|

QTM511S - QUANTITATIVE METHODS - 1ST OPP - JUNE 2023 |

|

1 Page 1 |

▲back to top |

nAm I 8 IA unlVERSITY

OF SCIEn CE Ano TECHn OLOGY

FACULTYOF HEALTH,NATURALRESOURCESAND APPLIEDSCIENCES

SCHOOLOF NATURALAND APPLIEDSCIENCES

DEPARTMENTOF MATHEMATICS, STATISTICSAND ACTUARIALSCIENCE

QUALIFICATION: Bachelor of Technology: Accounting and Finance, Advanced Diploma in the

Theory of Accounting, Bachelor of Accounting and Diploma in Accounting and Finance

QUALIFICATION CODE: 23BACF;07BACP;

06BDAF; 07 ADT A

LEVEL: 5

COURSE CODE: QTM511S

COURSE NAME: QUANTITATIVE METHODS

SESSION: JUNE 2023

DURATION: 3 HOURS

PAPER: THEORY

MARKS: 100

EXAMINER

FIRSTOPPORTUNITY EXAMINATION QUESTION PAPER

Mrs. H.Y. Nkalle; Mrs. A. Sakaria; Dr. D. Ntirampeba; Mr. A. Mpugulu

MODERATOR:

Dr. D.B.GEMECHU

INSTRUCTIONS

1. Answer ALL the questions.

2. Write clearly and neatly.

3. Number the answers clearly.

PERMISSIBLE MATERIALS

1. Non-Programmable Calculator without the cover

ATTACHMENTS

2. Formula Sheet

THIS QUESTION PAPER CONSISTS OF 8 PAGES (Including this front page and formula sheet)

IIPage

|

2 Page 2 |

▲back to top |

Question 1 [S, 4, 3 Marks]

On March 01, John joined a Christmas club. His bank will automatically deduct N$210 from

his checking account at the end of each month, and deposit it into his Christmas club

account, where it will earn 5 ~%annual interest compounded monthly. The account comes

4

to term on December 01, the same year.

1.1 Find the future value of John's Christmas club account.

1.2 Find John's total contribution to the account.

1.3 Find the total interest earned on the account.

Question 2 [9 Marks]

Dix want to be able to withdraw N$10 000 for his graduation at the end of 5 years and

withdraw N$20 000 for his wedding at the end of 8 years, leaving zero balance in the

account after the last withdrawal. If he can earn 5% p.a compounded yearly on the balance.

How much should he deposit to meet his withdrawal needs?

Question 3 [7 Marks]

Bank A offers 12.25% compounded semi-annually on its savings accounts and Bank B offers

12% compounded monthly. Determine which bank offers the higher effective rate.

Question 4 [6 Marks]

As on July 1, a man owes N$ 2,000. He paid N$ 500 on August 30 and N$ 600 on September

29. Find the balance on October 29 of the same year, by the Merchants' Rule if money is

worth 6% p.a. Use ordinary interest

Question 5 [6 Marks]

A sum of money amounts to N$ 9800 after 5 years and N$ 12005 after 8 years at the same

rate of simple interest. What is the rate of interest?

Question 6 [9 Marks]

Tania is planning for her marriage after six years. She decided to deposit a sum of

N$12000 at the end of each year for five years into a fund that earn interest at 5% p.a.

compounded monthly. Find how much the amount of the deposits will be at the end of

six years after the last deposit was made.

21Page

|

3 Page 3 |

▲back to top |

Question 7 [4 Marks]

Find the effective interest rate equivalent to a nominal rate of 10% compounded monthly?

Question 8 [4, 2, 6, 5 Marks]

The data below shows the shipments (in millions of dollars) for electric lighting and wiring

equipment over a 12-month period. Use the data to solve the questions that follow.

