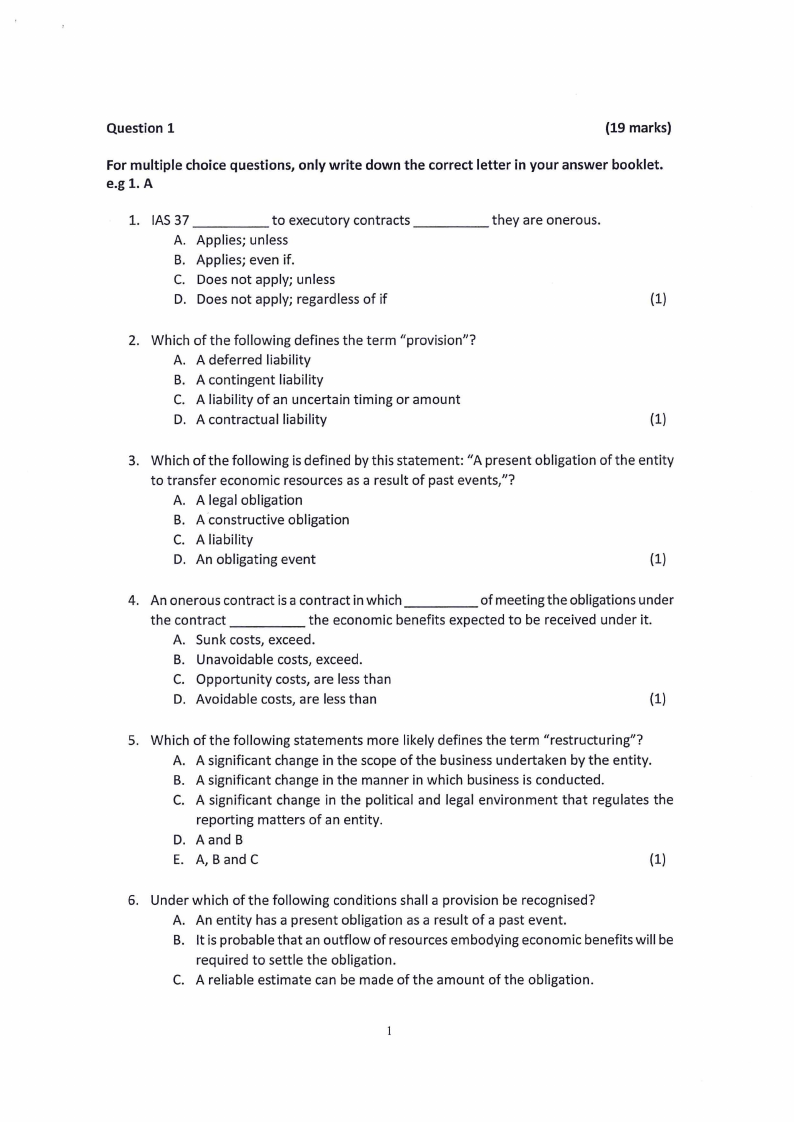

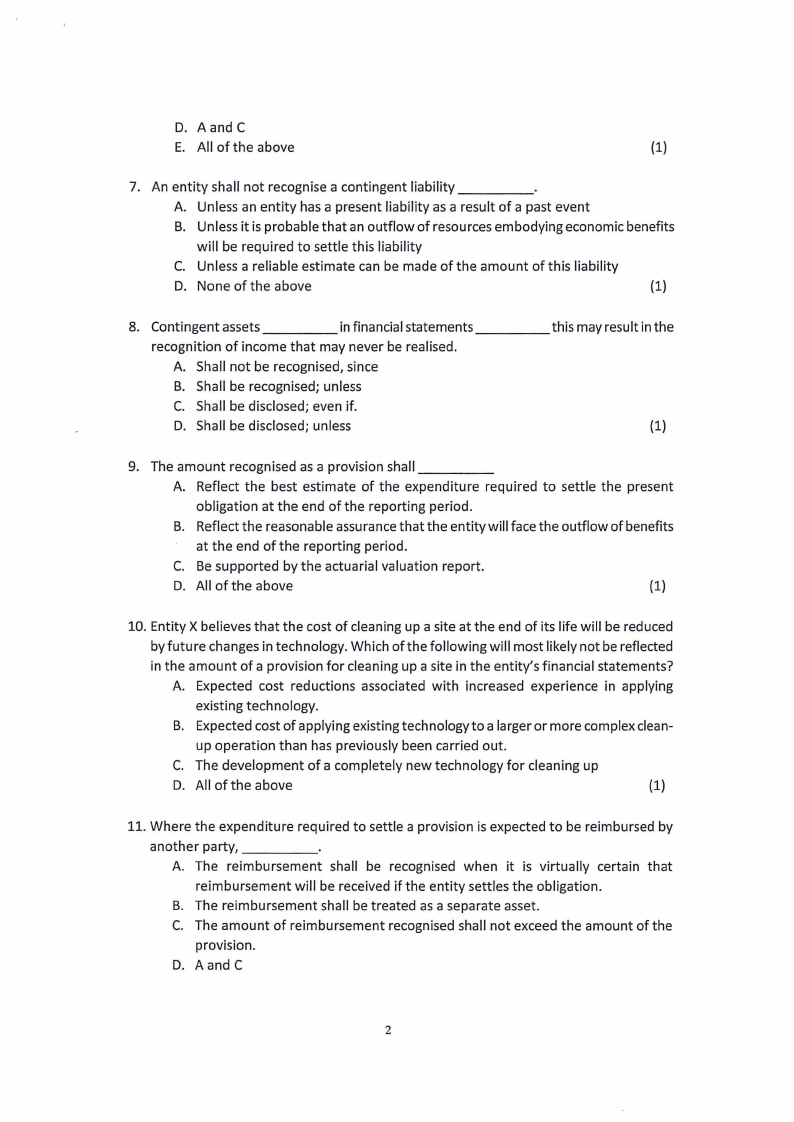

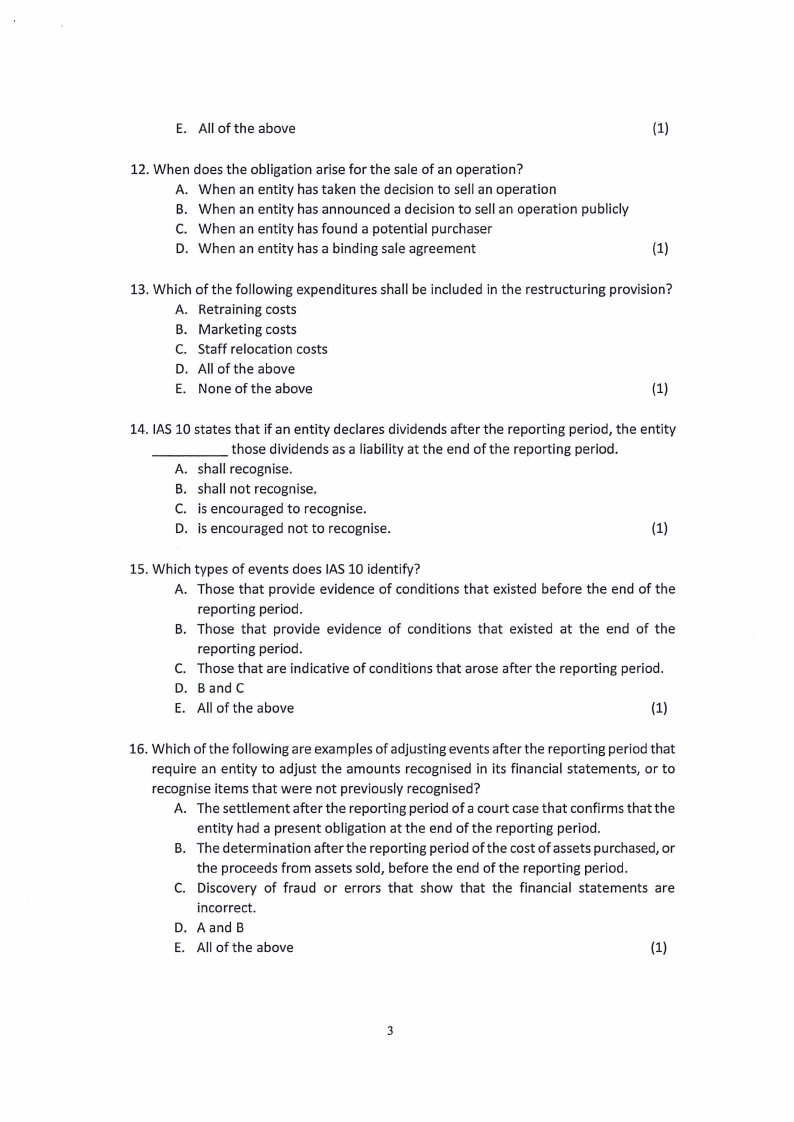

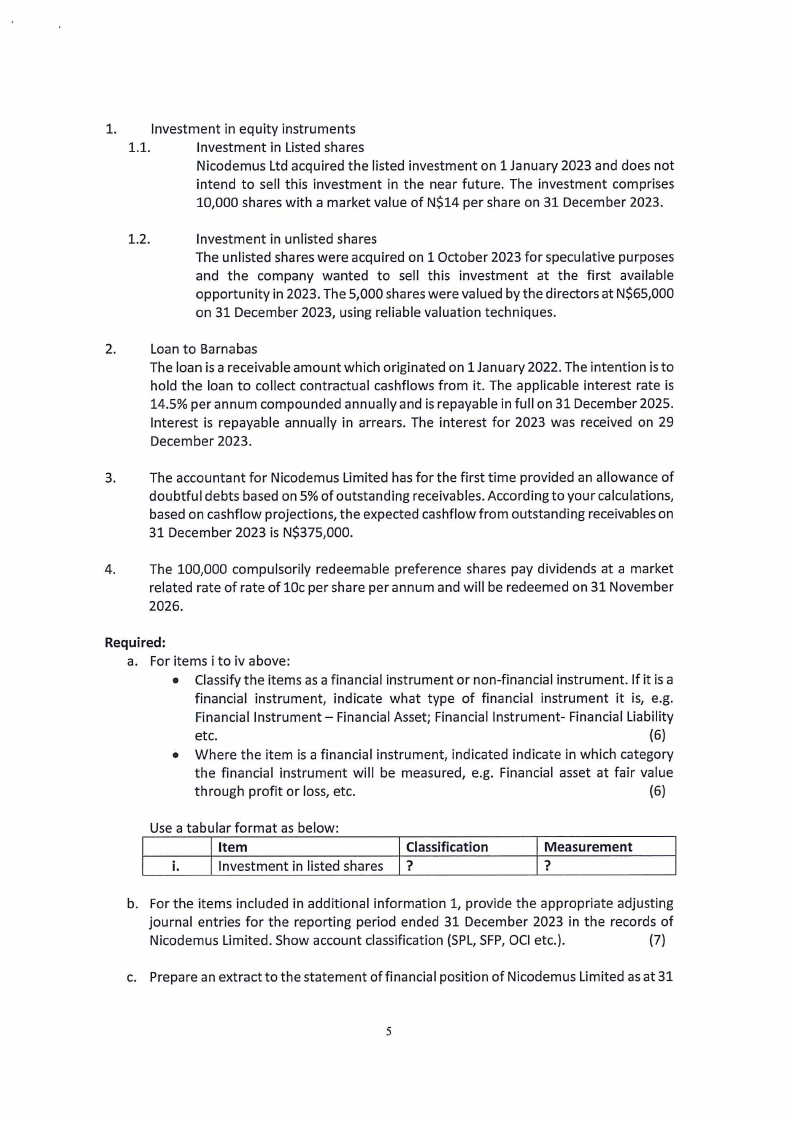

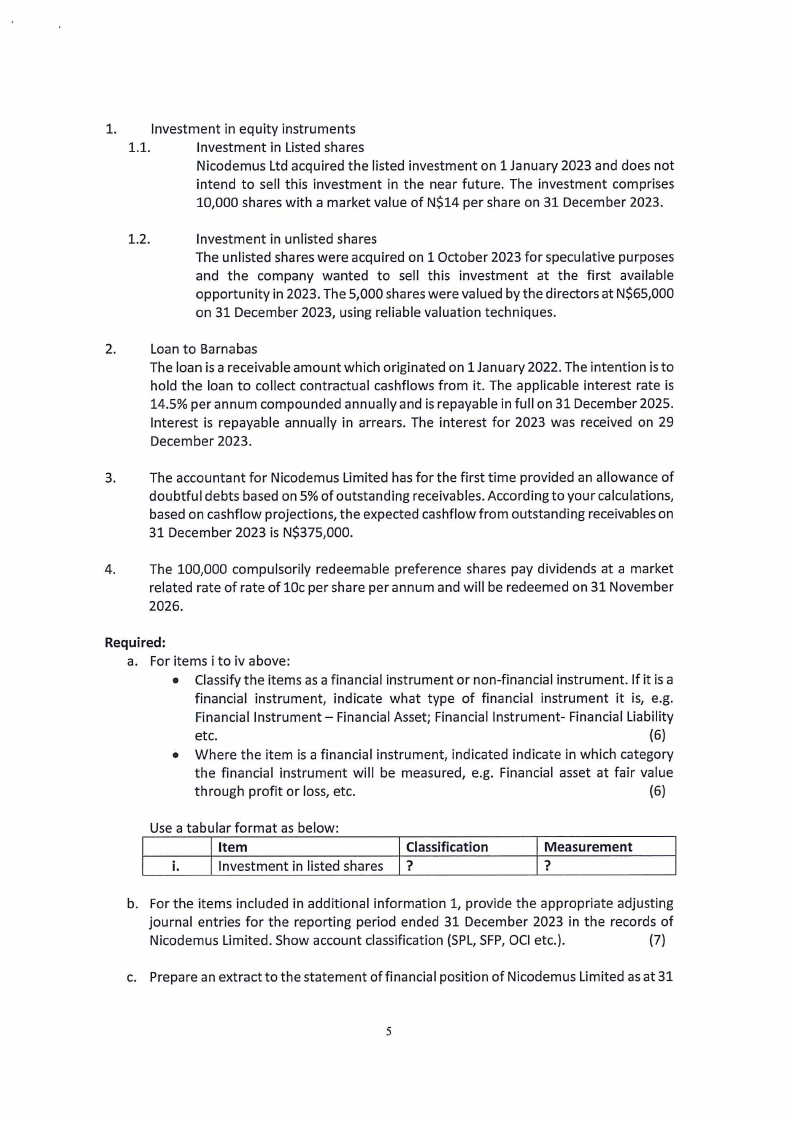

1. Investment in equity instruments

1.1.

Investment in Listed shares

Nicodemus Ltd acquired the listed investment on 1 January 2023 and does not

intend to sell this investment in the near future. The investment comprises

10,000 shares with a market value of N$14 per share on 31 December 2023.

1.2.

Investment in unlisted shares

The unlisted shares were acquired on 1 October 2023 for speculative purposes

and the company wanted to sell this investment at the first available

opportunity in 2023. The 5,000 shares were valued by the directors at N$65,000

on 31 December 2023, using reliable valuation techniques.

2.

Loan to Barnabas

The loan is a receivable amount which originated on 1 January 2022. The intention is to

hold the loan to collect contractual cashflows from it. The applicable interest rate is

14.5% per annum compounded annually and is repayable in full on 31 December 2025.

Interest is repayable annually in arrears. The interest for 2023 was received on 29

December 2023.

3. The accountant for Nicodemus Limited has for the first time provided an allowance of

doubtful debts based on 5% of outstanding receivables. According to your calculations,

based on cashflow projections, the expected cashflow from outstanding receivables on

31 December 2023 is N$375,000.

4. The 100,000 compulsorily redeemable preference shares pay dividends at a market

related rate of rate of 10c per share per annum and will be redeemed on 31 November

2026.

