|

FAC612S-FINANCIAL ACCOUNTING 202- 2ND OPP- JAN 2025 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

0 F SCIEnCE An D TECHn OLOGY

FACULTYOF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING

QUALIFICATION CODE:

07BGAC

07BOAC / LEVEL: 6

COURSE CODE: FAC612S

COURSE NAME: FINANCIALACCOUNTING202

DATE: JANUARY2025

DURATION: 3 HOURS

PAPER: THEORYAND CALCULATIONS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION PAPER

EXAMINER(S) Ms. P.Erkie, Mr. C. Mahindi and Ms. A. Gustav

MODERATOR: Dr. S. Dzomira

INSTRUCTIONS

1. Capture your full name, student number and assessment number on the first page.

2. Answer ALL the questions and manage your time properly.

3. Number each page correctly

4. Write clearly and neatly.

5. Do not write in pencil and do not use tip-ex, as this will not be marked.

6. The names of people and businesses used throughout this assessment do not reflect the

reality and may be purely coincidental.

7. SHOW ALL WORKINGS!

THIS QUESTION PAPER CONSISTS OF 5 PAGES (excluding this front page)

1

|

2 Page 2 |

▲back to top |

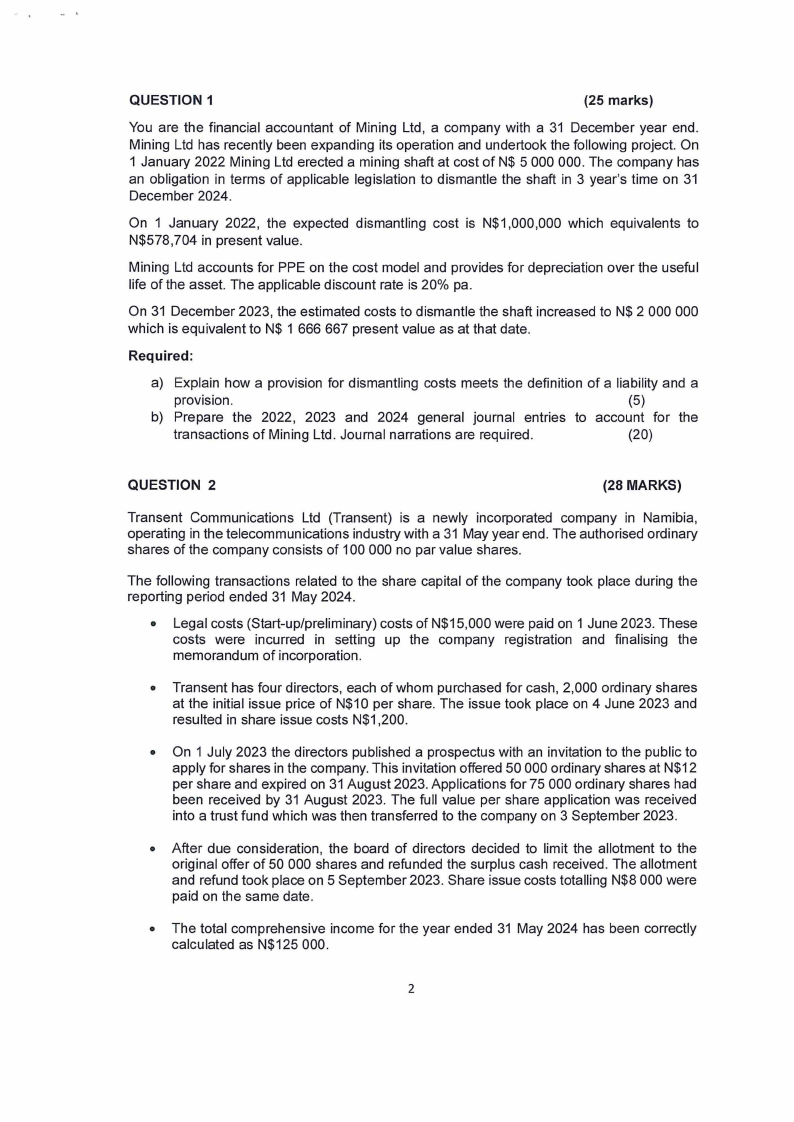

QUESTION 1

(25 marks)

You are the financial accountant of Mining Ltd, a company with a 31 December year end.

