|

CAC710S- COMPUTERIZED ACCOUNTING 301- 1ST OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

r

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT: ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION: Bachelor of Accounting/ Bachelor of Accounting Chartered

QUALIFICATION CODE: 07BOAC/07BACC

LEVEL: 7

COURSE: Computerised Accounting 301

COURSE CODE: CAC710S

DATE: June 2023

SESSION: Practical

DURATION: 3 Hours

MARKS: 100

EXAMINER(S)

MODERATOR:

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

E Kangootui & Y Elago

E. Milijala

INSTRUCTIONS

1. This exam paper is made up of one question with 3 parts (A-C).

2. Make sure that your student number appears on all reports. (Computer printed)

3. It is student's responsibility to ensure that all reports are handed in directly to the

invigilators.

4. Use of internet or any communication devices is strictly prohibited.

5. Questions relating to this examination may be raised in the initial 30 minutes after the

start of the paper. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities & any assumption made by the candidate should be clearly

stated.

6. Round of all calculations to the nearest two decimal place.

THIS QUESTION PAPER CONSISTS OF _8_ PAGES (Including this front page)

1

|

2 Page 2 |

▲back to top |

Part A

(30 marks)

Beetroot has a passion for photography and earned pocket money by taking photographs for

friends and family while at school. He did a course in photography when he left school and has

turned his hobby into a business and employed you to do his bookkeeping.

Beetroot's business is called Beetroot's Printing Shop (Pty) Ltd. He runs the business from Shop

3, Village Shopping Centre, New Road, Karibib. He has rented a post-box and the address is P. 0.

Box 1478, Karibib. He has an email address also, Beetrootsps@gmail.com. VAT vendor, number

is 4255112015 and he process all amounts 15% exclusive unless otherwise stated.

Beetroot's motto for the business is "Making memories last a lifetime", and he would like to

have it on the invoices and statements going out to customers.

The business has been in operation for a year, and they purchased a new computer and Sage

Pastel Partner V19 accounting software to computerize the accounting records of the firm.

Beetroot has a current account at Nedbank, and the bank account no. is 0527903514. The

balance at the beginning of the current year is $12 300. He has a $50 000-overdraft-facility

arrangement with the bank. He also has a petty cash box, which will be assigned to you, with

the imprest amount of $4000.

