|

MFN710S - MANAGERIAL FINANCE 320 - 2ND OPP - JAN 2020 |

|

1 Page 1 |

▲back to top |

NAMIBIA UNIVERSITY

OF SCIENCE AND TECHNOLOGY

FACULTY OF MANAGEMENT SCIENCES

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 07BAC

LEVEL: 7

COURSE CODE: MFN710S

COURSE NAME: MANAGERIAL FINANCE 320

SESSION: JANUARY 2020

DURATION: 3 HOURS

PAPER: THEORY AND CALCULATIONS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER(S) | E. Mushonga and L. Odada

MODERATOR: |A- Mokosa

INSTRUCTIONS

Answer ALL the questions in blue or black ink only. STRICTLY NO PENCIL

Start each question on a new page, number the answers correctly and clearly.

Show all your workings/calculations and round all calculations to two decimal places

Questions relating to this examination may be raised in the initial 30 minutes after

the start of the paper. Thereafter, candidates must use their initiative to deal with

any perceived error or ambiguities and any assumptions made by the candidate

should be clearly stated.

PERMISSIBLE MATERIALS

e Silent, non-programmable calculators

THIS QUESTION PAPER CONSISTS OF _4_ PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

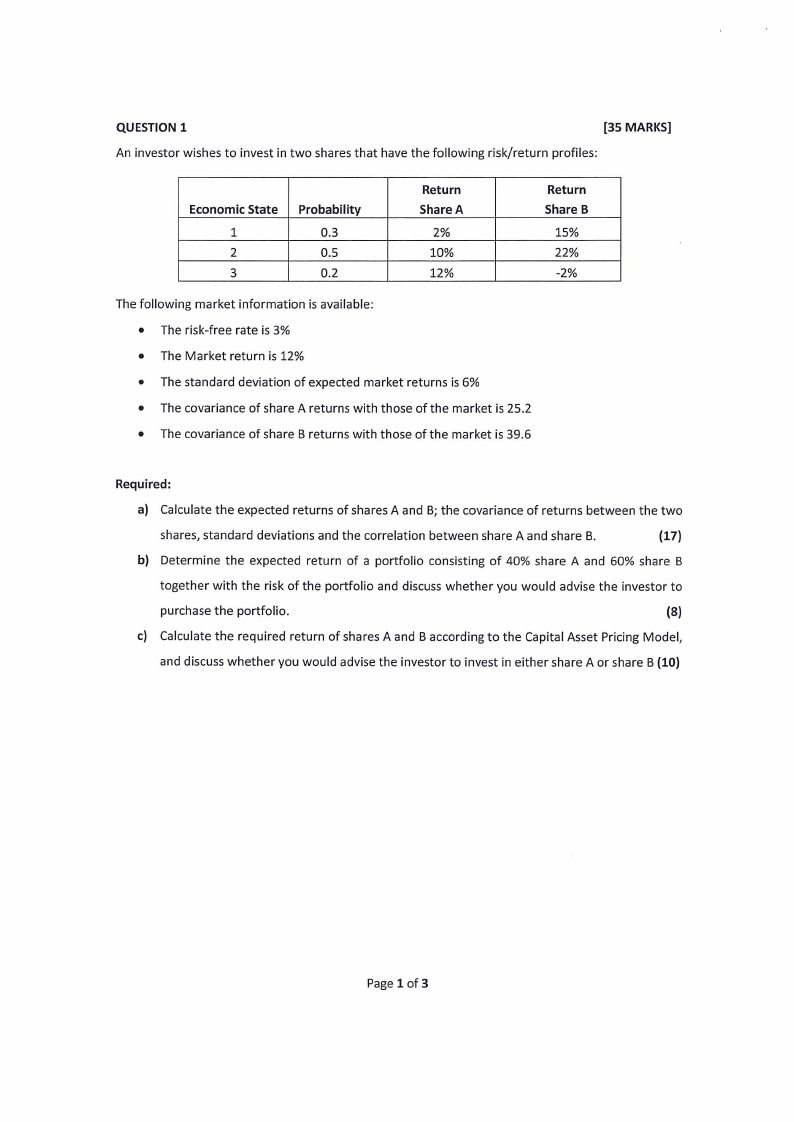

QUESTION 1

[35 MARKS]

An investor wishes to invest in two shares that have the following risk/return profiles:

Economic State | Probability

1

0.3

2

0.5

3

0.2

Return

Share A

2%

10%

12%

Return

Share B

15%

22%

-2%

The following market information is available:

The risk-free rate is 3%

The Market return is 12%

The standard deviation of expected market returns is 6%

The covariance of share A returns with those of the market is 25.2

The covariance of share B returns with those of the market is 39.6

Required:

a) Calculate the expected returns of shares A and B; the covariance of returns between the two

shares, standard deviations and the correlation between share A and share B.