Mining Ltd has recently been expanding its operation and undertook the following project. On

1 January 2022 Mining Ltd erected a mining shaft at cost of N$ 5 000 000. The company has

an obligation in terms of applicable legislation to dismantle the shaft in 3 year's time on 31

December 2024.

On 1 January 2022, the expected dismantling cost is N$1,000,000 which equivalents to

N$578,704 in present value.

Mining Ltd accounts for PPE on the cost model and provides for depreciation over the useful

life of the asset. The applicable discount rate is 20% pa.

On 31 December 2023, the estimated costs to dismantle the shaft increased to N$ 2 000 000

which is equivalent to N$ 1 666 667 present value as at that date.

Required:

a) Explain how a provision for dismantling costs meets the definition of a liability and a

provision.

(5)

b) Prepare the 2022, 2023 and 2024 general journal entries to account for the

transactions of Mining Ltd. Journal narrations are required.

(20)

QUESTION 2

(28 MARKS)

Transent Communications Ltd (Transent) is a newly incorporated company in Namibia,

operating in the telecommunications industry with a 31 May year end. The authorised ordinary

shares of the company consists of 100 000 no par value shares.

The following transactions related to the share capital of the company took place during the

reporting period ended 31 May 2024.

• Legal costs (Start-up/preliminary) costs of N$15,000 were paid on 1 June 2023. These

costs were incurred in setting up the company registration and finalising the

memorandum of incorporation.

• Transent has four directors, each of whom purchased for cash, 2,000 ordinary shares

at the initial issue price of N$10 per share. The issue took place on 4 June 2023 and

resulted in share issue costs N$1,200.

• On 1 July 2023 the directors published a prospectus with an invitation to the public to

apply for shares in the company. This invitation offered 50 000 ordinary shares at N$12

per share and expired on 31 August 2023. Applications for 75 000 ordinary shares had

been received by 31 August 2023. The full value per share application was received

into a trust fund which was then transferred to the company on 3 September 2023.

• After due consideration, the board of directors decided to limit the allotment to the

original offer of 50 000 shares and refunded the surplus cash received. The allotment

and refund took place on 5 September 2023. Share issue costs totalling N$8 000 were

paid on the same date.

• The total comprehensive income for the year ended 31 May 2024 has been correctly

calculated as N$125 000.

2

|

3 Page 3 |

▲back to top |

REQUIRED:

a) Provide all the general journal entries relating to the share transactions of Transent

Communications Ltd for the reporting period ended 31 May 2024. Journal narrations

are required. Show account classifications (SPL, SFP, SCE etc.).

(20)

b) Prepare the Statement of changes in equity of Transent Communications Ltd for the

reporting period ended 31 May 2024.

(8)

