|

FAC612S-FINANCIAL ACCOUNTING 202-1ST OPP -NOV 2024 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTYOF COMMERCE,HUMAN SCIENCESAND EDUCATION

DEPARTMENTOF ECONOMICSA, CCOUNTINGAND FINANCE

QUALIFICATIONB: ACHELOROFACCOUNTING

QUALIFICATIONCODE: 07BOAC

LEVEL:6

COURSECODE: FAC612S

COURSENAME: FINANCIALACCOUNTING202

DATE:NOVEMBER 2024

DURATION:3 HOURS

PAPERT: HEORYAND CALCULATIONS

MARKS:100

FIRSTOPPORTUNITYEXAMINATIONPAPER

EXAMINER(S} Ms. P.Erkie, Mr. C. Mahindi and Ms. A. Gustav

MODERATOR: Dr. S. Dzomira

INSTRUCTIONS

1. Capture your full name, student number and assessment number on the first page.

2. Answer ALL the questions and manage your time properly.

3. Number each page correctly

4. Write clearly and neatly.

5. Do not write in pencil and do not use tip-ex, as this will not be marked.

6. The names of people and businesses used throughout this assessment do not reflect the

reality and may be purely coincidental.

7. SHOWALLWORKINGS!

THISQUESTIONPAPERCONSISTSOF5 PAGES(excluding this front page)

|

2 Page 2 |

▲back to top |

Question 1

(20 marks)

CUBANGO PHARMACEUTICALS LTD

Cubango Pharmaceuticals Ltd ("Cubango") is a large, NSX-listed Namibian pharmaceutical

company which develops, manufactures and distributes a diverse array of medicines locally.

It has been doing this for many years.

Cubango is currently preparing its financial statements for its year ended 31 October 2024,

which are prepared in accordance with IFRS.

1. Debentures

On 1 November 2022, Cubango purchased 50 000 debentures for their fair value of N$ 5 per

debenture. It incurred transaction costs on 1 November 2022 of N$ 5 000 when purchasing

the debentures. Cubango is entitled to a 6% coupon on 31 October each year until 31

October 2027 when the debentures will be redeemed at N$ 350 000. The debentures are

held as a portfolio with the objective to collect contractual cash flows.

At the issue date, a fair rate of interest/ the effective interest rate is 11.7731% p.a.

The debentures were assessed to have a low credit risk. Thus, the loss allowance expected

were estimated as follows:

• 01 November 2023: N$ 15 000

• 31 October 2024: N$ 20 000

2. Investment in Shares

Cubango purchased 1 000 shares in Family Limited on 01 January 2024, each share cost

N$ 260. Family Limited had retaining earning of N$ 900 000 on 01 July 2023. The company

has profit after tax of N$ 350 000 for the 30 June 2024 financial year end. On 30 June 2024

Family Limited declared dividends of N$20 per share.

Required:

a) Prepare the journal entries to account for the debentures in Cubango's accounting

records for the years ended 31 October 2023 and 31 October 2024. Journal narrations

are required.

(15)

b) Prepare an extract of the statement of changes in equity for Family Limited for the year

ended 30 June 2024 to account for Investment in shares.

(5)

QUESTION 2

(25 MARKS)

Jay Ltd is a television manufacturing company. The company's year-end is 31 December

2023. At the beginning of the financial year ended 31 December 2023 Jay Ltd started selling

all its televisions with a refund policy. If the customer is not satisfied, the television may be

returned for a full refund. Sales for the year ended 31 December amounted to N$1 500 000.

The following came to your attention before the financial statements were authorised for

issue on 16 February 204

1

|

3 Page 3 |

▲back to top |

1. Refunds

At year-end on 31 December 2023 the company's directors reliably estimated that based on

the current year's returns and industry patterns 5% of the television sets sold will be returned

for a refund and raised a provision for refunds amounting to N$75 000 in the accounting

records of Jay Ltd for the year ended 31 December 2023.

