|

CAC710S-COMPUTERIZED ACCOUNTING-1ST OPP-JUNE 2022 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEn CE Ano TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT: ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION: Bachelor of Accounting/ Bachelor of Accounting (Chartered

Accountancy)

QUALIFICATION CODE: 07BOAC/07BACC

LEVEL: 7

COURSE: Computerized Accounting 301

COURSE CODE: CAC710S

DATE: June 2022

DURATION: 3 Hours

SESSION: Morning

MARKS: 100

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER(S) Y. Elago and E. Kangootui

MODERATOR: E. Milijala

THIS QUESTION PAPER CONSISTS OF 7 PAGES. (Excluding this front page)

INSTRUCTIONS

1. This assessment paper is made up of three questions which are related.

2. Read the whole question paper before you start.

3. Make sure that your student number appears on the reports. (Computer printout).

4. It is your responsibility to ensure that all the reports are handed in.

5. Use of internet or any communication devices during the assessment is prohibited.

6. Questions relating to this paper may be raised within the first 30 minutes of the

assessment. Thereafter, candidates must use their initiative to deal with any perceived

errors or ambiguities and any assumption made by the candidate should be written

and submitted together with the reports.

7. Round off all calculated amounts to two decimal places.

|

2 Page 2 |

▲back to top |

QUESTION 1

(25 Marks)

Mr. Kanyengela started a construction company in Oshikuku a few years back. The

company specialize in construction of residential houses. He wants to make it grow much

bigger to be able to compete with large constructions companies. He recently bought an

accounting program and asked you to process all his records on this new program. He

named the company as the Tutungeni construction (Pty) Ltd.

You are required to create a new company on the "C" drive, using the following

information.

Company name

Financial year

Date format

Processing method

Bankers

Printing

Supplier processing

: Student Number

: 1st September 2020 - 31st August 2021

: 01/09/2020

: Balance forward

: Bank Windhoek

: Plain Paper

: No GRN, No purchase and sales orders to be processed.

