|

CMA611S-COST MANAGEMENT ACCOUNTING 201-2ND OPP-JULY 2022 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION : BACHELOR OF ACCOUNTING

QUALi FiCATION CODE: 07BOAC

COURSE: COST & MANAGEMENT

ACCOUNTING 201

LEVEL: 6

COURSE CODE: CMA611S

DATE: JUNE 2022

SESSION: THEORY & CALCULATIONS

DURATION: 3 HOURS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION

FIRST

EXAMINER:

MODERATOR:

Ms H. Kangala, Mr G. Sheehama, Mr H. Namwandi

Mr K. Tjondu

INSTRUCTIONS

1. This question paper is made up of FIVE (5) questions.

2. Answer All the questions and in blue or black ink.

3. You are advised to pay due attention to expression and presentation. Failure to do so will

cost you marks.

4. Start each question on a new page in your answer booklet and show all your workings.

5. Questions relating to this paper may be raised in the initial 30 minutes after the start of the

paper. Thereafter, candidates must use their initiative to deal with any perceived error or

ambiquities and any assumption made by the candidate should be clearly stated.

PERMISSIBLE MATERIALS

Non-programmable calculator/financial calculator

THIS QUESTION PAPER CONSISTS OF 7 PAGES (Including this front page)

1

|

2 Page 2 |

▲back to top |

Question 1

20 Marks

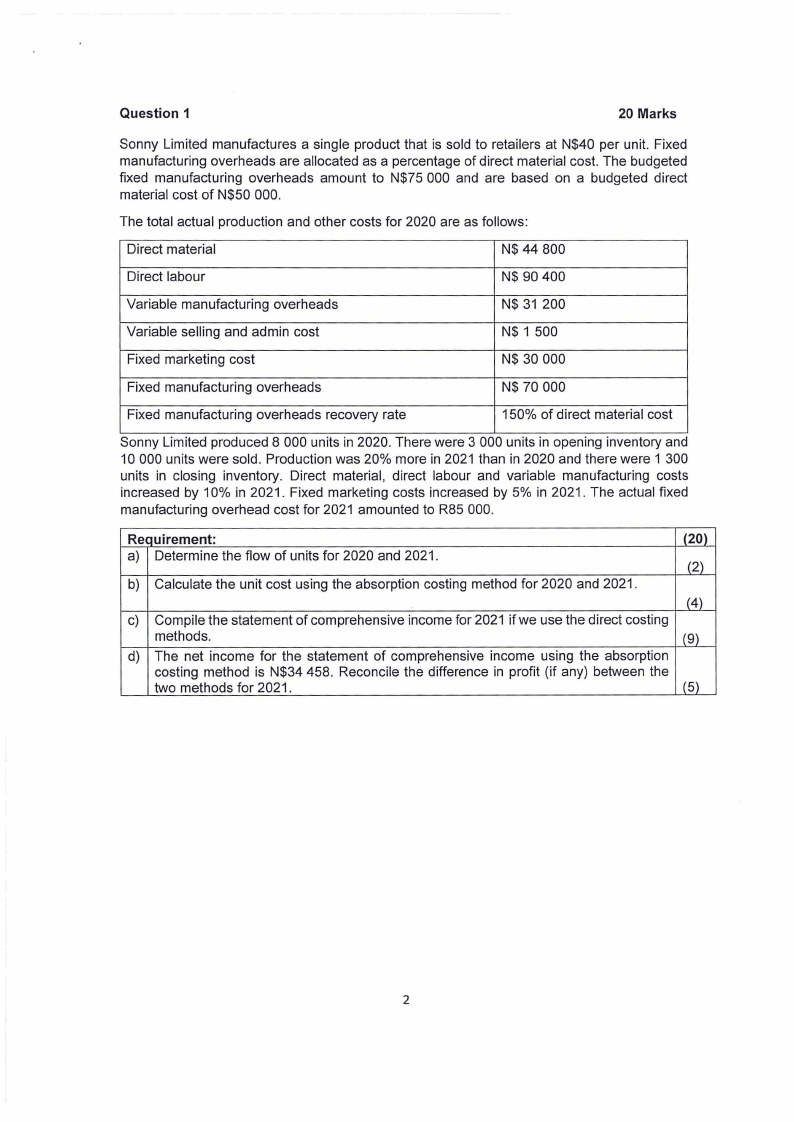

Sonny Limited manufactures a single product that is sold to retailers at N$40 per unit. Fixed

manufacturing overheads are allocated as a percentage of direct material cost. The budgeted

fixed manufacturing overheads amount to N$75 000 and are based on a budgeted direct

material cost of N$50 000.

