|

FAC501Y-ACCOUNTING 100-1ST OPP-NOV 2024 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING (CHARTERED ACCOUNTANCY)

QUALIFICATION CODE: 07BACC

LEVEL: 5

COURSE CODE: FAC501 Y

COURSE NAME: ACCOUNTING 100

DATE: NOVEMBER 2024

PAPER: THEORY AND PRACTICAL

TOTAL DURATION: 162 MINUTES

MARKS: 125

FIRST OPPORTUNITY EXAMINATION NOVEMBER 2024 - REQUIRED

EXAMINERS

MS Z STELLMACHER

MODERATOR:

MS M CLOETE

INSTRUCTIONS:

1. This paper consists of EIGHT pages (Including this cover page). If your paper does not contain all the pages, please put up

your hand so that a replacement paper can be handed to you.

2. Answer all the questions in blue or black ink only.

3. Eachquestion should be answered on a separate page.

4. Questions relating to the paper may be raised in the initial 30 minutes after the start of the paper. Thereafter, candidates

must use their initiative to deal with any perceived error or ambiguities & any assumption made by the candidate should

be clearly stated.

5. You may make notes on your question paper during the reading time but may not write in your answer booklet.

6. Permissible materials include stationery and a non-programmable calculator only.

7. The neatness, disclosure and presentation of your answers will be considered when marking your paper.

8. The scenarios presented are fictitious and any similarities, real or imagined, to real events, people, places, organisations are

purely coincidental and should be interpreted as such.

1

|

2 Page 2 |

▲back to top |

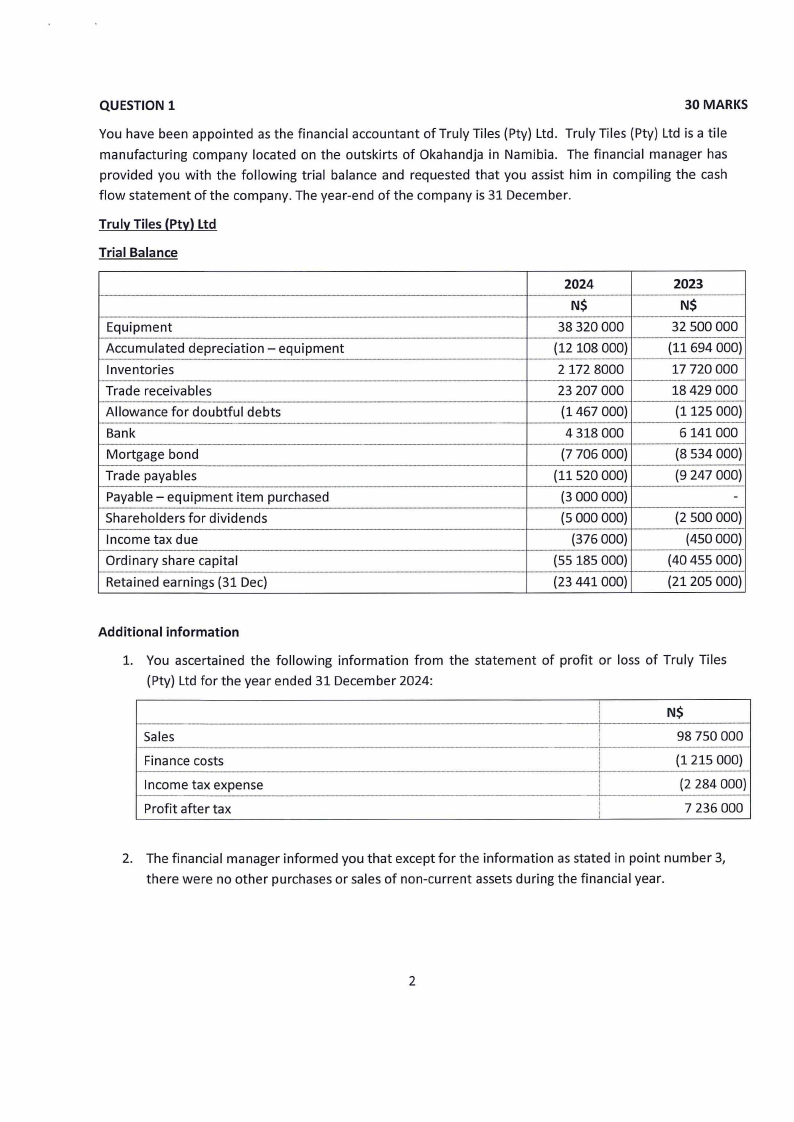

QUESTION 1

30 MARKS

You have been appointed as the financial accountant of Truly Tiles (Pty) Ltd. Truly Tiles (Pty) Ltd is a tile

manufacturing company located on the outskirts of Okahandja in Namibia. The financial manager has

provided you with the following trial balance and requested that you assist him in compiling the cash

flow statement of the company. The year-end of the company is 31 December.

