|

FMA712S - FINANCIAL MANAGEMENT AGRICULTURE - 2ND OPP - NOV 2024 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHn OLOGY

FACULTY OF HEAL TH, NATURAL RESOURCES AND APPLIED SCIENCES

SCHOOL OF AGRICULTURE AND NATURAL RESOURCE SCIENCES

DEPARTMENT OF AGRICULTURAL SCIENCES AND AGRIBUSINESS

QUALIFICATION: BACHELOR OF AGRICUL TURE/BSc: AGRICULTURE

QUALIFICATION CODE: 07BAGR/07BAGA

COURSE CODE: FMA712S/FMA720S

SESSION: JANUARY 2025

LEVEL:?

COURSE NAME: FINANCIAL MANAGEMENT-

AGRICULTURE

PAPER: THEORY AND CALCULATIONS

DURATION: 3 HOURS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER

Lameck Odada

MODERATOR Dr Kennedy Sean Kalundu

INSTRUCTIONS

1. This examination question paper consists of FOUR (4) questions

2. Answer ALL the questions in blue or black ink only. NO PENCIL.

3. Start each question on a new page and number the answers correctly and clearly.

4. Write clearly and neatly, showing all your workings/assumptions.

5. Work with at least four (4) decimal places in all your calculations and round off only final

answers to two (2) decimal places.

6. Questions relating to this examination may be raised in the initial 30 minutes after the start

of the examination. Thereafter, candidates must use their initiative to deal with any

perceived errors or ambiguities, and any assumptions the candidate makes should be

clearly stated.

PERMISSIBLE MATERIALS

1. Silent, non-programmable calculators

THIS QUESTION PAPER CONSISTS OF _8_ PAGES (including this front page)

|

2 Page 2 |

▲back to top |

QUESTION 1

[25 MARKS]

Suppose a loan of N$25 000 is made to an individual at 6% interest compounded quarterly.

The loan is repaid in 6 instalments. The loan provider requires a down payment of 20% of the

loan's value.

REQUIRED: use the information above to answer the following questions MARKS

a} Define an annuity and differentiate between the two (2) types of annuities.

6

b} Identify any four (4) examples of annuities.

4

c} Determine the size of the payments to the nearest dollar. Work with at

5

least 4 decimal places throughout your calculations

d} Prepare an amortization table to determine the total amount of interest 10

paid and the balance on the loan after five (5) installments. Work with

whole numbers throughout the amortization table

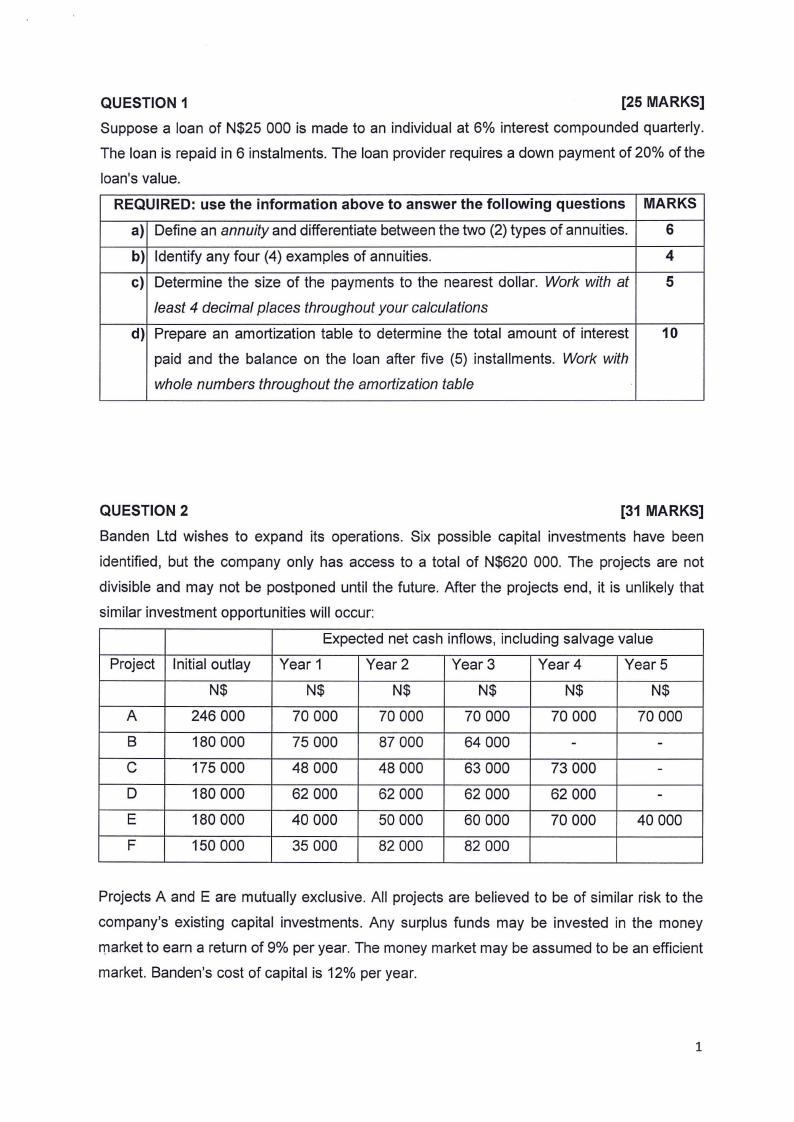

QUESTION 2

[31 MARKS]

Sanden Ltd wishes to expand its operations. Six possible capital investments have been

identified, but the company only has access to a total of N$620 000. The projects are not

divisible and may not be postponed until the future. After the projects end, it is unlikely that

similar investment opportunities will occur:

Expected net cash inflows, including salvage value

Project Initial outlay Year1

Year2

Year3

Year4

Year5

N$

N$

N$

N$

N$

N$

A

246 000

70 000

70 000

70 000

70 000

70 000

8

180 000

75 000

87 000

64 000

-

-

C

175 000

48 000

48 000

63 000

73 000

-

D

180 000

62 000

62 000

62 000

62 000

-

E

180 000

40 000

50 000

60 000

70 000

40 000

F

150 000

35 000

82 000

82 000

Projects A and E are mutually exclusive. All projects are believed to be of similar risk to the

company's existing capital investments. Any surplus funds may be invested in the money

n:iarketto earn a return of 9% per year. The money market may be assumed to be an efficient

market. Banden's cost of capital is 12% per year.