The total actual production and other costs for 2020 are as follows:

Direct material

N$ 44 800

Direct labour

N$ 90 400

Variable manufacturing overheads

N$ 31 200

Variable selling and admin cost

N$ 1 500

Fixed marketing cost

N$ 30 000

Fixed manufacturing overheads

N$ 70 000

Fixed manufacturing overheads recovery rate

150% of direct material cost

Sonny Limited produced 8 000 units in 2020. There were 3 000 units in opening inventory and

10 000 units were sold. Production was 20% more in 2021 than in 2020 and there were 1 300

units in closing inventory. Direct material, direct labour and variable manufacturing costs

increased by 10% in 2021. Fixed marketing costs increased by 5% in 2021. The actual fixed

manufacturing overhead cost for 2021 amounted to R85 000.

Requirement:

(20)

a) Determine the flow of units for 2020 and 2021.

(2)

b) Calculate the unit cost using the absorption costing method for 2020 and 2021.

(4)

c) Compile the statement of comprehensive income for 2021 if we use the direct costing

methods.

(9)

d) The net income for the statement of comprehensive income using the absorption

costing method is N$34 458. Reconcile the difference in profit (if any) between the

two methods for 2021.

(5)

2

|

3 Page 3 |

▲back to top |

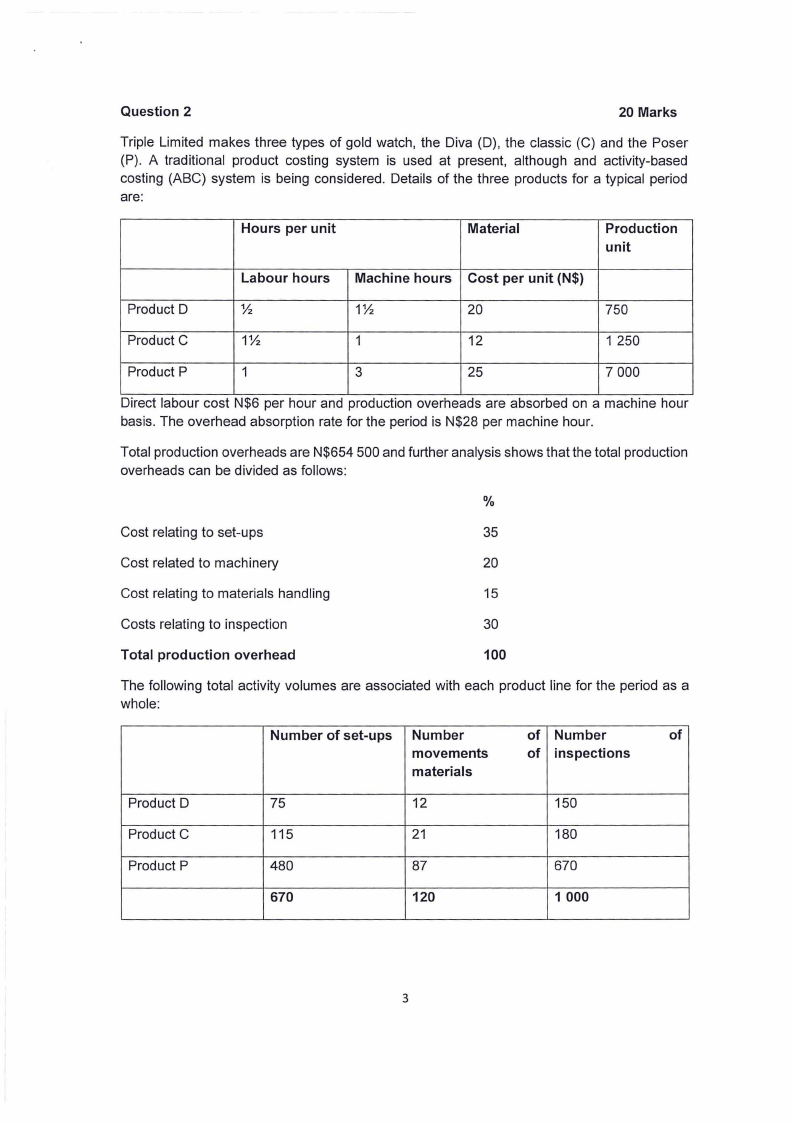

Question 2

20 Marks

Triple Limited makes three types of gold watch, the Diva (D), the classic (C) and the Poser

(P). A traditional product costing system is used at present, although and activity-based

costing (ABC) system is being considered. Details of the three products for a typical period

are:

Hours per unit

Material

Production

unit

Labour hours Machine hours Cost per unit (N$)

Product D

½

1½

20

750

Product C

1½

1

12

1 250

Product P

1

3

25

7 000

Direct labour cost N$6 per hour and production overheads are absorbed on a machine hour

basis. The overhead absorption rate for the period is N$28 per machine hour.

