|

MRE810S - Mine and Resource Enginnering Man 414 - 2nd OPP - JUN 2023 |

|

1 Page 1 |

▲back to top |

nAmI BIA unIVERSITY

OF SCIEn CE TECHn OLOGY

FACULTY OF ENGINEERING AND BUILT ENVIRONMENT

DEPARTMENT OF CIVIL, MINING AND PROCESSENGINEERING

QUALIFICATION: BACHELOR OF ENGINEERING: MINING ENGINEERING

QUALIFICATION CODE: 08BMEG

LEVEL: 8

COURSE CODE: MRE810S

COURSE NAME: MINE AND RESOURCEENGINEERING

MANAGEMENT 414

SESSION: JUNE 2023

DURATION: 3 HOURS

PAPER: THEORY

MARKS: 100

EXAMINER(S)

SUPPLEMENTARY EXAMINATION QUESTION PAPER

PROF. GODFREY DZINOMWA AND MR. RUBEN MWALWANGE

MODERATOR:

MR REHABEAM NEPAYA

INSTRUCTIONS

1. Answer all questions.

2. Read all the questions carefully before answering.

3. Marks for each question are indicated at the end of each question.

4. Please ensure that your writing is legible, neat and presentable.

PERMISSIBLE MATERIALS

1. Examination paper.

2. Calculator and appropriate stationery

THIS QUESTION PAPER CONSISTS OF 6 PAGES {Including this front page)

|

2 Page 2 |

▲back to top |

Question 1

[10 Marks]

(a) In the years 2019 - 2022, the COVID-19 pandemic has impacted on the minerals industry and is

projected to continue to do so in various ways.

(i) What are some of the changes that the pandemic has caused so far, and how doyou

project it to affect the mineral industry in future?

[5]

(ii) If you were the Chief Executive Officer (reporting to the Board of Directors) of alabor-

intensive mining operation, what changes would you make to your organisation, and

how would you communicate these to all stakeholders?

[5]

Question 2

[23 Marks]

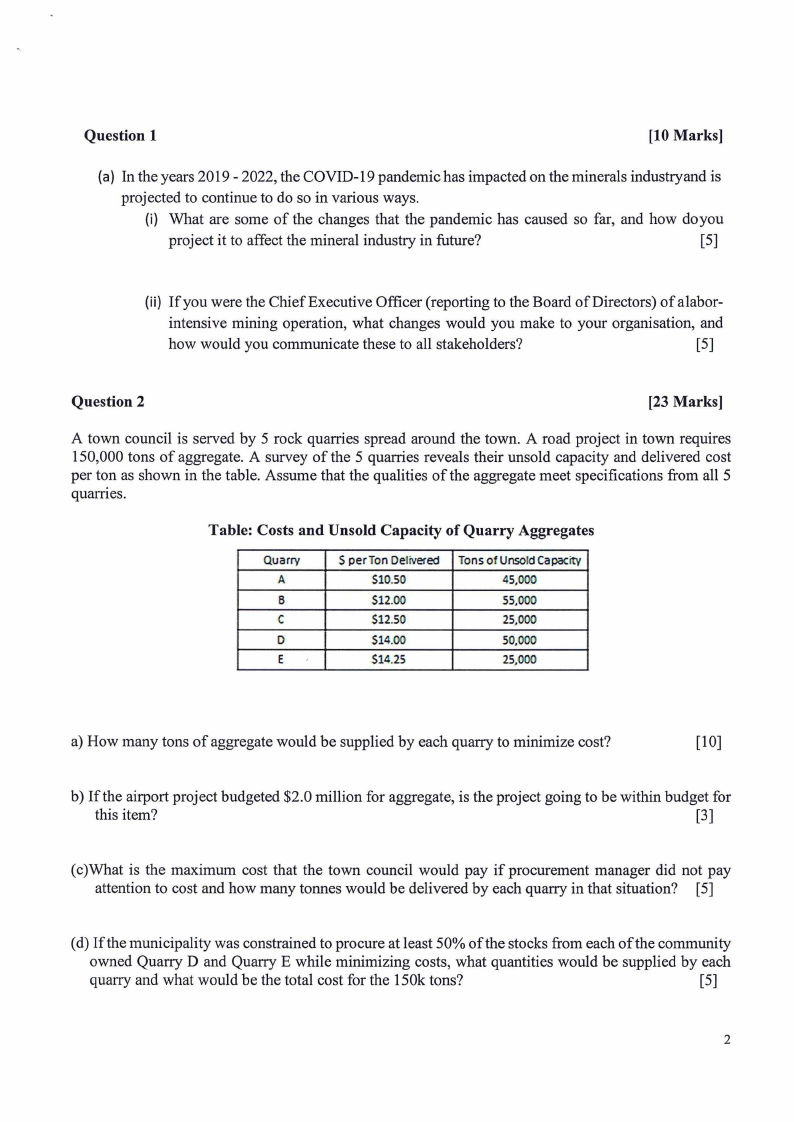

A town council is served by 5 rock quarries spread around the town. A road project in town requires

150,000 tons of aggregate. A survey of the 5 quarries reveals their unsold capacity and delivered cost

per ton as shown in the table. Assume that the qualities of the aggregate meet specifications from all 5

quarries.

