|

GFA711S-FINANACIAL ACCOUNTING 310-1ST OPP- JUNE 2024 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTYOF MANAGEMENTSCIENCES

DEPARTMENTOF ACCOUNTINGE, CONOMICSAND FINANCE

QUALIFICATION : BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 07 BOAC

COURSE: FINANCIAL ACCOUNTING 310

DATE: June 2024

DURATION: 3 HRS

LEVEL: 7

COURSE CODE: GFA 711S

SESSION: Jun 2024

MARKS: 100

EXAMINER(S)

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

Kamotho, D.W., Dzomira, S., Ms. Garas, E., Kamana, R.,

MODERATOR:

M Tondota

THIS QUESTION PAPER CONSISTS OF_ 4_ PAGES (Excluding this front page)

INSTRUCTIONS

1. Answer all the questions in blue or black ink

2. Start each question on a new page in your answer booklet & show all your workings

3. Questions relating to this examination may be raised in the initial 30 minutes after the start

of the paper. Thereafter, candidates must use their initiative to deal with any perceived error

or ambiguities & any assumption made by the candidate should be clearly stated.

PERMISSIBLE MATERIALS

1. Non-programmable scientific or financial calculator

|

2 Page 2 |

▲back to top |

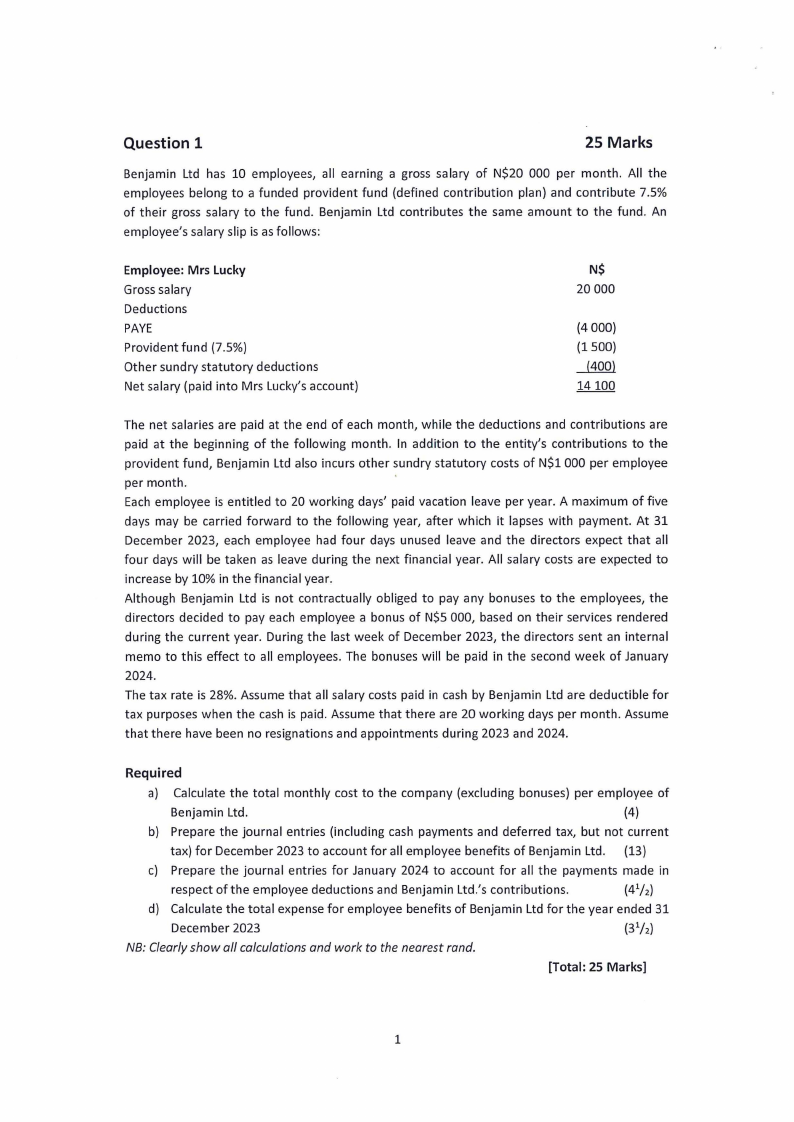

Question 1

25 Marks

Benjamin Ltd has 10 employees, all earning a gross salary of N$20 000 per month. All the

employees belong to a funded provident fund (defined contribution plan) and contribute 7.5%

of their gross salary to the fund. Benjamin Ltd contributes the same amount to the fund. An

employee's salary slip is as follows:

Employee: Mrs Lucky

Gross salary

Deductions

PAYE

Provident fund (7.5%)

Other sundry statutory deductions

Net salary (paid into Mrs Lucky's account)

N$

20 000

(4000)

(1500)

--11.QQl

14100

The net salaries are paid at the end of each month, while the deductions and contributions are

paid at the beginning of the following month. In addition to the entity's contributions to the

provident fund, Benjamin Ltd also incurs other sundry statutory costs of N$1 000 per employee

per month.

Each employee is entitled to 20 working days' paid vacation leave per year. A maximum of five

days may be carried forward to the following year, after which it lapses with payment. At 31

December 2023, each employee had four days unused leave and the directors expect that all

four days will be taken as leave during the next financial year. All salary costs are expected to

increase by 10% in the financial year.

Although Benjamin Ltd is not contractually obliged to pay any bonuses to the employees, the

directors decided to pay each employee a bonus of N$5 000, based on their services rendered

during the current year. During the last week of December 2023, the directors sent an internal

memo to this effect to all employees. The bonuses will be paid in the second week of January

2024.

The tax rate is 28%. Assume that all salary costs paid in cash by Benjamin Ltd are deductible for

tax purposes when the cash is paid. Assume that there are 20 working days per month. Assume

that there have been no resignations and appointments during 2023 and 2024.

Required

a) Calculate the total monthly cost to the company (excluding bonuses) per employee of

Benjamin Ltd.

(4)

b) Prepare the journal entries (including cash payments and deferred tax, but not current

tax) for December 2023 to account for all employee benefits of Benjamin Ltd. (13)

c) Prepare the journal entries for January 2024 to account for all the payments made in

respect of the employee deductions and Benjamin Ltd.'s contributions.

(4½)

d) Calculate the total expense for employee benefits of Benjamin Ltd for the year ended 31

December 2023

(3½)

NB: Clearly show all calculations and work to the nearest rand.

[Total: 25 Marks]

