|

GMA711S-MANAGEMENT ACCOUNTING310-2ND OPP JULY 2024 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEnCE AnD TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 07BOAC LEVEL: 7

COURSE CODE: GMA711S

COURSE NAME: MANAGEMENT ACCOUNTING 310

SESSION: JULY 2024

PAPER: THEORY AND CALCULATIONS

DURATION: 3 HOURS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS Lameck Odada; Labanus Nashinwe and Salmi Kasita

MOD ERA TOR Alfred Makosa

INSTRUCTIONS

1. This question paper consists of FOUR (4) Questions.

2. Answer ALL the FOUR (4) questions in blue or black ink only. NO PENCIL and TIPEX

3. Start each question on a new page, number the answers correctly and clearly.

4. Write clearly, neatly and show all your formulas, workings, and assumptions.

5. Unless otherwise stated, work with four (4) decimal places in all your calculations and

round off final answers only to two (2) decimal places.

6. Questions relating to this examination may be raised in the initial 30 minutes after the start

of the examination. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities, and any assumptions the candidate makes should be

clearly stated.

PERMISSIBLE MATERIALS

1. Silent, non-programmable calculators

THIS QUESTION PAPER CONSISTS OF _6_ PAGES (including this front page not tables)

|

2 Page 2 |

▲back to top |

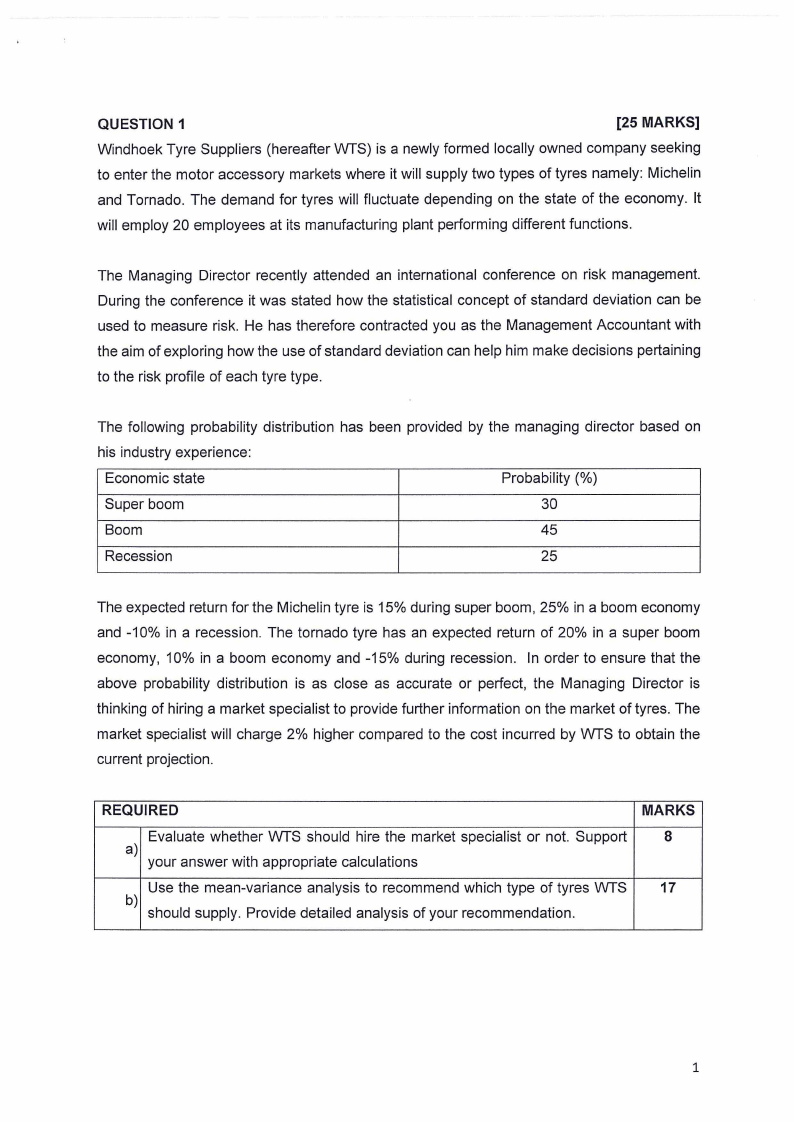

QUESTION 1

[25 MARKS]

Windhoek Tyre Suppliers (hereafter WTS) is a newly formed locally owned company seeking

to enter the motor accessory markets where it will supply two types of tyres namely: Michelin

and Tornado. The demand for tyres will fluctuate depending on the state of the economy. It

will employ 20 employees at its manufacturing plant performing different functions.

The Managing Director recently attended an international conference on risk management.

During the conference it was stated how the statistical concept of standard deviation can be

used to measure risk. He has therefore contracted you as the Management Accountant with

the aim of exploring how the use of standard deviation can help him make decisions pertaining

to the risk profile of each tyre type.

The following probability distribution has been provided by the managing director based on

his industry experience:

Economic state

Probability(%)

Super boom

30

Boom

45

Recession

25

The expected return for the Michelin tyre is 15% during super boom, 25% in a boom economy

and -10% in a recession. The tornado tyre has an expected return of 20% in a super boom

economy, 10% in a boom economy and -15% during recession. In order to ensure that the

above probability distribution is as close as accurate or perfect, the Managing Director is

thinking of hiring a market specialist to provide further information on the market of tyres. The

market specialist will charge 2% higher compared to the cost incurred by WTS to obtain the

current projection.

REQUIRED

MARKS

Evaluate whether WTS should hire the market specialist or not. Support

8

a)

your answer with appropriate calculations

Use the mean-variance analysis to recommend which type of tyres WTS 17

b)

should supply. Provide detailed analysis of your recommendation.