|

3 Page 3 |

▲back to top |

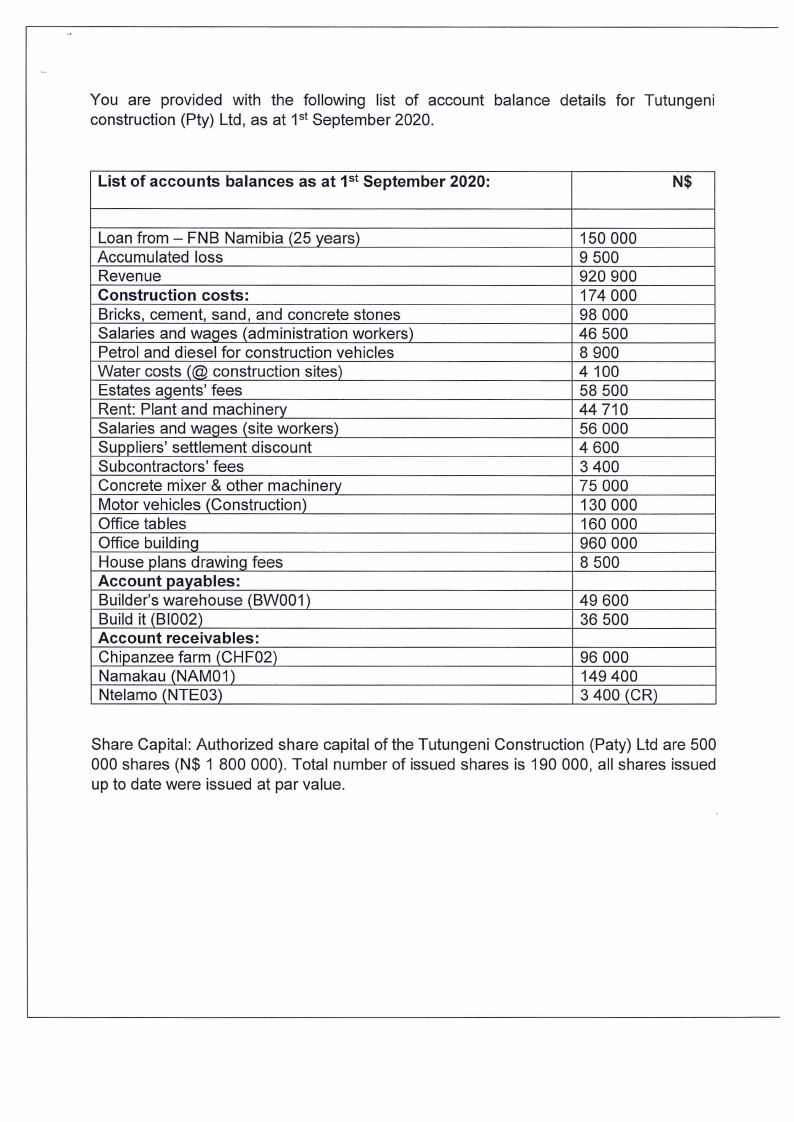

You are provided with the following list of account balance details for Tutungeni

construction (Pty) Ltd, as at 1st September 2020.

List of accounts balances as at 1st September 2020:

N$

Loan from - FNB Namibia (25 years)

Accumulated loss

Revenue

Construction costs:

Bricks, cement, sand, and concrete stones

Salaries and waqes (administration workers)

Petrol and diesel for construction vehicles

Water costs (@ construction sites)

Estates agents' fees

Rent: Plant and machinery

Salaries and wages (site workers)

Suppliers' settlement discount

Subcontractors' fees

Concrete mixer & other machinery

Motor vehicles (Construction)

Office tables

Office buildinq

House plans drawinq fees

Account payables:

Builder's warehouse (BW001)

Build it (81002)

Account receivables:

Chipanzee farm (CHF02)

Namakau (NAM01)

Ntelamo (NTE03)

150 000

9 500

920 900

174 000

98 000

46 500

8 900

4 100

58 500

44 710

56 000

4 600

3 400

75 000

130 000

160 000

960 000

8 500

49 600

36 500

96 000

149 400

3 400 (CR)

Share Capital: Authorized share capital of the Tutungeni Construction (Paty) Ltd are 500

000 shares (N$ 1 800 000). Total number of issued shares is 190 000, all shares issued

up to date were issued at par value.

