|

FDA621S - FORCASTING AND DATA ANALYSIS - 1ST OPP - NOV 2022 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTYOF COMMERCEH, UMANSCIENCEAND EDUCATION

DEPARTMENT OF MARKETING, LOGISTICS AND SPORTS MANAGEMENT

QUALIFICATION: BACHELOR OF LOGISTICS AND SUPPLY CHAIN MANAGEMENT

QUALIFICATION CODE: 07BLSC

COURSE CODE: FDA621S

SESSION: NOVEMBER 2022

DURATION: 3 HOURS

LEVEL: 6

COURSE NAME: FORECASTINGAND DATA ANALYSIS

PAPER:THEORY

MARKS: 100

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER(S)

Ms. Emilia Salomo (FT & DI)

Mr Tangi Nepolo (PT)

MODERATOR: Ms Gloria Tshoopara

INSTRUCTIONS

1. This paper consists of 2 Sections, A and B

2. Answer ALL 5 questions in all sections

3. Read each question carefully

4. Write as legible and precise as possible

5. Indicate your class lecturer's name on your answer sheet

THIS EXAMINATION QUESTION PAPER CONSISTS OF 8 PAGES (Including this front page)

1

|

2 Page 2 |

▲back to top |

SECTION A

[30 MARKS]

QUESTION 1: MULTIPLE CHOICE

[20 MARKS]

There are ten multiple-choice questions with several possible choices; choose the best possible

answer, e.g. 1.1 A. Each question is worth two marks.

1. Forecasts used for new product planning, capital expenditures, facility location or expansion,

and R&D typically utilise a

a) short-range time horizon

b) medium-range time horizon

c) long-range time horizon

d) naive method because there is no data history

2. Multiple regression analysis is used when

[2 marks]

a) there is insufficient data to carry out simple linear regression analysis.

b) the dependent variable depends on more than one independent variable.

c) one or more assumptions of simple linear regression are incorrect.

d) a linear function cannot describe the relationship between the dependent and

independent variables.

3. Which of the following is suitable for launching a new product?

a) Moving average

b) Product life cycle analysis

c) Exponential smoothing

d) all of the above

[2 marks]

4. Which of the below is an inherent assumption of forecasting?

[2 marks]

a) Forecasting tends to be more accurate for longer periods than nearer periods

b) Forecast is accurate

c) Forecast is never accurate

d) All of the above

5. When you over-forecast, you will most likely

a) High inventory cost

b) Low inventory cost

c) High shipping cost

d) Low obsolescence

[2 marks]

6. Which of the below is true

[2 marks]

a) In forecasting, data analytics must consist of data from internal sources only

b) Product improvement is not regarded as a new product in forecasting as historical

data of the older version is used

c) The unconstrained forecast is a forecast constrained by the operations side of the

business, such as capacity, materials, cash flow, etc

d) Before-after retail simulation overstate the true market potential thus forecaster

must discount results

2

|

3 Page 3 |

▲back to top |

7. Which of the below is false?

[2 marks]

a) Data analysis and prediction require collaboration between different departments.

b) Some forecasting models require more data than others.

c) Constraint forecasting doesn't consider the available capacity constraint

d) Unconstraint forecast is based on the actual market demand potential

8. A repeatable pattern of increases or decreases in demand, depending on periods of one year

or less, is a time series pattern called:

[2 marks]

a) Trend

b) Seasonality

c) Cycles

d) Random variations

9. Which of the below techniques requires multiple experts interviewed together to reach a

consensus?

[2 marks]

a) Expert Opinion

b) PanelConsensus

c) Delphi Technique

d) All of the above

10. Mature products with stable demand

a) Are usually easiest to forecast.

b) They Are usually the hardest to forecast.

c) Cannot be forecast.

d) Do not need to be forecast.

[2 marks]

