|

CMA611S-COST MANAGEMENT ACCOUNTING 201-1ST OPP-JUNE 2022 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVER s I TY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION : BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 07BOAC

COURSE: COST & MANAGEMENT

ACCOUNTING 201

LEVEL: 6

COURSE CODE: CMA611 S

DATE: JUNE 2022

SESSION: THEORY & CALCULATIONS

DURATION: 3 HOURS

MARKS: 100

FIRST OPPORTUNITY EXAMINATION

FIRST

EXAMINER:

MODERATOR:

Ms H. Kangala, Mr G. Sheehama, Mr H. Namwandi

Mr K. Tjondu

INSTRUCTIONS

1. This question paper is made up of FIVE(5) questions.

2. Answer All the questions and in blue or black ink.

3. You are advised to pay due attention to expression and presentation. Failure to do so will

cost you marks.

4. Start each question on a new page in your answer booklet and show all your workings.

5. Questions relating to this paper may be raised in the initial 30 minutes after the start of

the paper. Thereafter, candidates must use their initiative to deal with any perceived error

or ambiguities and any assumption made by the candidate should be clearly stated.

PERMISSIBLE MATERIALS

Non-programmable calculator/financial calculator

THIS QUESTION PAPER CONSISTS OF 6 PAGES (Including this front page)

1

|

2 Page 2 |

▲back to top |

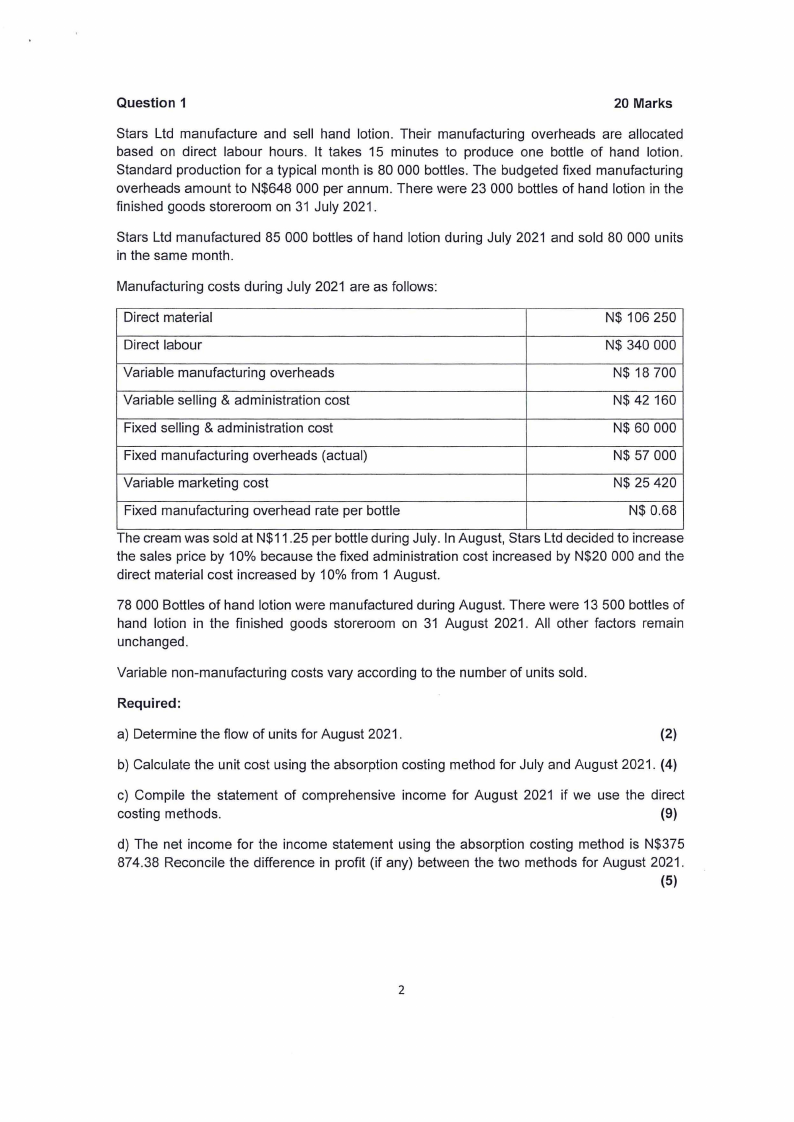

Question 1

20 Marks

Stars Ltd manufacture and sell hand lotion. Their manufacturing overheads are allocated

based on direct labour hours. It takes 15 minutes to produce one bottle of hand lotion.

