|

LET621S - LAND ECONONICS AND TAXATION - 2ND OPP - JAN 2024 |

|

1 Page 1 |

▲back to top |

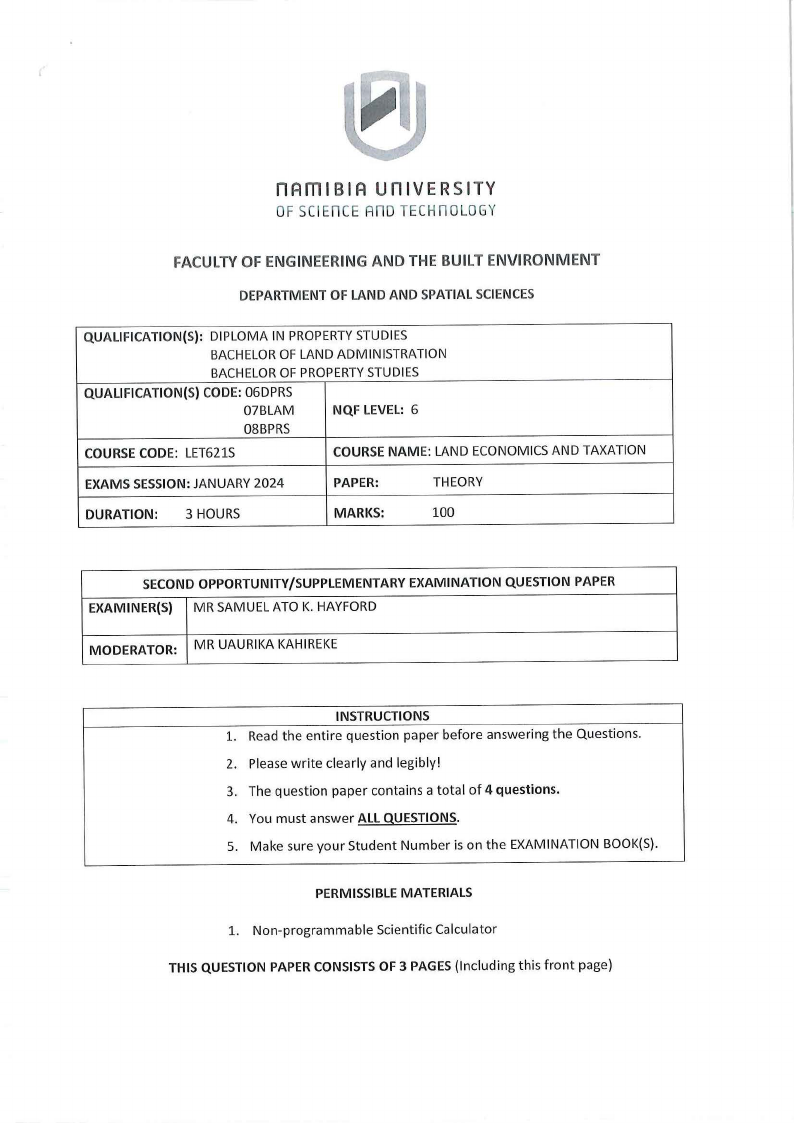

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF ENGINEERING AND THE BUILT ENVIRONMENT

DEPARTMENT OF LAND AND SPATIAL SCIENCES

QUALIFICATION(S):

DIPLOMA IN PROPERTYSTUDIES

BACHELOR OF LAND ADMINISTRATION

BACHELOROF PROPERTYSTUDIES

QUALIFICATION(S) CODE: 06DPRS

07BLAM

08BPRS

NQF LEVEL: 6

COURSE CODE: LET621S

COURSE NAME: LAND ECONOMICS AND TAXATION

EXAMS SESSION: JANUARY 2024

PAPER:

THEORY

DURATION:

3 HOURS

MARKS:

100

SECOND OPPORTUNITY/SUPPLEMENTARY EXAMINATION QUESTION PAPER

EXAMINER(S) MR SAMUEL ATO K. HAYFORD

MODERATOR: MR UAURIKA KAHIREKE

INSTRUCTIONS

1. Read the entire question paper before answering the Questions.

2. Please write clearly and legibly!

3. The question paper contains a total of 4 questions.

4. You must answer ALL QUESTIONS.

5. Make sure your Student Number is on the EXAMINATION BOOK(S}.

PERMISSIBLE MATERIALS

1. Non-programmable Scientific Calculator

THIS QUESTION PAPER CONSISTS OF 3 PAGES (Including this front page}

|

2 Page 2 |

▲back to top |

Land Economics and Taxation

Question 1

Examine in detail any four (4) effects of land taxation on land use and ownership.

LET621S

(20)

(20)

Question 2

a) Explain in detail the principles that provide a good basis for evaluating taxation forms. (12)

b) With the aid of a diagram (graph), explain what the following taxes are.

(7)

i) Proportional

ii) Progressive

iii) Regressive

c) Mention the significance of Variable tax rate and briefly explain the grounds on which its

application may be justified.

(11)

(30)

Question 3

The yield capacities of four grades of land are respectively given in the table below.

Land

Unit of Output (in tonnes)

A

B

C

D

65

56

45

35

Cost of Capital and labour amounting to N$120 was incurred on each of these tracts of land.

a) Determine the amount of land rent that accrues to each of these tracts of land as they are

employed successively in a production. [correct your answers to the two decimal place] (11)

b) By whose theory does land rents emerge and calculated in this way?

(1)

c) Mention the four (4) underlying assumptions of the Ricardo's theory of land rent?

(4)

Second Opportunity/Supplementary Question Paper Page 2 of 3

January 2024

|

3 Page 3 |

▲back to top |

Land Economics and Taxation

d) Briefly explain any three (3) of the following key concepts in land economics.

LET621S

(9)

i) Contract rent

ii) Land rent

iii) Economic rent

iv) The effect (application) of land rent on rental arrangements

e) Apart from the (iv) above what are the other three (3) principal areas of application of land

rent in real-life situations.

(3)

f) Calculate the expected land value if an expected return of N$3000 is discounted at 5%

interest rate for 10 years.

(2)

[30]

Question 4

a) Mention and briefly explain, with simple examples, the four (4) requirements/series of tests

which a land assessedfor its potential highest and best use must pass.

(12)

b) What do understand by 'land use capacity'?

(4)

c) List the two (2) major components of land use capacity.

(1)

d) Differentiate between the 'tax base of a rateable property (house)' and the 'tax base of a

taxing (local) authority'

(3)

[20]

Second Opportunity/Supplementary Question Paper Page 3 of 3

January 2024