|

CAC710S-COMPTERISED ACCOUNTING 310-2ND OPP-JAN 2025 |

|

1 Page 1 |

▲back to top |

.- ' '

nAmlBIA UnlVERSITY

OF SCIEnCE Ano TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT: ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: Bach.elor of Accounting/ Bachelor of Accounting Chartered

QUALIFICATION CODE: 07BOAC/07BACC

LEVEL: 7

COURSE: Computerised Accounting 301

COURSE CODE: CAC71 OS

DATE: Jan 2025

SESSION: Practical

DURATION: 3 Hours

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER(S) E Kangootui, Y Elago and H Namwandi

MODERATOR: E. Milijala

INSTRUCTIONS

1. This exam paper consists of one question with 3 parts, (A-C).

2. Please ensure that your student number appears on all reports. (Computer

printouts)

3. It is student's responsibility to ensure that all reports are handed in directly to

the invigilators.

4. Use of internet or any communication devices is strictly prohibited.

5. Questions relating to this examination may be raised in the initial 30 minutes

after the start of the paper. Thereafter, candidates must use their initiative to

deal with any perceived errors or ambiguities & any assumption made by the

candidate should be clearly stated.

6. Round of all calculations to the nearest two decimal places.

THIS QUESTION PAPER CONSISTS OF _5_ PAGES (Excluding this front page)

|

2 Page 2 |

▲back to top |

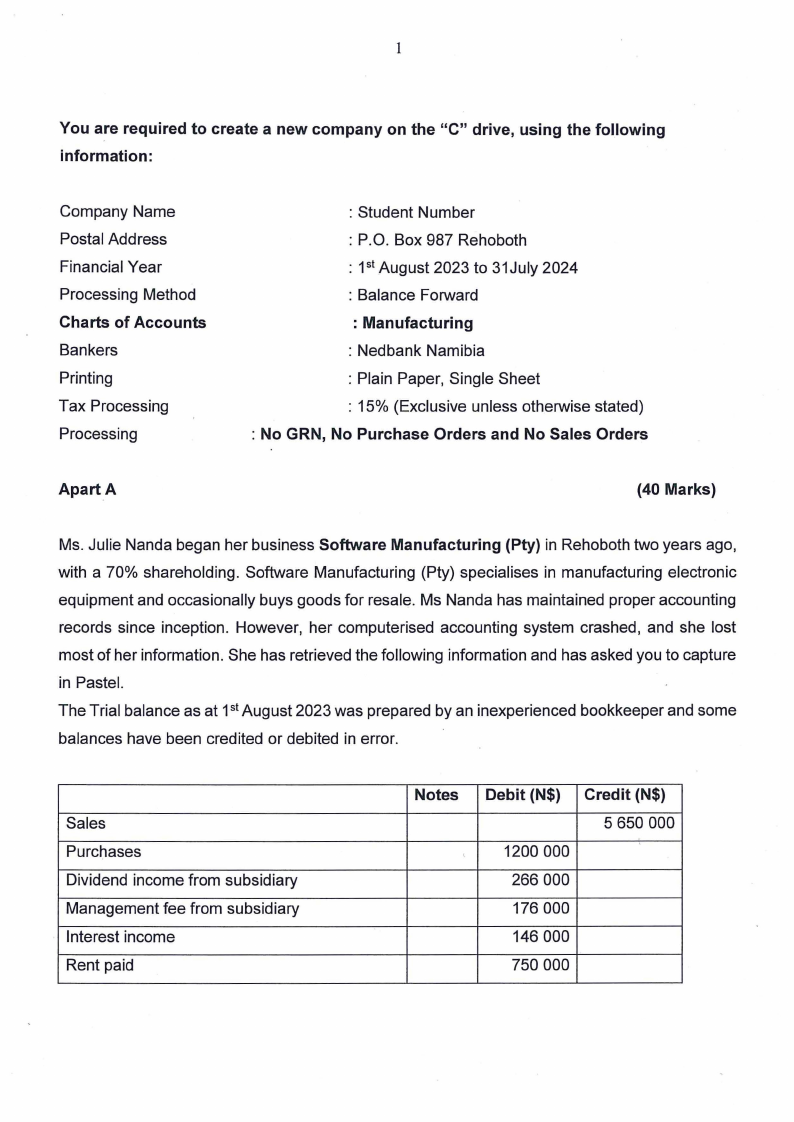

You are required to create a new company on the "C" drive, using the following

information:

Company Name

Postal Address

Financial Year

Processing Method

Charts of Accounts

Bankers

Printing

Tax Processing

Processing

: Student Number

: P.0. Box 987 Rehoboth

: 1st August 2023 to 31July 2024

: Balance Forward

: Manufacturing

: Nedbank Namibia

: Plain Paper, Single Sheet

: 15% (Exclusive unless otherwise stated)

: No GRN, No Purchase Orders and No Sales Orders

Apart A

(40 Marks)

Ms. Julie Nanda began her business Software Manufacturing (Pty) in Rehoboth two years ago,

with a 70% shareholding. Software Manufacturing (Pty) specialises in manufacturing electronic

equipment and occasionally buys goods for resale. Ms Nanda has maintained proper accounting

records since inception. However, her computerised accounting system crashed, and she lost

most of her information. She has retrieved the following information and has asked you to capture

in Pastel.

The Trial balance as at 1st August 2023 was prepared by an inexperienced bookkeeper and some

balances have been credited or debited in error.

Sales

Purchases

Dividend income from subsidiary

Management fee from subsidiary

Interest income

Rent paid

Notes

Debit (N$) Credit (N$)

1200 000

5 650 000

;

266 000

176 000

146 000

750 000

|

3 Page 3 |

▲back to top |

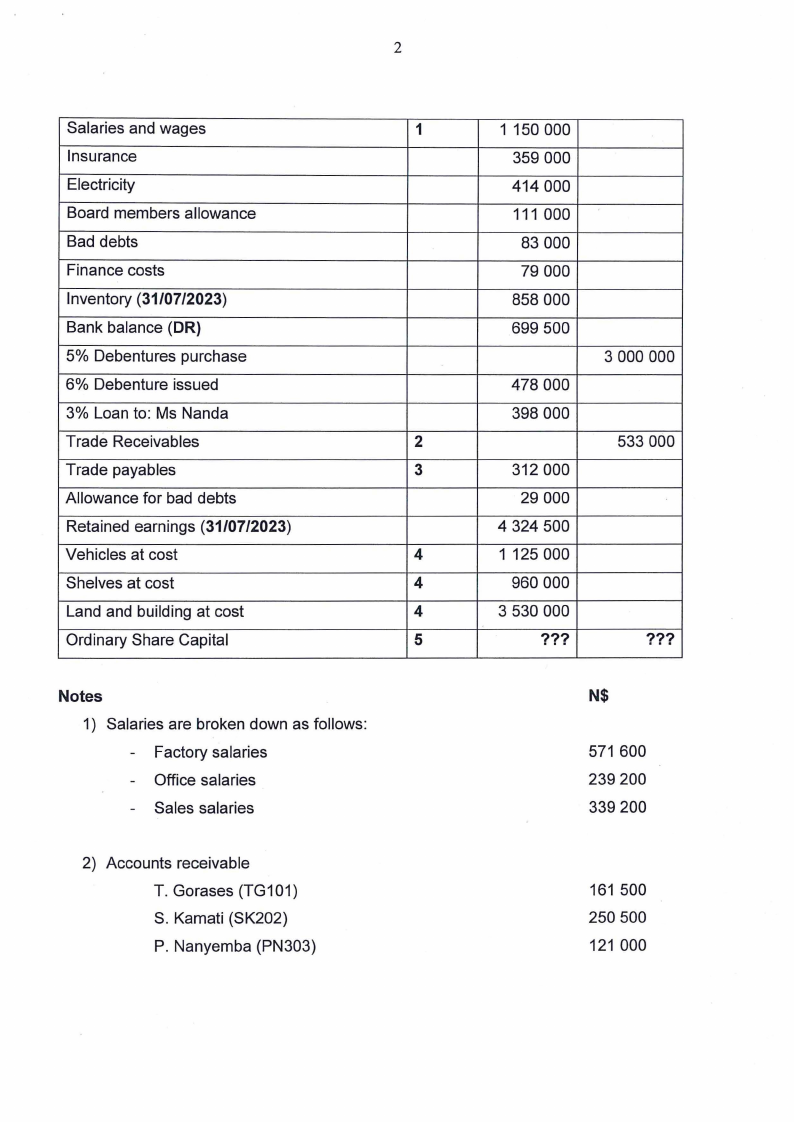

2

Salaries and wages

1

Insurance

Electricity

Board members allowance

Bad debts

Finance costs

Inventory (31/07/2023)

Bank balance (DR)

5% Debentures purchase

6% Debenture issued

3% Loan to: Ms Nanda

Trade Receivables

2

Trade payables

3

Allowance for bad debts

Retained earnings (31/07/2023)

Vehicles at cost

4

Shelves at cost

4

Land and building at cost

4

Ordinary Share Capital

5

Notes

1) Salaries are broken down as follows:

- Factory salaries

- Office salaries

- Sales salaries

2) Accounts receivable

T. Gorases (TG101)

S. Kamati (SK202)

P. Nanyemba (PN303)

1 150 000

359 000

414 000

111 000

83 000

79 000

858 000

699 500

478 000

398 000

312 000

29 000

4 324 500

1 125 000

960 000

3 530 000

???

