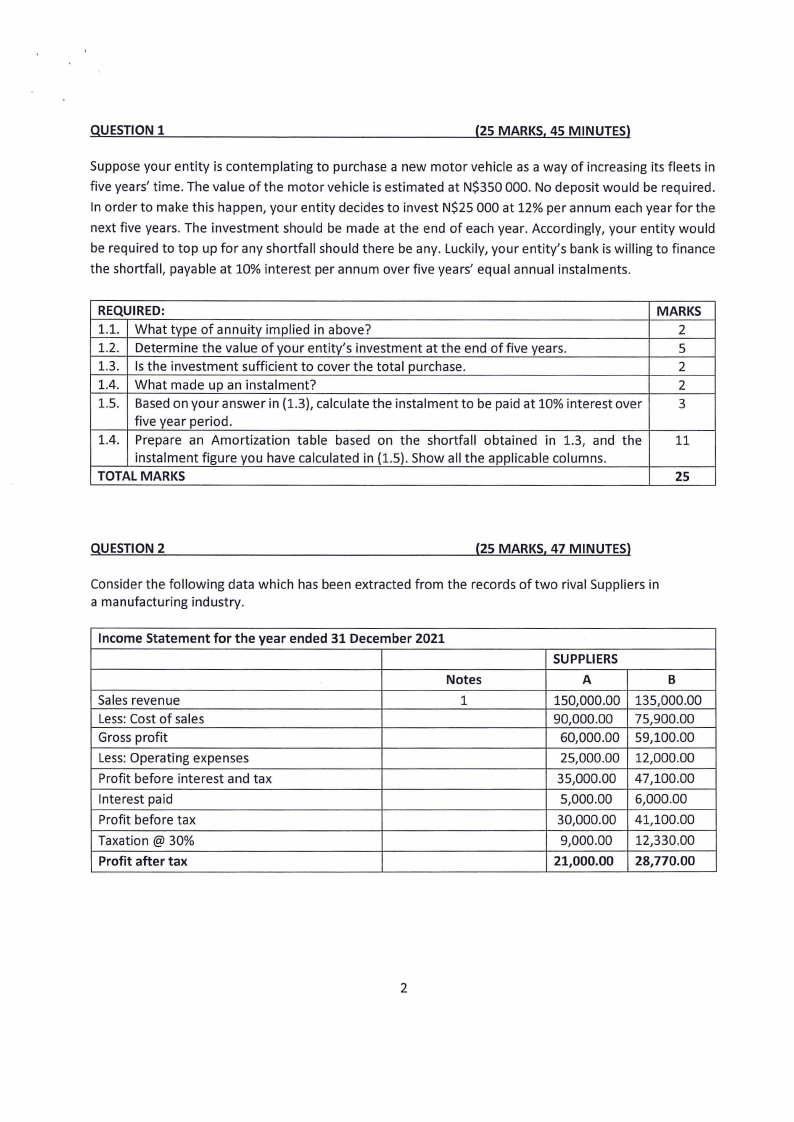

QUESTION 2

(25 MARKS, 47 MINUTES)

Consider the following data which has been extracted from the records of two rival Suppliers in

a manufacturing industry.

