|

MRE810S - Mine and Resource Enginnering Man 414 - 1st OPP - JUN 2023 |

|

1 Page 1 |

▲back to top |

'9

nAmI BIA unIVERSITY

OF SCIEn CE Ano TECHn OLOGY

FACULTY OF ENGINEERING AND BUILT ENVIRONMENT

DEPARTMENT OF CIVIL, MINING AND PROCESSENGINEERING

QUALIFICATION : BACHELOR OF ENGINEERING : MINING ENGINEERING

QUALIFICATION CODE: 08BMEG

LEVEL: 8

COURSE CODE: MRE810S

COURSE NAME: MINE AND RESOURCEENGINEERING

MANAGEMENT 414

SESSION: JUNE 2023

DURATION: 3 HOURS

PAPER: THEORY

MARKS: 100

EXAMINER(S)

MODERATOR:

FIRST OPPORTUNITY QUESTION PAPER

PROF. GODFREY DZINOMWA AND MR. RUBEN MWALWANGE

MR REHABEAM NEPAYA

INSTRUCTIONS

1. Answer all questions.

2. Read all the questions carefully before answering.

3. Marks for each question are indicated at the end of each question.

4. Please ensure that your writing is legible, neat and presentable.

PERMISSIBLE MATERIALS

1. Examination paper.

2. Calculator and appropriate stationery

THIS QUESTION PAPER CONSISTS OF 7 PAGES (including this front page)

|

2 Page 2 |

▲back to top |

Question 1

[20 marks]

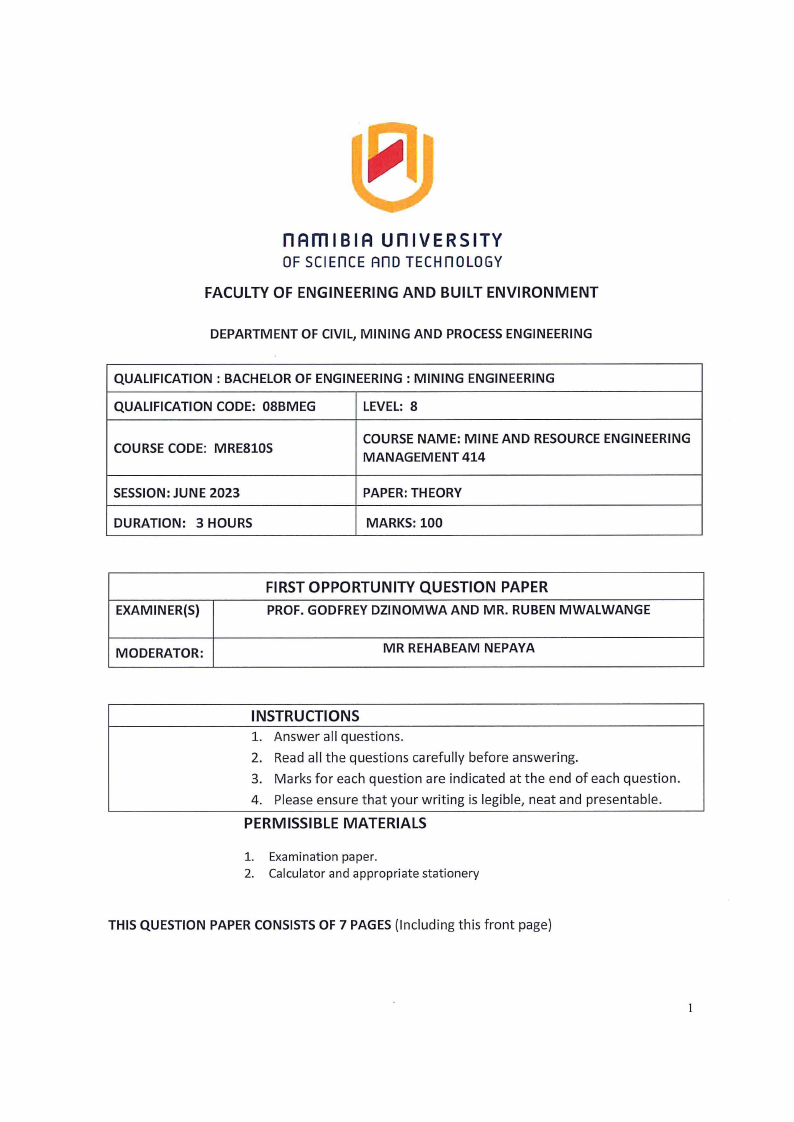

Nam Gold is a newly established mining company. It is presented with the organizational structure

shown in figure X. The initial stages of the strategic planning process have taken into consideration

whether a divisional or functional organizational structure should be employed.

