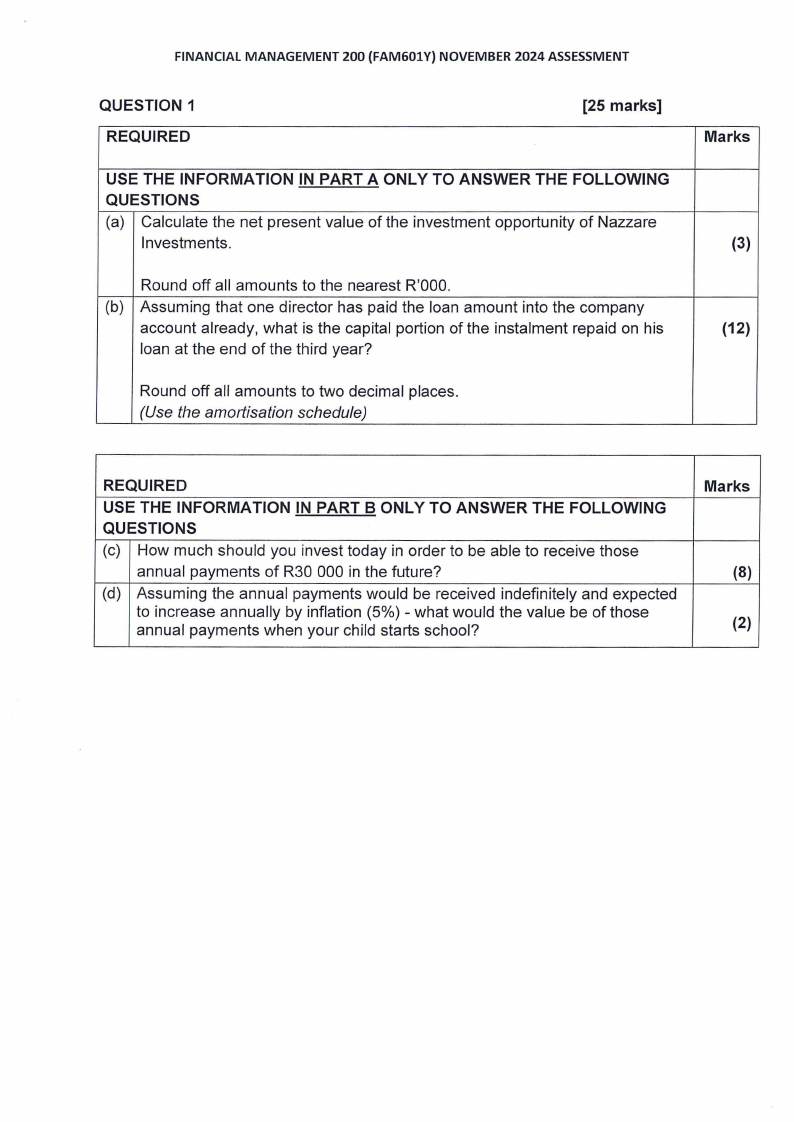

Financial Management 200 (FAM601Y) November 2024 Assessment

PARTS

10 MARKS

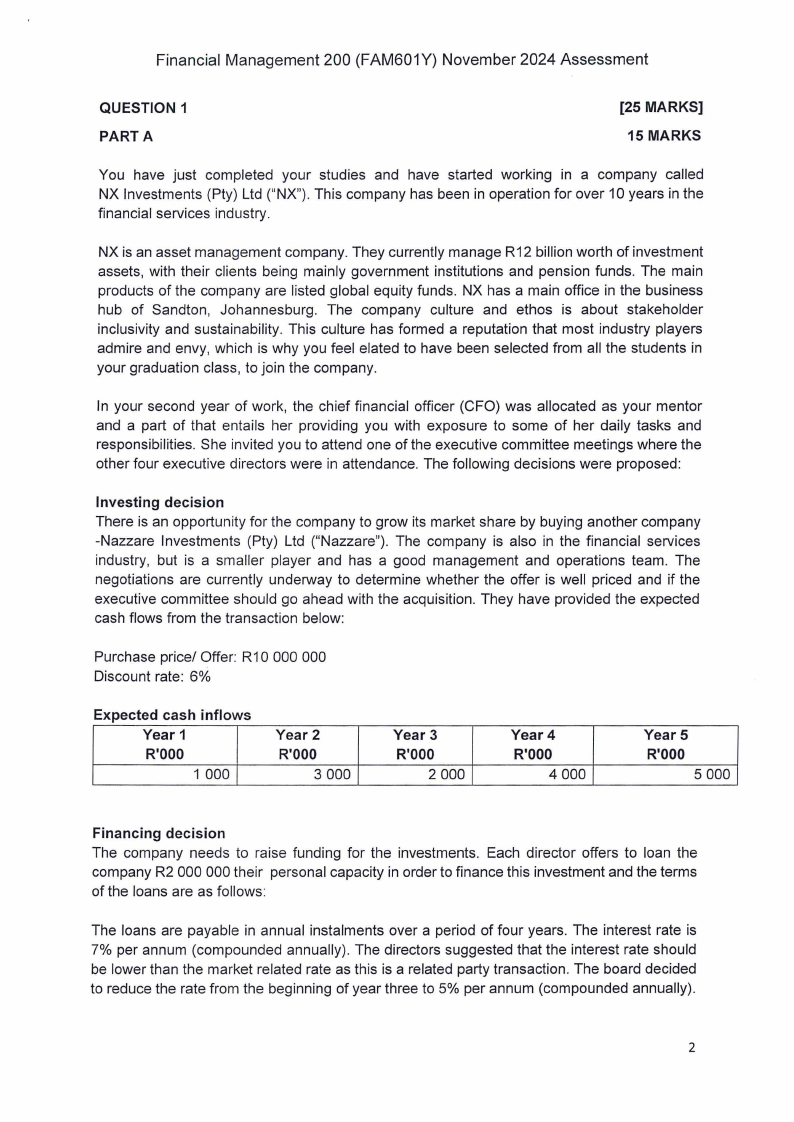

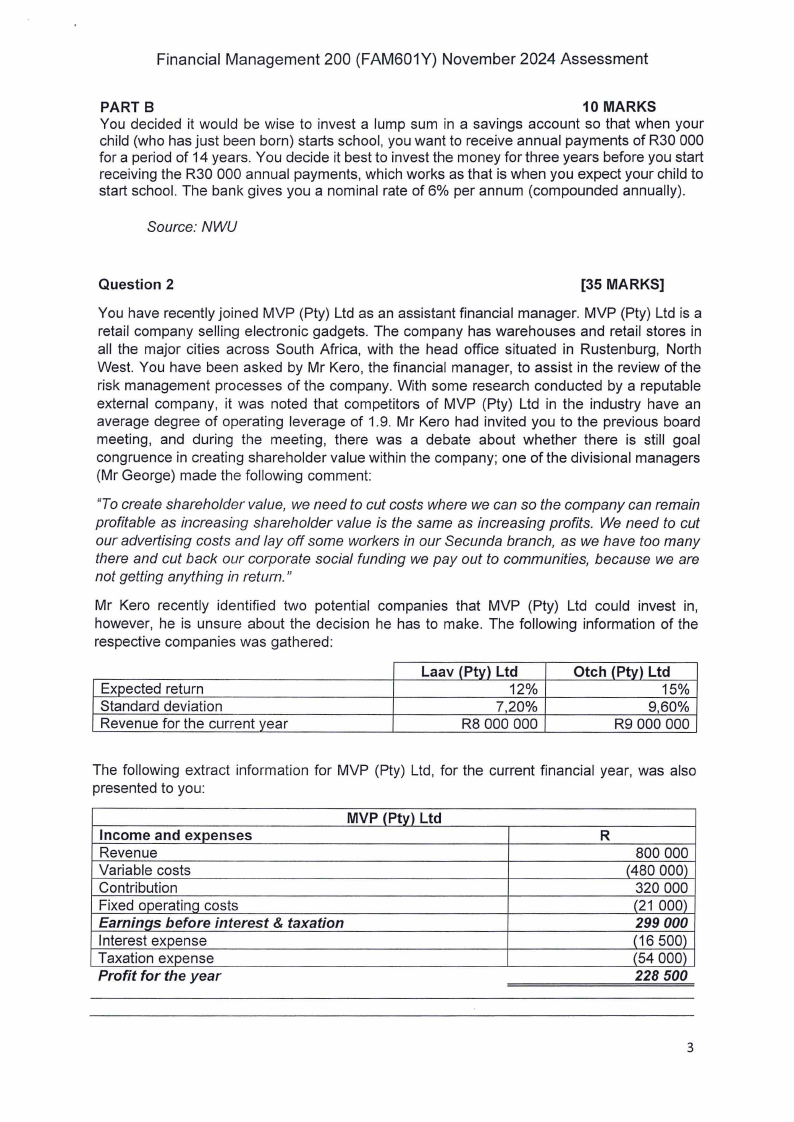

You decided it would be wise to invest a lump sum in a savings account so that when your

child (who has just been born) starts school, you want to receive annual payments of R30 000

for a period of 14 years. You decide it best to invest the money for three years before you start

receiving the R30 000 annual payments, which works as that is when you expect your child to

start school. The bank gives you a nominal rate of 6% per annum (compounded annually).

