|

FMH810S- FINANCIAL MANAGEMENT HOSPITALITY AND TOURISM- 1ST OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCEAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING & FINANCE

QUALIFICATION: BACHELOR OF HOSPITALITY MANAGEMENT (HONOURS)

QUALIFICATION CODE: 08BHTH

COURSE CODE: FMH810S

LEVEL: 8

COURSE NAME: FINANCIAL MANAGEMENT:

HOSPITALITY AND TOURISM

SESSION: JUNE 2023

DURATION: 3 HOURS

PAPER: PRACTICAL AND THEORY

MARKS: 100

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS:

H Namwandi

MODERATOR: A Okafor

INSTRUCTIONS

• This question paper is made up of four (4) questions.

• Start each question on a new page.

• Answer All the questions in blue or black ink only.

• You are advised to pay due attention to expression and presentation. Failure to do so will

cost you marks.

• Start each question on a new page in your answer booklet and show all your workings.

• Questions relating to this paper may be raised in the initial 30 minutes after the start of

the paper. Thereafter, candidates must use their initiative to deal with any perceived error

or ambiguities and any assumption made by the candidate should be clearly stated.

PERMISSIBLE MATERIALS

Non-programmable calculator

THIS QUESTION PAPER CONSISTS OF 5 PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

Question 1

(27 Marks)

Chef Club Ltd is a company that produces cooking utensils. The management of Master Chef

Ltd made a decision to venture into manufacturing a special cast iron pan which will result in

the improvement of the overall profit of the organisation. The cast iron pan is very competitive

and subject to frequent changes.

The finance team at Chef Club Ltd prepare monthly budgets as part of their planning and

management control process.

The data for the forthcoming new budget period related to the Casserole pot is as follows:

The variable cost of producing a cast iron pan is N$21.

The planned selling price of a cast iron pan is N$45 and at this selling price, the demand for

pots is expected to be 125 000 pans. Information from the marketing division at Chef Club Ltd

suggests that for every N$3 increase in the selling price, the customer demand would reduce

by 10 000 pots and that for every N$3 decrease in the selling price, the customer demand

would increase by 10 000 pans.

An additional cost of producing the product in relation to its output is as follows:

Annual output (units)

115 000

140 000

155 000

Overheads cost (N$)

950 000

950 000

950 000

Administrative costs are as follows:

Selling cost

N$525 000

Advertising cost

N$660 000

REQUIRED:

(a) Advise the management of Chef Club Ltd on the optimum selling price

that should be charged to customers in order to maximise orofit.

(b) Prepare a statement of profiUloss that show the total maximum profit that

Master Chef Ltd will generate from the selling price you calculated in part

(a).

(c) List four (4) limitations of using the profit maximization model.

(d) Explain what are price differentiation and premium pricing.

Total

Show all vour workim1sl

Marks

(12)

(9)

(4)

(2)

27

2

|

3 Page 3 |

▲back to top |

Question 2

(30 marks)

NUST Ltd specialises in the importation and sales of equipment for children's indoor play

centres. The company was set up by Mr. Sintentu. Mr Sintentu has asked you to assist him in

managing his cash balance over the next three months. You have been provided with the

following information:

Budgeted statement of profit or loss for three months ended 31 December 2023.

Sales: Credit

Cash

Total

Less: Cost of goods sold

Opening inventory

Add: Purchases - (all credit)

Less: Closing inventory

Gross profit

Discount received

Less: Expenses

Sundry expenses

Wages & salaries

Depreciation

Bad debts

Net profit

October

N$

138 000

36 000

174 000

(116000)

180 000

70 000

250 000

134 000

58 000

1 500

(43 500)

10 000

29 000

2 000

2 500

16 000

November

N$

140 000

40 000

180 000

(114 000)

134 000

85 000

219 000

105 000

66 000

1 100

(48 400)

12 000

32 000

2 000

2400

18 700

December

N$

185 000

65 000

250 000

(130 000)

105 000

55 000

160 000

30 000

120 000

2 400

(54 800)

14 000

36 000

2 000

2 800

67 600

Additional information:

1. It is expected that trade debtors will settle their accounts as follows:

20% during the month of sales

70% during the month after the month of sales

8% during the second month after the month of sales

The remaining 2% is written off as bad debts

2. Purchases will be paid during the month following the month of purchases.

3. Credit purchases for August 2023 are N$75 000 and September 2023 amounts to

N$60 000.

