|

FMH810S- FINANCIAL MANAGEMENT- HOSPITALITY AND TOURISM- 2ND OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA un1VERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCE AND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING & FINANCE

QUALIFICATION: BACHELOR OF HOSPITALITY MANAGEMENT (HONOURS)

QUALIFICATION CODE: 0SBHTH

COURSE CODE: FMH810S

LEVEL: 8

COURSE NAME: FINANCIAL MANAGEMENT:

HOSPITALITY AND TOURISM

SESSION: JULY 2023

DURATION: 3 HOURS

PAPER: PRACTICAL AND THEORY

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS:

H Namwandi

MODERATOR: A Okafor

INSTRUCTIONS

• This question paper is made up of four (4) questions.

• Start each question on a new page.

• Answer All the questions in blue or black ink only.

• You are advised to pay due attention to expression and presentation. Failure to do so will

cost you marks.

• Start each question on a new page in your answer booklet and show all your workings.

• Questions relating to this paper may be raised in the initial 30 minutes after the start of

the paper. Thereafter, candidates must use their initiative to deal with any perceived error

or ambiguities and any assumption made by the candidate should be clearly stated.

PERMISSIBLE MATERIALS

Non-programmable calculator

THIS QUESTION PAPER CONSISTS OF 5 PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

Question 1

25 Marks

HS manufactures components for use in computers. The business operates in a highly

competitive market where there are a large number of manufacturers of simial components.

HS is considering its pricing strategy for the next twelve weeks for one of its components. The

managing director seeks your advice to determine the selling price that will maximise the profit

to be made during this period.

You have been given the following data:

Market Demand

The current selling price of the component is N$1 350 and at this price, the average weekly

demand over the last four weeks has been 8 000 components. An analysis of the market

shows that for every N$50 increase in selling price, the demand reduces by 1 000 components

per week. Equally, for every N$50 reduction in selling price the demand increases by 1 000

components per week.

Costs

The direct material cost of each component is N$270. This price is part of a fixed-price contract

with the material suppliers and the contract does not expire for another year.