Months Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Shipment 1056 1345 1381 1191 1259 1361 1110 1334 1416 1282 1341 1382

8.1 Draw a time series plot for the data

8.2 Is there any evidence of trend in the data? Explain

8.3 Compute a 3-month moving average for all available months

8.4 Plot the 3-month moving average results on the same graph in (a) above?

Question 9 [3, 5, 2, 2 Marks]

The Statistics Department at NUST randomly selected 22 students and recorded their dairy

expenses during the holiday. The result are as follows, Use this dataset to compute the

following summary statistics.

210,221,217,221,213,217,218,207,210,214,210,199,209,202,208,212,200,210,

215, 203, 2 18, 208

9.1 Compute their average expenses

9.2 Compute the variance

9.3 Compute the standard deviation

9.4 compute the coefficient of variation

3IPage

|

4 Page 4 |

▲back to top |

Question 10 [6, 5, 7 Marks]

First National Bank recently surveyed a sample of employees to determine how far they lived

from their corporate headquarters. The results are shown below.

Distance (in Km)

0 up to 5

5 up to 10

10 up to 15

15 up to 20

20 up to 25

Number of days

4

15

27

18

6

10.1 Compute and interpret the modal distance.

10.2 Find the minimum distance associated with the 25% of employees living further away from

First National headquarter.

10.3 Compute the interquartile range.

End of paper

Total marks: 100

41Page

|

5 Page 5 |

▲back to top |

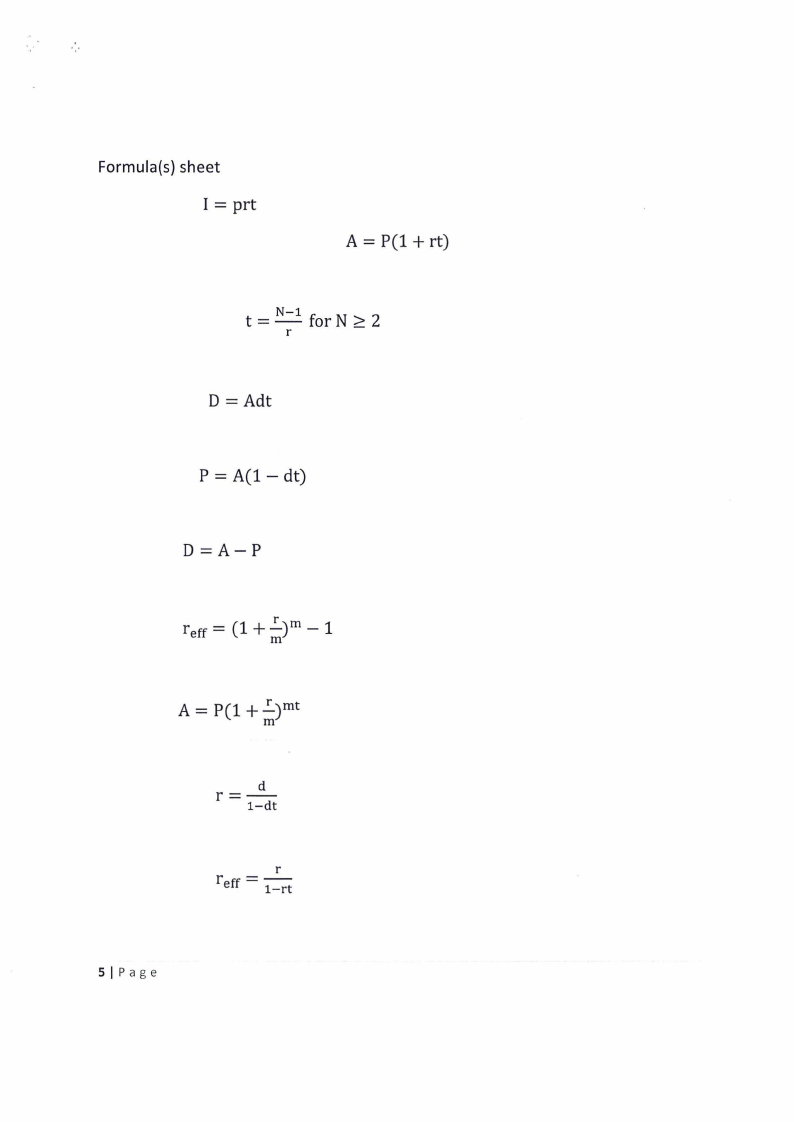

Formula(s) sheet

I= prt

A= P(l + rt)

t

=

-N-1

r

forN

>

2

D = Adt

P = A(l - dt)

