|

CAC710S-COMPUTERIZED ACCOUNTING-2ND OPP-JULY 2022 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEn CE Ano TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT: ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION : Bachelor of Accounting/ Bachelor of Accounting (Chartered Accountancy)

QUALIFICATION CODE: 07BOAC/07BACC

LEVEL: 7

COURSE: Computerised Accounting 301

COURSE CODE: CAC710S

DATE: July 2022

SESSION: Morning

DURATION: 3 Hours

MARKS: 100

EXAMINER(S)

MODERATOR:

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

Y. Elago and E. Kangootui

E. Milijala

THIS QUESTION PAPER CONSISTS OF 6 PAGES

(Excluding this front page)

INSTRUCTIONS

1. This assessment paper is made up of three questions which are related.

2. Read the whole question paper before you start.

3. Make sure that your student number appears on the reports. (Computer

printout).

4. It is your responsibility to see that all the reports are handed in.

5. Use of internet or any communication devices during the assessment is prohibited.

6. Questions relating to this paper may be raised within the first 30 minutes of the

assessment. Thereafter, candidates must use their initiative to deal with any

perceived errors or ambiguities and any assumption made by the candidate should

be written and submitted together with the reports.

7. Round off all calculated amounts to two decimal places.

|

2 Page 2 |

▲back to top |

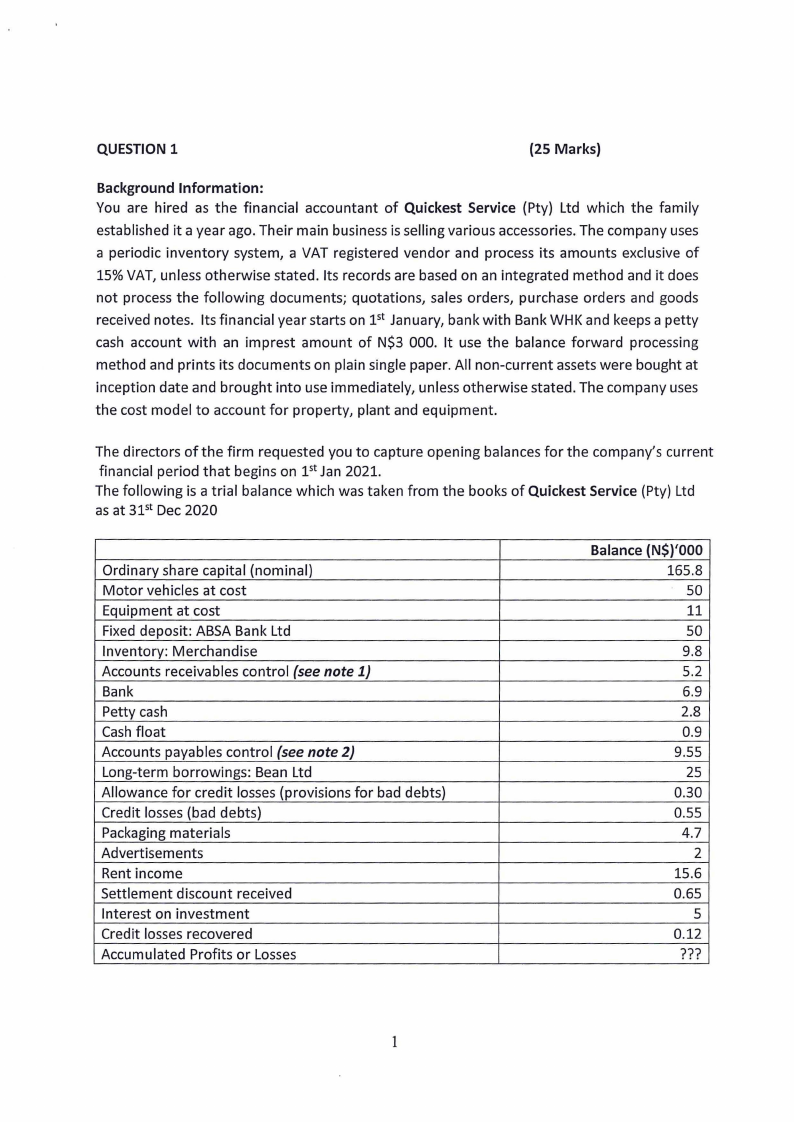

QUESTION 1

(25 Marks)

Background Information:

You are hired as the financial accountant of Quickest Service (Pty) Ltd which the family

established it a year ago. Their main business is selling various accessories. The company uses

a periodic inventory system, a VAT registered vendor and process its amounts exclusive of

15% VAT, unless otherwise stated. Its records are based on an integrated method and it does

not process the following documents; quotations, sales orders, purchase orders and goods

received notes. Its financial year starts on 1st January, bank with Bank WHK and keeps a petty

cash account with an imprest amount of N$3 000. It use the balance forward processing

method and prints its documents on plain single paper. All non-current assets were bought at

inception date and brought into use immediately, unless otherwise stated. The company uses

the cost model to account for property, plant and equipment.

