|

AMA811S-ADVANCED MANAGEMENT ACCOUNTING-2ND OPP-JULY 2022 |

|

1 Page 1 |

▲back to top |

nAm I Bl A un IVERS ITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ACCOUNTING, ECONOMICS & FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING (HONOURS)

QUALIFICATION CODE: 08BOAH

COURSE CODE: AMA811S

LEVEL: 8

COURSE NAME: ADVANCED MANAGEMENT

ACCOUNTING

SESSION: JUNE 2022

DURATION: 3 HOURS

PAPER: PRACTICAL AND THEORY

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS:

Kuhepa Tjondu

MODERATOR: Mr. L. Shinkeva

INSTRUCTIONS

• This question paper is made up of THREE(3) questions.

• Answer All the questions and in blue or black ink.

• Show all your working in the answer sheet.

• Start each question on a new page in your answer booklet and show all your workings.

• Questions relating to this paper may be raised in the initial 30 minutes after the start of

the paper. Thereafter, candidates must use their initiative to deal with any perceived error

or ambiguities and any assumption made by the candidate should be clearly stated.

PERMISSIBLE MATERIALS

Non-programmable calculator/financial calculator

THIS QUESTION PAPER CONSISTS OF 7 PAGES (Including this front page)

1

|

2 Page 2 |

▲back to top |

QUESTION 1

[40 MARKS]

It is now May 2022. Okandjira Co is a listed company which produces a range of

branded products all of which are well-established in their respective markets,

although overall sales have grown by an average of only 2% per annum over the past

decade. The board of directors is currently concerned about the company's level of

financial gearing, which although not high by industry standards, is near to breaching

the covenants attaching to its 15% debenture issue, made in 2009 at a time of high

market interest rates. Issued in order to finance the acquisition of the premises on

which it is secured, the debenture is repayable at par value of N$100 per unit at any

time during the period 2022 - 2025.

There are two covenants attaching to the debenture, which state:

'At no time shall the ratio of debt capital to shareholders' fund exceed 50%. The

company shall also maintain a prudent level of liquidity, defined as a current ratio at

no time outside the range of the industry average (as published by the corporate credit

rating agency, Creditrate), plus or minus 20%.'

Okandjira's most recent set of accounts is shown in summarised form below. The

buildings have been depreciated since 2009 at 4% per annum, and most of the

machinery is only two or three years old, having been purchased mainly via a bank

overdraft. The interest rate payable on the bank overdraft is currently 9%. The finance

director argues that Okandjira should take advantage of historically low interest rates

on the European money markets by issuing a medium-term Eurodollar bond at 5%.

The dollar is currently selling at a premium of about 1% on the three-month forward

market.

Okandjira's ordinary shares currently sell at a P/E ratio of 14, and look unattractive

compared to comparable companies in the sector which exhibit an average P/E ratio

of 18. According to the latest published credit assessment by Creditrate, the average

current ratio for the industry is 1.35. The loan stock currently sells in the market at

N$15 above par.

Summarised financial accounts for Okandjira Co for the year ended 31

December 2021:

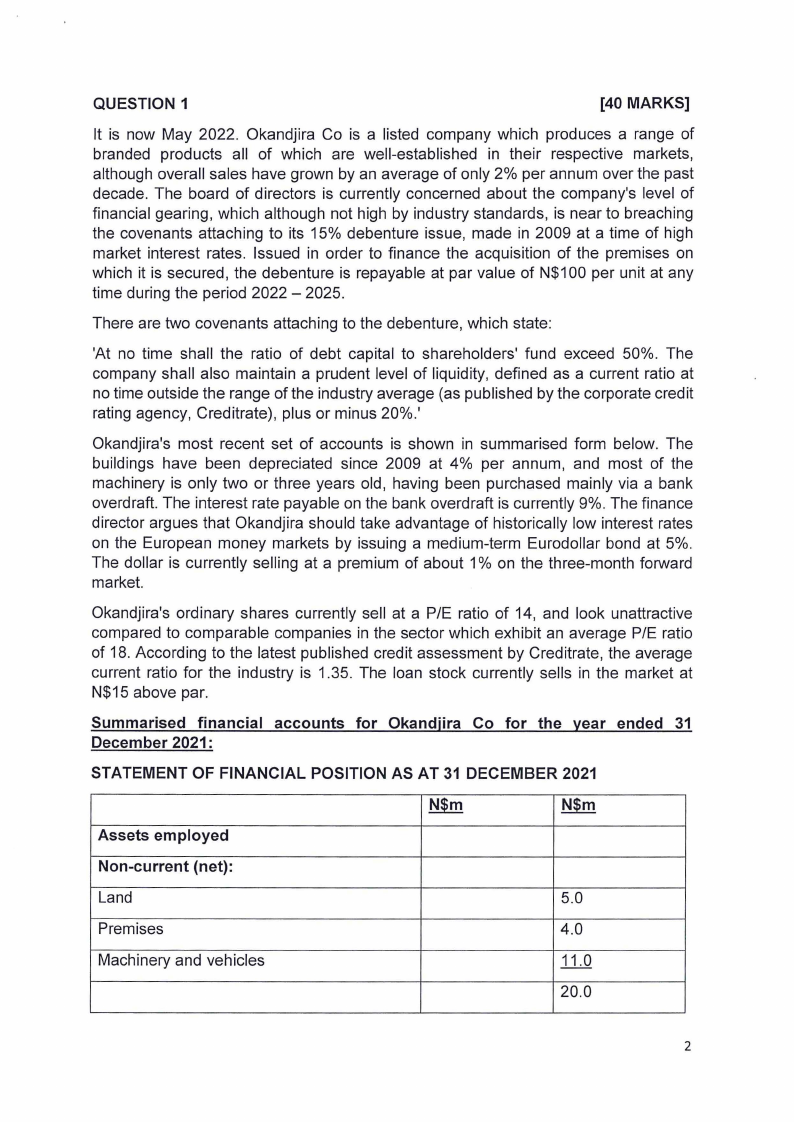

STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2021

N$m

N$m

Assets employed

Non-current (net):

Land

5.0

Premises

4.0

Machinery and vehicles

11.0

20.0

2

|

3 Page 3 |

▲back to top |

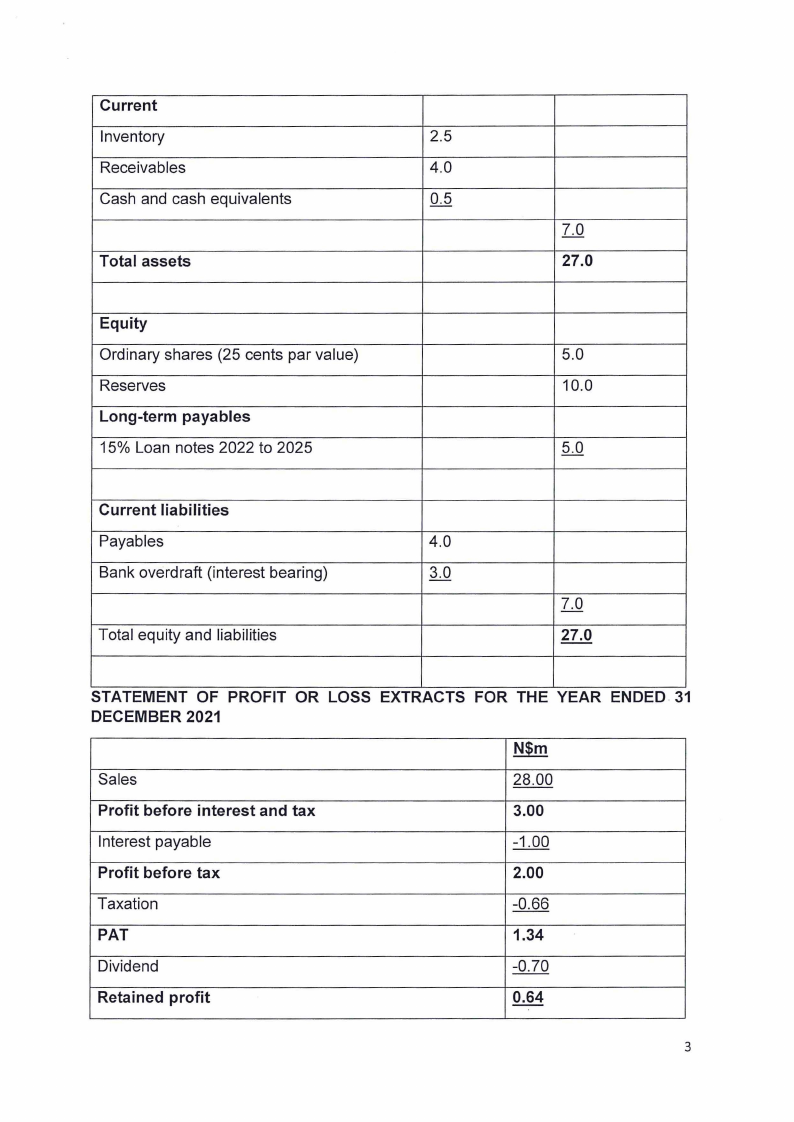

Current

Inventory

Receivables

Cash and cash equivalents

Total assets

2.5

4.0

0.5

7.0

27.0

Equity

Ordinary shares (25 cents par value)

