|

BAP521S - BUSINESS APPLICATION 1B - 1ST OPP - NOV 2024 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF GOVERNANCE AND MANAGEMENT SCIENCES

QUALIFICATION: Bachelor of Business and Information Administration

QUALIFICATION CODE: 07BBIA

LEVEL: 5

COURSE CODE: BAP521S

COURSE NAME: Business Applications lB

SESSION: November 2024

PAPER: Practical Paper

DURATION: 2 Hours

MARKS: 100

EXAMINER($)

FIRST OPPORTUNITY EXAMINATION PAPER

Ms Ester Vaino

MODERATOR: Ms Lindie Tripodi

INSTRUCTIONS

1. Answer ALL the questions.

2. Read questions carefully before answering.

3. Make sure your name, surname, question number and the date appear in the

Header and Footer.

4. Give special attention to the manuscript instructions.

5. Print all your questions and save all the questions in the folder on your desktop.

|

2 Page 2 |

▲back to top |

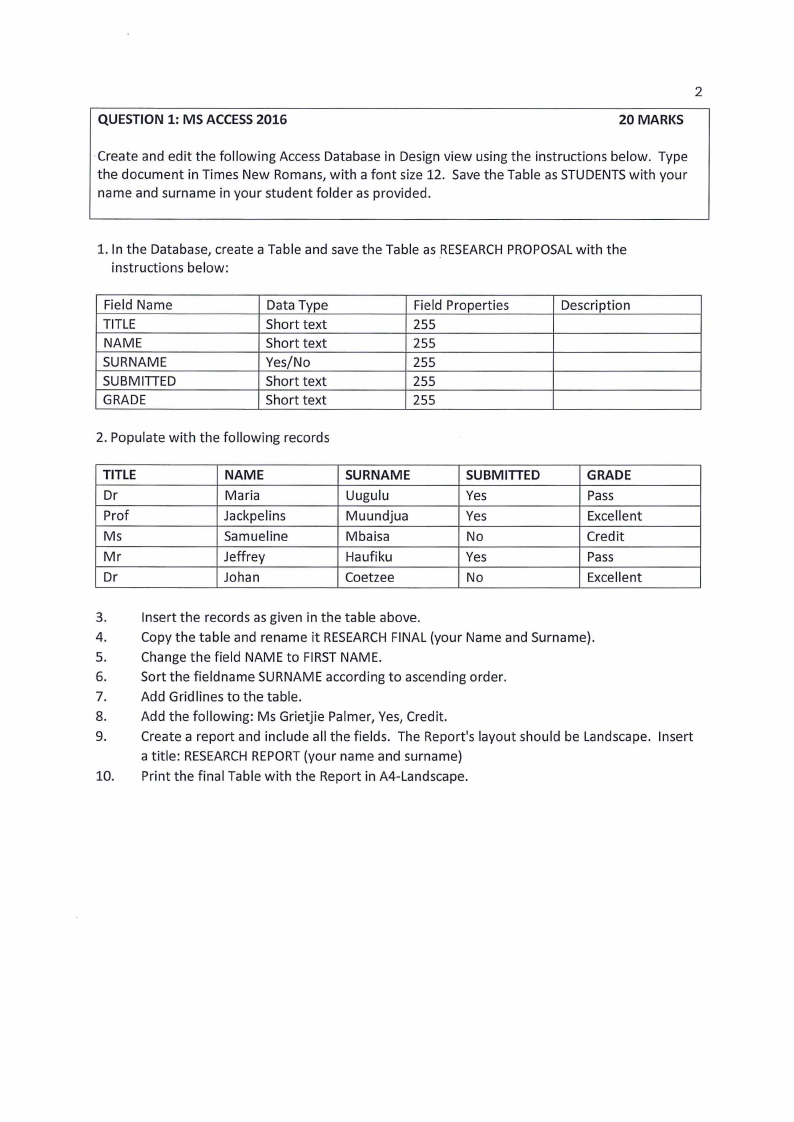

QUESTION 1: MS ACCESS2016

2

20 MARKS

·Create and edit the following Access Database in Design view using the instructions below. Type

the document in Times New Romans, with a font size 12. Save the Table as STUDENTSwith your

name and surname in your student folder as provided.

1. In the Database, create a Table and save the Table as .RESEARCHPROPOSALwith the

instructions below:

Field Name

TITLE

NAME

SURNAME

SUBMITTED

GRADE

Data Type

Short text

Short text

Yes/No

Short text

Short text

Field Properties

255

255

255

255

255

Description

2. Populate with the following records

TITLE

Dr

Prof

Ms

Mr

Dr

NAME

Maria

Jackpelins

Samueline

Jeffrey

Johan

SURNAME

Uugulu

Muundjua

Mbaisa

Haufiku

Coetzee

SUBMITTED

Yes

Yes

No

Yes

No

GRADE

Pass

Excellent

Credit

Pass

Excellent

3.