1

|

3 Page 3 |

▲back to top |

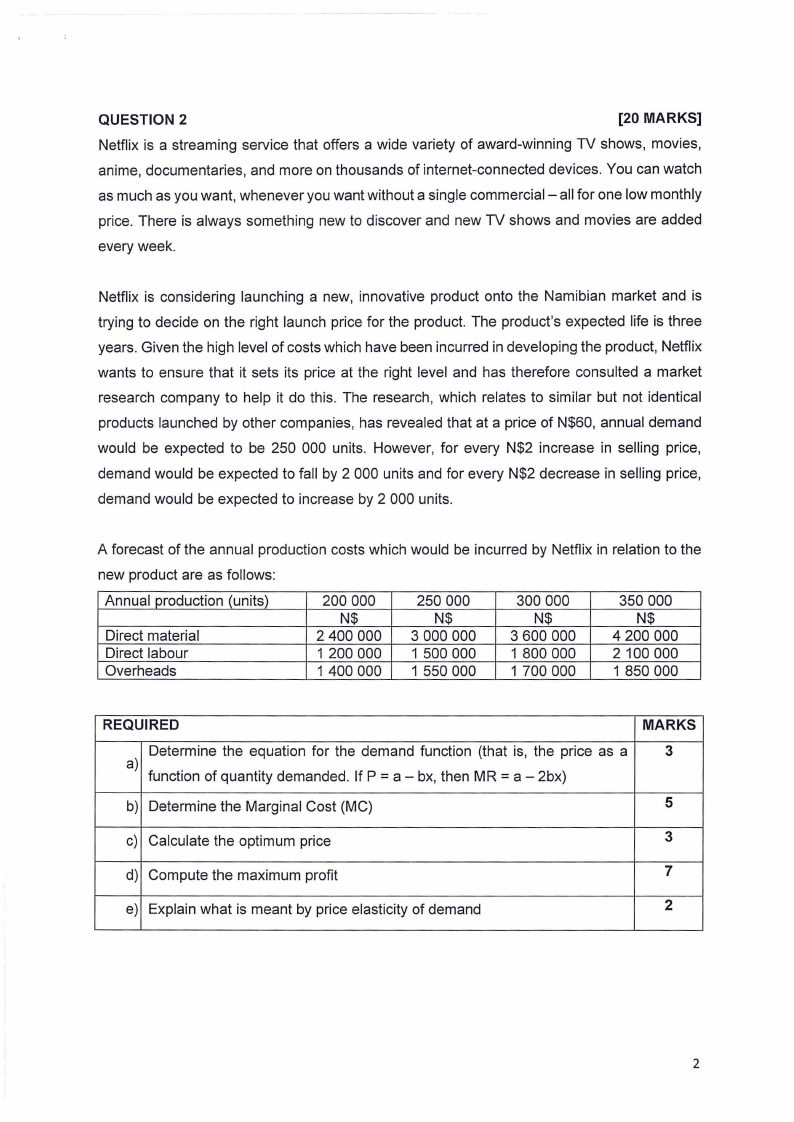

QUESTION 2

[20 MARKS]

Netflix is a streaming service that offers a wide variety of award-winning TV shows, movies,

anime, documentaries, and more on thousands of internet-connected devices. You can watch

as much as you want, whenever you want without a single commercial - all for one low monthly

price. There is always something new to discover and new TV shows and movies are added

every week.

Netflix is considering launching a new, innovative product onto the Namibian market and is

trying to decide on the right launch price for the product. The product's expected life is three

years. Given the high level of costs which have been incurred in developing the product, Netflix

wants to ensure that it sets its price at the right level and has therefore consulted a market

research company to help it do this. The research, which relates to similar but not identical

products launched by other companies, has revealed that at a price of N$60, annual demand

would be expected to be 250 000 units. However, for every N$2 increase in selling price,

demand would be expected to fall by 2 000 units and for every N$2 decrease in selling price,

demand would be expected to increase by 2 000 units.

A forecast of the annual production costs which would be incurred by Netflix in relation to the

new product are as follows:

Annual production (units)

Direct material

Direct labour

Overheads

200 000

N$

2 400 000

1 200 000

1 400 000

250 000

N$

3 000 000

1 500 000

1 550 000

300 000

N$

3 600 000

1 800 000

1 700 000

350 000

N$

4 200 000

2 100 000

1 850 000

REQUIRED

MARKS

Determine the equation for the demand function (that is, the price as a

3

= = a)

function of quantity demanded. If P a - bx, then MR a - 2bx)

b) Determine the Marginal Cost (MC)

5

c) Calculate the optimum price

3

d) Compute the maximum profit

7

e) Explain what is meant by price elasticity of demand

2

2

|

4 Page 4 |

▲back to top |

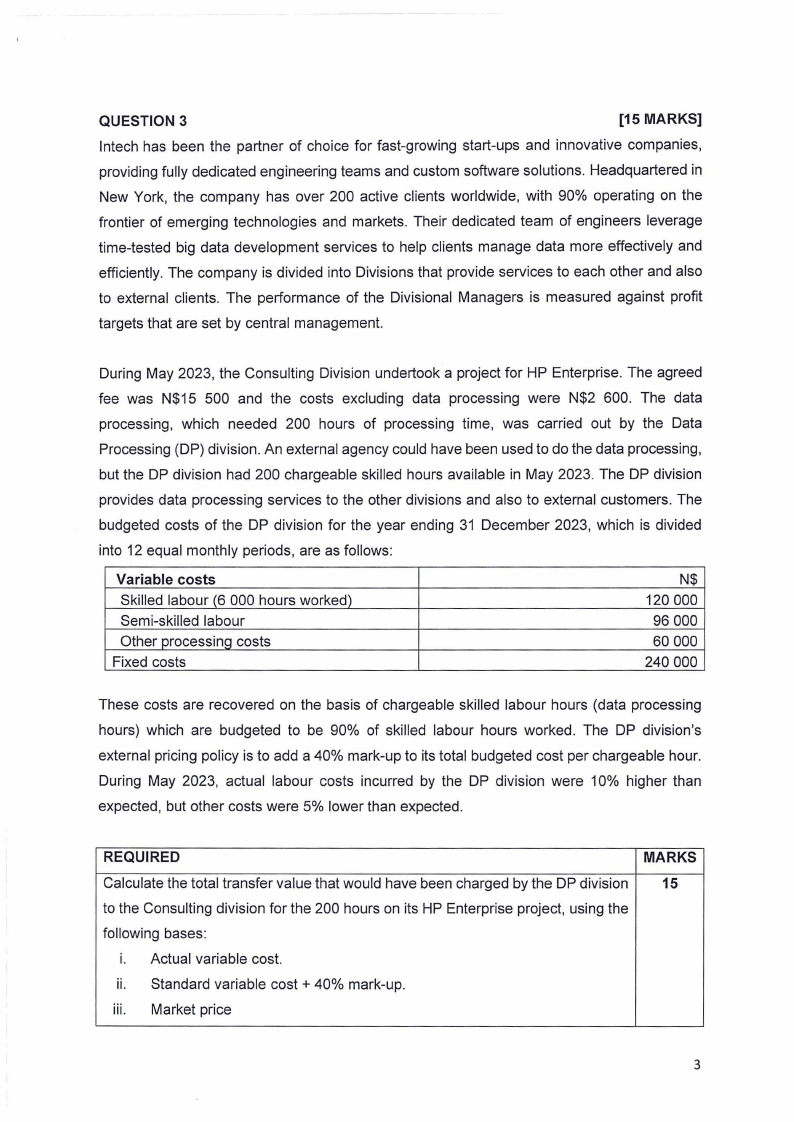

QUESTION 3

[15 MARKS]

lntech has been the partner of choice for fast-growing start-ups and innovative companies,

providing fully dedicated engineering teams and custom software solutions. Headquartered in

