|

FAC611S- FINACIAL ACCOUNTING 201- 1ST OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTYOF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENTOF ECONOMICS,ACCOUNTINGAND FINANCE .

QUALIFICATION:BACHELOROF ACCOUNTING

QUALIFICATIONCODE: 07BOAC

LEVEL: 6

COURSECODE: FAC611S

COURSENAME: FINANCIALACCOUNITNG 201

SESSION:JUNE 2023

DURATION: 3 HOURS

PAPER:THEORY

MARKS: 100

EXAMINER(S}

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

Dr. A SIMASIKU, Mr. C MAHINDI, Mr. C SIMASIKU and Ms. S IFUGULA

MODERATOR: DR. D KAMOTHO

INSTRUCTIONS

1. Answer ALL questions in blue or black ink only.

2. Write clearly and neatly.

3. Start each question on a new page and number the answers clearly.

4. Do not write in pencil and do not use tip-ex, as this will not be marked.

5. Questions relating to the paper may be raised in the initial 30 minutes after the start of

the paper. Thereafter, candidates must use their initiative to deal with any perceived

error or ambiguities & any assumption made by the candidate should be clearly stated.

6. The names of people and businesses used throughout this assessment do not reflect the

reality and may be purely coincidental.

7. Show all workings!

PERMISSABLE MATERIALS

1.

Non- programmable calculator

THIS QUESTION PAPERCONSISTSOF 3 PAGES(Excluding this front page)

|

2 Page 2 |

▲back to top |

Question 1

(50 marks)

Omaheke Limited is a company with a 31 May year end. It operates in various industries

throughout Namibia. On 1 June 2020, it acquired a machine for N$2,000,000 cash that would be

used to manufacture medical items such as surgical gloves and face masks that would be used

in the fight of the COV1D19pandemic.

On 1 September 2022, management decided to dispose of the machine due to a decline in the

demand for surgical gloves and face masks. On this date management decided to advertise the

machine at a reasonable price in relation to the prevailing market values. The target time frame

for completion of the sale was 1 February 2023. Management was adamant that the sale of the

machine should be completed as soon as possible so that they could use the funds to invest

another machine that would be used to manufacture medication.

On 31 May 2023 the machine remained unsold, however, management are still committed to

selling the machine.