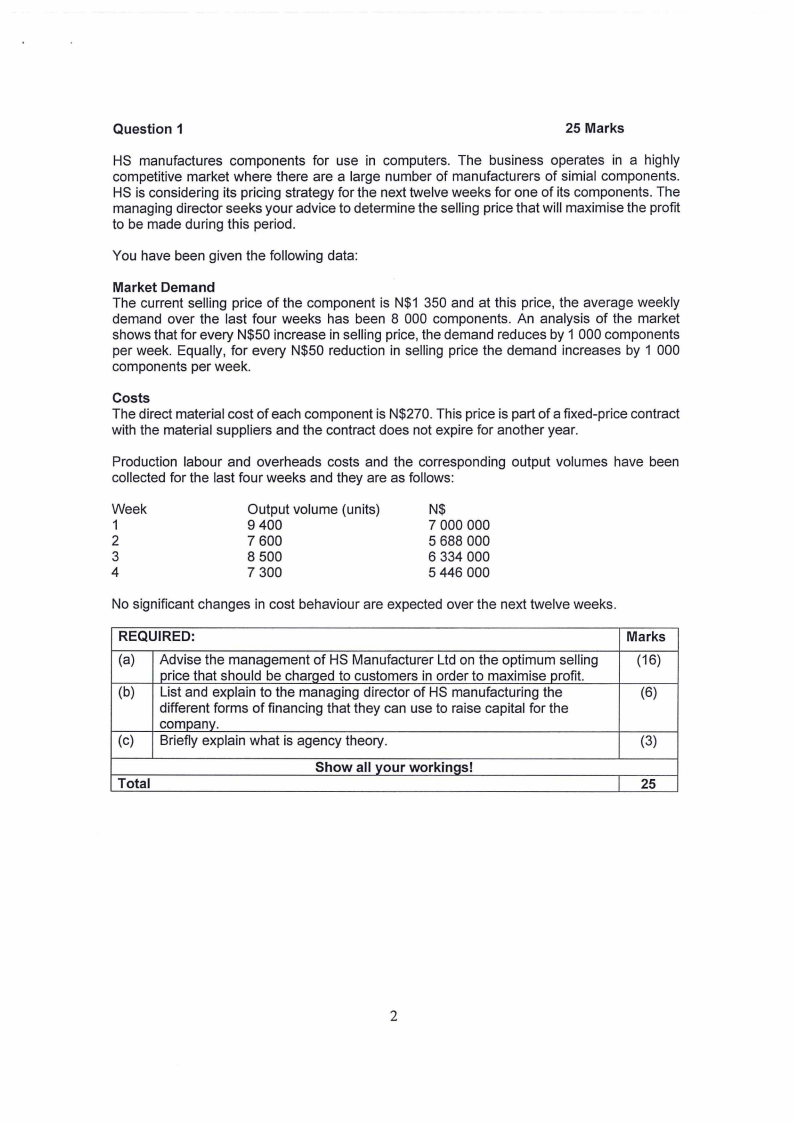

Production labour and overheads costs and the corresponding output volumes have been

collected for the last four weeks and they are as follows:

Week

1

2

3

4

Output volume (units)

9 400

7 600

8 500

7 300

N$

7 000 000

5 688 000

6 334 000

5 446 000

No significant changes in cost behaviour are expected over the next twelve weeks.

REQUIRED:

(a) Advise the management of HS Manufacturer Ltd on the optimum selling

price that should be charqed to customers in order to maximise profit.

(b) List and explain to the managing director of HS manufacturing the

different forms of financing that they can use to raise capital for the

company.

(c) Briefly explain what is agency theory.

Total

Show all your workings!

Marks

(16)

(6)

(3)

25

2

|

3 Page 3 |

▲back to top |

Question 2

15 Marks

You have recently been appointed as an independent business adviser of Tropizone (Pty) Ltd,

a company that designs and manufactures water bottles. Your appointment was made

because Tropizone (Pty) Ltd has just been awarded a tender in January 2023 to be the official

manufacturer of water bottles for the Namibia Wildlife Resorts (NWR). The water bottles will

be handed out to all resorts during April 2023. This is part of a campaign to promote healthy

habits amongst NWR customers. It might become an annual tender in future. Therefore,

Tropizone (Pty) Ltd requires a business adviser expert to assist in the implementation of a

good Management Control System (MCS) to ensure that they always win the tender.

The management of Tropizone (Pty) Ltd informed you that at the moment the organisation

does not have any strategic management control system in place regarding the effective

running of the tender process. Management of Tropizone (Pty) Ltd wants a control system put

in place to ensure that everyone working in the organisation carries out the organisation's

objectives and strategies.

REQUIRED:

(a) List and explain to the management of Tropizone (Pty) Ltd the different

elements of the control system. Also, give a key example of each element

related to the tender that they are undertakinQ.

(b) List three factors that influence the management control system

Marks

(12)

(3)

Total

15

Question 3

30 Marks

Protea Hotel by Marriott Walvis Bay Pelican Bay overlooks the wetland coastline of Walvis

Bay Lagoon, a protected naturalistic area. It features a spa with massage treatments, nearby

golf facilities and windsurf equipment. Decorated in soft pastel tones, rooms at Protea Hotel

by Marriott Walvis Bay Pelican Bay are well presented with a clean lay-out. Situated among

the green surroundings of the Esplanade Park, Protea Hotel by Marriott Walvis Bay Pelican

Bay is renowned for dolphin's spotting and the abundance of majestic flamingos in its environs.