Total production overheads are N$654 500 and further analysis shows that the total production

overheads can be divided as follows:

%

Cost relating to set-ups

35

Cost related to machinery

20

Cost relating to materials handling

15

Costs relating to inspection

30

Total production overhead

100

The following total activity volumes are associated with each product line for the period as a

whole:

Number of set-ups Number

of Number

of

movements

of inspections

materials

Product D

75

12

150

Product C

115

21

180

Product P

480

87

670

670

120

1 000

3

|

4 Page 4 |

▲back to top |

Requirement:

(20)

a) Calculate the cost per unit for each product using traditional methods, absorbing

overheads based on machine hours.

(3)

b) Calculate the cost per unit for each product using ABC principles (work to two decimal

places).

(12)

c) Explain why costs per unit calculated under ABC are often very different to costs per

unit calculated under more traditional methods. Use the information from Triple

Limited to illustrate.

(5)

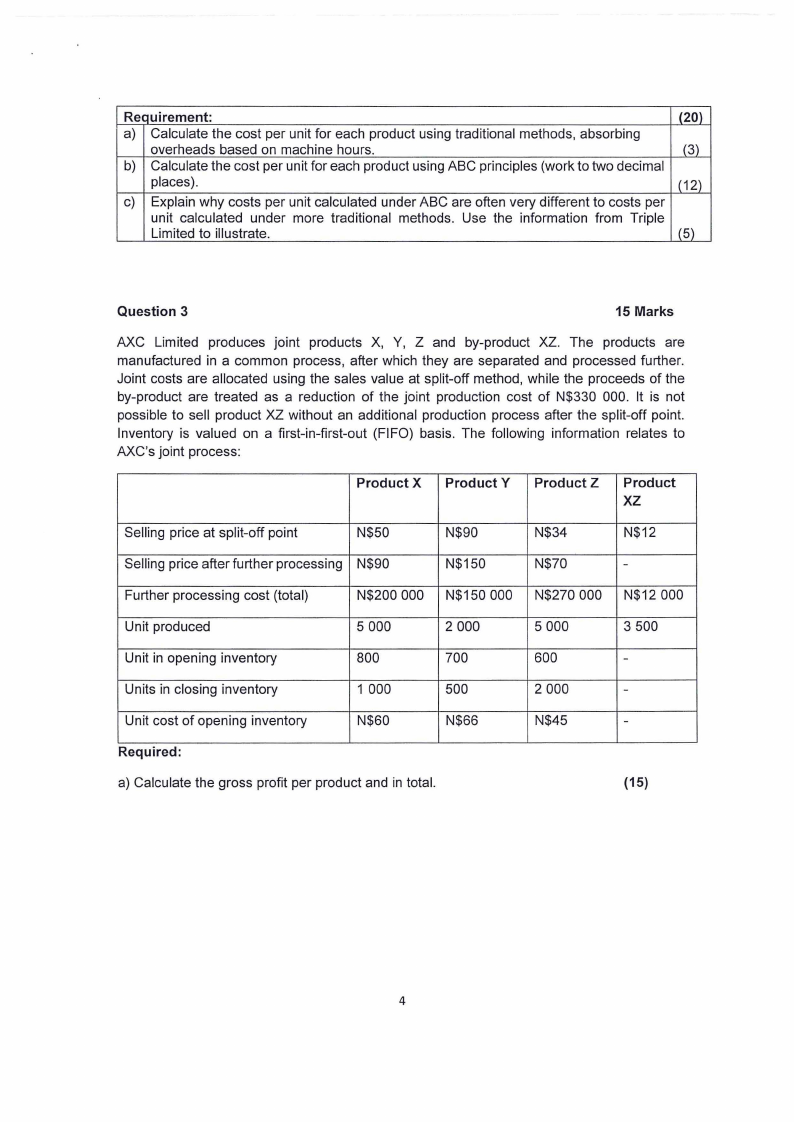

Question 3

15 Marks

AXC Limited produces joint products X, Y, Z and by-product XZ. The products are

manufactured in a common process, after which they are separated and processed further.

