|

IEC820S- INDUSTRIAL ECONOMICS- 1ST OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

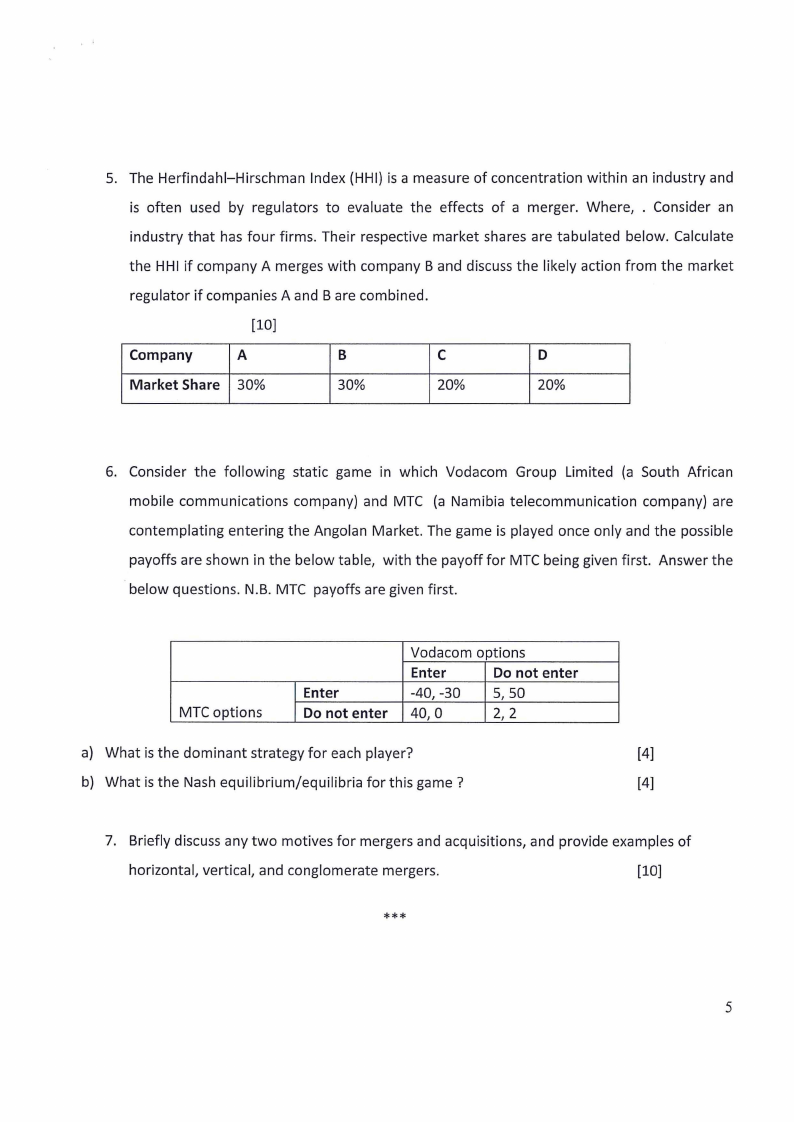

n Am I BIA u n IVERs ITY

OFSCIEnCEAno TECHnOLOGY

FACULTYOF COMMERCE, HUMAN SCIENCES& EDUCATION

DEPARTMENTOF ECONOMICS,ACCOUNTINGAND FINANCE

BACHELOROF ECONOMICSHONOURS

{08BECH)

INDUSTRIALECONOMICS{IEC820S)

DATE:

DURATION:

MARKS:

November 2023

3 Hours

100

EXAMINER

MODERATOR

FIRSTOPPORTUNITYEXAMINATION QUESTION PAPER

Prof. T. KAULIHOWA (Namibia University of Science and Technology)

Dr. E.TINGUM (University of Namibia)

1. This paper consists of 4 pages, excluding this cover page.

2. Calculators are allowed.

3. There are five (5) questions 1 answer any 4 questions

4. Show all your workings and round off only the final answers to 2 decimal places

This paper consists of 5 pages including this cover page and the tables

|

2 Page 2 |

▲back to top |

Question 1

25 Marks

a) The Namibia Competition Commission has hired you to analyse the market for rental cars. A

survey of clients of the top 2 car rental firms (constituting 60% of all rentals) at Hosea Kutako

International Airport reveals significant variation in the rental rates charged to different clients

of the same firm. The rental rates vary substantially across various dimensions: across days of

the week (with week-end rentals substantially lower than daily rental Monday - Thursday), over

rental periods (one-day v. week-end v. weekly v. monthly), and across car models. Furthermore,

the car rental industry is characterised by many promotional rates used by different clients

(corporate discounts, advertised specials, advance reservation rates, etc.). This implies that car

rentals that appear to have identical characteristics (day of week, length of rental, model of car)

often entail different prices. Use the Structure-Conduct-Performance paradigm to discuss

possible explanations for non-uniform pricing strategies and their implication for consumer

welfare.

[10]

b) Patents generate monopolies, and society would be better served by eliminating patents for

innovations. Discuss if this statement is true /false.

[5]

c) According to the Chicago School of thought, larger firms are unlikely to abuse market power in

the long run. Discuss.