4. Total credit sales for September 2015 are N$120 000.

5. Sundry expenses are paid for in cash in the month incurred. The amounts for sundry

expenses were obtained after deducting a prepayment of N$ 1000 each month.

6. Wages & salaries are paid for in the month incurred. Wages for each month included

accruals of N$4 000.

7. An income tax of N$40 000 will be paid in November.

8. The closing balance for September 2023 amounts to N$8 000.

REQUIRED:

(a) Prepare a cash budget for NUST Ltd for the period of October, November

and December 2023.

(b) List three (3) purposes of why an organisation needs to budget.

Marks

(27)

(3)

Show all vour workinas!

Total

30

3

|

4 Page 4 |

▲back to top |

Question 3

(13 Marks)

Gondwana Collection Namibia, is a hub of travel and safari in Namibia and also offers rental

cars and accommodation (hotel, lodges, campsite and self-catering). The company went

through a major strategic restructuring and has recently appointed new management to

implement the revised strategy. One of the key responsibilities of the new management is to

implement a new management control system (MCS) within the organisation specifically

looking at the performance of all employees in the area of hospitality. The management of

Gondwana asked you to advise them on certain key areas that are needed to be done to

successfully ensure that the management control system that will be designed and

implemented works as intended. Therefore, the management requires an adviser to assist

them in the implementation of a good Management Control System (MCS).

REQUIRED:

(a) Explain what is task control.

(b) Give four key differences between strategy formulation and management

control.

Total

Marks

(3)

(10)