1

|

3 Page 3 |

▲back to top |

REQUIRED: use the information above to answer the following questions.

Work with whole numbers in all your calculations

a) Define capital rationing and differentiate between the two types of

capital rationing

b) Calculate the expected net present value of each project

c) Calculate the expected profitability index associated with each of the six

projects. Answer to three (3) decimal places.

d) Rank the projects according to the investment appraisal methods in b)

and c) above.

e) Explain briefly why these rankings differ.

MARKS

5

12

6

6

2

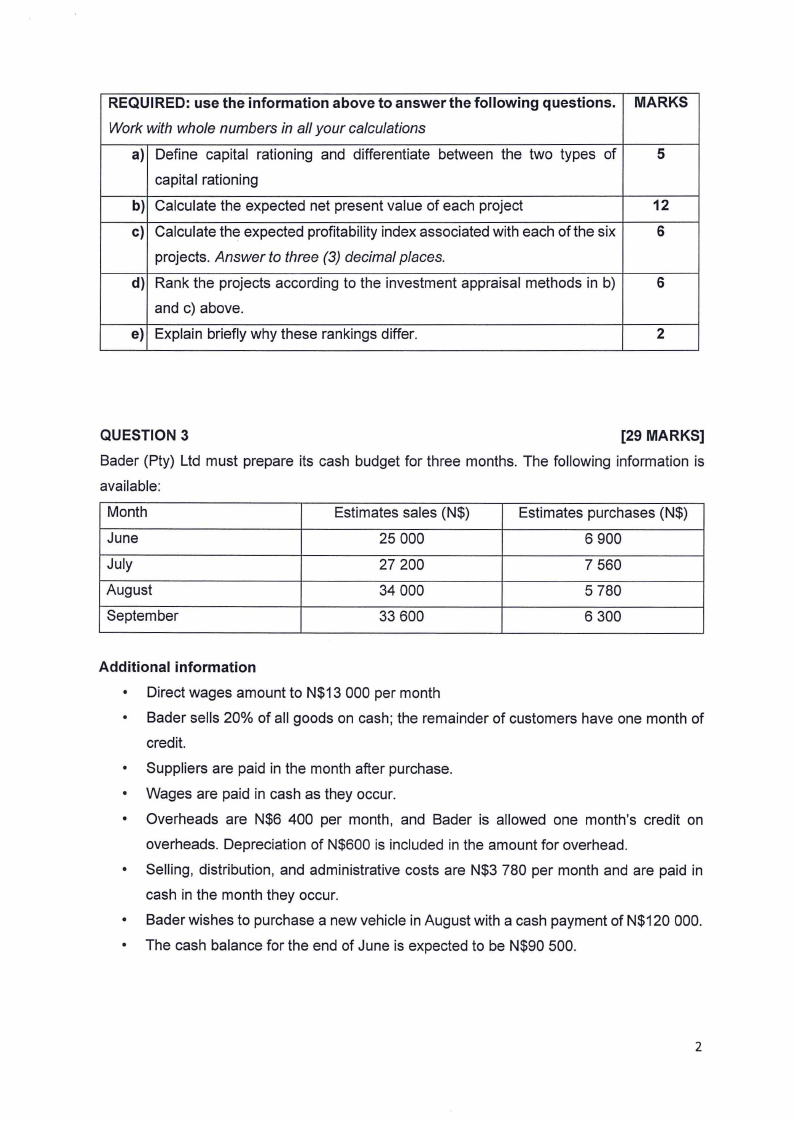

QUESTION 3

[29 MARKS]

Bader (Pty) Ltd must prepare its cash budget for three months. The following information is

available:

Month

Estimates sales (N$)

Estimates purchases (N$)

June

25 000

6 900

July

27 200

7 560

August

34 000

5 780

September

33 600

6 300

Additional information

• Direct wages amount to N$13 000 per month

• Bader sells 20% of all goods on cash; the remainder of customers have one month of

credit.

• Suppliers are paid in the month after purchase.

• Wages are paid in cash as they occur.

• Overheads are N$6 400 per month, and Bader is allowed one month's credit on

overheads. Depreciation of N$600 is included in the amount for overhead.

• Selling, distribution, and administrative costs are N$3 780 per month and are paid in

cash in the month they occur.

• Bader wishes to purchase a new vehicle in August with a cash payment of N$120 000.

• The cash balance for the end of June is expected to be N$90 500.

2

|

4 Page 4 |

▲back to top |

REQUIRED:

a) Calculate the total collections for the three months (July to September)

b) Calculate the total payments for the three months (July to September)

c) Prepare a cash budget for the three months (July to September)