Income Statement for the year ended 31 December 2021

Sales revenue

Less:Cost of sales

Gross profit

Less:Operating expenses

Profit before interest and tax

Interest paid

Profit before tax

Taxation @ 30%

Profit after tax

Notes

1

SUPPLIERS

A

150,000.00

90,000.00

60,000.00

25,000.00

35,000.00

5,000.00

30,000.00

9,000.00

21,000.00

B

135,000.00

75,900.00

59,100.00

12,000.00

47,100.00

6,000.00

41,100.00

12,330.00

28,770.00

2

|

3 Page 3 |

▲back to top |

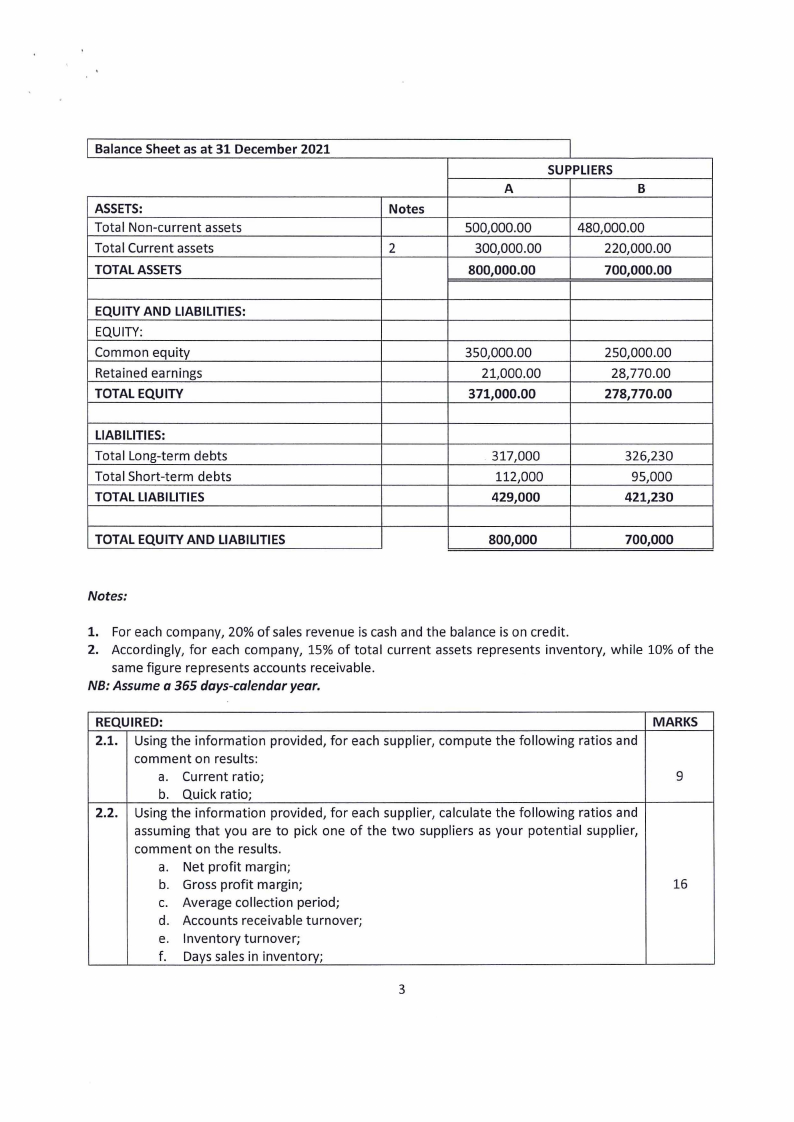

Balance Sheet as at 31 December 2021

ASSETS:

Total Non-current assets

Total Current assets

TOTAL ASSETS

EQUITY AND LIABILITIES:

EQUITY:

Common equity

Retained earnings

TOTAL EQUITY

LIABILITIES:

Total Long-term debts

Total Short-term debts

TOTAL LIABILITIES

TOTAL EQUITY AND LIABILITIES

Notes

2

SUPPLIERS

A

B

500,000.00

300,000.00

800,000.00

480,000.00

220,000.00

700,000.00

350,000.00

21,000.00

371,000.00

317,000

112,000

429,000

800,000

250,000.00

28,770.00

278,770.00

326,230

95,000

421,230

700,000

Notes:

1. For each company, 20% of sales revenue is cash and the balance is on credit.

2. Accordingly, for each company, 15% of total current assets represents inventory,

same figure represents accounts receivable.

