|

BBF612S - BUSINESS FINANCE - 2ND OPP - 2020 |

|

1 Page 1 |

▲back to top |

NAMIBIA UNIVERSITY

OF SCIENCE AND TECHNOLOGY

Faculty of Management Sciences

Department of Management

QUALIFICATION: Bachelor in Business Management

QUALIFICATION CODE: 07BBMA

COURSE: Business Finance

LEVEL: 7

COURSE CODE: BBF612S

DATE: January 2020

SESSION: 2"! Opportunity

DURATION: 2 hours

MARKS: 100

EXAMINER(S)

MODERATOR:

2"? OPPORTUNITY QUESTION PAPER

Ms C Kauami

Mr A Ndjavera

Mr B Kamudyariwa

Mr Ernest Mbanga

THIS QUESTION PAPER CONSISTS OF 6 PAGES

(Including this front page)

INSTRUCTIONS

Answer all questions.

Show all formulae and calculations as marks will be awarded for them.

Write clearly and neatly.

Number the answers clearly.

Please refer to financial statements and additional information for ratio

calculations.

PERMISSIBLE MATERIALS

1. Calculator.

|

2 Page 2 |

▲back to top |

Section A:

[15 Marks]

Question 1:

Multiple Choice Questions — Choose the correct Answer(s)

Please note that numerical questions carry 3 marks.

1. Credit standards refer to:

a. Terms required for all credit customers.

b. Limit of credit granted to a customer.

c. The different procedures that a firm uses to collect accounts receivable.

d. The minimum requirements for extending credit to a customer.

(1 mark)

2. What does initial outlay mean in time value of money investment decision?

a. Cash deposited for interest return

b. Cash outflow

c. Cash inflow

d. The number of years required to recover the initial investment.

(1 mark)

3. What is the disadvantage of raising finance through a share issue?

It is illegal

b. Existing shareholders will have less control

c. Liquidity will be reduced

d. Interest payments will rise

(1 mark)

4. What is the difference between R1 000 invested at 10% p.a. compounded interest for five

years if:

(3 marks)

e interest is calculated annually

interest is calculated semi-annually?

a. NSO

b. NS 18

c. NS$315

d. NS 611

5. The primary sources for financial analysis:

a. Statement of financial performance

b. Auditors’ report

c. Cashflow statement

d. Director’s report

(1 mark)

6. Inthe management of working capital, CCC refers to

a. convenient cash circulation

b. cash consumption cycle

c. cash conversion cycle

d. circulating cash cycle

(1 mark)

|

3 Page 3 |

▲back to top |

7. The following are characteristics of management accounting, except:

a. Must follow externally imposed rules

Internally focused

No mandatory rules

Emphasis on the future

Broad, multidisciplinary

(1 mark)

8. Which of the following is not a time-adjusted method of ranking investment proposals?

a. Net Present value method

(1 mark)

b. Payback method

c. Internal rate of return

d. Allof the above are time-adjusted methods

9. The fundamental accounting concept that transactions are accounted for when they occur

and not when cash is paid or received, is known as

(1 mark)

a. Going concern

b. Relevance

c. Accrual

d. Matching

10. Better liquidity may be achieved by the following except

(1 mark)

a. stocking a range of products that has seasonal demand

b. accelerating cash flows from accounts receivable (debtors)

c. delaying cash flows by paying creditors (accounts payable) as late as possible

d. not over-investing in inventory (stock)

11. A company sells its products on credit. It takes the firm an average of 24 days from buying

stocks to selling it. The firm takes an average of 70 days to collect the money from debtors.

What is the operating cycle?

(3 marks)

a)

94 days

b)

46 days

c)

70 days

d)

48 days

|

4 Page 4 |

▲back to top |

Section B: Short Questions

[54 Marks]

Question 2: Financial goal of a firm

Explain the fundamental principles of financial management.

(12 marks)

Question 3: Understanding financial statements

(14 marks)

List the principal users/stakeholders of financial statements and explain what information they

are interested in.

Question 4: Profit planning and control

(14 marks)

Briefly explain/define budgets and summarize their main functions.