New York, the company has over 200 active clients worldwide, with 90% operating on the

frontier of emerging technologies and markets. Their dedicated team of engineers leverage

time-tested big data development services to help clients manage data more effectively and

efficiently. The company is divided into Divisions that provide services to each other and also

to external clients. The performance of the Divisional Managers is measured against profit

targets that are set by central management.

During May 2023, the Consulting Division undertook a project for HP Enterprise. The agreed

fee was N$15 500 and the costs excluding data processing were N$2 600. The data

processing, which needed 200 hours of processing time, was carried out by the Data

Processing (DP) division. An external agency could have been used to do the data processing,

but the DP division had 200 chargeable skilled hours available in May 2023. The DP division

provides data processing services to the other divisions and also to external customers. The

budgeted costs of the DP division for the year ending 31 December 2023, which is divided

into 12 equal monthly periods, are as follows:

Variable costs

Skilled labour (6 000 hours worked)

Semi-skilled labour

Other processinq costs

Fixed costs

N$

120 000

96 000

60 000

240 000

These costs are recovered on the basis of chargeable skilled labour hours (data processing

hours) which are budgeted to be 90% of skilled labour hours worked. The DP division's

external pricing policy is to add a 40% mark-up to its total budgeted cost per chargeable hour.

During May 2023, actual labour costs incurred by the DP division were 10% higher than

expected, but other costs were 5% lower than expected.

REQUIRED

Calculate the total transfer value that would have been charged by the DP division

to the Consulting division for the 200 hours on its HP Enterprise project, using the

following bases:

i. Actual variable cost.

ii. Standard variable cost + 40% mark-up.

iii. Market price

MARKS

15

3

|

5 Page 5 |

▲back to top |

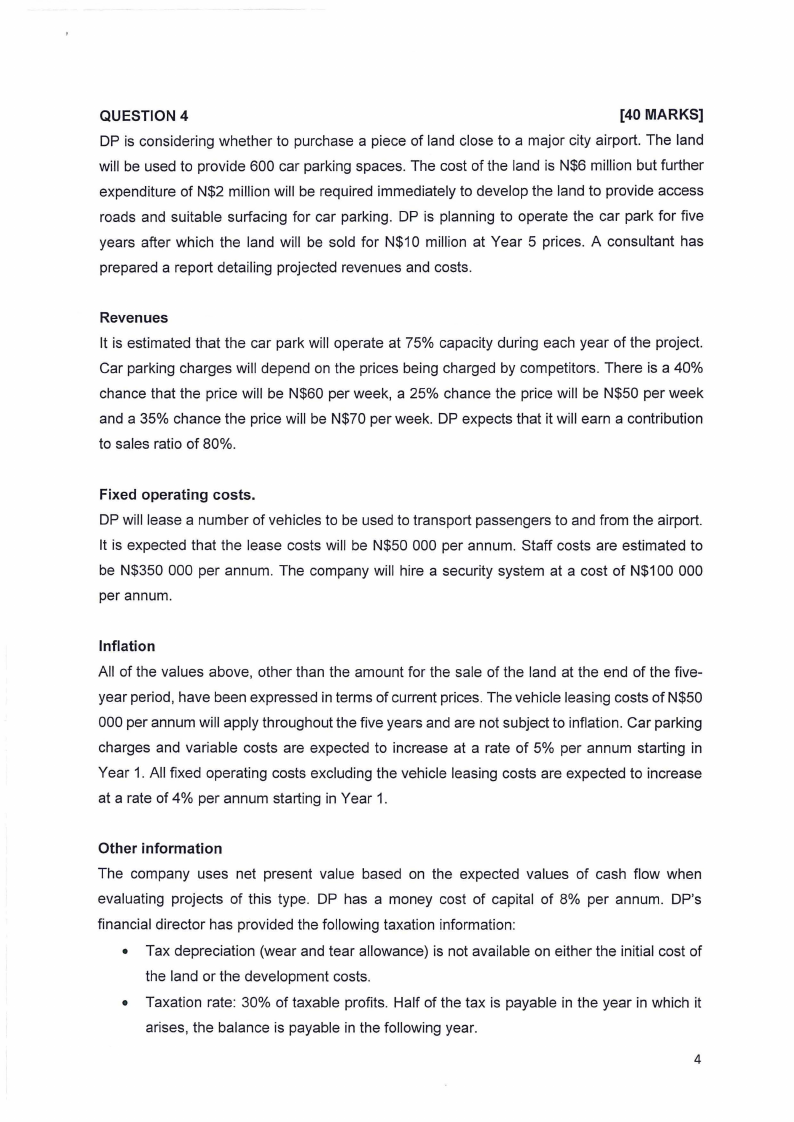

QUESTION 4

[40 MARKS]

DP is considering whether to purchase a piece of land close to a major city airport. The land

will be used to provide 600 car parking spaces. The cost of the land is N$6 million but further

expenditure of N$2 million will be required immediately to develop the land to provide access

roads and suitable surfacing for car parking. DP is planning to operate the car park for five

years after which the land will be sold for N$10 million at Year 5 prices. A consultant has

prepared a report detailing projected revenues and costs.

Revenues

It is estimated that the car park will operate at 75% capacity during each year of the project.

Car parking charges will depend on the prices being charged by competitors. There is a 40%

chance that the price will be N$60 per week, a 25% chance the price will be N$50 per week

and a 35% chance the price will be N$70 per week. DP expects that it will earn a contribution

to sales ratio of 80%.

Fixed operating costs.