(17)

b) Determine the expected return of a portfolio consisting of 40% share A and 60% share B

together with the risk of the portfolio and discuss whether you would advise the investor to

purchase the portfolio.

(8)

c) Calculate the required return of shares A and B according to the Capital Asset Pricing Model,

and discuss whether you would advise the investor to invest in either share A or share B (10)

Page 1 of 3

|

3 Page 3 |

▲back to top |

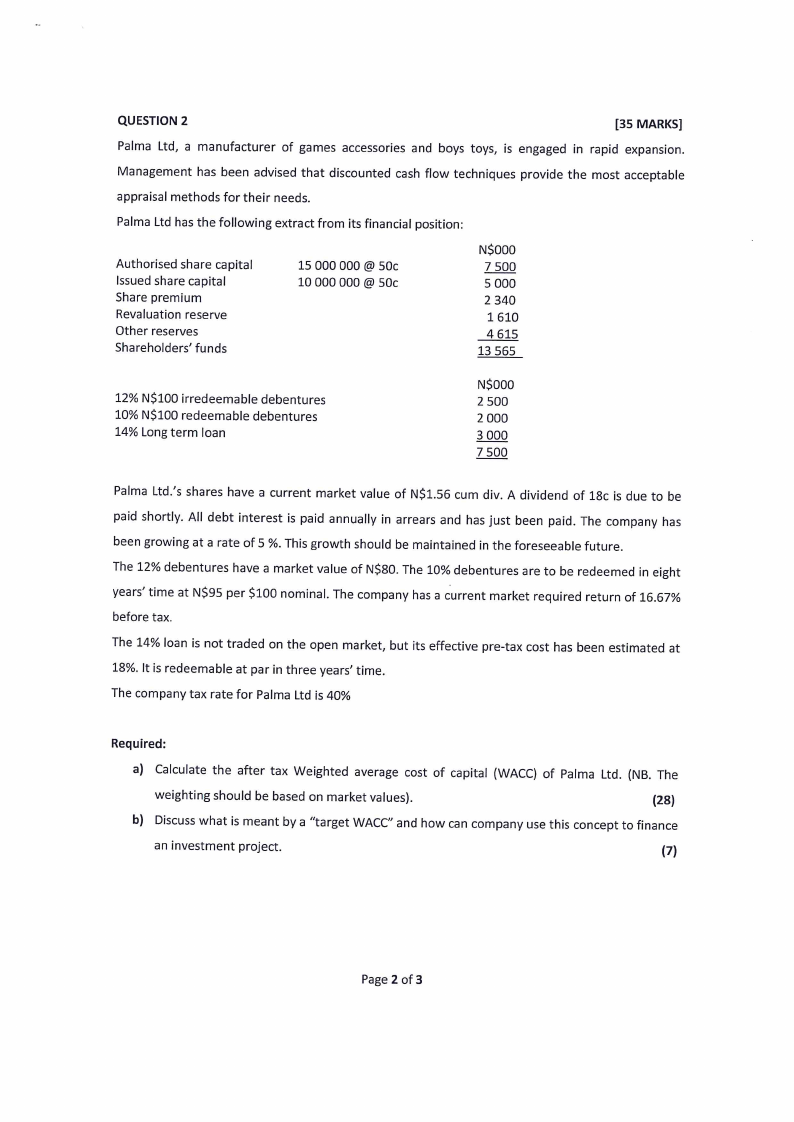

QUESTION 2

[35 MARKS]

Palma Ltd, a manufacturer of games accessories and boys toys, is engaged in rapid expansion.

Management has been advised that discounted cash flow techniques provide the most acceptable

appraisal methods for their needs.

Palma Ltd has the following extract from its financial position:

Authorised share capital

Issued share capital

Share premium

Revaluation reserve

Other reserves

Shareholders’ funds

15 000 000 @ 50c

10 000 000 @ 50c

NSOOO

7500

5 000

2 340

1610

4615

13 565

12% NS100 irredeemable debentures

10% N$100 redeemable debentures

14% Long term loan

NSOOoO

2 500

2 000

3 000

7 500

Palma Ltd.’s shares have a current market value of N$1.56 cum div. A dividend of 18c is due to be

paid shortly. All debt interest is paid annually in arrears and has just been paid. The company has

been growing at a rate of 5 %. This growth should be maintained in the foreseeable future.

The 12% debentures have a market value of NS80. The 10% debentures are to be redeemed in eight

years’ time at N$95 per $100 nominal. The company has a current market required return of 16.67%

before tax.

The 14% loan is not traded on the open market, but its effective pre-tax cost has been estimated at

18%, It is redeemable at par in three years’ time.

The company tax rate for Palma Ltd is 40%

Required:

a) Calculate the after tax Weighted average cost of capital (WACC) of Palma Ltd. (NB. The

weighting should be based on market values).

(28)

b) Discuss what is meant by a “target WACC” and how can company use this concept to finance

an investment project.