General

Manager

Process

Manager

Human

Resource

manager

Risk

Manager

Finance

Manager

Figure X. Organizational Structure

Engineerin

g manager

Health

and Safety

Man er

Public

relations

Manager

Mining Procureme

manager nt Manager

(a) Explicitly distinguish between divisional and functional organizational structure [2]

(b) By critically analyzing the organizational structure in figure X,

(i) What weakness can you point out in this structure?

[2]

(ii) What are the likely negative consequences of employing such a reporting structure

in Nam Gold Mining company?

[2]

(iii) How would you address the stated weaknesses to improve the organization's

operational efficiency?

[2]

(c) Advise the management of Nam Gold as a new mining company, on how to get a social

license to operate and the merits of having such a license.

[2]

(d) You are the manager of two supervisors, both of whom are not performing satisfactorily.

One (Alice) was recently transferred from another section and you attribute her poor

performance to lack of familiarity with the job. The other (Liz) has been in the position

for a while and you have spoken to her about the need to improve her performance several

times but there has been no notable improvement.

Explain how you would address the poor performance in each case (in terms coaching,

motivation and disciplining)

[IO]

2

|

3 Page 3 |

▲back to top |

Question 2

[15 Marks]

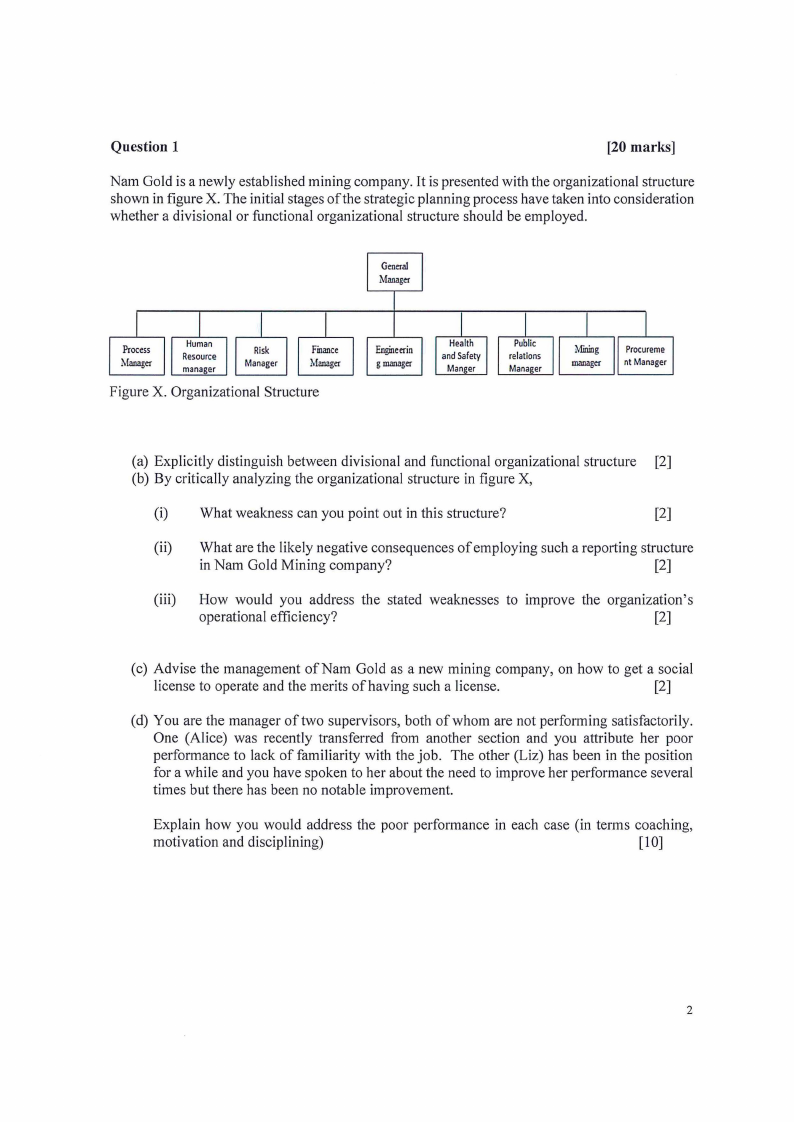

Agilent4.0 Mine, a copper producer in southern Africa took cognizance of embarking on a

modular Business Process Re-engineering (BPR) in 2002. In addition, the mine adopted the

concept of lean management. It was the management effort for the mine to remain competitive

amid serious threats to operational viability due to hyperinflation. Figure XY shows the simplified

BPR cycle for Agilent4.0 Mine.