3

|

4 Page 4 |

▲back to top |

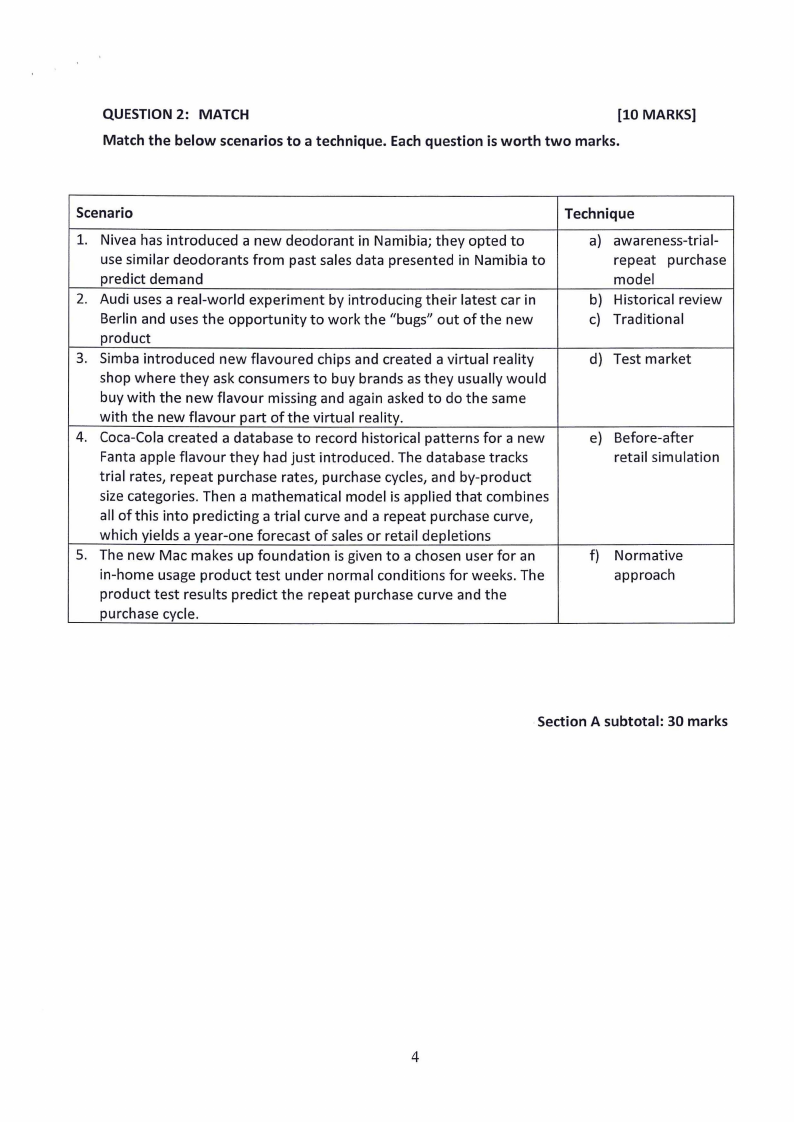

QUESTION 2: MATCH

[10 MARKS]

Match the below scenarios to a technique. Each question is worth two marks.

Scenario

1. Nivea has introduced a new deodorant in Namibia; they opted to

use similar deodorants from past sales data presented in Namibia to

predict demand

2. Audi uses a real-world experiment by introducing their latest car in

Berlin and uses the opportunity to work the "bugs" out of the new

product

3. Simba introduced new flavoured chips and created a virtual reality

shop where they ask consumers to buy brands as they usually would

buy with the new flavour missing and again asked to do the same

with the new flavour part of the virtual reality.

4. Coca-Cola created a database to record historical patterns for a new

Fanta apple flavour they had just introduced. The database tracks

trial rates, repeat purchase rates, purchase cycles, and by-product

size categories. Then a mathematical model is applied that combines

all ofthis into predicting a trial curve and a repeat purchase curve,

which yields a year-one forecast of sales or retail depletions

5. The new Mac makes up foundation is given to a chosen user for an

in-home usage product test under normal conditions for weeks. The

product test results predict the repeat purchase curve and the

purchase cycle.

Technique

a) awareness-trial-

repeat purchase

model

b) Historical review

c) Traditional

d) Test market

e) Before-after

retail simulation

f) Normative

approach

Section A subtotal: 30 marks

4

|

5 Page 5 |

▲back to top |

SECTION B: STRUCTURED QUESTIONS

[70 MARKS]

QUESTION 3

[S MARKS]

You are invited to an interview for a demand planner position. The interviewer asks you what

the qualities of a successful demand planner are. What is your response?

QUESTION 4

[46 MARKS]

Namibia breweries hire you as their demand planner. Part of your job is to provide forecasts to

suppliers and the production department for planning purposes. Below is your last 12 months 1

demand with the average price per unit.

