|

FAC501Y-ACCOUNTING 100-2ND OPP-JAN 2025 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEn CE

TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING (CHARTERED ACCOUNTANCY)

QUALIFICATION CODE: 0?BACC

LEVEL: 5

COURSE CODE: FAC501Y

COURSE NAME: ACCOUNTING 100

DATE: JANUARY 2025

PAPER: THEORY AND PRACTICAL

TOTAL DURATION: 162 MINUTES

MARKS: 125

EXAMINERS

MODERATOR:

SECOND OPPORTUNITY EXAMINATION

MS Z STELLMACHER

MS M CLOETE

2024 REQUIRED

INSTRUCTIONS:

1. This paper consists of EIGHT pages (Including this cover page). If your paper does not contain all the pages, please put up

your hand so that a replacement paper can be handed to you.

2. Answer all the questions in blue or black ink only.

3. Eachquestion should be answered on a separate page.

4. Questions relating to the paper may be raised in the initial 30 minutes after the start of the paper. Thereafter, candidates

must use their initiative to deal with any perceived error or ambiguities & any assumption made by the candidate should

be clearly stated.

5. You may make notes on your question paper during the reading time but may not write in your answer booklet.

6. Permissible materials include stationery and a non-programmable calculator only.

7. The neatness, disclosure and presentation of your answers will be considered when marking your paper.

8. The scenarios presented are fictitious and any similarities, real or imagined, to real events, people, places, organisations are

purely coincidental and should be interpreted as such.

