|

APM811S - ADVANCED PROJECT MANAGEMENT - 1ST OPP - JUNE 2024 |

|

1 Page 1 |

▲back to top |

nAmI BIA unIVERS ITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF GOVERNANCE AND MANAGEMENT SCIENCES

QUALIFICATION: BACHELOROF BUSINESSMANAGEMENT HONOURS

QUALIFICATIONCODE: 08BBMH

LEVEL: 8

COURSECODE:APM811S

COURSENAME: ADVANCED PROJECT

MANAGEMENT

SESSION:JUNE-JULY 2024

DURATION: 3 HOURS

PAPER:THEORY

MARKS: 100

FIRSTOPPORTUNITYEXAMINATION PAPER

EXAMINER(S) Dr VUSUMUZI SIBANDA

MODERATOR: MR. DANIEL KANDJIMI

INSTRUCTIONS

1. There are six questions, answer any FOUR.

2. Read all the questions carefully before answering.

3. Number the answers clearly

PERMISSIBLEMATERIALS

1. Examination question paper

2. Examination answer sheet

3. Calculator

THIS QUESTION PAPERCONSISTSOF _3_ PAGES(Including this front page)

|

2 Page 2 |

▲back to top |

Question 1

Explain the concept of project life cycle in project management and indicate how each stage

is very important in successful project management.

[25 marks]

Question 2

(a) With the aid of diagrams, compare the functional project structure and the matrix

project structure and demonstrate the strengths or appropriateness of each in

project management.

(15 marks)

(b) Outline any five (5) reasons why projects are started

(5 marks)

(c) State any five (5) reasons why projects are terminated.

(5 marks)

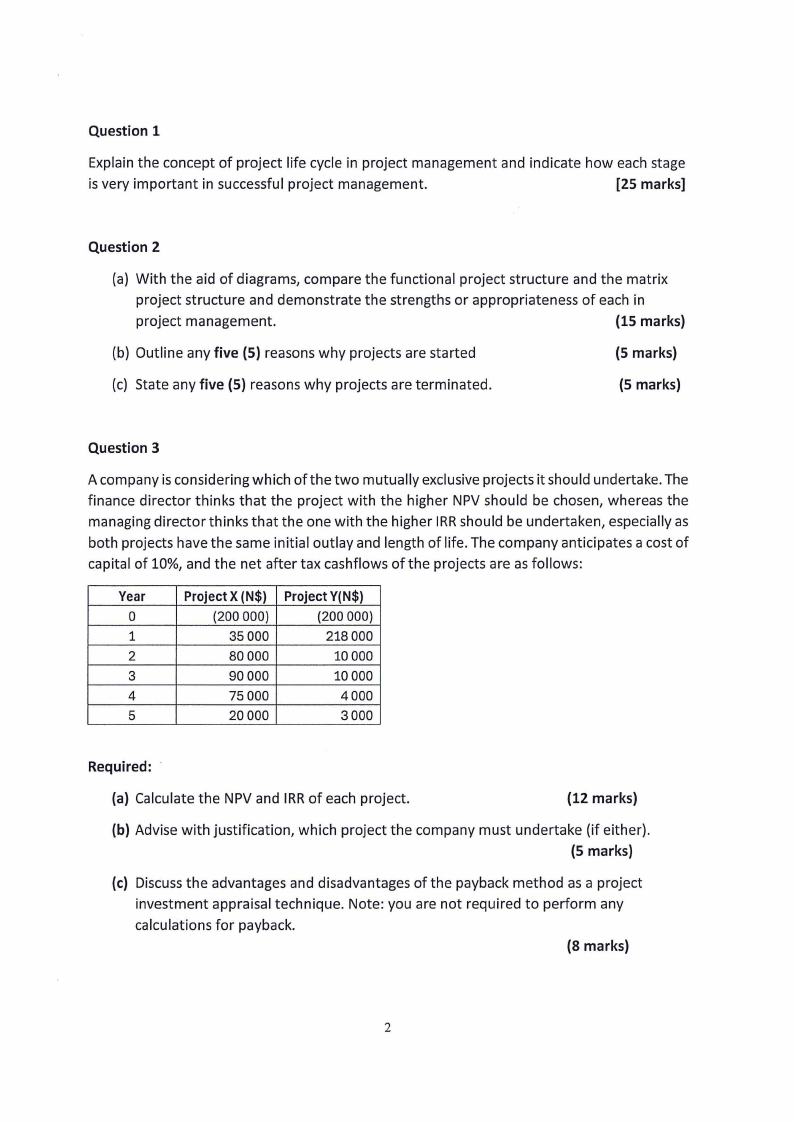

Question 3

A company is considering which of the two mutually exclusive projects it should undertake. The

finance director thinks that the project with the higher NPV should be chosen, whereas the

managing director thinks that the one with the higher IRRshould be undertaken, especially as

both projects have the same initial outlay and length of life. The company anticipates a cost of

capital of 10%, and the net after tax cashflows of the projects are as follows:

Year

0

1

2

3

4

5

Project X (N$)

(200 000)

35 000

80 000

90000

75 000

20 000

Project Y(N$)

(200 000)

218 000

10 000

10 000

4000

3000

Required:

(a) Calculate the NPV and IRRof each project.

{12 marks)

(b) Advise with justification, which project the company must undertake (if either).

(5 marks)

(c) Discussthe advantages and disadvantages of the payback method as a project

investment appraisal technique. Note: you are not required to perform any

calculations for payback.

(8 marks)

2

|

3 Page 3 |

▲back to top |

Question 4

A project has activities and duration times in days as shown in the table below:

Activities

A

B

C

D

E

F

G

H

I

J

Required:

Immediate

Predecessor

-

-

-

A

B

C

C

E,F

D

H,G

Optimistic

Time

6

3

4

2

3

4

3

6

5

3

Most Likely

Time

7

5

7

3

4

8

3

6

8

3

Pessimistic

Time

8

7

10

4

11

12

9

12

11

9

(i) Calculate the expected (mean) time for each activity

(5 marks)

(ii) Calculate the variance for each activity

(5 marks)

(iii) Construct the project activity network diagram using either AON or AOA

methodology and indicate the duration (mean time) for each activity. (8 marks)

(iv) Identify the critical path through the network diagram.

(2 marks)

(v) What is the earliest time that the project may be completed?

(3 marks)

(vi) Identify burst activities and merge activities on the network diagram. (2 marks)

Question 5

(a) Define the concept of project risk in project management

(2 marks)

(b) Discussany five (5) categories of risk in project management

{15 marks)

(c) With the aid of appropriate examples, discuss any four (4) risk mitigation strategies

(8 marks)

Question 6

(a) With the aid of appropriate examples, distinguish between the bottom-up and the

top-down methods of estimates in project management

{10 marks)

(b) Outline any five reasons why estimating costs, time and materials is important in

project management.

(5 marks)

(c) Why do some organisations continue with failed projects?

{10 marks)

3