DP will lease a number of vehicles to be used to transport passengers to and from the airport.

It is expected that the lease costs will be N$50 000 per annum. Staff costs are estimated to

be N$350 000 per annum. The company will hire a security system at a cost of N$100 000

per annum.

Inflation

All of the values above, other than the amount for the sale of the land at the end of the five-

year period, have been expressed in terms of current prices. The vehicle leasing costs of N$50

000 per annum will apply throughout the five years and are not subject to inflation. Car parking

charges and variable costs are expected to increase at a rate of 5% per annum starting in

Year 1. All fixed operating costs excluding the vehicle leasing costs are expected to increase

at a rate of 4% per annum starting in Year 1.

Other information

The company uses net present value based on the expected values of cash flow when

evaluating projects of this type. DP has a money cost of capital of 8% per annum. DP's

financial director has provided the following taxation information:

• Tax depreciation (wear and tear allowance) is not available on either the initial cost of

the land or the development costs.

• Taxation rate: 30% of taxable profits. Half of the tax is payable in the year in which it

arises, the balance is payable in the following year.

4

|

6 Page 6 |

▲back to top |

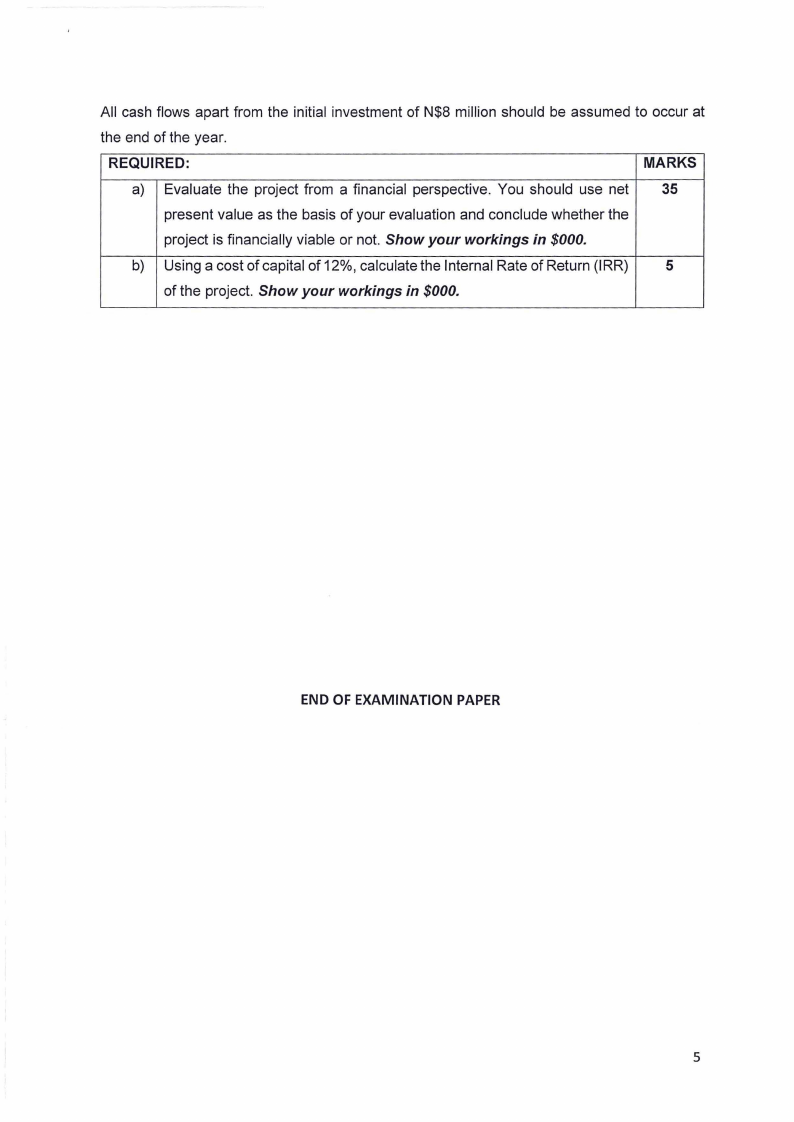

All cash flows apart from the initial investment of N$8 million should be assumed to occur at

the end of the year.

REQUIRED:

MARKS

a) Evaluate the project from a financial perspective. You should use net 35

present value as the basis of your evaluation and conclude whether the

project is financially viable or not. Show your workings in $000.

b) Using a cost of capital of 12%, calculate the Internal Rate of Return (IRR)

5

of the project. Show your workings in $000.

