|

FMA721S - FINANCIAL MANAGEMENT FOR AGRICULTURE - 1ST OPP - NOV 2022 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVE RS ITY

OF SCIEnCE Ano TECHnOLOGY

FACULTYOF HEALTH, NATURAL RESOURCESAND APPLIED SCIENCES

DEPARTMENT OF AGRICULTURE AND NATURAL RESOURCES SCIENCES

QUALIFICATION: BACHELOROF SCIENCEIN AGRICULTURE

QUALIFICATION CODE:

07BAGA

COURSECODE: FMA720S

LEVEL: 7

COURSENAME: FINANCIAL MANAGEMENT

FOR AGRICULTURE

DATE: NOVEMBER 2022

DURATION: 3 HOURS

MARKS: 100

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER(S}

M LUBINDA

MODERATOR:

S KALUNDU

INSTRUCTIONS

1. Answer ALL the questions.

2. Write clearly and neatly.

3. Number the answers clearly.

PERMISSIBLE MATERIALS

1. Examination question paper

2. Answering book

3. Calculator

THIS QUESTION PAPERCONSISTSOF 5 PAGES(Excluding this front page)

|

2 Page 2 |

▲back to top |

Financial Management

FMA720S

QUESTION ONE

a. Briefly explain the methods that used to prorate the value of an asset over its economic

useful life.

b. Consider a tractor whose purchasing cost, terminal value, and useful life are N$150,000,

N$50,000, and 10 years. Using the straight-line depreciation method, estimate the book

value of the tractor at the end of the fifth year.

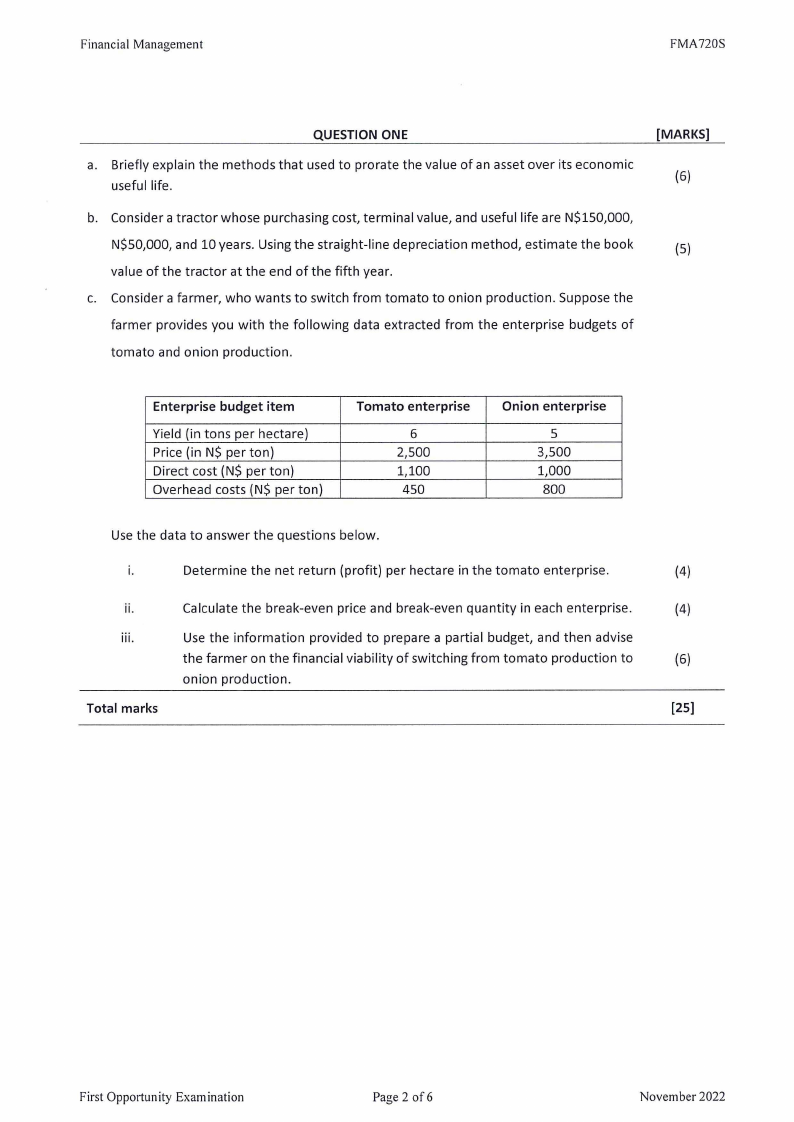

c. Consider a farmer, who wants to switch from tomato to onion production. Suppose the

