|

CAC710S- COMPUTERISED ACCOUNTING 301- 1ST OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT: ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: Bachelor of Accounting/ Bachelor of Accounting Chartered

QUALIFICATION CODE: 07BOAC/07BACC

LEVEL: 7

COURSE: Computerised Accounting 301

COURSE CODE: CAC71 OS

DATE:November2023

SESSION: Practical

DURATION: 3 Hours

MARKS: 100

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER(S) E Kangootui, Y Elago & H Namwandi

MODERATOR: E. Milijala

INSTRUCTIONS

1. This exam paper is consists of one question.

2. Make sure that your student number appears on all reports. (Computer

printouts)

3. It is student's responsibility to ensure that all reports are handed in directly to

the invigilators.

4. Use of internet or any communication devices is strictly prohibited.

5. Questions relating to this examination may be raised in the initial 30 minutes

after the start of the paper. Thereafter, candidates must use their initiative to

deal with any perceived error or ambiguities & any assumption made by the

candidate should be clearly stated.

6. Round of all calculations to the nearest two decimal places

f'\\

THIS QUESTION PAPE~ CONSISTS OF _7_ PAGES (Excluding this front page)

\\

0

|

2 Page 2 |

▲back to top |

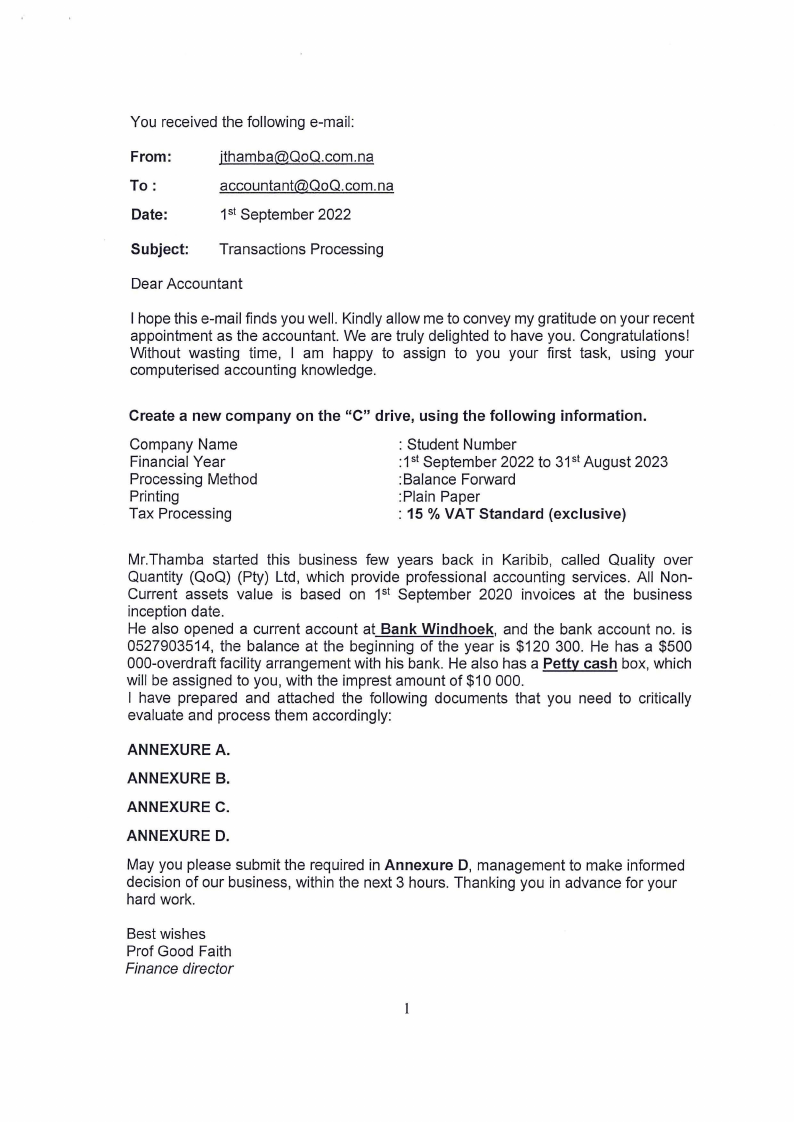

You received the following e-mail:

From:

To:

Date:

jthamba@QoQ.com.na

accountant@QoQ.com.na

1st September 2022

Subject: Transactions Processing

Dear Accountant

I hope this e-mail finds you well. Kindly allow me to convey my gratitude on your recent

appointment as the accountant. We are truly delighted to have you. Congratulations!

