|

QTM511S - QUANTITATIVE METHOODS - 1ST OPP - NOVEMBER 2024 |

|

1 Page 1 |

▲back to top |

p

nAmlBIA UnlVERSITY

OF SCIEnCE AnD TECHnOLOGY

FacultyofHealth,Natural

ResourceasndApplied

Sciences

Schoolof NaturalandApplied

Sciences

Departmentof Mathematics,

Statisticsand Actuarial Science

13JacksonKaujeuaStreet

Private Bag13388

Windhoek

NAMIBIA

T: +264 61207 2913

E: msas@nust.na

W: www.nust.na

QUALIFICATION: Bachelor of Technology: Accounting and Finance, Advanced Diploma in

the Theory of Accounting, Bachelor of Accounting and Diploma in Accounting and Finance

QUALIFICATION CODE: 23BACF, 07BACP, 06BDAF, 07ADTA NQF LEVEL: 5

COURSE: QUANTITATIVE METHODS

COURSE CODE: QTMSllS

DATE: NOVEMBER 2024

SESSION: 1

DURATION: 3 HOURS

MARKS: 100

EXAMINER:

MODERATOR:

FIRST OPPORTUNITY: EXAMINATION QUESTION PAPER

Mr. Akser L Mpugulu

Dr Dibaba Gemechu

INSTRUCTIONS:

1. There are 5 questions

2. Answer ALL questions on the separate answer sheet.

3. Please write neatly and legibly.

4. Do not use the left side margin of the exam paper. This must be allowed for the

examiner.

5. All written work must be done in blue or black ink and sketches must be done in

pencil.

6. Number all answers clearly and show clearly all the steps used in the calculations.

PERMISSIBLE MATERIALS:

Non-Programmable Calculator without a cover.

This question paper consists of 6 pages including this front page and the formula sheet.

|

2 Page 2 |

▲back to top |

1. Question 1:

(25 Marks]

1.1. Define the following terms as applicable in Quantitative Methods.

1.1.1. Interest

(2)

1.1.2. Time Value of Money

(2)

1.2. A nominal interest rate of 9% compounded quarterly is given. Calculate the

equivalent effective interest rate per annum.

(3)

1.3. A non-interest-bearing note of N$12,000, payable in one year, is sold today at a

simple discount rate of 7%. What is the amount that the buyer will pay for the note?

(4)

1.4. On February 5, a company signed a N$75,000 note with a simple interest rate of 11%

for 180 days. The company made payments of N$15,000 on April 12 and N$20,000

on June 20. How much will the company owe on the maturity date? (Use the USA

rule).

(7)

1.5. An investor is comparing two investment opportunities:

• Investment A: Simple interest at 6% per annum for 3 years.

• Investment B: Compound interest at 5.5% per annum, compounded annually for

3 years.

Calculate the final amount for both investments and determine which one is a better

option.

(7)

2. Question 2:

(22 Mark]

2.1. A company issues an interest-bearing debt with a future value of N$50,000, payable

in 6 years, at an interest rate of 9% per annum, compounded annually. Calculate the

present value of this debt.

(4)

2.2. You wish to accumulate N$50,000 over 8 years by making monthly contributions to

an account that pays 4% interest per annum, compounded monthly.

2.2.1. What should the monthly payment be?

(6)

2.2.2. What is the total amount of interest earned?

(2)

2.3. A company issues a debt of N$500,000 that must be repaid in 10 years. To

accumulate the repayment amount, the company sets up a sinking fund earning 6%

interest per annum, compounded semi-annually.

2.3.1. How much must be deposited into the sinking fund at the end of each six-month

period to accumulate the N$500,000 in 10 years?

(6)