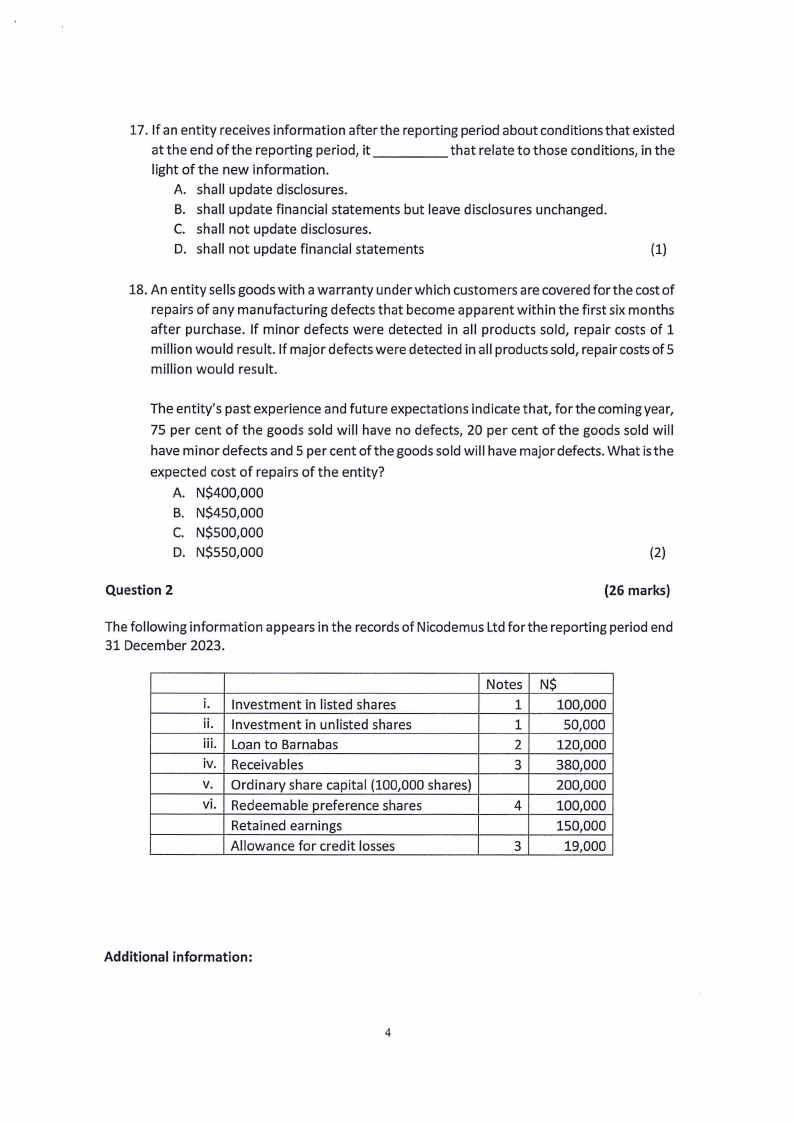

Required:

a. For items i to iv above:

• Classify the items as a financial instrument or non-financial instrument. If it is a

financial instrument, indicate what type of financial instrument it is, e.g.

Financial Instrument - Financial Asset; Financial Instrument- Financial Liability

etc.

(6)

• Where the item is a financial instrument, indicated indicate in which category

the financial instrument will be measured, e.g. Financial asset at fair value

through profit or loss, etc.

(6)

Use a tabular format as below:

Item

i.

Investment in listed shares

I Classification

I?

l Measurement

b. For the items included in additional information 1, provide the appropriate adjusting

journal entries for the reporting period ended 31 December 2023 in the records of

Nicodemus Limited. Show account classification (SPL,SFP,OCIetc.).

(7)

c. Prepare an extract to the statement of financial position of Nicodemus Limited as at 31

5