Without wasting time, I am happy to assign to you your first task, using your

computerised accounting knowledge.

Create a new company on the "C" drive, using the following information.

Company Name

Financial Year

Processing Method

Printing

Tax Processing

: Student Number

:1st September 2022 to 31st August 2023

:Balance Forward

:Plain Paper

: 15 % VAT Standard (exclusive)

Mr.Thamba started this business few years back in Karibib, called Quality over

Quantity (QoQ) (Pty) Ltd, which provide professional accounting services. All Non-

Current assets value is based on 1st September 2020 invoices at the business

inception date.

He also opened a current account at Bank Windhoek, and the bank account no. is

0527903514, the balance at the beginning of the year is $120 300. He has a $500

000-overdraft facility arrangement with his bank. He also has a Petty cash box, which

will be assigned to you, with the imprest amount of $10 000.

I have prepared and attached the following documents that you need to critically

evaluate and process them accordingly:

ANNEXURE A.

ANNEXURE 8.

ANNEXURE C.

ANNEXURE D.

May you please submit the required in Annexure D, management to make informed

decision of our business, within the next 3 hours. Thanking you in advance for your

hard work.

Best wishes

Prof Good Faith

Finance director

|

3 Page 3 |

▲back to top |

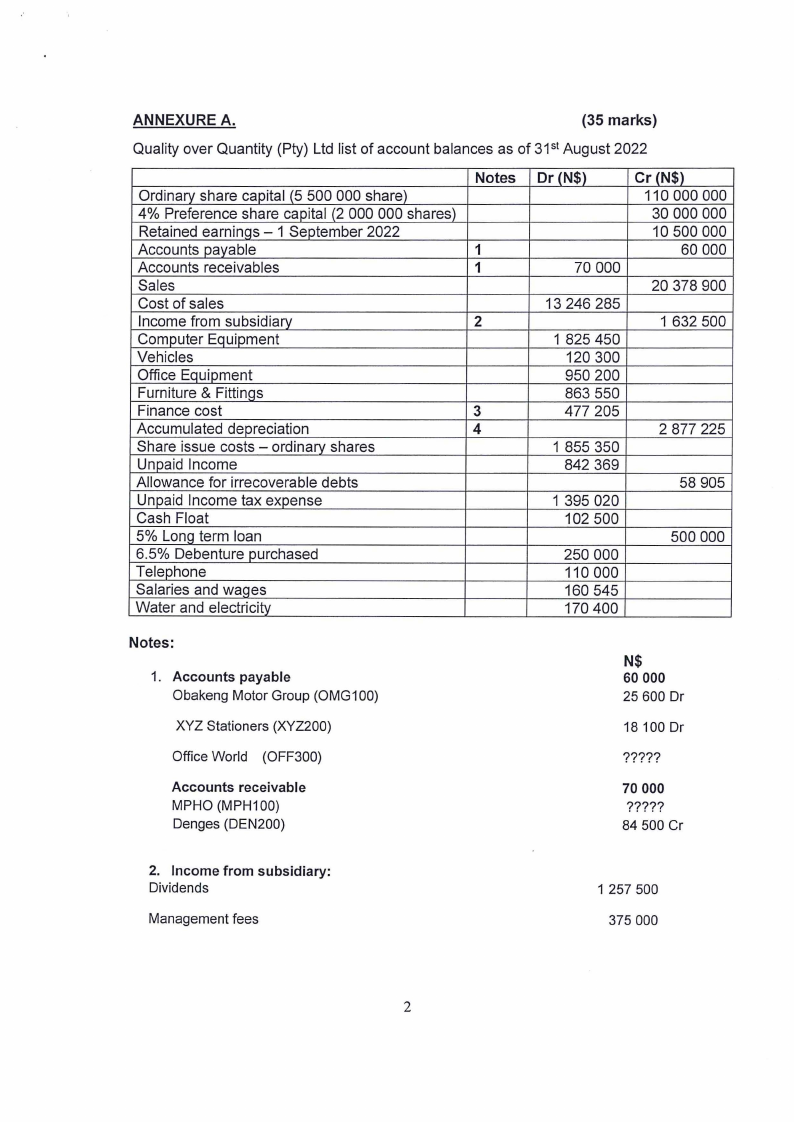

ANNEXURE A.