NB: Assume a 365 days-calendar year.

while

10% of the

REQUIRED:

2.1. Using the information provided, for each supplier, compute the following ratios and

comment on results:

a. Current ratio;

b. Quick ratio;

2.2. Using the information provided, for each supplier, calculate the following ratios and

assuming that you are to pick one of the two suppliers as your potential supplier,

comment on the results.

a. Net profit margin;

b. Gross profit margin;

C. Average collection period;

d. Accounts receivable turnover;

e. Inventory turnover;

f. Days sales in inventory;

MARKS

9

16

3

|

4 Page 4 |

▲back to top |

I

I g. Debt ratio.

TOTAL MARKS

QUESTION 3

25

(15 MARKS, 27 MINUTES)

As a way of raising finance to finance capital projects, suppose your organization has issued a N$ 1 000

bond with a coupon rate of 10% per annum paid annually, and promises to pay back the principal in five

years. Suppose the current market interest rate on similar bonds is 10%.

REQUIRED: Carefully, answer the following questions:

3.1. Distinguish between a bond holder and bond issuer, and explain how your

organization is called in this transaction.

3.2. Compute the value of this bond today as per the given information, and state how

it is trading.

Suppose no change in the coupon rate. What would happen if:

3.3.

i. Current market interest rate increases by 10%.

ii. Current market interest rate decreases by 10%.

TOTAL MARKS FOR QUESTION 4

MARKS

2

4

9

15

4

|

5 Page 5 |

▲back to top |

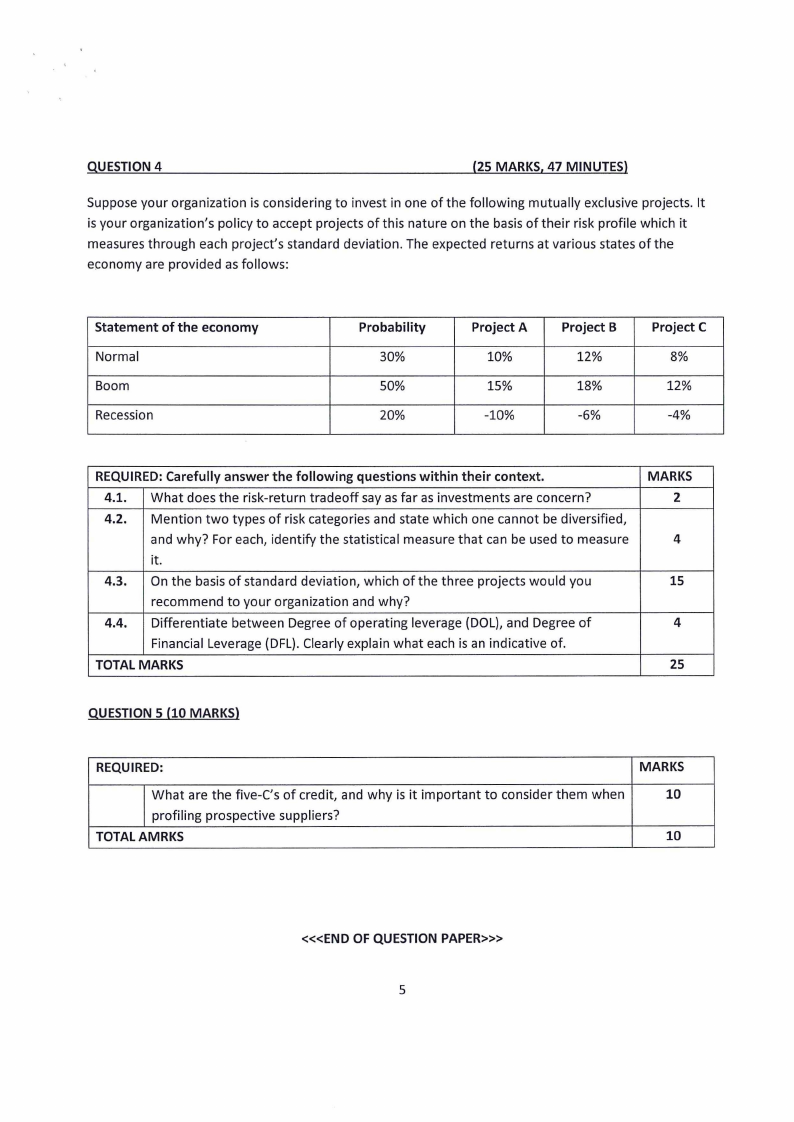

QUESTION 4

(25 MARKS, 47 MINUTES)