1

|

3 Page 3 |

▲back to top |

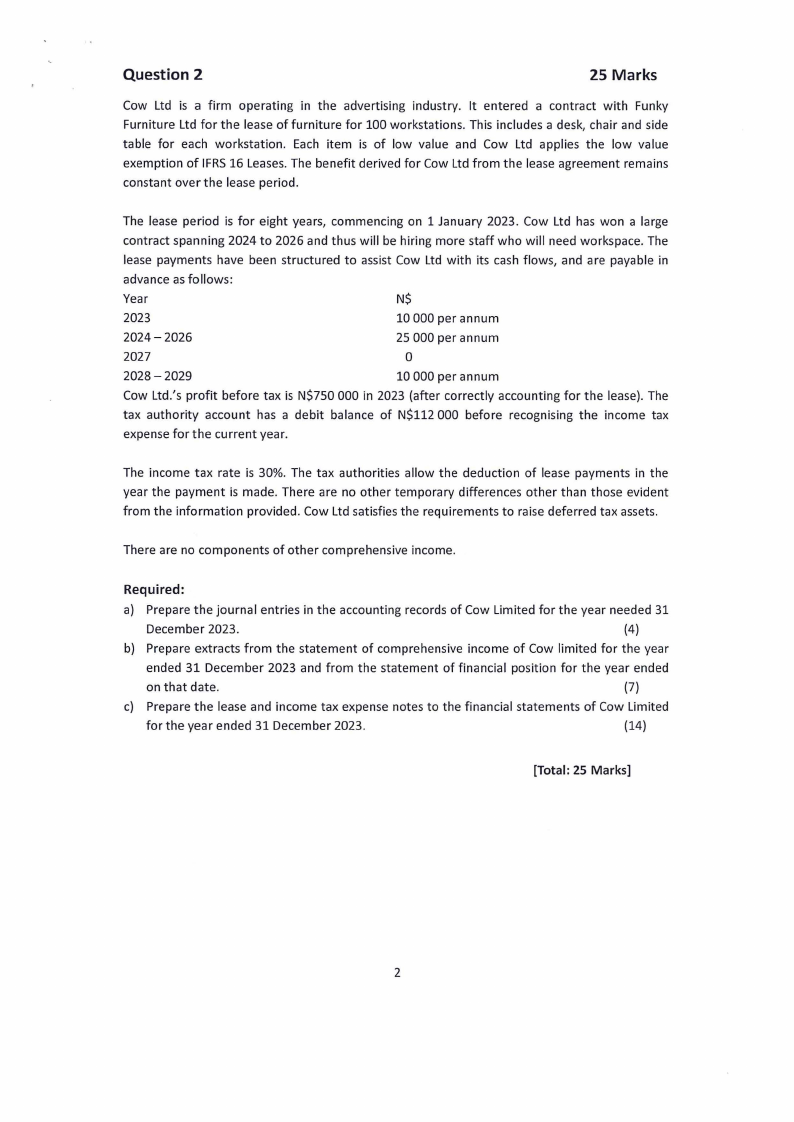

Question 2

25 Marks

Cow Ltd is a firm operating in the advertising industry. It entered a contract with Funky

Furniture Ltd for the lease of furniture for 100 workstations. This includes a desk, chair and side

table for each workstation. Each item is of low value and Cow Ltd applies the low value

exemption of IFRS16 Leases.The benefit derived for Cow Ltd from the lease agreement remains

constant over the lease period.

The lease period is for eight years, commencing on 1 January 2023. Cow Ltd has won a large

contract spanning 2024 to 2026 and thus will be hiring more staff who will need workspace. The

lease payments have been structured to assist Cow Ltd with its cash flows, and are payable in

advance as follows:

Year

N$

2023

10 000 per annum

2024- 2026

25 000 per annum

2027

0

2028-2029

10 000 per annum

Cow Ltd.'s profit before tax is N$750 000 in 2023 (after correctly accounting for the lease). The

tax authority account has a debit balance of N$112 000 before recognising the income tax

expense for the current year.

The income tax rate is 30%. The tax authorities allow the deduction of lease payments in the

year the payment is made. There are no other temporary differences other than those evident

from the information provided. Cow Ltd satisfies the requirements to raise deferred tax assets.

There are no components of other comprehensive income.

Required:

a) Prepare the journal entries in the accounting records of Cow Limited for the year needed 31

December 2023.

(4)

b) Prepare extracts from the statement of comprehensive income of Cow limited for the year

ended 31 December 2023 and from the statement of financial position for the year ended

on that date.

(7)

c) Prepare the lease and income tax expense notes to the financial statements of Cow Limited

for the year ended 31 December 2023.

(14)

[Total: 25 Marks]