(35 marks)

Quality over Quantity (Pty) Ltd list of account balances as of 31st August 2022

Ordinary share capital (5 500 000 share)

4% Preference share capital (2 000 000 shares)

Retained earnings - 1 September 2022

Accounts payable

Accounts receivables

Sales

Cost of sales

Income from subsidiary

Computer Equipment

Vehicles

Office Equipment

Furniture & Fittings

Finance cost

Accumulated depreciation

Share issue costs - ordinary shares

Unpaid Income

Allowance for irrecoverable debts

Unpaid Income tax expense

Cash Float

5% Lonq term loan

6.5% Debenture purchased

Telephone

Salaries and waqes

Water and electricity

Notes

1

1

2

3

4

Dr (N$)

70 000

13 246 285

1825450

120 300

950 200

863 550

477 205

1 855 350

842 369

1 395 020

102 500

250 000

110 000

160 545

170 400

Cr (N$)

110 000 000

30 000 000

10 500 000

60 000

20 378 900

1632500

2 877 225

58 905

500 000

Notes:

1. Accounts payable

Obakeng Motor Group (OMG100)

XYZ Stationers (XYZ200)

Office World (OFF300)

Accounts receivable

MPHO (MPH100)

Denges (DEN200)

N$

60 000

25 600 Dr

18 100 Dr

?????

70 000

?????