Standard production for a typical month is 80 000 bottles. The budgeted fixed manufacturing

overheads amount to N$648 000 per annum. There were 23 000 bottles of hand lotion in the

finished goods storeroom on 31 July 2021.

Stars Ltd manufactured 85 000 bottles of hand lotion during July 2021 and sold 80 000 units

in the same month.

Manufacturing costs during July 2021 are as follows:

Direct material

N$ 106 250

Direct labour

N$ 340 000

Variable manufacturing overheads

N$ 18 700

Variable selling & administration cost

N$ 42 160

Fixed selling & administration cost

N$ 60 000

Fixed manufacturing overheads (actual)

N$ 57 000

Variable marketing cost

N$ 25 420

Fixed manufacturing overhead rate per bottle

N$ 0.68

The cream was sold at N$11.25 per bottle during July. In August, Stars Ltd decided to increase

the sales price by 10% because the fixed administration cost increased by N$20 000 and the

direct material cost increased by 10% from 1 August.

78 000 Bottles of hand lotion were manufactured during August. There were 13 500 bottles of

hand lotion in the finished goods storeroom on 31 August 2021. All other factors remain

unchanged.

Variable non-manufacturing costs vary according to the number of units sold.

Required:

a) Determine the flow of units for August 2021.

(2)

b) Calculate the unit cost using the absorption costing method for July and August 2021. (4)

c) Compile the statement of comprehensive income for August 2021 if we use the direct

costing methods.

(9)

d) The net income for the income statement using the absorption costing method is N$375

874.38 Reconcile the difference in profit (if any) between the two methods for August 2021.

(5)