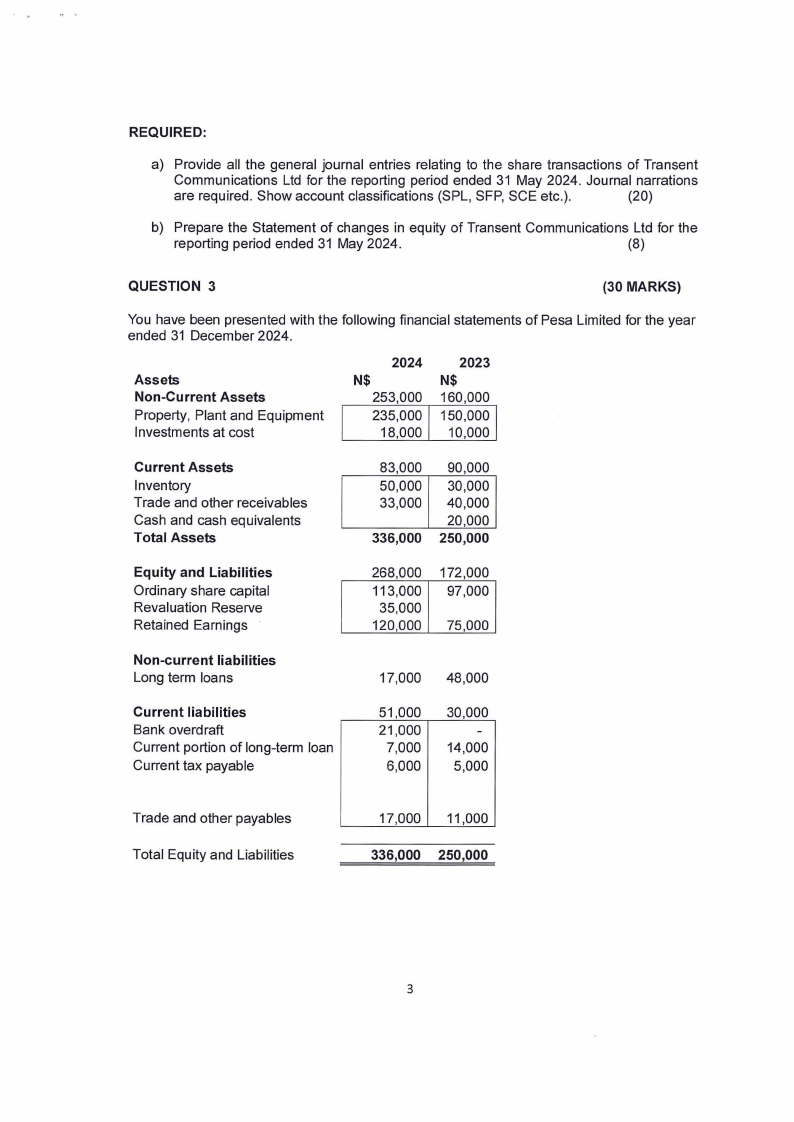

QUESTION 3

(30 MARKS)

You have been presented with the following financial statements of Pesa Limited for the year

ended 31 December 2024.