Reserves

Long-term payables

15% Loan notes 2022 to 2025

5.0

10.0

5.0

Current liabilities

Payables

4.0

Bank overdraft (interest bearing)

3.0

7.0

Total equity and liabilities

27.0

STATEMENT OF PROFIT OR LOSS EXTRACTS FOR THE YEAR ENDED 31

DECEMBER 2021

N$m

Sales

28.00

Profit before interest and tax

3.00

Interest payable

-1.00

Profit before tax

2.00

Taxation

-0.66

PAT

1.34

Dividend

-0.70

Retained profit

0.64

3

|

4 Page 4 |

▲back to top |

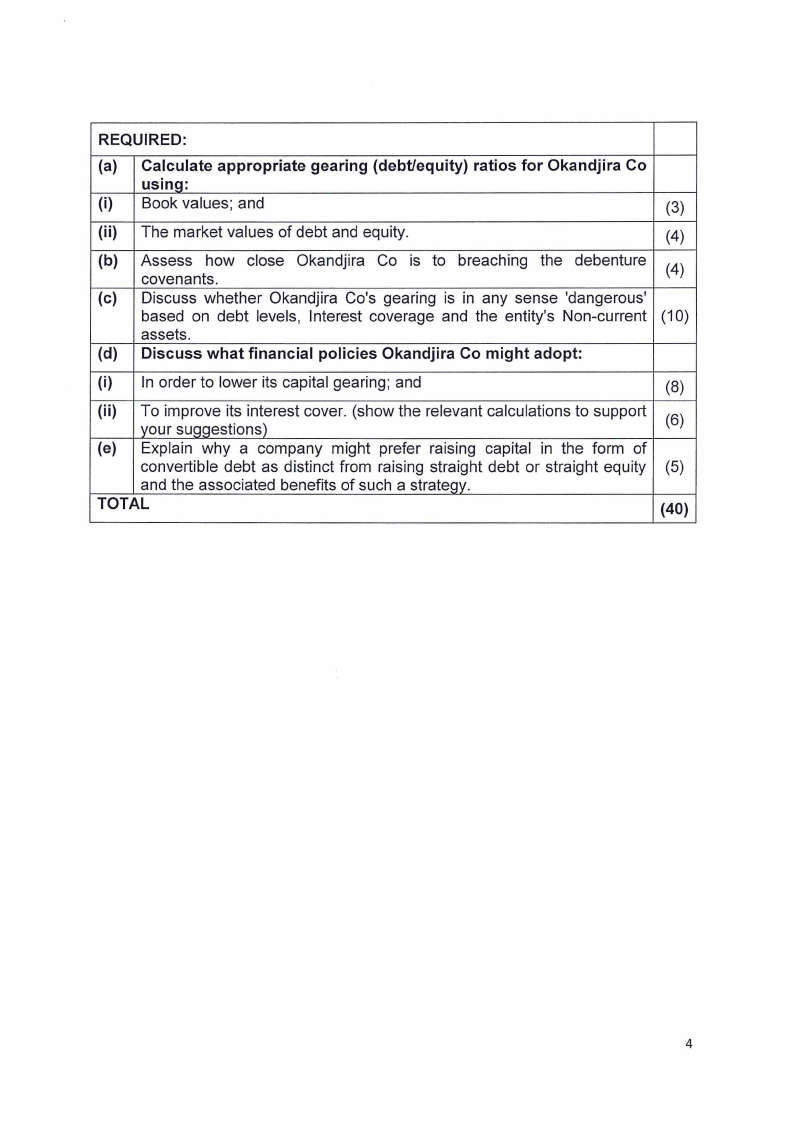

REQUIRED:

(a) Calculate appropriate gearing (debt/equity) ratios for Okandjira Co

using:

(i) Book values; and

(3)

(ii) The market values of debt and equity.

(4)

(b)

Assess how close Okandjira Co is to breaching the debenture

covenants.

(4)

(c) Discuss whether Okandjira Co's gearing is in any sense 'dangerous'

based on debt levels, Interest coverage and the entity's Non-current (10)

assets.