farmer provides you with the following data extracted from the enterprise budgets of

tomato and onion production.

[MARKS]

(6)

(5)

Enterprise budget item

Yield (in tons per hectare)

Price (in N$ per ton)

Direct cost (N$ per ton)

Overhead costs (N$ per ton)

Tomato enterprise

6

2,500

1,100

450

Onion enterprise

5

3,500

1,000

800

Use the data to answer the questions below.

i.

Determine the net return (profit) per hectare in the tomato enterprise.

(4)

ii.

Calculate the break-even price and break-even quantity in each enterprise.

(4)

iii.

Use the information provided to prepare a partial budget, and then advise

the farmer on the financial viability of switching from tomato production to

(6)

onion production.

Total marks

[25)

First Opportunity Examination

Page2 of6

November 2022

|

3 Page 3 |

▲back to top |

Financial Management

FMA720S

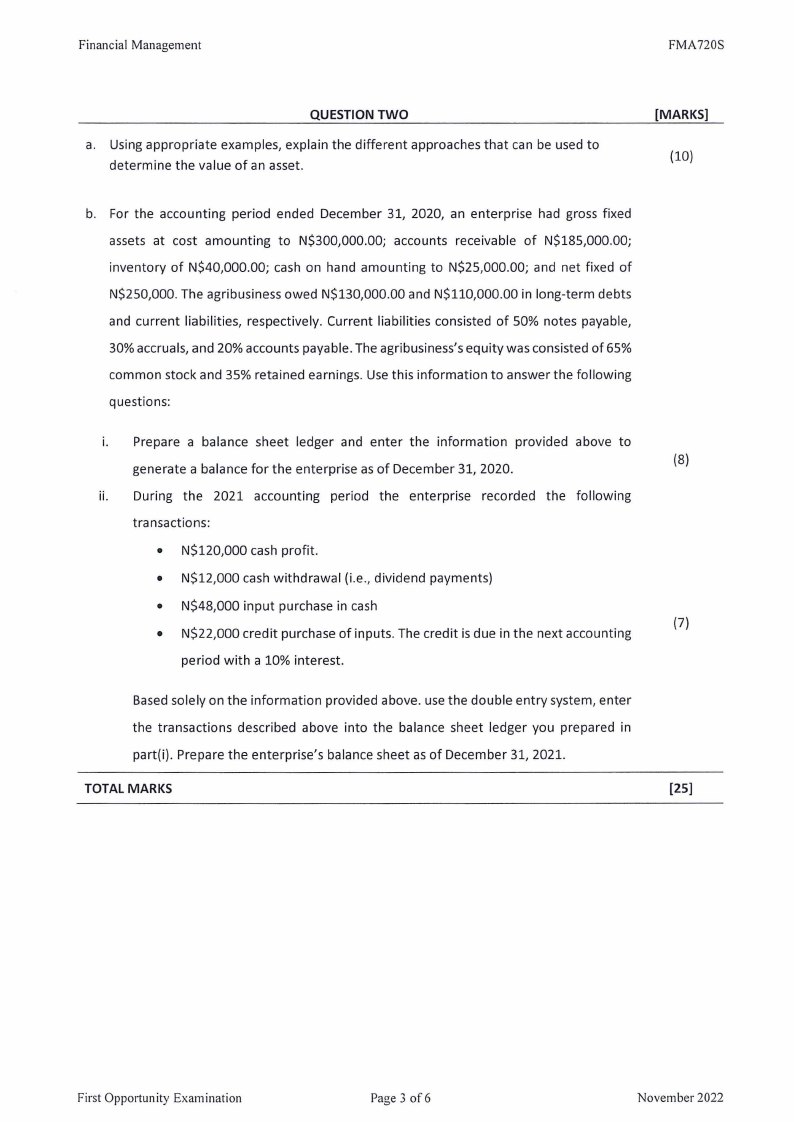

QUESTION TWO

a. Using appropriate examples, explain the different approaches that can be used to

determine the value of an asset.