Table: Costs and Unsold Capacity of Quarry Aggregates

Quarry

A

8

C

0

E

S per Ton Delivered

$10.50

$12.00

$12.50

.$14.•00

$14.25

Tonsof UnsoldCapac,ity

45,000

55,000

25,000

50,000

25,,000

a) How many tons of aggregate would be supplied by each quarry to minimize cost?

[10]

b) If the airport project budgeted $2.0 million for aggregate, is the project going to be within budget for

this item?

[3]

(c)What is the maximum cost that the town council would pay if procurement manager did not pay

attention to cost and how many tonnes would be delivered by each quarry in that situation? [5]

(d) If the municipality was constrained to procure at least 50% of the stocks from each of the community

owned Quarry D and Quarry E while minimizing costs, what quantities would be supplied by each

quarry and what would be the total cost for the 150k tons?

[5]

2

|

3 Page 3 |

▲back to top |

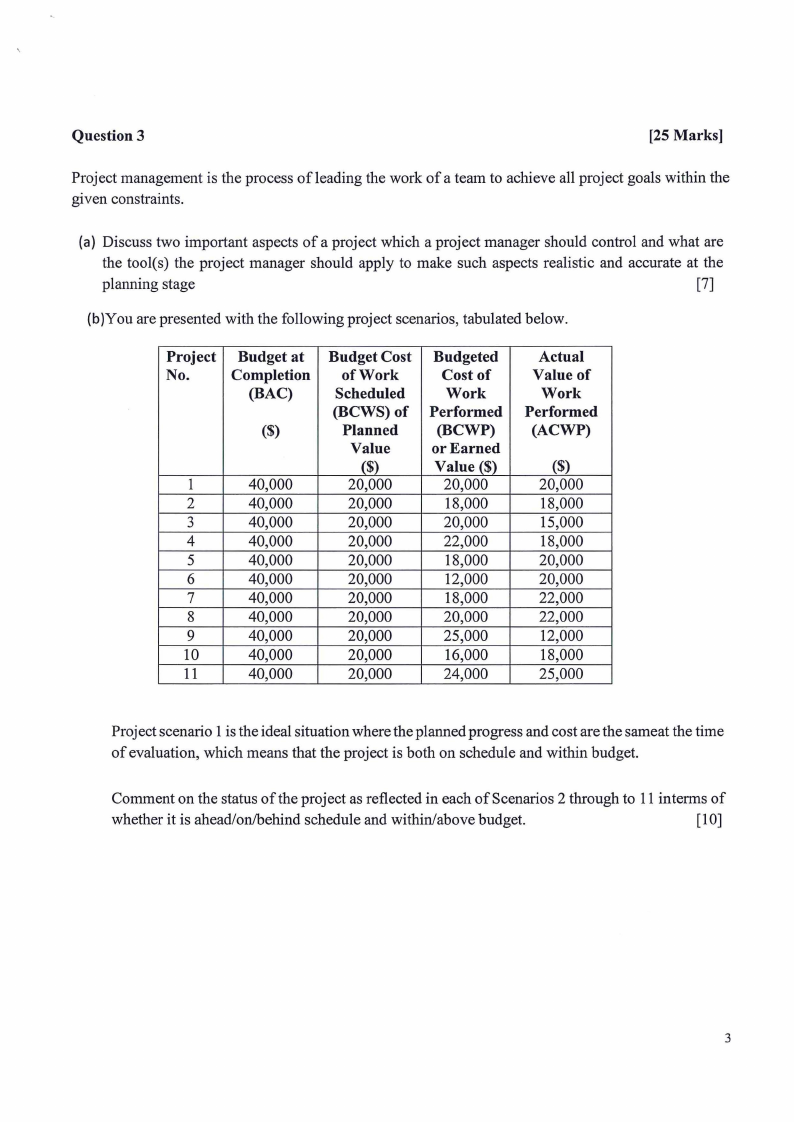

Question 3

[25 Marks]

Project management is the process of leading the work of a team to achieve all project goals within the

given constraints.

(a) Discuss two important aspects of a project which a project manager should control and what are

the tool(s) the project manager should apply to make such aspects realistic and accurate at the

planning stage

[7]

(b)You are presented with the following project scenarios, tabulated below.

Project Budget at

No.

