|

BAC611C-BUSINESS ACCOUNTING 2A-1ST OPP-NOV 2024 |

|

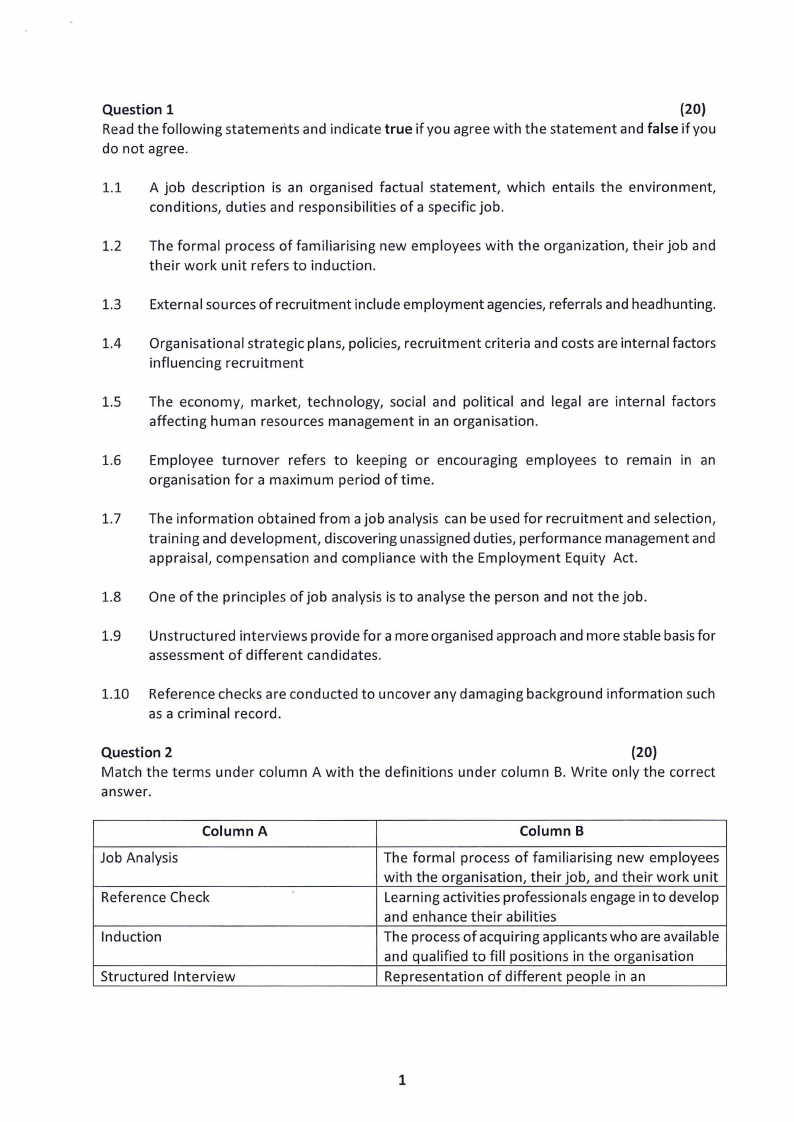

1 Page 1 |

▲back to top |

|

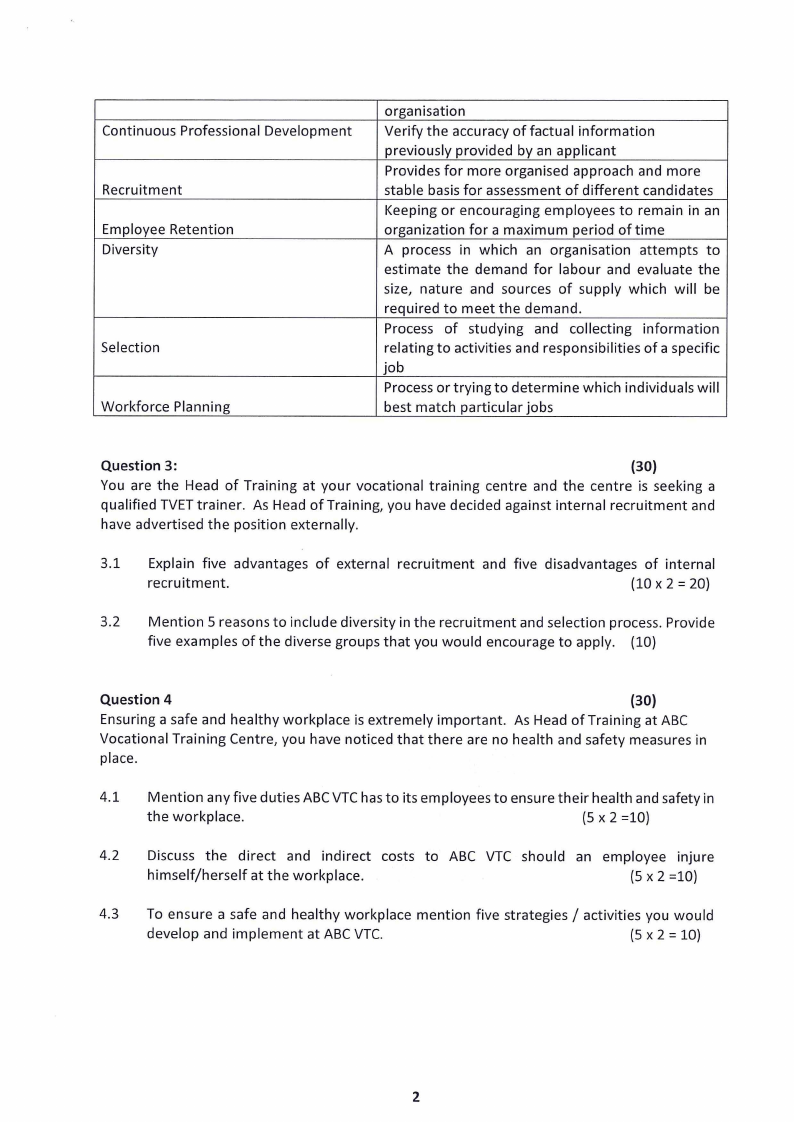