Insert the records as given in the table above.

4.

Copy the table and rename it RESEARCHFINAL (your Name and Surname).

5.

Change the field NAME to FIRSTNAME.

6.

Sort the field name SURNAME according to ascending order.

7.

Add Grid lines to the table.

8.

Add the following: Ms Grietjie Palmer, Yes, Credit.

9.

Create a report and include all the fields. The Report's layout should be Landscape. Insert

a title: RESEARCHREPORT(your name and surname)

10. Print the final Table with the Report in A4-Landscape.

|

3 Page 3 |

▲back to top |

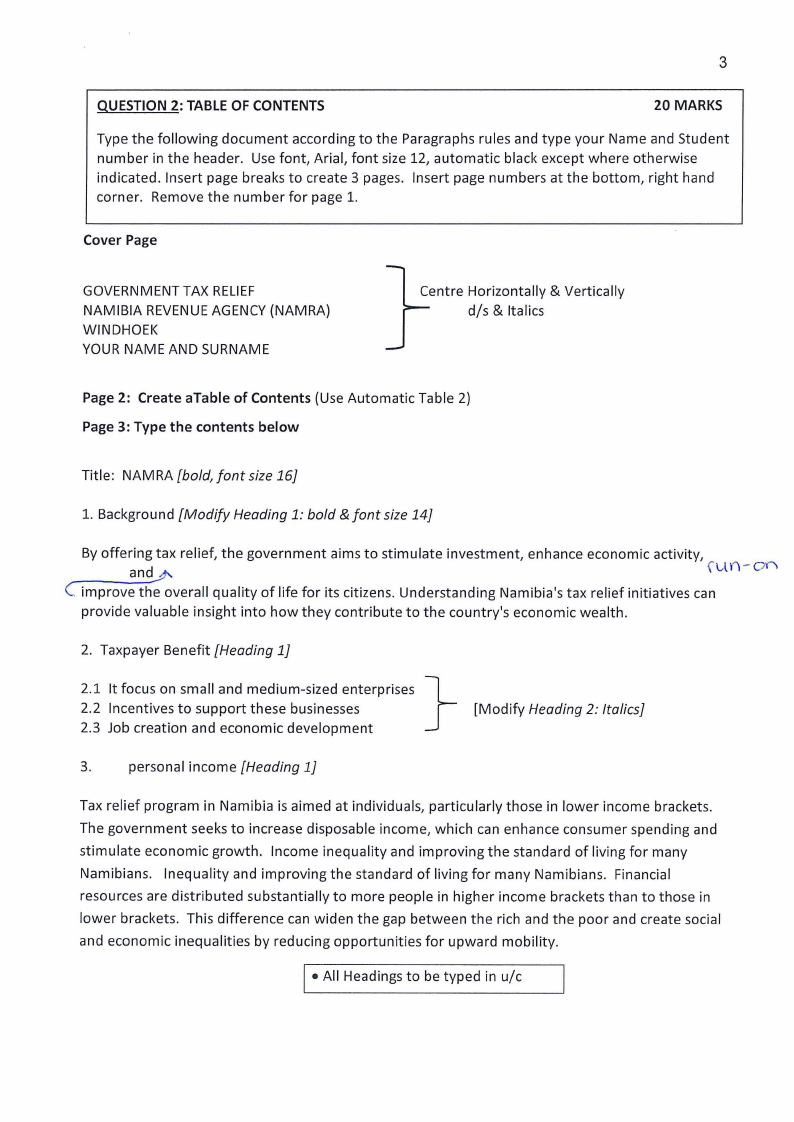

3

QUESTION 2: TABLE OF CONTENTS

20 MARKS

Type the following document according to the Paragraphs rules and type your Name and Student

number in the header. Use font, Arial, font size 12, automatic black except where otherwise

indicated. Insert page breaks to create 3 pages. Insert page numbers at the bottom, right hand

corner. Remove the number for page 1.

Cover Page

GOVERNMENT TAX RELIEF

NAMIBIA REVENUEAGENCY(NAMRA)

WINDHOEK

YOUR NAME AND SURNAME

Centre Horizontally & Vertically

d/s & Italics

Page 2: Create aTable of Contents (Use Automatic Table 2)

Page 3: Type the contents below

Title: NAM RA [bold,font size 16}

1. Background [Modify Heading 1: bold & font size 14}

By offering tax relief, the government aims to stimulate investment, enhance economic activity,

and_p

fl,ln·-OY""\\

C.improve the overall quality of life for its citizens. Understanding Namibia's tax relief initiatives can

provide valuable insight into how they contribute to the country's economic wealth.