END OF EXAMINATION PAPER

5

|

7 Page 7 |

▲back to top |

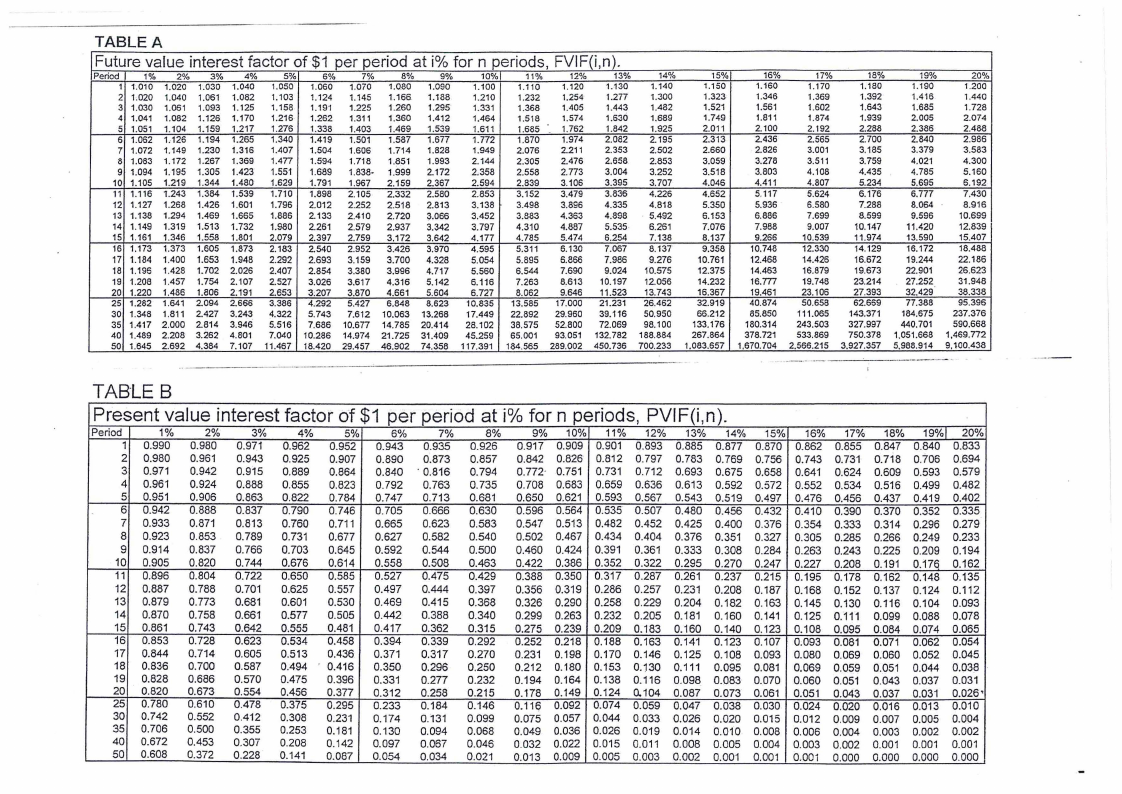

TABLE A

Future value interest factor of $1 per period at io/ofor n periods, FVIF(i,n).

Period

1

2

3

4

5

6

7

8

9

10

11

1%

1.010

1.020

1.030

1.041

1.051

1.062

1.072

1.083

1.094

1.105

1.116

2%

1.020

1.040

1.061

1.082

1.104

1,126

1.149

1.172

1.195

1.219

1.243

3%

1.030

1.061

1.093

1.126

1.159

1.194

1.230

1.267

1.305

1.344

1.384

4%

1.040

1.082

1.125

1,170

1.217

1.265

1.316

1.369

1.423

1.480

1.539

5%

1.050

1.103

1.158

1.216

1.276

1.340

1.407

1.477

1.551

1.629

1.710

6%

1.060

1.124

1.191

1.262

1.338

1.419

1.504

1.594

1.689

1.791

1.898

7%

1.070

1.145

1.225

1.311

1.403

1.501

1.606

1.718

1.838-

1.967

2.105

8%

1.0.80

1.166

1.260

1.360

1.469

1.587

1.714

1.851

1.999

2.159

2.332

9%

1.090

1.188

1.295

1,412

1.539

1.677

1.828

1.993

2.172

2.367

2.580

10%

1.100

1.210

1.331

1.464

1.611

1.772

1.949

2.144

2.358

2.594

2.853

11%

12%

1.110

1.120

1.232 1.254·

1.368 1.405

1.518 1,574

1.685 ·_ 1.762

1.870 1.974

2.076 2.211

2.305 2.476

2.558 2.773

2.839 3.106

3.152 3.479

13%

1.-130

1.277

1.443

1.630

1.842

2.082

2.353

2.658

3,004

3.395

3.836

14%

1.140

1.300

1,482

1.689

1.925

2.195

2.502

2.853

3.252

3.707

4.226

12 1.127

13 1.138

14 1.149

15 1.161

16 1.173

17 1.184

18 1.196

19 1.208

20 1.220

25 1.282

30 1.348

35 1.417

40 1.489

so 1.645

1.268

1.294

1.319

1.346

1.373

1.400

1.428

1.457

1.486

1.641

1.811

2.000

2.208

2.692

1.426

1.469

1.513

1.558

1.605

1.653

1.702

1.754

1.806

2.094

2.427

2.814

3.262

4.384

1.601

1.665

1.732

1.801

1.873

1.948

2.026

2.107

2.t91

2.666

3.243

3.946

4.801

7.107

1.796

1.886

1.980

2.079

2.183

2.292

2.407

2.527

2.653

3.386

4.322

5.516

7,040

11.467

2.012

2.133

2.261

2.397

2.540

2.693

2.854

3.026

3:207

4.-292

5.743

7.686

10.286

18.420

2.252

2.410

2.579

2.759

2.952

3.159

3.380

3.617

3.870

5.427

7.612

10.677

14.974

29.457

2.518

2.720

2.937

3.172

3.426

3.700

3.996

4.316

4.661

6.848

10.063

14.785

21.725

46.902

2.813

3.066

3.342

3.642

3.970

4.328

4.717

5.142

5,604

8.623

13.268

20.414

31.409

74,358

3.138

3.452

3.797

4.177

4.595

5.054

5.560

6.116

6.727

10.835

17.449

28.102

45.259

117.391

3.498

3.883

4.310

4.785

5.311

5.895

6.544

7.263

8.062

13.585

22.892

38.575

65.001

184.565

3.896

4.363

4.887

5.474

6.130

6.866

7.690

8.613

9.646

17.000

29.960

52.800

93,051

289.002

4.335

4.898

5.535

6.254

7.067

7.986

9.024

10.197

11.523

21.231

39.116

72.069

132.782

450.736

4.818

5.492

6.261

7.138

8.137

9.276

10.575

12.056

13.743

26.462

50.950

98.100

188.884

700.233

15%

1.150

1.323

1.521

1.749

2.011

2.313

2.660

3.059

3.518

4.046

4.652

5.350

6.153

7.076

8.137

9.358

10.761

12.375

14.232

16.367

32.919

66.212

133.176

267.864

1.083.657

16%

17%

18%

19%

1.160

1.170

1.180

1.190

1.346

1.369

1.392

1.416

1.561

1.602

1.643

1.685

1.811

1.874

1.939

2.005

2.100

2.192

2.288

2.386

2.436

2.565

2.700

2.840

2.826

3.001

3.185

3,379

3.278

3.511

3.759

4.021

3.803

4.108

4.435

4.785

4.411

4.807

5.234

5.695

5.117

5.624

6.176

6.777

5.936

6.580

7.288

8.064

6.886

7.699

8.599

9.596

7.988

9.007

10.147

11.420

9.266

10.539

11.974

13.590

10.748

12.330

14.129

16.172

12.468

14.426

16.672

19.244

14.463

16.879

19.673

22.901

16.m

19.748

23.214

27.252

19.461

23.106

27.393

32.429

40,874

50,658

62.669

77.388

85.850 111.065 143.371 184.675

180.314 243.503 327.997 440.701

378.721 533.869 750.378 1.051.668

1,670.704 2.566.215 3.927.357 5,988.914

20%

1.200

1.440

1.728

2.074

2.488

2.986

3.583

4.300

5.160

6.192

7.430

8.916

10.699

12.839

15.407

18.488

22.186

26.623

31.948

38.338

95.396

237.376

590.668

1,469.772

9,100.438

TABLE B

Present value interest factor of $1 per period at io/ofor n periods, PVIF(i,n).