2 Page 2 |

▲back to top |

|

3 Page 3 |

▲back to top |

|

4 Page 4 |

▲back to top |

|

5 Page 5 |

▲back to top |

|

6 Page 6 |

▲back to top |

|

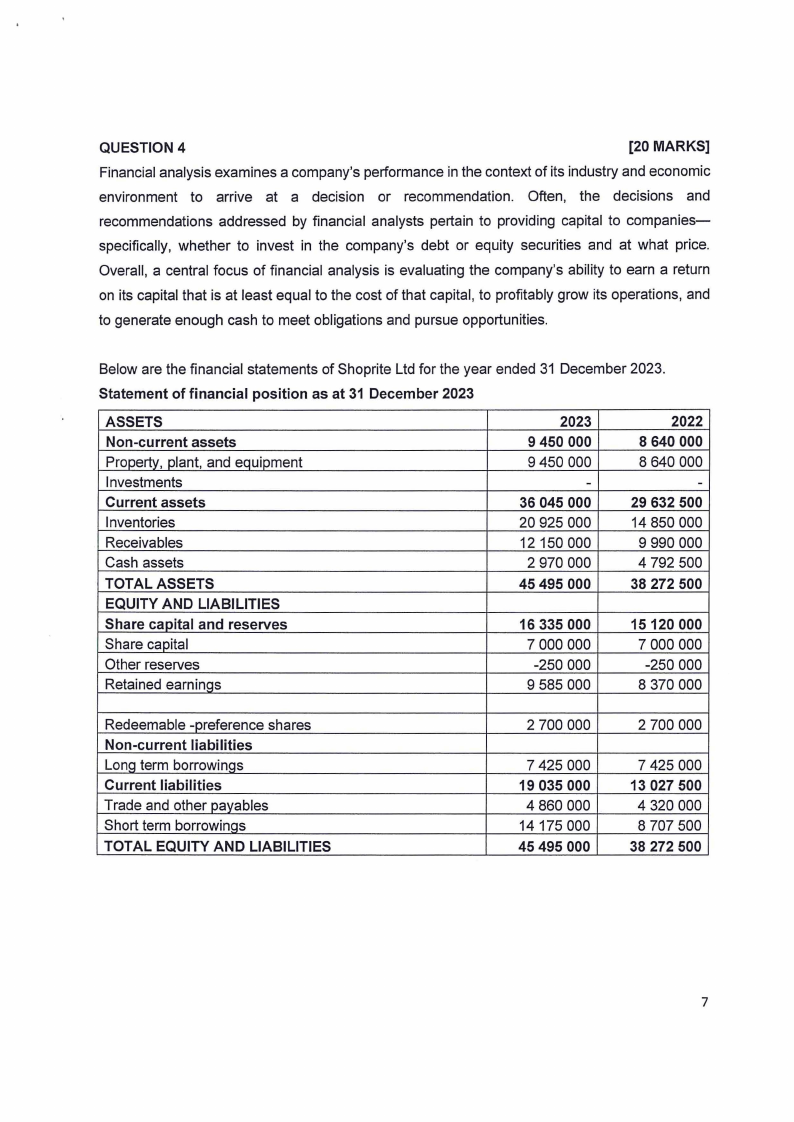

7 Page 7 |

▲back to top |

|

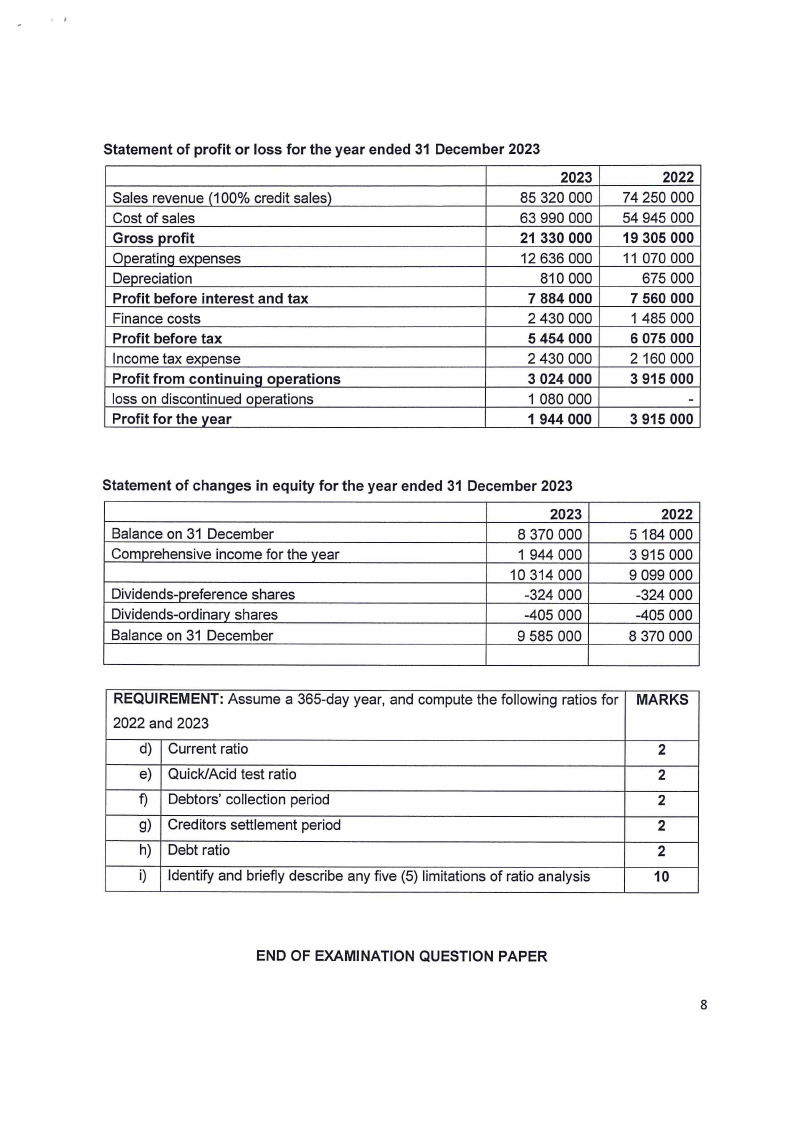

8 Page 8 |

▲back to top |

|

9 Page 9 |

▲back to top |