|

ITA412S- INTRODUCTION TO ACCOUNTING- 2ND OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

nAm I 8 I A Un IVE RSITV

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BRIDGING PROGRAMME

QUALIFICATION CODE: 04NBR

COURSE CODE: ITA412S

LEVEL: 4

COURSE NAME: INTRODUCTION TO

ACCOUNTING

SESSION: JANUARY 2024

DURATION: 3 HOURS

PAPER: THEORY AND APPLICATION

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS:

Kuhepa Tjondu

MODERATOR: Daniel Kamotho

INSTRUCTIONS

• This question paper is made up of TWO (2) questions.

• Answer ALL the questions and in blue or black ink.

• Start each question on a new page in your answer booklet & show all your workings

• Questions relating to this test may be raised in the initial 30 minutes after the start of the

paper. Thereafter, candidates must use their initiative to deal with any perceived error or

ambiguities & any assumption made by the candidate should be clearly stated.

• The names of people and businesses used throughout this test paper do not reflect the

reality and are purely coincidental.

PERMISSIBLE MATERIALS

Non-programmable calculator/financial calculator

THIS QUESTION PAPER CONSISTS OF 4 PAGES {Including this front page)

1

|

2 Page 2 |

▲back to top |

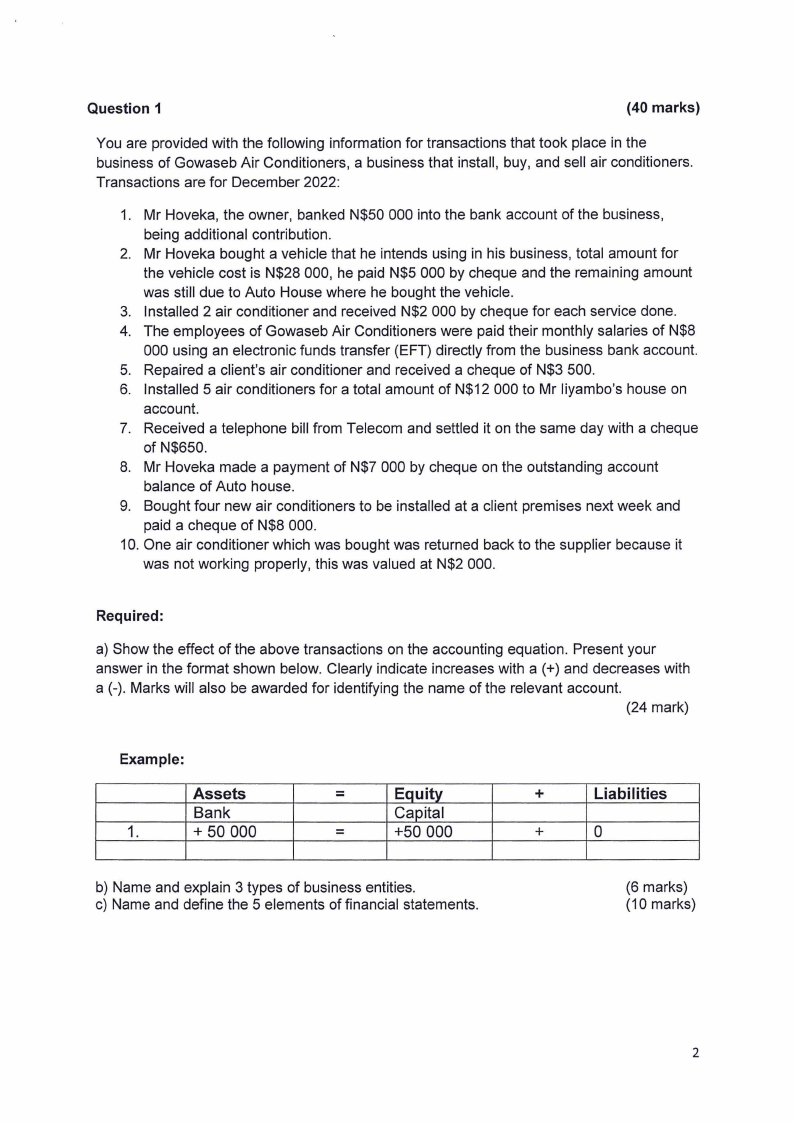

Question 1

(40 marks)

You are provided with the following information for transactions that took place in the

business of Gowaseb Air Conditioners, a business that install, buy, and sell air conditioners.

Transactions are for December 2022:

1. Mr Hoveka, the owner, banked N$50 000 into the bank account of the business,

being additional contribution.

2. Mr Hoveka bought a vehicle that he intends using in his business, total amount for

the vehicle cost is N$28 000, he paid N$5 000 by cheque and the remaining amount

was still due to Auto House where he bought the vehicle.

3. Installed 2 air conditioner and received N$2 000 by cheque for each service done.

4. The employees of Gowaseb Air Conditioners were paid their monthly salaries of N$8

000 using an electronic funds transfer (EFT) directly from the business bank account.