Period

Nov-21

Dec-21

Jan-22

Feb-22

Mar-22

Apr-22

May-22

Jun-22

Jul-22

Aug-22

Sep-22

Oct-22

Product

price (NAD)

10.00

8.00

9.50

9.50

10.50

9.50

10.00

10.50

8.50

8.50

8.90

9.50

product A

sales

2449

2319

2536

2473

2447

2761

2731

2775

2546

2462

2561

2647

3.1 Forecast for November 2022 using the below methods; [15 marks]

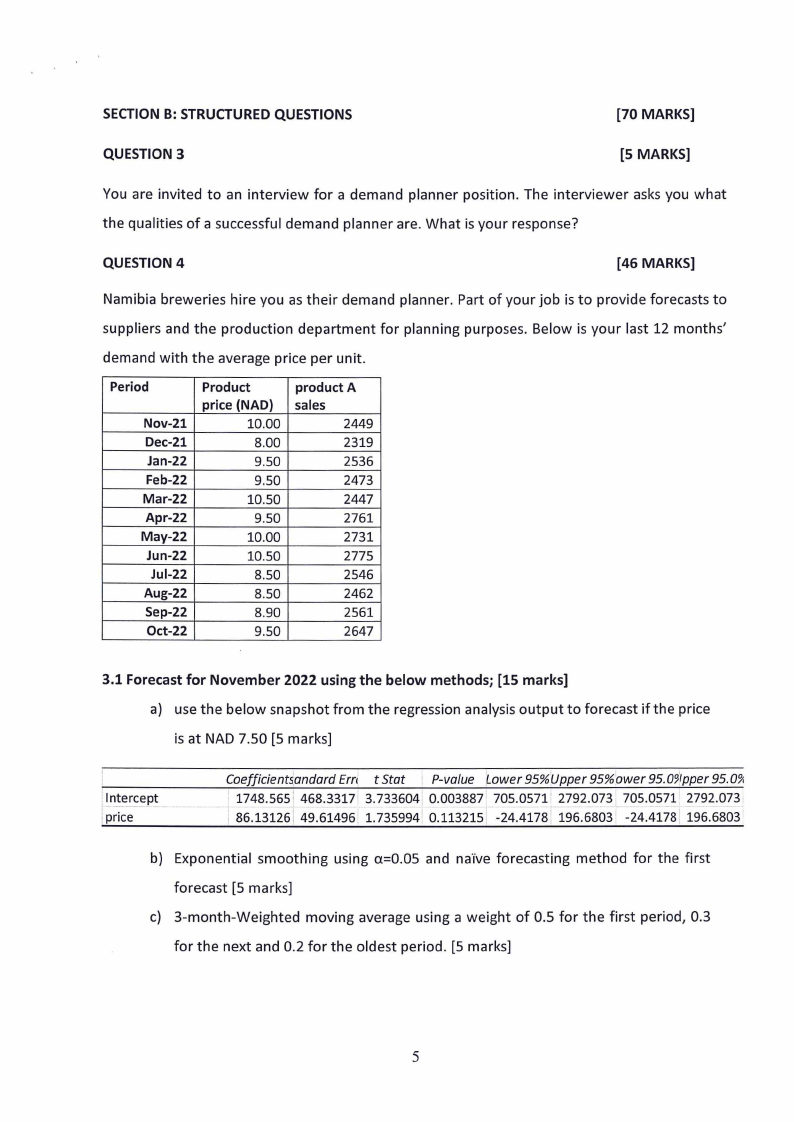

a) use the below snapshot from the regression analysis output to forecast if the price

is at NAD 7.50 [5 marks]

IIpnt~eric~ep;t- -

Coefficients'andard Em t Stat : P-value ,Lower 95%'Upper 95%ower 95.0~'tpper95.09'.

1748.565 1 468.3317 3.733604 0.003887 705.0571' 2792.073 705.0571 2792.073

I 86,13126! 49,6i496: 1.735994 1 0.113215 -24,41781 196,6803- -24.4178, 196,6803

b) Exponential smoothing using a=0.05 and na'ive forecasting method for the first

forecast [5 marks]

c) 3-month-Weighted moving average using a weight of 0.5 for the first period, 0.3

for the next and 0.2 for the oldest period. [5 marks]

5

|

6 Page 6 |

▲back to top |

3.2 Calculate the below for all the three methods used in 3.1 above [26 marks]

a) CFE [5 marks]

b) MAD [8 marks]

c) MAPE [8 marks]

d) TS [5 marks]