[5]

d) Assume a sequential game where two companies, A and B, must decide each month whether to

spend $10 million on advertising or not. If in the first month, one company spends the $10

million and the other does not, the game is over: the first company becomes a monopolist

worth $100 million, and the second company looks for something else to do. If neither

company invests $10 million in the first month, the game is likewise over, with neither company

losing or making money. However, if both companies spend $10 million in the first month,

neither one wins anything. We then move to the second month, where again each company

must decide whether to spend $10 million. If both companies again spend $10 million, we move

to the third month, and so on. If, at the start of some month, one of the companies spends $10

million and the other does not, the first company wins the $100 million prize. But of course,

many months (and much money) could go by before this happens. Suppose you are Company A

and one of your classmates is Company B. Collusion is not permitted. All you can do is decide

whether (and how) to play the game. What should you do in this situation?

[5]

2

|

3 Page 3 |

▲back to top |

Question 2

25 Marks

a) Assume that Namibia's telecommunication Industry is represented by the following cost

function. C (q1, q2) = 10 + q1+ 5q2- 4q1q2 . Where q1 denotes MTC output and q2 represents

Telecom Namibia output. Further to this, assume that Ray's average costs (RAC)adopt 111,= 0.6

production ratio. Use Ray's average cost of multi-product firms to determine if the

telecommunication industry exhibits a global economy or diseconomies of scale. Where. Show

all your steps.

[10]

b) Consider an industry with 6 firms. There are 2 firms, each with a 30% market share, with 4 firms

sharing the remainder. Assume that the Total Industry output measured using revenue is

approximately N$ 1 million. Calculate the Herfindahl-Hirschman Index (HHI) and discuss any

two demerits of using this method to measure Market Concentration. Where; .

[10]

c) Use the information in 2 above to calculate and interpret the CR2. Where [5]

Question 3

25 Marks

1. A new local green hydrogen company XYZ has market power and is characterized by the

downward-sloping demand curve depicted below. It's marginal cost identity is expressed; .

Answer the following questions.

Quantity in Kg

a) Calculate XYZprofit-maximizing output and price.

[5]

b) Due to supply chain disruptions, XYZ demand decreases to . Calculate XYZ profit-maximizing

level of output and price. Comment on how this compares with your answer in a) above.

[5]

3

|

4 Page 4 |

▲back to top |

c) Draw a diagram showing the above two outcomes. Holding the marginal cost constant, discuss

how the shape of the demand curve affects XYZ's ability to exercise market power (i.e. charge

high price).

[S]

2. Suppose that the Bank Windhoek Ltd made an offer to acquire Letshego Bank that consists of

the purchase of 4 million shares at $10 per share. The value of Letshego Bank shares before the

bid was made public was $8 per share. Bank Windhoek shares are trading at $20 per share, and

there are 8 million shares outstanding. Bank Windhoek estimates that it is likely to reduce costs

through economics of scale with this merger of $1 million per year, forever. The appropriate

discount rate for these gains is assumed to be 10%. Answer the following question.

a) Calculate the synergistic gains from this merger?

[2]

b) What is the estimated value of the Bank Windhoek post-merger?

[S]

c) Briefly discuss if this proposed merger is likely to be approved/rejected by the regulator [3]

Question 4

25 Marks

1. Assume an oligopolistic industry with two identical firms (MTC-Namibia & Paratus) with inverse

demand function P = 62 - 2Q and total cost functions , . Where q1 & Cl are the quantity and

cost for MTC-Namibia and q2 & C2 represent quantity & cost for Paratus respectively. Answer

the following questions.

a) Assume MTC has a first-mover advantage to set prices and Paratus follows. What are the

equilibrium values of profit and quantities for each firm?

[10]

b) Use the Lerner index to determine the level of market power and discuss its implication to the

Structure Contact Performance Paradigm.

[3]

c) Calculate the welfare loss (WL) arising from market power, where ; and represents price

elasticity of demand.

[4]

2. Consider a differentiated product duopoly game in which firms have three price strategies:

C=collusion, B=Bertrand and W= price war. Pay-offs for the two firms are given below in order.

Where; denotes profit. Answer the subsequent questions.

I Firm2 strategies

4

|

5 Page 5 |

▲back to top |

Firm1 strategies

C

B

w

C

2;2

0;5

-1; 5

B

5;0

2;2

-1; 1

w

5, -1

2; -1

O;O

a) What is the dominant strategy for each player?

[2]

b) What is the Nash Equilibrium/equilibria if the game is played only once?

[2]

c) Is there any sub-prefect equilibrium? Motivate your answer.

[4]

Question 5

25 marks

1. Namib Poultry PTY LTD wants to impose an exclusive dealing clause with retailers. Discuss the

market power effects of this practice on both the consumer and upstream competition. [9]

2. Explain the basic determinants of market structure and key issues for competition policy and

regulation.

[8]

3. It is often argued that monopoly firms are bad due to their inability to ensure allocative and

productive efficiencies. Discuss the implications of National utility companies such as

NAM POWER& NAMWATER on static and dynamic efficiencies.

[8]

****

5