2

|

3 Page 3 |

▲back to top |

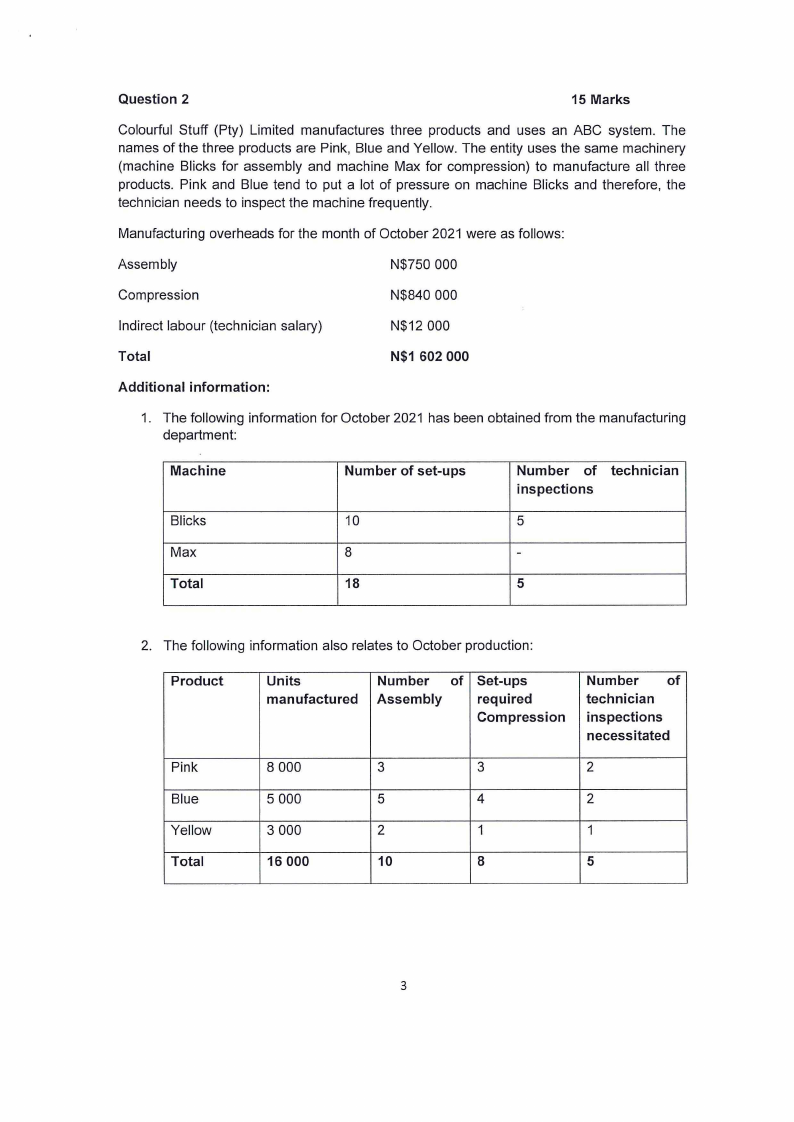

Question 2

15 Marks

Colourful Stuff (Pty) Limited manufactures three products and uses an ABC system. The

names of the three products are Pink, Blue and Yellow. The entity uses the same machinery

(machine Slicks for assembly and machine Max for compression) to manufacture all three

products. Pink and Blue tend to put a lot of pressure on machine Slicks and therefore, the

technician needs to inspect the machine frequently.

Manufacturing overheads for the month of October 2021 were as follows:

Assembly

N$750 000

Compression

N$840 000

Indirect labour (technician salary)

N$12 000

Total

N$1 602 000

Additional information:

1. The following information for October 2021 has been obtained from the manufacturing

department:

Machine

Slicks

Max

Total

Number of set-ups

10

8

18

Number of technician

inspections

5

-

5

2. The following information also relates to October production:

Product

Pink

Blue

Yellow

Total

Units

manufactured

8 000

5 000

3 000

16 000

Number of Set-ups

Assembly

required

Compression

3

3

5

4

2

1

10

8

Number of

technician

inspections

necessitated

2

2

1

5

3

|

4 Page 4 |

▲back to top |

3. Management has determined that the number of set-ups of the relevant machine is an

appropriate cost driver regarding the activities of assembly and compression and that

the number of technician inspections is an appropriate cost driver for the inspection

activity. All activity costs were deemed material in size and justified separate treatment.

The only task of the technician is to inspect the assembly machine.

Required:

Calculate the following (round off all amounts to two decimal places)

a) The activity rates to be used for: Assembly, Compression and Inspection activity. (3)

b) The overhead costs per unit for each of the products.

(12)