84 500 Cr

2. Income from subsidiary:

Dividends

Management fees

1 257 500

375 000

2

|

4 Page 4 |

▲back to top |

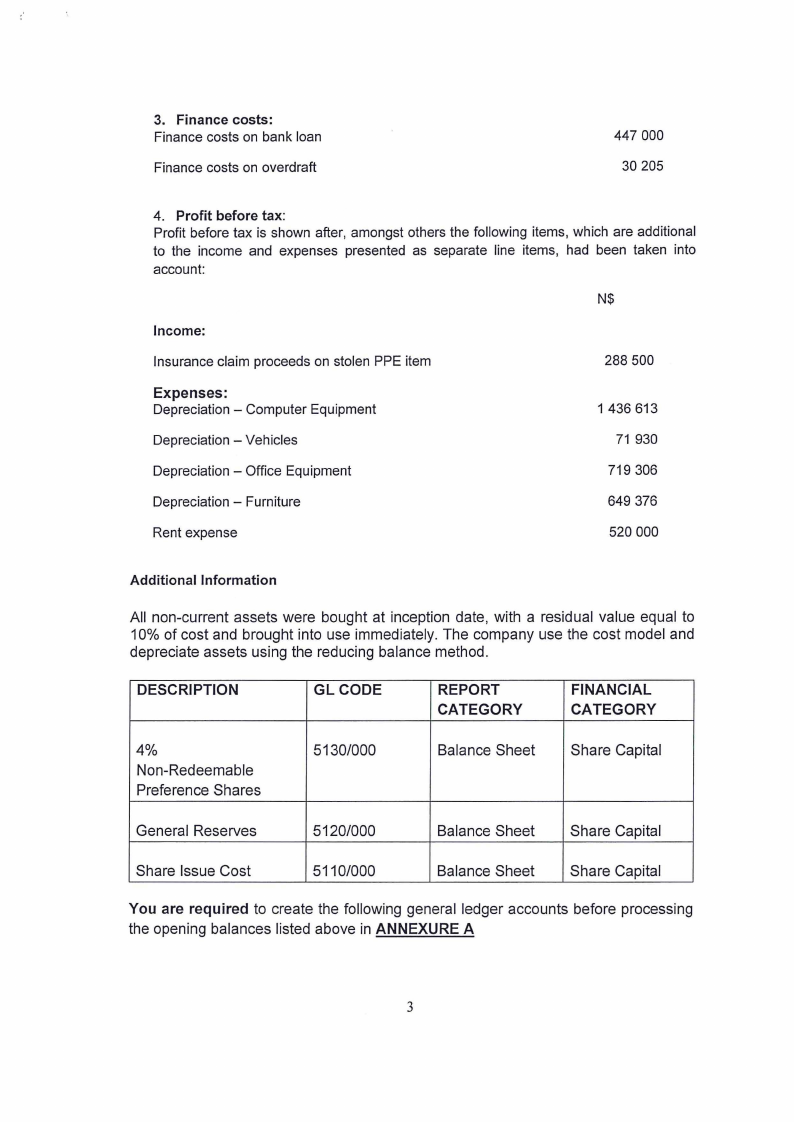

3. Finance costs:

Finance costs on bank loan

Finance costs on overdraft

447 000

30 205

4. Profit before tax:

Profit before tax is shown after, amongst others the following items, which are additional

to the income and expenses presented as separate line items, had been taken into

account:

N$

Income:

Insurance claim proceeds on stolen PPE item

288 500

Expenses:

Depreciation - Computer Equipment

1 436 613

Depreciation - Vehicles

71 930

Depreciation - Office Equipment

719 306

Depreciation - Furniture

649 376

Rent expense

520 000

Additional Information

All non-current assets were bought at inception date, with a residual value equal to

10% of cost and brought into use immediately. The company use the cost model and

depreciate assets using the reducing balance method.

DESCRIPTION

GL CODE

REPORT

CATEGORY

FINANCIAL

CATEGORY

4%

Non-Redeemable

Preference Shares

5130/000

Balance Sheet

Share Capital

General Reserves

5120/000

Balance Sheet

Share Capital

Share Issue Cost

5110/000

Balance Sheet

Share Capital

You are required to create the following general ledger accounts before processing

the opening balances listed above in ANNEXURE A

3

|

5 Page 5 |

▲back to top |

ANNEXURE B.

(20 Marks)

Quantity over Quality received and issued the following invoices during period two

October 2022.

Service price list

Service items

Risk & Assurance

Taxation

Management

Bookkeeping

Code

RIS100

TAX100

MAN100

BOO100

Rate per hour (N$)

625

145

465

310

Obakeng Motors Group (OMG100) INVOICE No. 1025

P. 0. Box 96437

Date: 1 October 2022

Windhoek

Tell: 061 - 400 125

TO: Quality over Quality

Physical address:

P. 0. Box 234

No. 125 Shop Centre

Windhoek

Strom Street

Tell: 061 250 340

Quantity Description

Discount Unit Price (N$) Total

2

Ford Ranger 4WD

10

310 000

???

SUBTOTAL

???

VAT@15%

???

TOTAL DUE

???