15

4

|

5 Page 5 |

▲back to top |

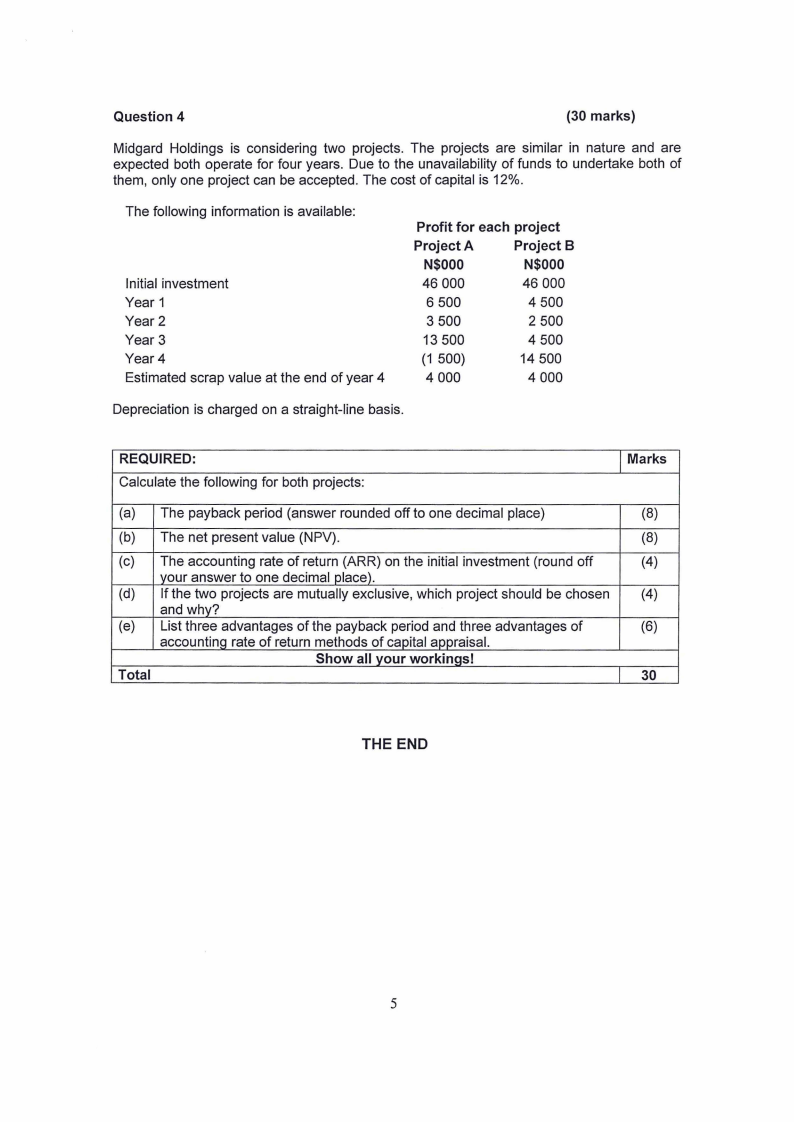

Question 4

(30 marks)

Midgard Holdings is considering two projects. The projects are similar in nature and are

expected both operate for four years. Due to the unavailability of funds to undertake both of

them, only one project can be accepted. The cost of capital is 12%.

The following information is available:

Initial investment

Year 1

Year2

Year3

Year4

Estimated scrap value at the end of year 4

Profit for each project

Project A

Project B

N$000

N$000

46 000

46 000

6 500

4 500

3 500

2 500

13 500

4 500

(1 500)

14 500

4 000

4 000

Depreciation is charged on a straight-line basis.

REQUIRED:

Calculate the following for both projects:

Marks

(a) The payback period (answer rounded off to one decimal place)

(8)

(b) The net present value (NPV).

(8)

(c) The accounting rate of return (ARR) on the initial investment (round off

(4)

vour answer to one decimal place).

(d) If the two projects are mutually exclusive, which project should be chosen

(4)

and why?

(e) List three advantages of the payback period and three advantages of

(6)

accounting rate of return methods of capital aooraisal.

Show all your workinQs!

