|

IHA521S-INTRODUCATION TO HOSPITALITY AND TOURISM ACCOUNTING-1ST OPP- JUNE 2024 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEn CE Ano TECHn OLOGY

FACULTYOF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENTOF ECONOMICS,ACCOUNTINGAND FINANCE

QUALIFICATIONCODE:07BHOM & 07BOTM LEVEL:6

COURSECODE: IHA521S

COURSENAME: INTRODUCTIONTO HOSPITALITY

& TOURISM ACCOUNTING

SESSION:JUNE 2024

PAPER:THEORYAND CALCULATIONS

DURATION: 3 HOURS

MARKS: 100

FIRSTOPPORTUNITYEXAMINATION QUESTIONPAPER

EXAMINER

Sheehama, K.G.H.

MODERATOR Odada, L.

INSTRUCTIONS

• Answer ALL four (4) questions in blue or black ink only. NO PENCIL.

• Start each question on a new page, number the answers correctly and clearly.

• Write clearly, and neatly showing all your workings/assumptions.

• Work with at least four (4) decimal places in all your calculations and only round off only

final answers to two (2) decimal places.

• Questions relating to this examination may be raised in the initial 30 minutes after the start

of the examination. Thereafter, candidates must use their initiative to deal with any

perceived errors or ambiguities and any assumptions made by the candidate should be

clearlv stated.

PERMISSIBLEMATERIALS

• Silent, non-programmable calculators

THIS QUESTION PAPERCONSISTSOF _6_ PAGES(including this front page)

|

2 Page 2 |

▲back to top |

QUESTION 1

(30 MARKS]

For questions 1.1 - 1.15, just write the answer only (the correct letter chosen) in your answer sheet provided;

and not on the question paper. Do not copy the question and the answers again.

1.14 The basic accounting equation may be expressed as

a) Assets= Equities - Liabilities

b) Assets+ Liabilities= Owner's Equity.

c) Assets= Liabilities+ Owner's Equity.

d) All of these.

1.2 Capital/owner's equity can be described as

a) creditorship claims on total assets.

b) ownership claim on total assets less liabilities.

c) government claim on total assets.

d) Accounts receivables claim on total assets.

1.3 The left side of an account is

a) blank.

b) a description of the account.

c) the debit side.

d) the balance of the account.

1.4 Salesrevenue less cost of goods sold is called

a) gross profit.

b) net profit.

c) net income.

d) marginal income.

1.5 If total liabilities increased by N$8 000, then

a) assets must have decreased by N$8 000.

b) owner's equity must have decreased by N$8 000.

c) assets must have increased by N$8 000 and owner's equity must have

d) decreased by N$8 000.

e) assets and owner's equity each increased by N$4 000.

1.6 Mr. Zoo has a dancing school and sells dancing shoes to clients. He won an important dancing competition.

Mr Zoo proposes to include as an asset in the statement of financial position his dancing skills and

experience. You inform him that this is not allowed. Which of the following accounting rules apply?

2

|

3 Page 3 |

▲back to top |

a) The rule periodicity rule

b) The realization rule

c) The quantitative rule

d) The prudence rule

1.7 At the end of year 2022, a business owes N$100 electricity charges. How will this be recorded in the

statement of financial position?

a) As a trade creditor

b) As an overdraft

c) As a prepaid

d) As an accrual

1.8 A business is considering making a provision for depreciation on the vehicle. Which of the following

statements best describes depreciation?

a) Depreciation always provides an equal amount to be charged as a businessexpense each year

b) Depreciation is the name given to describe the interest paid on a long-term loan

c) Depreciation is a way of charging the cost of a non-current asset to the statement profit or loss

d) Depreciation is an adjustment that usually takes the form of an increase in the existing account

1.9 Businessdecides to make a provision for depreciation for the year ending 31 December 2022. It is agreed

that a provision on the vehicle of 6%, on a reducing balance. The Net book value is N$36 000 (i.e. after

deduction of accumulated depreciation) on 1st January 2022. What value for depreciation will be recorded

in the statement profit or loss for the year ending 31 December 2022?

a) N$2 160.00

b) N$2 030.40

c) N$2 289.60

d) N$4 194.40

1.10 A business agreed to write off an amount of N$500 owed by accounts receivable as a bad debt. Which of

the following entries in the final accounts should the business now perform?

a) Charge the bad debt to the statement profit or loss only.

b} Charge the bad debt to the statement financial position only.

c) Reduce the value of the accounts receivables balance to allow for the bad debt.

d) Reduce the value of the accounts receivables balance AND charge the bad debt to the statement

profit or loss.

