|

BAC212S - BUSINESS ACCOUNTING 2B - 2ND OPP - JAN 2020 |

|

1 Page 1 |

▲back to top |

3

NAMIBIA UNIVERSITY

OF SCIENCE AND TECHNOLOGY

FACULTY OF MANAGEMENT SCIENCES

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION : VARIOUS

QUALIFICATION CODE: VARIOUS

COURSE CODE: BAC212S

SESSION: JAN 2020

DURATION: 3 HOURS

LEVEL: 6

COURSE NAME: BUSINESS ACCOUNTING 2B

PAPER: THEORY

MARKS: 100

EXAMINER(S)

MODERATOR:

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

Mr. C Jerry

Mr. D Kamotho

INSTRUCTIONS

This question paper is made up of four (4) questions.

Answer ALL the questions and in blue or black ink.

Start each question on a new page in your answer booklet.

Questions relating to this examination may be raised in the initial 30 minutes after the start of

the paper. Thereafter, candidates must use their initiative to deal with any perceived error or

ambiguities & any assumption made by the candidate should be clearly stated.

5. Programmable calculators are not allowed

THIS QUESTION PAPER CONSISTS OF 3 PAGES (Excluding this front page)

|

2 Page 2 |

▲back to top |

Question 1

(20 Marks)

Southways Ltd uses a standard absorption costing system. The company has budgeted the following

figures for January 2019 for a capacity of 10 000 units:

N$

Direct material — 20 000 kg at N$3 per kg

60 000

Direct labour — 10 000 hours at N$5 per hour

50 000

Manufacturing overheads — variable (N$1 per hour)

10 000

— fixed (N$4 per hour)

40 000

160 000

Variable manufacturing overhead is recovered on direct labour hours.

- During January 2019 the company started and completed 11 000 units. The following

transactions were recorded:

- Credit purchases of material, 30 000 kg at N$3.10 per kg.

- Material issued to production, 22 500 kg.

- Direct wages paid, 11 500 hours at N$5 per hour.

- Manufacturing overheads incurred, variable N$11 800

- Fixed Manufacturing overhead is N$40 500.

Required:

Calculate the operating variances for January:

Material price variance

Material quantity (usage) variance

Wage rate variance

Labour efficiency variance

Variable overhead expenditure variance

Variable overhead efficiency variance

Fixed overheads expenditure variance

Fixed production overheads volume variance

(2 marks)

(3 marks)

(2 marks)

(3 marks)

(3 marks)

(2 marks)

(2 marks)

(3 marks)

Question 2

(30 Marks)

The following budgeted information regarding the first quarter of 2019 were supplied by Chineke CC:

Al,

Expected sales:

January

February

March

5 000 units

3 000 units

7 000 units

2.

Selling price per unit:

N$70

3

Opening and closing inventory of completed goods:

January

February

March

Opening inventory

1 000 units

1 500 units

?

Closing inventory

?