2. Insolvent debtor

A debtor with an outstanding balance of N$ 60 500 on 31 December 2024, was declared

insolvent and placed under liquidation on 20 January 2024. The liquidator indicated that

creditors would receive 30 cents in the N$.

3. Inventory damage

In January 2024 inventory with a value of N$ 20 000 was destroyed when a store was burnt

down during a strike.

Required:

a) Discuss, according to the requirements of IAS 37, Provisions, contingent liabilities and

contingent assets whether the provision raised for refunds by the directors is correct.

Your discussion should include the definitions and recognition criteria.

(10)

b) At year-end on 31 December 2023 assume that the company's directors cannot reliably

estimate the possible returns and related refunds for television sets with certainty.

Discuss the accounting treatment in terms of IAS 37, Provisions, contingent liabilities and

contingent assets under these circumstances.

(3)

c) Define events occurring after the reporting period according to IAS 10.

(3)

d) With reference to insolvent debtor and damaged inventory:

i}

Discuss briefly how the event will affect assets and liabilities in the financial

statement (ie. must the ass~ts and/or liabilities be adjusted or not.)

(4)

ii)

Disclose this in the notes to the financial statements if required.

(5)

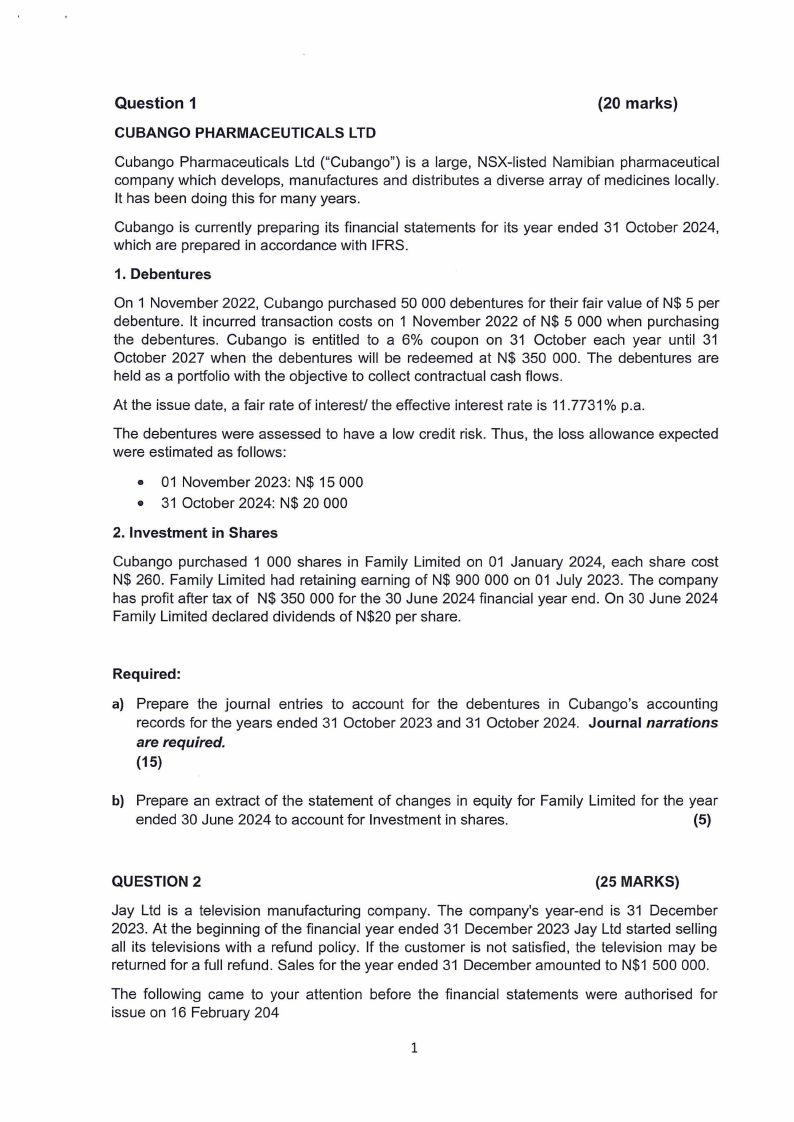

Question 3

(30 marks)

Blue Waters Limited is a company operating in fishing industry in Henties Bay. The following

information relates to the reporting period ended 31 October 2024.

