|

IHA521S-INTRODUCATION TO HOSPITALITY AND TOURISM ACCOUNTING - JULY 2024 |

|

1 Page 1 |

▲back to top |

nAmI BIA un IVERSITY

0 F SCIEn CE An D TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION CODE: 07BHOM & 07BOTM LEVEL:6

COURSE CODE: IHA521S

COURSE NAME: INTRODUCTION TO HOSPITALITY

& TOURISM ACCOUNTING

SESSION: JULY 2024

PAPER: THEORY AND CALCULATIONS

DURATION: 3 HOURS

MARKS: 70

EXAMINER

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

Sheehama, K.G.H.

MODERATOR Odada, L.

INSTRUCTIONS

• Answer ALL four (4) questions in blue or black ink only. NO PENCIL.

• Start each question on a new page, number the answers correctly and clearly.

• Write clearly, and neatly showing all your workings/assumptions.

• Work with at least four (4) decimal places in all your calculations and only round

off only final answers to two (2) decimal places.

• Questions relating to this examination may be raised in the initial 30 minutes after

the start of the examination. Thereafter, candidates must use their initiative to deal

with any perceived errors or ambiguities and any assumptions made by the

candidate should be clearly stated.

PERMISSIBLE MATERIALS

• Silent, non-programmable calculators

THIS QUESTION PAPER CONSISTS OF _6_ PAGES (including this front page)

|

2 Page 2 |

▲back to top |

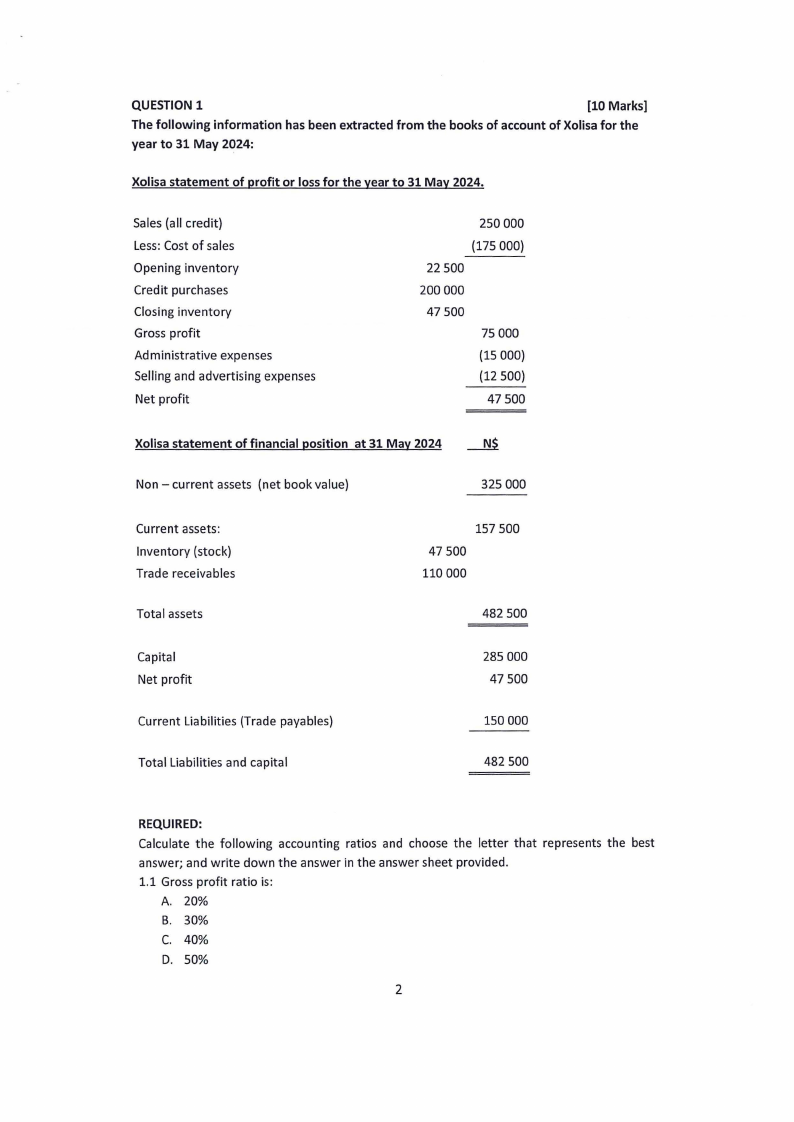

QUESTION1

[10 Marks]

The following information has been extracted from the books of account of Xolisa for the

year to 31 May 2024:

Xolisa statement of profit or loss for the year to 31 May 2024.

Sales (all credit)

Less: Cost of sales

Opening inventory

Credit purchases

Closing inventory

Gross profit

Administrative expenses

Selling and advertising expenses

Net profit

250 000

(175 000)

22 500

200 000

47 500

75 000

(15 000)

(12 500)

47 500

Xolisa statement of financial position at 31 May 2024

Non - current assets (net book value)

325 000

Current assets:

Inventory (stock)

Trade receivables

Total assets

157 500

47 500

110 000

482 500

Capital

Net profit

Current Liabilities (Trade payables)

Total Liabilities and capital

285 000

47 500

150 000

482 500

REQUIRED:

Calculate the following accounting ratios and choose the letter that represents the best

answer; and write down the answer in the answer sheet provided.