Question 5: Management of working capital

(14 marks)

Briefly discuss the factors that are essential in the management of accounts receivable

|

5 Page 5 |

▲back to top |

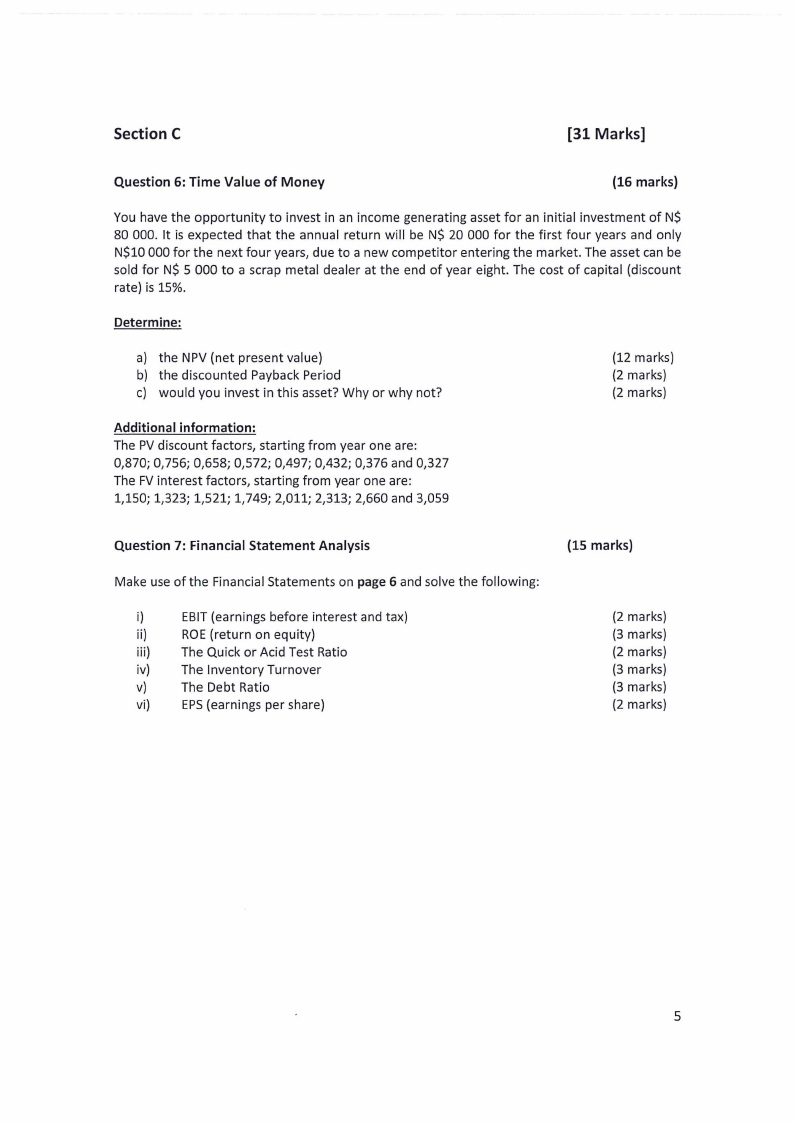

Section C

[31 Marks]

Question 6: Time Value of Money

(16 marks)

You have the opportunity to invest in an income generating asset for an initial investment of NS

80 O00. It is expected that the annual return will be NS 20 000 for the first four years and only

NS$10 000 for the next four years, due to a new competitor entering the market. The asset can be

sold for NS 5 000 to a scrap metal dealer at the end of year eight. The cost of capital (discount

rate) is 15%.

Determine:

a) the NPV (net present value)

b) the discounted Payback Period

c) would you invest in this asset? Why or why not?