MARKS

6

13

10

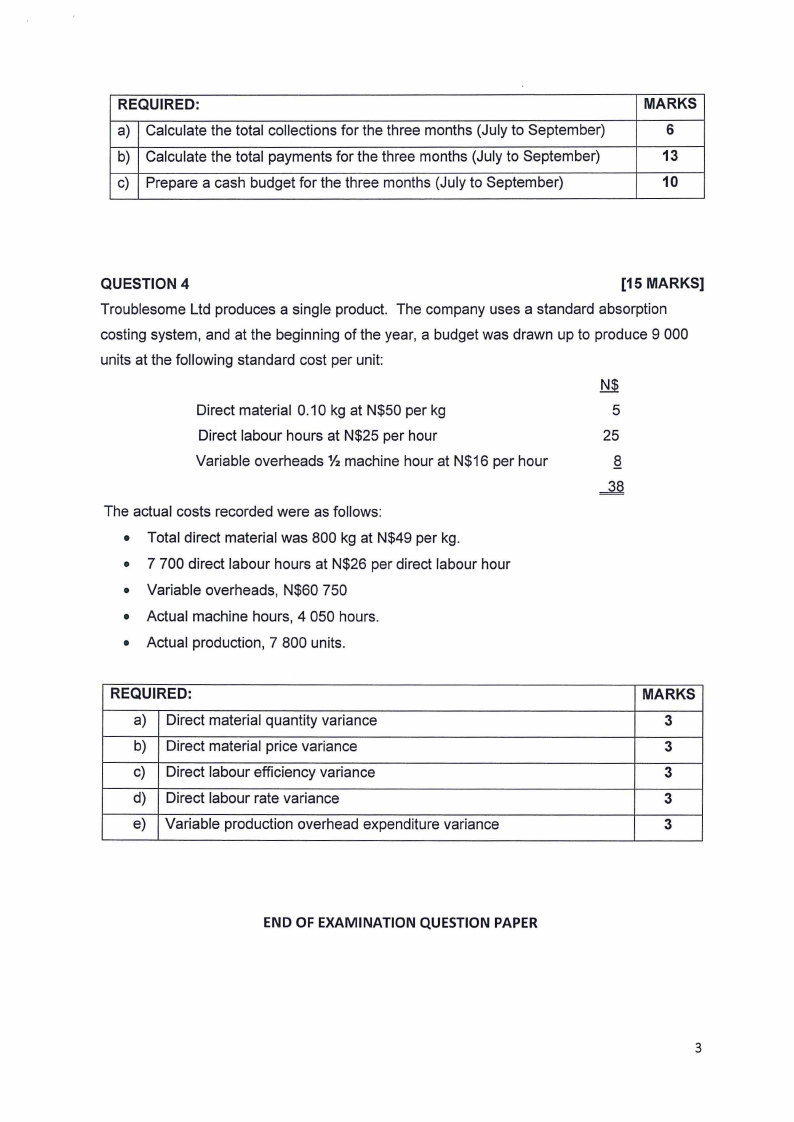

QUESTION 4

[15 MARKS]

Troublesome Ltd produces a single product. The company uses a standard absorption

costing system, and at the beginning of the year, a budget was drawn up to produce 9 000

units at the following standard cost per unit:

Direct material 0.10 kg at N$50 per kg

Direct labour hours at N$25 per hour

Variable overheads ½ machine hour at N$16 per hour

The actual costs recorded were as follows:

• Total direct material was 800 kg at N$49 per kg.

• 7 700 direct labour hours at N$26 per direct labour hour

• Variable overheads, N$60 750

• Actual machine hours, 4 050 hours.

• Actual production, 7 800 units.

5

25

§.

-3..8

REQUIRED:

a) Direct material quantity variance

b) Direct material price variance

c) Direct labour efficiency variance

d) Direct labour rate variance

e) Variable production overhead expenditure variance

MARKS

3

3

3

3

3

END OF EXAMINATION QUESTION PAPER

3

|

5 Page 5 |

▲back to top |

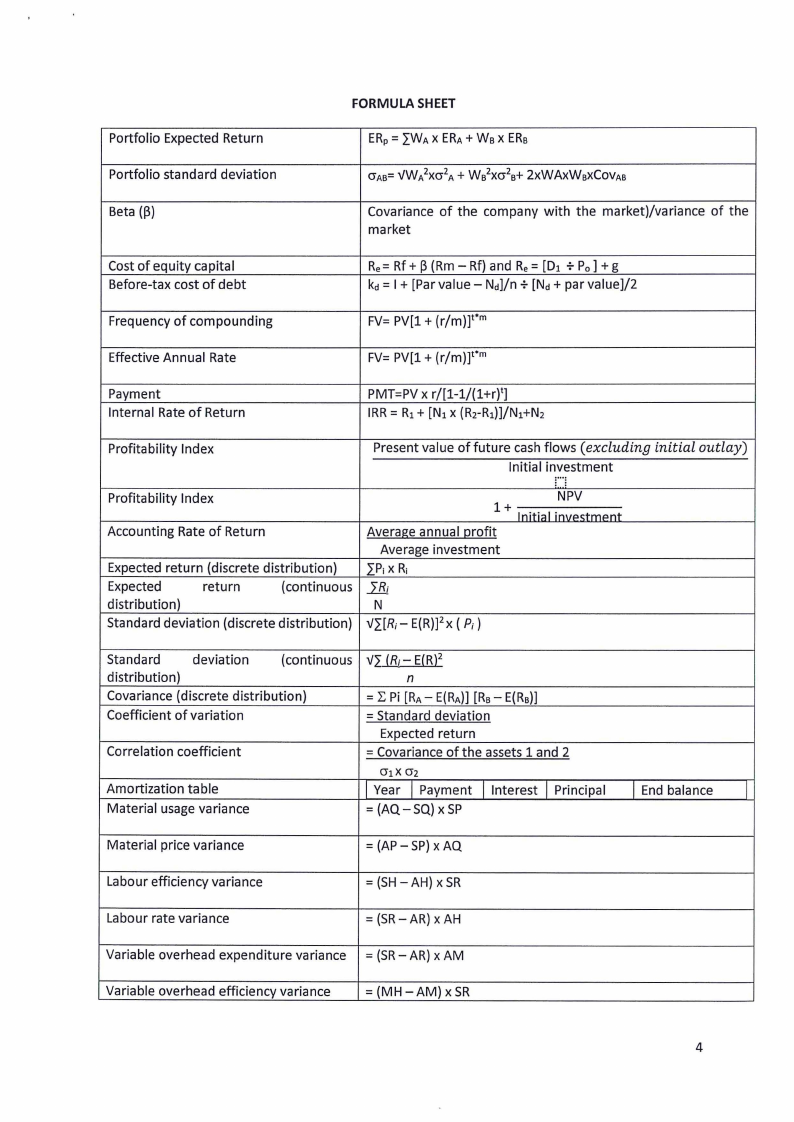

FORMULA SHEET

Portfolio Expected Return

Portfolio standard deviation

ERp= "i._WXA ERA+Ws X ERs

O"As=vWixcr 2A+ Ws2xcr2s+ 2xWAxWsxCoVAB

Beta(~)