Suppose your organization is considering to invest in one of the following mutually exclusive projects. It

is your organization's policy to accept projects of this nature on the basis of their risk profile which it

measures through each project's standard deviation. The expected returns at various states of the

economy are provided as follows:

Statement of the economy

Normal

Boom

Recession

Probability

30%

50%

20%

Project A

10%

15%

-10%

Project B

12%

18%

-6%

Project C

8%

12%

-4%

REQUIRED: Carefully answer the following questions within their context.

4.1. What does the risk-return tradeoff say as far as investments are concern?

4.2. Mention two types of risk categories and state which one cannot be diversified,

and why? For each, identify the statistical measure that can be used to measure

it.

4.3. On the basis of standard deviation, which of the three projects would you

recommend to your organization and why?

4.4. Differentiate between Degree of operating leverage (DOL), and Degree of

Financial Leverage (DFL). Clearly explain what each is an indicative of.

TOTAL MARKS

MARKS

2

4

15

4

25

QUESTION 5 (10 MARKS)

REQUIRED:

MARKS

What are the five-C's of credit, and why is it important to consider them when

10

profiling prospective suppliers?

TOTALAMRKS

10

<«END OF QUESTION PAPER»>

5

|

6 Page 6 |

▲back to top |

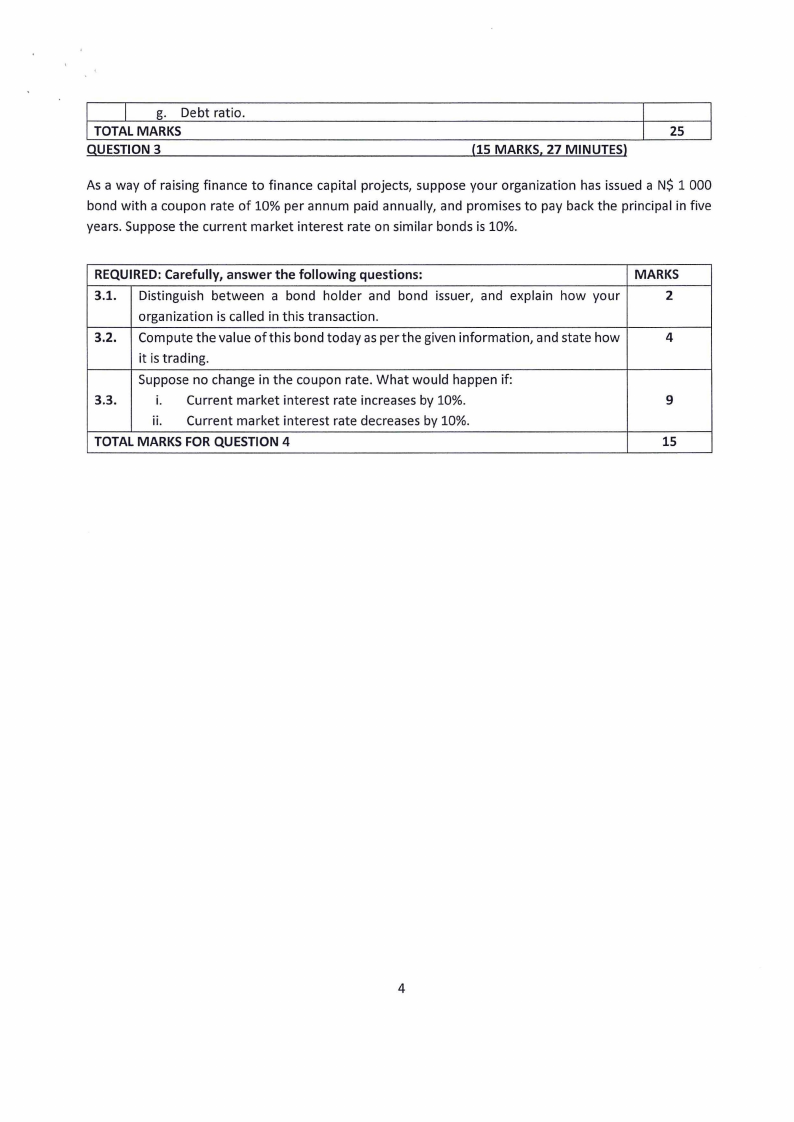

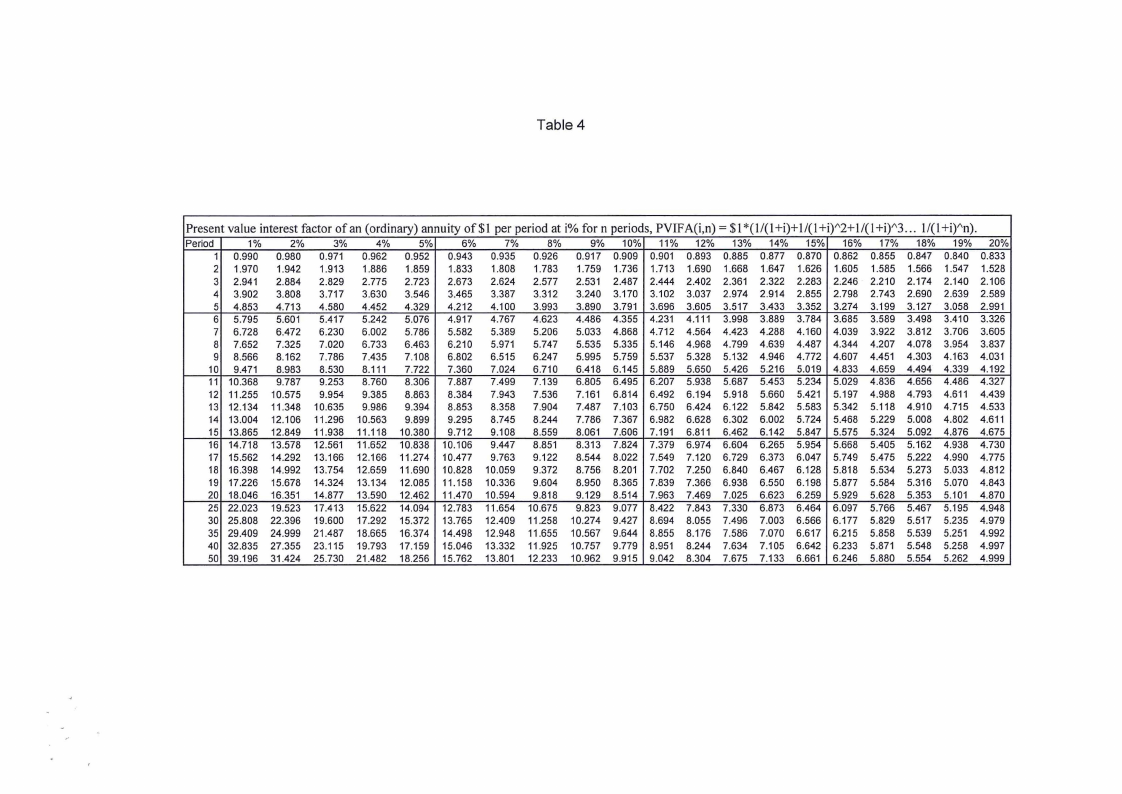

Table 4

Present value interest factor of an (ordinary) annuity of $1 per period at i% for n periods, PVIF A(i,n) = $1 *(1/(1 +i)+ 1/(1+i)1'2+ 1/(1+i)1'3... 1/(1+i)"n).

