|

FAC511S- FINANCIAL ACCOUNTING 102- 2ND OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IV ERs ITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING AND BACHELOR OF LOGISTICSAND

SUPPLYCHAIN MANAGEMENT

QUALIFICATION CODE: 07BOAC AND

07BLSC

LEVEL: 5

COURSE: FINANCIAL ACCOUNTING 101 COURSE CODE: FACSllS

SESSION: JUNE/JULY 2023

PAPER: THEORY & CALCULATIONS

DURATION: 3 Hours

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS:

Ms Y Andrew, Ms H Kangala, Mr L Odada, Mr Chikambi and Mr C

Simasiku

MODERATOR:

Mr C Mahindi

INSTRUCTIONS TO CANDIDATES

1. Answer all questions in blue or black ink.

2. Round off all amounts to the nearest Namibian Dollar (N$), where applicable.

3. A silent, non-programmable calculator is permissible.

4. Show all your workings (where applicable).

This paper consists of 5 pages, excluding the cover page.

|

2 Page 2 |

▲back to top |

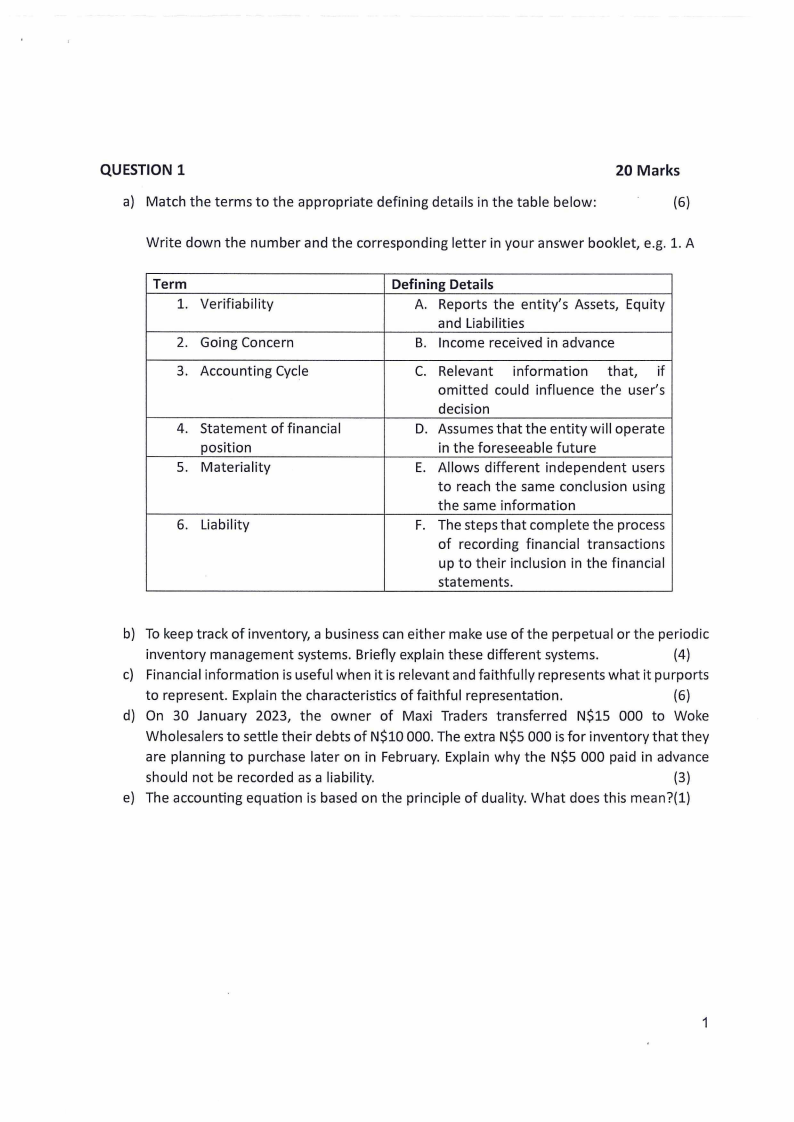

QUESTION 1

a) Match the terms to the appropriate defining details in the table below:

20 Marks

(6)

Write down the number and the corresponding letter in your answer booklet, e.g. 1. A

Term

1. Verifiability

2. Going Concern

3. Accounting Cycle

4. Statement of financial

position

5. Materiality

6. Liability

Defining Details

A. Reports the entity's Assets, Equity

and Liabilities

B. Income received in advance

C. Relevant information that, if

omitted could influence the user's

decision

D. Assumes that the entity will operate

in the foreseeable future

E. Allows different independent users

to reach the same conclusion using

the same information

F. The steps that complete the process

of recording financial transactions

up to their inclusion in the financial

statements.

b) To keep track of inventory, a business can either make use of the perpetual or the periodic

inventory management systems. Briefly explain these different systems.

(4)

c) Financial information is useful when it is relevant and faithfully represents what it purports

to represent. Explain the characteristics of faithful representation.

(6)

d) On 30 January 2023, the owner of Maxi Traders transferred N$15 000 to Woke

Wholesalers to settle their debts of N$10 000. The extra N$5 000 is for inventory that they

are planning to purchase later on in February. Explain why the N$5 000 paid in advance

should not be recorded as a liability.

(3)

e) The accounting equation is based on the principle of duality. What does this mean?(l)

1

|

3 Page 3 |

▲back to top |

QUESTION 2

30 Marks

You are the accountant of TMU Entity and have been provided the following Trial balance as at

31 October 2022.

Land & buildings

Furniture

Accumulated depreciation: furniture

Vehicles

Accumulated depreciation: vehicles

Sales

Purchases

Inventories (1 November 2021)

Sales Returns

Commission on purchases

Credit losses

Drawings

Interest expense

Loan

Interest income

Rent received

Salaries & wages

Sundry expenses

Accounts receivables

Accounts payables

Bank

Capital

Debit

N$

150,000.00

30,000.00

45,000.00

450,000.00

180,000.00

7,500.00

15,000.00

3,000.00

45,000.00

4,500.00

27,000.00

16,500.00

76,500.00

12,000.00

1,062,000.00

Credit

N$

7,500.00

12,000.00

750,000.00

90,000.00

3,000.00

30,000.00

54,000.00

115,500.00

1,062,000.00

Additional information:

1. Inventories on 31 October 2022 amount to N$195 000.

2. Interest on loan is calculated at 5% per year. The loan is repayable on 31 December

2023.

3. Property, plant and equipment:

3.1 The buildings are occupied for the purposes of the activities of the entity and are

accounted for in terms of the cost model. The value of the buildings is N$45,000 and

the land N$105,000 at the date of purchase, 1 November 2021.

3.2 Depreciation for the year has to be provided for as follows:

• Buildings at 3% on per year on cost

2

|

4 Page 4 |

▲back to top |

• Furniture at 6% per year on cost

• Vehicles at 10% per year on the diminishing balance method.

4. N$7 500 of receivables must be written off as irrecoverable.

5. The rental contract stipulates a monthly rental amount N$3 000.

REQUIRED

a} Prepare the Statement of profit or loss of TMU Entity for the year ended 31 October

2022.

(18}

b) Prepare the Statement of financial position of TMU Entity as at 31 October 2022. (12}