3

|

4 Page 4 |

▲back to top |

1.11 What accounting transaction would result in the following double entry being posted?

Dr Purchases

CrBank

a) The purchases of vehicles by electronic fund transfer (EFT).

b) The receipt of cash from a credit customer.

c) The goods for resale bought by electronic fund transfer (EFT)

d) The banking of cash.

The following information relates to questions 1.12 -1.15.

1.12 Mr Paul purchased goods on credit with a list price of N$1 000 from Mr John. During the month Mr Paul

returned N$200 of goods to Mr John. At the end of the month, Mr Paul settled his account with Mr John

and was given a discount of 10%. In Mr Paul's view the above-mentioned discount was a...

a) Discount allowed of N$80

b) Trade discount of N$80

c) Discount received of N$80

d) Prepaid discount of N$200

1.13 lri Mr John's view the above-mentioned discount was a...

a) Discount allowed of N$80

b) Trade discount of N$80

c) Discount received of N$80

d) Prepaid discount of N$200

1.14 In Mr John's view the above-mentioned returned goods were ...

a) Purchases returns of N$200

b) Cash returns of N$80

c) Sales returns of N$200

d) Discount returns of N$80

1.15 In Mr. Paul's view the above-mentioned returned goods were ...

a) Returns inwards of N$200

b) Discount outwards of N$80

c) Returns outwards of N$200

d) Discount inwards of N$80

2 marks each, 15 x 2 = 30 marks

4

|

5 Page 5 |

▲back to top |

'.

QUESTION 2

[10 MARKS]

For items 2.1 to 2.5 below state the name of the error which would not have an effect on the trial balance:

(write the answer only in your answer sheet provided, e.g.; 1. The error of omission)

2.1 A sale to Mr. Lulu of N$5 600 was entered in both accounts as N$6 S0o in the correct ledger accounts.

2.2 Payment of N$5 000 to accounts payable Mr. Xola was entered on the debit side of the bank account in

error and credited to Mr. Xola's account.

2.3 Billing to Mr. Ben of N$15 000 was wrongly posted to Mr Benra's account.

2.4 Office maintenance of N$10 000 wrongly posted into the Machinery account.

2.5 Purchases account was overcast by N$20 000 and so was Sales account.

QUESTION 3

[36 MARKS]

The following transactions took place during the month of May 2023 in the books of account of Mr Bob, a sole

trader:

May 1 Mr Bob opened a business bank account and deposited N$S00 000.

3 Mr Bob rented premises for N$15 000 per month payable in advance by

electronic fund transfer (EFT).

5 He brought into the business equipment worth N$25 000.

6 He purchased a motor vehicle for N$120 000 by electronic fund transfer (EFT).

10 He bought goods on credit from Tau for N$20 000.

11 Mr Bob sold goods on credit to Zono for N$25 000.

20 Mr Bob returned goods to Tau of N$5 000.

21 Zono settled his account with Mr Bob by electronic fund transfer (EFT);paying N$24 000.

25 Mr Bob settled his account with Tau by electronic fund transfer (EFT)and was given a

settlement discount of 10%.

26 Mr Bob paid N$15 000 by electronic fund transfer (EFT)for his daughter's school fee.

Requirement:

a) Enter the above transactions in appropriate Mr Bob's 'T'accounts and balance off all the accounts. (24)

b) Prepare Mr Bob's trial balance as at 31 May 2024. (12)