|

4 Page 4 |

▲back to top |

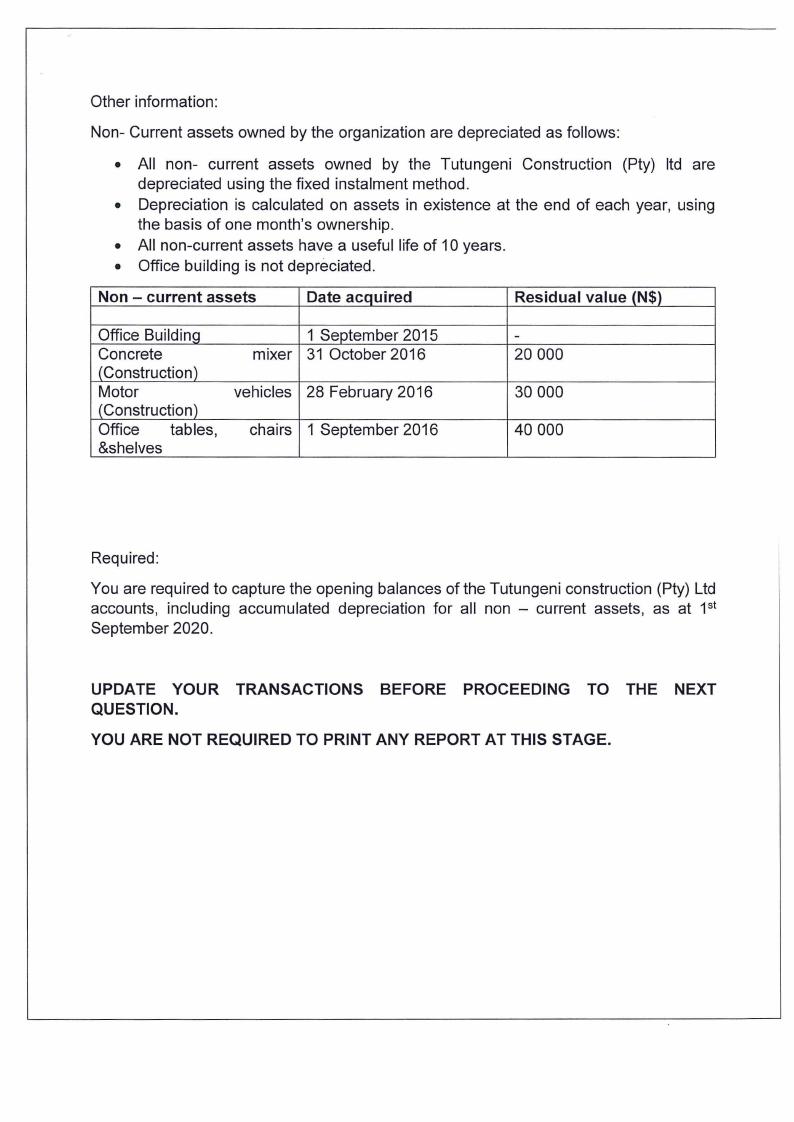

Other information:

Non- Current assets owned by the organization are depreciated as follows:

• All non- current assets owned by the Tutungeni Construction (Pty) ltd are

depreciated using the fixed instalment method.

• Depreciation is calculated on assets in existence at the end of each year, using

the basis of one month's ownership.

• All non-current assets have a useful life of 10 years.

• Office building is not depreciated.

Non - current assets

Date acquired

Residual value (N$)

Office Building

Concrete

(Construction)

Motor

(Construction)

Office tables,

&shelves

mixer

vehicles

chairs

1 September 2015

31 October 2016

28 February 2016

1 September 2016

-

20 000

30 000

40 000

Required:

You are required to capture the opening balances of the Tutungeni construction (Pty) Ltd

accounts, including accumulated depreciation for all non - current assets, as at 1st

September 2020.

UPDATE YOUR TRANSACTIONS BEFORE PROCEEDING TO THE NEXT

QUESTION.

YOU ARE NOT REQUIRED TO PRINT ANY REPORT AT THIS STAGE.

|

5 Page 5 |

▲back to top |

QUESTION 2

(25 Marks)

PART A

YEAR- END ADJUSTMNET:

You are required to process the year- end adjustments provided to you. All adjustments

should be processed at the end of financial year (period 12).

• Income tax of the year was determined to be N$40 140 by NAMRA, payable in

the next financial period.

• On 31 August 2021 it was discovered that the total invoice amount paid for a motor

vehicle on 28 February 2019 was over-cast in error by N$ 30 000. No adjustment

was made for this error.

• The directors of the company declare dividends on all issued share at N$ 0.50 per

share.

• Due to the various reasons debtors were not settling their accounts on time. The

directors of the company decided to make a provision for debtors who they think

will not pay. this amount was estimated to be N$ 21 410 for the current year.

• Total amount paid for rent on plant and machinery covers from 1 September 2020

to 30 N_ovember2021.

• Provide depreciation on all non- current assets owned by the company for the

current financial year end.