Truly Tiles (Pty) Ltd

Trial Balance

Equipment

Accumulated depreciation - equipment

Inventories

Trade receivables

Allowance for doubtful debts

Bank

Mortgage bond

Trade payables

Payable - equipment item purchased

Shareholders for dividends

Income tax due

Ordinary share capital

Retained earnings (31 Dec)

2024

N$

38 320 000

(12108 000)

2 172 8000

23 207 000

(1467 000)

4 318 000

(7 706 000)

(11520 000)

(3 000 000)

(5 000 000)

(376 000)

(55185 000)

(23 441 000)

2023

N$

32 500 000

(11694 000)

17 720000

18 429 000

(1125 000)

6141000

(8 534 000)

(9 247 000)

-

(2 500 000)

(450 000)

(40 455 000)

(21205 000)

Additional information

l. You ascertained the following information from the statement of profit or loss of Truly Tiles

(Pty) Ltd for the year ended 31 December 2024:

Sales

Finance costs

Income tax expense

Profit after tax

N$

98 750 000

(1 215 000)

(2 284 000)

7 236 000

2. The financial manager informed you that except for the information as stated in point number 3,

there were no other purchases or sales of non-current assets during the financial year.

2

|

3 Page 3 |

▲back to top |

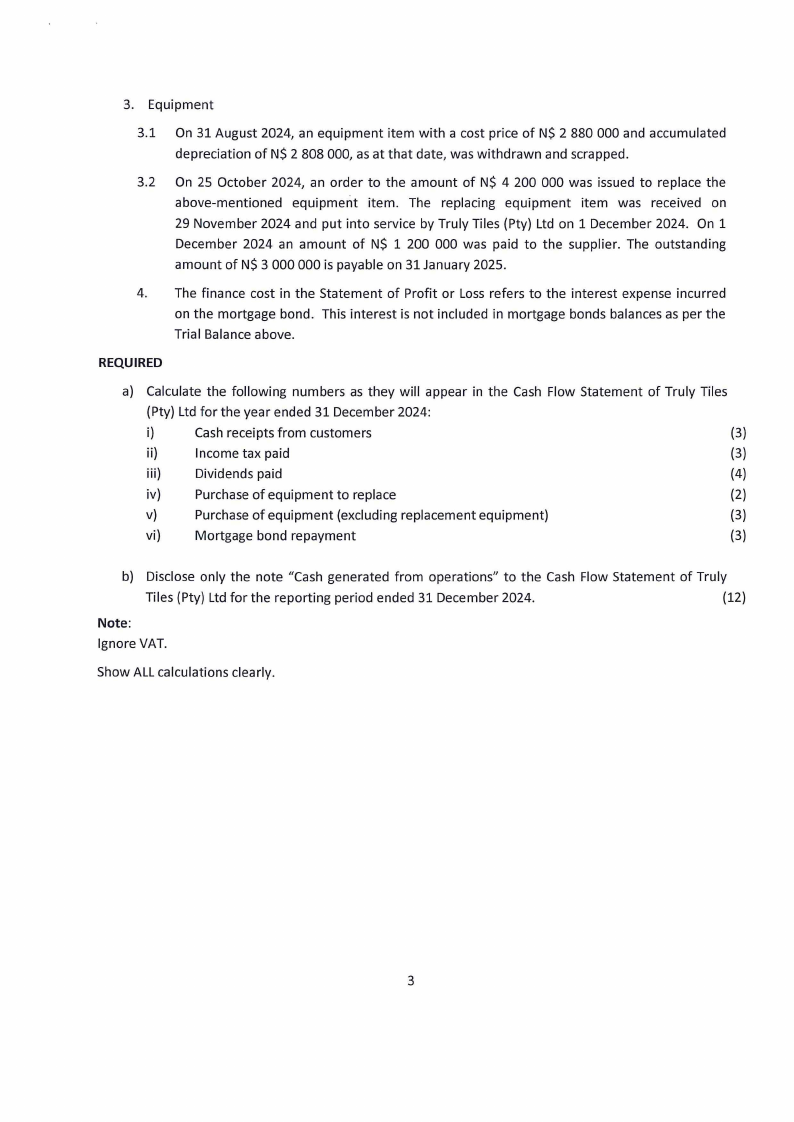

3. Equipment

3.1 On 31 August 2024, an equipment item with a cost price of N$ 2 880 000 and accumulated

depreciation of N$ 2 808 000, as at that date, was withdrawn and scrapped.

3.2 On 25 October 2024, an order to the amount of N$ 4 200 000 was issued to replace the

above-mentioned equipment item. The replacing equipment item was received on

29 November 2024 and put into service by Truly Tiles (Pty) Ltd on 1 December 2024. On 1

December 2024 an amount of N$ 1 200 000 was paid to the supplier. The outstanding

amount of N$ 3 000 000 is payable on 31 January 2025.

4. The finance cost in the Statement of Profit or Loss refers to the interest expense incurred

on the mortgage bond. This interest is not included in mortgage bonds balances as per the

Trial Balance above.

REQUIRED

a) Calculate the following numbers as they will appear in the Cash Flow Statement of Truly Tiles

(Pty) Ltd for the year ended 31 December 2024:

i)

Cash receipts from customers

(3)

ii)

Income tax paid

(3)

iii)

Dividends paid

(4)

iv)

Purchase of equipment to replace

(2)

v)

Purchase of equipment (excluding replacement equipment)

(3)

vi)

Mortgage bond repayment

(3)

b) Disclose only the note "Cash generated from operations" to the Cash Flow Statement of Truly

Tiles (Pty) Ltd for the reporting period ended 31 December 2024.

(12)

Note:

Ignore VAT.

Show ALL calculations clearly.