Period

1%

2%

3%

4%

5%

6%

7%

8%

9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19%1 20%

1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833

2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694

3 0.971

4 0.961

5 0.951

6 0.942

7 0.933

0.942

0.924

0.906

0.888

0.871

0.915

0.888

0.863

0.837

0.813

0.889

0.855

0.822

0.790

0.760

0.864

0.823

0.784

0.746

0.711

0.840

0.792

0.747

0.705

0.665

· 0.816

0.763

0.713

0.666

0.623

0.794

0.735

0.681

0.630

0.583

0.772

0.708

0.650

0.596

0.547

0.751

0.683

0.621

0.564

0.513

0.731

0.659

0.593

0.535

0.482

0.712

0.636

0.567

0.507

0.452

0.693

0.613

0.543

0.480

0.425

0.675

0.592

0.519

0.456

0.400

0.658

0.572

0.497

0.432

0.376

0.641

0.552

0.476

0.410

0.354

0.624

0.534

0.456

0.390

0.333

0.609

0.516

0.437

0.370

0.314

0.593

0.499

0.419

0.352

0.296

0.579

0.482

0.402

0.335

0.279

8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233

9 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194

10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162

11 0.896

12 0.887

13 0.879

14 0.870

15 0.861

16 0.853

17 0.844

18 0.836

19 0.828

20 0.820

25 0.780

30 0.742

35 0.706

40 0.672

50 0.608

0.804

0.788

0.773

0.758

0.743

0.728

0.714

0.700

0.686

0.673

0.610

0.552

0.500

0.453

0.372

0.722

0.701

0.681

0.661

0.642

0.623

0.605

0.587

0.570

0.554

0.478

0.412

0.355

0.307

0.228

0.650

0.625

0.601

0.577

0.555

0.534

0.513

0.494

0.475

0.456

0.375

0.308

0.253

0.208

0.141

0.585

0.557

0.530

0.505

0.481

0.458

0.436

' 0.416

0.396

0.377

0.295

0.231

0.181

0.142

0.087

0.527

0.497

0.469

0.442

0.417

0.394

0.371

0.350

0.331

0.312

0.233

0.174

0.130

0.097

0.054

0.475

0.444

0.415

0.388

0.362

0.339

0.317

0.296

0.277

0.258

0.184

0.131

0.094

0.067

0.034

0.429

0.397

0.368

0.340

0.315

0.292

0.270

0.250

0.232

0.215

0.146

0.099

0.068

0.046

0.021

0.388

0.356

0.326

0.299

0.275

0.252

0.231

0.212

0.194

0.178

0.116

0.075

0.049

0.032

0.013

0.350

0.319

0.290

0.263

0.239

0.218

0.198

0.180

0.164

0.149

0.092

0.057

0.036

0.022

0.009

0.317

0.286

0.258

0.232

0.209

0.188

0.170

0.153

0.138

0.124

0.074

0.044

0.026

0.015

0.005

0.287

0.257

0.229

0.205

0.183

0.163

0.146

0.130

0.116

0.104

0.059

0.033

0.019

0.011

0.003

0.261

0.231

0.204

0.181

0.160

0.141

0.125

0.111

0.098

0.087

0.047

0.026

0.014

0.008

0.002

0.237

0.208

0.182

0.160

0.140

0.123

0.108

0.095

0.083

0.073

0.038

0.020

0.010

0.005

0.001

0.215

0.187

0.163

0.141

0.123

0.107

0.093

0.081

0.070

0.061

0.030

0.015

0.008

0.004

0.001

0.195

0.168

0.145

0.125

0.108

0.093

0.080

0.069

0.060

0.051

0.024

0.012

0.006

0.003

0.001

0.178

0.152

0.130

0.111

0.095

0.081

0.069

0.059

0.051

0.043

0.020

0.009

0.004

0.002

0.000

0.162

0.137

0.116

0.099

0.084

0.071

0.060

0.051

0.043

0.037

0.016

0.007

0.003

0.001

0.000

0.148

0.124

0.104

0.088

0.074

0.062

0.052

0.044

0.037

0.031

0.013

0.005

0.002

0.001

0.000

0.135

0.112

0.093

0.078

0.065

0.054

0.045

0.038

0.031

0.026•

0.010

0.004

0.002

0.001

0.000

|

8 Page 8 |

▲back to top |

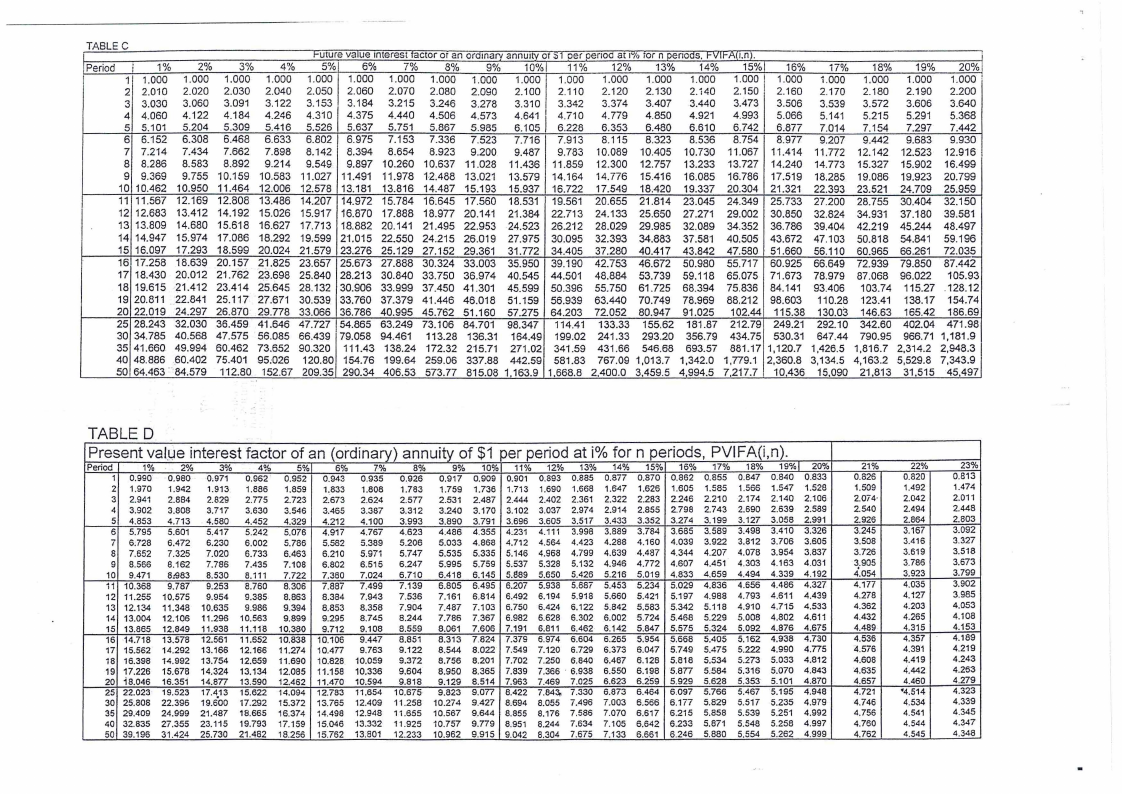

TABLE C

f-uture value interest Tactor OTan oramarv annu1tv OT:.1, oer oenoo at 11/0ror n oenoos. r-1/lf-All.m.

Period

I

I

1%

2%

3%

4~{,

5%1 6%

7%

8%

9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20%

