|

BEM711S - SME Management - 1st OPP - june 2023 |

|

1 Page 1 |

▲back to top |

nAm I BI A un IVE RSITY

OF SCIEn CE Ano TECHn 0L0GY

FACULTYOF COMMERCE,HUMAN SCIENCESAND EDUCATION

DEPARTMENTOF GOVERNANCEAND MANAGEMENT SCIENCES

QUALIFICATION:BACHELOROF BUSINESSADMINISTRATION

QUALIFICATIONCODE:07BMAR

LEVEL:7

COURSECODE:BEM 711S

COURSENAME: SMALLAND MEDIUM

ENTERPRISEMANAGEMENT

SESSION:JUNE 2023

DURATION: 3 HOURS

PAPER:THEORY(PAPER1)

MARKS: 100

FIRSTOPPORTUNITYEXAMINATION QUESTIONPAPER

EXAMINER{S) Ms. ANNA SHIMPANDA- PARTTIME

Dr MOSESWAIGANJO- FULLTIME& DISTANCE

MODERATOR: Mr. ERNESTMBANGA

INSTRUCTIONS

1. Answer ALL the questions.

2. Read all the questions carefully before answering.

3. Number the answers clearly

THIS QUESTIONPAPERCONSISTSOF _6_ PAGES(Including this front page)

|

2 Page 2 |

▲back to top |

SECTIONA

[20 MARKS]

Choose the correct option and indicate your choice {a-e) next to the appropriate

number in the examination book provided. For example, 1.1. b.

QUESTION 1

1.) Which of the following statements is incorrect?

A. Franchising systems have grown at a very high rate since 1994 and the

expectation is that growth will be sustained until 2005.

B. The franchisor gives the franchisee the right to operate a business using the

franchise company's name, products and systems.

C. Franchising is only suitable for a specific kind of business system.

D. A franchise operation is a contractual relationship between the franchisor and

the franchisee.

2.) Which of the following statements is incorrect?

A. Contracts of the various franchise networks differ and don't have certain terms in

common.

B. Franchise contracts leave little room for negotiation.

C. Franchise contracts are used as a tool to regulate the franchisor/franchisee

relationship and to enforce uniformity within the franchise network.

D. A franchise contract places obligations on both parties to their mutual advantage

and provides a framework.

3.) Which of the following statements is false?

A. Franchise agreements may provide for the termination of the contract after a

period of time.

B. Franchise contracts do not oblige franchisees upon termination of the contract to

participate directly or indirectly in the management of a business which conducts

business in the nature of franchised business for a certain period of time.

C. The former franchisee is obliged not to disclose confidential information or other

trade secrets of the franchisor.

D. Upon termination of the agreement the franchisee must immediately cease any

further use of trademarks and other intellectual property which was licensed to him

4.) Buying an existing business is known as

A. a buy-out.

2

|

3 Page 3 |

▲back to top |

8. joining a family business.

C. starting a new business.

D. entrepreneurship.

5.) The disadvantage(s) of buying an existing business is/are

A. the business was never profitable.

8. inadequate sales volume.

C. poor reputation/image.

D. operating in the shadow of the previous owner.

E. all of the above

F. a and c

6.) The fact that equipment, facilities and inventory are in place when you buy an

existing business may be a disadvantage when

A. their capacity is not great enough.

8. they are obsolete.

C. the technology used is too old.

D. none of the above

7.) A ____

will identify the type of business you will be happy in and make a

success of.

A. self-audit.

8. business analysis.

C. environment analysis.

D. none of the above

8.) According to the asset-based method, the value of a firm can be determined by using

the following equation:

A. equity+ liabilities - total assets.

8. total assets+ equity- liabilities.

C. equity- total assets - liabilities.

D. liabilities - equity+ total assets.

E. none of the above

9.) Using the capitalised earnings approach, what will the value of the firm be if the net

earnings (after deduction of the owner's salary) are R258 850 and the rate of return is

20%?

A. R 51 770

8. R 1294 250

C. R 1105 000

D. R 517 700

E. None of the above

3

|

4 Page 4 |

▲back to top |

10.) In order to achieve growth, the venture's ability to attract new ....... is important.