3

|

4 Page 4 |

▲back to top |

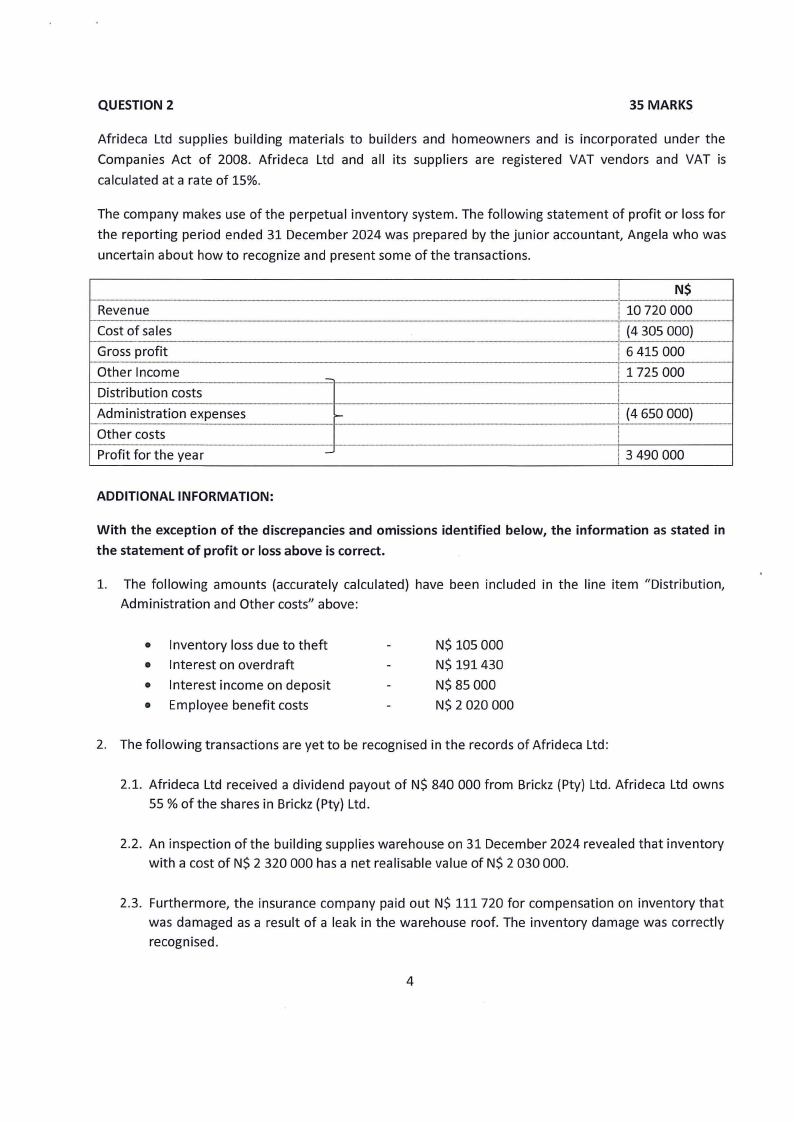

QUESTION 2

35 MARKS

Afrideca Ltd supplies building materials to builders and homeowners and is incorporated under the

Companies Act of 2008. Afrideca Ltd and all its suppliers are registered VAT vendors and VAT is

calculated at a rate of 15%.

The company makes use of the perpetual inventory system. The following statement of profit or loss for

the reporting period ended 31 December 2024 was prepared by the junior accountant, Angela who was

uncertain about how to recognize and present some of the transactions.

Revenue

Cost of sales

Gross profit

Other Income

-

Distribution costs

Administration expenses

-

Other costs

Profit for the year

-

N$

10720 000

(4 305 000)

6 415 000

1725000

(4 650 000)

3 490 000

ADDITIONAL INFORMATION:

With the exception of the discrepancies and omissions identified below, the information as stated in

the statement of profit or lossabove is correct.

1. The following amounts (accurately calculated) have been included in the line item "Distribution,

Administration and Other costs" above:

• Inventory loss due to theft

• Interest on overdraft

• Interest income on deposit

• Employee benefit costs

N$105 000

N$191430

N$ 85 000

N$ 2 020 000

2. The following transactions are yet to be recognised in the records of Afrideca Ltd:

2.1. Afrideca Ltd received a dividend payout of N$ 840 000 from Brickz (Pty) Ltd. Afrideca Ltd owns

55 % of the shares in Brickz (Pty) Ltd.

2.2. An inspection of the building supplies warehouse on 31 December 2024 revealed that inventory

with a cost of N$ 2 320 000 has a net realisable value of N$ 2 030 000.

2.3. Furthermore, the insurance company paid out N$ 111 720 for compensation on inventory that