3.3 Choose which forecasting method is best suitable for the data and justify [5 marks]

6

|

7 Page 7 |

▲back to top |

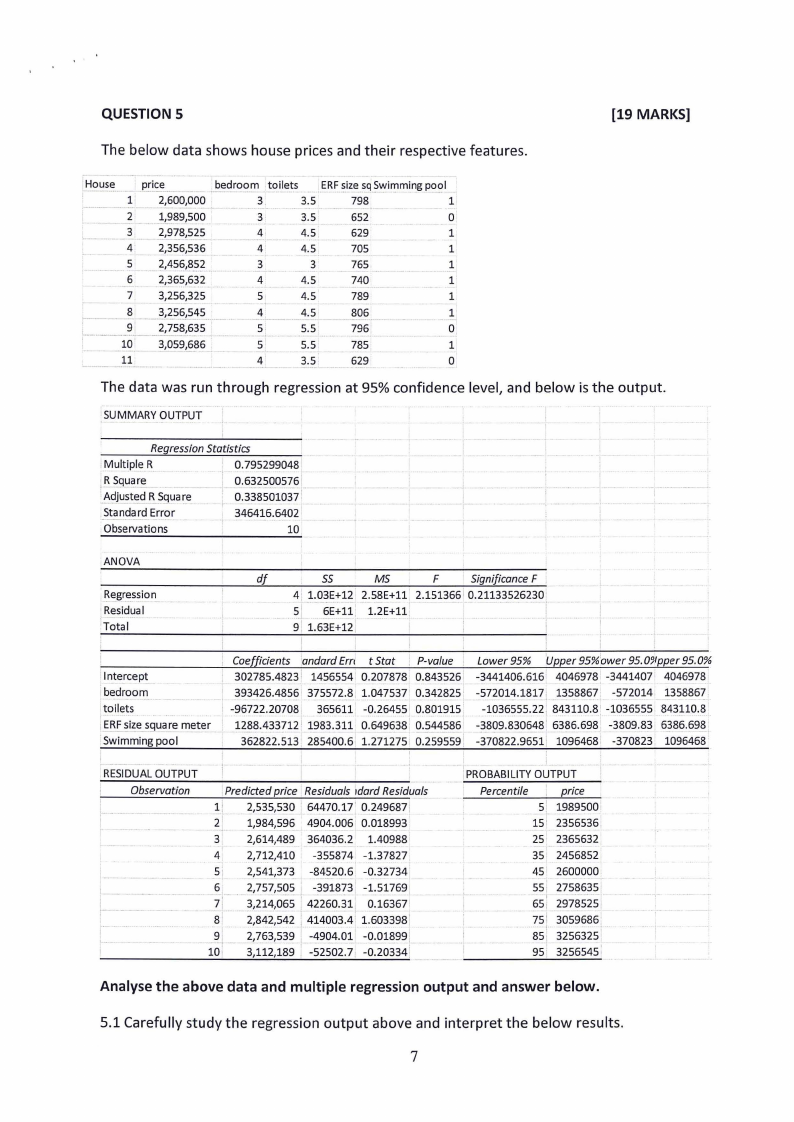

QUESTION 5

[19 MARKS]

The below data shows house prices and their respective features.

House p_r~~-

.. ·---- -- -1-- 2,60~000

2 _ .. }~89,500

bedroom toilets ERF~ize_sq?~imming pool

3

3.5

798

1

3

3.5

652

0

3 ?,97_8,525

4...

4.5

629

1

4 2,356,536

4

4.5

705

1

5 ~,456-,8_?~_

3

3

765

1

6 2,365,632

4

4.5

740

1

7 3,256,325

5

4.5

789

1

8 __id_56-.L545...,

4

4.5

806

1

--------·-·9 . 2,758,635

5

5.5

796

0,

10 ~,059~86

5

5.5

785

1

11

4

3.5

629

0

The data was run through regression at 95% confidence level, and below is the output.

SUMMARYOUTPUT

Regression Statistics

l\\/lultiple R

0.795299048

,~~_l_!~r~

~~jjusted Square

0.632500576

0.338501037

Standard Error

346416.6402

Observations

10

ANOVA

~egre,ssion

1 Residual

Total

In_te_rcep.!__

bedroom

toilets

ERFsiz~sguare m~ter

Swimming pool

df

55

MS

F

Significance F

4: l.03-E· +12 2.58E+ll 2.151366 i 0.21133526230

5 6E+ll, l.2E+ll

9 l.63E+l2

i

.,

l

Coefficients andard Em t Stat . P-value Lower 95% 'upper 95%ower 95.0'Jfpper 95.0%