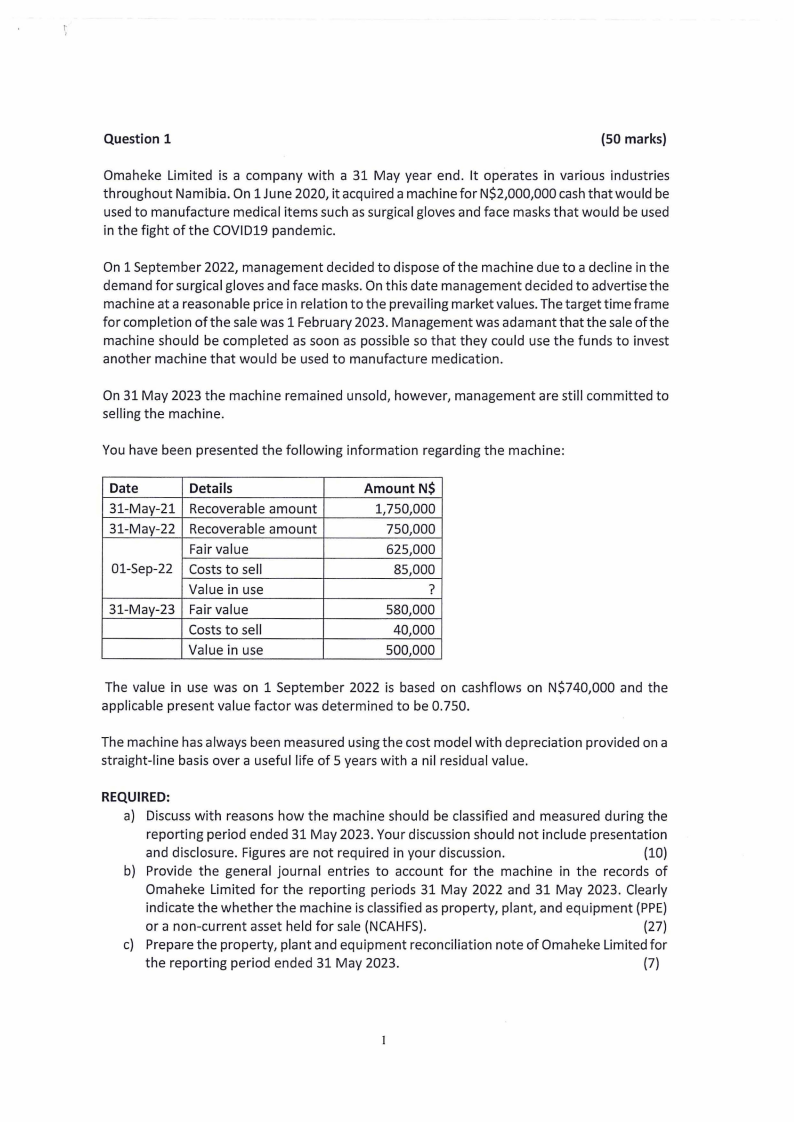

You have been presented the following information regarding the machine:

Date

31-May-21

31-May-22

01-Sep-22

31-May-23

Details

Recoverable amount

Recoverable amount

Fair value

Costs to sell

Value in use

Fair value

Costs to sell

Value in use

Amount N$

1,750,000

750,000

625,000

85,000

?

580,000

40,000

500,000

The value in use was on 1 September 2022 is based on cashflows on N$740,000 and the

applicable present value factor was determined to be 0.750.

The machine has always been measured using the cost model with depreciation provided on a

straight-line basis over a useful life of 5 years with a nil residual value.

REQUIRED:

a) Discuss with reasons how the machine should be classified and measured during the

reporting period ended 31 May 2023. Your discussion should not include presentation

and disclosure. Figures are not required in your discussion.

(10)

b) Provide the general journal entries to account for the machine in the records of

Omaheke Limited for the reporting periods 31 May 2022 and 31 May 2023. Clearly

indicate the whether the machine is classified as property, plant, and equipment (PPE)

or a non-current asset held for sale (NCAHFS).

(27)

c) Prepare the property, plant and equipment reconciliation note of Omaheke Limited for

the reporting period ended 31 May 2023.

(7)

|

3 Page 3 |

▲back to top |

d) Discuss the IFRS5 criteria which must be satisfied in order for a non-current asset to

be classified as held for sale.

(6)

Question 2

(30 marks)

Kitchen Essentialss Limited is an on line business that focuses on selling a wide variety of kitchen

products. The entity has a 31 May year end.

Kitchen Essentialss operates a website that is divided into two main sections:

• One section showcases the various kitchen products of the entity (marketing); and

• the other section deals with orders placed by customers (sales).

On 30 September 2022, the company's website was attacked malware which completely

rendered the website inaccessible even after numerous attempts to do so. On 1 June 2022 the

website had a carrying amount of N$120,000 and a remaining useful life of 2 years. The policy

of the company was to amortise the website over its total useful life of 3 years with a nil

residual value.

As a result of the destruction of the old website, a new website had to be created. This took

place between 1 October 2022 and 31 December 2022. The total costs to create the website

amounted to N$433,000 which was paid by cash.