A. customers.

B. resources.

C. people.

D. markets.

E. attention.

[20]

4

|

5 Page 5 |

▲back to top |

SECTIONB

[80 MARKS]

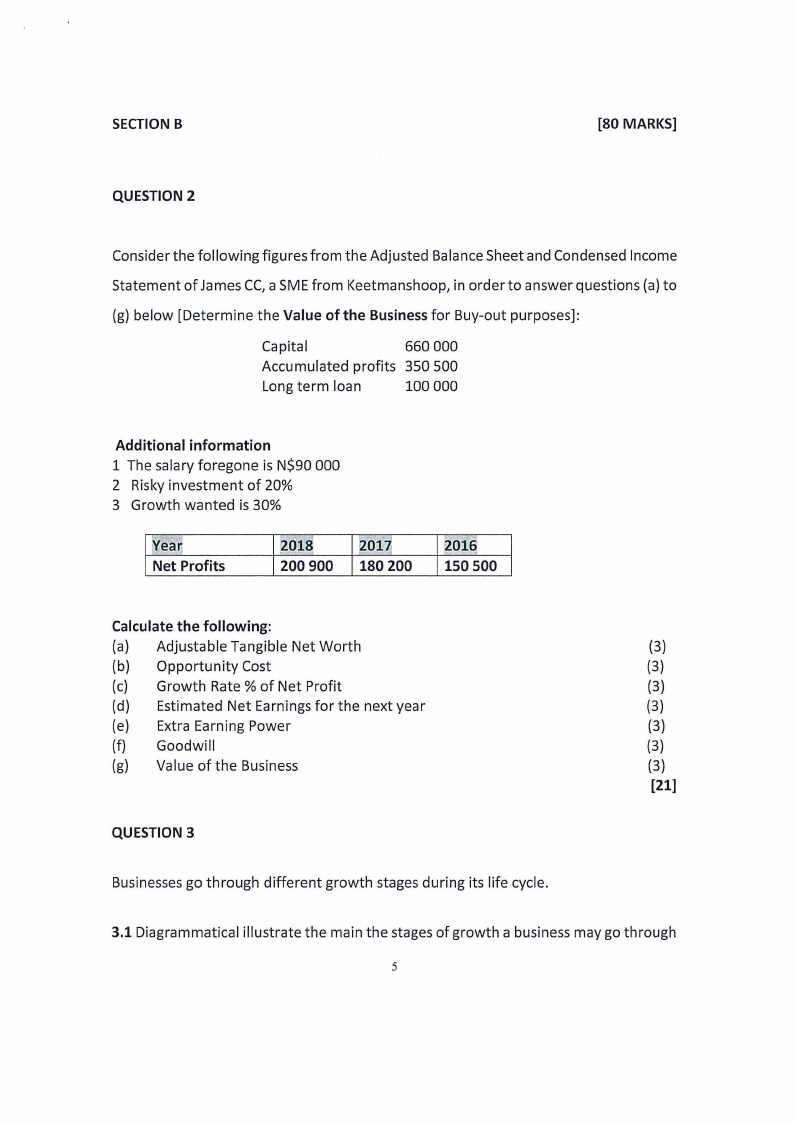

QUESTION 2

Consider the following figures from the Adjusted Balance Sheet and Condensed Income

Statement of James CC,a SMEfrom Keetmanshoop, in order to answer questions {a) to

{g) below [Determine the Value of the Businessfor Buy-out purposes]:

Capital

660 000

Accumulated profits 350 500

Long term loan

100 000

Additional information

1 The salary foregone is N$90 000

2 Risky investment of 20%

3 Growth wanted is 30%

>1' 'Y~e-lia.:-'·r-j"'

Net Profits

~018,

200 900

'~·.01~'

180 200

2016-l

150 500

Calculate the following:

{a) Adjustable Tangible Net Worth

(b) Opportunity Cost

(c) Growth Rate% of Net Profit

(d) Estimated Net Earnings for the next year

(e) Extra Earning Power

(f) Goodwill

{g) Value of the Business

QUESTION 3

(3)

{3)

{3)

{3)

(3)

(3)

{3)

[21]

Businessesgo through different growth stages during its life cycle.

3.1 Diagrammatical illustrate the main the stages of growth a business may go through

5

|

6 Page 6 |

▲back to top |

in its life cycle.

(10)

3.2 List four types of growth that a firm must achieve.

(4)

3.3 Briefly discuss the key factors that the entrepreneur needs to address during the

growth stages of its business venture.

(10)

[24)

QUESTION4

Successionis the process through which leadership in a family business istransferred to

a subsequent family member.

1.) Identify and explain the management styles that may influence succession. (8)

2.) Name the most appropriate management style that may positively impact

succession.

(2)

[10)

QUESTION 5

Identify and discuss ANY six (6) factors that may impact export efforts of Namibian small

and medium businesses.

(12)

QUESTION 6

To turnaround an ailing venture and put it back on the road to good performance and

growth is no small task. (Nieman and Nieuwenhuizen, 2000).

6.1 Identify and briefly explain the principles of restructuring (turnaround) to ensure a

successful turnaround process.

(10)

6.2 In your opinion, if a turnaround is not viable, suggest (three) 3 other options that a

business may consider.

(3)

[13)

END OF EXAM PAPER

6