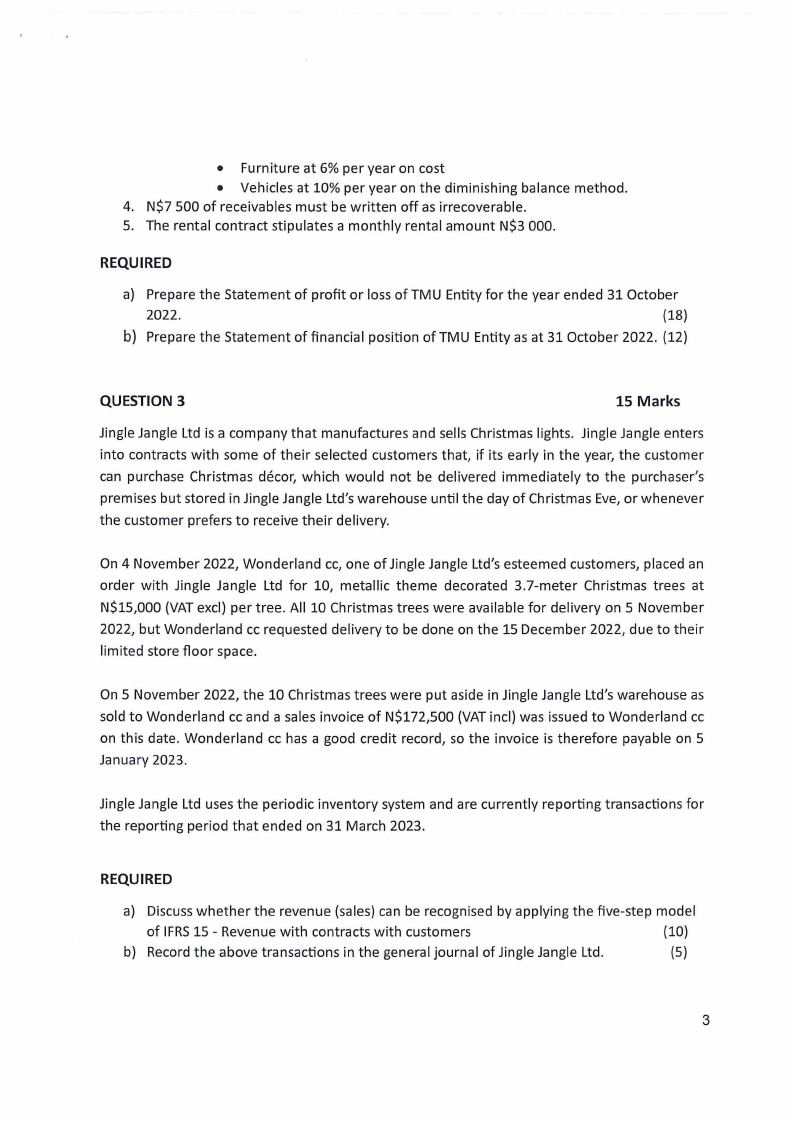

QUESTION 3

15 Marks

Jingle Jangle Ltd is a company that manufactures and sells Christmas lights. Jingle Jangle enters

into contracts with some of their selected customers that, if its early in the year, the customer

can purchase Christmas decor, which would not be delivered immediately to the purchaser's

premises but stored in Jingle Jangle Ltd's warehouse until the day of Christmas Eve, or whenever

the customer prefers to receive their delivery.

On 4 November 2022, Wonderland cc, one of Jingle Jangle Ltd's esteemed customers, placed an

order with Jingle Jangle Ltd for 10, metallic theme decorated 3.7-meter Christmas trees at

N$15,000 (VAT excl} per tree. All 10 Christmas trees were available for delivery on 5 November

2022, but Wonderland cc requested delivery to be done on the 15 December 2022, due to their

limited store floor space.

On 5 November 2022, the 10 Christmas trees were put aside in Jingle Jangle Ltd's warehouse as

sold to Wonderland cc and a sales invoice of N$172,500 (VAT incl} was issued to Wonderland cc

on this date. Wonderland cc has a good credit record, so the invoice is therefore payable on 5

January 2023.

Jingle Jangle Ltd uses the periodic inventory system and are currently reporting transactions for

the reporting period that ended on 31 March 2023.

REQUIRED

a} Discuss whether the revenue (sales} can be recognised by applying the five-step model

of IFRS15 - Revenue with contracts with customers

(10}

b} Record the above transactions in the general journal of Jingle Jangle Ltd.