Business ,ision

and mission

statement

l

Critical Success

Factors and Key

performance

Indicators

Benchmarking and

i-----. Comparative

Analysis

i

Redesign

Processes and

Eliminate 1--J

Redundant

Processes

l

Integrate

Redesigned

Processes

- Measurementof

Progress

Process analysis

and Baseline data

People Education,

Training and

Development

Figure XY. Simplified BPR cycle for Agilent4.0 Mine

(a) Evaluate the significance of adopting the concept of lean management m Agilent4.0

Mine's mining and processing operations.

[5]

(b) Evaluate the strength of the developed BPR model in figure XY and outline at least four

main objectives of Business Process Re-engineering.

[2;4]

(c) Advise the management of Agilent4.0 Mine of what is not considered as Business Process

Re-engineering practice.

[4]

Question 3

[15 Marks]

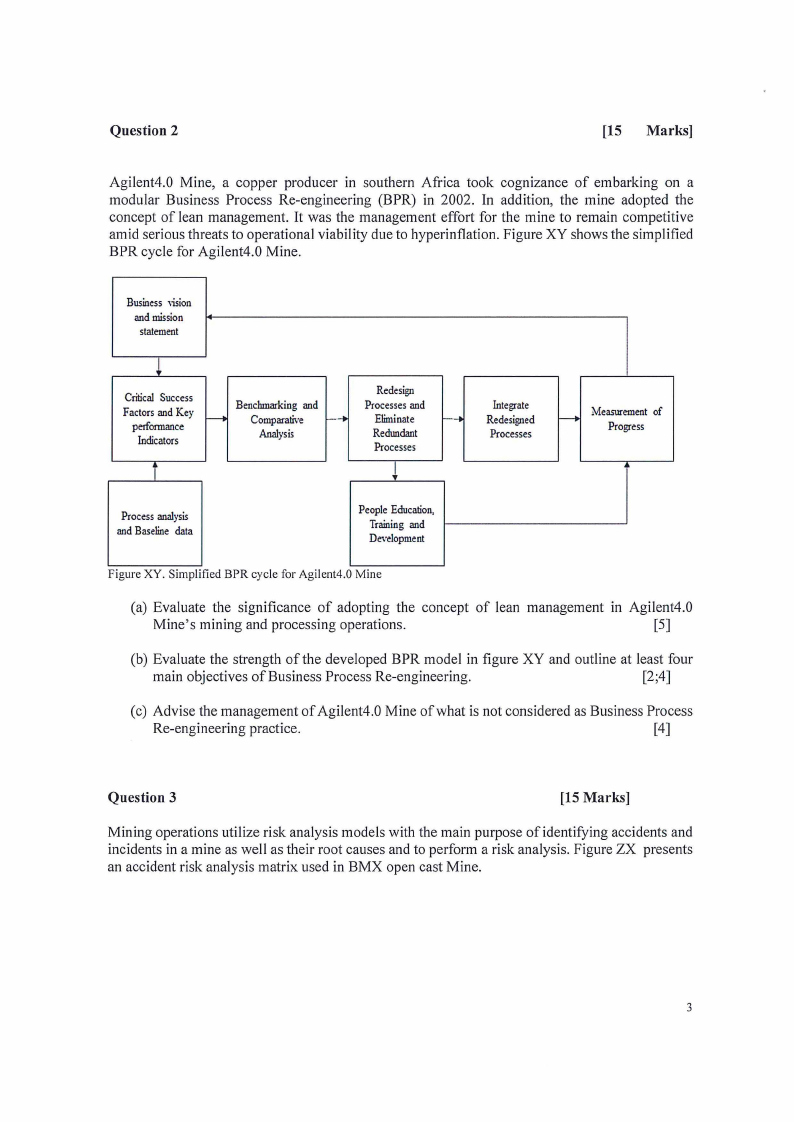

Mining operations utilize risk analysis models with the main purpose of identifying accidents and

incidents in a mine as well as their root causes and to perform a risk analysis. Figure ZX presents

an accident risk analysis matrix used in BMX open cast Mine.