Covariance of the company with the market)/variance of the

market

Cost of equity capital

Before-tax cost of debt

Re= Rf+~ (Rm - Rf) and Re= [D1 +Po] + g

kd =I+ [Par value - Nd]/n +[Nd+ par value]/2

Frequency of compounding

FV= PV[l + (r/m)fm

Effective Annual Rate

FV= PV[l + (r/m)]1•m

Payment

Internal Rate of Return

PMT=PV x r/[1-1/(l+rJt]

IRR= R1+ [N1x (R2-R1)]/N1+N2

Profitability Index

Profitability Index

Accounting Rate of Return

Expected return (discrete distribution)

Expected

return

(continuous

distribution)

Standard deviation (discrete distribution)

Present value of future cash flows (excluding

Initial investment

..

NPV

1+ Initial l, --L,Pnt

Average annual i::1rofit

Average investment

IP;X R;

211

N

v"i._[R-; E(R)]2x ( P;)

initial

outlay)

Standard

deviation

(continuous v"i._(R;- E(R)2

distribution)

n

Covariance (discrete distribution)

= I: Pi [RA- E(RA)][Rs- E(Rs)]

Coefficient of variation

= Standard deviation

Expected return

Correlation coefficient

= Covariance of the assets 1 and 2

Amortization table

0-1X 0-2

I I I I I Year Payment Interest Principal

End balance

I

Material usage variance

= (AQ - SQ) x SP

Material price variance

= (AP-SP) xAQ

Labour efficiency variance

= (SH- AH) x SR

Labour rate variance

= (SR- AR) x AH

Variable overhead expenditure variance = (SR- AR) x AM

Variable overhead efficiency variance

=(MH-AM)xSR

4

|

6 Page 6 |

▲back to top |

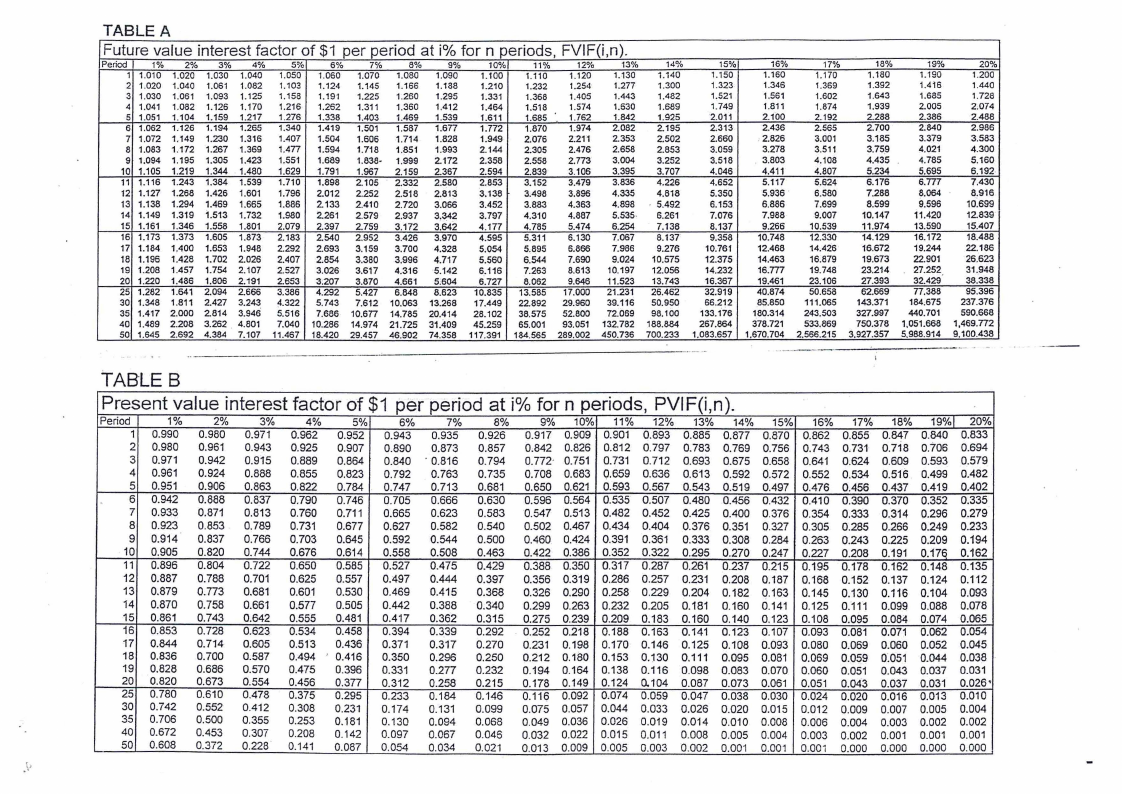

TABLE A

Future value interest factor of $1 per period at i% for n periods, FVIF(i,n).

