|

IMA612S- INTERMEDIATE MACROECONOMICS- 2ND OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA untVERSITY

OF SCIEnCE TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATIONS:

BACHELOR OF ECONOMICS, BACHELOR OF ACCOUNTING GENERAL AND BACHELOR OF

ACCOUNTING (CHARTERED)

QUALIFICATION CODE:

O7BECO, 07BOAC AND 07 BACC

LEVEL: 7

COURSE CODE: IMA612S

SESSION: NOVEMBER 2023

DURATION: 3 HOURS

COURSE NAME: INTERMEDIATE MACROECONIMICS

PAPER: THEORY

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER(S) Mr Eslon Ngeendepi

MODERATOR: Miss Ndeshi Shitenga

INSTRUCTIONS

1. Answer ALL the questions.

2. Write clearly and neatly.

3. Number the answers clearly.

PERMISSIBLE MATERIALS

1. Pens/pencils/erasers

2. Calculator

3. Ruler

THIS QUESTION PAPER CONSISTS OF 4 PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

QUESTION 1

[10 Marks]

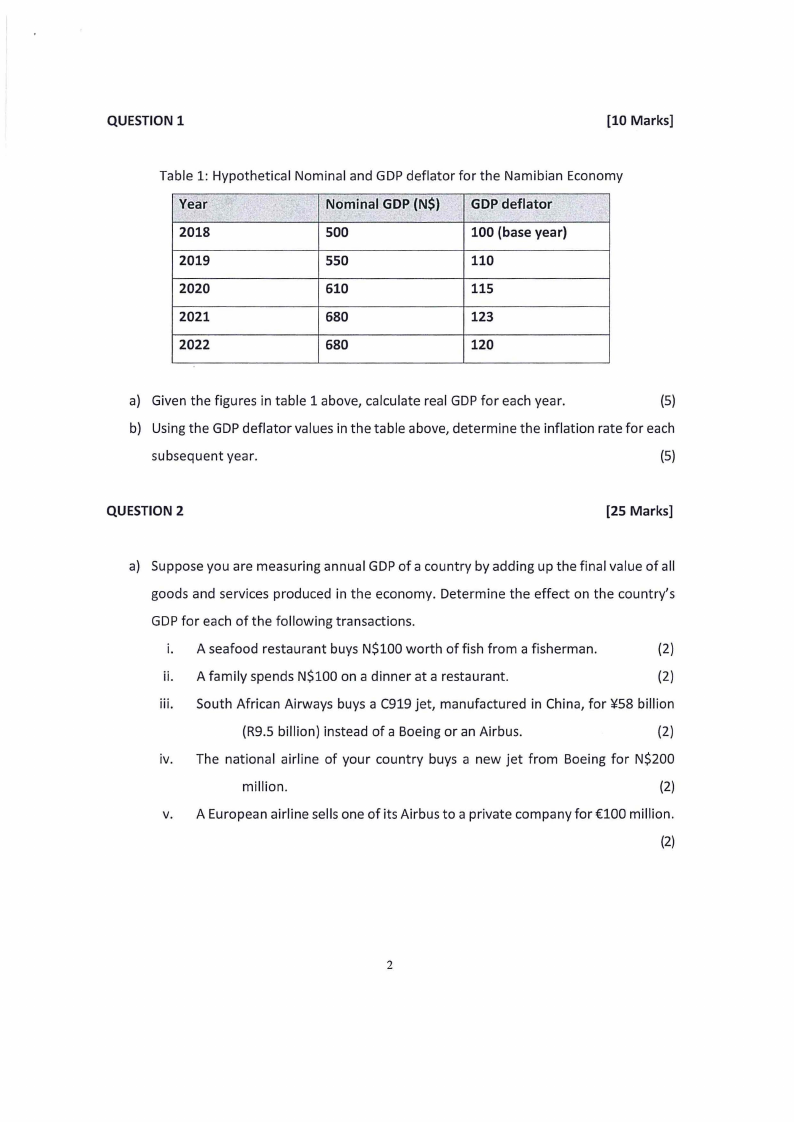

Table 1: Hypothetical Nominal and GDP deflator for the Namibian Economy

Year

..

2018

. Nominal GOP (N$)

500

GDP deflator

100 (base year)

2019

550

110

2020

610

115

2021

680

123

2022

680

120

a) Given the figures in table 1 above, calculate real GDPfor each year.