was damaged as a result of a leak in the warehouse roof. The inventory damage was correctly

recognised.

4

|

5 Page 5 |

▲back to top |

2.4. The company made a first provisional tax payment of N$ 550 000 to NAM RA on 30 June 2024.

The accounting profit for the 2024 financial year amounted to N$ 3 893 718 and the taxable

income amounted to N$ 3 161 290. The income tax expense for the current financial year has

not been recorded in the records of the company.

3. The share capital of Afrideca Ltd on 1 January 2024 comprised of 2 500 000 ordinary issued shares of

N$ 15 each and 1 750 000 7.5 % issued preference shares of N$ 10 each. On 1 October 2024, a

further 1000 000 ordinary shares were issued for N$ 15 each as well as a further 1 000 000 7.5 %

preference shares at N$ 10 each. The directors declared an ordinary dividend of 10c per share on 31

December 2024. Retained earnings on 1 January 2024 amounted to N$ 4 850 000.

4. Management fees of N$ 805 000 (VAT inclusive) were received from Jump (Pty) Ltd during the

reporting period.

REQUIRED

a) Present the Statement of profit or loss for the financial year ended 31 December 2024 in compliance

with the IFRS.

(20)

b) Prepare the retained earnings column in the Statement of Changes in equity for the year ended 31

December 2024.

(6)

c) Name the three (3) reports that should be discussed at the AGM of the company.

(3)

d) Name instances as per the Companies Act of 2008, when a person cannot be elected as a director of

a company.

(6)

Note:

Accounting policy notes are not required.

Show all calculations and reference clearly.

Comparative figures are not required.

Round up to the nearest Namibian Dollar where applicable.

5

|

6 Page 6 |

▲back to top |

QUESTION 3

20 MARKS

XYZ Ltd is registered VAT vendor with a 30 June financial year-end.