1

|

2 Page 2 |

▲back to top |

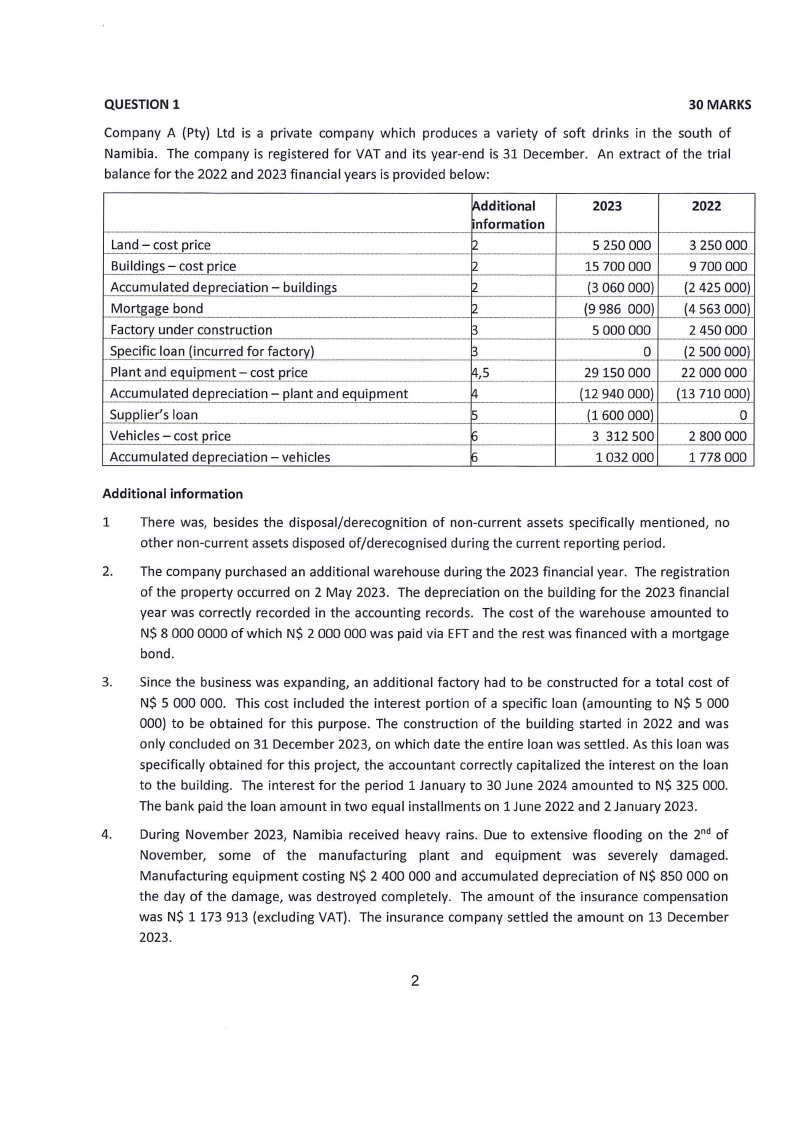

QUESTION 1

30 MARKS

Company A {Pty) Ltd is a private company which produces a variety of soft drinks in the south of

Namibia. The company is registered for VAT and its year-end is 31 December. An extract of the trial

balance for the 2022 and 2023 financial years is provided below:

Land - cost price

Buildings - cost price

Accumulated depreciation - buildings

Mortgage bond

Factory under construction

Specific loan (incurred for factory)

Plant and equipment - cost price

Accumulated depreciation - plant and equipment

Supplier's loan

Vehicles - cost price

Accumulated depreciation - vehicles

~dditional

nformation

2

2

2

2

3

B

~,5

15

2023

2022

5 250 000

15 700 000

{3 060 000)

{9 986 000)

5 000 000

0

29150 000

(12 940 000)

(1600 000)

3 312 500

1032 000

3 250 000

9 700 000

{2 425 000)

{4 563 000)

2 450 000

{2 500 000)

22 000 000

(13 710 000)

0

2 800 000

1778000

Additional information

1 There was, besides the disposal/derecognition of non-current assets specifically mentioned, no

other non-current assets disposed of/derecognised during the current reporting period.

2. The company purchased an additional warehouse during the 2023 financial year. The registration

of the property occurred on 2 May 2023. The depreciation on the building for the 2023 financial

year was correctly recorded in the accounting records. The cost of the warehouse amounted to

N$ 8 000 0000 of which N$ 2 000 000 was paid via EFTand the rest was financed with a mortgage

bond.

3. Since the business was expanding, an additional factory had to be constructed for a total cost of

N$ 5 000 000. This cost included the interest portion of a specific loan {amounting to N$ 5 000

000) to be obtained for this purpose. The construction of the building started in 2022 and was

only concluded on 31 December 2023, on which date the entire loan was settled. As this loan was

specifically obtained for this project, the accountant correctly capitalized the interest on the loan

to the building. The interest for the period 1 January to 30 June 2024 amounted to N$ 325 000.

The bank paid the loan amount in two equal installments on 1 June 2022 and 2 January 2023.

4. During November 2023, Namibia received heavy rains. Due to extensive flooding on the 2nd of

November, some of the manufacturing plant and equipment was severely damaged.

Manufacturing equipment costing N$ 2 400 000 and accumulated depreciation of N$ 850 000 on

the day of the damage, was destroyed completely. The amount of the insurance compensation

was N$ 1173 913 {excluding VAT). The insurance company settled the amount on 13 December

2023.