Joint costs are allocated using the sales value at split-off method, while the proceeds of the

by-product are treated as a reduction of the joint production cost of N$330 000. It is not

possible to sell product XZ without an additional production process after the split-off point.

Inventory is valued on a first-in-first-out (FIFO) basis. The following information relates to

AXC's joint process:

Product X

Product Y

Product Z

Product

xz

Selling price at split-off point

N$50

N$90

N$34

N$12

Selling price after further processing N$90

N$150

N$70

-

Further processing cost (total)

N$200 000 N$150 000 N$270 000 N$12 000

Unit produced

5 000

2 000

5 000

3 500

Unit in opening inventory

800

700

600

-

Units in closing inventory

1 000

500

2 000

-

Unit cost of opening inventory

N$60

N$66

N$45

-

Required:

a) Calculate the gross profit per product and in total.

(15)

4

|

5 Page 5 |

▲back to top |

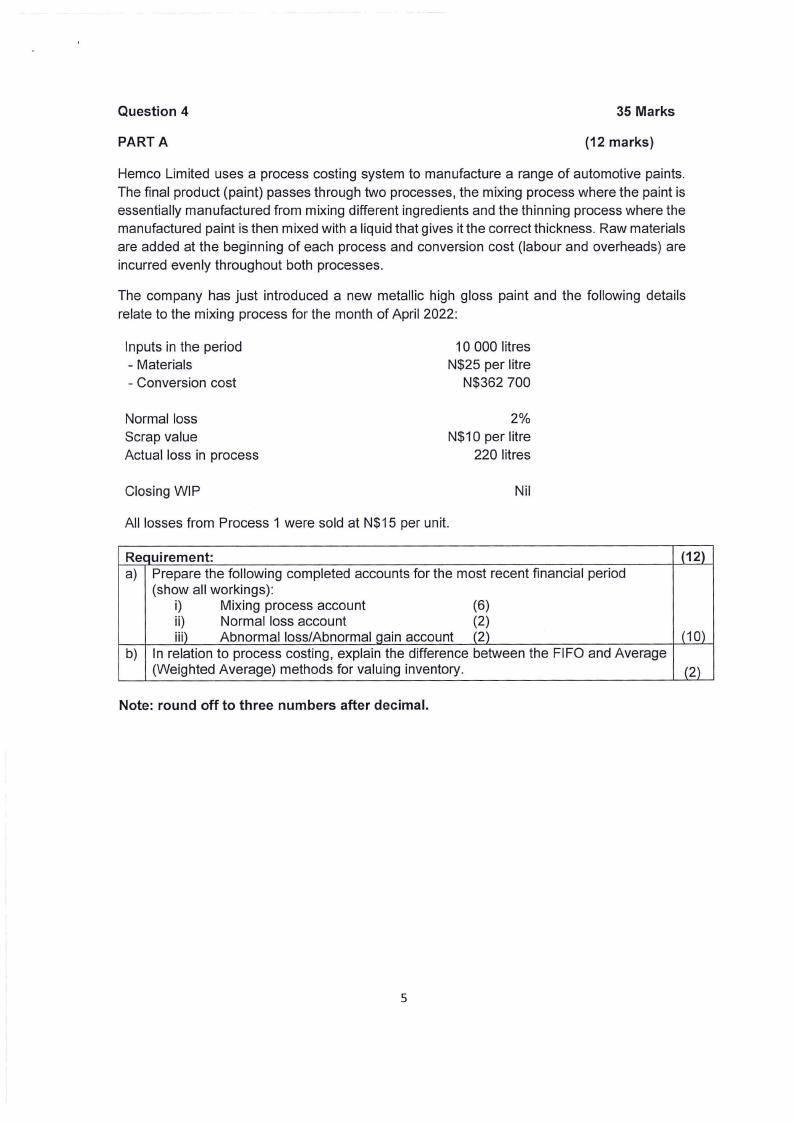

Question 4

35 Marks

PART A

(12 marks)

Hemco Limited uses a process costing system to manufacture a range of automotive paints.

The final product (paint) passes through two processes, the mixing process where the paint is

essentially manufactured from mixing different ingredients and the thinning process where the

manufactured paint is then mixed with a liquid that gives it the correct thickness. Raw materials

are added at the beginning of each process and conversion cost (labour and overheads) are

incurred evenly throughout both processes.

