|

BEP712S - SME PROJECTS - 1ST OPP - NOV 2024 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVE Rs ITY

OF SCIEnCE Ano TECHn0L0GY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF GOVERNANCE AND MANAGEMENT SCIENCES

QUALIFICATION: BACHELOR OF BUSINESS MANAGEMENT HONOURS

QUALIFICATION CODE: 07BBMA

LEVEL: 7

COURSE CODE: BEP712S

COURSE NAME: SME Projects

SESSION: NOVEMBER 2024

DURATION: 3 HOURS

PAPER: THEORY (PAPER 1)

MARKS: 100

FIRST OPPORTUNITY EXAMINATION

EXAMINER(S) Ms. B. NDUNGAUA

Mr. V. SINALUMBU

MODERATOR MR. KANDJIMI

INSTRUCTIONS

1. Answer ALL the questions.

2. This paper comprises of FIVE questions.

3. Read all the questions carefully before answering.

4. Number the answers clearly

PERMISSIBLE MATERIAL

CALCULATOR

THIS QUESTION PAPER CONSISTS OF_ 4_ PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

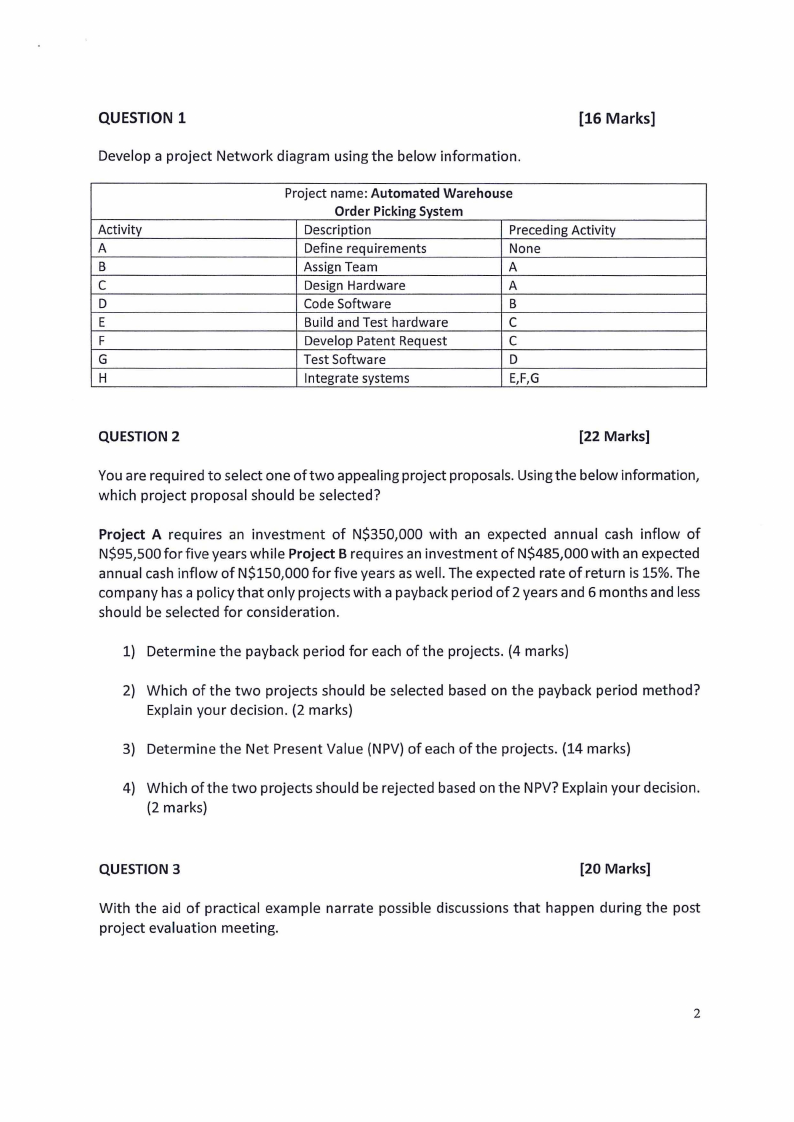

QUESTION 1

[16 Marks]

Develop a project Network diagram using the below information.