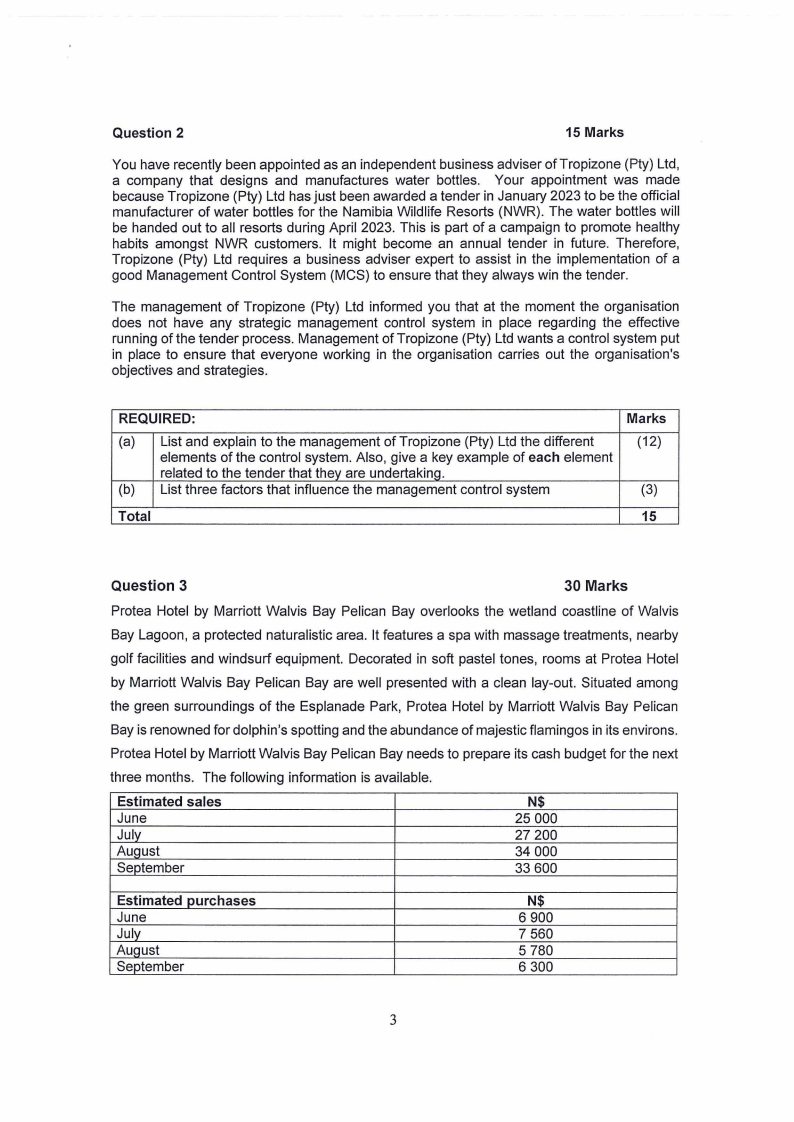

Protea Hotel by Marriott Walvis Bay Pelican Bay needs to prepare its cash budget for the next

three months. The following information is available.

Estimated sales

June

Julv

Auqust

September

N$

25 000

27 200

34 000

33 600

Estimated purchases

June

July

AUQUSt

September

N$

6 900

7 560

5 780

6 300

3

|

4 Page 4 |

▲back to top |

Additional information:

• Direct wages amount to N$13 000 per month and are paid in cash as they occur.

• Badger sells 20% of all goods on cash; the remainder of customers have one month

of credit

• Suppliers are paid in the month after purchase.

• Overheads are N$6 400 per month and Badger is allowed one month's credit on

overheads. A depreciation of N$6 000 is included in the amount of overheads.

• Selling, distribution and administrative costs are N$3 780 per month and are paid in

cash in the month in which they occur.

• Badger wishes to purchase a new vehicle in August with a cash payment of N$120

000.

• The cash balance for the end of June is expected to be N$90 500.

REQUIRED:

(a) Prepare a cash budget for Protea Hotel by Marriott Walvis Bay Pelican

Bay for the months of July to September.

(b) List other fives types of budgets apart from the cash budget that an

organisation in the production sector may need to prepare.

Total

Show all vour workin~s!

Marks

(25)

(5)