2

|

4 Page 4 |

▲back to top |

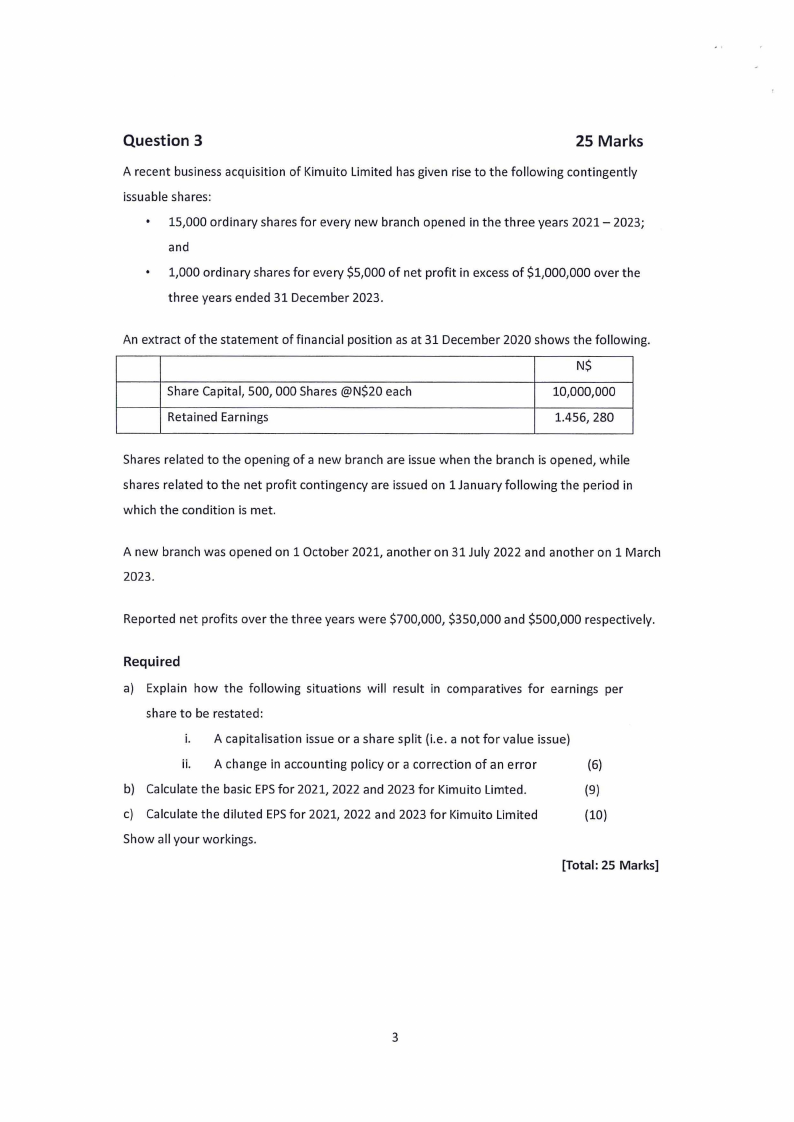

Question 3

25 Marks

A recent business acquisition of Kimuito Limited has given rise to the following contingently

issuable shares:

15,000 ordinary shares for every new branch opened in the three years 2021- 2023;

and

1,000 ordinary shares for every $5,000 of net profit in excess of $1,000,000 over the

three years ended 31 December 2023.

An extract of the statement of financial position as at 31 December 2020 shows the following.

N$

Share Capital, 500, 000 Shares @N$20 each

10,000,000

Retained Earnings

1.456, 280

Shares related to the opening of a new branch are issue when the branch is opened, while

shares related to the net profit contingency are issued on 1 January following the period in

which the condition is met.

A new branch was opened on 1 October 2021, another on 31 July 2022 and another on 1 March

2023.

Reported net profits over the three years were $700,000, $350,000 and $500,000 respectively.

Required

a) Explain how the following situations will result in comparatives for earnings per

share to be restated:

i. A capitalisation issue or a share split (i.e. a not for value issue)

ii. A change in accounting policy or a correction of an error

(6)

b) Calculate the basic EPSfor 2021, 2022 and 2023 for Kimuito Limted.

(9)

c) Calculate the diluted EPSfor 2021, 2022 and 2023 for Kimuito Limited

(10)

Show all your workings.

[Total: 25 Marks]

3

|

5 Page 5 |

▲back to top |

Question 4

25 Marks

The following items were taken from the trial balance of Party limited for the year ended 28th

February 2024.

Sales

Cost of sales

Other expenses - not specified

Loss on disposal of vehicle (tax deductible).

Depreciation - machinery

Net profit from inventory damaged by flood (taxable)

- (Cost of inventory 50,000; Insurance claim 60,000}

Loss due to expropriation of inventories by government tax deductible

Machinery at cost one

Accumulated depreciation machinery 28 February 2024

N$

700,000

280,000

100,000

30,000

30,000.

10,000

12,000

150,000

60,000

Additional information.

• The useful life of the machinery was originally estimated be five years from the date of

purchase. Owing to technological changes, the remaining useful life as a 28 February 2023 is

estimated to be only two years. The change in useful life has yet to be reflected in the trial

balance. The machinery has no residual value.

• The company tax rate is 28% and NAM RAthe Namibian tax authority is prepared to allow

additional wear and tear needed to write off the value of the machinery over the remaining

useful life. There are no other non-deductible or non-taxable items.

Required:

Prepare the statement of profit or loss and other comprehensive income of Party limited for the

year ended 28 February 2024 so as to comply with the requirements of the international

Financial

Reporting

Standards.

(25)

Only the Note on profit before tax is required and it carries 12 marks.

END OF QUESTION PAPER

[Total: 25 Marks]

4

|

6 Page 6 |

▲back to top |