(d) Discuss what financial policies Okandjira Co might adopt:

(i) In order to lower its capital gearing; and

(8)

(ii)

To improve its interest cover. (show the relevant calculations to support

your suaaestions)

(6)

(e) Explain why a company might prefer raising capital in the form of

convertible debt as distinct from raising straight debt or straight equity (5)

and the associated benefits of such a strategy.

TOTAL

(40)

4

|

5 Page 5 |

▲back to top |

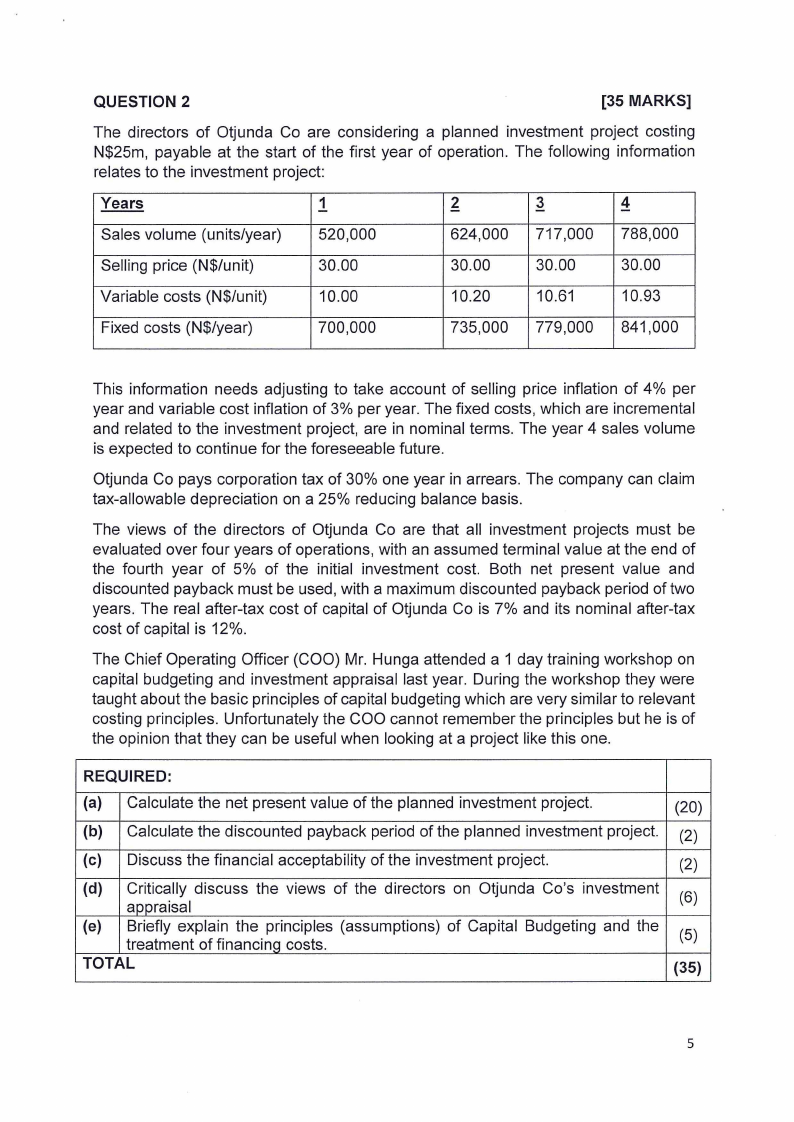

QUESTION 2

[35 MARKS]

The directors of Otjunda Co are considering a planned investment project costing

N$25m, payable at the start of the first year of operation. The following information

relates to the investment project:

Years

1

2

3

4

Sales volume (units/year)

520,000

624,000 717,000 788,000

Selling price (N$/unit)

30.00

30.00

30.00

30.00

Variable costs (N$/unit)

10.00

10.20

10.61

10.93

Fixed costs (N$/year)

700,000

735,000 779,000 841,000

This information needs adjusting to take account of selling price inflation of 4% per

year and variable cost inflation of 3% per year. The fixed costs, which are incremental

and related to the investment project, are in nominal terms. The year 4 sales volume

is expected to continue for the foreseeable future.

Otjunda Co pays corporation tax of 30% one year in arrears. The company can claim

tax-allowable depreciation on a 25% reducing balance basis.

The views of the directors of Otjunda Co are that all investment projects must be

evaluated over four years of operations, with an assumed terminal value at the end of

the fourth year of 5% of the initial investment cost. Both net present value and

discounted payback must be used, with a maximum discounted payback period of two

years. The real after-tax cost of capital of Otjunda Co is 7% and its nominal after-tax

cost of capital is 12%.