Activity

A

B

C

D

E

F

G

H

Project name: Automated Warehouse

Order Picking System

Description

Preceding Activity

Define requirements

None

Assign Team

A

Design Hardware

A

Code Software

B

Build and Test hardware

C

Develop Patent Request

C

Test Software

D

Integrate systems

E,F,G

QUESTION 2

(22 Marks]

You are required to select one of two appealing project proposals. Using the below information,

which project proposal should be selected?

Project A requires an investment of N$350,000 with an expected annual cash inflow of

N$95,500 for five years while Project B requires an investment of N$485,000 with an expected

annual cash inflow of N$150,000 for five years as well. The expected rate ofreturn is 15%. The

company has a policy that only projects with a payback period of 2 years and 6 months and less

should be selected for consideration.

1) Determine the payback period for each of the projects. (4 marks)

2) Which of the two projects should be selected based on the payback period method?

Explain your decision. (2 marks)

3) Determine the Net Present Value (NPV) of each of the projects. (14 marks)

4) Which ofthe two projects should be rejected based on the NPV? Explain your decision.

(2 marks)

QUESTION 3

(20 Marks]

With the aid of practical example narrate possible discussions that happen during the post

project evaluation meeting.

2

|

3 Page 3 |

▲back to top |

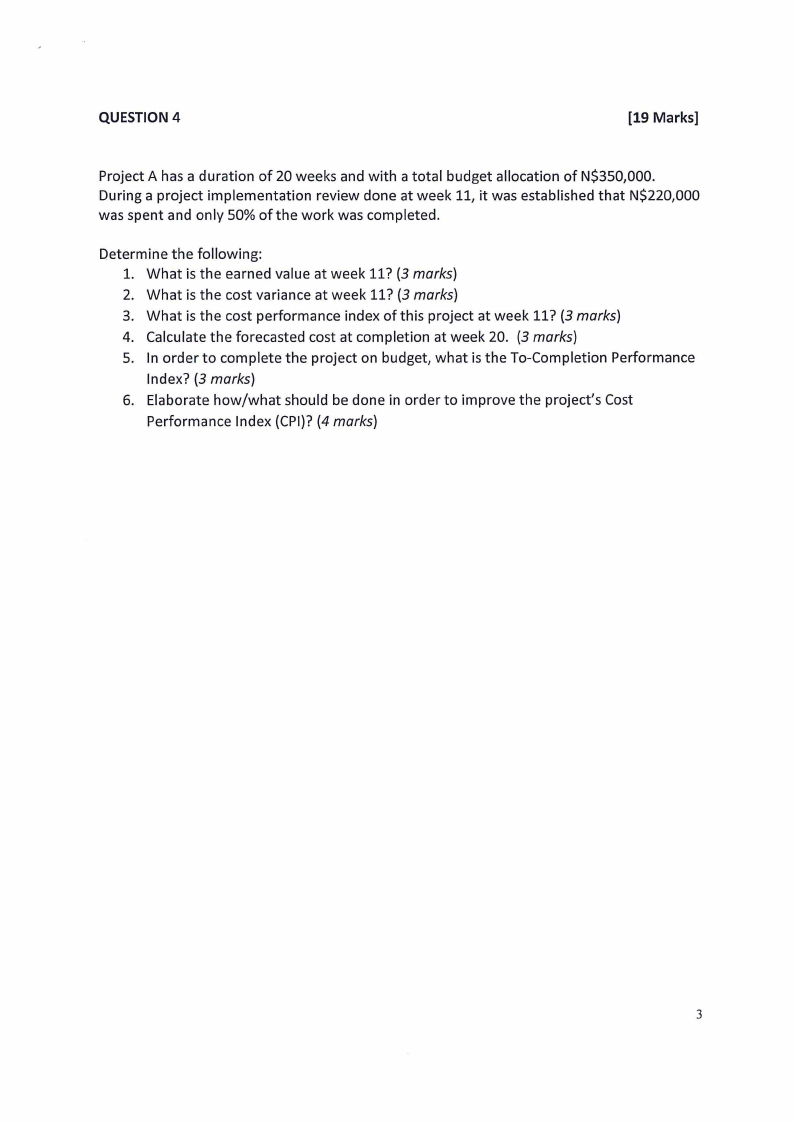

QUESTION 4

[19 Marks]

Project A has a duration of 20 weeks and with a total budget allocation of N$350,000.

During a project implementation review done at week 11, it was established that N$220,000

was spent and only 50% of the work was completed.