30

Question 4

30 Marks

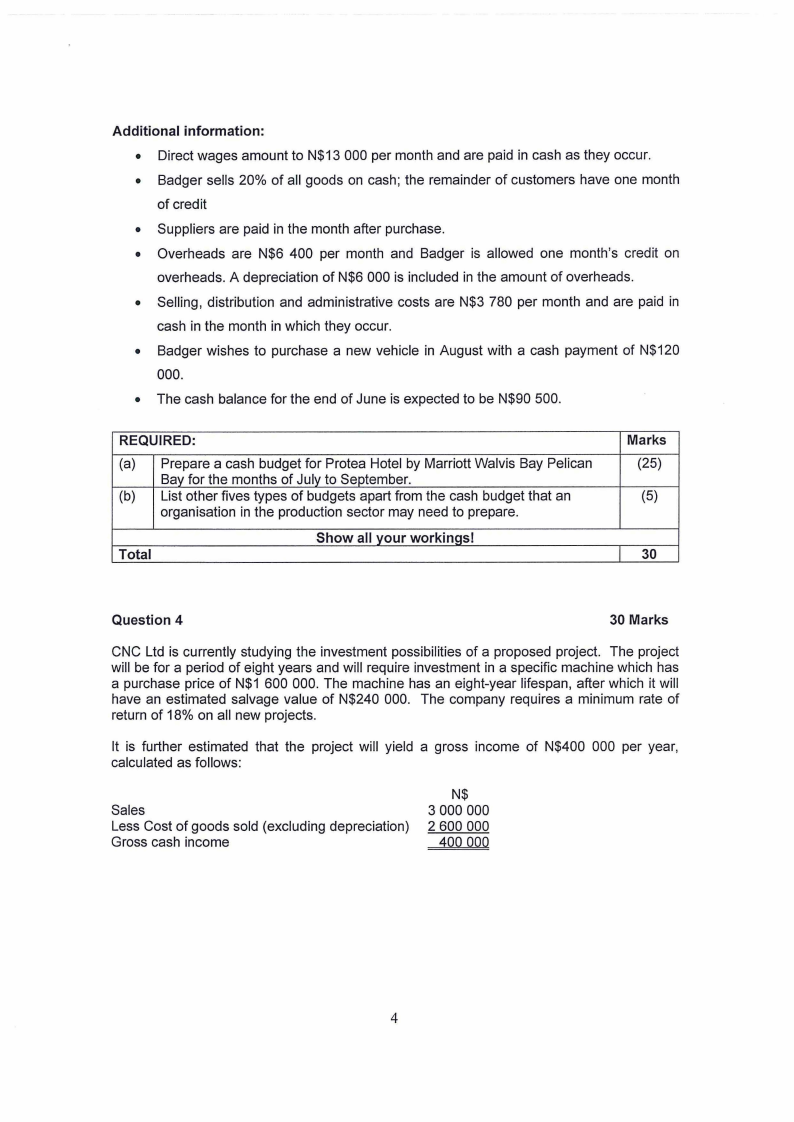

CNC Ltd is currently studying the investment possibilities of a proposed project. The project

will be for a period of eight years and will require investment in a specific machine which has

a purchase price of N$1 600 000. The machine has an eight-year lifespan, after which it will

have an estimated salvage value of N$240 000. The company requires a minimum rate of

return of 18% on all new projects.

It is further estimated that the project will yield a gross income of N$400 000 per year,

calculated as follows:

Sales

Less Cost of goods sold (excluding depreciation)