QUANTITATIVE METHODS

2

15T OPPORTUNITY

|

3 Page 3 |

▲back to top |

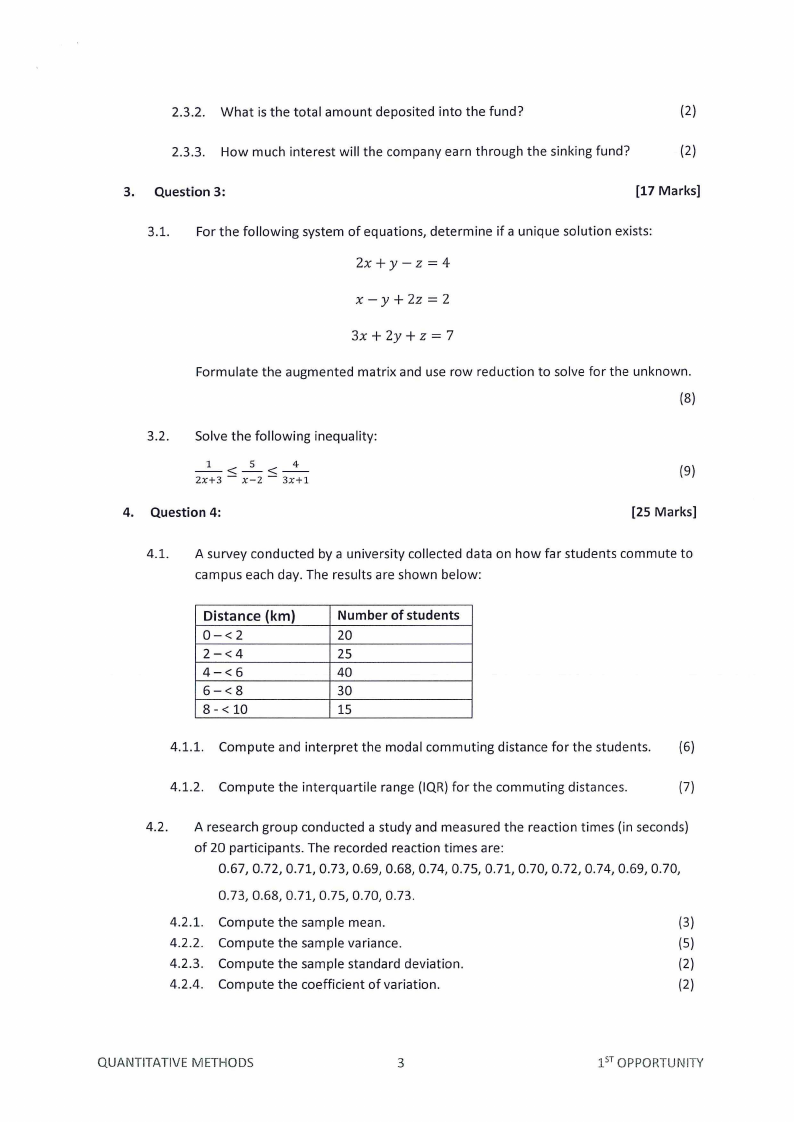

2.3.2. What is the total amount deposited into the fund?

(2)

2.3.3. How much interest will the company earn through the sinking fund?

(2)

3. Question 3:

[17 Marks]

3.1. For the following system of equations, determine if a unique solution exists:

2x + y-z = 4

X -y + 2z = 2

3x + 2y + z = 7

Formulate the augmented matrix and use row reduction to solve for the unknown.

(8)

3.2. Solve the following inequality:

_1_ < _s_ < _4_

2x+3 - x-2 - 3x+l

4. Question 4:

(9)

[25 Marks]

4.1. A survey conducted by a university collected data on how far students commute to

campus each day. The results are shown below:

Distance (km)

0-<2

2-<4

4-<6

6-<8

8- < 10

Number of students

20

25

40

30

15

4.1.1. Compute and interpret the modal commuting distance for the students. (6)

4.1.2. Compute the interquartile range (IQR) for the commuting distances.

(7)

4.2. A research group conducted a study and measured the reaction times (in seconds)

of 20 participants. The recorded reaction times are:

0.67, 0.72, 0.71, 0.73, 0.69, 0.68, 0.74, 0.75, 0.71, 0.70, 0.72, 0.74, 0.69, 0.70,

0.73, 0.68, 0.71, 0.75, 0.70, 0.73.

4.2.1. Compute the sample mean.

(3)

4.2.2. Compute the sample variance.

(5)

4.2.3. Compute the sample standard deviation.

(2)

4.2.4. Compute the coefficient of variation.

(2)

QUANTITATIVE METHODS

3

15T OPPORTUNITY

|

4 Page 4 |

▲back to top |

5. Question 5

[11]

5.1. Differentiate between the cyclical component and the irregular component as

defined in time series.

(4)

5.2. A student is preparing for a multiple-choice exam. The probability that the student

studies for the exam is 0.7. If the student studies, the probability that they pass the

exam is 0.9. If the student does not study, the probability that they pass is 0.3.

5.2.1. What is the probability that the student passes the exam?

(3)

5.2.2. What is the probability that the student studied given that they passed the

exam?