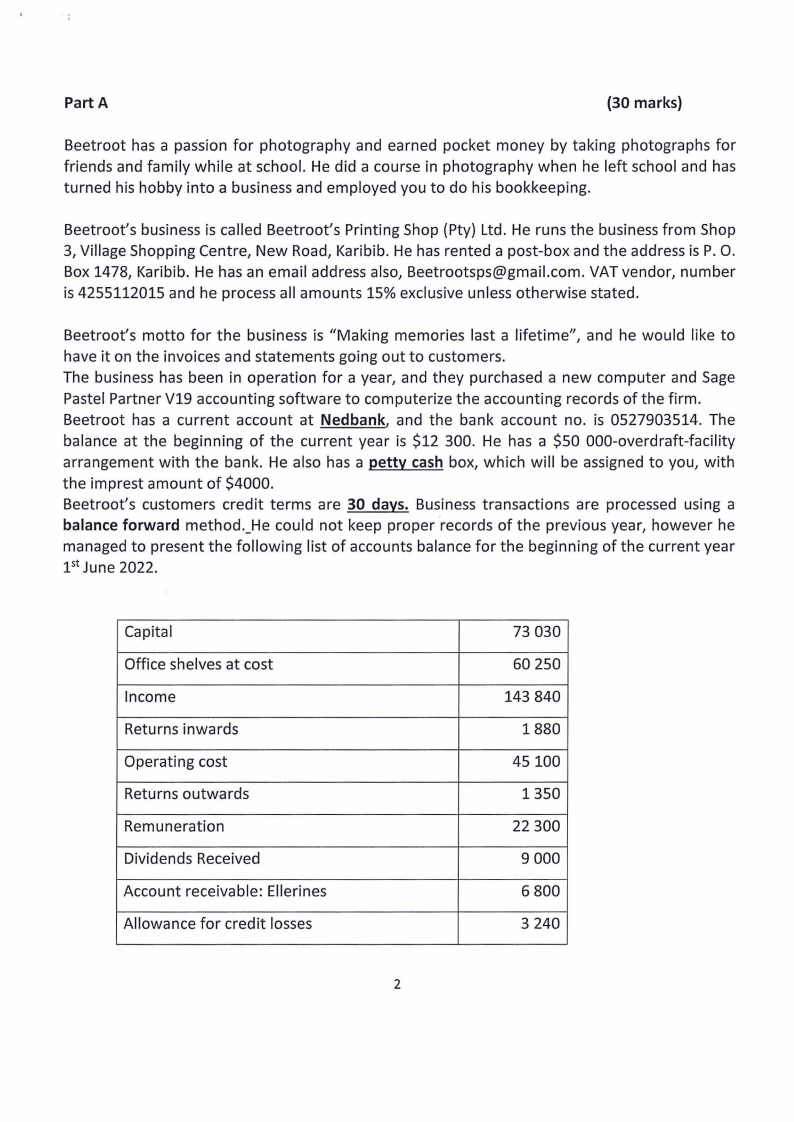

Beetroot's customers credit terms are 30 days. Business transactions are processed using a

balance forward method._He could not keep proper ·records of the previous year, however he

managed to present the following list of accounts balance for the beginning of the current year

1st June 2022.