The company has just introduced a new metallic high gloss paint and the following details

relate to the mixing process for the month of April 2022:

Inputs in the period

- Materials

- Conversion cost

10 000 litres

N$25 per litre

N$362 700

Normal loss

Scrap value

Actual loss in process

2%

N$10 per litre

220 litres

Closing WIP

Nil

All losses from Process 1 were sold at N$15 per unit.

Requirement:

(12)

a) Prepare the following completed accounts for the most recent financial period

(show all workings):

i)

Mixing process account

(6)

ii)

Normal loss account

(2)

iii) Abnormal loss/Abnormal qain account (2)

(10)

b) In relation to process costing, explain the difference between the FIFO and Average

(Weighted Average) methods for valuing inventory.

(2)

Note: round off to three numbers after decimal.

5

|

6 Page 6 |

▲back to top |

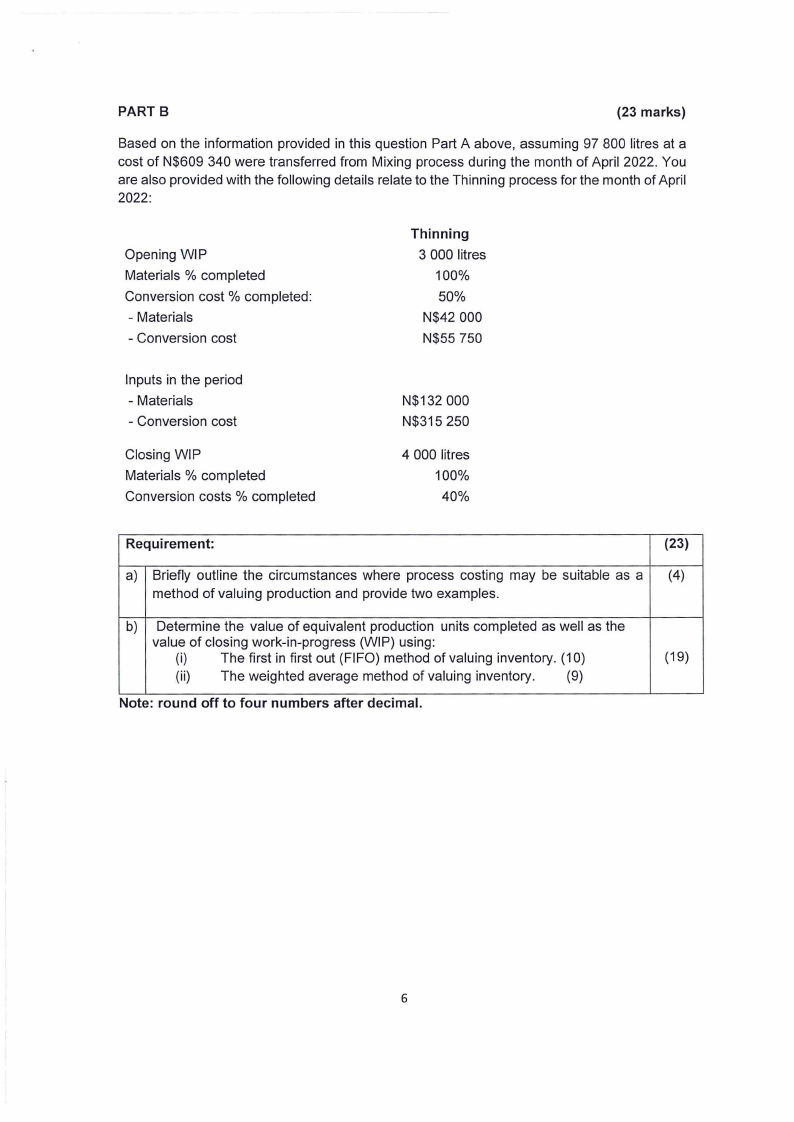

PART B

(23 marks)

Based on the information provided in this question Part A above, assuming 97 800 litres at a

cost of N$609 340 were transferred from Mixing process during the month of April 2022. You

are also provided with the following details relate to the Thinning process for the month of April

2022:

Opening WIP

Materials % completed

Conversion cost% completed:

- Materials

- Conversion cost

Thinning

3 000 litres

100%

50%

N$42 000

N$55 750

Inputs in the period

- Materials

- Conversion cost

Closing WIP

Materials % completed

Conversion costs % completed

N$132 000

N$315 250

4 000 litres

100%

40%

Requirement:

(23)

a) Briefly outline the circumstances where process costing may be suitable as a (4)

method of valuing production and provide two examples.

b) Determine the value of equivalent production units completed as well as the

value of closing work-in-progress (WIP) using:

(i) The first in first out (FIFO) method of valuing inventory. (10)

(19)

(ii) The weighted average method of valuing inventory. (9)

Note: round off to four numbers after decimal.