The Chief Operating Officer (COO) Mr. Hunga attended a 1 day training workshop on

capital budgeting and investment appraisal last year. During the workshop they were

taught about the basic principles of capital budgeting which are very similar to relevant

costing principles. Unfortunately the COO cannot remember the principles but he is of

the opinion that they can be useful when looking at a project like this one.

REQUIRED:

(a) Calculate the net present value of the planned investment project.

(20)

(b) Calculate the discounted payback period of the planned investment project. (2)

(c) Discuss the financial acceptability of the investment project.

(2)

(d)

Critically discuss the views of the directors on Otjunda Co's investment

appraisal

(6)

(e)

Briefly explain the principles (assumptions) of Capital Budgeting and the

treatment of financinq costs.

(5)

TOTAL

(35)

5

|

6 Page 6 |

▲back to top |

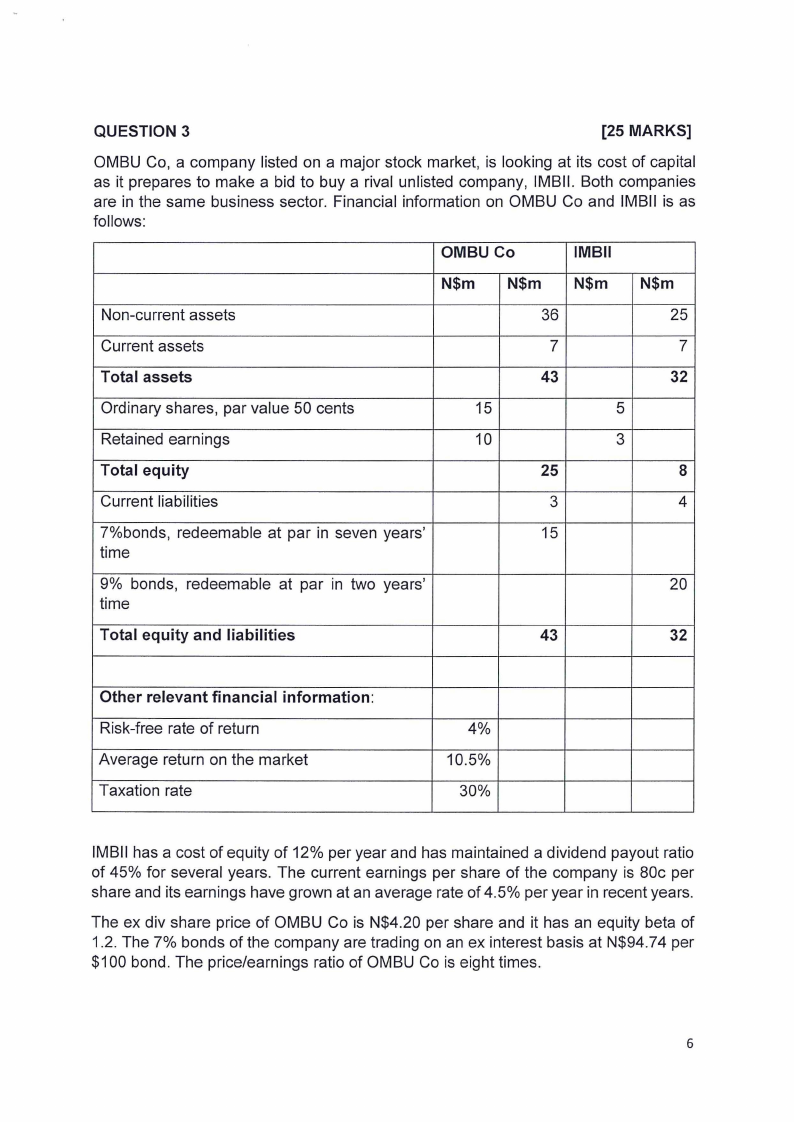

QUESTION 3

[25 MARKS]

OMBU Co, a company listed on a major stock market, is looking at its cost of capital

as it prepares to make a bid to buy a rival unlisted company, IMBII. Both companies

are in the same business sector. Financial information on OMBU Co and IMBII is as

follows:

OMBU Co

IMBII

N$m N$m N$m N$m

Non-current assets

36

25

Current assets

7

7

Total assets

43

32

Ordinary shares, par value 50 cents

15

5

Retained earnings

10

3

Total equity

25

8

Current liabilities

3

4

?%bonds, redeemable at par in seven years'

15

time

9% bonds, redeemable at par in two years'

20

time

Total equity and liabilities

43

32

Other relevant financial information:

Risk-free rate of return

Average return on the market

Taxation rate

4%

10.5%

30%

IMBII has a cost of equity of 12% per year and has maintained a dividend payout ratio

of 45% for several years. The current earnings per share of the company is 80c per

share and its earnings have grown at an average rate of 4.5% per year in recent years.