1.1 Gross profit ratio is:

A. 20%

8. 30%

C. 40%

D. 50%

2

|

3 Page 3 |

▲back to top |

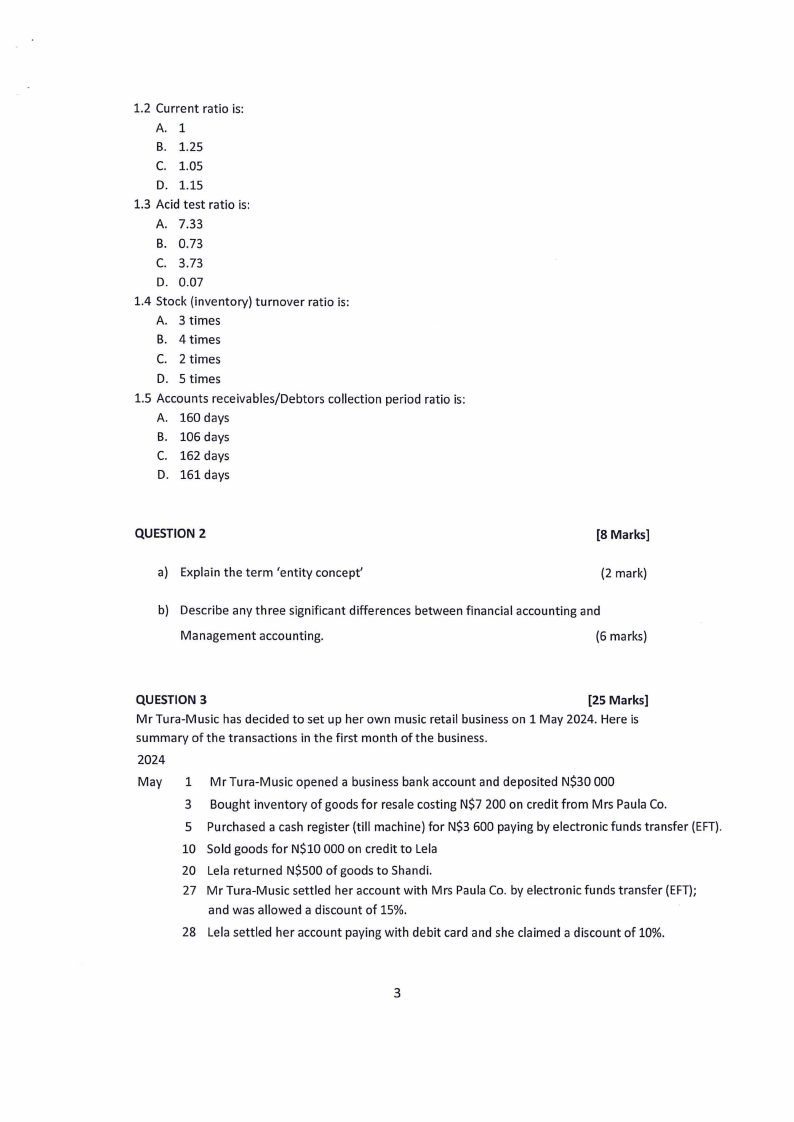

1.2 Current ratio is:

A. 1

B. 1.25

C. 1.05

D. 1.15

1.3 Acid test ratio is:

A. 7.33

B. 0.73

C. 3.73

D. 0.07

1.4 Stock (inventory) turnover ratio is:

A. 3 times

B. 4 times

C. 2 times

D. 5 times

1.5 Accounts receivables/Debtors collection period ratio is:

A. 160 days

B. 106 days

C. 162 days

D. 161 days

QUESTION 2

[8 Marks]

a) Explain the term 'entity concept'

(2 mark)

b) Describe any three significant differences between financial accounting and

Management accounting.

(6 marks)

QUESTION 3

[25 Marks]

Mr Tura-Music has decided to set up her own music retail business on 1 May 2024. Here is

summary of the transactions in the first month of the business.

2024

May 1 Mr Tura-Music opened a business bank account and deposited N$30 ODO

3 Bought inventory of goods for resale costing N$7 200 on credit from Mrs Paula Co.

5 Purchased a cash register (till machine) for N$3 600 paying by electronic funds transfer (EFT).

10 Sold goods for N$10 000 on credit to Lela

20 Lela returned N$500 of goods to Shandi.

27 Mr Tura-Music settled her account with Mrs Paula Co. by electronic funds transfer (EFT);

and was allowed a discount of 15%.

28 Lela settled her account paying with debit card and she claimed a discount of 10%.

3

|

4 Page 4 |

▲back to top |

REQUIREMENT:

a) Record the above transactions in appropriately-named ledger accounts of Mr Tura

Music. Balance the ledger accounts, showing balances carried down and brought

down at the end of the week.