5. Repaired a client's air conditioner and received a cheque of N$3 500.

6. Installed 5 air conditioners for a total amount of N$12 000 to Mr liyambo's house on

account.

7. Received a telephone bill from Telecom and settled it on the same day with a cheque

of N$650.

8. Mr Hoveka made a payment of N$7 000 by cheque on the outstanding account

balance of Auto house.

9. Bought four new air conditioners to be installed at a client premises next week and

paid a cheque of N$8 000.

10. One air conditioner which was bought was returned back to the supplier because it

was not working properly, this was valued at N$2 000.

Required:

a) Show the effect of the above transactions on the accounting equation. Present your

answer in the format shown below. Clearly indicate increases with a(+) and decreases with

a(-). Marks will also be awarded for identifying the name of the relevant account.

(24 mark)

Example:

Assets

Bank

1.

+ 50 000

=

Equity

Capital

=

+50 000

+

Liabilities

+

0

b) Name and explain 3 types of business entities.

c) Name and define the 5 elements of financial statements.

(6 marks)

(10 marks)

2

|

3 Page 3 |

▲back to top |

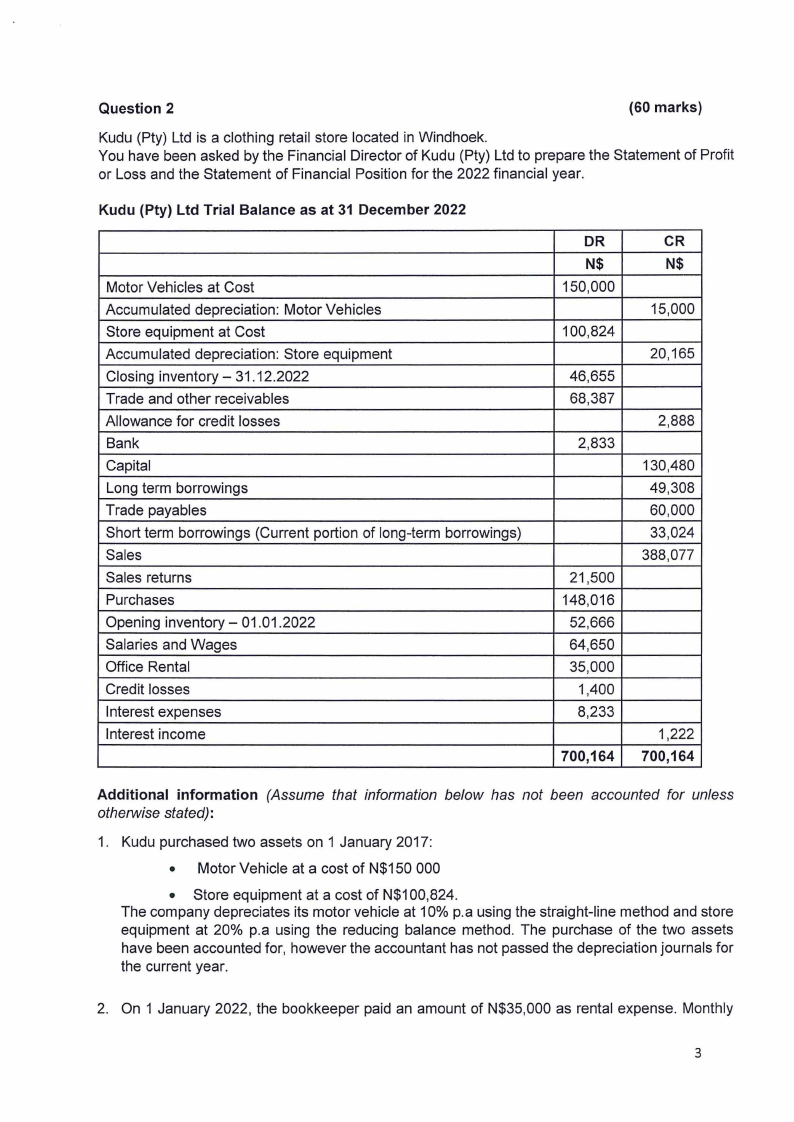

Question 2

(60 marks)

Kudu (Pty) Ltd is a clothing retail store located in Windhoek.

You have been asked by the Financial Director of Kudu (Pty) Ltd to prepare the Statement of Profit

or Loss and the Statement of Financial Position for the 2022 financial year.

Kudu (Pty) Ltd Trial Balance as at 31 December 2022

Motor Vehicles at Cost

Accumulated depreciation: Motor Vehicles

Store equipment at Cost

Accumulated depreciation: Store equipment

Closing inventory - 31.12.2022

Trade and other receivables

Allowance for credit losses

Bank

Capital

Long term borrowings

Trade payables

Short term borrowings (Current portion of long-term borrowings)

Sales

Sales returns

Purchases

Opening inventory - 01.01.2022

Salaries and Wages

Office Rental

Credit losses

Interest expenses

Interest income

DR

N$

150,000

100,824

46,655

68,387

2,833

21,500

148,016

52,666

64,650

35,000

1,400

8,233

700,164

CR

N$

15,000

20,165

2,888

130,480

49,308

60,000

33,024

388,077

1,222

700,164

Additional information (Assume that information below has not been accounted for unless

otherwise stated):

1. Kudu purchased two assets on 1 January 2017:

• Motor Vehicle at a cost of N$150 000

• Store equipment at a cost of N$100,824.