4

|

6 Page 6 |

▲back to top |

.I

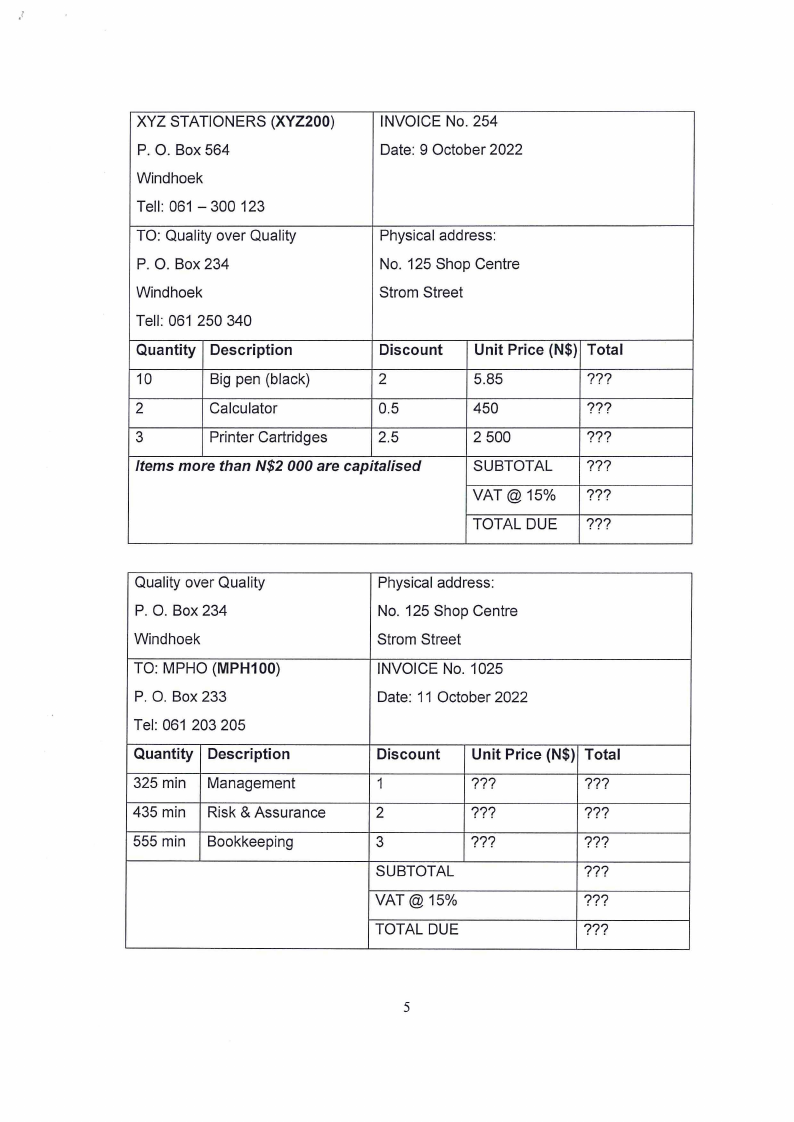

XYZ STATIONERS (XYZ200)

INVOICE No. 254

P. 0. Box 564

Date: 9 October 2022

Windhoek

Tell: 061 - 300 123

TO: Quality over Quality

Physical address:

P. 0. Box 234

No. 125 Shop Centre

Windhoek

Strom Street

Tell: 061 250 340

Quantity Description

Discount Unit Price (N$) Total

10

Big pen (black)

2

5.85

???

2

Calculator

0.5

450

???

3

Printer Cartridges

2.5

2 500

???

Items more than N$2 000 are capitalised

SUBTOTAL

???

VAT@15%

???

TOTAL DUE ???

Quality over Quality

P. 0. Box 234

Windhoek

TO: MPHO (MPH100)

P. 0. Box 233

Tel: 061 203 205

Quantity Description

325 min Management

435 min Risk & Assurance

555 min Bookkeeping

Physical address:

No. 125 Shop Centre

Strom Street

INVOICE No. 1025

Date: 11 October 2022

Discount Unit Price (N$) Total

1

???

???

2

???

???

3

???

???

SUBTOTAL

???

VAT@15%

???

TOTAL DUE

???