Extract of the Statement of Financial Position as at 31 October 2024

2024

N$

Property, Plant and Equipment

?

Income received in advance (Taxable in year of receipt)

33 600

Expenses prepaid (allowed as a deduction for tax purposes

12 000

in 2024)

2023

N$

426,000

18 000

0

2

|

4 Page 4 |

▲back to top |

Additional information:

• The profit before tax for the year ended 31 October 2024 amounted to N$350,000.

Included in profit before tax is dividend income of N$6,000.

• The tax base of the property, plant and equipment at 31 October 2023 was

N$348,000. During the year ended 31 October 2024, the depreciation expense

amounted to N$42,000 and tax allowances granted by Namra amounted to

N$30,000. There was no other movement of property, plant and equipment during

the year ended 31 October 2024.

• There are no other temporary differences, items of exempt income or non-

deductible expenses other than those evident from the information provided.

• The corporate tax rate is 30%.

Required:

a) Calculate the deferred income tax balance at 31 October 2023 and 31 October

2024 using the balance sheet method clearly showing the opening balances and

movements during the year. Indicate whether the components used in the deferred

tax calculation are deferred assets or liabilities.

( 11)

b) Calculate the current income tax for the year ended 31 October 2024.

(9)

c) Prepare the journals relating to current and deferred income tax for the year ended

31 October 2024.

(5)

d) Show the deferred tax note to the statement of financial position as at 31 October

2024 in accordance with International Financial Reporting Standards.

(5)