3 000 000

533 000

???

N$

571 600

239 200

339 200

161 500

250 500

121 000

|

4 Page 4 |

▲back to top |

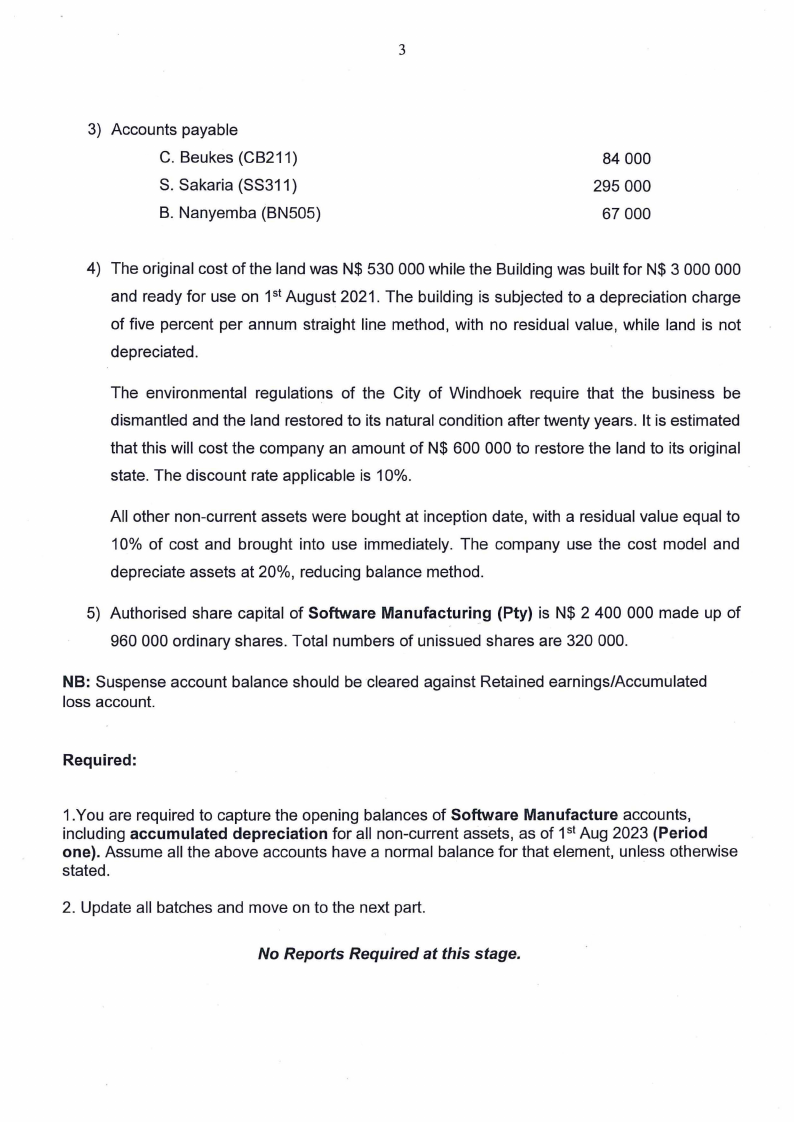

3

3) Accounts payable

C. Beukes (CB211)

S. Sakaria (SS311)

8. Nanyemba (BN505)

84 000

295 000

67 000

4) The original cost of the land was N$ 530 000 while the Building was built for N$ 3 000 000

and ready for use on 1st August 2021. The building is subjected to a depreciation charge

of five percent per annum straight line method, with no residual value, while land is not

depreciated.

The environmental regulations of the City of Windhoek require that the business be

dismantled and the land restored to its natural condition after twenty years. It is estimated

that this will cost the company an amount of N$ 600 000 to restore the land to its original

state. The discount rate applicable is 10%.

All other non-current assets were bought at inception date, with a residual value equal to

10% of cost and brought into use immediately. The company use the cost model and

depreciate assets at 20%, reducing balance method.

5) Authorised share capital of Software Manufacturing (Pty) is N$ 2 400 000 made up of

960 000 ordinary shares. Total numbers of unissued shares are 320 000.