2

|

3 Page 3 |

▲back to top |

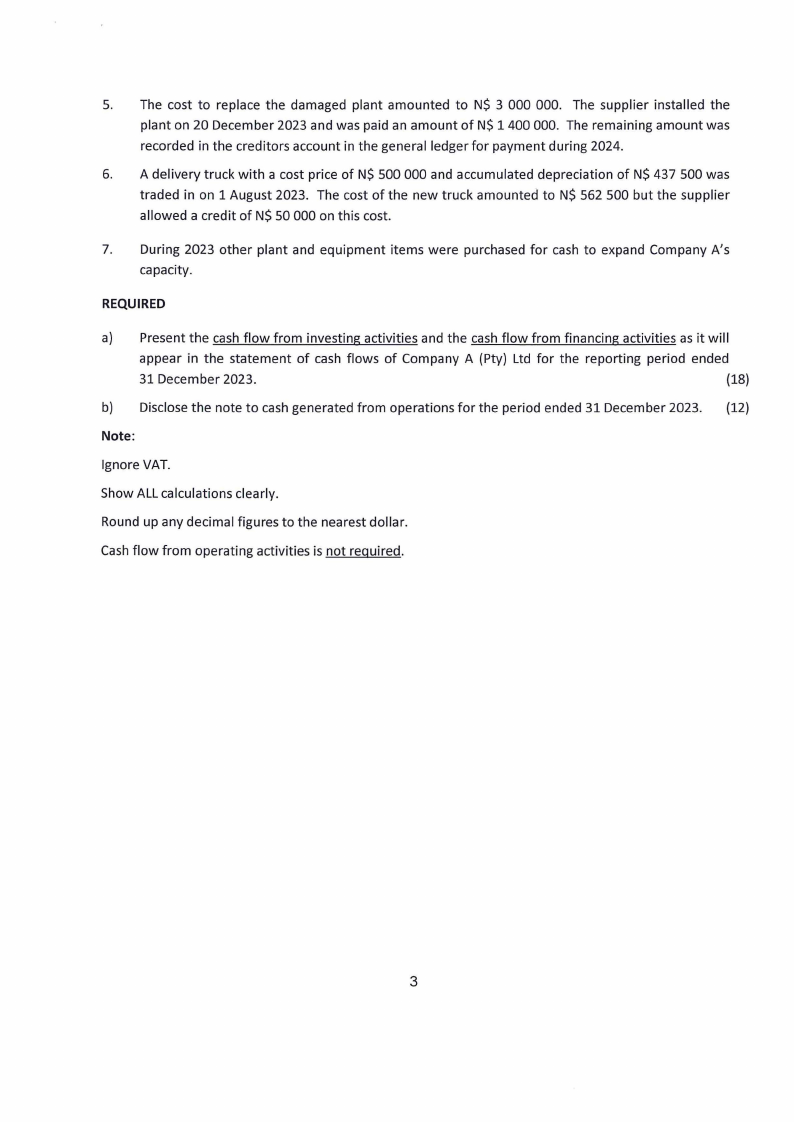

5. The cost to replace the damaged plant amounted to N$ 3 000 000. The supplier installed the

plant on 20 December 2023 and was paid an amount of N$ 1 400 000. The remaining amount was

recorded in the creditors account in the general ledger for payment during 2024.

6. A delivery truck with a cost price of N$ 500 000 and accumulated depreciation of N$ 437 500 was

traded in on 1 August 2023. The cost of the new truck amounted to N$ 562 500 but the supplier

allowed a credit of N$ 50 000 on this cost.

7. During 2023 other plant and equipment items were purchased for cash to expand Company A's

capacity.

REQUIRED

a) Present the cash flow from investing activities and the cash flow from financing activities as it will

appear in the statement of cash flows of Company A (Pty) Ltd for the reporting period ended

31 December 2023.

(18)

b) Disclose the note to cash generated from operations for the period ended 31 December 2023. (12)

Note:

Ignore VAT.

Show ALL calculations clearly.

Round up any decimal figures to the nearest dollar.

Cashflow from operating activities is not required.

3

|

4 Page 4 |

▲back to top |

QUESTION 2

25 MARKS

PART A

Company B is a fast food business in Swakopmund. The year end of the business is 30 September. The

company acquired the registered trademark "Best Burgers" during the current financial year. The

contract price of the trademark amounted to N$ 1 744 000 and the payment was made on 30 July 2023.

The registration of the trademark in the name of Company B occurred on 1 August 2023. The law firm

which handled the registration was paid N$ 98 000 for this service.

Company B already owned the trademark "Super Sandwiches" which was acquired at the end of May in

2019 for a total cost of N$ 680 000. Trademarks and software are amortised on a straight line basis at

10 % per annum.