1 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1,000 1.000 1.000

2 2.010 2.020 2.030 2.040 2.050 2.060 2.070 2.080 2.090 2.100 2.110 2.120 2.130 2.140 2.150 2.160 2.170 2.180 2.190 2.200

3 3.030 3.060 3.091 3.122 3.153 3.184 3.215 3.246 3.278 3.310 3.342 3.374 3.407 3.440 3.473 3.506 3,539 3.572 3.606 3.640

4 4.060 4.122 4.184 4.246 4.310 4.375 4.440 4.506 4.573 4.641 4.710 4.779 4.850 4.921 4.993 5.066 5.141 5.215 5.291 5.368

5 5.101 5.204 5.309 5.416 5.526 5.637 5.751 5.867 5.985 6.105 6.228 6.353 6.480 6.610 6,742 6.877 7.014 7.154 7.297 7.442

6 6.152 6.308 6.468 6.633 6.802 6.975 7.153 7.336 7.523 7.716 7.913 8.115 8.323 8.536 8.754 8.977 9.207 9.442 9.683 9.930

7 7.214 7.434 7.662 7.898 8.142 8.394 8.654 8.923 9.200 9.487 9.783 10.089 10.405 10.730 11.067 11.414 11.772 12.142 12.523 12.916

8 8.286 8.583 8.892 9.214 9.549 9.897 10.260 10.637 11.028 11.436 11.859 12.300 12.757 13.233 13.727 14.240 14.773 15.327 15.902 16.499

9 9.369 9.755 10.159 10.583 11.027 11.491 11.978 12.488 13.021 13.579 14.164 14.776 15.416 16.085 16.786 17.519 18.285 19.086 19.923 20.799

10 10.462 10.950 11.464 12.006 12.578 13.181 13.816 14.487 15.193 15.937 16.722 17.549 18.420 19.337 20.304 21.321 22.393 23.521 24.709 25.959

11 11.567 12.169 12.808 13.486 14.207 14.972 15.784 16.645 17.560 18.531 19.561 20.655 21.814 23.045 24.349 25.733 27.200 28.755 30.404 32.150

12 12.683 13.412 14.192 15.026 15.917 16.870 17.888 18.977 20.141 21.384 22.713 24.133 25.650 27.271 29.002 30.850 32.824 34.931 37.180 39.581

13 13.809 14.680 15.618 16.627 17.713 18,882 20.141 21 .495 22.953 24.523 26.212 28.029 29.985 32.089 34.352 36.786 39.404 42.219 45.244 48.497

14 14.947 15.974 17.086 18.292 19.599 21.015 22.550 24.215 26.019 27.975 30.095 32.393 34.883 37.581 40.505 43,672 47.103 50.818 54.841 59.196

15 16.097 17,293 18.599 20.024 21.579 23.276 25.129 27.152 29.361 31.772 34.405 37.280 40.417 43.842 47.580 51.660 56.110 60.965 66.261 72.035

16 17.258 18.639 20.157 21.825 23.657 25.673 27.888 30.324 33.003 35.950 39.190 42.753 46.672 50.980 55,717 60.925 66.649 72.939 79.850 87.442

17 18.430 20.012 21.762 ~3.698 25.840 28.213 30.840 33.750 36.974 40.545 44.501 48,884 53.739 59.118 65.075 71,673 78.979 87.068 96.022 105.93

18 19.615 21.412 23.414 25.645 28.132 30.906 33.999 37.450 41.301 45.599 50.396 55.750 61.725 68.394 75,836 84.141 93.406 103.74 115.27 .128.12

19 20.811 22.841 25.117 27.671 30.539 33.760 37.379 41.446 46.018 51.159 56.939 63.440 70.749 78.969 88.212 98.603 110.28 123.41 138.17 154.74

20 22,019 24.297 26.870 29.778 33.066 36.786 40.995 45.762 51.160 57.275 64.203 72.052 80.947 91.025 102.44 115.38 130.03 146.63 165.42 186.69

25 28.243 32.030 36.459 41.646 47.727 54.865 63.249 73.106 84.701 98.347 114.41 133.33 155.62 181.87 212.79 249.21 292,10 342.60 402.04 471.98

30 34.785 40.568 47.575 56.085 66.439 79.058 94.461 113.28 136.31 164.49 199.02 241.33 293.20 356.79 434.75 530.31 647.44 790.95 966.71 1,181.9

35 41.660 49.994 60.462 73.652 90.320 111.43 138.24 172.32 215.71 271.02 341.59 431.66 546.68 693.57 881.17 1,120.7 1,426.5 1,816.7 2,314.2 2,948.3

40 48.886 60.402 75.401 95:026 120.80 154.76 199.64 259.06 337.88 442.59 581.83 767.09 1,013.7 1,342.0 1,779.1 2,360.8 3,134.5 4,163.2 5,529.8 7,343.9

50 64.463. 84.579 112.80 152.67 209.35 290.34 406.53 573.77 815.08 1,163.9 1,668.8 2,400.0 3.459.5 4,994.5 7,217.7 10.436 15,090 21,813 31,515 45.497

TABLED

Present valJ,Jeinterest factor of an (ordinary) annuity of $1 per period at i% for n periods, PVIFA(i,n).