[MARKS]

(10)

b. For the accounting period ended December 31, 2020, an enterprise had gross fixed

assets at cost amounting to N$300,000.00; accounts receivable of N$185,000.00;

inventory of N$40,000.00; cash on hand amounting to N$25,000.00; and net fixed of

N$250,000. The agribusiness owed N$130,000.00 and N$110,000.00 in long-term debts

and current liabilities, respectively. Current liabilities consisted of 50% notes payable,

30% accruals, and 20% accounts payable. The agribusiness's equity was consisted of 65%

common stock and 35% retained earnings. Use this information to answer the following

questions:

i. Prepare a balance sheet ledger and enter the information provided above to

generate a balance for the enterprise as of December 31, 2020.

(8)

ii. During the 2021 accounting period the enterprise recorded the following

transactions:

• N$120,000 cash profit.

• N$12,000 cash withdrawal (i.e., dividend payments)

• N$48,000 input purchase in cash

(7)

• N$22,000 credit purchase of inputs. The credit is due in the next accounting

period with a 10% interest.

Based solely on the information provided above. use the double entry system, enter

the transactions described above into the balance sheet ledger you prepared in

part(i). Prepare the enterprise's balance sheet as of December 31, 2021.

TOTAL MARKS

[25]

First Opportunity Examination

Page 3 of6

November 2022

|

4 Page 4 |

▲back to top |

Financial Management

FMA720S

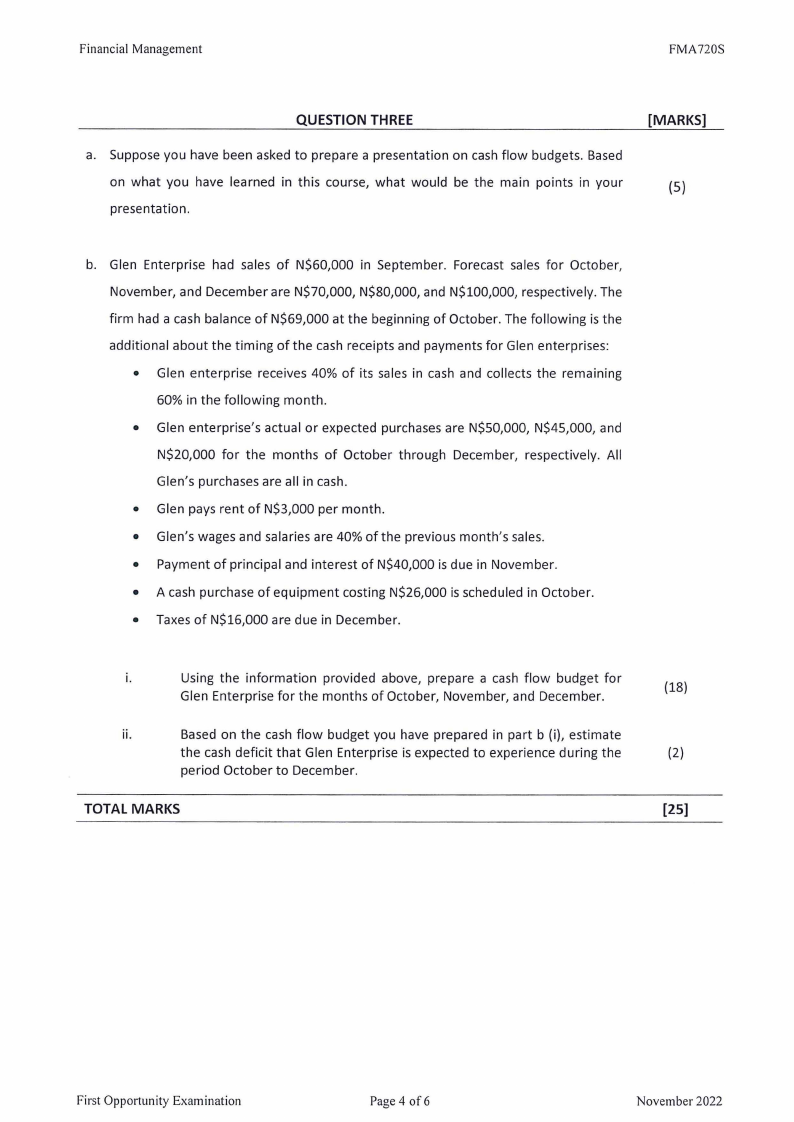

QUESTION THREE

[MARKS]