Company B uses software which it acquired from South Africa 3 years ago for an amount of N$ 1 300

000. The software has been in use since 1 October 2020. At the end of the current financial year the

software distributor informed Company B that the remaining life of the software is 5 years.

PARTB

Company C (Pty) Ltd established a solar plant to provide electricity for its business. The plant was

commissioned on 1 March 2020 and its total cost as recorded in the general ledger account for assets

was N$ 6 000 000. The financial year-end of the company is 30 September.

Plant is depreciated at 20 % per annum on a straight-line basis. The electricity output of the plant

steadily reduced from October 2022. The company hired an expert in the solar industry in January 2023

who determined that the technology of the plant did not function optimally anymore.

On 28 February 2023 it was determined that the amount receivable from the sale of the plant in an

arm's length transaction is estimated at N$ 900 000 (excluding VAT) and its selling expenses is N$ 75 000

(excluding VAT). Value in use amounted to N$ 450 000 (excluding VAT) on 28 February 2023. During

2024 two other experts informed Company C (Pty) Ltd that the values of the plant provided at the end

of 2023 was too low. The recoverable amount of the plant was N$ N$ 1 350 000 (excluding VAT) on 28

February 2024.

REQUIRED

PART A

Disclose the above in the note for Intangible Assets to the Statement of Financial Position of Company B

as at 30 September 2023. Accounting policy notes are not required. IGNOREVAT.

Round up any numbers to the nearest dollar.

(12)

4

|

5 Page 5 |

▲back to top |

PARTB

a) Define the term "recoverable amount" as it is contained in International Accounting

Standards.

(6)

b) Calculate the carrying value of the plant as at 28 February 2024.

(7)