Gross cash income

N$

3 000 000

2 600 000

400 000

4

|

5 Page 5 |

▲back to top |

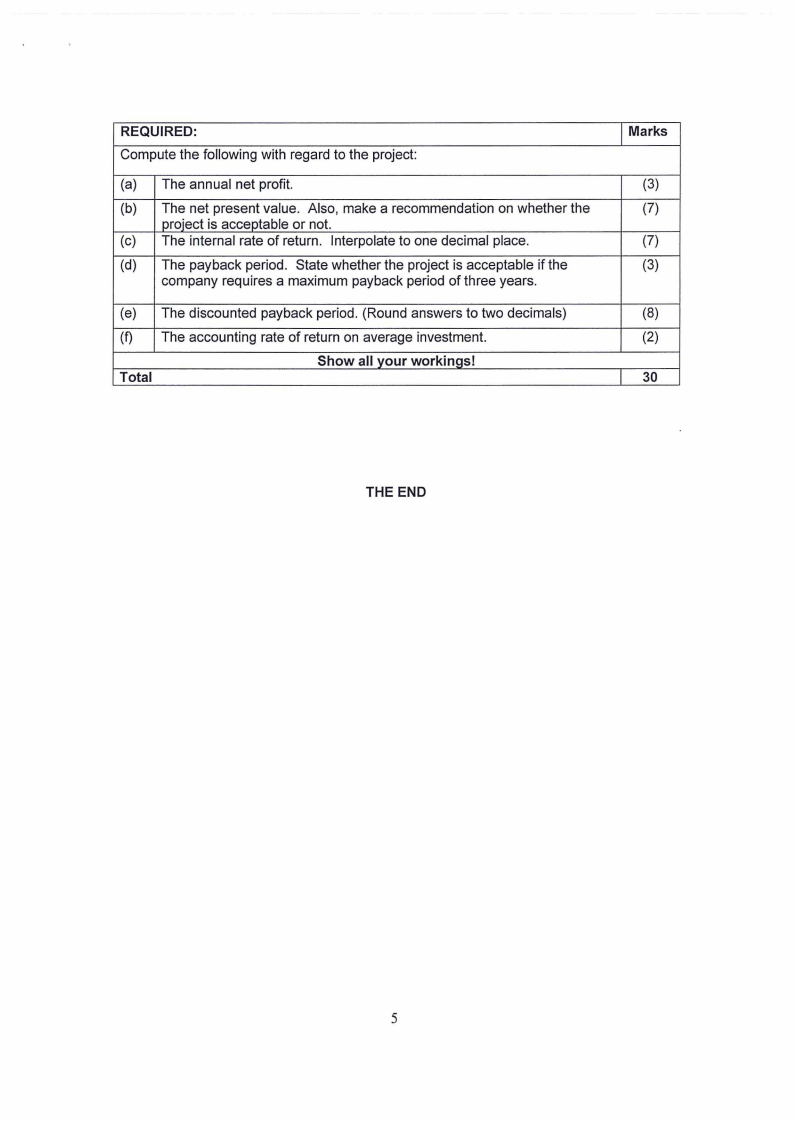

REQUIRED:

Compute the following with regard to the project:

(a) The annual net profit.

(b) The net present value. Also, make a recommendation on whether the

project is acceptable or not.

(c) The internal rate of return. Interpolate to one decimal place.

(d) The payback period. State whether the project is acceptable if the

company requires a maximum payback period of three years.

(e) The discounted payback period. (Round answers to two decimals)

(f) The accounting rate of return on average investment.

Total

Show all vour workinas!

Marks

(3)

(7)

(7)

(3)

(8)

(2)