|

6 Page 6 |

▲back to top |

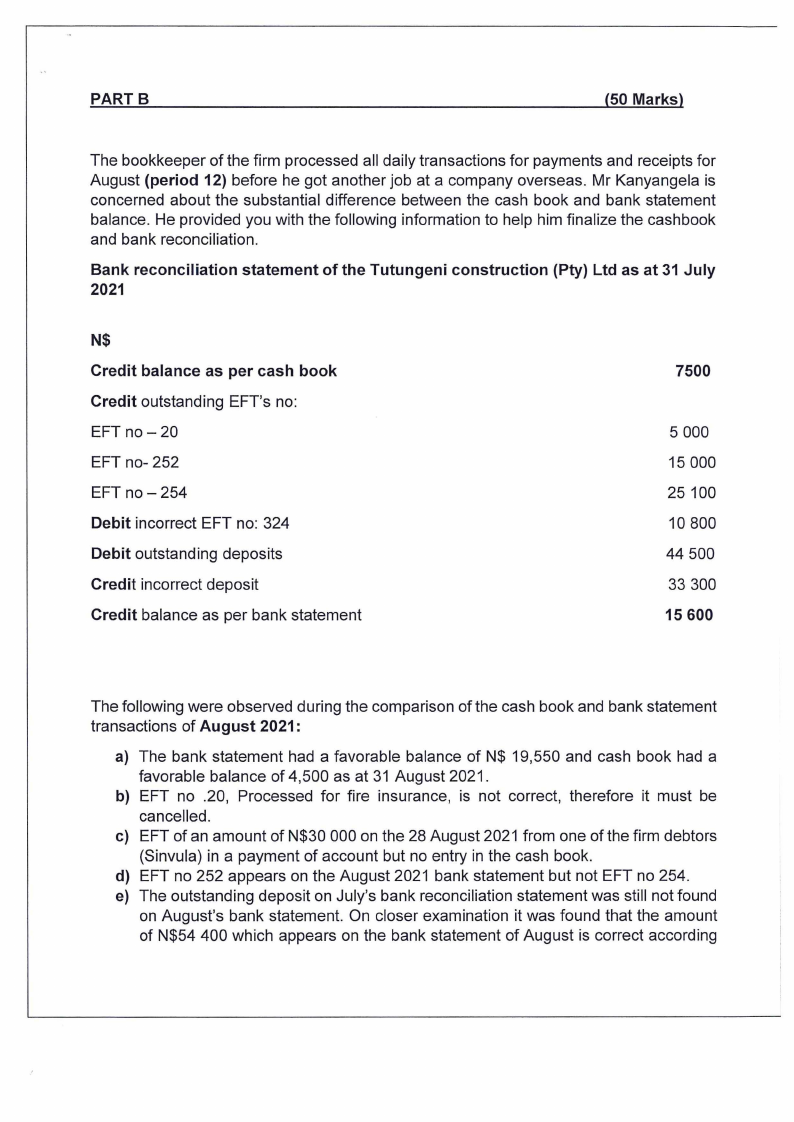

PARTS

(50 Marks)

The bookkeeper of the firm processed all daily transactions for payments and receipts for

August (period 12) before he got another job at a company overseas. Mr Kanyangela is

concerned about the substantial difference between the cash book and bank statement

balance. He provided you with the following information to help him finalize the cashbook

and bank reconciliation.

Bank reconciliation statement of the Tutungeni construction (Pty) Ltd as at 31 July

2021

N$

Credit balance as per cash book

Credit outstanding EFT's no:

EFT no-20

EFT no- 252

EFT no-254

Debit incorrect EFT no: 324

Debit outstanding deposits

Credit incorrect deposit

Credit balance as per bank statement

7500

5 000

15 000

25 100

10 800

44 500

33 300

15 600

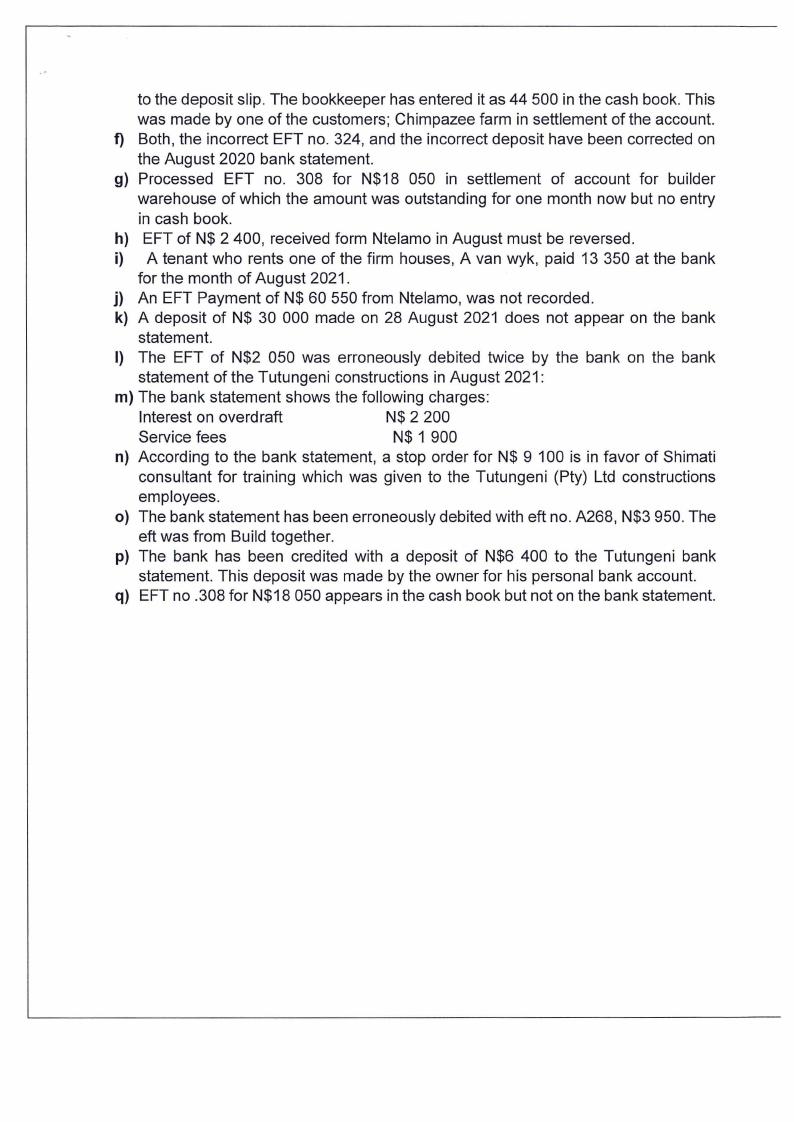

The following were observed during the comparison of the cash book and bank statement

transactions of August 2021:

a) The bank statement had a favorable balance of N$ 19,550 and cash book had a

favorable balance of 4,500 as at 31 August 2021.

b) EFT no .20, Processed for fire insurance, is not correct, therefore it must be

cancelled.

c) EFT of an amount of N$30 000 on the 28 August 2021 from one of the firm debtors

(Sinvula) in a payment of account but no entry in the cash book.

d) EFT no 252 appears on the August 2021 bank statement but not EFT no 254.

e) The outstanding deposit on July's bank reconciliation statement was still not found

on August's bank statement. On closer examination it was found that the amount

of N$54 400 which appears on the bank statement of August is correct according

|

7 Page 7 |

▲back to top |

to the deposit slip. The bookkeeper has entered it as 44 500 in the cash book. This

was made by one of the customers; Chimpazee farm in settlement of the account.

f) Both, the incorrect EFT no. 324, and the incorrect deposit have been corrected on

the August 2020 bank statement.

g) Processed EFT no. 308 for N$18 050 in settlement of account for builder

warehouse of which the amount was outstanding for one month now but no entry

in cash book.

h) EFT of N$ 2 400, received form Ntelamo in August must be reversed.

i) A tenant who rents one of the firm houses, A van wyk, paid 13 350 at the bank

for the month of August 2021.

j) An EFT Payment of N$ 60 550 from Ntelamo, was not recorded.

k) A deposit of N$ 30 000 made on 28 August 2021 does not appear on the bank

statement.

I) The EFT of N$2 050 was erroneously debited twice by the bank on the bank

statement of the Tutungeni constructions in August 2021:

m) The bank statement shows the following charges:

Interest on overdraft

N$ 2 200

Service fees

N$ 1 900

n) According to the bank statement, a stop order for N$ 9 100 is in favor of Shimati

consultant for training which was given to the Tutungeni (Pty) Ltd constructions

employees.

o) The bank statement has been erroneously debited with eft no. A268, N$3 950. The

eft was from Build together.

p) The bank has been credited with a deposit of N$6 400 to the Tutungeni bank

statement. This deposit was made by the owner for his personal bank account.

q) EFT no .308 for N$18 050 appears in the cash book but not on the bank statement.

|

8 Page 8 |

▲back to top |

Required:

Process the above transactions, update, and print the following reports:

1. You are required to make the necessary entries in the cash book (update the cash

book) of the Tutungeni construction (Pty) Ltd for August transactions, (in Period

12). Print out a cash book detailed ledger as at that period.

2. Prepare a bank reconciliation statement of the Tutungeni construction (Pty) Ltd for

August in period12. Print the bank reconciliation report at the same date.

3. Print out a detailed ledger for the year ended 31st August 2021

(View - General ledger - Transaction - Detailed ledger)

• Account starts 1000 - Account end 9990

• Sub account start 000 - Sub account end 999

• Period 1 - period 12

4. Print out suppliers and customer's detailed ledgers.

• Customers: View- Customers - Detailed ledger- By customers

• Suppliers: View - Suppliers - Detailed ledger - By suppliers

• Period: 1 - Period 12

--------------------End

of final assessment-------------------------