Period

1%

1 1.010

2 1.020

3 1.030

4 1.041

2%

1.020

1.040

1.061

1.082

3%

1.030

1.061

1.093

1.126

4%

1.040

1.082

1.125

1.170

5%

1.050

1.103

1.158

1.216·

6%

1.060

1.124

1.191

1.262

7%

1.070

1.145

1.225

1.311

8%

1.080

1.166

1.260

1.360

9%

1.090

1.188

1.295

1.412

10%

1.100

1.210

1.331

1.464

11%

1.110

1.232

1.368

1.518

12%

1.120

1.254

1.405

1.574

13%

1.130

1.277

1.443

1.630

14%

1.140

1.300

1.482

1.689

5 1.051 1.104 1.159 1.217 1.276 1.338 1.403 1.469 1.539

6 1.062 1.126 1.194 1.265 1.340 1.419 1.501 1.587 1.677

1.611

1.772

1.685 ·_ 1.762

1.870 1.974

1.842

2.082

1.925

2.195

7 1.072 1.149 1.230 1.316 1.407 1.504 1.606 1.714 1.828 1.949 2.076 2.211 2.353 2.502

8 1.083 1.172 1.267 1.369 1.477 1.594 1.718 1.851 1.993 2.144 2.305 2.476 2.658 2.853

9 1.094 1.195 1.305 1.423 1.551 1.689 1.838- 1.999 2.172

2.358

2.558

2.773

3.004

3.252

10 1.105 1.219 1.344 1.480 1.629 1.791 1.967 2.159 2.367 2.594 2.839 3.106 3.395 3.707

11 1.116 1.243 1.384 1.539 1.710 1.898 2.105 2.332 2.580 2.853 3.152 3.479 3.836 4.226

12 1.127 1.268 1.426 1.601 1.796 2.012 2.252 2.518 2.813

3.138

3.498

3.896

4.335

4.818

13 1.138 1.294 1.469 1.665 1.886 2.133 2.410 2.720 3.066

3.452

3.883

4.363

4.898

5.492

14 1.149 1.319 i.513 1.732

15 1.161 1.346 1.558 1.801

1.980

2.079

2.261

2.397

2.579

2.759

2.937

3.172

3.~2

3.642

3.797

4.177

4.310

4.785

4.887

5.474

5.535-

6.254

6.261

7.138

16 1.173 1.373 1.605 1.873 2.183 2.540 2.952 3.426 3.970 4.595 5.311 6.130 7.067 8.137

17 1.184

18 1.196

19 1.208

20 1.220

1.400

1.428

1.457

1.486

1.653

1.702

1.754

1.806

1.948

2.026

2.107

2.191

2.292

2.407

2.527

2.653

2.693

2.854

3.026

3.207

3.159

3.380

3.617

3.870

3.700

3,996

4.316

4.661

4.328

4.717

5.142

5.604

5.054

5.560

6.116

6.727

5.895

6.544

7.263

8.062

6.866

7.690

8.613

9.646

7.986

9.024

10.197

11.523

9.276

10.575

12.056

13.743

25 1.282 1.641 2.094 2.666 3.386 4.292 5.427 6.848 8.623 10.835 13.585 17.000 21.231 26.462

30 1.348 1.811 2.427 3.243

35 1.417 2.000 2.814 3.946

40 1.489 2.208 3.262 4.801

f322

5.516

7.040

5.743

7.686

10.286

7.612

10.677

14.974

10.063

14.785

21.725

13.268

20.414

31.409

17.449

28.102

45.259

22.892

38.575

65.001

29.960

52.800

93.051

39.116

72.069

132.782

50.950

98.100

188.884

50 1.645 2.692 4.384 7.107 11.467 18.420 29.457 46.902 74.358 117.391 184.565 289.002 450.736 700.233

15%

1.150

1.323

1.521

1.749

2.011

2.313

2.660

3.059

3.518

4.046

4.652

5.350

6.153

7.076

8.137

9.358

10.761

12.375

14.232

16.367

32.919

66.212

133.176

267.864

1.083.657

16%

17%

1.160

1.170

1.346

1.369

1.561

1.602

1.811

1.874

2.100

2.192

2.436

2.565

2.826

3.001

3.278

3.511

3.803

4.108

4.411

4.807

5.117

5.624

5.936 · 6.580

6.886

7.699

7.988

9.007

9.266

10.539

10.748

12.330

12.468

14.426

14.463

16.879

16.m

19.748

19.461

23.106

40.874

50.658

85.850 111.065

180.314 243.503

378.721 533.869

1,670.704 2.566.215

18%

19%

1.180

1.190

1.392

1.416

1.643

1.685

1.939

2.005

2.288

2.386

2.700

2.840

3.185

3.379

3.75_9

4.021

4.435 . 4.785

5.234

5.695

6.176

6.m

7.288

8.064

8.599

9.596

10.147

11.420

11.974

13.590

14.129

16.172

16.672

19.244

19.673

22.901

23.214 . 27.252

27.393

32.429

62.669

77.388

143.371 184.675

327.997 440.701

750.378 1,051.668

3.927.357 5,988.914

20%

1.200

1.440

1.728

2.074

2.488

2.986

3.583

4.300

5.160

6.192-

7.430

8.916

10.699

12.839

15.407

18.488

22.186

26.623

31.948

38.338

95.396

237.376

590.668

1,469.772

9,100.438

TABLE B

Present value interest factor of $1 per period at i0/o for n periods, PVIF(i,n).