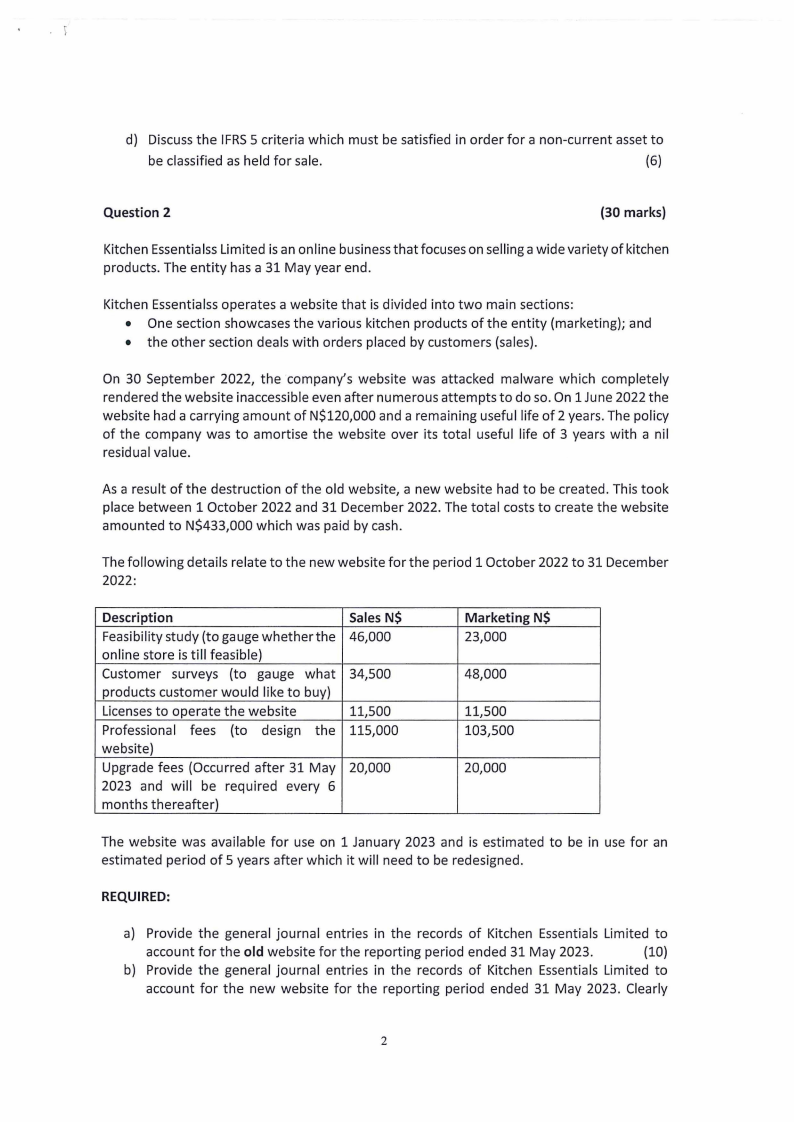

The following details relate to the new website for the period 1 October 2022 to 31 December

2022:

Description

Feasibility study (toga uge whether the

on line store is till feasible)

Customer surveys (to gauge what

products customer would like to buy)

Licensesto operate the website

Professiona I fees (to design the

website)

Upgrade fees (Occurred after 31 May

2023 and will be required every 6

months thereafter)

Sales N$

46,000

34,500

11,500

115,000

20,000

Marketing N$

23,000

48,000

11,500

103,500

20,000

The website was available for use on 1 January 2023 and is estimated to be in use for an

estimated period of 5 years after which it will need to be redesigned.

REQUIRED:

a) Provide the general journal entries in the records of Kitchen Essentials Limited to

account for the old website for the reporting period ended 31 May 2023.

(10)

b) Provide the general journal entries in the records of Kitchen Essentials Limited to

account for the new website for the reporting period ended 31 May 2023. Clearly

2

|

4 Page 4 |

▲back to top |

,I

distinguish between research expenditure and development expenditure and show

account classifications (SPL,SFPetc.).

(9)

c) Prepare the Intangible asset reconciliation note of Kitchen Essentials Limited for the

reporting period ended 31 May 2023.

(11)

Question 3

(20 marks)

Tower Heights Limited is a property company based in Windhoek with a 31 December year end.

In addition to land and buildings that it owns for day-to-day administrative activities, it has land

and buildings that are sold in the ordinary course of business as well as buildings that it leases

out to tenants in terms of operating leases.

The following information relates to an office building that it acquired on 1 January 2021 as a

cost of N$4,200,000 via an electronic funds transfer (EFT). It was immediately leased out in

terms of an operating lease until 30 June 2022. On 1 July 2022 the company took occupation of

the building and began to use it as its administrative headquarters.

The fair values of the property were determined as follows:

• 31 December 2021- N$4,500,000

• 1 July 2022 -

N$5,200,000

• 31 December 2022 - N$5,300,000

Tower Heights Limited depreciates buildings at a rate of 4% per annum on the straight-line basis

from the date the buildings are classified as property, plant and equipment. The company uses

the cost model to account for property, plant and equipment and the fair value model for

investment properties.

On 1 December 2022, Tower Heights acquired a plot of land for N$1,000,000 cash whose use

has yet to be determined.

REQUIRED:

a) Discusshow the office building will be classified in the records ofTower Heights Limited

on 1 January 2021. Provide the appropriate definition to justify your answer. (5)

b) Provide the general journal entries to account for the office building for the reporting

periods ended 31 December 2021 and 2022. Clearly indicate whether the property is

investment property (IP) or property, plant and equipment (PPE).

(10)

c) Disclose the investment property reconciliation note of Tower Heights Limited for the

reporting period ended 31 December 2022.

(5)

END OF QUESTION PAPER

r·-._.,.... ,,: ,· {

\\,fl,; }J\\ ~'

. '~,./~/,~j·i,"

lu,,,} :I:

."!,,

3