(7)

Page 2 of 3

|

4 Page 4 |

▲back to top |

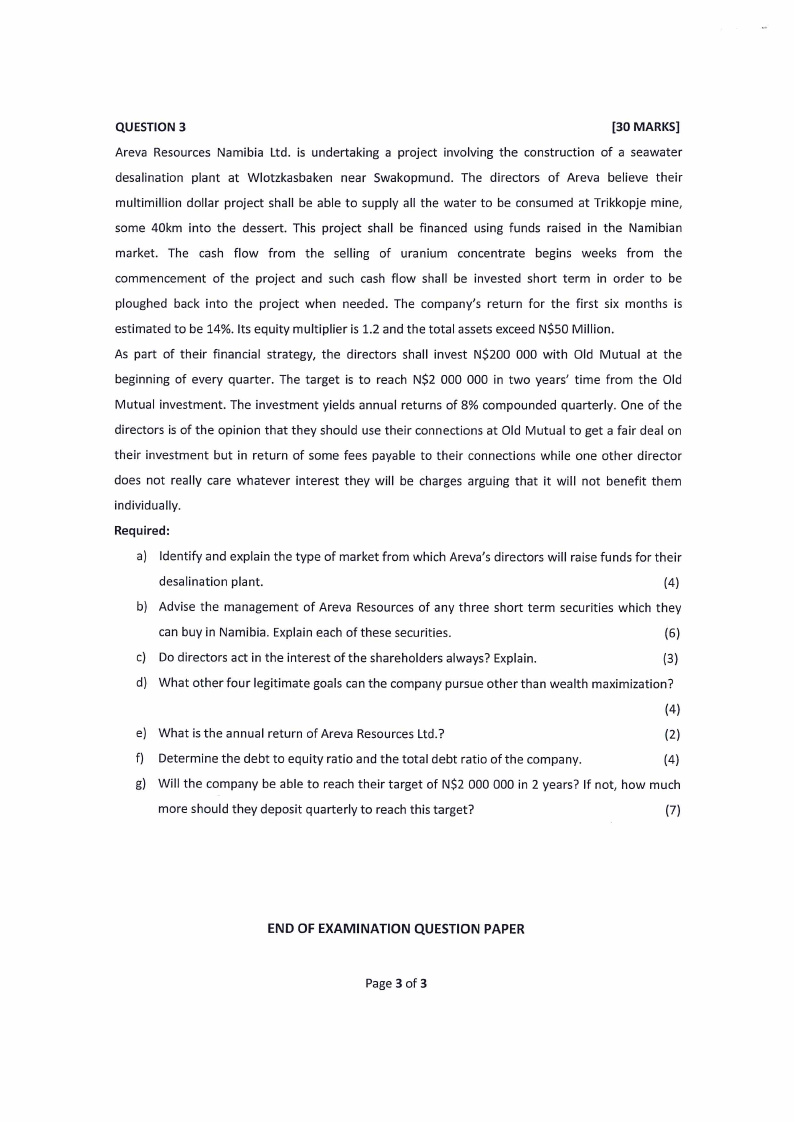

QUESTION 3

[30 MARKS]

Areva Resources Namibia Ltd. is undertaking a project involving the construction of a seawater

desalination plant at Wlotzkasbaken near Swakopmund. The directors of Areva believe their

multimillion dollar project shall be able to supply all the water to be consumed at Trikkopje mine,

some 40km into the dessert. This project shall be financed using funds raised in the Namibian

market. The cash flow from the selling of uranium concentrate begins weeks from the

commencement of the project and such cash flow shall be invested short term in order to be

ploughed back into the project when needed. The company’s return for the first six months is

estimated to be 14%. Its equity multiplier is 1.2 and the total assets exceed NS5O Million.

As part of their financial strategy, the directors shall invest NS200 000 with Old Mutual at the

beginning of every quarter. The target is to reach NS2 000 000 in two years’ time from the Old

Mutual investment. The investment yields annual returns of 8% compounded quarterly. One of the

directors is of the opinion that they should use their connections at Old Mutual to get a fair deal on

their investment but in return of some fees payable to their connections while one other director

does not really care whatever interest they will be charges arguing that it will not benefit them

individually.

Required:

a) Identify and explain the type of market from which Areva’s directors will raise funds for their

desalination plant.

(4)

b) Advise the management of Areva Resources of any three short term securities which they

can buy in Namibia. Explain each of these securities.

(6)

c) Do directors act in the interest of the shareholders always? Explain.

(3)

d) What other four legitimate goals can the company pursue other than wealth maximization?

(4)

e) What is the annual return of Areva Resources Ltd.?

(2)

f) Determine the debt to equity ratio and the total debt ratio of the company.

(4)

g) Will the company be able to reach their target of NS2 000 000 in 2 years? If not, how much

more should they deposit quarterly to reach this target?

(7)

END OF EXAMINATION QUESTION PAPER

Page 3 of 3