Period

1

2

3

4

5

6

7

8

1%

0.990

0.980

0.971

0.961

0.951

0.942

0.933

0.923

2%

0.980

0.961

0.942

0.924

0.906

0.888

0.871

0.853

3%

0.971

0.943

0.915

0.888

0.863

0.837

0.813

0.789

4%

0.962

0.925

0.889

0.855

0.822

0.790

0.760

0.731

5%

0.952

0.907

0.864

0.823

0.784

0.746

0.711

0.677

6%

0.943

0.890

0.840

0.792

0.747

0.705

0.665

0.627

7%

0.935

0.873

· 0.816

0.763

0.713

0.666

0.623

0.582

8%

0.926

0.857

0.794

0.735

0.681

0.630

0.583

0.540

9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19%1 20%

0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833

0.842 0.826 0.812 0.797 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694

0.772· 0.751 0.731 0.712 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579

0.708 0.683 Q.659 0.636 0.613 0.592 0.572 0.552 0.534 0.516 0.499 0.482

0.650 0.621 0.593 0.567 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402

0.596 0.564 0.535 0.507 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335

0.547 0.513 0.482 0.452 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279

0.502 0.467 0.434 0.404 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233

9 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194

10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162

11 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0.287 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135

12 0.887

13 0.879

14 0.870

15 0.861

16 0.853

17 0.844

18 0.836

19 0.828

20 0.820

25 0.780

30 0.742

35 0.706

40 0.672

50 0.608

0.788

0.773

0.758

0.743

0.728

0.714

0.700

0.686

0.673

0.610

0.552

0.500

0.453

0.372

0.701

0.681

0.661

0.642

0.623

0.605

0.587

0.570

0.554

0.478

0.412

0.355

0.307

0.228'

0.625 0.557

0.601 0.530

0.577 0.505

0.555 0.481

0.534 0.458

0.513 0.436

0.494 ' 0.416

0.475 0.396

0.456 0.377

0.375 0.295

0.308 0.231

0.253 0.181

0.208 0.142

0.141 0.087

0.497

0.469

0.442

0.417

0.394

0.371

0.350

0.331

0.312

0.233

0.174

0.130

0.097

0.054

0.444

0.415

0.388

0.362

0.339

0.317

0.296

0.277

0.258

0.184

0.131

0.094

0.067

0.034

0.397

0.368

0.340

0.315

0.292

0.270

0.250

0.232

0.215

0.146

0.099

0.068

0.046

0.021

0.356

0.326

0.299

0.275

. 0.252

0.231

0.212

0.194

0.178

0.116

0.075

0.049

0.032

0.013

0.319

0.290

0.263

0.239

0.218

0.198

0.180

0.164

0.149

0.092

0.057

0.036

0.022

0.009

0.286

0.258

0.232

0.209

0.188

0.170

0.153

0.138

0.124

0.074

0.044

0.026

0.015

0.005

0.257

0.229

0.205

0.183

0.163

0.146

0.130

0.116

0.104

0.059

0.033

0.019

0.011

0.003

0.231

0.204

0.181

0.160

0.141

0.125

0.111

0.098

0.087

0.047

0.026

0.014

0.008

0.002

0.208

0.182

0.160

0.140

0.123

0.108

0.095

0.083

0.073

0.038

0.020

0.010

0.005

0.001

0.187

0.163

0.141

0.123

0.107

0.093

0.081

0.070

0.061

0.030

0.015

0.008

0.004

0.001

0.168

0.145

0.125

0.108

0.093

0.080

0.069

0.060

0.051

0.024

0.012

0.006

0.003

0.001

0.152

0.130

0.111

0.095

0.081

0.069

0.059

0.051

0.043

0.020

0.009

0.004

0.002

0.000

0.137 0.124

0.116 0.104

0.099 0.088

0.084 0.074

0.071 0.062

0.060 0.052

0~051 0.044

0.043 0.037

0.037 0.031

0.016 0.013

0.007 0.005

0.003 0.002

0.001 0.001

0.000 0.000

0.112

0.093

0.078

0.065

0.054

0.045

0.038 ·

0.031

0.026•

0.010

0.004

0.002

0.001

0.000

y

|

7 Page 7 |

▲back to top |

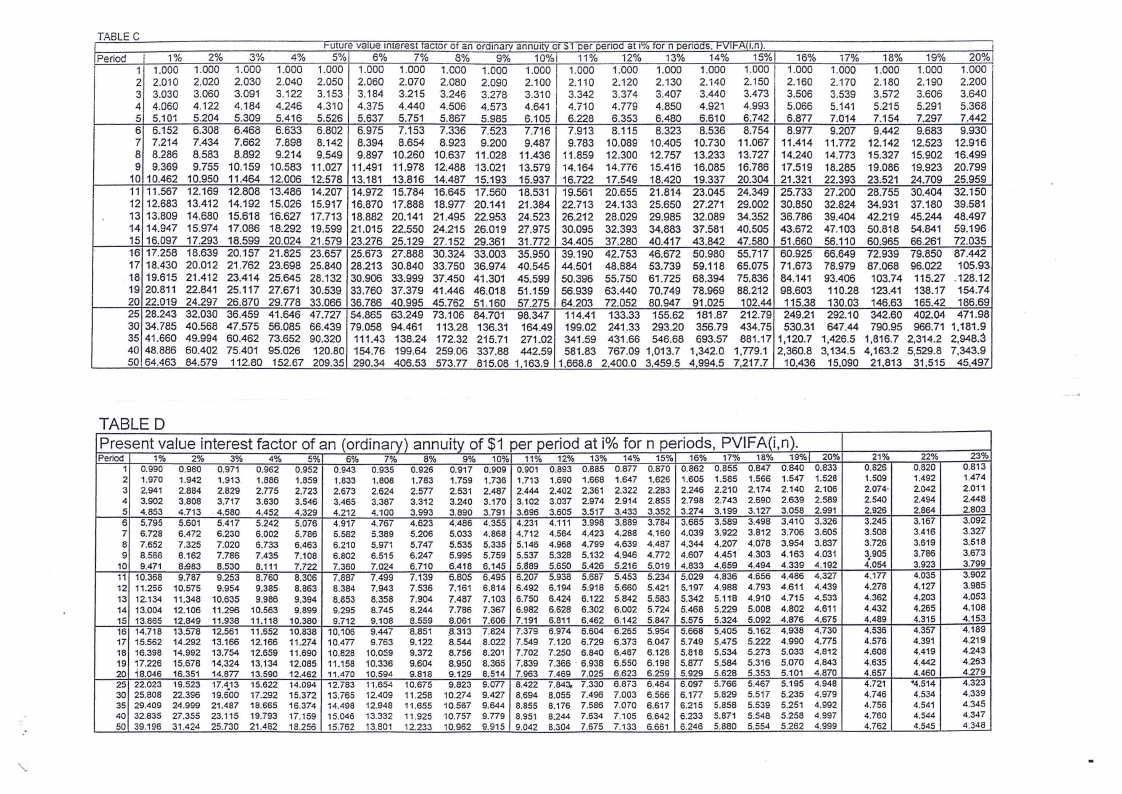

TABLE C

t-uture vatue interest tacmr OT an orarnarv annurtv OT :.,1cer oenoa at 1°10ror n cenoas. r-vir·AIJ.nl.