(5)

3

|

5 Page 5 |

▲back to top |

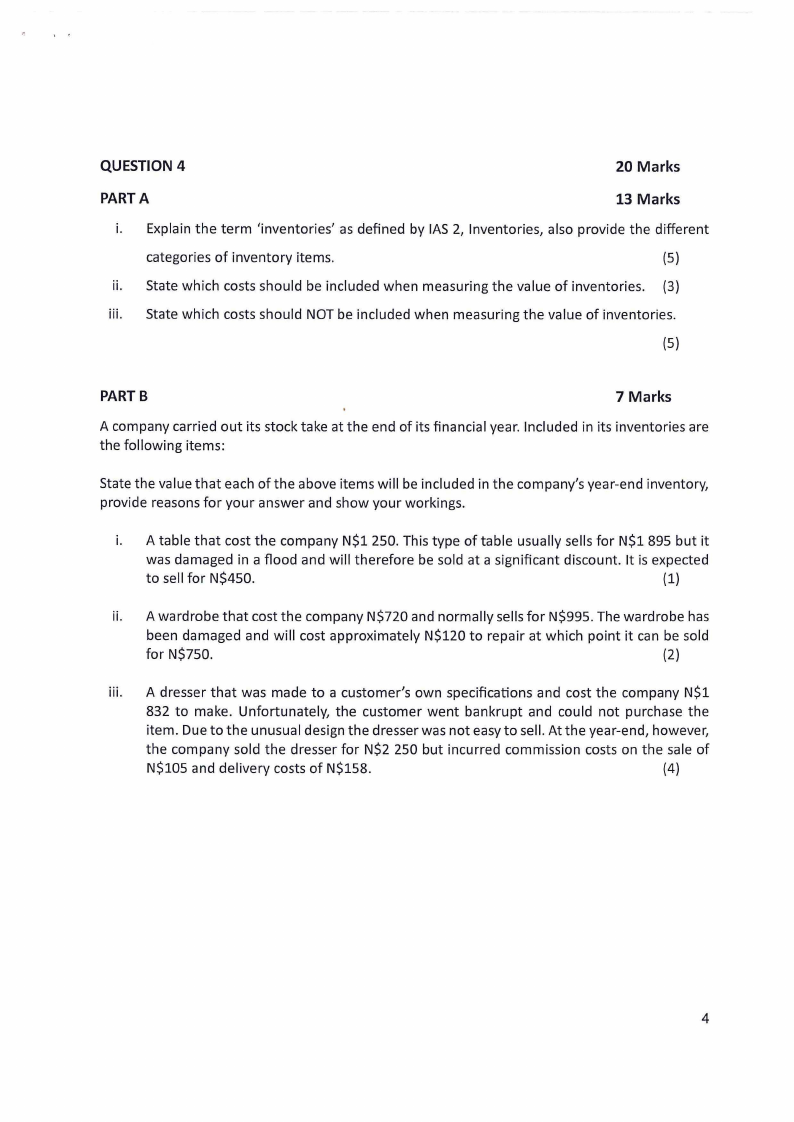

QUESTION 4

20 Marks

PARTA

13 Marks

i. Explain the term 'inventories' as defined by IAS 2, Inventories, also provide the different

categories of inventory items.

(5)

ii. State which costs should be included when measuring the value of inventories. (3)

iii. State which costs should NOT be included when measuring the value of inventories.

(5)

PARTB

7 Marks

A company carried out its stock take at the end of its financial year. Included in its inventories are

the following items:

State the value that each of the above items will be included in the company's year-end inventory,

provide reasons for your answer and show your workings.

i. A table that cost the company N$1 250. This type of table usually sells for N$1 895 but it

was damaged in a flood and will therefore be sold at a significant discount. It is expected

to sell for N$450.

(1)

ii. A wardrobe that cost the company N$720 and normally sells for N$995. The wardrobe has

been damaged and will cost approximately N$120 to repair at which point it can be sold

for N$750.

(2)

iii. A dresser that was made to a customer's own specifications and cost the company N$1

832 to make. Unfortunately, the customer went bankrupt and could not purchase the

item. Due to the unusual design the dresser was not easy to sell. At the year-end, however,

the company sold the dresser for N$2 250 but incurred commission costs on the sale of

N$105 and delivery costs of N$158.

