|

QTM511S - QUANTITATIVE METHOODS - 2ND OPP - JANUARY 2025 |

|

1 Page 1 |

▲back to top |

r

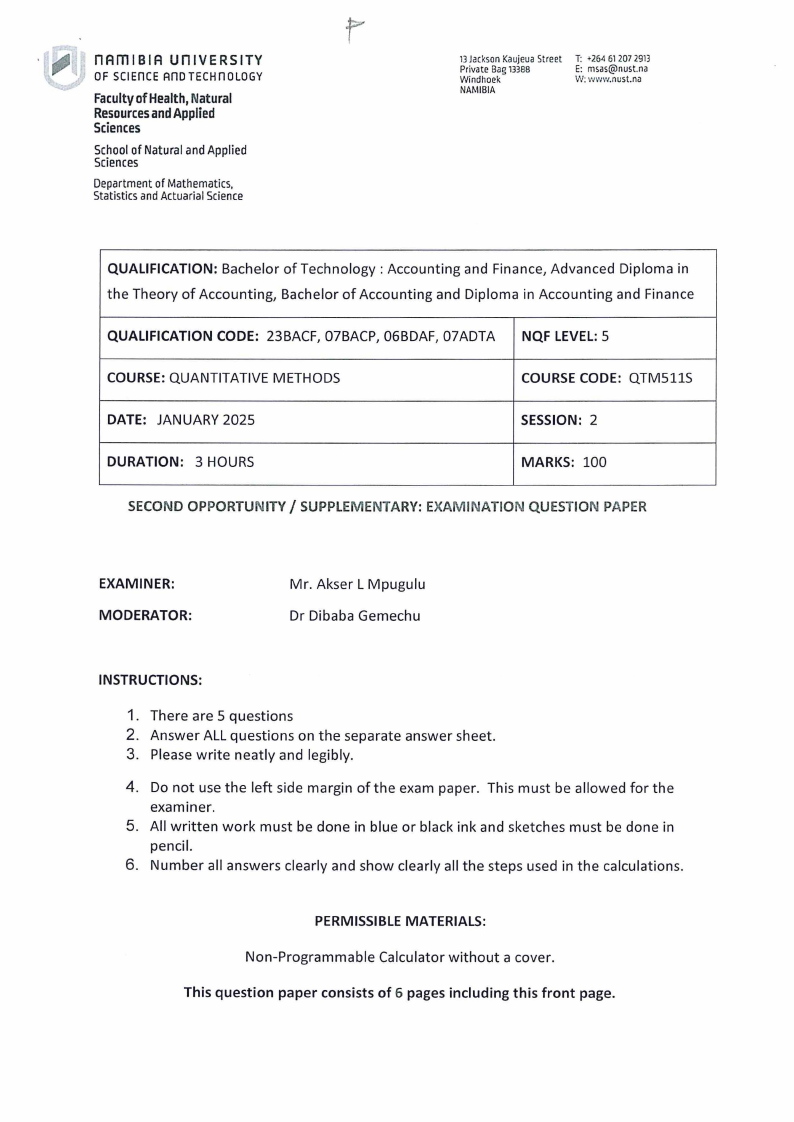

nAm I BIA UnlVERSITY

OF SCIEnCEAnDTECHnOLOGY

FacultyofHealthN, atural

ResourceasndApplied

Sciences

Schoolof NaturalandApplied

Sciences

Departmentof Mathematics,

StatisticsandActuarialScience

13JacksonKaujeuaStreet

Private Bag 13388

Windhoek

NAMIBIA

T: •264 61207 2913

E: msas@nust.na

W: www.nust.na

QUALIFICATION: Bachelor of Technology: Accounting and Finance, Advanced Diploma in

the Theory of Accounting, Bachelor of Accounting and Diploma in Accounting and Finance

QUALIFICATION CODE: 23BACF, 07BACP, 06BDAF, 07ADTA NQF LEVEL:5

COURSE: QUANTITATIVE METHODS

COURSE CODE: QTMSllS

DATE: JANUARY 2025

SESSION: 2

DURATION: 3 HOURS

MARKS: 100

SECOND OPPORTUNITY/ SUPPLEMENTARY: EXAMINATION QUESTION PAPER

EXAMINER:

MODERATOR:

Mr. Akser L Mpugulu

Dr Dibaba Gemechu

INSTRUCTIONS:

1. There are 5 questions

2. Answer ALL questions on the separate answer sheet.

3. Please write neatly and legibly.

4. Do not use the left side margin of the exam paper. This must be allowed for the

examiner.

5. All written work must be done in blue or black ink and sketches must be done in

pencil.

6. Number all answers clearly and show clearly all the steps used in the calculations.

PERMISSIBLE MATERIALS:

Non-Programmable Calculator without a cover.

This question paper consists of 6 pages including this front page.

|

2 Page 2 |

▲back to top |

1. Question 1:

[20 Marks]

1.1. A principal of N$5000 is invested at a simple interest rate of 7% per annum. How

long will it take for the principal to triple in value?

(5)

1.2. A loan of N$5,000 is due in 18 months, with a 6.5% interest rate. If the loan is repaid

6 months earlier than the due date, calculate the value of the debt.

(6)

1.3. On February 5, a company signed a N$75,000 note with a simple interest rate of 11%

for 180 days. The company made payments of N$15,000 on April 12 and N$20,000

on June 20. How much will the company owe on the maturity date? (Use the USA

rule).