Source GAAP Graded Questions 2024/2025

3

|

5 Page 5 |

▲back to top |

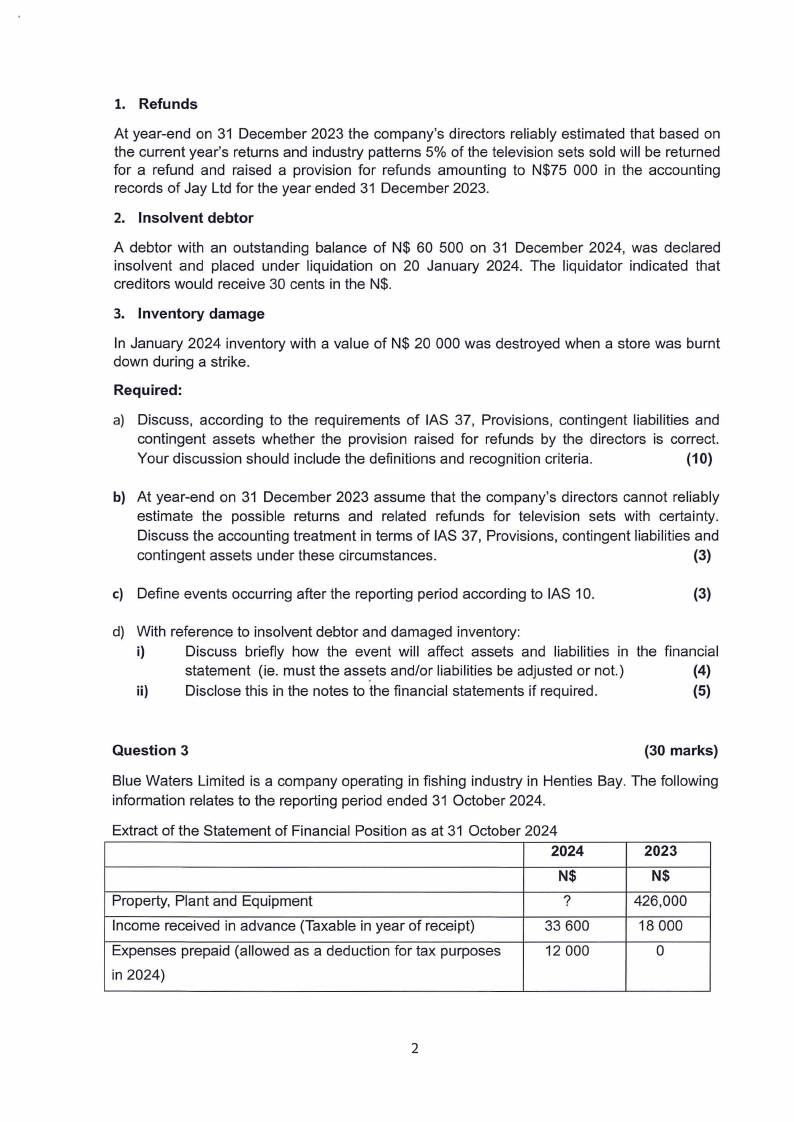

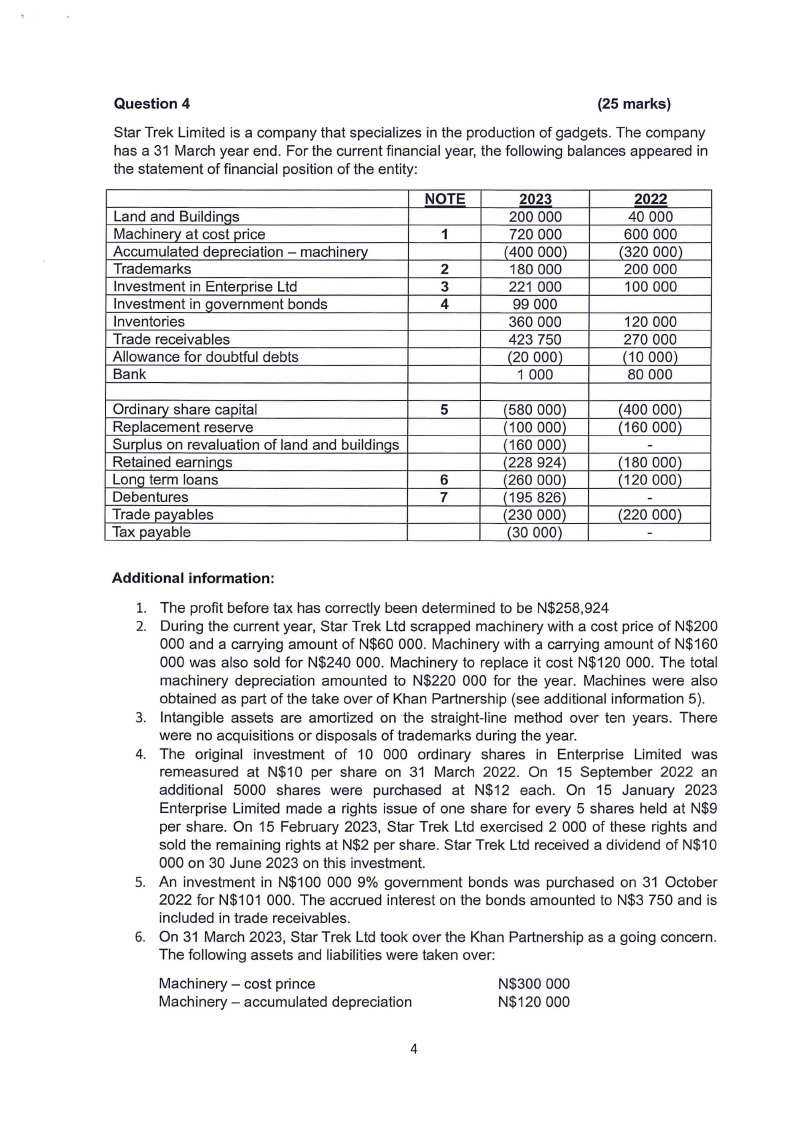

Question 4

(25 marks)