Period

1%

2%

3%

4%

5%

6%

7%

8%

9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20%

1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833

2 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.713 1.690 1.668 1.647 1.626 1.605 1.585 1.566 1.547 1.528

3 2.941

4 3.902

5 4.853

6 5.795

2.884

3.808

4.713

5.601

2.829

3.717

4.580

5.417

2.775

3.630

4.452

5.242

2.723

3.546

4.329

5.076

2.673

3.465

4.212

4.917

2.624

3.387

4.100

4.767

2.577

3.312

3.993

4.623

2.531

3.240

3.890

4.486

2.487

3.170

3.791

4.355

2.444

3.102

3.696

4.231

2.402

3.037

3.605

4.111

2.361

2.974

3.517

3.998

2.322

2.914

3.433

3.889

2.283

2.855

3.352

3.784

2.246

2.798

3.274

3.685

2.210

2.743

3.199

3.589

2.174

2.690

3.127

3.498

2.140

2.639

3.058

3.410

2.106

2.589

2.991

3.326

7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 4.423 4.288 4.160 4.039 3.922 3.812 3.706 3.605

8 7.652

9 8.566

10 9.471

7.325

8.162

8.983

7.020

7.786

8.530

6.733

7.435

8.111

6.463

7.108

7.722

6.210

6.802

7.360

5.971

6.515

7.024

5.747

6.247

6.710

5.535 5.335 5.146 4.968 4.799 4.639 4.487 4.344 4.207 4.078 3.954 3.837

5.995 5.759 5.537 5.328 5.132 4.946 4.772 4.607 4.451 4.303 4.163 4.031

6.418 6.145 5.889 5.650 5.426 5.216 5.019 4.833 4.659 4.494 4.339 4.192

11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 6.207 5.938 5.687 5.453 5.234 5.029 4.836 4.656 4.486 4.327

12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.492 6.194 5.918 5.660 5.421 5.197 4.988 4.793 4.611 4.439

13 12.134

14 13.004

15 13.865

11.348

12.106

12.849

10.635

11.296

11.938

9.986

10.563

11.118

9.394

9.899

10.380

8.853

9.295

9.712

8.358

8.745

9.108

7.904

8.244

8.559

7.487 7.103 6.750 6.424 6.122 5.842 5.583 5.342 5.118 4.910 4.715 4.533

7.786 7.367 6.982 6.628 6.302 6.002 5.724 5.468 5.229 5.008 4.802 4.611

8.061 7.606 7.191 6.811 6.462 6.142 5.847 5.575 5.324 5.092 4.876 4.675

16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 7.379 6.974 6.604 6.265 5.954 5.668 5.405 5.162 4.938 4.730

17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.549 7.120 6.729 6.373 6.047 5.749 5.475 5.222 4.990 4.775

18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.702 7.250 6.840 6.467 6.128 5.818 5.534 5.273 5.033 4.812

19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.839 7.366 6.938 6.550 6.198 5.877 5.584 5.316 5.070 4.843

20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 8.514 7.963 7.469 7.025 6.623 6.259 5.929 5.628 5.353 5.101 4.870

25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 8.422 7.843 7.330 6.873 6.464 6.097 5.766 5.467 5.195 4.948

30 25.808 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.694 8.055 7.496 7.003 6.566 6.177 5.829 5.517 5.235 4.979

35 29.409 24.999 21.487 18.665 16.374 14.498 12.948 11.655 10.567 9.644 8.855 8.176 7.586 7.070 6.617 6.215 5.858 5.539 5.251 4.992

40 32.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.951 8.244 7.634 7.105 6.642 6.233 5.871 5.548 5.258 4.997

50 39.196 31.424 25.730 21.482 18.256 15.762 13.801 12.233 10.962 9.915 9.042 8.304 7.675 7.133 6.661 6.246 5.880 5.554 5.262 4.999