Period

I

I

1%

2%

3%

4~{,

5%1 6%

7%

8%

9% 10%1 11% 12% 13% 14% 15%1 16% 17% 18% 19% 20%

1 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000

2 2.010 2.020 2.030 2.040 2.050 2.060 2.070 2.080 2.090 2.100 2.110 2.120 2.130 2.140 2.150 2.160 2.170 2.180 2.190 2.200

3 3.030 3.060 3.091 3.122 3.153 3.184 3.215 3.246 3.278 3.310 3.342 3.374 3.407 3.440 3.473 3.506 3.539 3.572 3.606 3.640

4 4.060 4.122 4.184 4.246 4.310 4.375 4.440 4.506 4.573 4.641 4.710 4.779 4.850 4.921 4.993 5.066 5.141 5.215 5.291 5.368

5 5.101 5.204 5.309 5.416 5.526 5.637 5.751 5.867 5.985 6.105 6.228 6.353 6.480 6.610 6.742 6.877 7.014 7.154 7.297 7.442

6 6.152 6.308 6.468 6.633 6.802 6.975 7.153 7.336 7.523 7.716 7.913 8.115 8.323 8.536 8.754 8.977 9.207 9.442 9.683 9.930

7 7.214 7.434 7.662 7.898 8.142 8.394 8.654 8.923 9.200 9.487 9.783 10.089 10.405 10.730 11.067 11.414 11.772 12.142 12.523 12.916

8 8.286 8.583 8.892 9.214 9.549 9.897 10.260 10.637 11.028 11.436 11.859 12.300 12.757 13.233 13.727 14.240 14.773 15.327 15.902 16.499

9 9.369 9.755 10.159 10.583 11.027 11.491 11.978 1-2.488 13,021 13.579 14,164 14.776 15.416 16,085 16,786 17.519 18,285 19.086 19.923 20,799

10 10.462 10.950 11.464 12.006 12.578 13.181 13.816 14.487 15.193 15.937 16.722 17.549 18.420 19.337 20,304 21.321 22,393 23.521 24,709 25,959

11 11.567 12.169 12.808 13.486 14,207 14.972 15.784 16,645 17.560 18.531 19.561 20.655 21.814 23.045 24.349 25.733 27.200 28.755 30.404 32.150

12 12.683 13.412 14.192 15.026 15.917 16.870 17.888 18.977 20.141 21.384 22.713 24.133 25.650 27.271 29.002 30.850 32.824 34.931 37.180 39.581

13 13.809 14.680 15.618 16.627 17.713 18.882 20.141 21.495 22.953 24.523 26.212 28.029 29.985 32.089 34.352 36.786 39.404 42.219 45.244 48.497

14 14.947 15.974 17.086 18.292 19.599 21.015 22.550 24.215 26.019 27.975 30.095 32.393 34.883 37.581 40.505 43.672 47.103 50.818 54.841 59.196

15 16.097 17.293 18.599 20.024 21.579 23.276 25.129 27.152 29.361 31.772 34.405 37.280 40.417 43.842 47.580 51.660 56.110 60.965 66.261 72.035

16 17.258 18.639 20.157 21.825 23.657 25.673 27.888 30.324 33.003 35.950 39.190 42.753 46.672 50.980 55.717 60.925 66.649 72.939 79.850 87.442

17 18.430 20.012 21.762 23.698 25.840 28.213 30.840 33.750 36.974 40.545 44.501 48.884 53.739 59.118 65.075 71.673 78.979 87.068 96.022 105.93

18 19.615 21.412 23.414 25.645 28.132 30.906 33.999 37.450 41.301 45.599 50.396 55.750 61.725 68.394 75.836 84.141 93.406 103.74 115.27 .128.12

19 20.811 22.841 25.117 27.671 30.539 33.760 37.379 41.446 46.018 51.159 56.939 63.440 70.749 78.969 88.212 98.603 110.28 123.41 138.17 154.74

20 22.019 24.297 26.870 29.778 33.066 36.786 40.995 45.762 51.160 57.275 64.203 72.052 80.947 91.025 102.44 115.38 130.03 146.63 165.42 186.69

25 28.243 32.030 36.459 41.646 47.727 54.865 63.249 73.106 84. 701 98.347 114.41 133.33 155.62 181.87 212.79 249.21 292.10 342.60 402.04 471.98

30 34.785 40.568 47.575 56.085 66.439 79.058 94.461 113.28 136.31 164.49 199.02 241.33 293.20 356.79 434.75 530.31 647.44 790.95 966.71 1,181.9

35 41.660 49.994 60.462 73.652 90.320 111.43 138.24 172.32 215.71 271.02 341.59 431.66 546.68 693.57 881.17 1,120.7 1,426.5 1,816.7 2,314.2 2,948.3

40 48.886 60.402 75.401 95:026 120.80 154.76 199.64 259.06 337.88 442.59 581.83 767.09 1,013.7 1,342.0 1,779.1 2,360.8 3,134.5 4,163.2 5,529.8 7,343.9

50 64.463 84.579 112.80 152.67 209.35 290.34 406.53 573.77 815.08 1,163.9 1.668.8 2,400.0 3,459.5 4,994.5 7,217.7 10,436 15.090 21.813 31.515 45,497

TABLED

Present value interest factor of an (ordinary) annuity of $1 per period at i% for n periods, PVIFA(i,n).

