|

FMS721S - FINANCIAL MANAGEMENT IN HEALHT SERVICES - 1ST OPP - JUNE 2022 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVER s I TY

OF SCI En CE Ano TECH n OLOGY

FACULTY OF HEALTH, APPLIED SCIENCES AND NATURAL RESOURCES

DEPARTMENT OF HEALTH SCIENCES

QUALIFICATION: BACHELOROF SCIENCEIN HEALTHINFORMATION SYSTEMSMANAGEMENT

QUALIFICATION CODE: 07BHIS

COURSE: FINANCIAL MANAGEMENT IN

HEALTHSERVICES

SESSION: JUNE 2022

LEVEL: 7

COURSE CODE: FMS721S

PAPER: THEORY

DURATION: 3 HOURS

MARKS: 100

EXAMINER

MODERATOR

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

DR MOIPI NGAUJAKE

MR NELSONPRADA

INSTRUCTIONS

1. Read the questions and instructions carefully

2. Answer Allthe questions

3. Write neatly and clearly

4. Begin each question on a separate sheet of paper and number the answers clearly

PERMISSIBLE MATERIALS

1. SCIENTIFICCALCULATOR

THIS QUESTION PAPER CONSISTS OF 3 PAGES

(including this front page)

1

|

2 Page 2 |

▲back to top |

[SECTION A]

QUESTION 1

(40 MARKS)

1.1 Discuss five (5) sources of equity financing?

(16)

1.2 Explain the following accounting concepts: Entity, Reliability, Cost valuation,

(10)

Going concern, and Stable monetary unit?

1.3 Differentiate between the Classical, Demand and Supply Free Market Theories?

(10)

1.4 Explain the Capitated Method of Payment?

(4)

[SECTION B]

QUESTION 2

(40 MARKS)

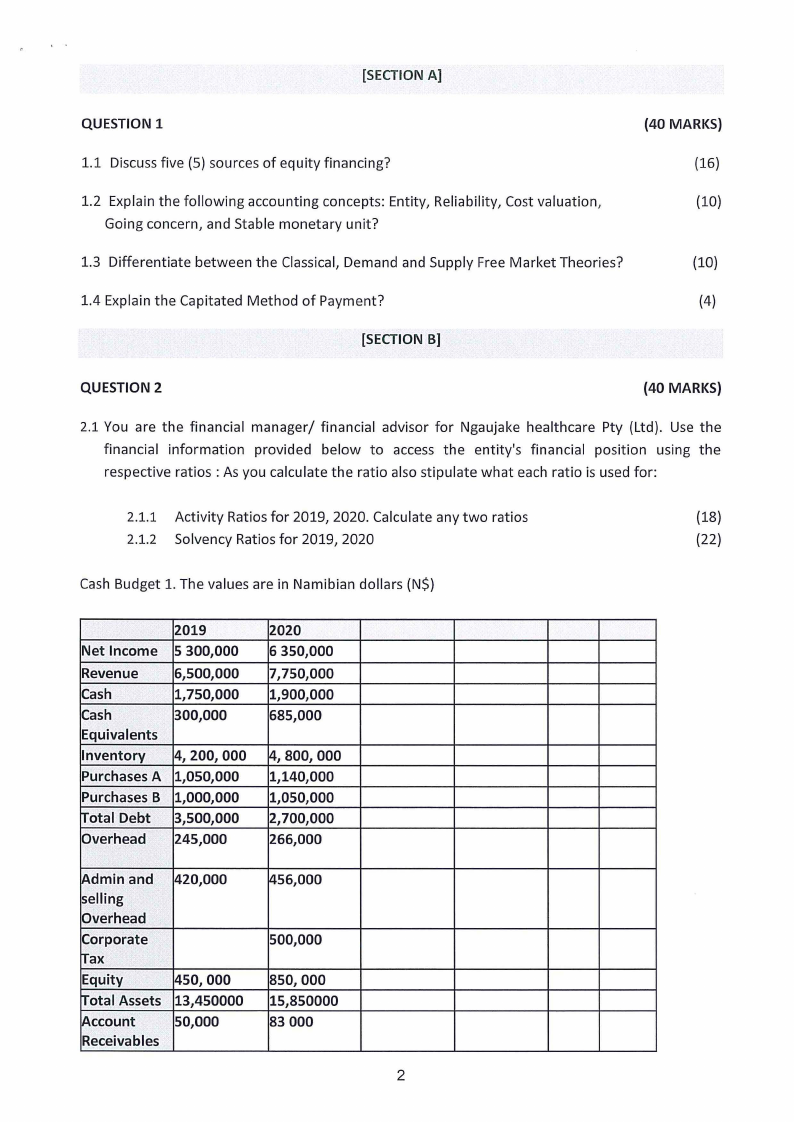

2.1 You are the financial manager/ financial advisor for Ngaujake healthcare Pty (Ltd). Use the

financial information provided below to access the entity's financial position using the

respective ratios : As you calculate the ratio also stipulate what each ratio is used for:

2.1.1 Activity Ratios for 2019, 2020. Calculate any two ratios

(18)

2.1.2 Solvency Ratios for 2019, 2020

(22)

Cash Budget 1. The values are in Namibian dollars (N$)

2019

Net Income 5 300,000

Revenue

6,500,000

Cash

1,750,000

Cash

300,000

Equivalents

Inventory 4,200,000

Purchases A 1,050,000

Purchases B 1,000,000

Total Debt 3,500,000

Overhead 245,000

2020

6 350,000

7,750,000

1,900,000

685,000

14,800,000

1,140,000

1,050,000

2,700,000

266,000

Admin and

selling

Overhead

Corporate

Tax

Equity

Total Assets

Account

Receivables

420,000

450,000

13,450000

50,000

1456,000

500,000

850,000

15,850000

83 000

2

|

3 Page 3 |

▲back to top |

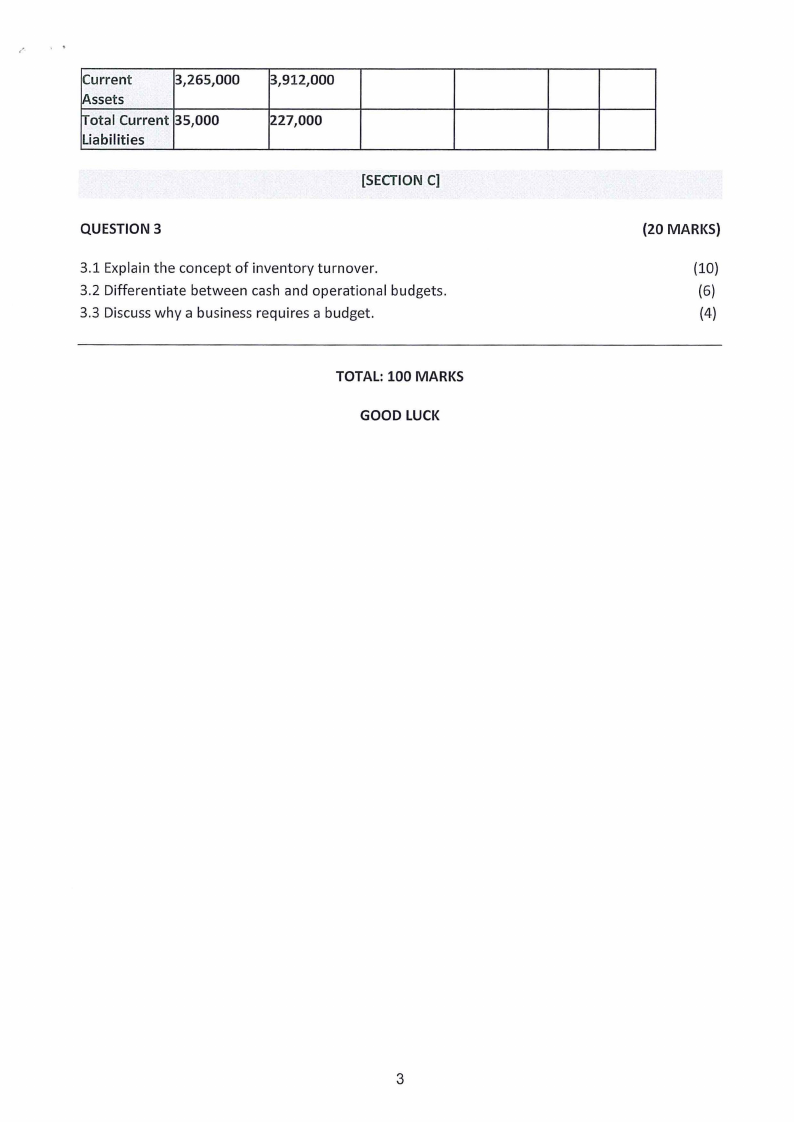

Current

3,265,000

~ssets

!Total Current 35,000

Liabilities

3,912,000

227,000

[SECTION C]

QUESTION 3

3.1 Explain the concept of inventory turnover.

3.2 Differentiate between cash and operational budgets.

3.3 Discuss why a business requires a budget.

TOTAL: 100 MARKS

GOOD LUCK

(20 MARKS}

(10}

(6)

(4)

3