2. Taxpayer Benefit [Heading 1}

2.1 It focus on small and medium-sized enterprises }

2.2 Incentives to support these businesses

2.3 Job creation and economic development

[Modify Heading 2: Italics]

3.

personal income [Heading 1}

Tax relief program in Namibia is aimed at individuals, particularly those in lower income brackets.

The government seeks to increase disposable income, which can enhance consumer spending and

stimulate economic growth. Income inequality and improving the standard of living for many

Namibians. Inequality and improving the standard of living for many Namibians. Financial

resources are distributed substantially to more people in higher income brackets than to those in

lower brackets. This difference can widen the gap between the rich and the poor and create social

and economic inequalities by reducing opportunities for upward mobility.

I • All Headings to be typed in u/c

|

4 Page 4 |

▲back to top |

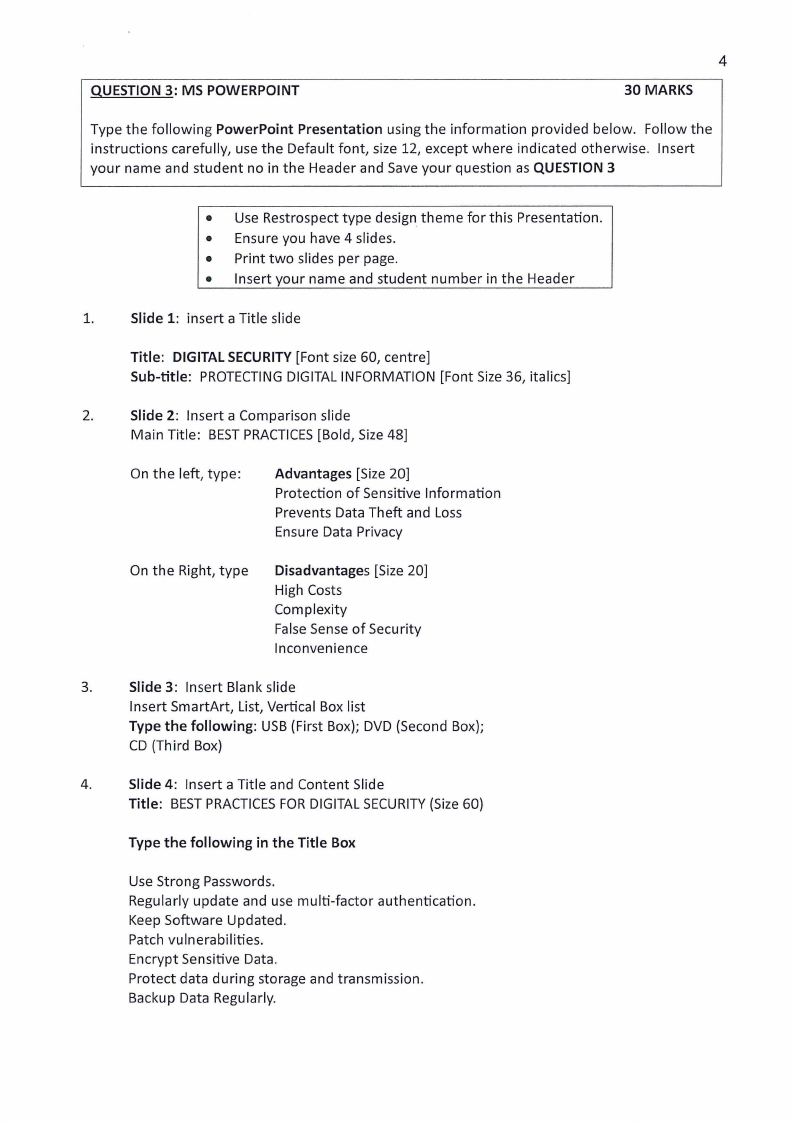

QUESTION 3: MS POWERPOINT

4

30 MARKS

Type the following PowerPoint Presentation using the information provided below. Follow the

instructions carefully, use the Default font, size 12, except where indicated otherwise. Insert

your name and student no in the Header and Save your question as QUESTION 3

• Use Restrospect type design theme for this Presentation.

• Ensure you have 4 slides.

• Print two slides per page.

• Insert your name and student number in the Header

1.

Slide 1: insert a Title slide

Title: DIGITAL SECURITY [Font size 60, centre]

Sub-title: PROTECTINGDIGITAL INFORMATION [Font Size 36, italics]

2.

Slide 2: Insert a Comparison slide

Main Title: BESTPRACTICES[Bold, Size 48]

On the left, type:

Advantages [Size 20]

Protection of Sensitive Information

Prevents Data Theft and Loss

Ensure Data Privacy

On the Right, type

Disadvantages [Size 20]

High Costs

Complexity

False Sense of Security

Inconvenience

3.