3

|

4 Page 4 |

▲back to top |

Likelihood

Almost Never

Low

Moderate

High

Fatal

rnHospitalization

Doctor's Visit

First Aid

No Injury

Figure ZX. Risk Analysis Matrix

Almost

Certain

(a) What risk management strategies would you employ at an accident-prone BMX opencast mine,

in order to move from the 'Fatal -Almost certain' operating zone to 'No injury-Almost never'

operating environment

[5]

(b) Discuss the succession management plan of a multi-national company to select and develop a

future Chief Executive Officer

[5]

(c) A civil engineer decides to present himself to potential employers as professionally competent

in mine engineering, based on his belief that the two disciplines are similar. Discuss the

shortcomings of such conduct from an ethical point of view

[5]

Question 4

[7 Marks]

(a) Mine ZV's Human Resource department renegotiated with a retirement fund

representative on behalf of their employees, who are their important assets. They decided

to pay $ 6000 per year for 30 years into a retirement account at an annual interest rate of

5% compounded annually.

(i) What is the value of the account in 30 years?

[5]

(ii) What would be the lump sum value of the arrangement in present dollars? [4]

4

|

5 Page 5 |

▲back to top |

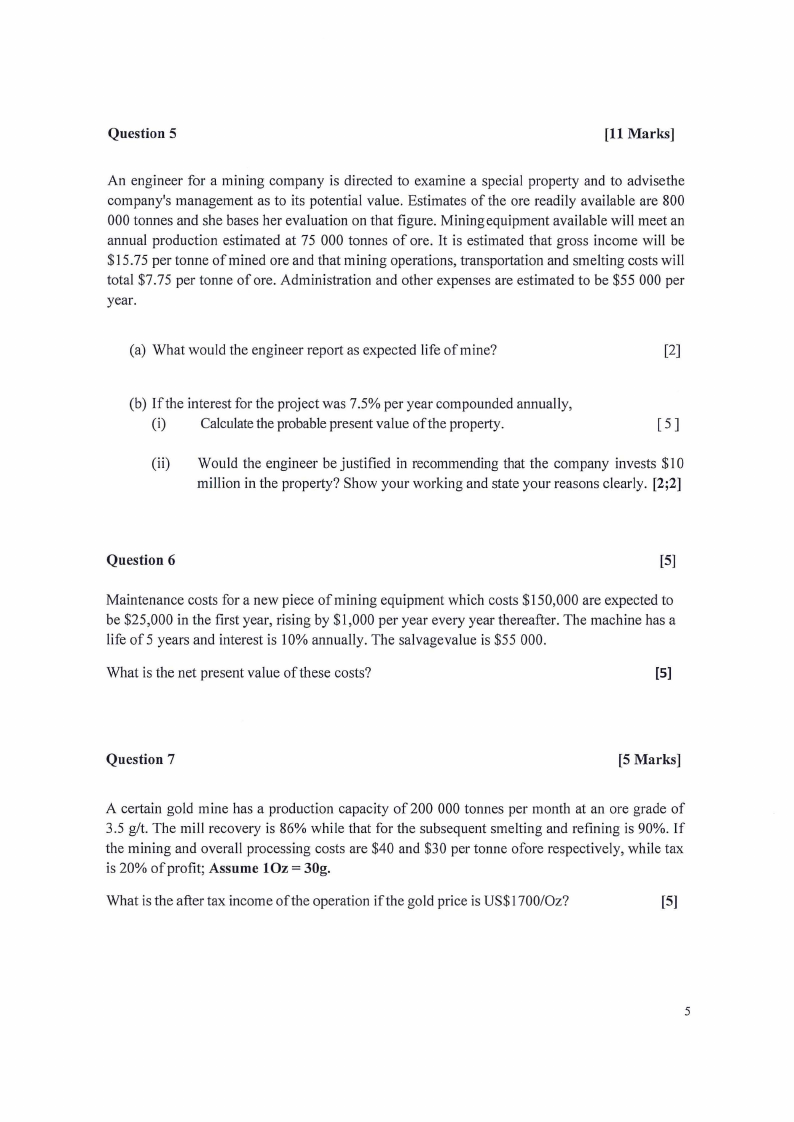

Question 5

[11 Marks]

An engineer for a mining company is directed to examine a special property and to advisethe

company's management as to its potential value. Estimates of the ore readily available are 800

000 tonnes and she bases her evaluation on that figure. Mining equipment available will meet an

annual production estimated at 75 000 tonnes of ore. It is estimated that gross income will be

$15.75 per tonne of mined ore and that mining operations, transportation and smelting costs will

total $7.75 per tonne of ore. Administration and other expenses are estimated to be $55 000 per

year.