(5)

b) Using the GDP deflator values in the table above, determine the inflation rate for each

subsequent year.

(5)

QUESTION 2

[25 Marks]

a) Suppose you are measuring annual GDPof a country by adding up the final value of all

goods and services produced in the economy. Determine the effect on the country's

GDP for each of the following transactions.

i. A seafood restaurant buys N$100 worth of fish from a fisherman.

(2)

ii. A family spends N$100 on a dinner at a restaurant.

(2)

iii. South African Airways buys a C919 jet, manufactured in China, for ¥58 billion

(R9.5 billion) instead of a Boeing or an Airbus.

(2)

iv. The national airline of your country buys a new jet from Boeing for N$200

million.

(2)

v. A European airline sells one of its Airbus to a private company for €100 million.

(2)

2

|

3 Page 3 |

▲back to top |

b) During a given year, suppose the following activities occur in an economy.

An automobile manufacturing company pays its workers N$10 mi/lion to assemble 5,000

cars. The cars are then sold to an automobile store for N$12 million.

That year, the store pays N$1 million in wages to its salespeople, who sell the cars

directly to consumers for N$15 million.

a) Using the production-of-final-goods approach, what is GDP in this economy?

(6)

b) What is the value added at each stage of production? Using the value-added approach,

what is GDP?

(4)

c) What are the costs incurred in terms of wage payment and the profits earned? Using

the income approach, what is GDP?

(5)

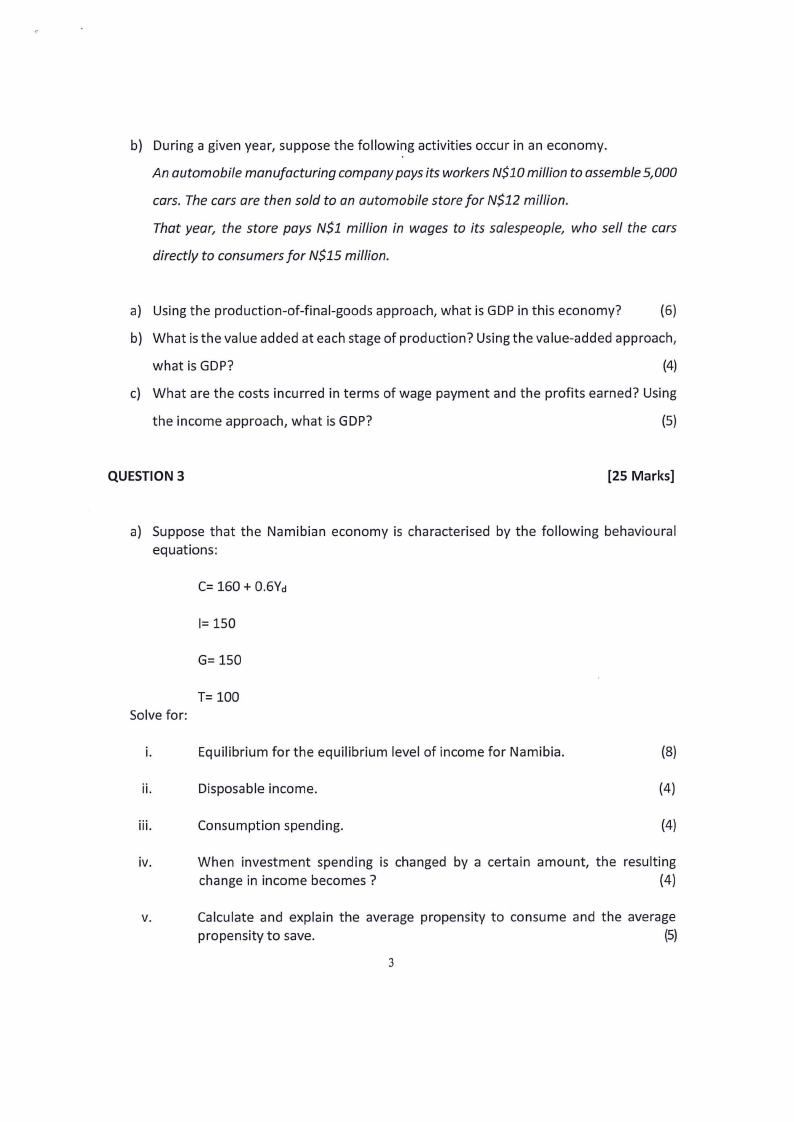

QUESTION 3

[25 Marks]

a) Suppose that the Namibian economy is characterised by the following behavioural

equations:

C= 160 + 0.6Vct

I= 150

G= 150

T= 100

Solve for:

i.