The directors of the firm requested you to capture opening balances for the company's current

financial period that begins on 1st Jan 2021.

The following is a trial balance which was taken from the books of Quickest Service (Pty) Ltd

as at 31st Dec 2020

Ordinary share capital (nominal)

Motor vehicles at cost

Equipment at cost

Fixed deposit: ABSA Bank Ltd

Inventory: Merchandise

Accounts receivables control (see note 1)

Bank

Petty cash

Cash float

Accounts payables control (see note 2)

Long-term borrowings: Bean Ltd

Allowance for credit losses (provisions for bad debts)

Credit losses (bad debts)

Packaging materials

Advertisements

Rent income

Settlement discount received

Interest on investment

Credit losses recovered

Accumulated Profits or Losses

Balance {N$}'000

165.8

50

11

50

9.8

5.2

6.9

2.8

0.9

9.55

25

0.30

0.55

4.7

2

15.6

0.65

5

0.12

???

1

|

3 Page 3 |

▲back to top |

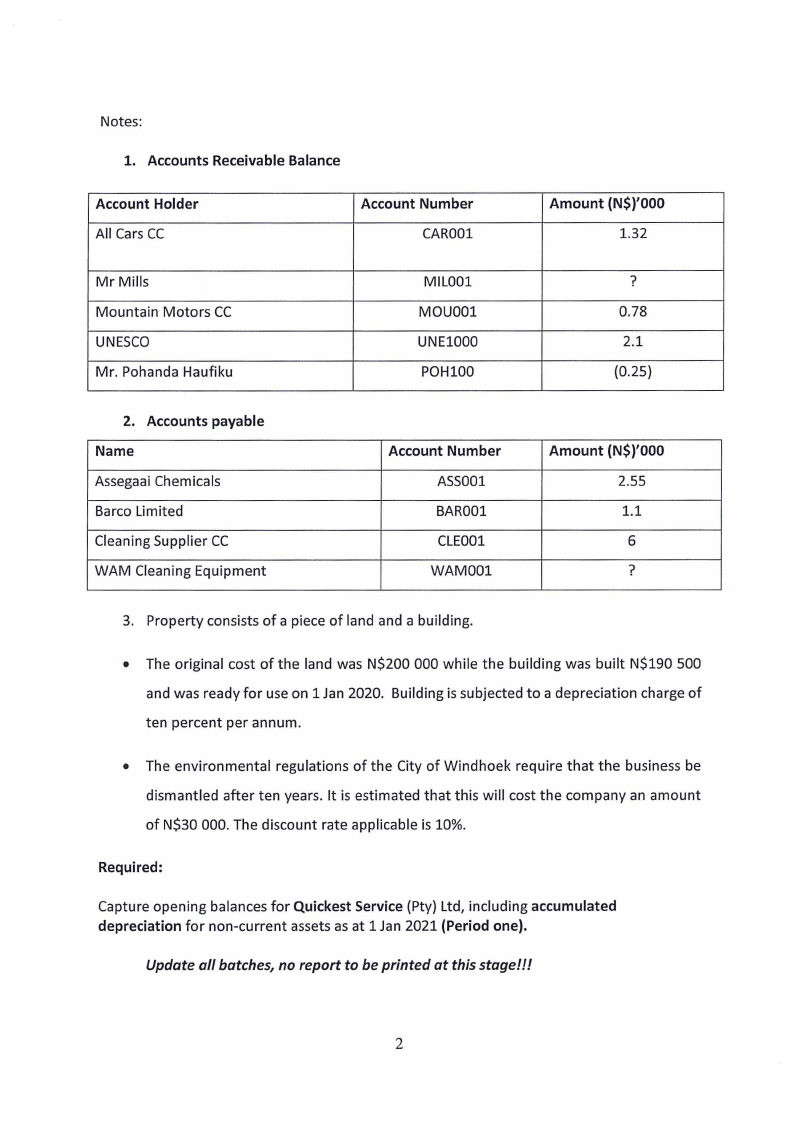

Notes:

1. Accounts Receivable Balance

Account Holder

All Cars CC

Account Number

CAR00l

Amount (N$)'000

1.32

Mr Mills

Mountain Motors CC

UNESCO

Mr. Pohanda Haufiku

MIL00l

MOU00l

UNEl000

POHl00

?