5

|

7 Page 7 |

▲back to top |

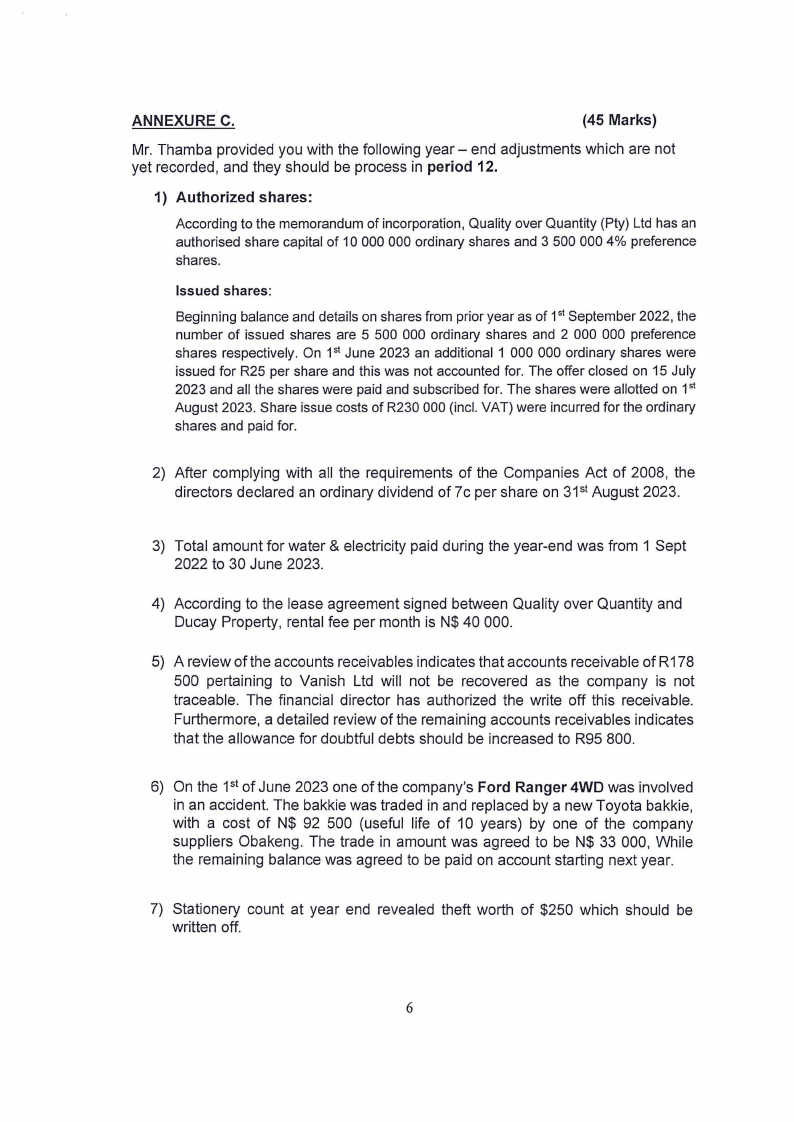

ANNEXURE C.

(45 Marks)

Mr. Thamba provided you with the following year - end adjustments which are not

yet recorded, and they should be process in period 12.

1) Authorized shares:

According to the memorandum of incorporation, Quality over Quantity (Pty) Ltd has an

authorised share capital of 10 000 000 ordinary shares and 3 500 000 4% preference

shares.

Issued shares:

Beginning balance and details on shares from prior year as of 1st September 2022, the

number of issued shares are 5 500 000 ordinary shares and 2 000 000 preference

shares respectively. On 1st June 2023 an additional 1 000 000 ordinary shares were

issued for R25 per share and this was not accounted for. The offer closed on 15 July

2023 and all the shares were paid and subscribed for. The shares were allotted on 1st

August 2023. Share issue costs of R230 000 (incl. VAT) were incurred for the ordinary

shares and paid for.

2) After complying with all the requirements of the Companies Act of 2008, the

directors declared an ordinary dividend of 7c per share on 31st August 2023.

3) Total amount for water & electricity paid during the year-end was from 1 Sept

2022 to 30 June 2023.

4) According to the lease agreement signed between Quality over Quantity and

Ducay Property, rental fee per month is N$ 40 000.

5) A review of the accounts receivables indicates that accounts receivable of R178

500 pertaining to Vanish Ltd will not be recovered as the company is not

traceable. The financial director has authorized the write off this receivable.

Furthermore, a detailed review of the remaining accounts receivables indicates

that the allowance for doubtful debts should be increased to R95 800.

6) On the 1stof June 2023 one of the company's Ford Ranger 4WD was involved

in an accident. The bakkie was traded in and replaced by a new Toyota bakkie,

with a cost of N$ 92 500 (useful life of 1O years) by one of the company

suppliers Obakeng. The trade in amount was agreed to be N$ 33 000, While

the remaining balance was agreed to be paid on account starting next year.

7) Stationery count at year end revealed theft worth of $250 which should be

written off.

6

|

8 Page 8 |

▲back to top |

8) The company purchased Case Ware software application with a life span of 10

years from Chengeta (Ch?00) on the 31st April 2023 on account. It was

delivered on the same day at the firm premises incurring $800 for transport.

Quality over Quantity received an invoice from Chengeta totalling N$ 25 340

which is made up of the following items:

i. Actual invoice amount for the software is N$22 500.

ii. Installation cost done at the firm premises is N$1 300.

iii. Training cost to the employee N$750.

iv. Lunch provided during training N$ 790.