Capital

Office shelves at cost

Income

Returns inwards

Operating cost

Returns outwards

Remuneration

Dividends Received

Account receivable: Ellerines

Allowance for credit losses

2

73 030

60 250

143 840

1880

45100

1350

22 300

9 000

6800

3 240

|

3 Page 3 |

▲back to top |

Rates & taxes

Delivery vehicle at cost

Bad debts

Casual cleaners

Promotion pamphlets

Commission received

Petty cash

Interest earned

Carriage on consumables

Drawings

11.25% Fixed deposit: FNB

6% Debenture issued

5% Debenture purchased

48% Controlling interest: Fedex Ltd

HP Praline laptop

2 890

94 550

1200

3 565

1300

2 390

2 500

1530

815

17100

15 000

50 580

60450

80 000

30 450

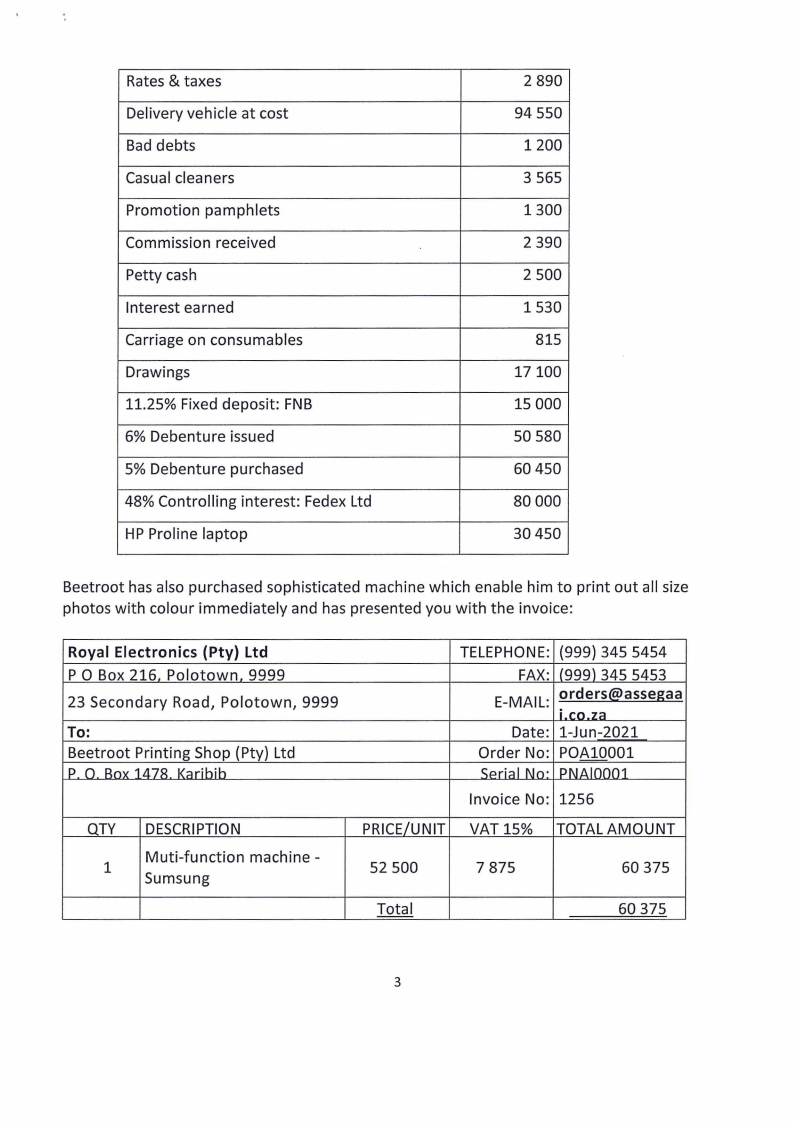

Beetroot has also purchased sophisticated machine which enable him to print out all size

photos with colour immediately and has presented you with the invoice:

Royal Electronics {Pty) Ltd

PO Box 216 Polotown. 9999

23 Secondary Road, Polotown, 9999

To:

Beetroot Printing Shop (Pty) Ltd

P n Rrw 14.7g K;:irihih

QTY

1

DESCRIPTION

Muti-function machine -

Sumsung

TELEPHONE: (999) 345 5454

FAX: (999) 345 5453

E-MAIL: orders@assegaa

i rn 7~

Date: 1-Jun-2021

Order No: POA10001

<:;pri;:il Nn· PNAlnnn1

Invoice No: 1256

PRICE/UNIT VAT 15% TOTAL AMOUNT

52 500

7 875

60 375

Total

60 375

3

|

4 Page 4 |

▲back to top |

All non-current assets were brought into use at the inception date and are depreciated using

the straight-line method. These ·assetshave a useful life five years and a residual value equal

to 10% of their cost. The firm use the cost method to account for all its non-current asset.

Required:

1. You are required to process the opening balances of Beetroot's Printing Shop (Pty) Ltd

accounts, including accumulated depreciation for all non-current assets (Period one).

2. Update all batches and move on the next question.

Part B

(40 Marks)