Assets

Non-Current Assets

Property, Plant and Equipment

Investments at cost

2024

N$

253,000

235,000

18,000

2023

N$

160,000

150,000

10,000

Current Assets

Inventory

Trade and other receivables

Cash and cash equivalents

Total Assets

83,000

50,000

33,000

336,000

90,000

30,000

40,000

20,000

250,000

Equity and Liabilities

Ordinary share capital

Revaluation Reserve

Retained Earnings ·

268,000

113,000

35,000

120,000

172,000

97,000

75,000

Non-current liabilities

Long term loans

17,000 48,000

Current liabilities

Bank overdraft

Current portion of long-term loan

Current tax payable

51,000

21,000

7,000

6,000

30,000

14,000

5,000

Trade and other payables

Total Equity and Liabilities

17,000 11,000

336,000 250,000

3

|

4 Page 4 |

▲back to top |

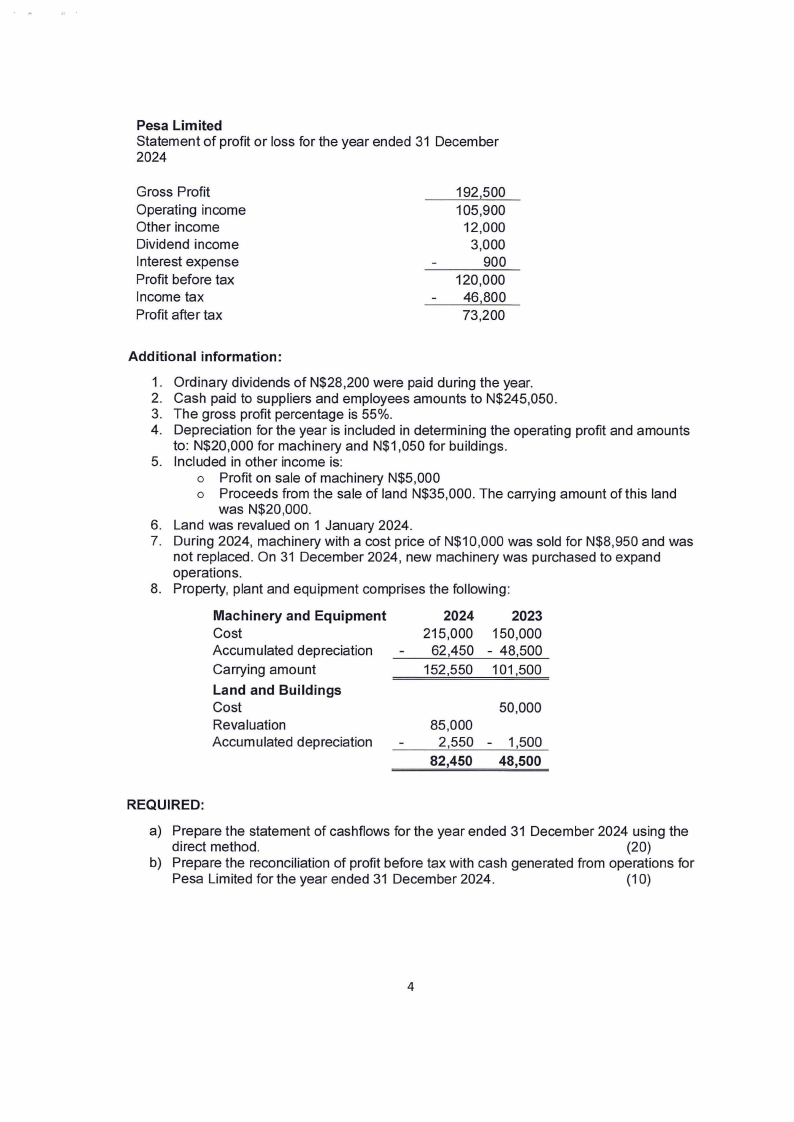

Pesa Limited

Statement of profit or loss for the year ended 31 December

2024

Gross Profit

Operating income

Other income

Dividend income

Interest expense

Profit before tax

Income tax

Profit after tax

192,500

105,900

12,000

3,000

900

120,000

46,800

73,200

Additional information:

1. Ordinary dividends of N$28,200 were paid during the year.

2. Cash paid to suppliers and employees amounts to N$245,050.

3. The gross profit percentage is 55%.

4. Depreciation for the year is included in determining the operating profit and amounts

to: N$20,000 for machinery and N$1,050 for buildings.

5. Included in other income is:

o Profit on sale of machinery N$5,000

o Proceeds from the sale of land N$35,000. The carrying amount of this land

was N$20,000.

6. Land was revalued on 1 January 2024.

7. During 2024, machinery with a cost price of N$10,000 was sold for N$8,950 and was

not replaced. On 31 December 2024, new machinery was purchased to expand

operations.

8. Property, plant and equipment comprises the following:

Machinery and Equipment

Cost

Accumulated depreciation

Carrying amount

Land and Buildings

Cost

Revaluation

Accumulated depreciation

2024

215,000

62,450

152,550

2023

150,000

- 48,500

101,500

85,000

2,550

82,450

50,000

- 1,500

48,500

REQUIRED:

a) Prepare the statement of cashflows for the year ended 31 December 2024 using the

direct method.

(20)

b) Prepare the reconciliation of profit before tax with cash generated from operations for

Pesa Limited for the year ended 31 December 2024.

(10)

4

|

5 Page 5 |

▲back to top |

QUESTION 4

(17 MARKS)

Lostit limited issues 2000 convertible bonds at the start of 2024. The bonds have a three-year

term and are issued at par with the face value of N$1,000 per bond, giving total proceeds of

N$2 000 000. Interest is payable annually in arrears at the nominal annual interest rate of 6%.

Each bond is convertible at any time up to maturity into 250 ordinary shares.

When the bonds are issued, the prevailing market interest rate for similar debt without

conversion options is 9%.

Required.

a) Discuss in detail whether the issue of debentures is a compound financial instrument.

(7)

b} Calculate the value of the liability and equity component in the bond?

(10)

END OF EXAMINATION QUESTION PAPER

5