a. Suppose you have been asked to prepare a presentation on cash flow budgets. Based

on what you have learned in this course, what would be the main points in your

(S}

presentation.

b. Glen Enterprise had sales of N$60,000 in September. Forecast sales for October,

November, and December are N$70,000, N$80,000, and N$100,000, respectively. The

firm had a cash balance of N$69,000 at the beginning of October. The following is the

additional about the timing of the cash receipts and payments for Glen enterprises:

• Glen enterprise receives 40% of its sales in cash and collects the remaining

60% in the following month.

• Glen enterprise's actual or expected purchases are N$50,000, N$45,000, and

N$20,000 for the months of October through December, respectively. All

Glen's purchases are all in cash.

• Glen pays rent of N$3,000 per month.

• Glen's wages and salaries are 40% of the previous month's sales.

• Payment of principal and interest of N$40,000 is due in November.

• A cash purchase of equipment costing N$26,000 is scheduled in October.

• Taxes of N$16,000 are due in December.

i.

Using the information provided above, prepare a cash flow budget for

Glen Enterprise for the months of October, November, and December.

(18)

ii.

Based on the cash flow budget you have prepared in part b (i), estimate

the cash deficit that Glen Enterprise is expected to experience during the

(2)

period October to December.

TOTAL MARKS

[25]

First Opportunity Examination

Page 4 of6

November 2022

|

5 Page 5 |

▲back to top |

Financial Management

FMA720S

QUESTION FOUR

[MARKS]