Completion

(BAC)

($)

1

40,000

2

40,000

3

40,000

4

40,000

5

40,000

6

40,000

7

40,000

8

40,000

9

40,000

10

40,000

11

40,000

Budget Cost

of Work

Scheduled

(BCWS) of

Planned

Value

($)

20,000

20,000

20,000

20,000

20,000

20,000

20,000

20,000

20,000

20,000

20,000

Budgeted

Cost of

Work

Performed

(BCWP)

or Earned

Value($)

20,000

18,000

20,000

22,000

18,000

12,000

18,000

20,000

25,000

16,000

24,000

Actual

Value of

Work

Performed

(ACWP)

($)

20,000

18,000

15,000

18,000

20,000

20,000

22,000

22,000

12,000

18,000

25,000

Project scenario 1 is the ideal situation where the planned progress and cost are the sameat the time

of evaluation, which means that the project is both on schedule and within budget.

Comment on the status of the project as reflected in each of Scenarios 2 through to 11 in terms of

whether it is ahead/on/behind schedule and within/above budget.

[10]

3

|

4 Page 4 |

▲back to top |

(c) In the case of a new Gold mine that has been approved for construction within a certain

period, what are the possible risks of completing the construction and commissioning the

mine a year later than scheduled?

[8]

Question 4

[5 Marks]

A potential investor considers four projects with the same present values and the cashflows shown in

Figure MX.

Which project( s) would the investor select if the interest is 10%? Justify your answer.

[ 5]

Year, n Cash Flow

( 1)

1

2

3

4

Total

$1,000

$1,000

$1,000

$11,000

$14,000

Figure MX: Cash Flow

Cash Flow

(2)

$3,500

$3,250

$3,000

$2,750

$12,500

Cash Flow Cash Flow

(3)

(4)

$3,154.71

$0

$3,154.71

$0

$3,154.71

$0

$3,154.71 $14,641

$12,618.84 $14,641

Question 5

[10 Marks]

Mine XY's executive committee of management (EXCO) decided to invest $20 000 in a Cash

Deposit compounded annually at 4% annual interest for 10 years.

(a) What is the value of a cash deposit when it matures in 10 years?

[5]

(b) What is the value of the Cash deposit at maturity if the interest compounds every 3 months?

[5]

4

|

5 Page 5 |

▲back to top |

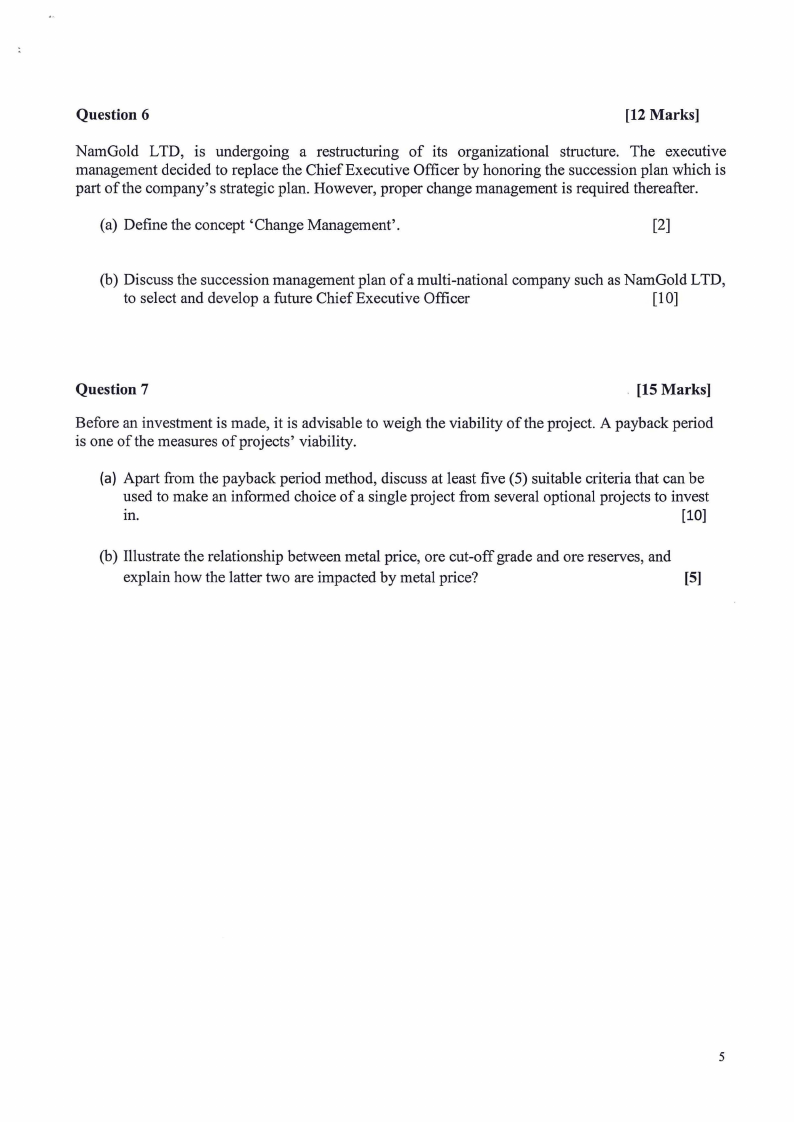

Question 6

[12 Marks]