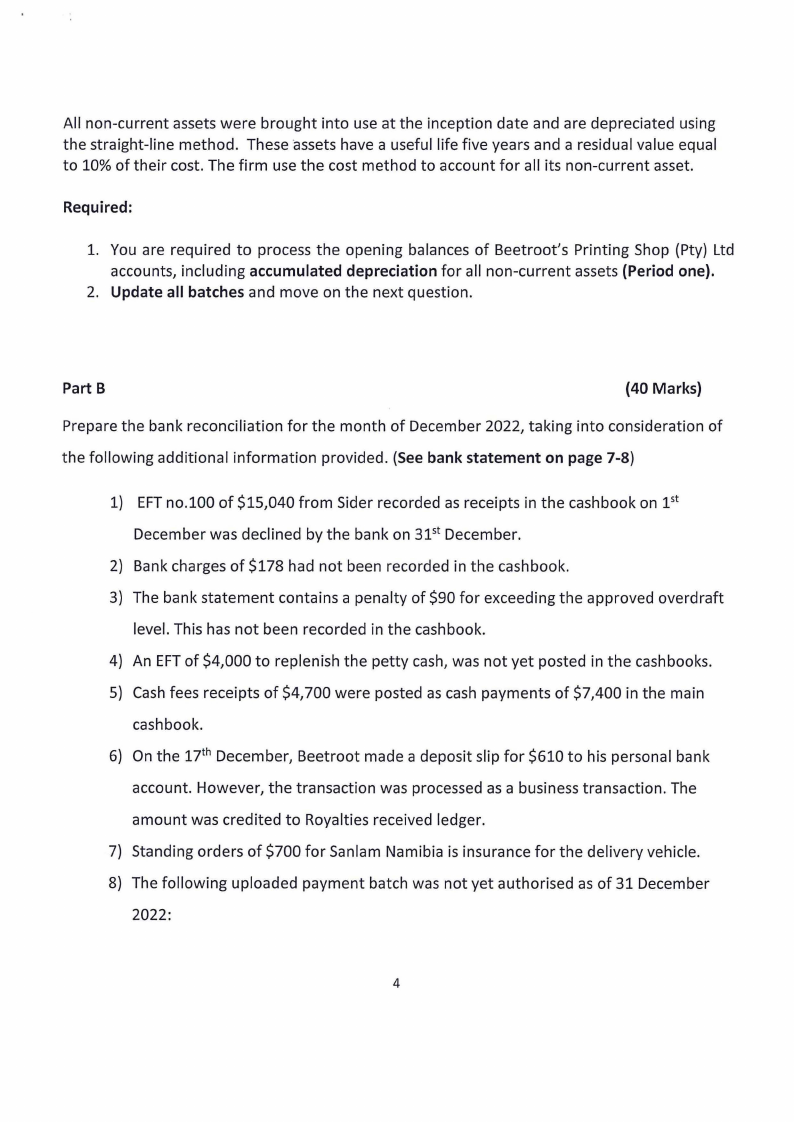

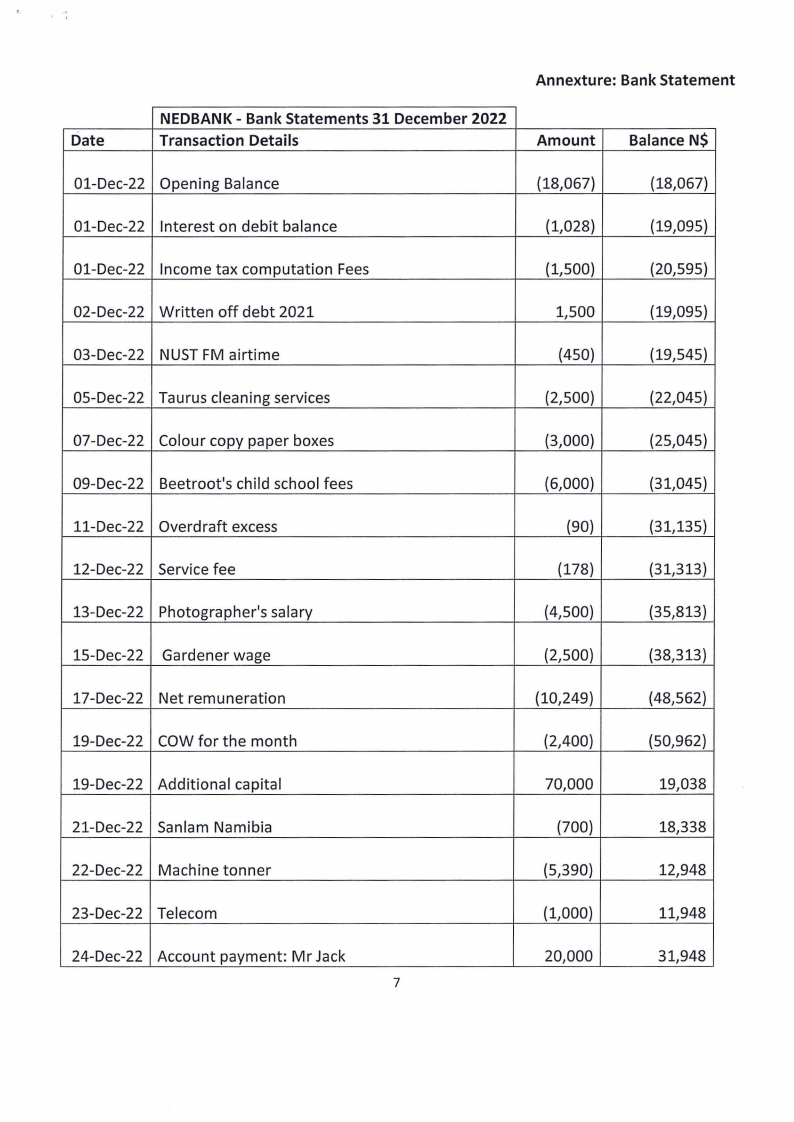

Prepare the bank reconciliation for the month of December 2022, taking into consideration of

the following additional information provided. (See bank statement on page 7-8)

1) EFTno.100 of $15,040 from Sider recorded as receipts in the cashbook on pt

December was declined by the bank on 3i5t December.

2) Bank charges of $178 had not been recorded in the cashbook.

3) The bank statement contains a penalty of $90 for exceeding the approved overdraft

level. This has not been recorded in the cashbook.

4) An EFTof $4,000 to replenish the petty cash, was not yet posted in the cashbooks.

5) Cash fees receipts of $4,700 were posted as cash payments of $7,400 in the main

cashbook.

6) On the 17th December, Beetroot made a deposit slip for $610 to his personal bank

account. However, the transaction was processed as a business transaction. The

amount was credited to Royalties received ledger.

7) Standing orders of $700 for Sanlam Namibia is insurance for the delivery vehicle.

8) The following uploaded payment batch was not yet authorised as of 31 December

2022:

4

|

5 Page 5 |

▲back to top |

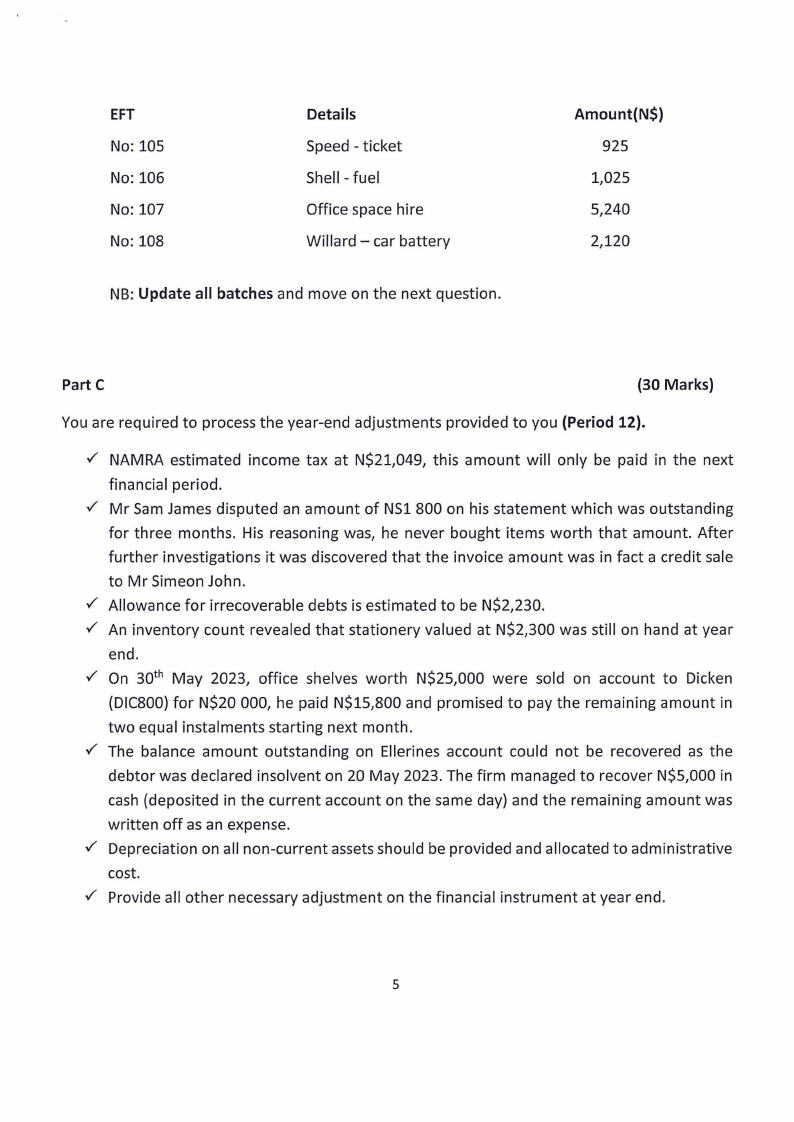

EFT

No:105

No:106

No: 107

No:108

Details

Speed - ticket

Shell - fuel

Office space hire

Willard - car battery

NB: Update all batches and move on the next question.

Amount(N$)

925

1,025

5,240

2,120

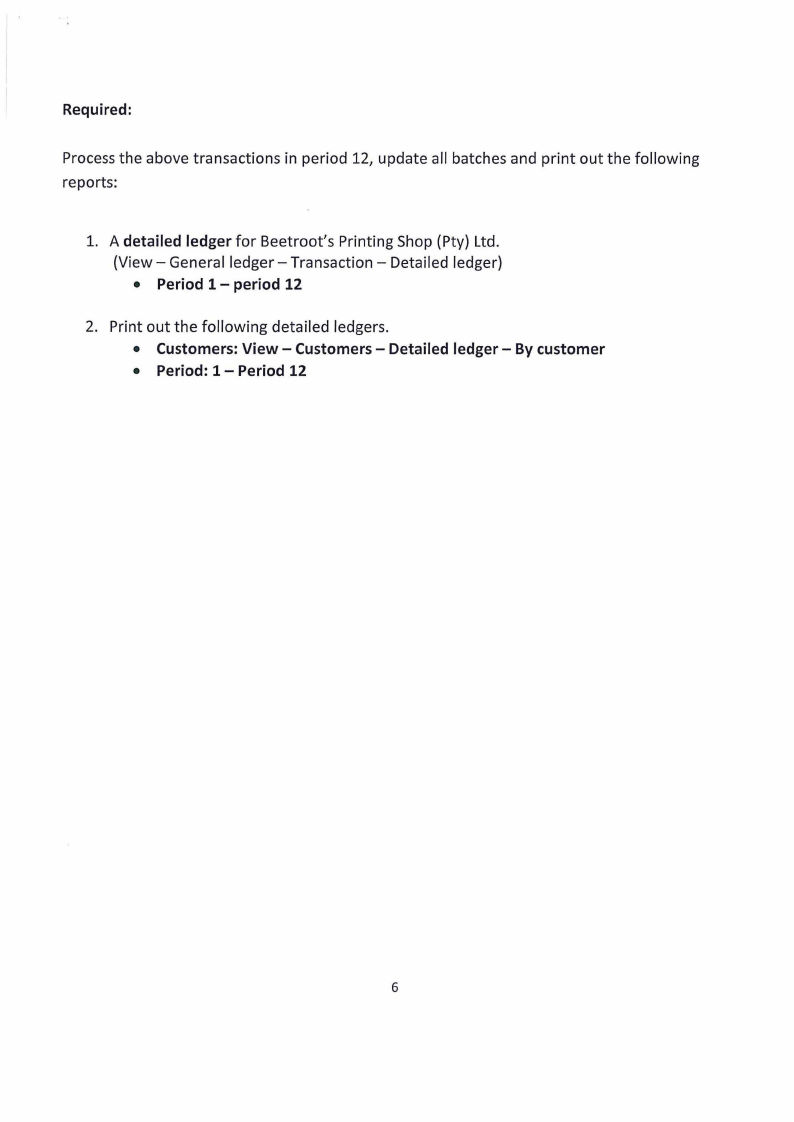

Part C

(30 Marks)

You are required to process the year-end adjustments provided to you (Period 12).