5

|

6 Page 6 |

▲back to top |

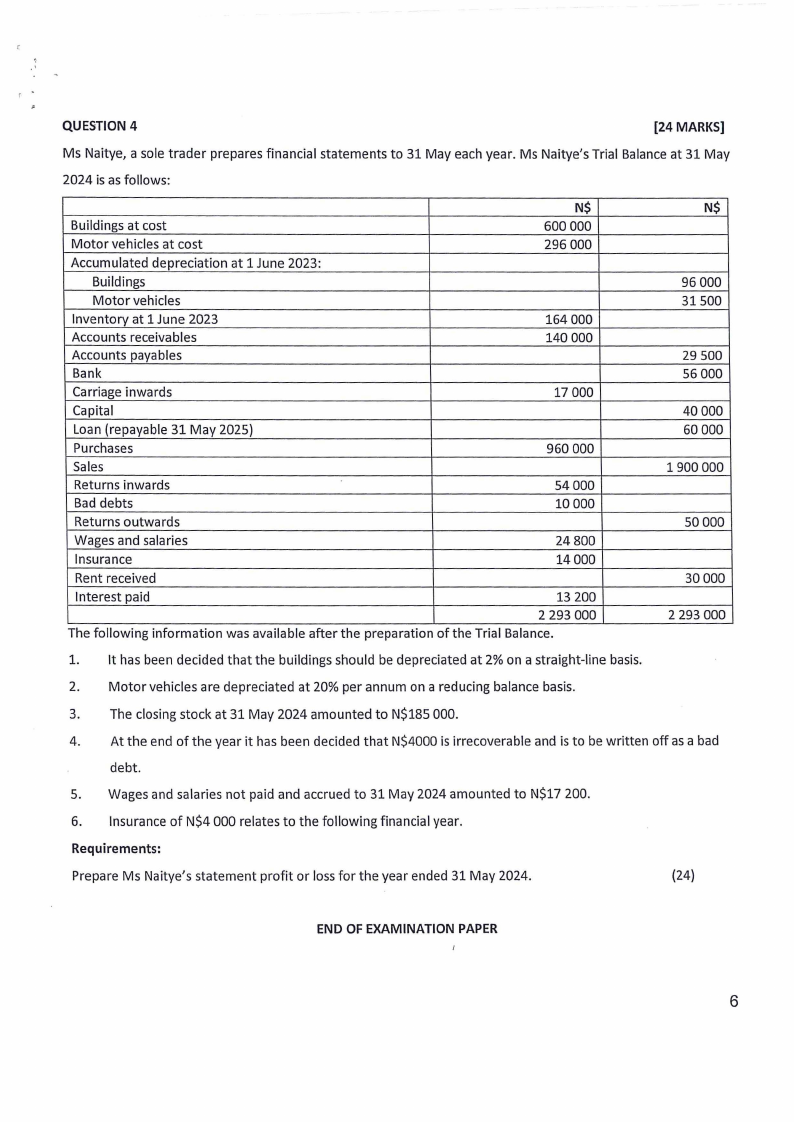

QUESTION 4

[24 MARKS]

Ms Naitye, a sole trader prepares financial statements to 31 May each year. Ms Naitye's Trial Balance at 31 May

2024 is as follows:

N$

Buildings at cost

600 000

Motor vehicles at cost

296 000

Accumulated depreciation at 1 June 2023:

Buildings

Motor vehicles

Inventory at 1 June 2023

164 000

Accounts receivables

140 000

Accounts payables

Bank

Carriage inwards

17 000

Capital

Loan (repayable 31 May 2025)

Purchases

960 000

Sales

Returns inwards

54000

Bad debts

10000

Returns outwards

Wages and salaries

24 800

Insurance

14000

Rent received

Interest paid

13 200

2 293 000

The following information was available after the preparation of the Trial Balance.

N$

96 000

31500

29 500

56 000

40000

60000

1900 000

50000

30000

2 293 000

1. It has been decided that the buildings should be depreciated at 2% on a straight-line basis.

2. Motor vehicles are depreciated at 20% per annum on a reducing balance basis.

3. The closing stock at 31 May 2024 amounted to N$185 000.

4. At the end of the year it has been decided that N$4000 is irrecoverable and is to be written off as a bad

debt.

5. Wages and salaries not paid and accrued to 31 May 2024 amounted to N$17 200.

6. Insurance of N$4 000 relates to the following financial year.

Requirements:

Prepare Ms Naitye's statement profit or loss for the year ended 31 May 2024.

(24)

END OF EXAMINATION PAPER

6