NamGold LTD, is undergoing a restructuring of its organizational structure. The executive

management decided to replace the Chief Executive Officer by honoring the succession plan which is

part of the company's strategic plan. However, proper change management is required thereafter.

(a) Define the concept 'Change Management'.

[2]

(b) Discuss the succession management plan of a multi-national company such as NamGold LTD,

to select and develop a future Chief Executive Officer

[10]

Question 7

. [15 Marks]

Before an investment is made, it is advisable to weigh the viability of the project. A payback period

is one of the measures of projects' viability.

(a} Apart from the payback period method, discuss at least five (5) suitable criteria that can be

used to make an informed choice of a single project from several optional projects to invest

m.

[10]

(b) Illustrate the relationship between metal price, ore cut-off grade and ore reserves, and

explain how the latter two are impacted by metal price?

[5]

5

|

6 Page 6 |

▲back to top |

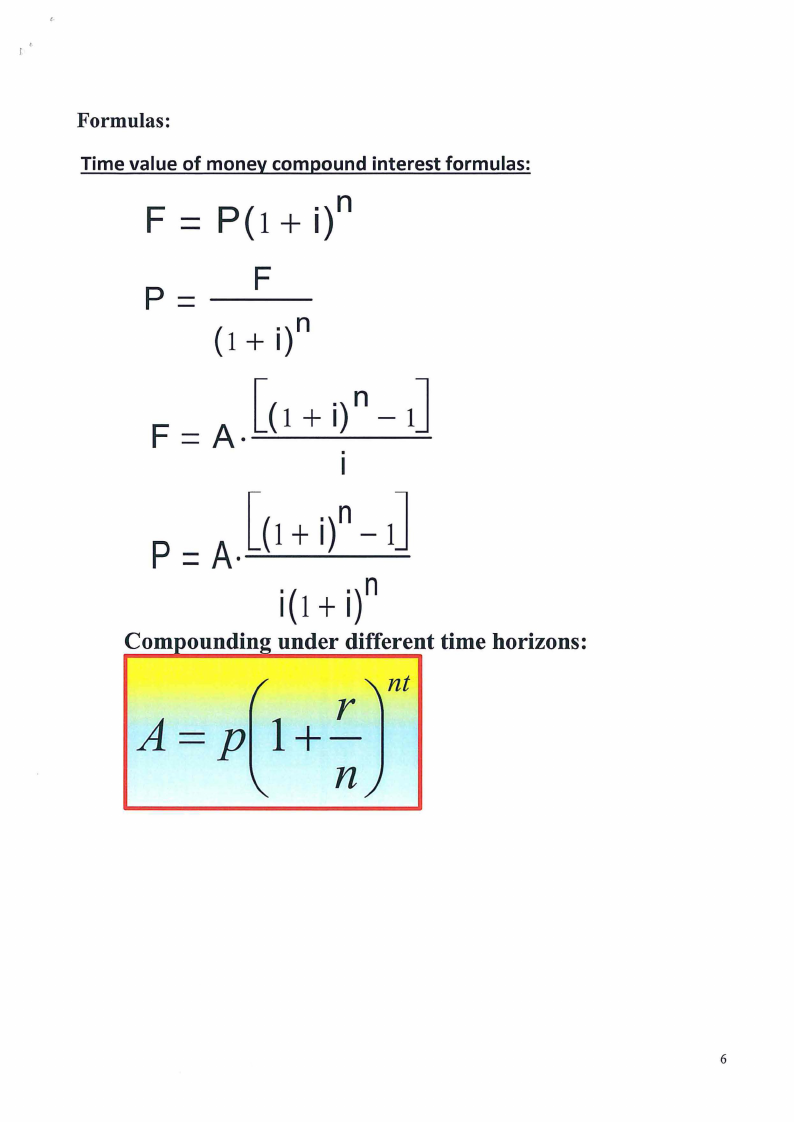

Formulas:

Time value of money compound interest formulas:

F = P(l + i)n

P=-- F

(1 + i)n

F = A.[( 1+ i.t - 1]

P=A_[(1+i)n-1]

i(l+ i)n

Com oundin under different time horizons:

A=pl+- r nt

n

6