Source: NWU

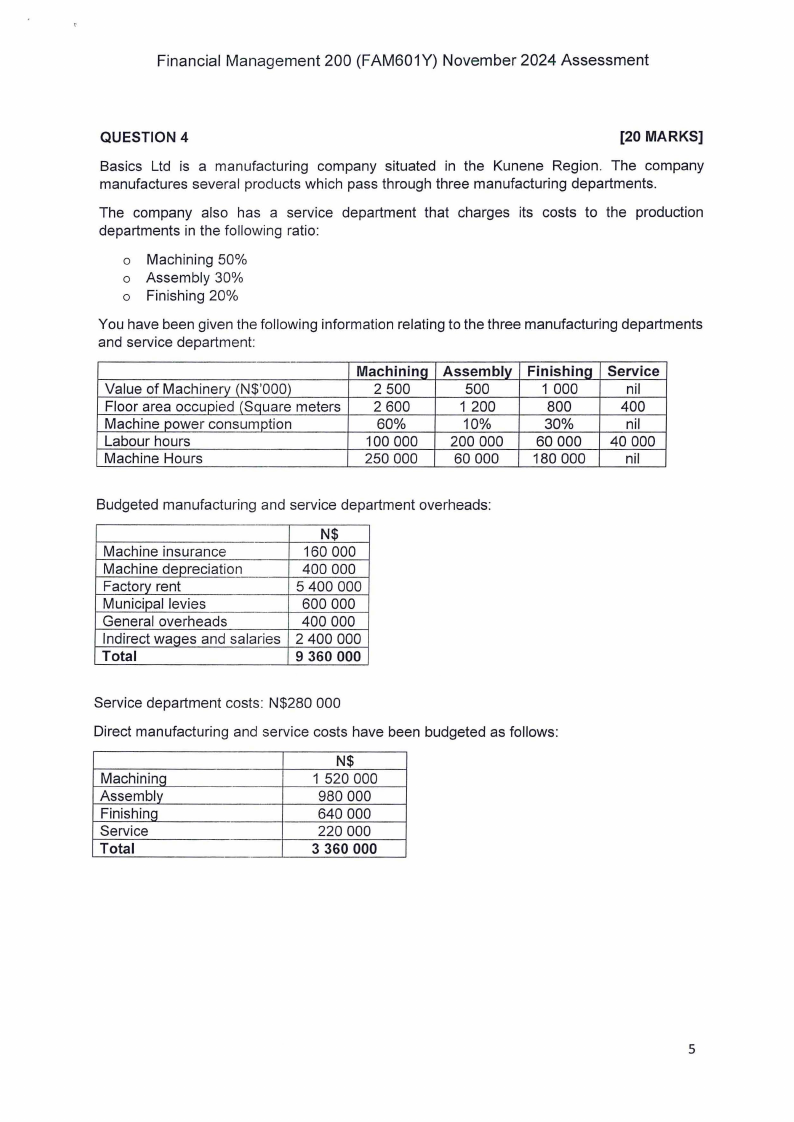

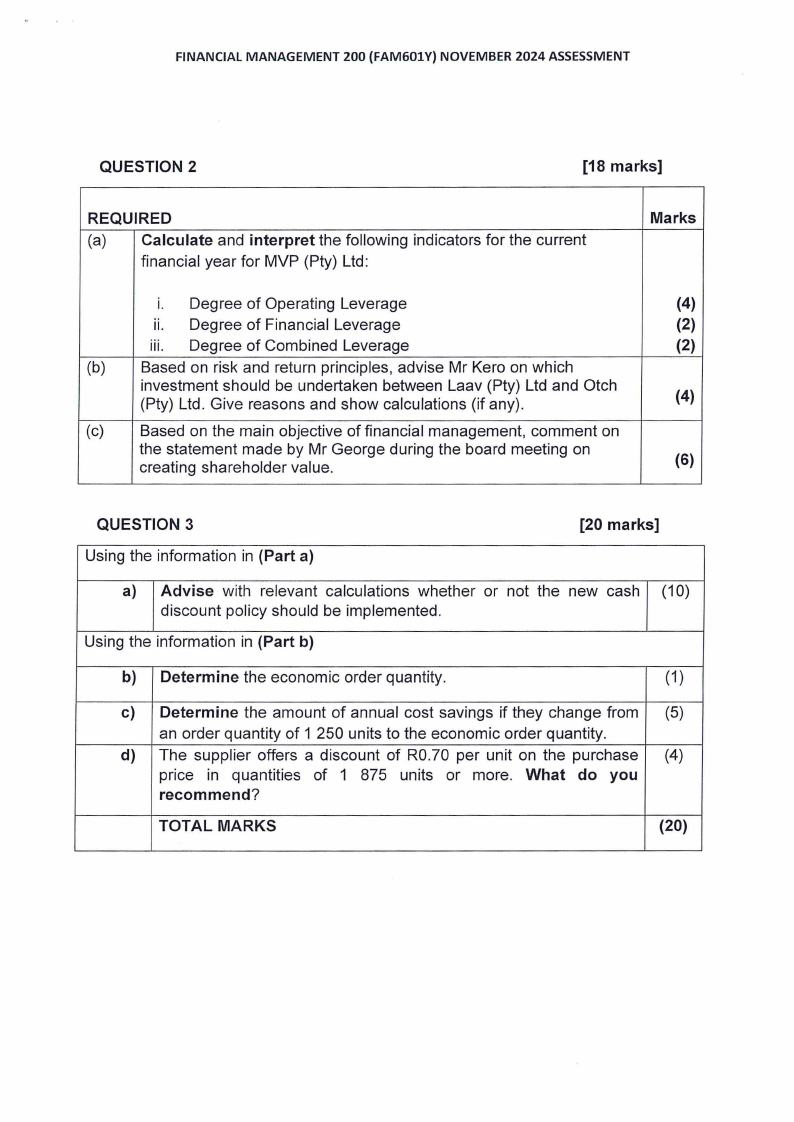

Question 2

[35 MARKS]

You have recently joined MVP (Pty) Ltd as an assistant financial manager. MVP (Pty) Ltd is a

retail company selling electronic gadgets. The company has warehouses and retail stores in

all the major cities across South Africa, with the head office situated in Rustenburg, North

West. You have been asked by Mr Kero, the financial manager, to assist in the review of the

risk management processes of the company. With some research conducted by a reputable

external company, it was noted that competitors of MVP (Pty) Ltd in the industry have an

average degree of operating leverage of 1.9. Mr Kero had invited you to the previous board

meeting, and during the meeting, there was a debate about whether there is still goal

congruence in creating shareholder value within the company; one of the divisional managers

(Mr George) made the following comment:

"To create shareholder value, we need to cut costs where we can so the company can remain

profitable as increasing shareholder value is the same as increasing profits. We need to cut

our advertising costs and lay off some workers in our Secunda branch, as we have too many

there and cut back our corporate social funding we pay out to communities, because we are

not getting anything in return."