Equilibrium for the equilibrium level of income for Namibia.

(8)

ii.

Disposable income.

(4)

iii.

Consumption spending.

(4)

iv.

When investment spending is changed by a certain amount, the resulting

change in income becomes?

(4)

v.

Calculate and explain the average propensity to consume and the average

propensity to save.

(5)

3

|

4 Page 4 |

▲back to top |

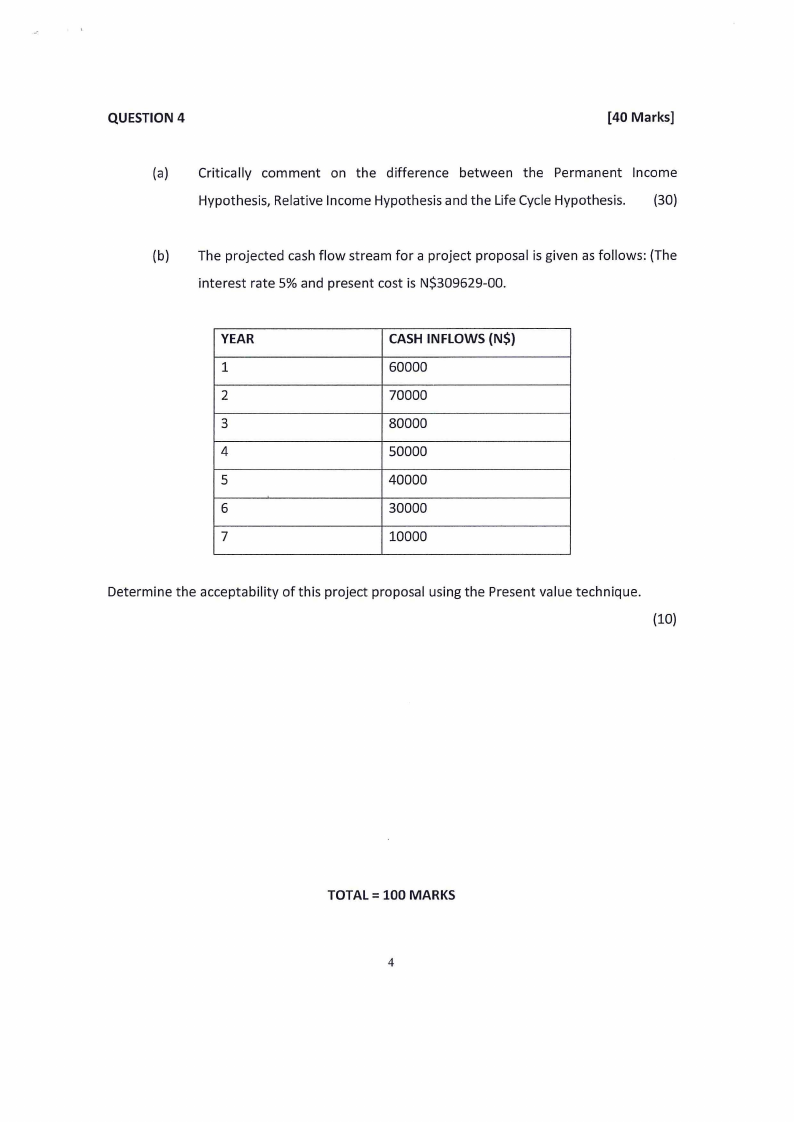

QUESTION 4

[40 Marks]

{a) Critically comment on the difference between the Permanent Income

Hypothesis, Relative Income Hypothesis and the Life Cycle Hypothesis. {30)

{b) The projected cash flow stream for a project proposal is given as follows: {The

interest rate 5% and present cost is N$309629-00.

YEAR

1

2

3

4

5

6

7

CASH INFLOWS (N$)

60000

70000

80000

50000

40000

30000

10000

Determine the acceptability of this project proposal using the Present value technique.

{10)

TOTAL = 100 MARKS

4