0.78

2.1

(0.25)

2. Accounts payable

Name

Assegaai Chemicals

Barco Limited

Cleaning Supplier CC

WAM Cleaning Equipment

Account Number

ASS00l

BAR00l

CLEO0l

WAM00l

Amount (N$)'OOO

2.55

1.1

6

?

3. Property consists of a piece of land and a building.

• The original cost of the land was N$200 000 while the building was built N$190 500

and was ready for use on 1 Jan 2020. Building is subjected to a depreciation charge of

ten percent per annum.

• The environmental regulations of the City of Windhoek require that the business be

dismantled after ten years. It is estimated that this will cost the company an amount

of N$30 000. The discount rate applicable is 10%.

Required:

Capture opening balances for Quickest Service (Pty) Ltd, including accumulated

depreciation for non-current assets as at 1 Jan 2021 (Period one).

Update all batches, no report to be printed at this stage!!!

2

|

4 Page 4 |

▲back to top |

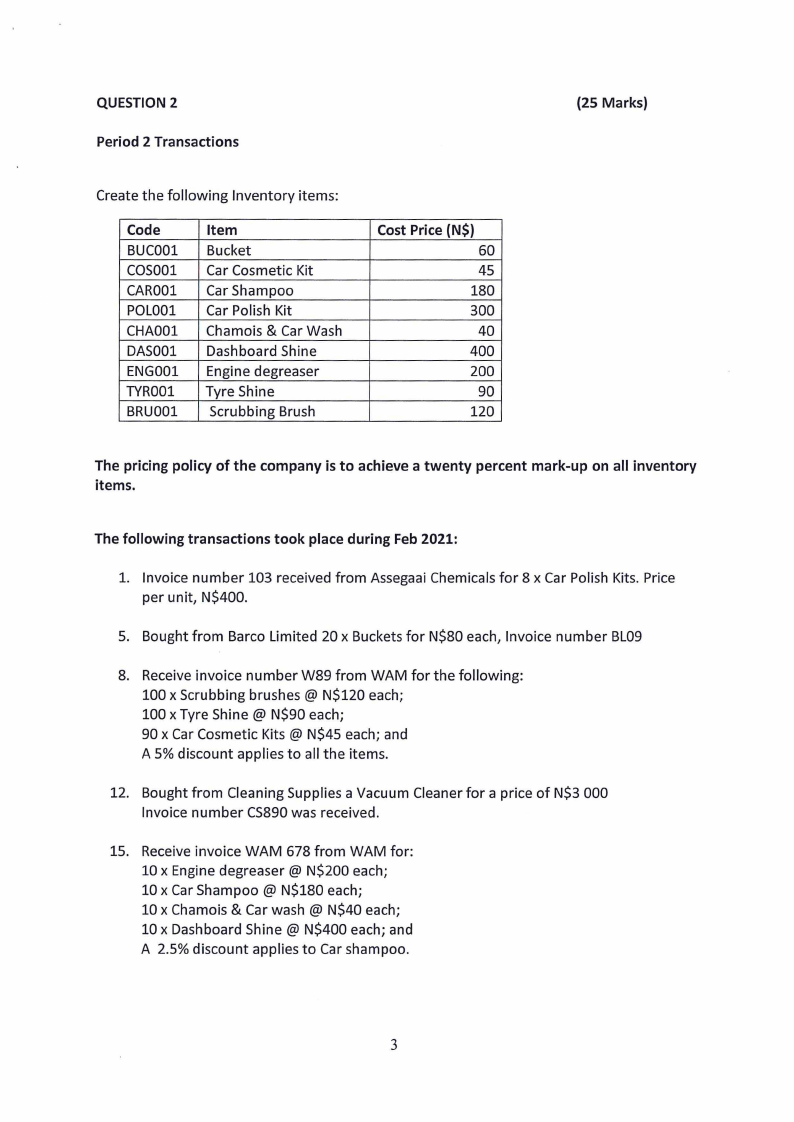

QUESTION 2

Period 2 Transactions

(25 Marks)

Create the following Inventory items:

Code

BUC00l

COS00l

CAR00l

POLO0l

CHA00l

DAS00l

ENG00l

TYR00l

BRU00l

Item

Bucket

Car Cosmetic Kit

Car Shampoo

Car Polish Kit

Chamois & Car Wash

Dashboard Shine

Engine degreaser

Tyre Shine

Scrubbing Brush

Cost Price (N$)

60

45

180

300

40

400

200

90

120

The pricing policy of the company is to achieve a twenty percent mark-up on all inventory

items.