6

|

7 Page 7 |

▲back to top |

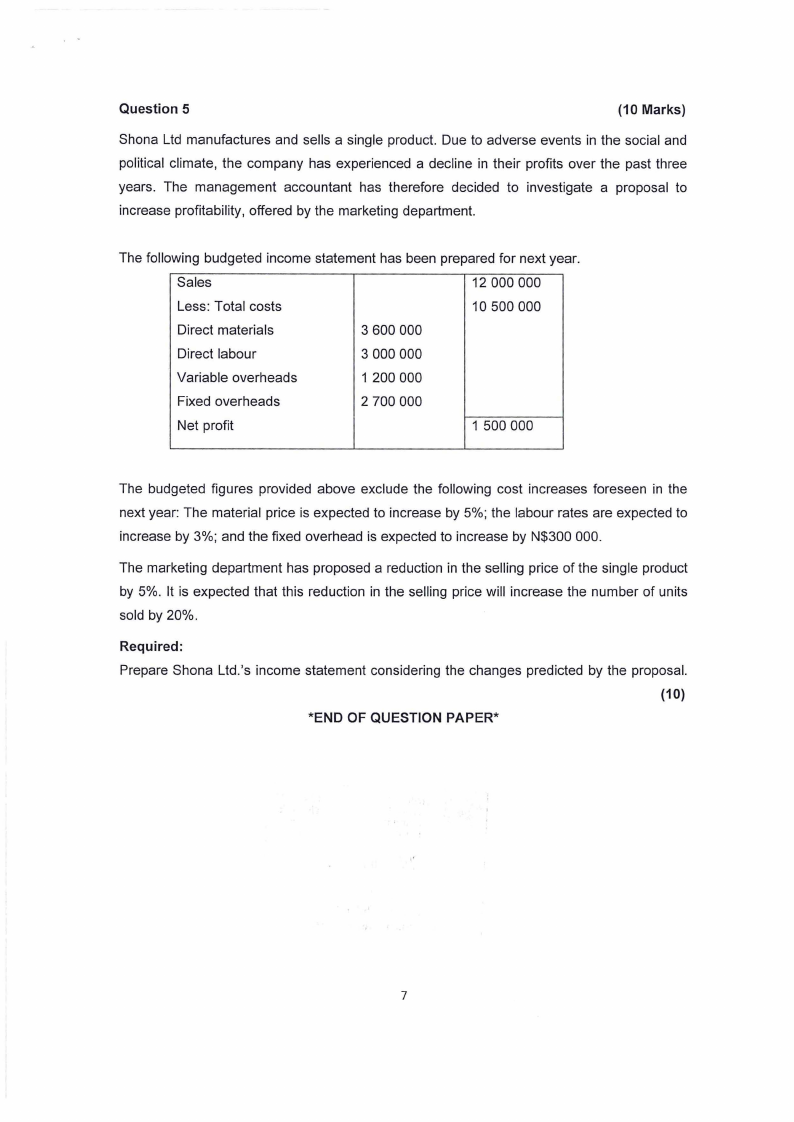

Question 5

(10 Marks)

Shona Ltd manufactures and sells a single product. Due to adverse events in the social and

political climate, the company has experienced a decline in their profits over the past three

years. The management accountant has therefore decided to investigate a proposal to

increase profitability, offered by the marketing department.

The following budgeted income statement has been prepared for next year.

Sales

12 000 000

Less: Total costs

10 500 000

Direct materials

3 600 000

Direct labour

3 000 000

Variable overheads

1 200 000

Fixed overheads

2 700 000

Net profit

1 500 000

The budgeted figures provided above exclude the following cost increases foreseen in the

next year: The material price is expected to increase by 5%; the labour rates are expected to

increase by 3%; and the fixed overhead is expected to increase by N$300 000.

The marketing department has proposed a reduction in the selling price of the single product

by 5%. It is expected that this reduction in the selling price will increase the number of units

sold by 20%.

Required:

Prepare Shona Ltd.'s income statement considering the changes predicted by the proposal.

(10)

*END OF QUESTION PAPER*

7