|

AME820S-ADVANCED MACROECONOMICS-2ND OPP-JAN 2025 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVE Rs ITY

OF SCIEnCE Ano TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ECONOMICS HONOURS DEGREE

QUALIFICATION CODE:

08HECO

COURSE CODE:

AME820S

LEVEL:

8

COURSE NAME: ADV AN CED

MACROECONOMICS

SESSION:

JAN 2025 PAPER:

THEORY

DURATION:

HOURS

3

MARKS:

100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER (S) Prof. T. Sunde

MODERATOR: Dr Reinhold Kamati

INSTRUCTIONS

1. Answer ALL the questions.

2. Write clearly and neatly.

3. Number the answers.

PERMISSIBLE MATERIALS

I.Ruler

2.Calculator

THIS QUESTION PAPER CONSISTS OF 3 PAGES INCLUDING THE COVER

PAGE.

1

|

2 Page 2 |

▲back to top |

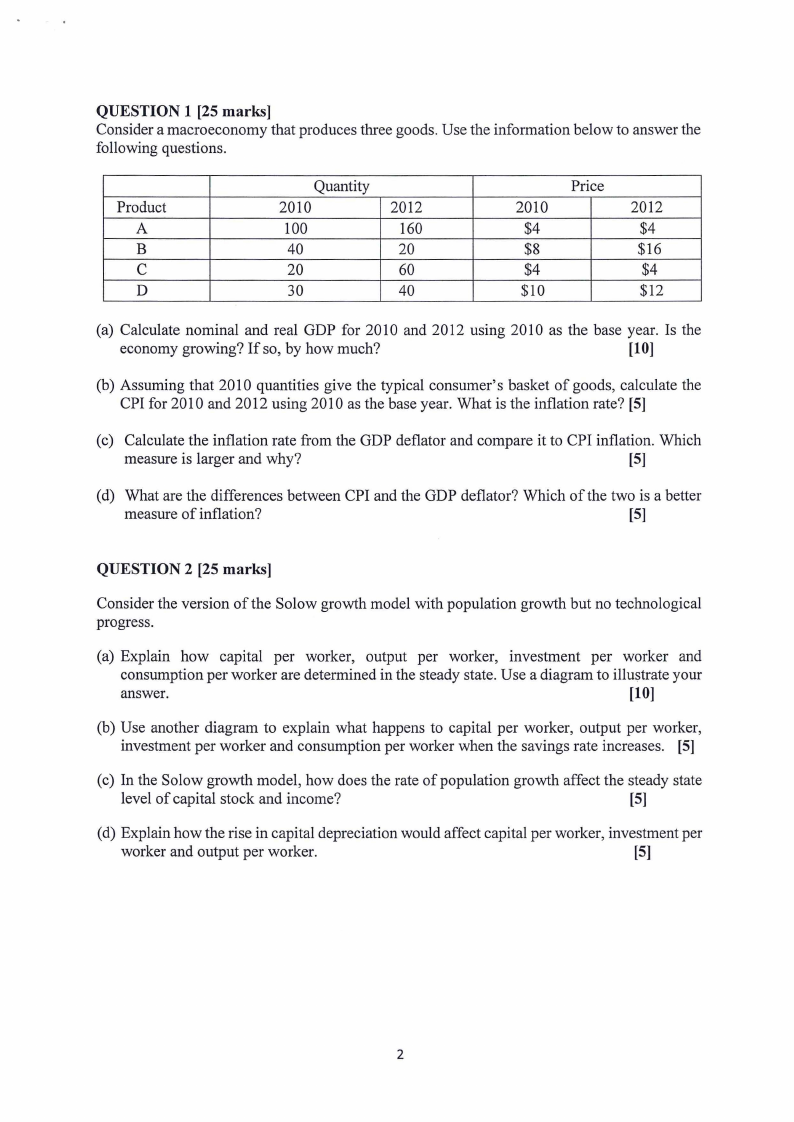

QUESTION 1 [25 marks]

Consider a macroeconomy that produces three goods. Use the information below to answer the

following questions.

Product

A

B

C

D

Quantity

2010

100

40

20

30

2012

160

20

60

40

2010

$4

$8

$4

$10

Price

2012

$4

$16

$4

$12

(a) Calculate nominal and real GDP for 2010 and 2012 using 2010 as the base year. Is the

economy growing? If so, by how much?

[10]

(b) Assuming that 2010 quantities give the typical consumer's basket of goods, calculate the

CPI for 2010 and 2012 using 2010 as the base year. What is the inflation rate? [5]

(c) Calculate the inflation rate from the GDP deflator and compare it to CPI inflation. Which

measure is larger and why?

[5]

(d) What are the differences between CPI and the GDP deflator? Which of the two is a better

measure of inflation?

[5]

QUESTION 2 [25 marks]

Consider the version of the Solow growth model with population growth but no technological

progress.

(a) Explain how capital per worker, output per worker, investment per worker and

consumption per worker are determined in the steady state. Use a diagram to illustrate your

answer.

[10]

(b) Use another diagram to explain what happens to capital per worker, output per worker,

investment per worker and consumption per worker when the savings rate increases. [5]

(c) In the Solow growth model, how does the rate of population growth affect the steady state

level of capital stock and income?