5

|

6 Page 6 |

▲back to top |

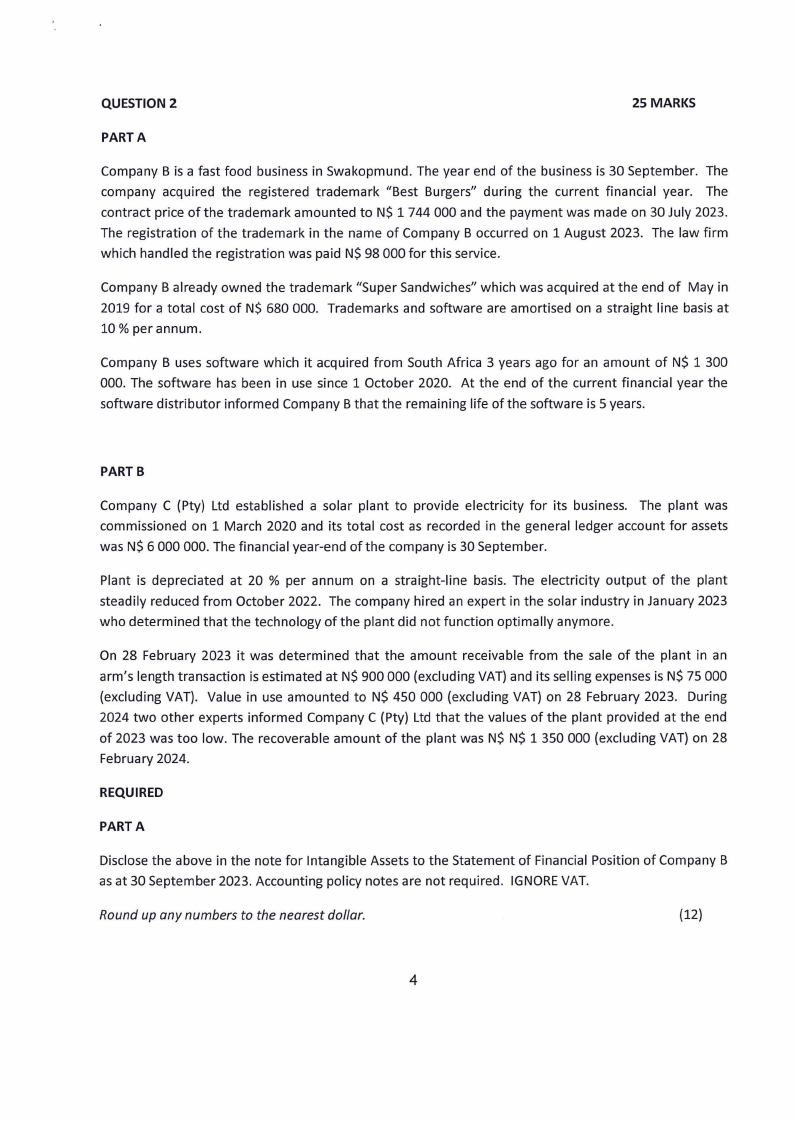

QUESTION 3

20 MARKS

Company D (Pty) Ltd is a general dealer. During the month of August 2023 the following transactions

occurred:

2 August

5 August

6 August

7 August

8 August

9 August

10 August

29 August

Opening inventory

Purchases

Purchases

Sales

Sales

Return to supplier

Sales

Purchases

100 units

120 units

180 units

200 units

150 units

20 units

20 units

110 units

@N$5.00 per unit

@N$5.75 per unit

@N$6.00 per unit

@N$6.15 per unit

The units returned to the supplier were units purchased on 6 August.

Company D (Pty) Ltd utilises the perpetual inventory system to account for inventory. An inventory

count on 31 August 2023 revealed that the company had 100 units of inventory on hand.

REQUIRED

a) Using a tabular format, calculate the value of closing inventory and cost of sales for the month

of August assuming that the weighted average cost formula method is used.

(14)

b) Assuming that the periodic inventory system is used, prepare the cost of sales general ledger

account for the month of August 2023 using the First in First Out (FIFO)cost formula. (6)

6

|

7 Page 7 |

▲back to top |

QUESTION4

25 MARKS

Rapid Repairs is a hardware store in Windhoek. It is a registered VAT vendor with a financial year-end of

30 June. The following transactions pertains to the debtors in the business.

A sales transaction was concluded with Plummeting Plumbers (who is not registered for VAT purposes)

on 20 September 2023. The full amount of the sale was N$ 28 750 and Rapid Repairs assumed (due to

the fact that Plummeting Plumbers was a good customer) that Plummeting Plumbers will take

advantage of the 3 % settlement discount if payment was done within 30 days.

REQUIRED

PART A

Prepare the journal entries for the above transaction in the records of Rapid Repairs.

Show all journal narrations.

(7)

PARTB

Prepare the journal entries for the above transaction in the records of Rapid Repairs but assume that

Plummeting Plumbers were not known to Rapid Repairs at all. Explain which accounting concept you

applied in this

regard.

(6)

PARTC

Write a memorandum to the owner of Rapid Repairs in which you discuss the term "contract" as it is

outlined in IFRS15.

{12)