9) Income tax for the year was determined to be N$50 640 by the receiver of

revenue, payable in the next month.

10)The company auditors discover an amount of N$ 21 200 for accounting

expenses incorrectly entered on the credit side of the customers allowance

account.

11) Non-current assets are depreciated on 15 % reducing balance method. Provide

depreciation on all non-current assets owned by the company at year and

account for interest on financial instruments for the year. Intangible assets are

not depreciated.

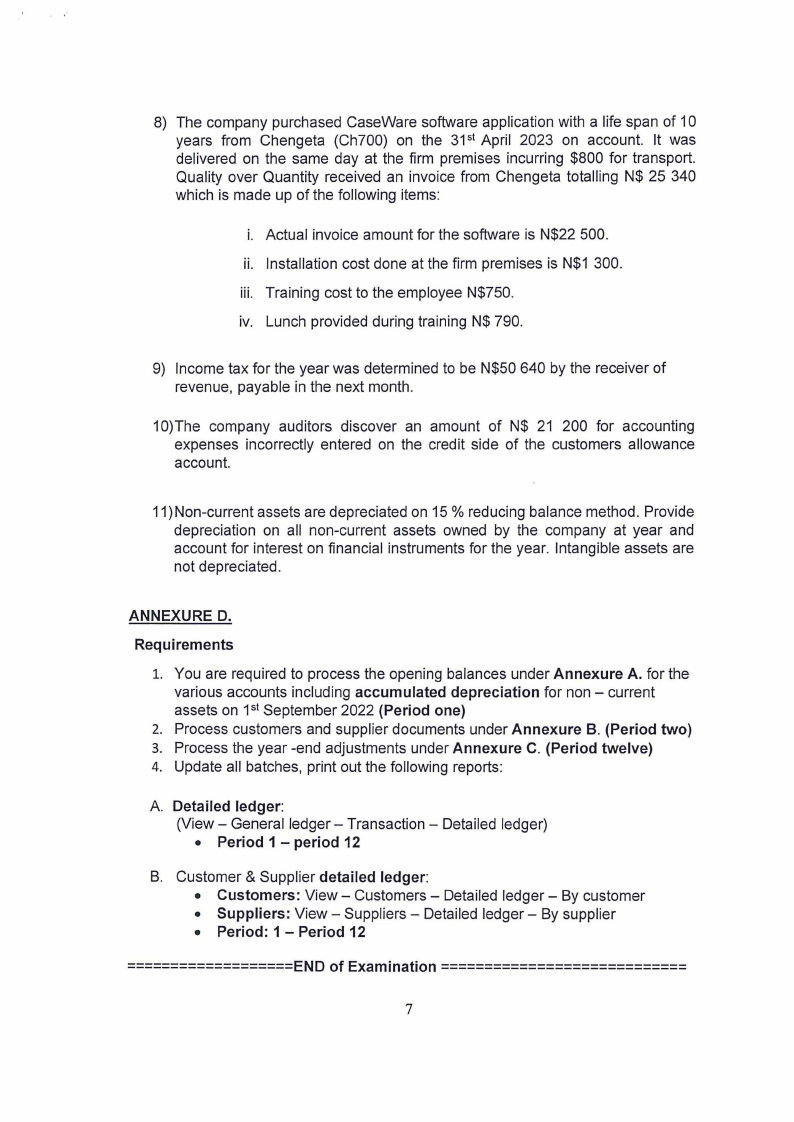

ANNEXURE D.

Requirements

1. You are required to process the opening balances under Annexure A. for the

various accounts including accumulated depreciation for non - current

assets on 1st September 2022 (Period one)

2. Process customers and supplier documents under Annexure B. (Period two)

3. Process the year -end adjustments under Annexure C. (Period twelve)

4. Update all batches, print out the following reports:

A Detailed ledger:

(View - General ledger - Transaction - Detailed ledger)

• Period 1 - period 12

B. Customer & Supplier detailed ledger:

• Customers: View - Customers - Detailed ledger - By customer

• Suppliers: View - Suppliers - Detailed ledger - By supplier

• Period: 1 - Period 12

-------------------END

of Examination----------------------------

7