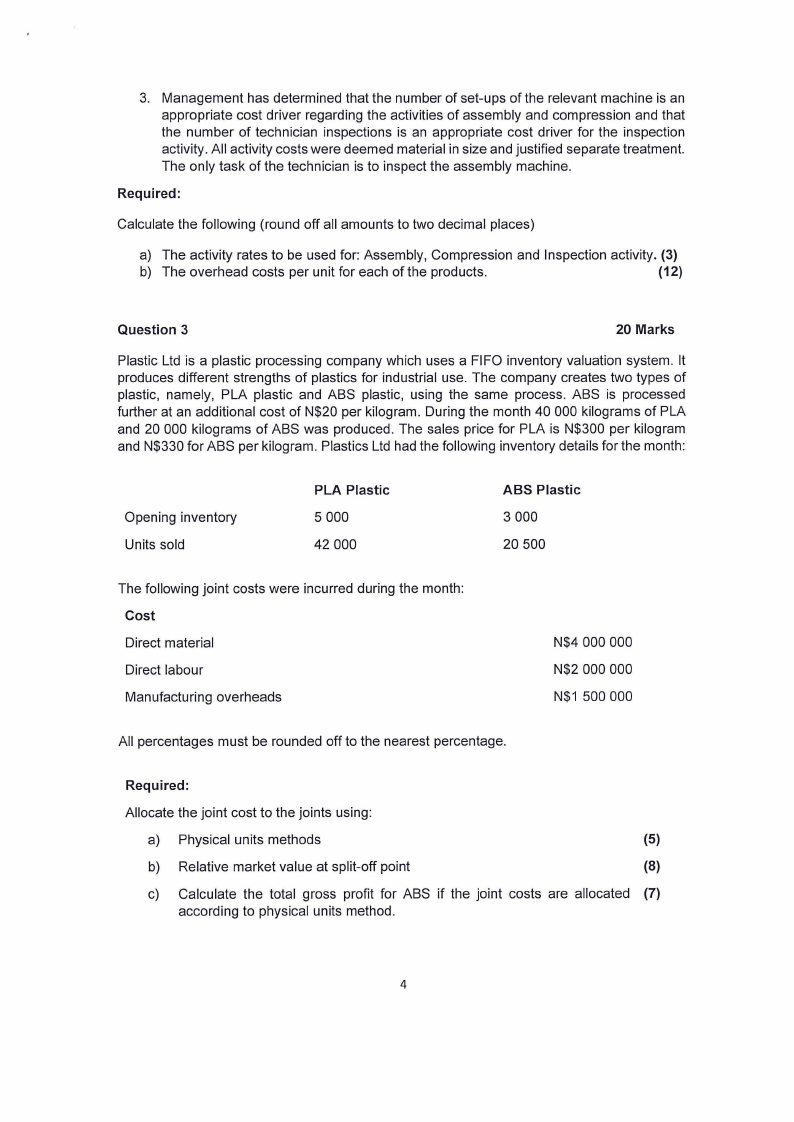

Question 3

20 Marks

Plastic Ltd is a plastic processing company which uses a FIFO inventory valuation system. It

produces different strengths of plastics for industrial use. The company creates two types of

plastic, namely, PLA plastic and ABS plastic, using the same process. ABS is processed

further at an additional cost of N$20 per kilogram. During the month 40 000 kilograms of PLA

and 20 000 kilograms of ABS was produced. The sales price for PLA is N$300 per kilogram

and N$330 for ABS per kilogram. Plastics Ltd had the following inventory details for the month:

Opening inventory

Units sold

PLA Plastic

5 000

42 000

ABS Plastic

3 000

20 500

The following joint costs were incurred during the month:

Cost

Direct material

Direct labour

Manufacturing overheads

N$4 000 000

N$2 000 000

N$1 500 000

All percentages must be rounded off to the nearest percentage.

Required:

Allocate the joint cost to the joints using:

a) Physical units methods

(5)

b) Relative market value at split-off point

(8)

c) Calculate the total gross profit for ABS if the joint costs are allocated (7)

according to physical units method.