Slide 3: Insert Blank slide

Insert SmartArt, List, Vertical Box list

Type the following: USB (First Box); DVD (Second Box);

CD (Third Box)

4.

Slide 4: Insert a Title and Content Slide

Title: BESTPRACTICESFOR DIGITALSECURITY(Size 60)

Type the following in the Title Box

Use Strong Passwords.

Regularly update and use multi-factor authentication.

Keep Software Updated.

Patch vulnerabilities.

Encrypt Sensitive Data.

Protect data during storage and transmission.

Backup Data Regularly.

|

5 Page 5 |

▲back to top |

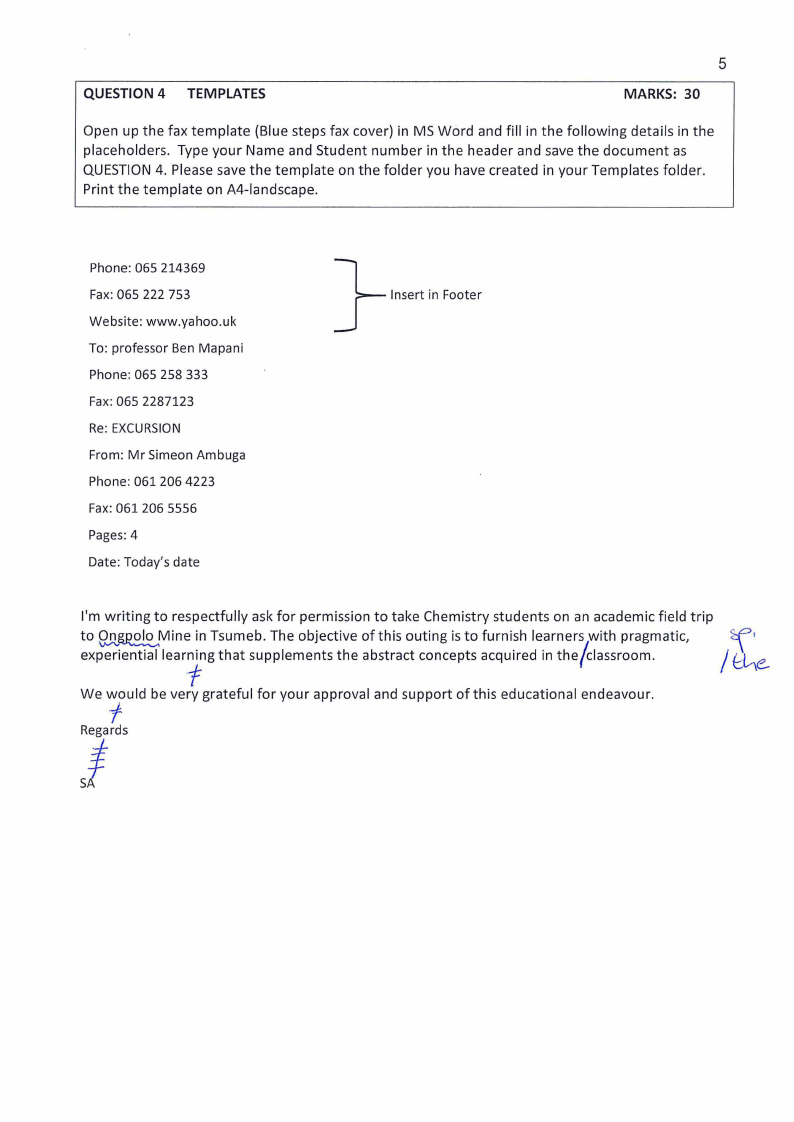

QUESTION 4 TEMPLATES

5

MARKS: 30

Open up the fax template (Blue steps fax cover) in MS Word and fill in the following details in the

placeholders. Type your Name and Student number in the header and save the document as

QUESTION 4. Please save the template on the folder you have created in your Templates folder.

Print the template on A4-landscape.

Phone: 065 214369

Fax: 065 222 753

Website: www.yahoo.uk

To: professor Ben Mapani

Phone: 065 258 333

Fax:065 2287123

Re: EXCURSION

From: Mr Simeon Ambuga

Phone: 061 206 4223

Fax: 061 206 5556

Pages:4

Date: Today's date

}

Insert in Footer

I'm writing to respectfully ask for permission to take Chemistry students on an academic field trip

to~~

Mine in Tsumeb. The objective of this outing is to furnish learners with pragmatic,

experiential learning that supplements the abstract concepts acquired in the/classroom.

·i

We would be very grateful for your approval and support of this educational endeavour.

-f

Regards

I

SA

~s

/ f::~e..