D=A-P

r=- d

1-dt

r eff

---

r

1-rt

SI Page

|

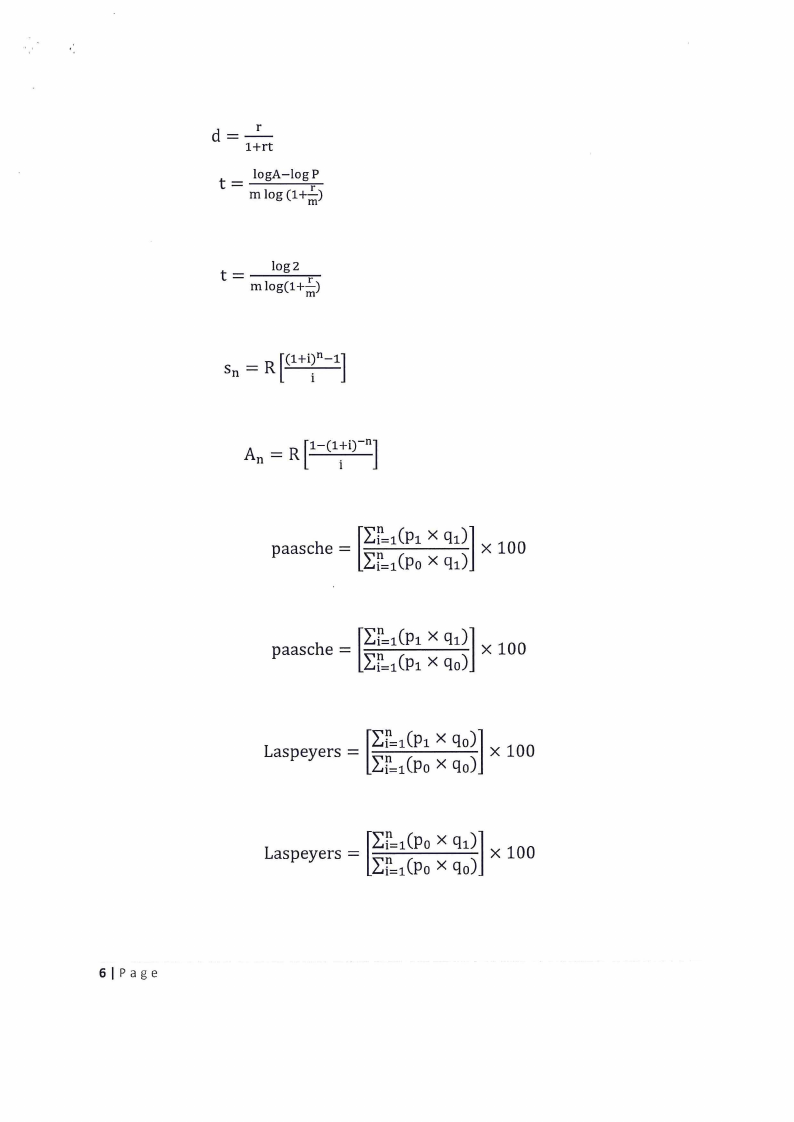

6 Page 6 |

▲back to top |

r

= d l+rt

JogA-logP

= t m log (1+ :)

log2

= t m log(l+ :)

= A n

R [ 1-(l+il).-n]