4

|

5 Page 5 |

▲back to top |

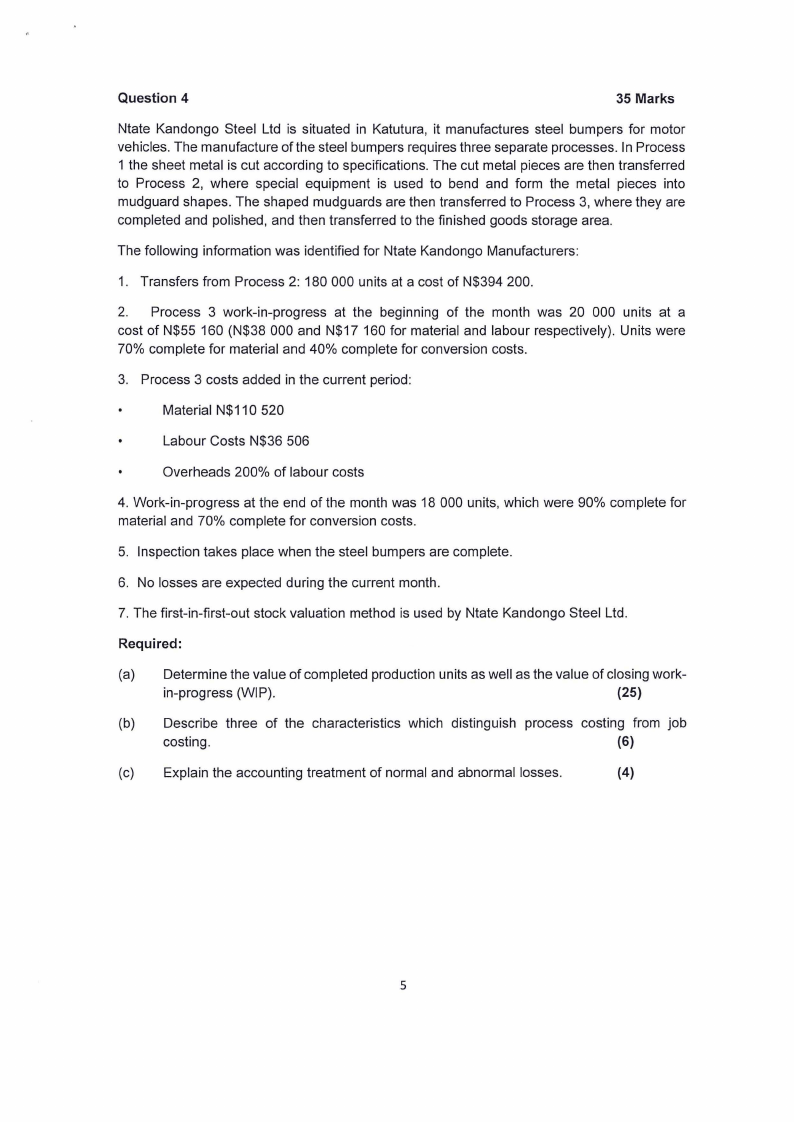

Question 4

35 Marks

Ntate Kandongo Steel Ltd is situated in Katutura, it manufactures steel bumpers for motor

vehicles. The manufacture of the steel bumpers requires three separate processes. In Process

1 the sheet metal is cut according to specifications. The cut metal pieces are then transferred

to Process 2, where special equipment is used to bend and form the metal pieces into

mudguard shapes. The shaped mudguards are then transferred to Process 3, where they are

completed and polished, and then transferred to the finished goods storage area.

The following information was identified for Ntate Kandongo Manufacturers:

1. Transfers from Process 2: 180 000 units at a cost of N$394 200.

2. Process 3 work-in-progress at the beginning of the month was 20 000 units at a

cost of N$55 160 (N$38 000 and N$17 160 for material and labour respectively). Units were

70% complete for material and 40% complete for conversion costs.

3. Process 3 costs added in the current period:

Material N$11O 520

Labour Costs N$36 506

Overheads 200% of labour costs

4. Work-in-progress at the end of the month was 18 000 units, which were 90% complete for

material and 70% complete for conversion costs.

5. Inspection takes place when the steel bumpers are complete.

6. No losses are expected during the current month.

7. The first-in-first-out stock valuation method is used by Ntate Kandongo Steel Ltd.

Required:

(a) Determine the value of completed production units as well as the value of closing work-

in-progress (WIP).

(25)

(b) Describe three of the characteristics which distinguish process costing from job

costing.

(6)

(c) Explain the accounting treatment of normal and abnormal losses.

(4)