30

THE END

5

|

6 Page 6 |

▲back to top |

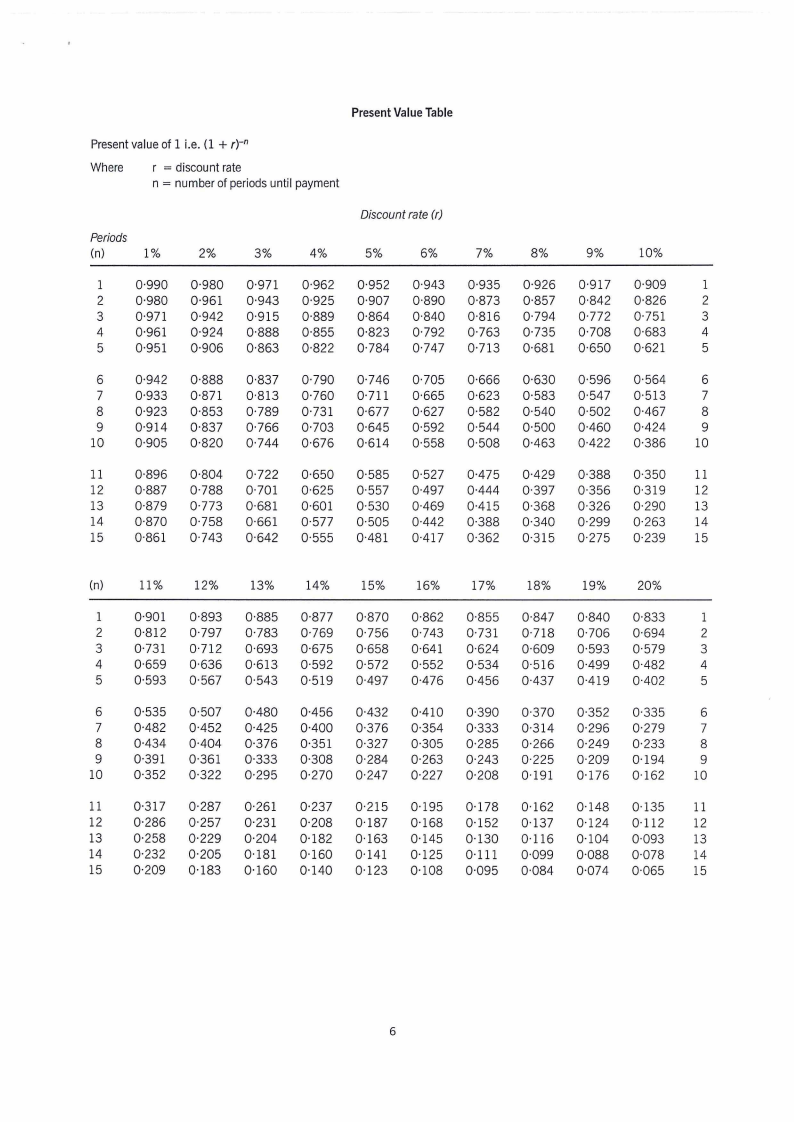

PresentValueTable

Present value of 1 i.e. (1 + r)-n

Where

r = discount rate

n = number of periods until payment

Discountrate (r)

Periods

(n)

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

1 0·990 0·980 0·971 0·962 0·952 0·943 0·935 0·926 0·917 0·909

1

2 0·980 0·961 0·943 0·925 0·907 0·890 0·873 0·857 0·842 0·826

2

3 0·971 0·942 0·915 0·889 0·864 0·840 0·816 0·794 0·772 0·751

3

4 0·961 0·924 0·888 0·855 0·823 0·792 0·763 0·735 0·708 0·683

4

5 0·951 0·906 0·863 0·822 0·784 0·747 0·713 0·681 0·650 0·621

5

6 0·942 0·888 0·837 0·790 0·746 0·705 0·666 0·630 0·596 0·564

6

7 0·933 0·871 0·813 0·760 0·711 0·665 0·623 0·583 0·547 0·513

7

8 0·923 0·853 0·789 0·731 0·677 0·627 0·582 0·540 0·502 0·467

8

9 0·914 0·837 0·766 0·703 0·645 0·592 0·544 0·500 0·460 0·424

9

10 0·905 0·820 0·744 0·676 0·614 0·558 0·508 0-463 0·422 0·386 10

11 0·896 0·804 0·722 0·650 0·585 0·527 0·475 0·429 0·388 0·350 11

12 0·887 0·788 0·701 0·625 0·557 0·497 0·444 0·397 0·356 0·319 12

13 0·879 0·773 0·681 0·601 0·530 0-469 0·415 0·368 0·326 0·290 13

14 0·870 0·758 0·661 0·577 0·505 0·442 0·388 0·340 0·299 0·263 14

15 0·861 0·743 0·642 0·555 0·481 0·417 0·362 0·315 0·275 0·239 15

(n)

11% 12% 13% 14% 15% 16% 17% 18% 19% 20%

1 0·901 0·893 0·885 0·877 0·870 0·862 0·855 0·847 0·840 0·833

1

2 0·812 0·797 0·783 0·769 0·756 0·743 0·731 0·718 0·706 0·694

2

3 0·731 0·712 0·693 0·675 0·658 0·641 0·624 0·609 0·593 0·579

3

4 0·659 0·636 0·613 0·592 0·572 0·552 0·534 0·516 0·499 0·482

4

5 0·593 0·567 0·543 0·519 0·497 0-476 0·456 0·437 0·419 0·402

5

6 0·535 0·507 0·480 0·456 0·432 0·410 0·390 0·370 0·352 0·335

6

7 0-482 0-452 0·425 0·400 0·376 0·354 0·333 0·314 0·296 0·279

7

8 0·434 0·404 0·376 0·351 0·327 0·305 0·285 0·266 0·249 0·233

8

9 0·391 0·361 0·333 0·308 0·284 0·263 0·243 0·225 0·209 0·194

9

10 0·352 0·322 0·295 0·270 0·247 0·227 0·208 0·191 0·176 0·162 10

11 0·317 0·287 0·261 0·237 0·215 0·195 0·178 0·162 0·148 0·135 11

12 0·286 0·257 0·231 0·208 0·187 0·168 0·152 0·137 0·124 0·112 12

13 0·258 0·229 0·204 0·182 0·163 0·145 0·130 0·116 0·104 0·093 13

14 0·232 0·205 0·181 0·160 0·141 0·125 0·111 0·099 0·088 0·078 14

15 0·209 0·183 0·160 0·140 0·123 0·108 0·095 0·084 0·074 0·065 15

6