Period

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

1%

0.990

1.970

2.941

3.902

4.853

5,795

6:728

7.652

8.566

9.471

10.368

11.255

12.134

13.004

13.865

2%

0.980

1.942

2.884

3.808

4.713

5.601

6.472

7.325

8.162

8'983

9,787

10.575

11.348

12.106

12.849

3%

0.971

1.913.

2.829

3.717

. 4.580

5.417

6,230

7.020

7.786

8,530

9.253

9.954

10.635

11.296

11.938

4%

0.962

1.886

2.775

3,630

4.452

5.242

6.002

6,733

7.435

8.111

8.760

9.385

9.986

10.563

11.118

5%

0.952

1.859

2.723

3.546

4.329

5.076

5.786

6.463

7.108

7.722

8.306

8,863

9.394

9,899

10.380

6%

0.943

1.833

2.673

3.465

4.212

4.917

5.562

6.210

6.802

7.360

7.887

8.384

8,853

9.295

9.712

7%

0.935

1.808

2.624

3.387

4.100

4.767

5.389

5.971

6.515

7.024

7.499

7,943

8.358

8.745

9,108

8%

0.926

1.783

2.577

3.312

3.993

4.623

5.206

5.747

6,247

6.710

7.139

7.536

7.904

8.244

8.559

9%

0.917

1.759

2.531

3.240

3.890

4.486

5.033

5.535

5.995

6.418

6.805

7.161

7.487

7.786

8.061

10%

0.909

1.736

2.487

3.170

3.791

4.355

4.868

5,335

5.759

6.145

6.495

6.814

7.103

7.367

7.606

11%

0.901

1,713

2.444

3.102

3,696

4.231

4.712

5.146

5.537

5.889

6.207

6.492

6.750

6.982

7.191

12%

0.893

1,690

2.402

3.037

3.605

4.111

4.564

4.968

5.328

5.650

5.938

6.194

6.424

6.628

6,811

13%

o.a05

1.668

2.361

2.974

3.517

3.998

4.423

4.799

5.132

5.426

5.667

5.918

6.122

6.302

6.462

14%

0.877

1.647

2.322

2.914

3.433

3.889

4.288

4.639

4.946

5.216

5.453

5.660

5.842

6.002

6.142

15%

0.870

1.626

2.283

2.855

3.352

3.784

4.160

4.487

4.772

5.019

5.234

5.421

5.583

5.724

5.847

16%

0.862

1.605

2.246

2.798

3.274

3,665

4.039

4.344

4.607

4.833

5.029

5.197

5.342

5.468

5.575

17%

0.855

1.585

2.210

2.743

3.199

3.589

3.922

4.207

4.451

4.659

4.836

4.988

5.118

5.229

5.324

18%

0.847

1.566

2.174

2.690

3.127

3.498

3.812

4.078

4.303

4.494

4.656

4.793

4.910

5.008

5.092

19%1 20%

0.840 0.833

1.547 1.528

2.140 2.106

2.639 2.589

3.058 2.991

3.410 3.326

3.706 3.605

3.954 3.837

4.163 4.031

4.339 4.192

4.486 4.327

4.611 4.439

4.715 4.533

4.802 4.611

4.876 4.675

16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 Jl.313 7.824 7.379 6.974 6.604 6.265 5.954 5.668 5.405 5.162 4.938 4.730

17 15.562' 14.292

18 16.398 14.992

19 17.226 15.678

13.166

13.754

14,324

12.166

12.659

13.134

11.274

11.690

12,085

10.477

10.828

11.158

9.763

10.059

10.336

9.122

9.372

9,604

8.544

8.756

8.950

8.022

8.201

8.365

7.549

7.702

7,839

7.120 6.729

7.250 6.840

7.366 · 6.938

6.373

6.467

6.550

6.047

6.128

6.198

5.749

5.818

5.877

5.475

5.534

5.584

5.222

5.273

5.316

4.990

5.033

5.070

4.775

4.812

4.843

20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.618 9.129 8.514 7.963 7.469 7.025 6,623 6.2°59 5.929 5.628 5.353 5.101 4.870

25 22.023 19.523 17.4.13 15.622 14.094 12.783 11,654 10.675 9.823 9.077 8.422 7.843, 7.330 6.873 6.464 6.097 5.766 5.467 5.195 4.948

30 25.808 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.694 8.055 7.496 7.003 6.566 6.177 5.829 5.517 5.235 4.979

35 29.409 24.999 21.487 18.665 16.374 14.498 12.948 11,655 10.567 9.644 8.855 8.176 7.586 7.070 6.617 6.215 5.858 5.539 5.251 4.992

40 32.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.951 8.244 7.634 7.105 6.642 6.233 5.871 5.548 5.258 4.997

50 39.196 31.424 25.730 21.482 18.256 15.762 13.801 12.233 10.962 9.915 9.042 8,304 7.675 7.133 6.661 6.246 5.880 5.554 5.262 4.999

21%

0.826

1.509

2.074·

2.540

2.926

3.245

3.508

3.726

3.905

4.054

4.177

4.278

4.362

4.432

4.489

4.536

4.576

4.608

4.635

4.657

4.721

4.746

4.756

4.760

4.762

22%

0.820

1.492

2.042

2.494

2.864

3.167

3.416

3.619

3.786

3.923

4.035

4.127

4.203

4.265

4.315

4.357

4.391

4.419

4.442

4.460

'4.514

4.534

4.541

4.544

4.545

23%

0.813

1.474

2.011

2.448

2.803

3.092

3.327

3.518

3.673

3.799

3.902

3.985

4,053

4.108

4.153

4.189

4.219

4.243

4.263

4.279

4.323

4.339

4,345

4,347

4,348

"'