(17 marks)

b) Prepare Shandi's trial balance as at end ofthe week.

(8 marks)

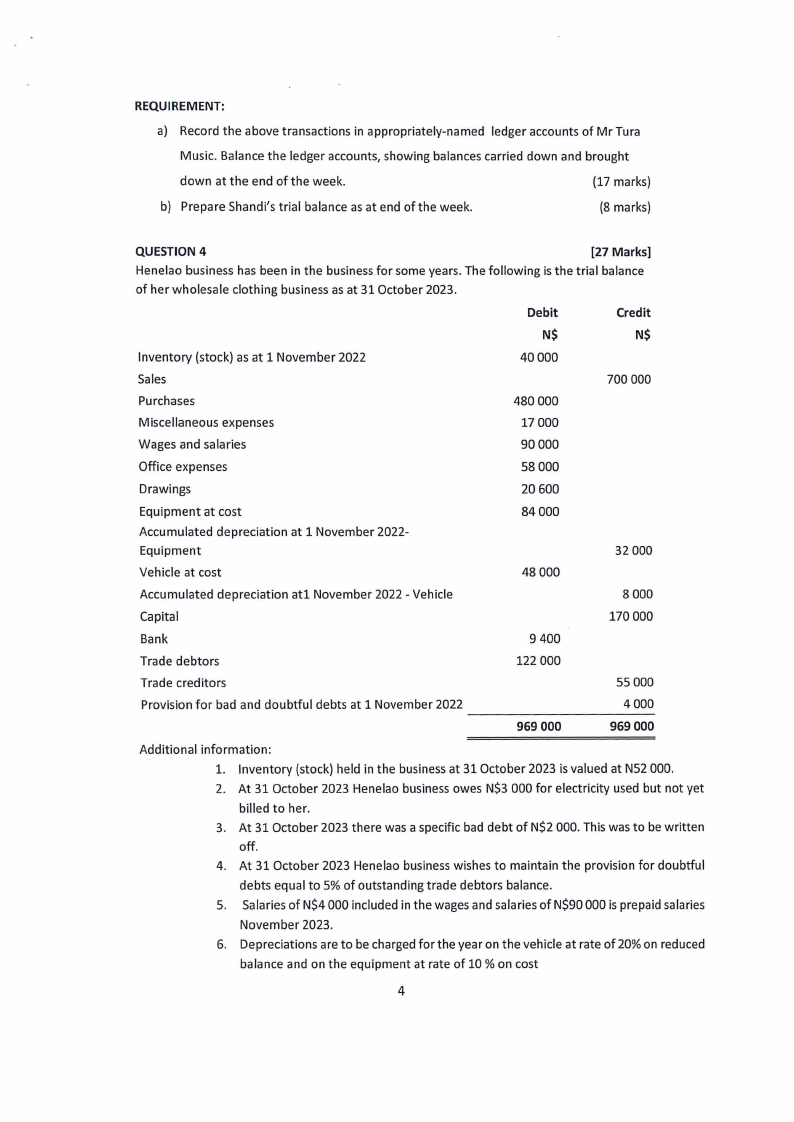

QUESTION 4

[27 Marks]

Henelao business has been in the business for some years. The following is the trial balance

of her wholesale clothing business as at 31 October 2023.

Debit

N$

Credit

N$

Inventory (stock) as at 1 November 2022

40000

Sales

700 000

Purchases

480 000

Miscellaneous expenses

17000

Wages and salaries

90000

Office expenses

58000

Drawings

20 600

Equipment at cost

Accumulated depreciation at 1 November 2022-

Equipment

84000

32 000

Vehicle at cost

48 000

Accumulated depreciation atl November 2022 - Vehicle

8000

Capital

170 000

Bank

9 400

Trade debtors

Trade creditors

122 000

55 000

Provision for bad and doubtful debts at 1 November 2022

4000

969 000

969 000

Additional information:

1. Inventory (stock) held in the business at 31 October 2023 is valued at N52 000.

2. At 31 October 2023 Henelao business owes N$3 000 for electricity used but not yet

billed to her.

3. At 31 October 2023 there was a specific bad debt of N$2 000. This was to be written

off.

4. At 31 October 2023 Henelao business wishes to maintain the provision for doubtful

debts equal to 5% of outstanding trade debtors balance.

5. Salaries of N$4 000 included in the wages and salaries of N$90 000 is prepaid salaries

November 2023.

6. Depreciations are to be charged for the year on the vehicle at rate of 20% on reduced

balance and on the equipment at rate of 10 % on cost

4

|

5 Page 5 |

▲back to top |

REQUIREMENT:

a) Prepare Henelao business statement of Profit or Loss for the year ended

31 October 2023.

(16 marks)

b) Prepare statement offinancial position as at 31 October 2023 for Henelao

business.

(11 marks)

END OF EXAMINATION QUESTION PAPER

5