Star Trek Limited is a company that specializes in the production of gadgets. The company

has a 31 March year end. For the current financial year, the following balances appeared in

the statement of financial position of the entity:

Land and Buildinqs

Machinery at cost price

Accumulated depreciation - machinery

Trademarks

Investment in Enterprise Ltd

Investment in government bonds

Inventories

Trade receivables

Allowance for doubtful debts

Bank

NOTE

1

2

3

4

2023

200 000

720 000

(400 000)

180 000

221 000

99 000

360 000

423 750

(20 000)

1 000

2022

40 000

600 000

(320 000)

200 000

100 000

120 000

270 000

(10000)

80 000

Ordinary share capital

5

Replacement reserve

Surplus on revaluation of land and buildings

Retained earninqs

Long term loans

6

Debentures

7

Trade payables

Tax payable

(580 000)

(100 000)

(160 000)

(228 924)

(260 000)

(195 826)

(230 000)

(30 000)

(400 000)

(160 000)

-

(180 000)

(120000)

-

(220 000)

-

Additional information:

1. The profit before tax has correctly been determined to be N$258,924

2. During the current year, Star Trek Ltd scrapped machinery with a cost price of N$200

000 and a carrying amount of N$60 000. Machinery with a carrying amount of N$160

000 was also sold for N$240 000. Machinery to replace it cost N$120 000. The total

machinery depreciation amounted to N$220 000 for the year. Machines were also

obtained as part of the take over of Khan Partnership (see additional information 5).

3. Intangible assets are amortized on the straight-line method over ten years. There

were no acquisitions or disposals of trademarks during the year.

4. The original investment of 10 000 ordinary shares in Enterprise Limited was

remeasured at N$10 per share on 31 March 2022. On 15 September 2022 an

additional 5000 shares were purchased at N$12 each. On 15 January 2023

Enterprise Limited made a rights issue of one share for every 5 shares held at N$9

per share. On 15 February 2023, Star Trek Ltd exercised 2 000 of these rights and

sold the remaining rights at N$2 per share. Star Trek Ltd received a dividend of N$10

000 on 30 June 2023 on this investment.

5. An investment in N$100 000 9% government bonds was purchased on 31 October

2022 for N$101 000. The accrued interest on the bonds amounted to N$3 750 and is

included in trade receivables.

6. On 31 March 2023, Star Trek Ltd took over the Khan Partnership as a going concern.

The following assets and liabilities were taken over:

Machinery - cost prince

Machinery - accumulated depreciation

N$300 000

N$120 000

4

|

6 Page 6 |

▲back to top |

-

•

I

I

10% loan (interest implications may be ignored) N$120 000

In settlement, Star Trek Ltd issued 40 000 shares at N$1.50 per share to Mr and Mrs

Khan, the former partners.

7. Interest expense on the loan amounted to N$5 000 for the year and was paid during

the current financial year.

8. On 1 April 2022 Star Trek Ltd issued N$200 000 8% debentures at 97%. The

debentures are redeemable on 31 March 2025. Interest is payable annually on 31

March. All debentures were taken up. The interest expense for the year amounted to

N$17 826 and the interest payment was N$16 000. Debentures are shown at

amortised cost in the statement of financial position.

9. Tax expense for the year amounted to N$70 000.

10. Sales for the year amounted to N$900 000.

11. The company declared dividends of N$200 000 during the year. N$160 000 of this

amount had already been paid. The outstanding amount is included in the trade

payables. There were no arrear dividends on 1 April 2022.

Required:

Prepare only the cash flows from operating activities section of the statement of cash flows

of Star Trek Ltd for the reporting period 31 March 2023, according to the indirect method.

(25)

ENDOFEXAMINATIOQNUESTIONPAPER

5