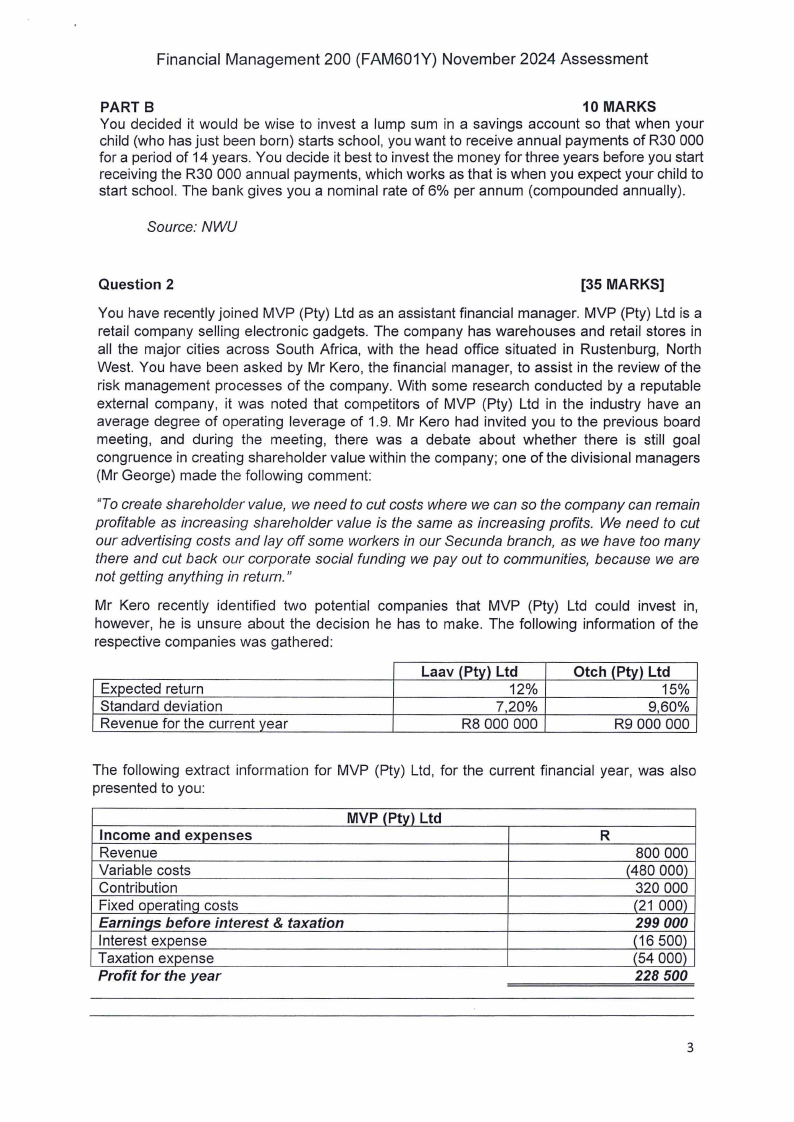

Mr Kero recently identified two potential companies that MVP (Pty) Ltd could invest in,

however, he is unsure about the decision he has to make. The following information of the

respective companies was gathered:

Expected return

Standard deviation

Revenue for the current vear

Laav (Pty) Ltd

12%

7,20%

R8 000 000

Otch (Pty) Ltd

15%

9,60%

R9 000 000

The following extract information for MVP (Pty) Ltd, for the current financial year, was also

presented to you:

MVP (Ptv) Ltd

Income and expenses

Revenue

Variable costs

Contribution

Fixed operatinq costs

Earnings before interest & taxation

Interest expense

Taxation expense

Profit for the year

R

800 000

(480 000)

320 000

(21 000)

299 000

(16 500)

(54 000)

228 500

3