Total

30

THE END

5

|

6 Page 6 |

▲back to top |

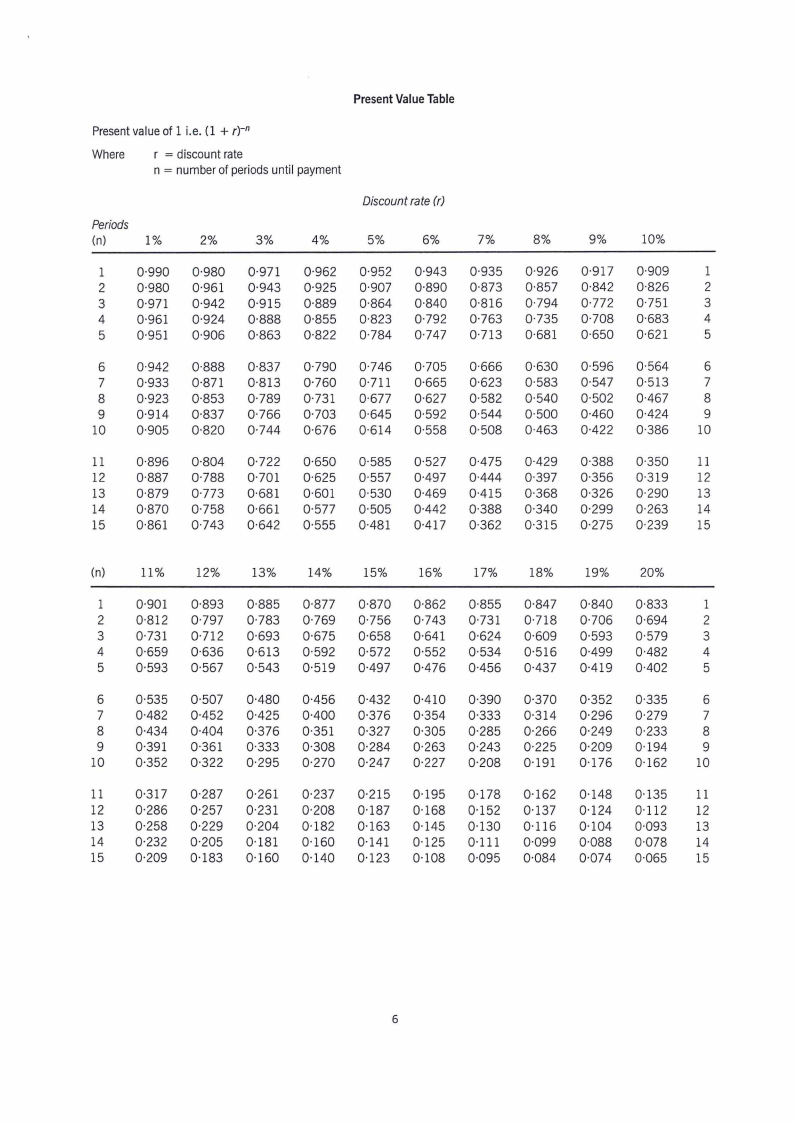

PresentValueTable

Present value of 1 i.e. (1 + r)-n

Where

r = discount rate

n = number of periods until payment

Discountrate (r)

Periods

(n)

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

1 0·990 0·980 0·971 0·962 0·952 0·943 0·935 0·926 0·917 0·909

1

2 0·980 0·961 0·943 0·925 0·907 0·890 0·873 0·857 0·842 0·826

2

3 0·971 0·942 0·915 0·889 0·864 0·840 0·816 0·794 0·772 0·751

3

4 0·961 0·924 0·888 0·855 0·823 0·792 0·763 0·735 0·708 0·683

4

5 0·951 0·906 0·863 0·822 0·784 0·747 0·713 0·681 0·650 0·621

5

6 0·942 0·888 0·837 0·790 0·746 0·705 0·666 0·630 0·596 0·564

6

7 0·933 0·871 0·813 0·760 0·711 0·665 0·623 0·583 0·547 0·513

7

8 0·923 0·853 0·789 0·731 0·677 0·627 0·582 0·540 0·502 0-467

8

9 0·914 0·837 0·766 0·703 0·645 0·592 0·544 0·500 0-460 0-424

9

10 0·905 0·820 0·744 0·676 0·614 0·558 0·508 0-463 0-422 0·386 10

11 0·896 0·804 0·722 0·650 0·585 0·527 0-475 0-429 0·388 0·350 11

12 0·887 0·788 0·701 0·625 0·557 0·497 0-444 0·397 0·356 0·319 12

13 0·879 0·773 0·681 0·601 0·530 0·469 0-415 0·368 0·326 0·290 13

14 0·870 0·758 0·661 0·577 0·505 0-442 0·388 0·340 0·299 0·263 14

15 0·861 0·743 0·642 0·555 0-481 0-417 0·362 0·315 0·275 0·239 15

(n)

11% 12% 13% 14% 15% 16% 17% 18% 19% 20%

1 0·901 0·893 0·885 0·877 0·870 0·862 0·855 0·847 0·840 0·833

1

2 0·812 0·797 0·783 0·769 0·756 0·743 0·731 0·718 0·706 0·694

2

3 0·731 0·712 0·693 0·675 0·658 0·641 0·624 0·609 0·593 0·579

3

4 0·659 0·636 0·613 0·592 0·572 0·552 0·534 0·516 0·499 0·482

4

5 0·593 0·567 0·543 0·519 0-497 0-476 0-456 0-437 0-419 0-402

5

6 0·535 0·507 0·480 0-456 0·432 0·410 0·390 0·370 0·352 0·335

6

7 0-482 0·452 0-425 0·400 0·376 0·354 0·333 0·314 0·296 0·279

7

8 0·434 0-404 0·376 0·351 0·327 0·305 0·285 0·266 0·249 0·233

8

9 0·391 0·361 0·333 0·308 0·284 0·263 0·243 0·225 0·209 0·194

9

10 0·352 0·322 0·295 0·270 0·247 0·227 0·208 0·191 0·176 0·162 10

11 0·317 0·287 0·261 0·237 0·215 0·195 0·178 0·162 0·148 0·135 11

12 0·286 0·257 0·231 0·208 0·187 0·168 0·152 0·137 0·124 0·112 12

13 0·258 0·229 0·204 0·182 0·163 0·145 0·130 0·116 0·104 0·093 13

14 0·232 0·205 0·181 0·160 0·141 0·125 0·111 0·099 0·088 0·078 14

15 0·209 0·183 0·160 0·140 0·123 0·108 0·095 0·084 0·074 0·065 15

6