7

|

8 Page 8 |

▲back to top |

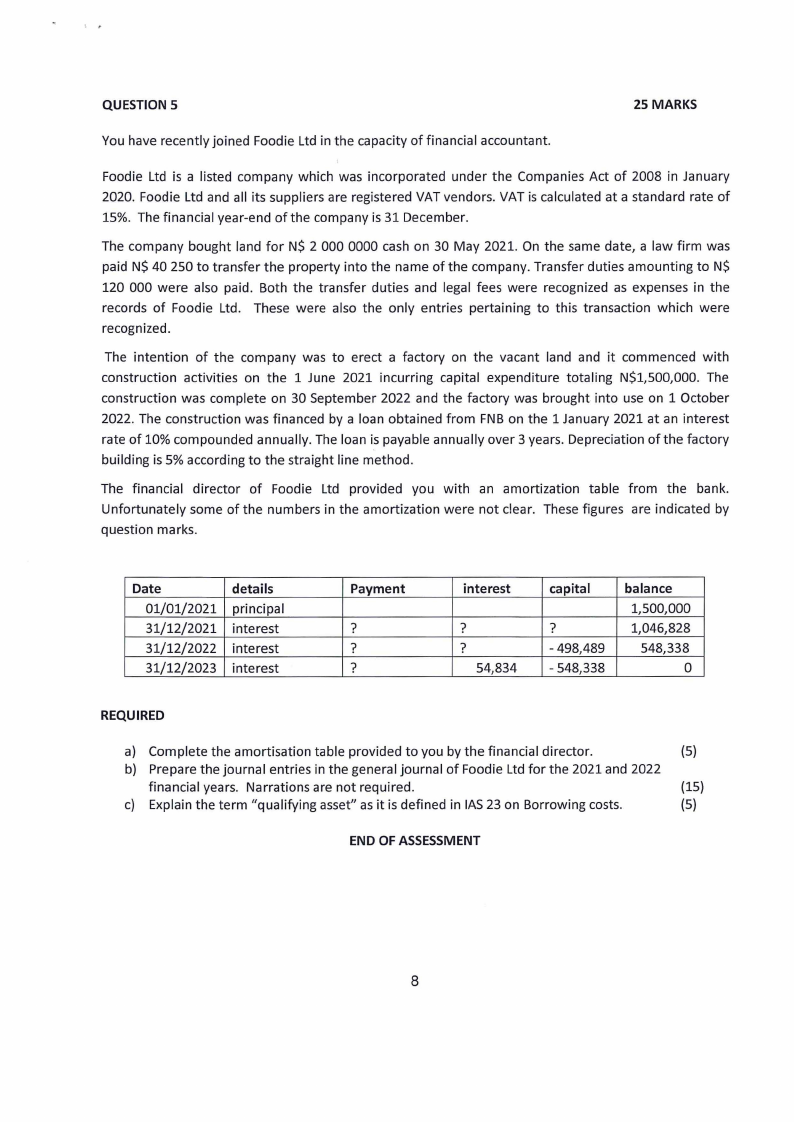

QUESTION 5

25 MARKS

You have recently joined Foodie Ltd in the capacity of financial accountant.

Foodie Ltd is a listed company which was incorporated under the Companies Act of 2008 in January

2020. Foodie Ltd and all its suppliers are registered VAT vendors. VAT is calculated at a standard rate of

15%. The financial year-end of the company is 31 December.

The company bought land for N$ 2 000 0000 cash on 30 May 2021. On the same date, a law firm was

paid N$ 40 250 to transfer the property into the name of the company. Transfer duties amounting to N$

120 000 were also paid. Both the transfer duties and legal fees were recognized as expenses in the

records of Foodie Ltd. These were also the only entries pertaining to this transaction which were

recognized.

The intention of the company was to erect a factory on the vacant land and it commenced with

construction activities on the 1 June 2021 incurring capital expenditure totaling N$1,500,000. The

construction was complete on 30 September 2022 and the factory was brought into use on 1 October

2022. The construction was financed by a loan obtained from FNB on the 1 January 2021 at an interest

rate of 10% compounded annually. The loan is payable annually over 3 years. Depreciation of the factory

building is 5% according to the straight line method.

The financial director of Foodie Ltd provided you with an amortization table from the bank.

Unfortunately some of the numbers in the amortization were not clear. These figures are indicated by

question marks.

Date

01/01/2021

31/12/2021

31/12/2022

31/12/2023

details

principal

interest

interest

interest

Payment

?

?

?

interest

?

?

54,834

capital

?

- 498,489

- 548,338

balance

1,500,000

1,046,828

548,338

0

REQUIRED

a) Complete the amortisation table provided to you by the financial director.

(5)

b) Prepare the journal entries in the general journal of Foodie Ltd for the 2021 and 2022

financial years. Narrations are not required.

(15}

c) Explain the term "qualifying asset" as it is defined in IAS23 on Borrowing costs.

(5)

END OF ASSESSMENT

8