302785.4823 · 1456554 0.207878 0.843526 -3441406.616 4046978 -3441407 4046978

393426.4856 375572.8 1.047537 0.342825· -57201'7,1817, . 1358867 -572014 1358867

-96722- .20708 365611 -0.26455 0.801915

12-88.4. 33712 1 1. 983.311 0.649638 0.544586

362822.513 285400.6 1.271275 0.259559,

-1036555.22, 843110.8. -1036555 843110.8

-3809.830648 I 6386.698 -3809.83 6386.698

-370822.9651 1096468 -370823 1096468

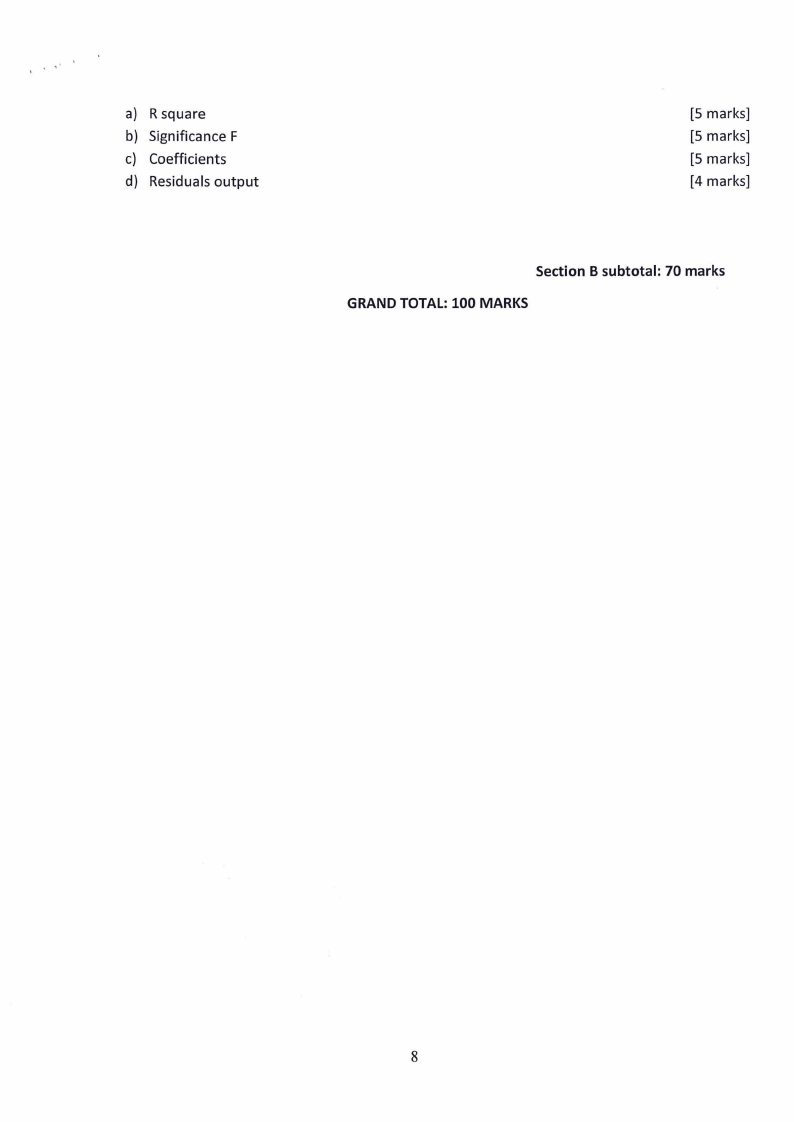

RESIDUALOUTPUT

Observation

Predicted price Residuals ,dard Residuals

li ?,535,530 64_470.17' 0.2496871

2 1,984,596 4904.006 0.018993

3 2,614,489 364036.2 1.40988

4 2,712,410 -355874 -1.37827

5 I 2,541,373 -84520.6 -0,32734

6 2,757,5.Q_~ -391873 -1.51769

7i 3,214,065 42260.31 0.16367

8' 2,842,542 ; 4i~cio~~-4•1.603398'

9 2,763~539 _-~904.01 -0.01899

10 3,112,189 -52502.7 -0.2033{

·' ·

PROBABILITYOUTPUT

Percentile

price

5' 1989500

15 I 2356536,

25 2365632

35 2456852

45 2600000

55• 2758635

65,I

-

2978525

7.5. \\i 3059686

85 3256325

95' 3256545'

Analyse the above data and multiple regression output and answer below.

5.1 Carefully study the regression output above and interpret the below results.

7

|

8 Page 8 |

▲back to top |

a) R square

b) Significance F

c) Coefficients

d) Residuals output

(5 marks]

(5 marks]

(5 marks]

(4 marks]

Section B subtotal: 70 marks

GRAND TOTAL: 100 MARKS

8