|

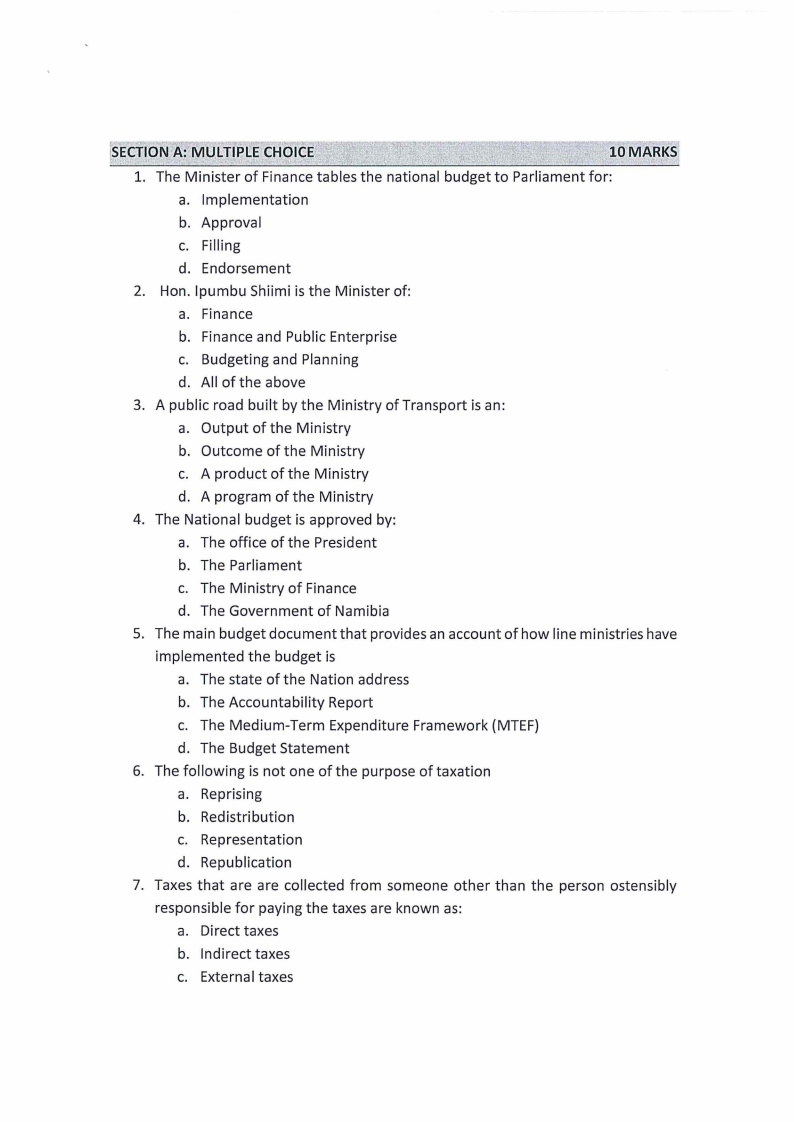

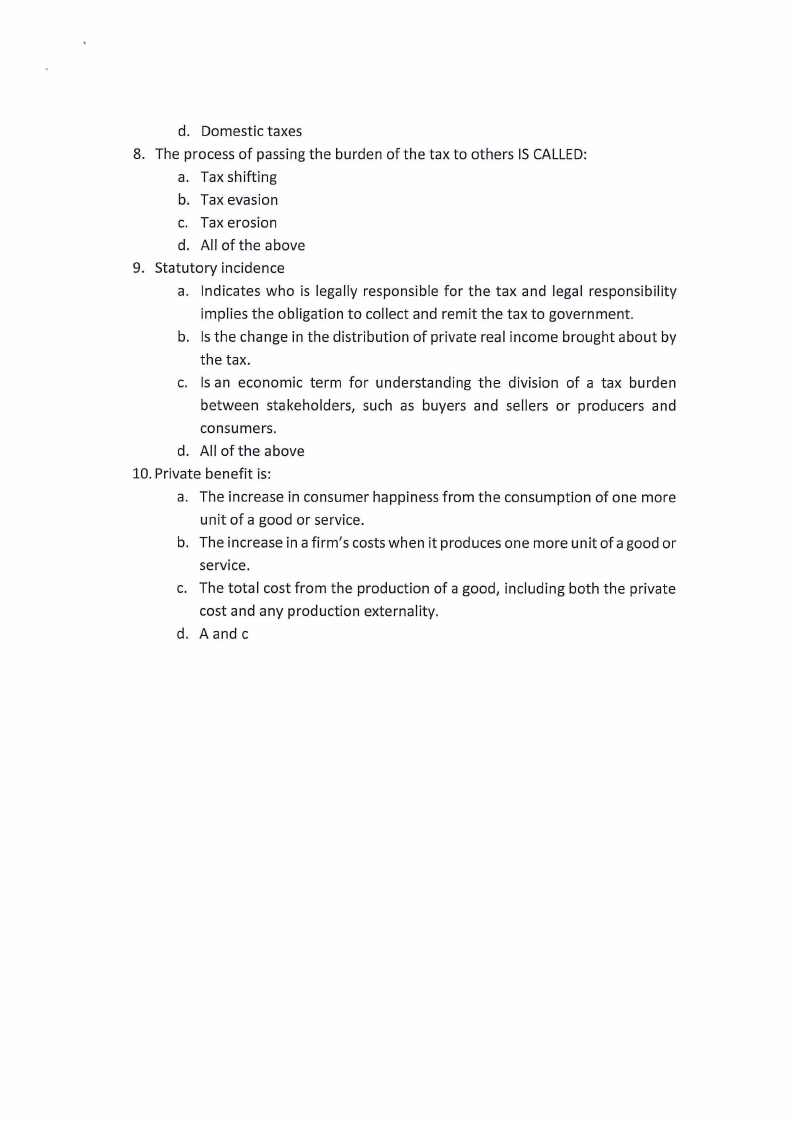

PFN712S- PUBLIC FINANCE- 2ND OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

|

2 Page 2 |

▲back to top |

|

3 Page 3 |

▲back to top |

|

4 Page 4 |

▲back to top |

|

5 Page 5 |

▲back to top |

|

6 Page 6 |

▲back to top |

|

7 Page 7 |

▲back to top |

|

8 Page 8 |

▲back to top |

|

9 Page 9 |

▲back to top |

|

10 Page 10 |

▲back to top |