(4)

4

|

6 Page 6 |

▲back to top |

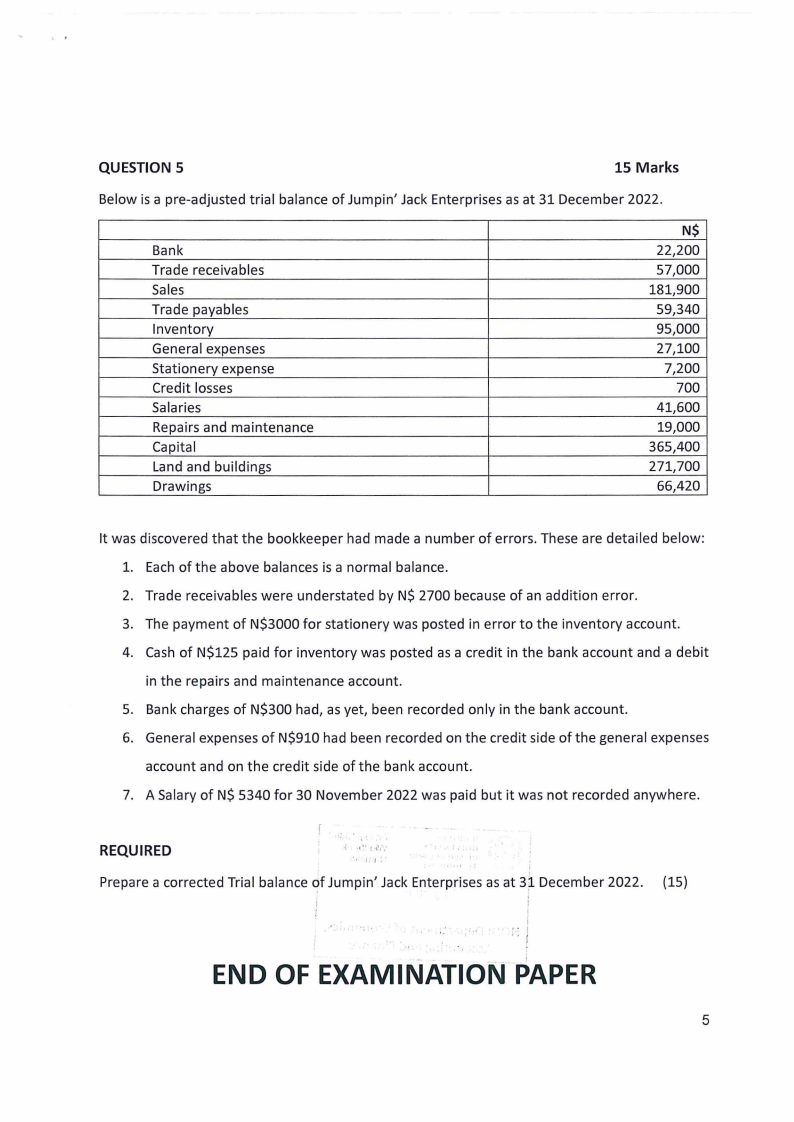

QUESTION 5

15 Marks

Below is a pre-adjusted trial balance of Jumpin' Jack Enterprises as at 31 December 2022.

Bank

Trade receivables

Sales

Trade payables

Inventory

General expenses

Stationery expense

Credit losses

Salaries

Repairs and maintenance

Capital

Land and buildings

Drawings

N$

22,200

57,000

181,900

59,340

95,000

27,100

7,200

700

41,600

19,000

365,400

271,700

66,420

It was discovered that the bookkeeper had made a number of errors. These are detailed below:

1. Each of the above balances is a normal balance.

2. Trade receivables were understated by N$ 2700 because of an addition error.

3. The payment of N$3000 for stationery was posted in error to the inventory account.

4. Cash of N$125 paid for inventory was posted as a credit in the bank account and a debit

in the repairs and maintenance account.

5. Bank charges of N$300 had, as yet, been recorded only in the bank account.

6. General expenses of N$910 had been recorded on the credit side of the general expenses

account and on the credit side of the bank account.

7. A Salary of N$ 5340 for 30 November 2022 was paid but it was not recorded anywhere.

REQUIRED

' ; !•

Prepare a corrected Trial balance of Jumpin' Jack Enterprises as at 3f December 2022. (15)

!

i

,. I

', !

END OF EXAMINATION PAPER

5