XYZ Ltd owns an investment property, consisting of an office block in the city centre which it acquired

for an amount of N$ 13 000 000. Prior to acquiring the property, the Board of Directors was of the

opinion that real estate in that area will appreciate in value. The registration of the property was done

on 30 June 2021. In order to finance this asset, N$ 8 000 000 was paid via EFTwhile the remainder was

funded by a 11.5 % mortgage bond, which is payable in 25 instalments twice a year. Shortly after

registration, the company signed a lease agreement with an international law firm which will lease the

property for N$ 129 375 (VAT inclusive) every month.

An independent valuation by Twafeni Property Valuators indicated the fair value of the property to be

N$ 13 850 000 on 30 June 2023 (N$ 13 300 000 for 2022).

The company's policy is to account for investment property according to the fair value model.

REQUIRED

Disclose the above information

ended 30 June 2023.

Note:

in the notes to the financial statements of XYZ Ltd for the financial year

(20)

Accounting policy notes are not required.

Show all calculations and reference clearly.

Comparative figures are not required.

Round up to the nearest Namibian Dollar where applicable.

6

|

7 Page 7 |

▲back to top |

QUESTION 4

15 MARKS

Distinct Devices (Pty) Ltd is a private company which imports highly sought-after electronic devices in

Namibia. The company's current reporting period ends on 31 December 2024. The company is

registered for VAT and it uses the periodic inventory system.

At the end of May 2024, a good customer of Distinct Devices (Pty) Ltd, Blue (Pty) Ltd, contacted Distinct

Devices (Pty) Ltd to order 300 specialized tablets for their organization. Blue (Pty) Ltd has always paid its

obligations on time and it is expected that this situation will continue in the foreseeable future.

On 10 June 2024, Distinct Devices (Pty) Ltd signed a contract with Blue (Pty) Ltd. The contract stipulated

that Distinct Devices (Pty) Ltd will deliver the following items to Blue (Pty) Ltd's main warehouse in

Windhoek as follows:

• 175 cellphones will be delivered on 20 June 2024; and

• 125 cellphones will be delivered on 6 July 2024.

The sales price of the 300 cellphones is N$862 500 (including VAT) and it will remain fixed irrespective of

the number of units sold. The total amount is payable on 31 July 2024.

REQUIRED

Discuss the application of the 5 step model of IFRS15 in relation to the above information.

(15)

7

|

8 Page 8 |

▲back to top |

QUESTION 5

25 MARKS

Enigma Ltd is a company which manufactures vehicles parts and is located in the northern industrial

area of Windhoek. The company has a 30 June year-end.

During December 2023 the Board of Directors of Enigma Ltd thought it appropriate to expand their

operations into the tyre manufacturing sector. Engima Ltd purchased a 55 % of the 100 000 ordinary

shares in issue ofTyre-Rama (Pty) Ltd for N$ 2 000 000. The shares were paid for on 3 June 2024.

Many of the key positions in Tyre-Rama (Pty) Ltd were vacant at the time when Enigma Ltd made the

investment. Enigma Ltd therefore provided management services to Tyre-Rama (Pty) Ltd to the amount

of N$ 82 000 during the month of June 2024.

On 30 June 2024, a dividend of 25 cents per ordinary share was declared by Tyre-Rama (Pty) Ltd. This

dividend was paid on 18 August 2024.

On 1 December 2023, Engima Ltd purchased 44 000 listed shares in Car Parts Ltd at a cost of N$ 4.50 per

share via bank transfer. The total number of issued shares of Car Parts Ltd amounted to 250 000.

On 30 June 2024 the market value of Car Parts Ltd's total ordinary shares was N$ 1 625 000. On the 1st

of May 2024, the directors of Car Parts Ltd declared a dividend of 40 cents per share.

It is the accounting policy of Engima Ltd to measure investments in listed shares at fair value through

Profit and Loss, while investments in unlisted shares are measured using the cost model.

REQUIRED

a) Prepare all the general journal entries relating to the investments in Tyre-Rama (Pty) Ltd and Car Parts

Ltd in the records of Enigma Ltd, which is evident from the above information. Narrations are required

for all journal entries.

(14)

b) Disclose the above information in the

i) Statement of Profit or Loss (5 Marks) and

ii) The notes to the Financial Statements (6 Marks)

of Enigma Ltd for the reporting period ended 30 June 2024.

(11)

Note:

Accounting policy notes are not required.

END OF ASSESSMENT

8