1 600 units

1 700 units

Page 1 of 3

|

3 Page 3 |

▲back to top |

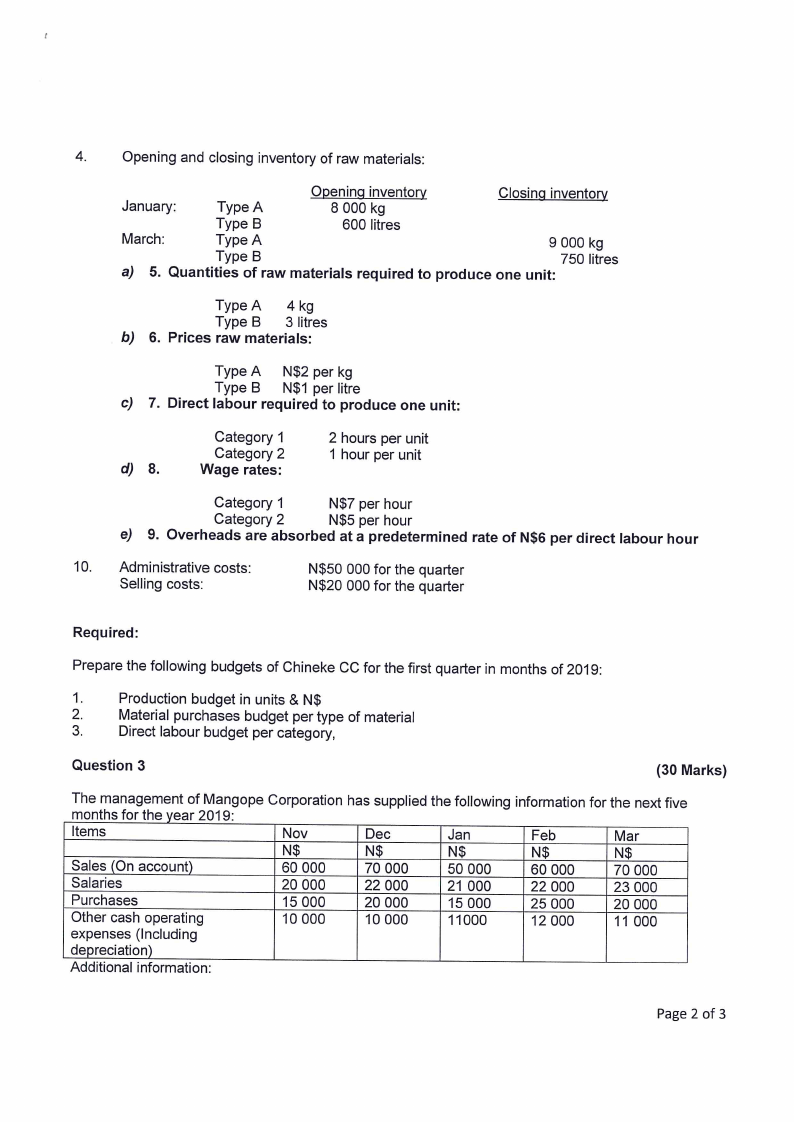

4.

Opening and closing inventory of raw materials:

January:

Type A

Opening inventory

8 000 kg

Closing inventory

Type B

600 litres

March:

Type A

9 000 kg

Type B

750 litres

a) 5. Quantities of raw materials required to produce one unit:

TypeA 4kg

TypeB 3 litres

b) 6. Prices raw materials:

Type A N$2 per kg

Type B_ N$1 per litre

c) 7. Direct labour required to produce one unit:

d) 8.

Category 1

Category 2

Wage rates:

2 hours per unit

1 hour per unit

Category 1

N$7 per hour

Category 2

N$5 per hour

e) 9. Overheads are absorbed at a predetermined rate of N$6 per direct labour hour

10. Administrative costs:

Selling costs:

N$50 000 for the quarter

N$20 000 for the quarter

Required:

Prepare the following budgets of Chineke CC for the first quarter in months of 2019:

1.

Production budget in units & N$

2.

Material purchases budget per type of material

3.

Direct labour budget per category,

Question 3

(30 Marks)

The management of Mangope

months for the year 2019:

Items

Sales (On account)

Salaries

Purchases

Other cash operating

expenses (Including

depreciation)

Additional information:

Corporation

Nov

N$

60 000

20 000

15 000

10 000

has supplied

Dec

N$

70 000

22 000

20 000

10 000

the following

Jan

N$

50 000

21 000

15 000

11000

information

Feb

NS

60 000

22 000

25 000

12 000

for the next five

Mar

N$

70 000

23 000

20 000

11 000

Page 2 of 3

|

4 Page 4 |

▲back to top |

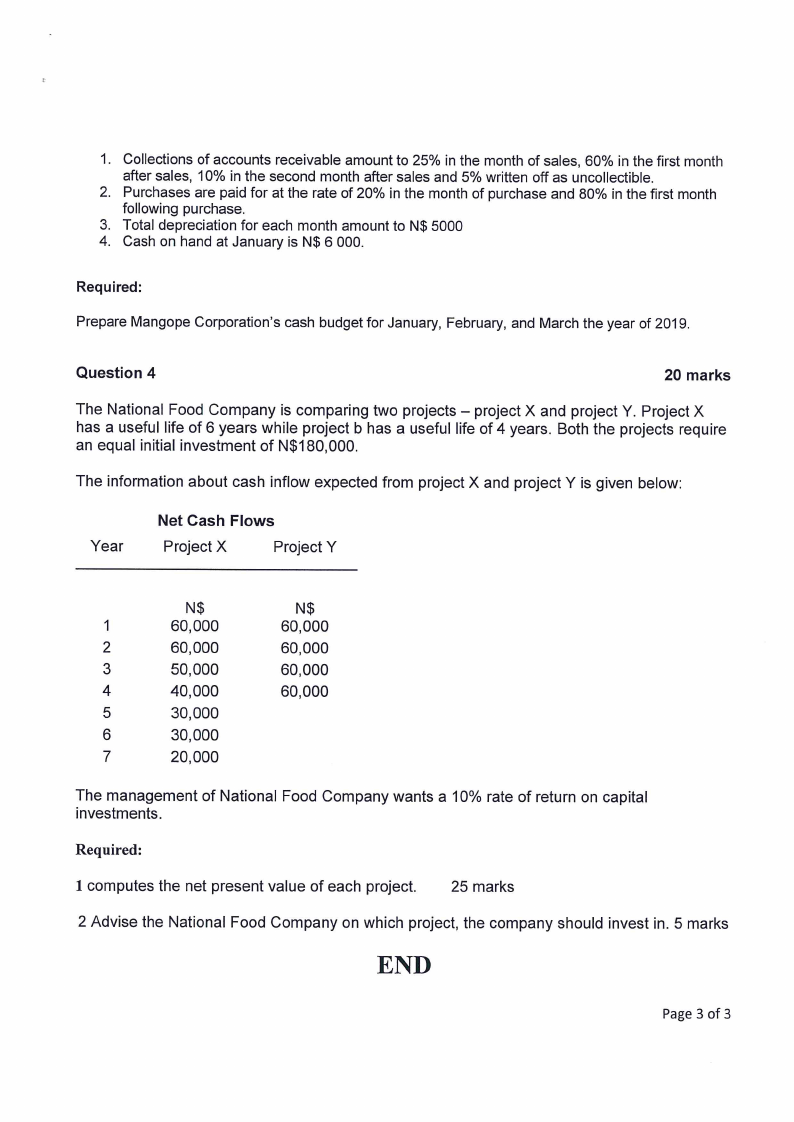

1. Collections of accounts receivable amount to 25% in the month of sales, 60% in the first month

after sales, 10% in the second month after sales and 5% written off as uncollectible.

2. Purchases are paid for at the rate of 20% in the month of purchase and 80% in the first month

following purchase.

3. Total depreciation for each month amount to N$ 5000

4. Cash on hand at January is N$ 6 000.

Required:

Prepare Mangope Corporation’s cash budget for January, February, and March the year of 2019.

Question 4

20 marks

The National Food Company is comparing two projects — project X and project Y. Project X

has a useful life of 6 years while project b has a useful life of 4 years. Both the projects require

an equal initial investment of N$180,000.

The information about cash inflow expected from project X and project Y is given below:

Net Cash Flows

Year

Project X

Project Y

N$

1

60,000

2

60,000

3

50,000

4

40,000

5

30,000

6

30,000

7

20,000

N$

60,000

60,000

60,000

60,000

The management of National Food Company wants a 10% rate of return on capital

investments.

Required:

1 computes the net present value of each project.

25 marks

2 Advise the National Food Company on which project, the company should invest in. 5 marks

END

Page 3 of 3