(9)

2. Question 2:

[21 Marks]

2.1. Dr. Amunjela invested N$40,000 in two different schemes, X and Y. Scheme X

offers a simple interest rate of 9% p.a., and Scheme Y offers a rate of 5% p.a. The

total simple interest earned in 4 years is N$10,800. How much was invested in

Scheme X?

(7)

2.2. An investor makes monthly payments of N$1,000 into an account that earns 6%

interest per annum, compounded monthly, for 5 years.

2.2.1. Calculate the future value of this ordinary annuity.

(4)

2.2.2. Explain how would the future value change, If the payments were made at the

beginning of each month.

(2)

2.3. A business owner takes out a loan of N$100,000, to be repaid over 10 years at an

interest rate of 7% per annum, compounded monthly.

2.3.1. Calculate the monthly repayment amount.

(4)

2.3.2. How much of the first payment goes toward interest.

(2)

2.3.3. What is the total amount repaid over the 10 years.

(1)

2.3.4. How much interest paid?

(1)

3. Question 3:

3.1. Consider the linear system of equations:

QUANTITATIVE METHODS

2

[14 Marks]

2NDOPPORTUNITY

|

3 Page 3 |

▲back to top |

X + 2y + Z = 0

2x + 4y + 3z = 0

-x - 2y- 2z = 0

3.1.1. Construct the augmented matrix and reduce it to row echelon form.

(6)

3.1.2. Discuss the implications of your row reduction results regarding the existence of

solutions.

(2)

3.2. Solve the following inequality:

3.2.1.

zx < < zx-4

x+S - 3 - 3x

4. Question 4:

(6)

[12 Marks]

4.1. An investor has a portfolio of real estate properties. The prices and square footage

owned in 2015 and 2020 are shown below:

Property

X

y

z

2015 Price

(N$)

300,000

500,000

450,000

2015 Area

(mz)

1,000

1,200

900

2020 Price

(N$)

350,000

550,000

480,000

2020 Area

(mz)

950

1,100

1,000

4.1.1. Calculate the Paasche Price Index for the real estate portfolio using the weighted

aggregate method.

(7)

4.1.2. Calculate the Laspeyres Quantity Index for the real estate portfolio using the

weighted aggregate method.

(5)

5. Question 5:

[33 Marks]

5.1. A restaurant recorded the dining times (in hours) of 80 customers. The frequency

distribution is as follows:

Time Interval (hours)

0.5-< 1.0

1.0-< 1.5

1.5-<2.0

2.0-<2.5

2.5-< 3.0

Number of Customers

15

25

20

12

8

5.1.1. Calculate the estimated average dining time for a customer.

(8)

5.1.2. Calculate the modal dinning time.

(5)

QUANTITATIVE METHODS

3

2No OPPORTUNITY

|

4 Page 4 |

▲back to top |

5.2. The number of units sold for a product over a span of eleven years is recorded. The

data is as follows:

Year

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Units Sold

(1,000)

245

290

303

275

265

281

316

282

272

295

327

5.2.1. Determine the least squares trend line equation for the above dataset. Use the

sequential coding method.

Hint: start your coding by assigning 1 for the first time period.

(11)

5.2.2. Predict the trend value for the sales of the product for 2017.

(3)

5.3. In a local election, 55% of eligible voters are aware of the candidate's campaign. The

probability that an aware voter will vote is 80%, while the probability that an

unaware voter will vote is 40%.

5.3.1. What is the probability that a randomly chosen voter will vote?

(3)

5.3.2. What is the probability that a voter was aware of the campaign, given that they

voted?

(3)

END OF QUESTION PAPER

QUANTITATIVE METHODS

4

2ND OPPORTUNITY

|

5 Page 5 |

▲back to top |

SUMMARY OF FORMULAE QTM511S: 2024

Simple Interest:

Discount:

Compound Interest:

Simple discount Rate:

Effective Interest Rate:

Effective Interest Rate:

I =Prt

P=A(l-dt),

A= P(l+rt)

D=Adt

+:Ill/

A= P ( 1

)

d

r

1 + rt

r

elf

----1-r rt

I+: = refl

(

Ill

) -1

Nominal Interest Rate:

Annuity:

Sn =R

r

m

s f---- ;;-J;

1-+(!1:._)-l7

= A R ___ 11_-1

17

r

m

lo(gI+;)' log(!+:) Period: t = _l_o_g_S_-_lo_g_P_ n=-___,,1.o__g2_

m

t=--Nfo-r1

r

N>2

log(- iS 11 + I)

n=------ R

log(l + i)

Measures of Central Tendency

log(l- -iA11 )

n=-'-

R

log(l + i)

QUANTITATIVE METHODS

5

2ND OPPORTUNITY

|

6 Page 6 |

▲back to top |

Mean

Median

Mode

+h[ M =l

0 Mo

2J;J_;-lfoo_h ] '

Measures of dispersion

I {' I( Variance=

;;X- ? -n (X-)2

11

or

X;-X )'

Variance = ---'-----'--

n-1

n- I

Standard

variance ,

Quartile

)x coefficient of variation =( I01

Index Numbers

f Laspeyres price index = ip, x % x I00%

·

Po X qo

I(Pi xq,)

Paasche price index= """'(

) x 100%

Pox q,

f iPo i Laspeyres quantity index -

x q, x I00%

Po xq"

f i i Paasche quantity ;ndex - P, x qI x I00%

P1X%

Time Series

y=a+bx

n

Probability

P(AuB)=P(A)+P(B)-P(AnB) P(AnB)=P(A)P(B)

PB(A-I

)

_P(AnB)

P(A)

QUANTITATIVE METHODS

6

2ND OPPORTUNITY