The company depreciates its motor vehicle at 10% p.a using the straight-line method and store

equipment at 20% p.a using the reducing balance method. The purchase of the two assets

have been accounted for, however the accountant has not passed the depreciation journals for

the current year.

2. On 1 January 2022, the bookkeeper paid an amount of N$35,000 as rental expense. Monthly

3

|

4 Page 4 |

▲back to top |

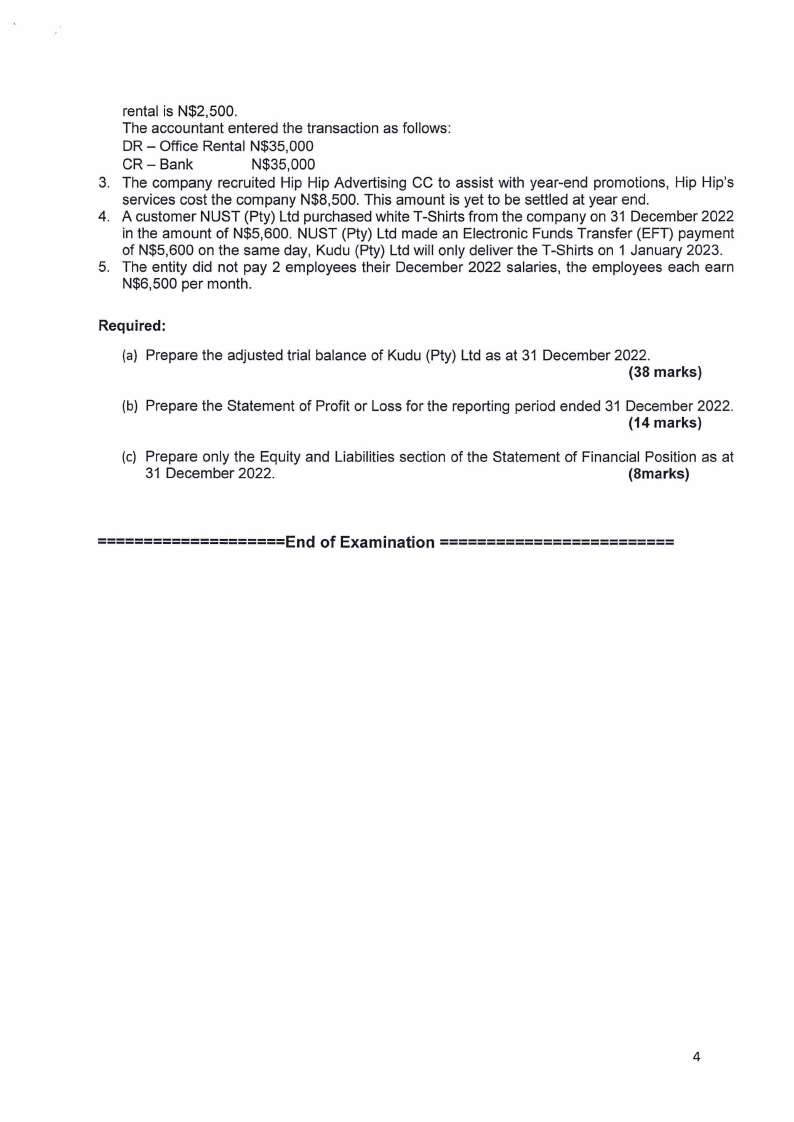

rental is N$2,500.

The accountant entered the transaction as follows:

DR - Office Rental N$35,000

CR - Bank

N$35,000

3. The company recruited Hip Hip Advertising CC to assist with year-end promotions, Hip Hip's

services cost the company N$8,500. This amount is yet to be settled at year end.

4. A customer NUST (Pty) Ltd purchased white T-Shirts from the company on 31 December 2022

in the amount of N$5,600. NUST (Pty) Ltd made an Electronic Funds Transfer (EFT) payment

of N$5,600 on the same day, Kudu (Pty) Ltd will only deliver the T-Shirts on 1 January 2023.

5. The entity did not pay 2 employees their December 2022 salaries, the employees each earn

N$6,500 per month.

Required:

{a) Prepare the adjusted trial balance of Kudu (Pty) Ltd as at 31 December 2022.

(38 marks)

{b) Prepare the Statement of Profit or Loss for the reporting period ended 31 December 2022.

(14 marks)

(c) Prepare only the Equity and Liabilities section of the Statement of Financial Position as at

31 December 2022.

(Smarks)

--------------------End

of Examination -------------------------

4