Determine the following:

1. What is the earned value at week 11? {3 marks)

2. What is the cost variance at week 11? {3 marks)

3. What is the cost performance index of this project at week 11? (3 marks)

4. Calculate the forecasted cost at completion at week 20. {3 marks)

5. In order to complete the project on budget, what is the To-Completion Performance

Index? {3 marks)

6. Elaborate how/what should be done in order to improve the project's Cost

Performance Index (CPI)? (4 marks)

3

|

4 Page 4 |

▲back to top |

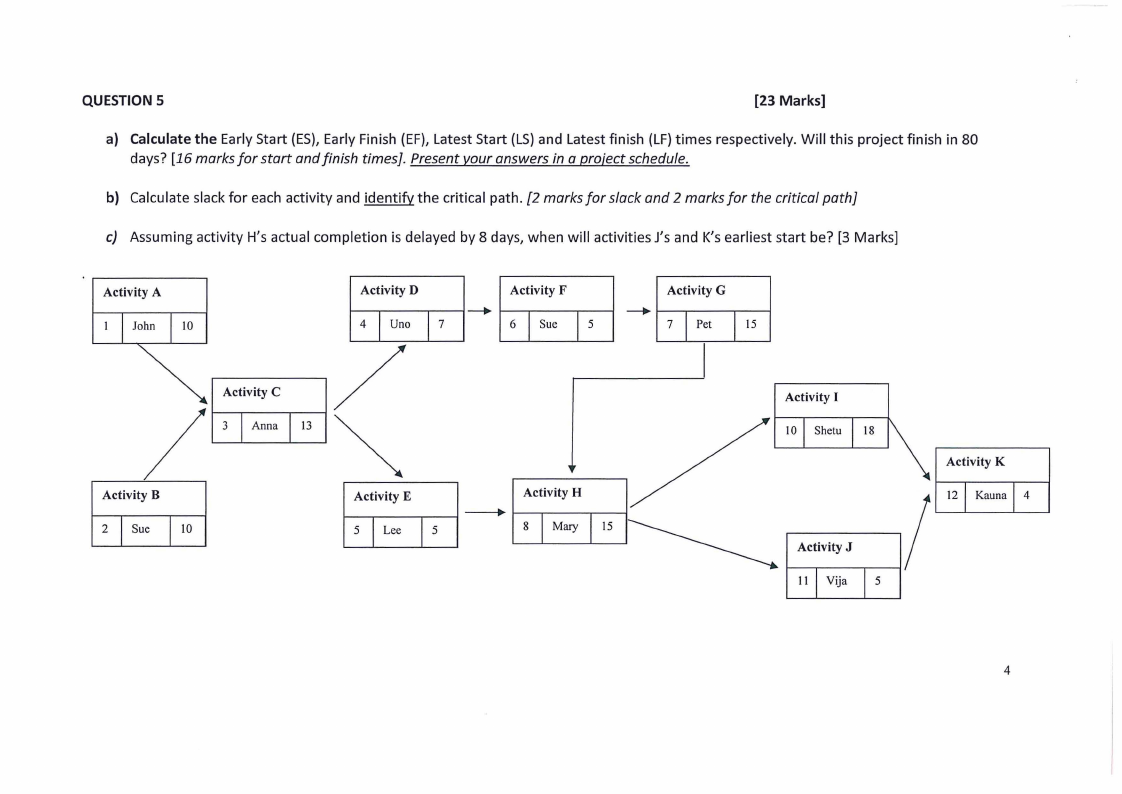

QUESTION 5

[23 Marks]

a) Calculate the Early Start (ES),Early Finish (EF), Latest Start (LS)and Latest finish (LF)times respectively. Will this project finish in 80

days? [16 marks for start and finish times]. Present your answers in a proiect schedule.

b) Calculate slack for each activity and identify the critical path. [2 marks for slack and 2 marks for the critical path]

c) Assuming activity H's actual completion is delayed by 8 days, when will activities J's and K's earliest start be? [3 Marks]

Activity A

John I IO

Activity D

Uno 7

Activity F

6 Sue

5

Activity G

----.

I 15

I~ Activity C

/l'IA""'I I13

Activity B

I 2 Sue 110

j Activity E

I

5 I Lee I 5 I

I

I

•

Activity H

8 Mary 15

I Activity I

/ I Io I Shetu I 18

/

1/II I \\ I Activity K

12 K•""' 4

j Activity J

I 11 LVija

5

4