Period

1%

1 0,990

2 1.970

3 2.941

4 3.902

5 4.853

6 5,795

7 6:728

s 7,652

9 8.566

10 9.471

11 10,368

12 11.255

13 12.134

14 13.0.04

15 13.865

16 14.718

17 15.562

18 16.398

19 17,226

20 18.046

25 22.023

30 25.808

2%

0.980

1.942

2.884

3,808

4.713

5.601

6.472

7.325

8.162

8&383

9.787

10.575

11.348

12.106

12.849

13,578

14.292

14.992

15.678

16.351

19.523

22.396

3%

0,971

1.913

2.829

3.717

4.580

5.417

6.230

7.020

7.786

8.530

9.253

9.954

10.635

11.296

11.938

12.561

13.166

13.754

14.324

14.877

17.413

19.600

4%

0.962

1.886

2.n5

3,630

4.452

5.242

6.002

6.733

7.435

8,111

8.760

9,385

9.986

10.563

11.118

11.652

12.166

12.659

13.134

13.590

15.622

17.292

5%

0.952

1,859

2.723

3.546

4.329

5,076

5.786

6.463

7.108

7.722

8.306

8.863

9.394

9.899

10.380

10,838

11.274

11.690

12.085

12.462

14.094

15.372

6%

0.943

1.833

2.673

3.465

4.212

4.917

5.562

6.210

6.802

7.360

7.887

8.384

8.853

9.295

9.712

10.106

10.477

10.828

11.158

11.470

12.783

13.765

7-%

8%

0.935 0.926

1.808 1.783

2,624 2.577

3.387 3.312

4.100 3.993

4.767 4.623

5.389 5.206

5.971 5,747

6.515 6.247

7.024 6.710

7.499 7.139

7,943 7.536

8,358 7.904

8,745 8.244

9,108 8.559

9.447 8.851

9.763 9.122

10.059 9.372

10.336 9.604

10.594 9.818

11,654 10.675·

12.409 11.258

9%

0.917

1.759

2.531

3.240

3.890

4.486

5.033

5.535

5.995

6.418

6.805

7.161

7.487

7.786

8.061

8.313

8.544

8,756

8.950

9.129

9.823

10.274

10%

0.909

1.736

2.487

3.170

3,791

4.355

4.868

5,335

5.759

6.145

6.495

6.814

7.103

7.367

7.606

7.824

8.022

8.201

8.365

8.514

9.on

9.427

11% 12% 13%

0.901 0,893 0.885

1.713 1,690 1.668

2.444 2.402 2.361

3.102 3,037 2.974

3.696 3.605 3,517

4.231 4,111 3.998

4.712 4.564 4.423

5.146 4,968 4.799

5.537 5.328 5.132

5.889 5.650 5.426

6.207 5.938 5.667

6.492 6.194 5.918

6.750 6.424 6.122

6.982 6.628 6.302

7.191 6.811 6.462

7.379 6.974 6.604

7,549 7.120 6.729

7.702 7.250 6.840

7,839 7 .366 · 6.938

7.963 7.469 7.025

8.422 7.843, 7.330

8,694 8.055 7.496

14%

0,877

1.647

2.322

2.914

3.433

3.889

4.288

4.639

4.946

5.216

5.453

5.660

5,842

6.002

6.142

6,265

6,373

6.467

6.550

6.623

6.873

7.003

15%

0.870

1.626

2.283

2.855

3.352

3.784

4,160

4,487

4.772

5.019

5,234

5.421

5.583

5.724

5.847

5.954

6.047

6.128

6.198

6.259

6.464

6.566

16%

0.862

1,605

2.246

2.798

3.274

3,685

4.039

4.344

4.607

4.8.33

5.029

5.197

5.342

5.468

5.575

5.668

5,749

5.818

5.8n

5.929

6.097

6,177

17%

0,855

1.585

2.210

2.743

3.199

3.589

3.922

4.207

4.451

4.659

4.836

4.988

5.118

5.229

5.324

5.405

5.475

5.534

5.584

5.628

5.766

5.829

18%

0.847

1.566

2.174

2.690

3,127

3.498

3.812

4,078

4.303

4.494

4,656

4.793

4.910

5.008

5.092

5.162

5.222

5.273

5.316

5.353

5.467

5.517

19%1 20%

0.840 0.833

1.547 1.528

2.140 2.106

2.639 2.589

3.058 2.991

3.410 3,326

3,706 3.605

3.954 3.837

4.163 4.031

4.339 4.192

4.486 4.327

4,611 4.439

4.715 4,533

4.802 4.611

4.876 4.675

4.938 4,730

4.990 4.775

5.033 4.812

5.070 4,843

5.101 4,870

5.195 4.948

5.235 4,979

35 29.409 24.999 21.487 18,665 16.374 14.498 12.948 11.655 10.567 9.644 8,855 8.176 7.586 7.070 6.617 6.215 5,858 5.539 5.251 4.992

40 32.835 27.355 23.115 19.793 17.159 15,046 13.332 11.925 10.757 9.TT9 8,951 8.244 7.634 7,105 6.642 6.233 5.871 5.548 5.258 4.997

50 39.196 31.424 25.730 21.482 18,256 15,762 13,801 12.233 10,962 9,915 9,042 8.304 7.675 7.133 6.661 6.246 5.880 5,554 5,262 4.999

21%

0.826

1.509

2.074·

2.540

2.926

3.245

3.508

3.726

3,905

4,054

4.177

4.278

4.362

4.432

4.489

4.536

<1.576

4.608

'4,635

4.657

4.721

4.746

4,756

4.760

4.762

22%

0.820

1.492

2.042

2.494

2.864

3.167

3.416

3.619

3.786

3.923

4.035

4.127

4.203

4.265

4.315

4.357

4.391

4.419

4,442

4.460

'4.514

4.534

4.541

4,544

4,545

23%

0.813

1.474

2.011

2.448

2.803

3.092

3.327

3.518

3.673

3.799

3.902

3.985

4.053

4.108

4.153

4.189

4.219

4,243

4.263

4.279

4,323

4.339

4.345

4.347

4,348