The following transactions took place during Feb 2021:

1. Invoice number 103 received from Assegaai Chemicals for 8 x Car Polish Kits. Price

per unit, N$400.

5. Bought from Barco Limited 20 x Buckets for N$80 each, Invoice number BL09

8. Receive invoice number W89 from WAM for the following:

100 x Scrubbing brushes @ N$120 each;

100 x Tyre Shine @ N$90 each;

90 x Car Cosmetic Kits @ N$45 each; and

A 5% discount applies to all the items.

12. Bought from Cleaning Supplies a Vacuum Cleaner for a price of N$3 000

Invoice number CS890 was received.

15. Receive invoice WAM 678 from WAM for:

10 x Engine degreaser@ N$200 each;

10 x Car Shampoo @ N$180 each;

10 x Chamois & Car wash @ N$40 each;

10 x Dashboard Shine@ N$400 each; and

A 2.5% discount applies to Car shampoo.

3

|

5 Page 5 |

▲back to top |

The following transactions also took place during Feb 2021:

2. Send an invoice to All Cars CCfor four Car Polish Kits

9. Sold on cash the following items:

10 x Scrubbing brushes @N$200 each; and

10 x Tyre Shine @ N$190 each.

10. Sold the following to Mr Mills

5 x Engine degreaser allowing a discount of 3.5% and 4 x Car Shampoo

20. The buckets bought from Barco Ltd were damaged. These were returned to the supplier

the same day and receive a Debit note INV400

21. Two bottles containing Car Shampoo bought from WAM were leaking. They were

returned and receive doc number 456

25. Three of the Tyre Shine which were sold were returned.

27. Two of the Engine degreaser was returned to the business and we eventually returned

them to the supplier.

Required:

Create inventory items, process suppliers and customers' transactions accordingly for the

month of Feb 2021.

Update all batches1 no report to be printed at this stage!!!

4

|

6 Page 6 |

▲back to top |

Question 3

(SO Marks)

The following year-end adjustments must still be taken into account:

(a) Packaging material on hand at 31 December 2021, N$980.

(b) The long-term borrowing was entered into on 1 October 2019. According to the agreement,

interest will be payable bi-annually at a rate of 18% per annum.

(c) Advertisements include an amount of N$400 paid for January 2022.

(d) Rent income includes an amount in respect of January 2022. No increase in rental fee for the

past 2 years.

(e) Interest on the fixed deposit has not yet been received for the last two months of the financial

year. Interest is calculated at a rate of 12% per annum. The deposit is classified as long-term

financial asset.

(f) Insurance includes an amount of N$750 paid for the period 31 December 2021 to 31 January

2022.

(g) The telephone account of N$165 for December 2021 was not yet paid.

(h) Depreciation must be provided for as follows:

• Vehicles: 20% per annum on the diminished balance.

• Plant: 25% per annum on cost with no residual value.

• Equipment: 10% per annum on the diminished balance.

Equipment with a cost of N$2 000 was purchased on 1 July 2021

(i) Quickest Service (Pty) Ltd acquired a plant for N$100 000 on 1 January 2021 and transferred

the payment immediately. Quickest Service (Pty) Ltd has a legal obligation to dismantle the

plant at the end of its 4 year useful life. The dismantling will cost N$20 000.The current

average cost of capital is 9.5%. No entries were recorded in the books.

(j) The account of Loose-Ends Ltd, a debtor owing the entity N$2000, must be written off as

irrecoverable.

(k) It was determined that the allowance of credit losses account should amount to N$250 at 31

December 2021.

(I) Income tax for the year is estimated to be N$30 000.

(m)Settlement discount granted and received are set off against revenue and cost of sales

respectively.

5

|

7 Page 7 |

▲back to top |

Required:

Processthe above transactions in period 12, update all batches, and print out the following

reports:

1. A detailed ledger of Quickest Service (Pty) Ltd for the year ended 31st Dec 2021

{View - General ledger - Transaction - Detailed ledger)

• Account start 1000 -Account end 9990

• Sub account start 000 - Sub account end 999

• Period 1- period 12

2. Suppliers and customer's detailed ledgers.

• Customers: View - Customers - Detailed ledger - By customers

• Suppliers: View - Suppliers - Detailed ledger - By suppliers

• Period: 1- Period 12

====================End of 2nd Opportunity Examination==============

6