NAMRA estimated income tax at N$21,049, this amount will only be paid in the next

financial period.

Mr Sam James disputed an amount of NS1 800 on his statement which was outstanding

for three months. His reasoning was, he never bought items worth that amount. After

further investigations it was discovered that the invoice amount was in fact a credit sale

to Mr Simeon John.

Allowance for irrecoverable debts is estimated to be N$2,230.

An inventory count revealed that stationery valued at N$2,300 was still on hand at year

end.

On 30th May 2023, office shelves worth N$25,000 were sold on account to Dicken

(DIC800) for N$20 000, he paid N$15,800 and promised to pay the remaining amount in

two equal instalments starting next month.

The balance amount outstanding on Ellerines account could not be recovered as the

debtor was declared insolvent on 20 May 2023. The firm managed to recover N$5,000 in

cash (deposited in the current account on the same day) and the remaining amount was

written off as an expense.

Depreciation on all non-current assets should be provided and allocated to administrative

cost.

Provide all other necessary adjustment on the financial instrument at year end.

5

|

6 Page 6 |

▲back to top |

Required:

Process the above transactions in period 12, update all batches and print out the following

reports:

1. A detailed ledger for Beetroot's Printing Shop (Pty) Ltd.

(View - General ledger-Transaction - Detailed ledger)

• Period 1 - period 12

2. Print out the following detailed ledgers.

• Customers: View - Customers - Detailed ledger - By customer

• Period: 1- Period 12

6

|

7 Page 7 |

▲back to top |

Date

NEDBANK - Bank Statements 31 December 2022

Transaction Details

Annexture: Bank Statement

Amount

Balance N$

01-Dec-22 Opening Balance

(18,067)

(18,067)

01-Dec-22 Interest on debit balance

(1,028)

(19,095)

01-Dec-22 Income tax computation Fees

(1,500)

(20,595)

02-Dec-22 Written off debt 2021

1,500

(19,095)

03-Dec-22 NUST FM airtime

(450)

(19,545)

0S-Dec-22 Taurus cleaning services

(2,500)

(22,045)

07-Dec-22 Colour copy paper boxes

(3,000)

(25,045)

09-Dec-22 Beetroot's child school fees

(6,000)

(31,045)

11-Dec-22 Overdraft excess

(90)

(31,135)

12-Dec-22 Service fee

(178)

(31,313)

13-Dec-22 Photographer's salary

(4,500)

(35,813)

15-Dec-22 Gardener wage

(2,500)

(38,313)

17-Dec-22 Net remuneration

(10,249)

(48,562)

19-Dec-22 COW for the month

(2,400)

(50,962)

19-Dec-22 Additional capital

70,000

19,038

21-Dec-22 Sanlam Namibia

(700)

18,338

22-Dec-22 Machine tanner

(5,390)

12,948

23-Dec-22 Telecom

(1,000)