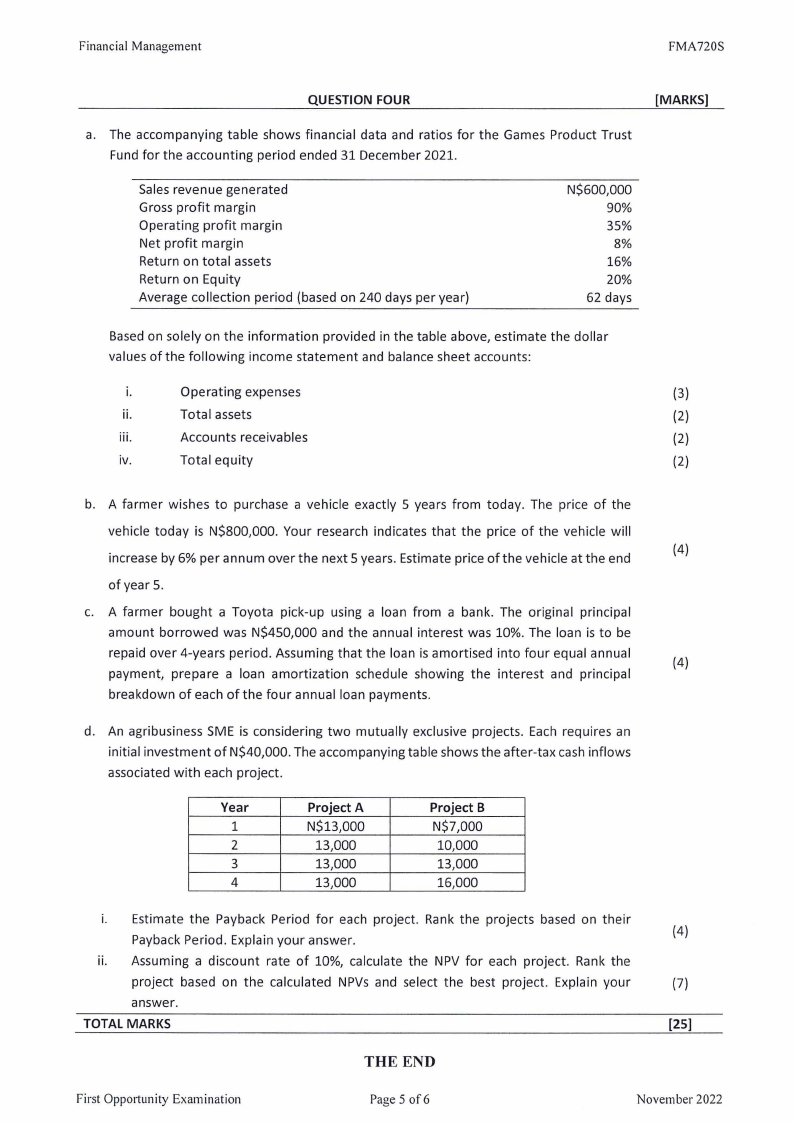

a. The accompanying table shows financial data and ratios for the Games Product Trust

Fund for the accounting period ended 31 December 2021.

Sales revenue generated

Gross profit margin

Operating profit margin

Net profit margin

Return on total assets

Return on Equity

Average collection period (based on 240 days per year)

N$600,000

90%

35%

8%

16%

20%

62 days

Based on solely on the information provided in the table above, estimate the dollar

values of the following income statement and balance sheet accounts:

i.

Operating expenses

(3)

ii.

Total assets

(2)

iii.

Accounts receivables

(2)

iv.

Total equity

(2)

b. A farmer wishes to purchase a vehicle exactly 5 years from today. The price of the

vehicle today is N$800,000. Your research indicates that the price of the vehicle will

increase by 6% per annum over the next 5 years. Estimate price of the vehicle at the end

(4)

of year 5.

c. A farmer bought a Toyota pick-up using a loan from a bank. The original principal

amount borrowed was N$450,000 and the annual interest was 10%. The loan is to be

repaid over 4-years period. Assuming that the loan is amortised into four equal annual

(4)

payment, prepare a loan amortization schedule showing the interest and principal

breakdown of each of the four annual loan payments.

d. An agribusiness SME is considering two mutually exclusive projects. Each requires an

initial investment of N$40,000. The accompanying table shows the after-tax cash inflows

associated with each project.

Year

1

2

3

4

Project A

N$13,000

13,000

13,000

13,000

Project B

N$7,000

10,000

13,000

16,000

i. Estimate the Payback Period for each project. Rank the projects based on their

Payback Period. Explain your answer.

(4)

ii. Assuming a discount rate of 10%, calculate the NPV for each project. Rank the

project based on the calculated NPVs and select the best project. Explain your

(7)

answer.

TOTAL MARKS

[25]