GI Page

Laspeyers

=

rr=l

[rr=l

(P1 X qo)l

(Po X qo)

X 100

Laspeyers

=

Lr=l(Po

[rr=l (Po

X qi)]

X qo)

X 100

|

7 Page 7 |

▲back to top |

'_,

sx2 --

-L~-,ni-=-l-

fi (xi

n-1

-

-x)2

--

-L~-n,i-=-l-

fixi 2

n-1

-

nx-2

M=

k

I+j!!_4(-kFn)

= X

-'--i=----"l'---_

Lk .t;

i=l

71Page

P(A n B)

P(B\\A) = P(A)

|

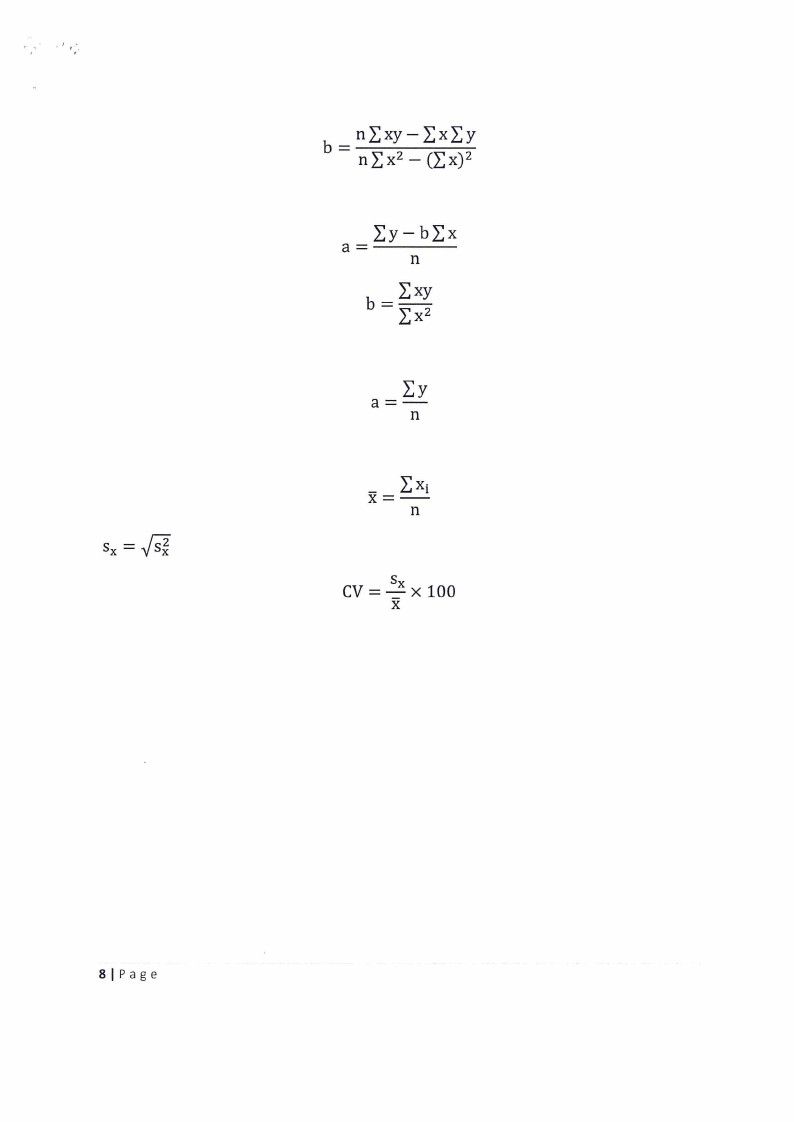

8 Page 8 |

▲back to top |

sX = V':s:,2X

b = _n_I_xy_-_I_x_I_Y

nix 2 - (Ix) 2

n

a=-

LY

n

x- =-

L",X· l

n

CV=

s

-2x

x 100

Bl Page