11,948

24-Dec-22 Account payment: Mr Jack

7

20,000

31,948

|

8 Page 8 |

▲back to top |

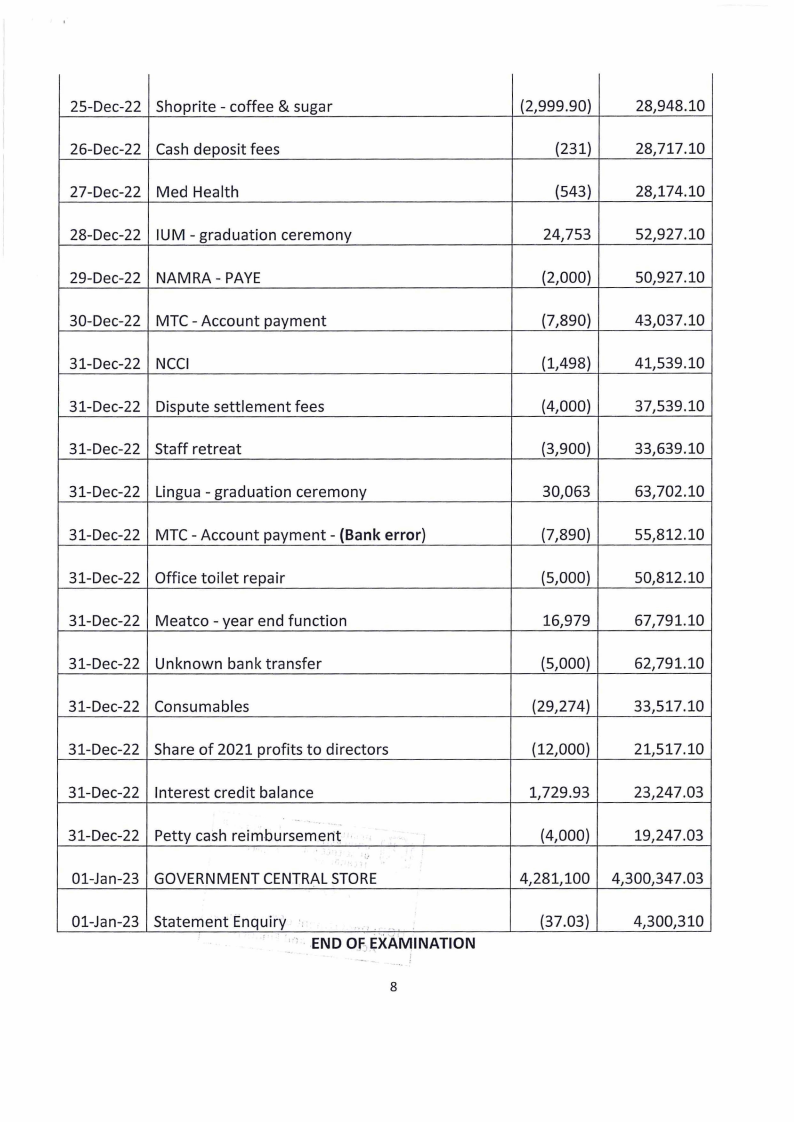

25-Dec-22 Shoprite - coffee & sugar

26-Dec-22 Cash deposit fees

27-Dec-22 Med Health

28-Dec-22 IUM - graduation ceremony

29-Dec-22 NAMRA- PAYE

30-Dec-22 MTC - Account payment

31-Dec-22 NCCI

31-Dec-22 Dispute settlement fees

31-Dec-22 Staff retreat

31-Dec-22 Lingua - graduation ceremony

31-Dec-22 MTC - Account payment - {Bankerror)

31-Dec-22 Office toilet repair

31-Dec-22 Meatco - year end function

31-Dec-22 Unknown bank transfer

31-Dec-22 Consumables

31-Dec-22 Share of 2021 profits to directors

31-Dec-22 Interest credit balance

.,

31-Dec-22 Petty cash reimbursemen~ •

'

01-Jan-23 GOVERNMENTCENTRALSTORE

01-Jan-23 Statement Enquiry ·.

. : . ....

END Of:,~XAMINATION

8

(2,999.90)

28,948.10

(231)

28,717.10

(543)

28,174.10

24,753

52,927.10

(2,000)

50,927.10

(7,890)

43,037.10

(1,498)

41,539.10

(4,000)

37,539.10

(3,900)

33,639.10

30,063

63,702.10

(7,890)

55,812.10

(5,000)

50,812.10

16,979

67,791.10

(5,000)

62,791.10

(29,274)

33,517.10

(12,000)

21,517.10

1,729.93

23,247.03

(4,000)

19,247.03

4,281,100 4,300,347.03

(37.03)

4,300,310