(12 marks)

(2 marks)

(2 marks)

Additional information:

The PV discount factors, starting from year one are:

0,870; 0,756; 0,658; 0,572; 0,497; 0,432; 0,376 and 0,327

The FV interest factors, starting from year one are:

1,150; 1,323; 1,521; 1,749; 2,011; 2,313; 2,660 and 3,059

Question 7: Financial Statement Analysis

Make use of the Financial Statements on page 6 and solve the following:

i)

EBIT (earnings before interest and tax)

ii)

ROE (return on equity)

iii)

The Quick or Acid Test Ratio

iv)

The Inventory Turnover

v)

The Debt Ratio

vi)

EPS (earnings per share)

(15 marks)

(2 marks)

(3 marks)

(2 marks)

(3 marks)

(3 marks)

(2 marks)

|

6 Page 6 |

▲back to top |

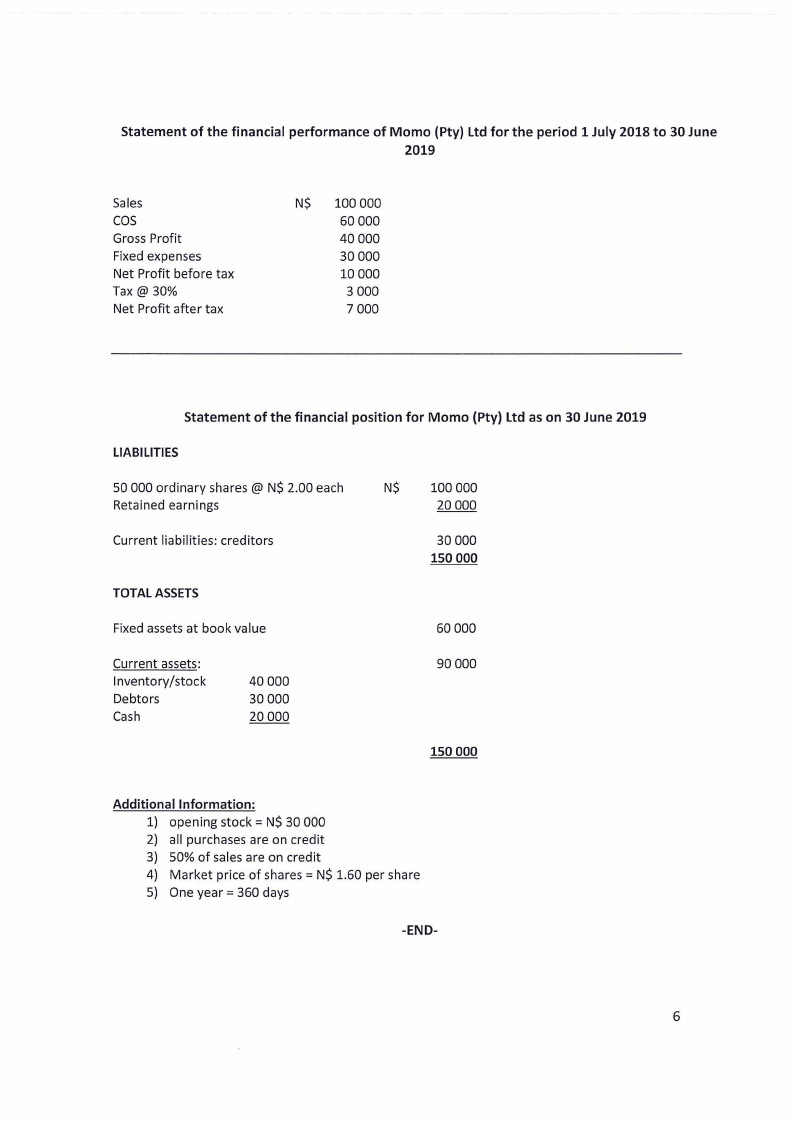

Statement of the financial performance of Momo (Pty) Ltd for the period 1 July 2018 to 30 June

2019

Sales

cos

Gross Profit

Fixed expenses

Net Profit before tax

Tax @ 30%

Net Profit after tax

NS 100000

60 000

40 000

30 000

10 000

3 000

7 000

Statement of the financial position for Momo (Pty) Ltd as on 30 June 2019

LIABILITIES

50 000 ordinary shares @ NS 2.00 each

Retained earnings

NS

100 000

20 000

Current liabilities: creditors

30 000

150 000

TOTAL ASSETS

Fixed assets at book value

60 000

Current assets:

Inventory/stock

Debtors

Cash

40 000

30 000

20 000

90 000

150 000

Additional Information:

1) opening stock = NS 30 000

2) all purchases are on credit

3) 50% of sales are on credit

4) Market price of shares = NS 1.60 per share

5) One year = 360 days

-END-