(a) What would the engineer report as expected life of mine?

[2]

(b) If the interest for the project was 7.5% per year compounded annually,

(i) Calculate the probable present value of the property.

[5]

(ii) Would the engineer be justified in recommending that the company invests $ 10

million in the property? Show your working and state your reasons clearly. [2;2]

Question 6

[5]

Maintenance costs for a new piece of mining equipment which costs $150,000 are expected to

be $25,000 in the first year, rising by $1,000 per year every year thereafter. The machine has a

life of 5 years and interest is 10% annually. The salvagevalue is $55 000.

What is the net present value of these costs?

[5]

Question 7

[5 Marks]

A certain gold mine has a production capacity of 200 000 tonnes per month at an ore grade of

3.5 git. The mill recovery is 86% while that for the subsequent smelting and refining is 90%. If

the mining and overall processing costs are $40 and $30 per tonne ofore respectively, while tax

is 20% of profit; Assume 1Oz = 30g.

What is the after tax income of the operation if the gold price is US$1700/Oz?

[5]

5

|

6 Page 6 |

▲back to top |

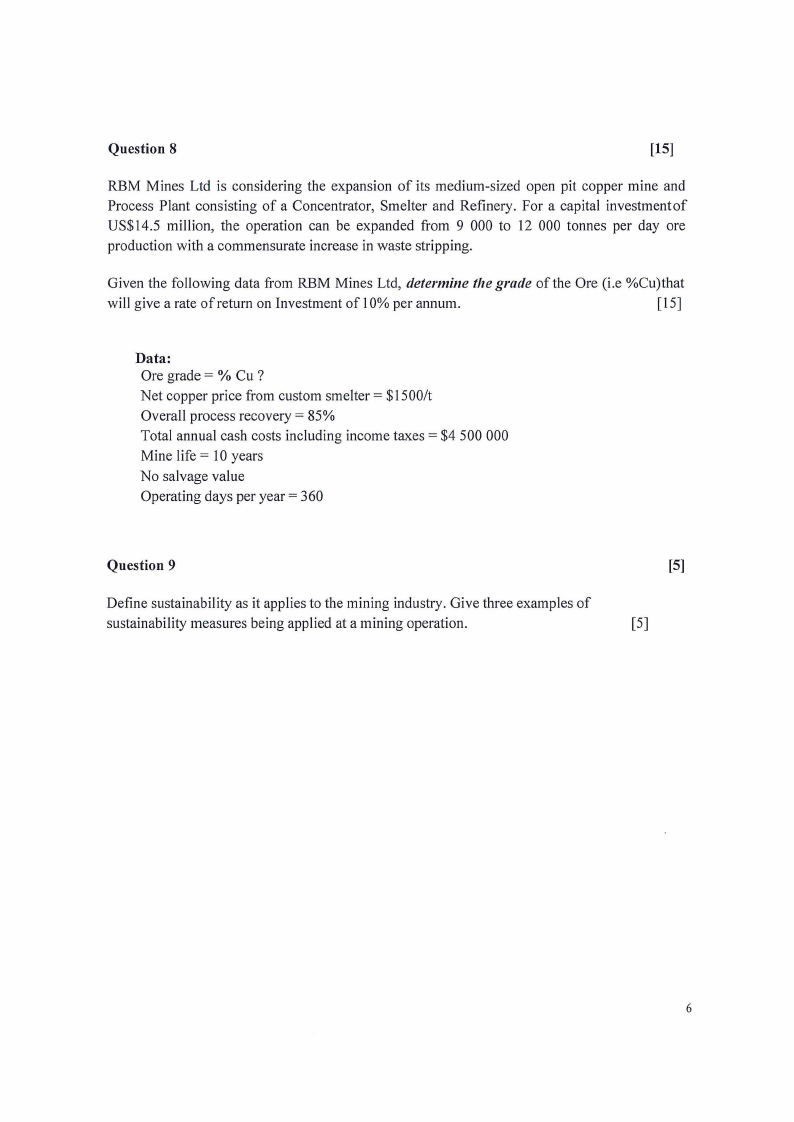

Question 8

[15]

RBM Mines Ltd is considering the expansion of its medium-sized open pit copper mine and

Process Plant consisting of a Concentrator, Smelter and Refinery. For a capital investmentof

US$14.5 million, the operation can be expanded from 9 000 to 12 000 tonnes per day ore

production with a commensurate increase in waste stripping.