The ex div share price of OMBU Co is N$4.20 per share and it has an equity beta of

1.2. The 7% bonds of the company are trading on an ex interest basis at N$94.74 per

$100 bond. The price/earnings ratio of OMBU Co is eight times.

6

|

7 Page 7 |

▲back to top |

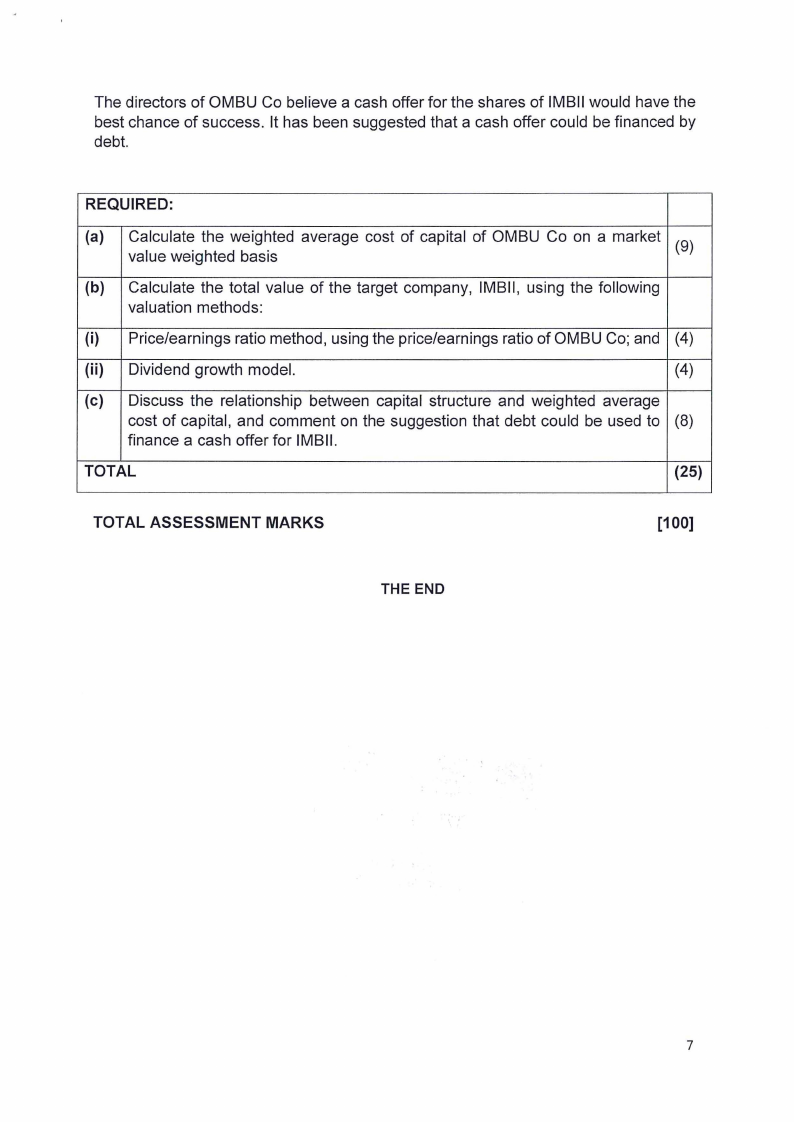

The directors of OMBU Co believe a cash offer for the shares of IMBII would have the

best chance of success. It has been suggested that a cash offer could be financed by

debt.

REQUIRED:

{a)

Calculate the weighted average cost of capital of OMBU Co on a market

value weighted basis

(9)

{b) Calculate the total value of the target company, IMBII, using the following

valuation methods:

{i) Price/earnings ratio method, using the price/earnings ratio of OMBU Co; and (4)

{ii) Dividend growth model.

(4)

{c) Discuss the relationship between capital structure and weighted average

cost of capital, and comment on the suggestion that debt could be used to (8)

finance a cash offer for IMBII.

TOTAL

(25)

TOTALASSESSMENTMARKS

[100]

THE END

7