(4)

END OF QUESTION PAPER

QUANTITATIVE METHODS

4

15T OPPORTUNITY

|

5 Page 5 |

▲back to top |

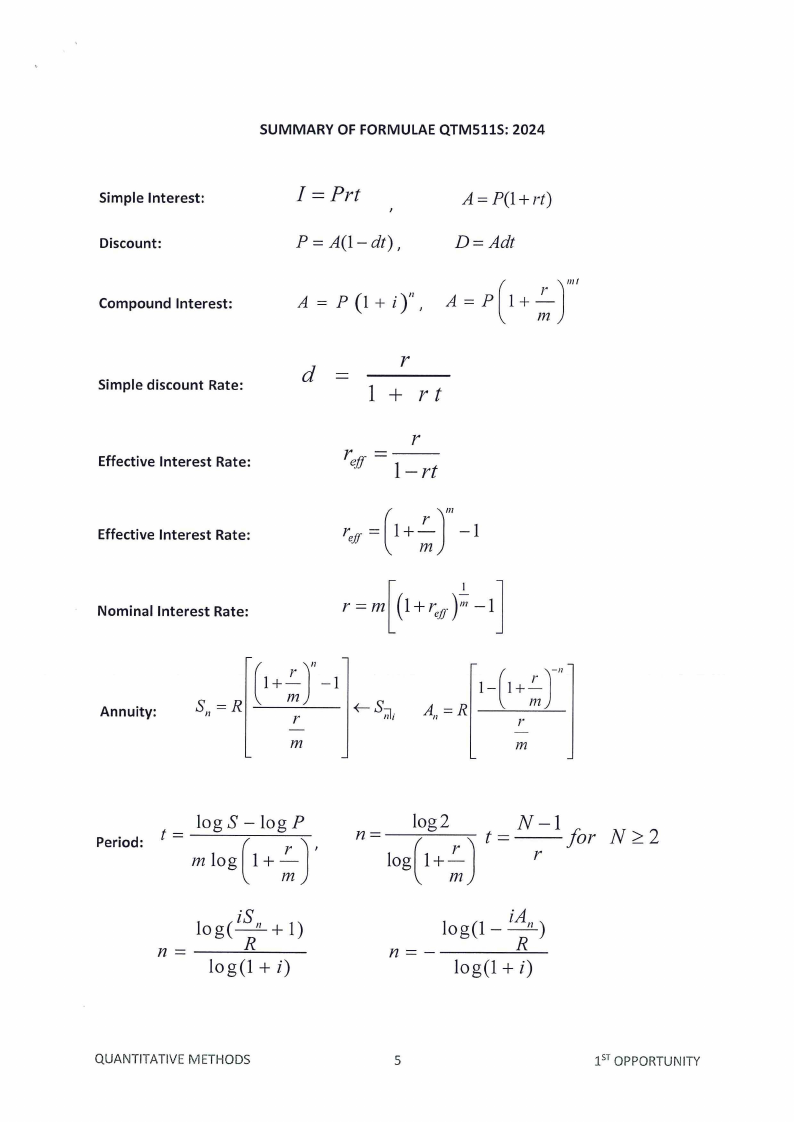

SUMMARY OF FORMULAE QTM511S: 2024

Simple Interest:

Discount:

Compound Interest:

Simple discount Rate:

Effective Interest Rate:

I =Prt

A= P(l +rt)

P=A(I-dt),

D=Adt

A = P (1 + i )",

Iii/

( J A=P l+_c_

m

d

r

1 + rt

r

elf

----1-r rt

Effective Interest Rate:

Nominal Interest Rate:

Annuity:

m

1-(1+ __C_)-/1

A =R ___ 11_1_

11

r

m

t = _I_go_S_-_I_o_g_P_

Iog2

N -l

Period:

n = ( ,,.) t = for

mlog(l+ :)'

log 1+-

r

m

log(-

iS

11

+

1)

n = -----=-'-R--

Io g (l + i)

log(l- -i)A11

n=-

R

log(l + i)

QUANTITATIVE METHODS

5

15T OPPORTUNITY

|

6 Page 6 |

▲back to top |

Measures of Central Tendency

Mean

Median

Mode

Measures of dispersion

'°'~J;X-r ? -n (X_)2

I(X;-X )'

Variance=

''

or Variance=-----

n-1

n -1

Standard

variance ,

Quartile

f) coefficient of variation =( x l 01

Index Numbers

laspeyres price index = ip, x q, x 100% Paasche price index = i P, x q, x l 00%

AX~

AX~

f iPo Laspeyres quantity index =

x q, \\ x I00%

Po xqo

f ip, Paasche quantity index=

x q, \\ x I00%

P1X%

Time Series

y=a+bx

n

Probability

P(AuB)=P(A)+P(B)-P(AnB) P(AnB)=P(A)P(B)

p

(BAI

)

_P(AnB)

- P(A)

QUANTITATIVE METHODS

6

1sr OPPORTUNITY