Given the following data from RBM Mines Ltd, determine the grade of the Ore (i.e %Cu)that

will give a rate of return on Investment of 10% per annum.

[ 15]

Data:

Ore grade = % Cu ?

Net copper price from custom smelter = $ 1500/t

Overall process recovery = 85%

Total annual cash costs including income taxes= $4 500 000

Mine life = 10 years

No salvage value

Operating days per year= 360

Question 9

Define sustainability as it applies to the mining industry. Give three examples of

sustainability measures being applied at a mining operation.

[5]

[5]

6

|

7 Page 7 |

▲back to top |

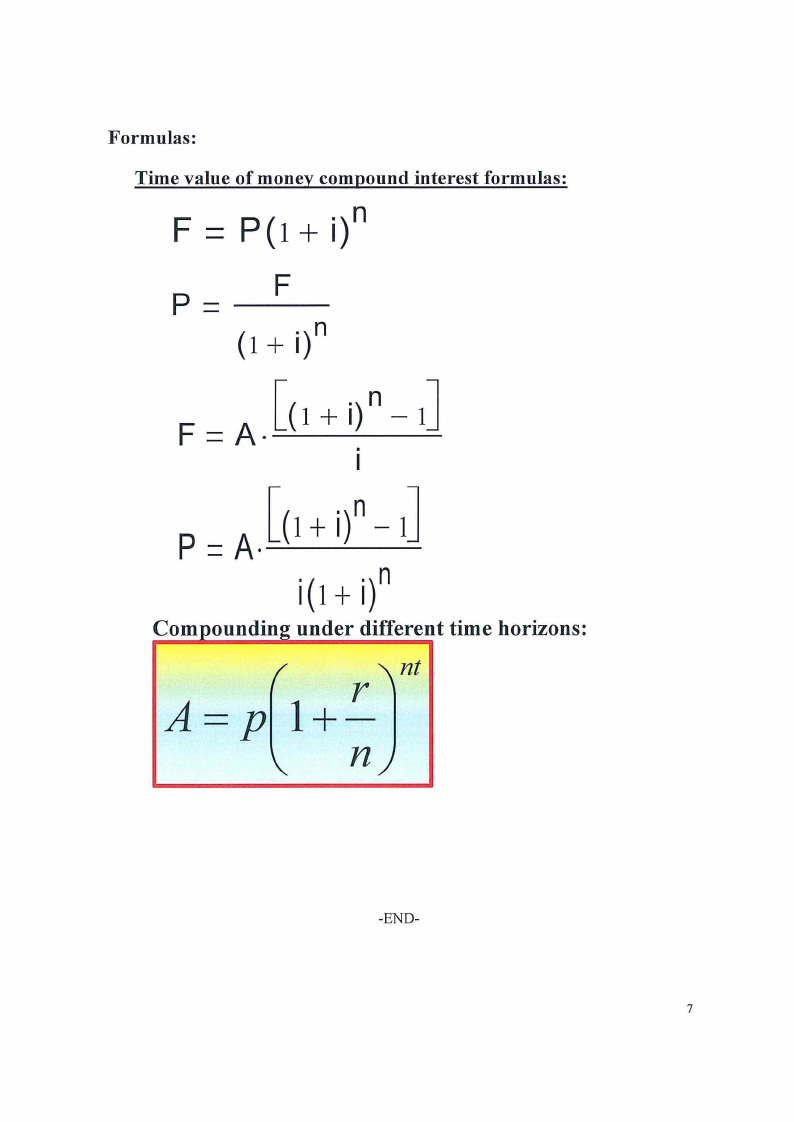

Formulas:

Time value of money compound interest formulas:

F = P(1 + it

P=

F

(1 + i)n

F = A. [( 1+ i.t - 1]

p = A-[+(i1)n- 1]

i(I + it

Com oundin under different time horizons:

A==pl+- r nt

n

-END-

7