5

|

6 Page 6 |

▲back to top |

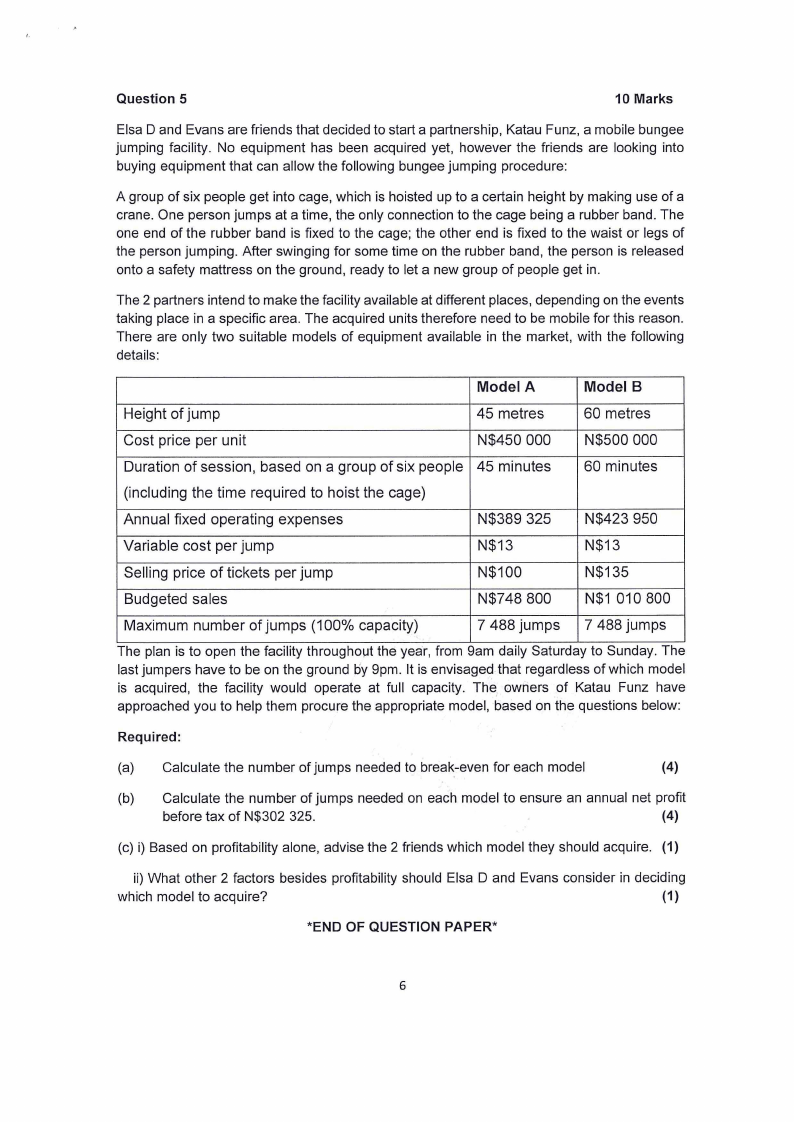

Question 5

10 Marks

Elsa D and Evans are friends that decided to start a partnership, Katau Funz, a mobile bungee

jumping facility. No equipment has been acquired yet, however the friends are looking into

buying equipment that can allow the following bungee jumping procedure:

A group of six people get into cage, which is hoisted up to a certain height by making use of a

crane. One person jumps at a time, the only connection to the cage being a rubber band. The

one end of the rubber band is fixed to the cage; the other end is fixed to the waist or legs of

the person jumping. After swinging for some time on the rubber band, the person is released

onto a safety mattress on the ground, ready to let a new group of people get in.

The 2 partners intend to make the facility available at different places, depending on the events

taking place in a specific area. The acquired units therefore need to be mobile for this reason.

There are only two suitable models of equipment available in the market, with the following

details:

Model A

Model B

Height of jump

45 metres

60 metres

Cost price per unit

N$450 000 N$500 000

Duration of session, based on a group of six people 45 minutes 60 minutes

(including the time required to hoist the cage)

Annual fixed operating expenses

N$389 325 N$423 950

Variable cost per jump

N$13

N$13

Selling price of tickets per jump

N$100

N$135

Budgeted sales

N$748 800 N$1 010 800

Maximum number of jumps (100% capacity)

7 488 jumps 7 488 jumps

The plan is to open the facility throughout the year, from 9am daily Saturday to Sunday. The

last jumpers have to be on the ground by 9pm. It is envisaged that regardless of which model

is acquired, the facility would operate at full capacity. The owners of Katau Funz have

approached you to help them procure the appropriate model, based on the questions below:

Required:

(a) Calculate the number of jumps needed to brea~-even for each model

(4)

(b) Calculate the number of jumps needed on each model to ensure an annual net profit

before tax of N$302 325.

(4)

(c) i) Based on profitability alone, advise the 2 friends which model they should acquire. (1)

ii) What other 2 factors besides profitability should Elsa D and Evans consider in deciding

which model to acquire?

(1)

*END OF QUESTION PAPER*

6