NB: Suspense account balance should be cleared against Retained earnings/Accumulated

loss account.

Required:

1.You are required to capture the opening balances of Software Manufacture accounts,

including accumulated depreciation for all non-current assets, as of 1stAug 2023 (Period

one). Assume all the above accounts have a normal balance for that element, unless otherwise

stated.

2. Update all batches and move on to the next part.

No Reports Required at this stage.

|

5 Page 5 |

▲back to top |

4

Part B

(30 marks)

The bookkeeper in the process of preparing the bank reconciliation for the month of March.

You are presented will the following information which needs to be recorded in the main

bank account, cashbook before the bank reconciliation can be prepared.

1. On 31st March 2024 the bank column of Software Manufacturing (Pty)'s cash book

showed debit balance of N$ 800.

2. When comparing the cash book with the bank statement, it was discovered that

Royalty received of N$ 3 110 is incorrectly debited to the bank account.

·3. An amount of N$ 599 for Ms Nanda's home DSTV monthly payment was debited to

the business bank account.

4. A direct debit of N$ 690 for the insurance monthly payment, had not been recorded in

the cashbook.

5. An invoice amount of N$ 2 800 from City of Windhoek correctly recorded in the

cashbook, was recorded with an amount of N$ 2 080 on the bank statement.

6. The bank statement should the following items not yet captured in the cashbook:

Petty cash

N$ 1 500

Duty on debit entries

N$ 151.36

Interest on credit balance

N$ 285

Unknown cash deposit

N$ 1 000

7. A further check revealed the following items, two EFT drawn in favour of ABC Pty Ltd

N$ 2 250 and Wholesale Ltd N$ 4 290 reflected on bank statements as payments, but

no records found in the cashbook.

8. Cash sales of N$ 6 000 paid with a debit card on 31st March, not yet recorded in the

cash book.

9. Fuel cost of N$ 3 000 paid with the company's debit card has not yet been recorded in

the cash book.

·10.A payment received fro.m Miss Dolly White, in settlement of her overdue amount of N$

5 250, already recorded in the cashbook, bu~was not honoured by her bank account.

11. Debit order of N$ 450 for Smart Alarm armed response was not yet recorded in the

cashbook.

12. T. Gorases and P. Nanyemba settled their overdue balances, through bank transfers

respectively, no records in the cashbook.

13. The monthly bank statement as at 31st March 2024 showed a debit balance of N$ 3

450.

Required:

1. Process the necessary adjustments in the main current account cashbook, which

enables the bookkeeper to prepare the bank reconciliation for March 2024

2. Update all bathes and move on to the next part.

No Reports Required at this stage;

|

6 Page 6 |

▲back to top |

5

PartC

(30 Marks)

Additional information is available which needs to be considered in period 12:

I.

II.

Ill.

IV.

V.

VI.

VII.

VIII.

IX.

On 1st August 2023 sold a Sumsung Laptop for N$ 35 000, which was bought a year ago

.at cost price of N$ 50 000. The accountant processed this entry incorrectly by crediting

Laptop cost account with the amount received, the debit went to bank. Process all

necessary entries, to correctly account for the non-current asset disposal.

An inventory count of the information pamphlets on 31st July 2024 showed the value of on

hand amounted to N$ 3 750.

The allowance for bad debts at year should be N$ 18 300.

On 1 January 2024, the bookkeeper paid an amount of N$ 25 000 as telephone expense.

Monthly fee is N$ 2 500, no records were processed yet.

The company went to the coast for their year-end function for the cost of N$ 4 500, which

is not yet paid.

The company did not pay 2 temporary cleaning assistants for their July 2024 wages, the

employees each earn N$ 2 000 per month.

A stock count on 31st July 2024 showed the value of stock on hand amounted to N$ 318

000.

The income tax expense for the year ended 31st July 2024 is N$ 507 000. This expense

has not yet been recorded.

Provide annual depreciation charge, account for accrued interest expenses and interest

income on all financial instruments, including any other necessary year-end adjustments.

Required:

Process the above transactions in period 12, update all batches and print out the following

reports of Software Manufacturing (Pty)

1. A detailed ledger:

(View - General ledger - Transaction - Detailed ledger)

• Period 1 - period 12

2. Customer & Supplier detailed ledger:

• Customers: View - Customers - Detailed ledger - By customer

• Suppliers: View - Suppliers - Detailed ledger - By supplier

• Period: 1 - Period 12

-------------------------------End

of Examination-------------------------