THE END

First Opportunity Examination

Page 5 of6

November 2022

|

6 Page 6 |

▲back to top |

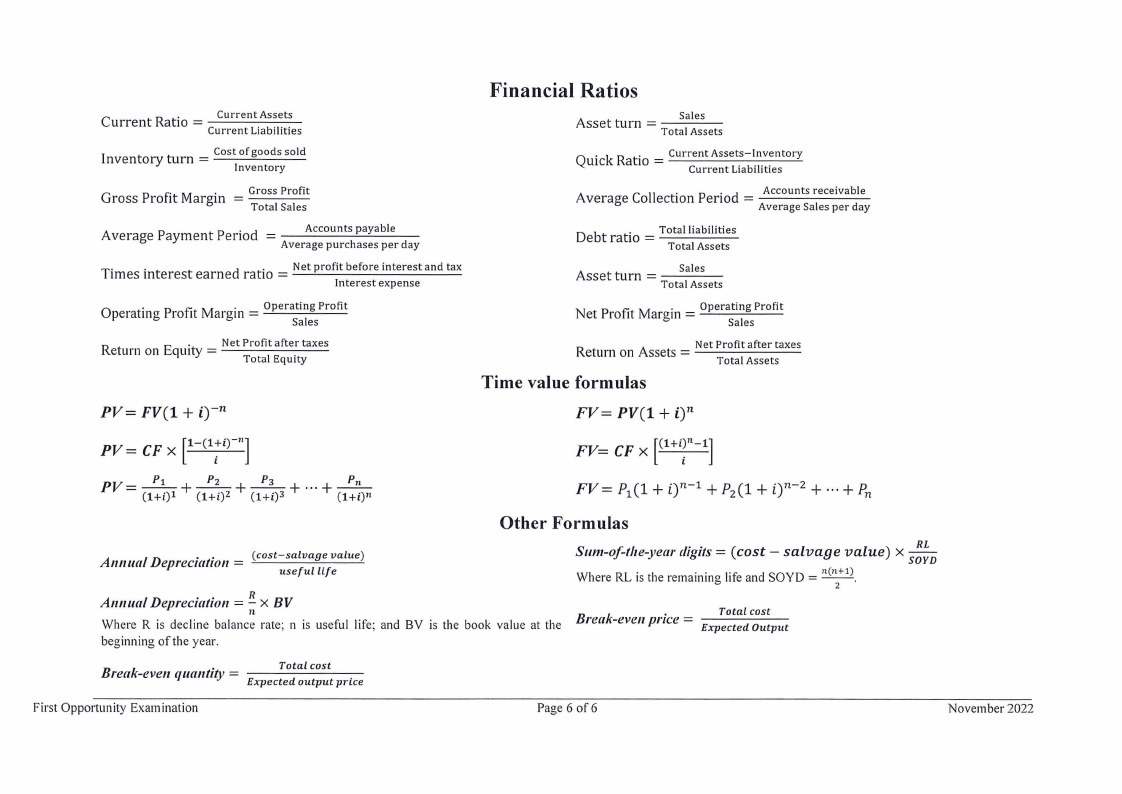

= Current Ratio Current Assets

Current Liabilities

Inventory turn = Cost of goods sold

Inventory

= Gross Profit Margin Gross Profit

Total Sales

= Average Payment Period

Accounts payable

Average purchases per day

= Times interest earned ratio Net profit before interest and tax

Interest expense

= Operating Profit Margin Operating Profit

Sales

= Return on Equity Net Profit after taxes

Total Equity

PV= FV(1 + i)-n

PV = CF x [l-(l;i)-"]

Financial Ratios

= Asset turn

Sales

Total Assets

= Quick Ratio Current Assets-Inventory

Current Liabilities

Average CoIIect1.0n peno. d = -A-c-c-o-u-nt-s receivable

Average Sales per day

= ----- Debt rati.o

Total liabilities

Total Assets

Asset

turn

= ---S-ales

Total Assets

= ------ Net Profi1tMarum.

t:>

Operating Profit

Sales

= ------ Return on Assets

Net Profit after taxes

Total Assets

Time value formulas

FV= PV(1 + i)n

FV= CF x [(1+1i]t-

PV -

-

+ ____!i_ _ll_

(l+i)l

(l+i)Z

+

(1+i)3

+ ···+ (l+i)"

FV= P1(l + 0n-1 + P2(l + 0n-2 + ...+ Pn

Other Formulas

= Annual Depreciation (cost-salvage value)

useful life

Annual Depreciation = !!.x BV

n

Where R is decline balance rate; n is useful life; and BY is the book value at the

beginning of the year.

Sum-of-the-year digits= (cost - salvage value) x .!!.!:.._

SOYD

= Where RL is the remaining life and SOYD n(n+i)_

2

= Total cost

Break-even price Expected Output

Break-even

quantity

=

Total cost

Expected output

price

First Opportunity Examination

Page 6 of6

November 2022