[5]

(d) Explain how the rise in capital depreciation would affect capital per worker, investment per

worker and output per worker.

[5]

2

|

3 Page 3 |

▲back to top |

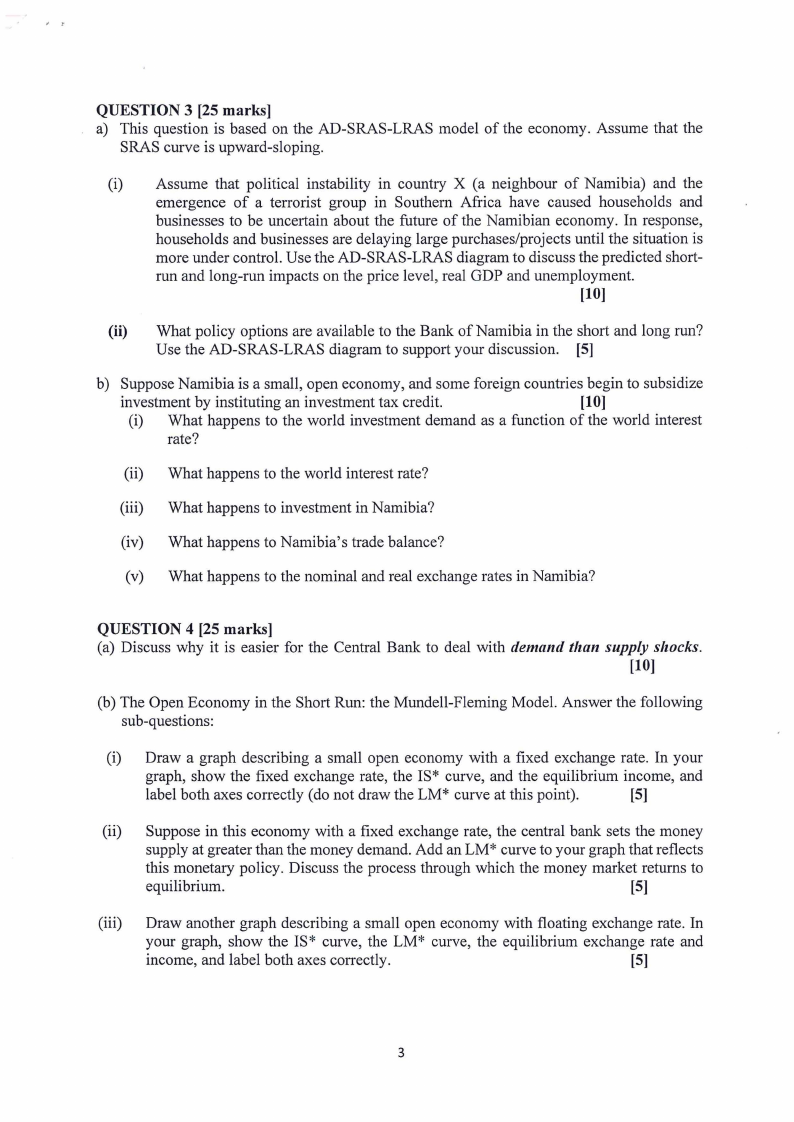

QUESTION 3 [25 marks]

a) This question is based on the AD-SRAS-LRAS model of the economy. Assume that the

SRAS curve is upward-sloping.

(i) Assume that political instability in country X (a neighbour of Namibia) and the

emergence of a terrorist group in Southern Africa have caused households and

businesses to be uncertain about the future of the Namibian economy. In response,

households and businesses are delaying large purchases/projects until the situation is

more under control. Use the AD-SRAS-LRAS diagram to discuss the predicted short-

run and long-run impacts on the price level, real GDP and unemployment.

[10]

(ii) What policy options are available to the Bank of Namibia in the short and long run?

Use the AD-SRAS-LRAS diagram to support your discussion. [5]

b) Suppose Namibia is a small, open economy, and some foreign countries begin to subsidize

investment by instituting an investment tax credit.

[10]

(i) What happens to the world investment demand as a function of the world interest

rate?

(ii) What happens to the world interest rate?

(iii) What happens to investment in Namibia?

(iv) What happens to Namibia's trade balance?

(v) What happens to the nominal and real exchange rates in Namibia?

QUESTION 4 [25 marks]

(a) Discuss why it is easier for the Central Bank to deal with demand than supply shocks.

[10]

(b) The Open Economy in the Short Run: the Mundell-Fleming Model. Answer the following

sub-questions:

(i) Draw a graph describing a small open economy with a fixed exchange rate. In your

graph, show the fixed exchange rate, the IS* curve, and the equilibrium income, and

label both axes correctly (do not draw the LM* curve at this point).

[5]

(ii) Suppose in this economy with a fixed exchange rate, the central bank sets the money

supply at greater than the money demand. Add an LM* curve to your graph that reflects

this monetary policy. Discuss the process through which the money market returns to

equilibrium.

[5]

(iii) Draw another graph describing a small open economy with floating exchange rate. In

your graph, show the IS* curve, the LM* curve, the equilibrium exchange rate and

income, and label both axes correctly.

[5]

3